false

0001101239

true

true

true

0001101239

2024-10-01

2024-10-01

0001101239

us-gaap:CommonStockMember

2024-10-01

2024-10-01

0001101239

eqix:SeniorNotes0.250PercentDue2027Member

2024-10-01

2024-10-01

0001101239

eqix:SeniorNotes1.000PercentDue2033Member

2024-10-01

2024-10-01

0001101239

eqix:SeniorNotes3.650PercentDue2033Member

2024-10-01

2024-10-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): October 1, 2024

EQUINIX, INC.

(Exact

Name of Registrant as Specified in Charter)

Delaware

(State or Other Jurisdiction

of Incorporation) |

001-40205

(Commission

File Number) |

77-0487526

(I.R.S.

Employer

Identification No.) |

One Lagoon Drive

Redwood City, CA 94065

(Address

of Principal Executive Offices, and Zip Code)

(650) 598-6000

Registrant’s

Telephone Number, Including Area Code

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

| ¨ | Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

stock, par value $0.001 per share |

EQIX |

The Nasdaq Stock Market LLC |

| 0.250% Senior Notes due 2027 |

true |

The Nasdaq Stock Market LLC |

| 1.000% Senior Notes due 2033 |

true |

The Nasdaq Stock Market LLC |

| 3.650%

Senior Notes due 2033 |

true |

The

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of

the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure

On October 1, 2024, Equinix, Inc. ("Equinix") issued

a press release that includes, among other matters, information related to an agreement to form a joint venture between Equinix, Canada

Pension Plan Investment Board, and GIC, Singapore’s sovereign wealth fund. A copy of the press release is furnished as Exhibit 99.1

and is incorporated into this Item 7.01 by reference.

The information in this Item 7.01 of this Current Report on Form 8-K,

including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section and shall not be incorporated

by reference into any registration statement or other document pursuant to the Securities Act, except as otherwise stated in such filings.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EQUINIX, INC. |

| |

|

| |

By: |

/s/ Keith D. Taylor |

| |

Name: |

Keith D. Taylor |

| |

Title: |

Chief Financial Officer |

Date: October 1, 2024

Exhibit 99.1

Equinix Agrees to Form Greater Than $15B

JV to Expand Hyperscale Data Centers in the U.S. and Support Growing AI and Cloud Innovation

CPP Investments to Join GIC in New JV Supporting

Expanding xScale® Program

REDWOOD CITY, Calif. – October 1,

2024 –– Equinix, Inc. (Nasdaq: EQIX), the world’s digital infrastructure company®,

today announced the signing of a joint venture (JV) agreement, subject to closing conditions, in the form of a limited liability partnership

with GIC and Canada Pension Plan Investment Board (CPP Investments), with the intent to raise over US$15 billion in capital together

with its partners. Driven by increasing artificial intelligence (AI) and cloud growth, the JV is intended to accelerate the Equinix xScale

data center portfolio, which enables hyperscale companies to add core deployments to their existing access point footprints at Equinix

International Business Exchange™ (IBX®) data centers. At full buildout, this new JV will nearly triple the investment

capital of the Equinix xScale program.

With the capital raised through the JV, Equinix

expects the JV to purchase land to build new state-of-the-art xScale facilities on multiple greater-than-100-megawatt (MW) campuses in

the U.S., eventually adding more than 1.5 gigawatts of new capacity for hyperscale customers.

Highlights / Key Facts:

| · | Equinix has a longstanding relationship with GIC, having

previously partnered on xScale projects in Asia, the Americas and Europe (see links below for details on other joint ventures). This agreement

represents the first JV between Equinix and CPP Investments, which manages the assets of the Canada Pension Plan for more than 22 million

contributors and beneficiaries. |

| · | Under the terms of the agreement, CPP Investments

and GIC will each control a 37.5% equity interest in the joint venture, and Equinix will own a 25% equity interest. Each party has made

equity commitments, and the joint venture also expects to take on debt to raise the total pool of investable capital to more than US$15

billion over time. |

| · | Equinix's existing hyperscale joint venture portfolio in

Europe, Asia-Pacific and the Americas has a committed investment of over US$8 billion, which is expected to result in greater than 725

MW of power capacity across more than 35 facilities at full buildout. |

| · | Platform Equinix® features nearly 40% of

the private on-ramps to the top global cloud service providers, which is more than any other provider. As hyperscale companies scale their

operations at Equinix, the ecosystem of over 10,000 enterprises and other companies currently operating at Equinix can benefit from increased

opportunities to directly connect and operate in proximity to the largest global cloud operators. |

| · | xScale data centers serve the unique core workload deployment needs of the

world's largest cloud service providers, including hyperscalers, which are key players in the AI ecosystem. These companies can add

core deployments to their existing access point footprints at Equinix IBX data centers, enabling their growth on a single platform that

can immediately span 72 global metros and offer direct interconnection to an ecosystem of more than 10,000 customers. |

| · | Equinix is committed to delivering sustainable digital infrastructure

and engaging our suppliers and partners in supply chain responsibility. Equinix has continued to make advancements in the way it designs,

builds and operates its data centers with high energy-efficiency standards, and all xScale data centers will be LEED certified (or certified

in the regional equivalent). |

| · | The closing of the joint venture is subject to the receipt

of required regulatory approvals, which are expected to be received in the fourth quarter of 2024. |

| · | Morgan Stanley & Co. LLC served as exclusive financial

advisor to Equinix in connection with this transaction. |

Quotes

| · | Adaire Fox-Martin, CEO and President, Equinix |

“As the world’s leading companies build out

their infrastructure to support key workloads such as artificial intelligence, they require the combination of large-scale data center

footprints optimized for AI training and interconnection nodes for the most efficient inferencing. Our xScale and IBX offerings are uniquely

positioned to address this business need, enabling companies to realize the powerful potential of AI.”

| · | Goh Chin Kiong, Chief Investment Officer, Real Estate at GIC |

“We are proud to expand our years-long partnership

with Equinix, addressing a massive and growing demand for digital infrastructure, driven by the rapid advancement of technology, including

AI. GIC’s capital and scale, paired with Equinix’s operational expertise, has driven meaningful value across our investments

together. Through this joint venture, we look forward to providing the funding needed to develop state-of-the-art digital infrastructure

across the U.S. alongside our likeminded partner, CPP Investments.”

| · | Max Biagosch, Senior Managing Director, Global Head of Real Assets &

Head of Europe for CPP Investments |

“CPP Investments has invested in data centers for

several years and we have developed strong expertise in this space. This investment will help meet the increasing demand for data centers

driven by rapid technological advancements and marks a significant step forward in our broader data center strategy. We are pleased to

partner with Equinix and GIC to deliver strong long-term risk-adjusted returns for the CPP Fund.”

Additional Resources

| · | Equinix

and PGIM Real Estate Enter Into $600 Million JV for First xScale® Data Center

in the U.S. [press release: April 2024] |

| · | Equinix

and GIC to Invest US$525 Million to Build Hyperscale Data Centers in Korea [press release:

January 2022] |

| · | Equinix

and GIC to Add $3.9B to Expand xScale Data Center Program [press release: June 2021] |

| · | Hyperscalers

Expand Beyond Core Locations for Proximity and Speed [Equinix Blog: January 2023] |

| · | Equinix

Climate Commitments and Greenhouse Gas Emissions [Equinix website] |

About Equinix

Equinix (Nasdaq: EQIX) is the world’s digital infrastructure

company®. Digital leaders harness Equinix’s trusted platform to bring together and interconnect foundational infrastructure

at software speed. Equinix enables organizations to access all the right places, partners and possibilities to scale with agility, speed

the launch of digital services, deliver world-class experiences and multiply their value, while supporting their sustainability goals.

Forward-Looking Statements

This press release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially from

expectations discussed in such forward-looking statements. Factors that might cause such differences include, but are not limited to,

risks related to Equinix and the joint venture partners' ability to complete the closing of the joint venture on the proposed terms and

schedule, including obtaining regulatory approval; any inability of Equinix, the partners or the joint venture to obtain financing as

needed; risks related to whether the data centers that will be developed will be integrated successfully, and whether such development

may be more difficult, time-consuming or costly than expected; risks that the expected benefits of the joint venture will not occur;

the challenges of operating and managing data centers and developing, deploying and delivering Equinix products and solutions; the ability

to generate sufficient cash flow or otherwise obtain funds to repay new or outstanding indebtedness; competition from existing and new

competitors; the loss or decline in business from key hyperscale companies; disruption from the joint venture making it more difficult

to conduct business as usual or maintain relationships with customers, employees or suppliers; risks to our business and operating results

related to the current inflationary environment; foreign currency exchange rate fluctuations; stock price fluctuations; increased costs

to procure power and the general volatility in the global energy market; risks related to our taxation as a REIT; and risks related to

regulatory inquiries or litigation and other risks described from time to time in Equinix filings with the Securities and Exchange Commission.

In particular, see recent and upcoming Equinix quarterly and annual reports filed with the Securities and Exchange Commission, copies

of which are available upon request from Equinix. Equinix does not assume any obligation to update the forward-looking information contained

in this press release.

| Equinix Media Relations |

Equinix Investor Relations |

| press@equinix.com |

invest@equinix.com |

GIC

Katy Conrad

KatyConrad@gic.com.sg

CPP Investments

Frank Switzer

fswitzer@cppib.com

###

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=eqix_SeniorNotes0.250PercentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=eqix_SeniorNotes1.000PercentDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=eqix_SeniorNotes3.650PercentDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

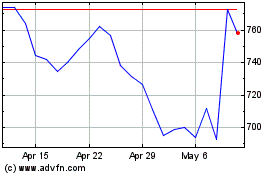

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Oct 2024 to Nov 2024

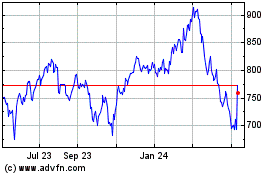

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Nov 2023 to Nov 2024