UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event

reported): March 10, 2025

AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.

(Exact Name of Registrant as Specified in

Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| 1-14303 | |

38-3161171 |

| (Commission File Number) | |

(IRS Employer Identification No.) |

| | |

|

| One Dauch Drive, Detroit, Michigan | |

48211-1198 |

| (Address of Principal Executive Offices) | |

(Zip Code) |

| (313) 758-2000 |

| (Registrant's Telephone Number, Including Area Code) |

| |

| |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

x

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | |

Trading Symbol(s) | |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | |

AXL | |

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

On March 13, 2025, American Axle & Manufacturing

Holdings, Inc. (the “Company”) and Dowlais Group plc, a public limited company incorporated in England and Wales (“Dowlais”),

released, via the Regulatory News Service in London, a joint announcement (the “RNS Announcement”) regarding the expiration

of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, with respect to the previously disclosed

terms of the recommended offer by the Company to acquire the entire issued and to be issued share capital of Dowlais (the “Business

Combination”). A copy of the RNS Announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K (this “Current

Report”) and is incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits

Cautionary Statement Concerning Forward-Looking

Statements

This Current Report, and the documents

incorporated by reference into this Current Report, contain statements concerning the Company’s expectations, beliefs, plans,

objectives, goals, strategies, and future events or performance, including, but not limited to, certain statements related to (i)

the ability of the Company and Dowlais to consummate the Business Combination in a timely manner or at all; (ii) the satisfaction

(or waiver) of conditions to the consummation of the Business Combination; (iii) adverse effects on the market price of the

Company’s or Dowlais’s operating results, including because of a failure to complete the Business Combination; (iv) the

effect of the announcement or pendency of the Business Combination on the Company’s or Dowlais’s business relationships,

operating results and business generally; (v) future capital expenditures, expenses, revenues, economic performance, synergies,

financial conditions, market growth, dividend policy, losses and future prospects; (vi) business and management strategies and the

expansion and growth of the operations of the Company or the Dowlais; and (vii) the effects of government regulation on the business

of the Company or Dowlais. Such statements are “forward-looking” statements within the meaning of the Private Securities

Litigation Reform Act of 1995 and relate to trends and events that may affect the Company’s future financial position and

operating results. The terms such as “will,” “may,” “could,” “would,”

“plan,” “believe,” “expect,” “anticipate,” “intend,”

“project,” “target,” and similar words or expressions, as well as statements in future tense, are intended

to identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or

results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be

achieved. Forward-looking statements are based on information available at the time those statements are made and/or the

Company’s management’s good faith belief as of that time with respect to future events and are subject to risks and may

differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such

differences include, but are not limited to: global economic conditions, including the impact of inflation, recession or

recessionary concerns, or slower growth in the markets in which the Company operates; reduced purchases of the Company’s

products by General Motors Company (GM), Stellantis N.V. (Stellantis), Ford Motor Company (Ford) or other customers; the

Company’s ability to respond to changes in technology, increased competition or pricing pressures; the Company’s ability

to develop and produce new products that reflect market demand; lower-than-anticipated market acceptance of new or existing

products; the Company’s ability to attract new customers and programs for new products; reduced demand for the Company’s

customers’ products (particularly light trucks and sport utility vehicles (SUVs) produced by GM, Stellantis and Ford); risks

inherent in the Company’s global operations (including tariffs and the potential consequences thereof to the Company, the

Company’s suppliers, and the Company’s customers and their suppliers, adverse changes in trade agreements, such as the

United States-Mexico-Canada Agreement (USMCA), compliance with customs and trade regulations, immigration policies, political

stability or geopolitical conflicts, taxes and other law changes, potential disruptions of production and supply, and currency rate

fluctuations); supply shortages and the availability of natural gas or other fuel and utility sources in certain regions, labor

shortages, including increased labor costs, or price increases in raw material and/or freight, utilities or other operating supplies

for the Company or the Company’s customers as a result of pandemic or epidemic illness, geopolitical conflicts, natural

disasters or otherwise; a significant disruption in operations at one or more of the Company’s key manufacturing facilities;

risks inherent in transitioning the Company’s business from internal combustion engine vehicle products to hybrid and electric

vehicle products; the Company’s ability to realize the expected revenues from the Company’s new and incremental business

backlog; negative or unexpected tax consequences, including those resulting from tax litigation; risks related to a failure of the

Company’s information technology systems and networks, including cloud-based applications, and risks associated with current

and emerging technology threats, and damage from computer viruses, unauthorized access, cyber attacks, including increasingly

sophisticated cyber attacks incorporating use of artificial intelligence, and other similar disruptions; the Company’s

suppliers’, the Company’s customers’ and their suppliers’ ability to maintain satisfactory labor relations

and avoid or minimize work stoppages; cost or availability of financing for working capital, capital expenditures, research and

development (R&D) or other general corporate purposes including acquisitions, as well as the Company’s ability to comply

with financial covenants; the Company’s customers’ and suppliers’ availability of financing for working capital,

capital expenditures, R&D or other general corporate purposes; an impairment of the Company’s goodwill, other intangible

assets, or long-lived assets if the Company’s business or market conditions indicate that the carrying values of those assets

exceed their fair values; liabilities arising from warranty claims, product recall or field actions, product liability and legal

proceedings to which the Company is or may become a party, or the impact of product recall or field actions on the Company’s

customers; the Company’s ability or the Company’s customers’ and suppliers’ ability to successfully launch

new product programs on a timely basis; risks of environmental issues, including impacts of climate-related events, that could

result in unforeseen issues or costs at the Company’s facilities, or risks of noncompliance with environmental laws and

regulations, including reputational damage; the Company’s ability to maintain satisfactory labor relations and avoid work

stoppages; the Company’s ability to consummate strategic initiatives and successfully integrate acquisitions and joint

ventures; the Company’s ability to achieve the level of cost reductions required to sustain global cost competitiveness or the

Company’s ability to recover certain cost increases from the Company’s customers; price volatility in, or reduced

availability of, fuel; the Company’s ability to protect the Company’s intellectual property and successfully defend

against assertions made against the Company; adverse changes in laws, government regulations or market conditions affecting the

Company’s products or the Company’s customers’ products; the Company’s ability or the Company’s

customers’ and suppliers’ ability to comply with regulatory requirements and the potential costs of such compliance;

changes in liabilities arising from pension and other postretirement benefit obligations; the Company’s ability to attract and

retain qualified personnel in key positions and functions; and other unanticipated events and conditions that may hinder the

Company’s ability to compete. It is not possible to foresee or identify all such factors and the Company makes no commitment

to update any forward-looking statement or to disclose any facts, events or circumstances after the date hereof that may affect the

accuracy of any forward-looking statement.

Additional Information

This Current Report may be deemed to be

solicitation material in respect of the Business Combination, including the issuance of shares of the Company’s common stock

(“Company Common Stock”) in respect of the Business Combination. In connection with the foregoing proposed issuance of

Company Common Stock (the “Share Issuance”), the Company expects to file a proxy statement on Schedule 14A, including

any amendments and supplements thereto (the “Proxy Statement”) with the United States Securities and Exchange Commission

(the “SEC”). To the extent the Business Combination is effected as a scheme of arrangement under English law, the Share

Issuance would not be expected to require registration under the Securities Act of 1933, as amended (the “Securities

Act”), pursuant to an exemption provided by Section 3(a)(10) under the Securities Act. In the event that the Company exercises

its right to elect to implement the Business Combination by way of a takeover offer (as defined in the UK Companies Act 2006) or

otherwise determines to conduct the Business Combination in a manner that is not exempt from the registration requirements of the

Securities Act, the Company expects to file a registration statement with the SEC containing a prospectus with respect to the Share

Issuance. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT, THE SCHEME DOCUMENT, AND OTHER RELEVANT DOCUMENTS FILED

OR TO BE FILED BY THE COMPANY WITH THE SEC OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT (IF ANY) CAREFULLY WHEN THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, THE BUSINESS COMBINATION AND RELATED MATTERS. Investors

and shareholders will be able to obtain free copies of the Proxy Statement, the scheme document, and other documents filed by the

Company with the SEC at the SEC’s website at http://www.sec.gov. In addition, investors and stockholders will be able to

obtain free copies of the Proxy Statement, the scheme document, and other documents filed by the Company with the SEC at

https://www.aam.com/investors.

Participants in the Solicitation

The Company and its directors, its directors,

executive officers and certain other members of management and employees will be participants in the solicitation of proxies from the

Company’s stockholders in respect of the Business Combination, including the proposed issuance of Company Common Stock in connection

with the Business Combination. Information regarding the Company’s directors and executive officers is contained in the Annual Report

on Form 10-K for the fiscal year ended December 31, 2024 of the Company, which was filed with the SEC on February 14, 2025 and in the

definitive proxy statement on Schedule 14A for the Company’s annual meeting of stockholders of the Company, which was filed with

the SEC on March 21, 2024 and the Current Report on Form 8-K of the Company, which was filed with the SEC on May 2, 2024. Additional information

regarding the identity of participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in

the Proxy Statement when it is filed with the SEC. To the extent holdings of the Company’s securities by its directors or executive

officers change from the amounts set forth in the Proxy Statement, such changes will be reflected on Initial Statements of Beneficial

Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC by the Company. These documents may be obtained

free of charge from the SEC’s website at www.sec.gov and the Company’s website at https://www.aam.com/investors.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

|

AMERICAN AXLE & MANUFACTURING HOLDINGS, INC. |

| |

|

|

| Date: |

March 13, 2025 |

By: |

/s/ Matthew K. Paroly |

| |

|

|

Matthew K. Paroly |

| |

|

|

Vice President, General Counsel & Secretary |

Exhibit 99.1

NOT FOR RELEASE,

PUBLICATION OR DISTRIBUTION IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS

OF SUCH JURISDICTION

FOR IMMEDIATE RELEASE

13 March 2025

RECOMMENDED CASH

AND SHARE COMBINATION

OF

DOWLAIS GROUP

PLC (“DOWLAIS”)

WITH

AMERICAN AXLE

& MANUFACTURING HOLDINGS, INC. (“AAM”)

COMBINATION UPDATE:

POSITIVE DEVELOPMENT IN U.S. ANTITRUST CLEARANCE

AAM (NYSE: AXL)

and Dowlais are pleased to announce the expiration of the waiting period under the U.S. Hart-Scott-Rodino Antitrust Improvements Act

of 1976 (the "HSR Act") for the proposed combination of Dowlais with AAM.

The expiration

of the waiting period under the HSR Act satisfies one of the conditions to closing the Combination. Filing processes in other jurisdictions

are progressing and the Combination is expected to close in the fourth quarter of 2025, subject to satisfaction of the remaining conditions

as set out in the Rule 2.7 announcement released by AAM and Dowlais on 29 January 2025 (the “Rule 2.7 Announcement”).

Unless otherwise

defined in this announcement, capitalised terms used in this announcement shall have the same meanings given to them in the Rule 2.7

Announcement.

Enquiries

| AAM |

|

| David H. Lim,

Head of Investor Relations |

+1 (313) 758-2006 |

| Christopher M. Son, Vice President,

Marketing & Communications |

+1 (313) 758-4814 |

| |

|

| J.P. Morgan

(Exclusive financial adviser to AAM) |

| David Walker / Ian MacAllister |

+1 (212) 270 6000 |

| Robert Constant / Jonty Edwards |

+44 (0) 203 493 8000 |

| |

|

| FGS Global (PR adviser to AAM) |

| Jared Levy / Jim Barron |

+1 212 687 8080 |

| Charlie Chichester / Rory King |

+44 20 7251 3801 |

| Dowlais |

|

| Investors |

|

| Pier Falcione |

+44 (0) 7855 185 420 |

| |

|

| Barclays Bank PLC, acting through its Investment Bank (“Barclays”) (Financial adviser and corporate broker to Dowlais) |

| Guy Bomford / Adrian Beidas / Neal West (Corporate Broking) |

+44 (0) 20 7623 2323 |

| |

|

| Rothschild & Co (Financial adviser to Dowlais) |

| Ravi Gupta / Nathalie Ferretti |

+44 (0) 20 7280 5000 |

| |

|

| Investec Bank plc (Joint corporate broker to Dowlais) |

| Carlton Nelson / Christopher Baird |

+44 (0) 20 7597 5970 |

| |

|

| Montfort Communications (PR adviser to Dowlais) |

| Nick Miles / Neil Craven |

+44 (0) 7739 701 634

+44 (0) 7876 475 419 |

Allen

Overy Shearman Sterling LLP is acting as legal adviser to AAM in connection with the Combination. Slaughter and May is acting as legal

adviser to Dowlais. Cravath, Swaine & Moore LLP is acting as U.S. legal adviser to Dowlais.

Disclaimers

Important

notices relating to financial advisers

J.P. Morgan

Securities LLC, together with its affiliate J.P. Morgan Securities plc (which conducts its UK investment banking business as J.P. Morgan

Cazenove and which is authorised in the United Kingdom by the Prudential Regulation Authority and regulated in the United Kingdom by

the Prudential Regulation Authority and the Financial Conduct Authority). J.P. Morgan is acting as financial adviser exclusively for

AAM and no one else in connection with the Combination and will not regard any other person as its client in relation to the Combination

and will not be responsible to anyone other than AAM for providing the protections afforded to clients of J.P. Morgan or its affiliates,

nor for providing advice in relation to the Combination or any other matter or arrangement referred to herein.

Barclays, which

is authorised by the Prudential Regulation Authority and regulated in the United Kingdom by the Financial Conduct Authority and the Prudential

Regulation Authority, is acting exclusively for Dowlais and no one else in connection with the Combination and will not be responsible

to anyone other than Dowlais for providing the protections afforded to clients of Barclays nor for providing advice in relation to the

Combination or any other matter referred to in this announcement.

In accordance

with the Code, normal United Kingdom market practice and Rule 14e-5(b) of the Exchange Act, Barclays and its affiliates will continue

to act as exempt principal trader in Dowlais securities on the London Stock Exchange. These purchases and activities by exempt principal

traders which are required to be made public in the United Kingdom pursuant to the Code will be reported to a Regulatory Information

Service and will be available on the London Stock Exchange website at www.londonstockexchange.com. This information will also

be publicly disclosed in the United States to the extent that such information is made public in the United Kingdom.

Rothschild &

Co, which is authorised and regulated in the UK by the Financial Conduct Authority, is acting exclusively as financial adviser to Dowlais

and for no-one else in connection with the Combination and shall not be responsible to anyone other than Dowlais for providing the

protections afforded to clients of Rothschild & Co, nor for providing advice in connection with the Combination or any matter referred

to herein. Neither Rothschild & Co nor any of its affiliates (nor their respective directors, officers, employees or agents) owes

or accepts any duty, liability or responsibility whatsoever (whether direct or indirect, whether in contract, in tort, under statute

or otherwise) to any person who is not a client of Rothschild & Co in connection with this announcement, any statement contained

herein, the Combination or otherwise. No representation or warranty, express or implied, is made by Rothschild & Co as to the contents

of this announcement.

Investec, which

is authorised in the United Kingdom by the PRA and regulated in the United Kingdom by the FCA and the PRA, is acting exclusively for

Dowlais and no one else in connection with the subject matter of this announcement and will not regard any other person as its client

in relation to the subject matter of this announcement and will not be responsible to anyone other than Dowlais for providing the protections

afforded to the clients of Investec, or for providing advice in connection with the subject matter of this announcement or any other

matters referred to herein. Neither Investec nor any of its subsidiaries, branches or affiliates owes or accepts any duty, liability

or responsibility whatsoever (whether direct or indirect, whether in contract, in tort, under statute or otherwise) to any person who

is not a client of Investec in connection with the subject matter of this announcement, any statement contained herein or otherwise,

and no representation, express or implied, is made by Investec or any of its subsidiaries, branches or affiliates, or purported to be

made on behalf of Investec or any of its subsidiaries, branches or affiliates, in relation to the contents of this announcement, including

with regard to the accuracy or completeness of the announcement or the verification of any other statements made or purported to be made

by or on behalf of Investec or any of its subsidiaries, branches or affiliates in connection with the matters described in this announcement.

Further information

This announcement

is for information purposes only and is not intended to, and does not, constitute or form part of any offer or invitation to purchase,

otherwise acquire, subscribe for, sell or otherwise dispose of, any securities or the solicitation of any vote or approval in any jurisdiction

pursuant to the Combination or otherwise. In particular, this announcement is not an offer of securities for sale into the U.S. No offer

of securities shall be made in the U.S. absent registration under the U.S. Securities Act, or pursuant to an exemption from, or in a

transaction not subject to, such registration requirements. The Combination will be made solely through the Scheme Document (or, if the

Combination is implemented by way of a Takeover Offer, the Takeover Offer documents), which, together with the accompanying Forms of

Proxy and Forms of Election in relation to the Mix and Match Facility, which will contain the full terms and conditions of the Combination,

including details of how to vote in respect of the Combination. Any decision in respect of the Combination should be made only on the

basis of the information in the Scheme Document (or, if the Combination is implemented by way of a Takeover Offer, the Takeover Offer

documents).

Dowlais will

prepare the Scheme Document to be distributed to Dowlais Shareholders. Dowlais and AAM urge Dowlais Shareholders to read the Scheme Document

(or any other document by which the Combination is made) in full when it becomes available because it will contain important information

relating to the Combination, including details of how to vote in respect of the Scheme.

The statements

contained in this announcement are made as at the date of this announcement, unless some other time is specified in relation to them,

and publication of this announcement shall not give rise to any implication that there has been no change in the facts set forth in this

announcement since such date.

This announcement

does not constitute a prospectus or a prospectus equivalent document.

This announcement

has been prepared for the purpose of complying with English law and the Code and the information disclosed may not be the same as that

which would have been disclosed if this announcement had been prepared in accordance with the laws of jurisdictions outside England.

The Combination

will be subject to the applicable requirements of English law, the Code, the Panel, the London Stock Exchange and the FCA.

Neither the

SEC nor any U.S. state securities commission has approved, disproved or passed judgment upon the fairness or the merits of the Combination

or determined if this announcement is adequate, accurate or complete. Any representation to the contrary is a criminal offence in the

U.S.

Overseas

Shareholders

The release,

publication or distribution of this announcement in jurisdictions other than the UK, and the availability of the Combination to Dowlais

Shareholders who are not resident in the UK, may be restricted by law and therefore any persons who are not resident in the UK or who

are subject to the laws of any jurisdiction other than the UK (including Restricted Jurisdictions) should inform themselves about, and

observe, any applicable legal or regulatory requirements. In particular, the ability of persons who are not resident in the UK or who

are subject to the laws of another jurisdiction to participate in the Combination or to vote their Dowlais Shares in respect of the Scheme

at the Court Meeting, or to execute and deliver Forms of Proxy appointing another to vote at the Court Meeting on their behalf, may be

affected by the laws of the relevant jurisdictions in which they are located or to which they are subject. Any failure to comply with

applicable legal or regulatory requirements of any jurisdiction may constitute a violation of securities laws in that jurisdiction. To

the fullest extent permitted by applicable law, the companies and persons involved in the Combination disclaim any responsibility or

liability for the violation of such restrictions by any person.

Unless otherwise

determined by AAM or required by the Code, and permitted by applicable law and regulation, the Combination shall not be made available,

directly or indirectly, in, into or from a Restricted Jurisdiction where to do so would violate the laws in that jurisdiction and no

person may vote in favour of the Combination by any such use, means, instrumentality or form within a Restricted Jurisdiction or any

other jurisdiction if to do so would constitute a violation of the laws of that jurisdiction.

Accordingly,

copies of this announcement and any formal documentation relating to the Combination are not being, and must not be, directly or indirectly,

mailed or otherwise forwarded, distributed or sent in or into or from any Restricted Jurisdiction or any jurisdiction where to do so

would constitute a violation of the laws of such jurisdiction and persons receiving such documents (including custodians, nominees and

trustees) must not mail or otherwise forward, distribute or send them in or into or from any Restricted Jurisdiction. Doing so may render

invalid any related purported vote in respect of acceptance of the Combination.

Further details

in relation to Dowlais Shareholders in overseas jurisdictions will be contained in the Scheme Document (or, if the Combination is implemented

by way of a Takeover Offer, the Takeover Offer documents).

Additional

information for U.S. investors in Dowlais

The Combination

relates to an offer for the shares of an English company and is proposed to be implemented by means of a scheme of arrangement provided

for under English company law. The Combination, implemented by way of a scheme of arrangement, is not subject to the tender offer rules

or the related proxy solicitation rules under the U.S. Exchange Act. Accordingly, the Combination is subject to the disclosure requirements

and practices applicable to a scheme of arrangement involving a target company in the UK listed on the London Stock Exchange, which differ

from the disclosure requirements of the U.S. tender offer and related proxy solicitation rules. If, in the future, AAM exercises its

right to elect to implement the Combination by way of a Takeover Offer and determines to extend the Takeover Offer into the U.S., such

Takeover Offer will be made in compliance with applicable U.S. laws and regulations.

The New AAM

Shares to be issued pursuant to the Combination have not been and will not be registered under the U.S. Securities Act, and may not be

offered or sold by AAM in the U.S. absent registration or an applicable exemption from the registration requirements of the U.S. Securities

Act. The New AAM Shares to be issued pursuant to the Combination will be issued pursuant to the exemption from registration set forth

in Section 3(a)(10) of the U.S. Securities Act. If, in the future, AAM exercises its right to elect to implement the Combination

by way of a Takeover Offer or otherwise determines to conduct the Combination in a manner that is not exempt from the registration

requirements of the U.S. Securities Act, it will file a registration statement with the SEC that will contain a prospectus with respect

to the issuance of New AAM Shares. In this event, Dowlais Shareholders are urged to read these documents and any other relevant documents

filed with the SEC, as well as any amendments or supplements to all such documents, because they will contain important information,

and such documents will be available free of charge at the SEC's website at www.sec.gov or by directing a request to

AAM's contact for enquiries identified above.

This announcement

contains, and the Scheme Document will contain certain unaudited financial information relating to Dowlais that has been prepared in

accordance with UK-endorsed International Financial Reporting Standards ("IFRS") and thus may not be comparable to financial

information of U.S. companies or companies whose financial statements are prepared in accordance with U.S. generally accepted accounting

principles. U.S. generally accepted accounting principles differ in certain significant respects from IFRS.

Dowlais is incorporated

under the laws of a non-U.S. jurisdiction, some or all of Dowlais' officers and directors reside outside the U.S., and some or all of

Dowlais' assets are or may be located in jurisdictions outside the U.S. Therefore, U.S. Dowlais Shareholders (defined as Dowlais Shareholders

who are U.S. persons as defined in the U.S. Internal Revenue Code or "IRC") may have difficulty effecting service of process

within the U.S. upon those persons or recovering against Dowlais or its officers or directors on judgments of U.S. courts, including

judgments based upon the civil liability provisions of the U.S. federal securities laws. Further, it may be difficult to compel a non-U.S.

company and its affiliates to subject themselves to a U.S. court's judgment. It may not be possible to sue Dowlais or its officers or

directors in a non-U.S. court for violations of the U.S. securities laws.

The receipt

of New AAM Shares and cash by Dowlais Shareholders as consideration for the transfer of Dowlais Shares pursuant to the Combination may

be a taxable transaction for U.S. federal income tax purposes and under applicable U.S. state and local, as well as foreign and other,

tax laws. Such consequences, if any, are not generally described herein. Each Dowlais Shareholder is urged to consult with legal, tax

and financial advisers in connection with making a decision regarding the Combination, including in light of the potential application

of Section 304 of the IRC to the Combination.

Forward-looking

statements

In this announcement,

AAM makes statements concerning its and Dowlais' expectations, beliefs, plans, objectives, goals, strategies, and future events or performance,

including, but not limited to, certain statements related to the ability of AAM and Dowlais to consummate AAM's business combination

with Dowlais (the "Business Combination") in a timely manner or at all; future capital expenditures, expenses, revenues, economic

performance, synergies, financial conditions, market growth, dividend policy, losses and future prospects and business; and management

strategies and the expansion and growth of AAM's and the combined company's operations. Such statements are "forward-looking"

statements within the meaning of the Private Securities Litigation Reform Act of 1995 and relate to trends and events that may affect

AAM's or the combined company's future financial position and operating results. The terms such as "will," "may,"

"could," "would," "plan," "believe," "expect," "anticipate," "intend,"

"project," "target," and similar words or expressions, as well as statements in future tense, are intended to identify

forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will

not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. These forward-looking

statements involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied

by these statements. These risks and uncertainties related to AAM include factors detailed in the reports AAM files with the United

States Securities and Exchange Commission (the "SEC"), including those described under "Risk Factors" in its most

recent Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. These forward-looking statements speak only as of the

date of this communication. AAM expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein to reflect any change in its or Dowlais' expectations with regard thereto or any change in

events, conditions or circumstances on which any such statement is based.

Additional

Information

This announcement

may be deemed to be solicitation material in respect of the Business Combination, including the issuance of AAM's shares of common stock

in respect of the Business Combination. In connection with the foregoing proposed issuance of AAM's shares of common stock, AAM

expects to file a proxy statement on Schedule 14A (together with any amendments and supplements thereto, the "Proxy Statement")

with the SEC. To the extent the Business Combination is effected as a scheme of arrangement under English law, the issuance of

AAM's shares of common stock in connection with the Business Combination would not be expected to require registration under the U.S.

Securities Act of 1933, as amended (the "Securities Act"), pursuant to an exemption provided by Section 3(a)(10) under the

Securities Act. In the event that AAM exercises its right to elect to implement the Business Combination by way of a takeover offer

(as defined in the UK Companies Act 2006) or otherwise determines to conduct the Business Combination in a manner that is not exempt

from the registration requirements of the Securities Act, AAM expects to file a registration statement with the SEC containing a prospectus

with respect to the AAM's shares that would be issued in the Business Combination. INVESTORS AND SHAREHOLDERS ARE URGED TO READ

THE PROXY STATEMENT, THE SCHEME DOCUMENT, AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED BY AAM WITH THE SEC OR INCORPORATED BY REFERENCE

IN THE PROXY STATEMENT (IF ANY) CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AAM, THE BUSINESS

COMBINATION AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the Proxy Statement, the scheme

document, and other documents filed by AAM with the SEC at the SEC's website at http://www.sec.gov. In addition, investors

and shareholders will be able to obtain free copies of the Proxy Statement, the scheme document, and other documents filed by AAM with

the SEC at https://www.aam.com/investors.

Participants in the Solicitation

AAM and its

directors, executive officers and certain other members of management and employees will be participants in the solicitation of proxies

from AAM's shareholders in respect of the Business Combination, including the proposed issuance of AAM's shares of common stock in connection

with the Business Combination. Information regarding AAM's directors and executive officers is contained in its Annual Report on

Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 16, 2024, the definitive proxy statement

on Schedule 14A for AAM's 2024 annual meeting of stockholders, which was filed with the SEC on March 21, 2024 and the Current Report

on Form 8-K of AAM, which was filed with the SEC on May 2, 2024. Additional information regarding the identity of participants,

and their direct or indirect interests, by security holdings or otherwise, will be set forth in the Proxy Statement when it is filed

with the SEC. To the extent holdings of AAM's securities by its directors or executive officers change from the amounts set forth

in the Proxy Statement, such changes will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change

in Ownership on Form 4 filed with the SEC by AAM. These documents may be obtained free of charge from the SEC's website at www.sec.gov

and AAM's website at https://www.aam.com/investors.

No Offer

or Solicitation

This announcement

is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer

to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Publication

on website

This

announcement is required to be published pursuant to Rule 26 of the Code and will be available, subject to certain restrictions

relating to persons resident in Restricted Jurisdictions, on AAM's website at https://www.aam.com/investors and on

Dowlais’ website at http://www.dowlais.com promptly and in any event by no later than 12 noon (London time) on the

business day (as defined in the Code) following the date of this announcement. Neither the content of the websites referred to in

this announcement nor the content of any website accessible from hyperlinks in this announcement is incorporated into, or forms part

of, this announcement.

Dowlais Shareholders

and persons with information rights may, subject to applicable securities laws, request a hard copy of this announcement, free of charge,

by contacting Dowlais’ registrars, Equiniti, by: (i) submitting a request in writing to Equiniti at Aspect House, Spencer Road,

Lancing, West Sussex BN99 6DA, United Kingdom; or (ii) contacting Equiniti between 8.30 a.m. and 5.30 p.m. (London time), Monday to Friday

(excluding English and Welsh public holidays), on +44 (0) 371 384 2030 (please use the country code when calling from outside the UK).

A person so entitled may, subject to applicable securities laws, also request that all future documents, announcements and information

to be sent in relation to the Combination should be in hard copy form.

Rounding

Certain figures

included in this announcement have been subjected to rounding adjustments. Accordingly, figures shown for the same category presented

in different tables may vary slightly and figures shown as totals in certain tables may not be an arithmetic aggregation of the figures

that precede them.

General

If you are in

any doubt about the contents of this announcement or the action you should take, you are recommended to seek your own independent financial

advice immediately from your stockbroker, bank manager, solicitor, accountant or independent financial adviser duly authorised under

FSMA if you are resident in the United Kingdom or, if not, from another appropriately authorised independent financial adviser.

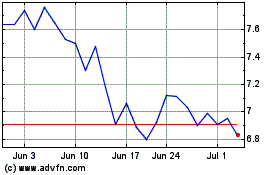

American Axle and Manufa... (NYSE:AXL)

Historical Stock Chart

From Feb 2025 to Mar 2025

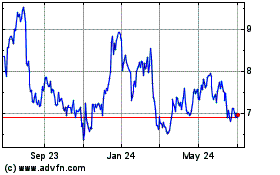

American Axle and Manufa... (NYSE:AXL)

Historical Stock Chart

From Mar 2024 to Mar 2025