U.S. Stocks Recover From Early Sell-Off To Close Modestly Higher

March 21 2025 - 5:24PM

IH Market News

After moving sharply lower early in the session, stocks showed a

significant recovery over the course of the trading day on Friday.

The major averages climbed well off their worst levels of the day

and into positive territory.

The tech-heavy Nasdaq saw a notable advance going into the

close, ending the day up 92.43 points or 0.5 percent at 17,784.05

after tumbling by as much as 1.2 percent in early trading.

The Dow and the S&P 500 (SPI:SP500) posted more modest

gains. The Dow inched up 32.03 points or 0.1 percent to 41,985.35

and the S&P 500 crept up 4.67 points or 0.1 percent to

5,667.56.

With the turnaround on the day, the major averages closed higher

for the week. The Dow jumped by 1.2 percent, while the S&P 500

and the Nasdaq snapped four-week losing streaks, rising by 0.5

percent and 0.2 percent, respectively.

The early weakness on Wall Street came amid ongoing concerns

about the economic outlook along with rising geopolitical tensions

and uncertainty about the impact of President Donald Trump’s

tariffs.

The selling pressure was partly offset by comments from Trump

suggesting “there’ll be flexibility” with the reciprocal tariffs

set to be imposed April 2nd.

However, Trump said during the same remarks in the Oval Office

that providing exceptions for one country means “you have to do

that for all,” furthering the uncertainty about his plans.

While the broader markets rebound, shares of FedEx (NYSE:FDX)

remained sharply lower, with the delivery giant plunging by 6.5

percent on the day.

The slump by FedEx came after the company reported slightly

weaker than expected fiscal third quarter earnings and lowered its

full-year earnings guidance due to “continued weakness and

uncertainty in the U.S. industrial economy.”

Dow component Nike (NYSE:NKE) also tumbled by 5.5 percent after

the athletic apparel and footwear giant reported fiscal third

quarter results that beat estimates but forecast a decrease in

sales in the current quarter.

Chipmaker Micron Technology (NASDAQ:MU) also plummeted by 8.0

percent even though the company reported better than expected

fiscal second quarter results and provided upbeat guidance.

Sector News

Despite the recovery by the broader markets, steel stocks

continued to see significant weakness, with the NYSE Arca Steel

Index tumbling by 2.2 percent.

Considerable weakness also remained visible among housing

stocks, as reflected by the 2.0 percent slump by the Philadelphia

Housing Sector Index.

Homebuilder Lennar (LEN) climbed well off its worst levels but

still closed down by 4.0 percent after reporting better than

expected fiscal first quarter results but forecasting fiscal second

quarter new orders below estimates.

Gold, commercial real estate and semiconductor stocks also saw

notable weakness, while strength emerged among software and

computer hardware stocks.

Other Markets

In overseas trading, stock markets across the Asia-Pacific ended

mixed on Friday. Hong Kong’s Hang Seng Index plunged by 2.2 percent

and China’s Shanghai Composite Index slumped by 1.2 percent, while

stocks in Japan, South Korea and Australia moved modestly

higher.

Meanwhile, the major European markets all moved to the downside

on the day. While the German DAX Index fell by 0.5 percent, the

French CAC 40 Index and the U.K.’s FTSE 100 Index both slid by 0.6

percent.

In the bond market, treasuries moved modestly lower over the

course of the session after seeing initial strength. As a result,

the yield on the benchmark ten-year note, which moves opposite of

its price, rose 1.9 basis points to 4.252 percent after hitting a

low of 4.20 percent.

Looking Ahead

The Federal Reserve’s preferred readings on consumer price

inflation are likely to be in the spotlight next week, while

reports on durable goods orders and new and pending home sales may

also attract attention.

SOURCE: RTTNEWS

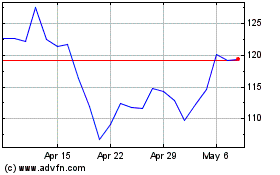

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Feb 2025 to Mar 2025

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Mar 2024 to Mar 2025