Interest rate cuts may impact Treasury bonds and stablecoins

The Federal Reserve cut interest rates by half a percentage

point, the first reduction since the onset of the pandemic, aiming

to prevent a slowdown in the labor market. With inflation

decreasing, the committee projects further cuts until 2025. Despite

a growing GDP, concerns about employment persist, leading to this

decision. This shift is expected to influence other central banks,

which are already considering similar cuts. Experts like Arthur

Hayes from BitMEX warn that this could diminish demand for

tokenized Treasury bonds. However, Alexander Deschatres from

Standard Chartered believes that stablecoins, with a supply of $170

billion, may mitigate this impact by redirecting investments to

money market tokens. Despite the cut, yields remain attractive

compared to holding stablecoins, while the market for tokenized

bonds is growing rapidly.

Just before the highly anticipated interest rate decision from

the Federal Reserve, the price of Bitcoin (COIN:BTCUSD) fell below

$60,000, down nearly 1% at $59,825. Moments after the Fed announced

the 0.5% cut, Bitcoin rose 0.5% to $60,610 in the last check. Key

resistance levels for Bitcoin are at $61,500 and $61,750.

Former Coinbase executives launch TrueX, innovative stablecoin

exchange

Former Coinbase (NASDAQ:COIN) executives Vishal Gupta and

Patrick McCreary have launched TrueX, a non-custodial exchange

focused on stablecoin trading, unveiled at the Token2049

conference. The platform employs a proprietary matching engine to

optimize trades and uses PayPal USD (COIN:PYUSDUSD) as its standard

currency. TrueX offers a separation between trade execution and

asset custody, enhancing transaction security. The startup raised

$9 million in funding from various investors, including Paxos and

the Solana Foundation.

River launches proof of reserves to enhance Bitcoin transparency

River, a Bitcoin exchange in the U.S., has introduced the River

Proof of Reserves, allowing clients to verify that their Bitcoin

assets are fully reserved. Following failures of exchanges like

FTX, this measure aims to boost trust. CEO Alex Leishman emphasized

that this initiative sets a new standard for transparency, with

River currently securing over $800 million in Bitcoin for its

clients.

SIX considers launching cryptocurrency platform for institutional

investors

According to the Financial Times, the Swiss stock exchange SIX

is exploring the launch of a cryptocurrency trading platform in

Europe. Targeted at institutional investors, the platform would

support spot and derivative trading. SIX aims to leverage its

reputation and Switzerland’s favorable regulations to attract major

investors. This move increases competition with dominant exchanges

like Coinbase and Binance, which account for approximately 70% of

the crypto market’s spot volume.

WisdomTree advances real asset tokenization with new platform

WisdomTree has launched WisdomTree Connect, a platform for

tokenizing real-world assets aimed at businesses and institutions.

Complementing the WisdomTree Prime app, the new platform allows

users to hold tokenized funds in digital wallets using dollars or

the USD Coin stablecoin (COIN:USDCUSD). Initially, tokens will be

minted on the Ethereum blockchain, with plans to include other

blockchains. This initiative aims to integrate traditional and

decentralized finance, expanding access to digital financial

products for businesses and consumers.

Monerium launches EURe, first euro stablecoin in the Cosmos

ecosystem via Noble

Fintech Monerium has launched EURe, the first euro-backed

stablecoin in the Cosmos ecosystem, utilizing the Noble blockchain.

EURe is backed by euro deposits and integrated with the SEPA

system, enabling instant transfers between bank accounts on-chain.

Monerium, regulated under the EU’s MiCA framework, has been a

pioneer in issuing electronic money on blockchains since 2019.

Noble, which also issues USDC from Circle, facilitates

interoperability among over 90 blockchains in Cosmos, promoting

liquidity and fast transfers, with $280 million in assets and over

$3 billion in transfer volume.

Bitcoin ETFs see significant inflows, while Ethereum experiences

outflows

On September 17, Bitcoin ETFs attracted $186.8 million, led by

Fidelity (AMEX:FBTC) with $56.6 million, Bitwise (AMEX:BITB) with

$45.4 million, and Ark (COIN:ARKB) with $42.2 million. VanEck

(AMEX:HODL) and Invesco (AMEX:BTCO) also contributed positively.

Meanwhile, Ethereum ETFs reported net outflows of $15.1 million on

Tuesday, with Grayscale (AMEX:ETHE) seeing a withdrawal of $17.9

million, partially offset by a smaller inflow of $2.8 million from

Grayscale Mini Trust (AMEX:ETH).

Leveraged ETFs from MicroStrategy increase exposure to crypto

market

REX Shares and Tuttle Capital have launched two new leveraged

ETFs, providing 2x long and short exposure to MicroStrategy’s stock

(NASDAQ:MSTR). These ETFs follow the success of a similar fund from

Defiance launched in August that attracted strong demand. With

these launches, investors gain more tools to expose themselves to

the volatility and growth of MicroStrategy in the cryptocurrency

market.

TRON drives growth with increased transactions and Tether usage

The TRON blockchain recorded 225 million transactions and $220

million in fees last month, along with 14.1 million active users.

Growth was fueled by increased Tether (COIN:USDTUSD) transfers and

the success of SunPump, a meme coin creation platform. Despite

facing challenges in DeFi, TRON (COIN:TRXUSD) continues to expand

its capabilities with infrastructure improvements and fee

reductions.

Solana faces criticism over inflation and bot activity on its

network

Solana, one of the most promising blockchains, has faced

criticism for its high inflation and bot activity, according to a

report from Cointelegraph Magazine. While the inflation rate has

decreased from 8% to 5% since 2021, concerns remain about the

sustainability of its economic model. Bot activity has also

inflated transaction volume, with many critics questioning the

authenticity of the network’s demand. Solana (COIN:SOLUSD)

continues to adjust its inflation and governance model to maintain

long-term sustainability.

CleanSpark expands Bitcoin mining with new acquisitions in

Mississippi

CleanSpark (NASDAQ:CLSK) has acquired two new Bitcoin mining

sites in Clinton, Mississippi, for $5.775 million, increasing its

capacity to 60.5 MW. The new sites support S21 Pro miners and will

provide a combined hash rate of 1 exahash per second. The company

plans further expansion, targeting 37 EH/s by the end of 2024 and

50 EH/s in 2025.

Advances in ZK technology drive scalability in blockchains

The month marked a significant advancement in zero-knowledge

(ZK) proofs. Polygon Labs acquired VPUs from Fabric Cryptography to

enhance ZK verification, while Succinct Labs, alongside Optimism,

introduced a framework for migrating optimistic rollups to ZK in an

hour. Additionally, RiscZero announced plans to be the distributed

computing layer for blockchains. These developments accelerate

scalability and privacy, paving the way for proof singularity and

greater adoption of blockchain technology.

Michelle Bond pleads not guilty to campaign finance charges

Michelle Bond, former partner of Ryan Salame, pleaded not guilty

to four campaign finance-related charges in a New York court.

During the September 17 hearing, she contested charges of

conspiracy and illegal contributions, claiming Salame, former

co-CEO of FTX, funded her campaign with $400,000. Salame has

already pleaded guilty and faces a 90-month prison sentence. Bond,

who launched a cryptocurrency think tank, remains free on $1

million bail.

Infinex reaches $40 million in NFT sales in four days

Infinex’s new NFT collection, called Patron, raised over $40

million in sales within the first four days, despite a slowdown in

the NFT market. With over 74% of the tokens sold, Infinex hopes to

attract even more investors. The NFTs are available in three price

tiers, and early participants include major industry names. This

success comes as blue-chip NFT collections, like CryptoPunks and

Bored Ape Yacht Club, face significant declines in their

valuations.

Borderless Capital launches $100 million fund for decentralized

infrastructure

Borderless Capital has announced its third fund, dedicated to

decentralized physical infrastructure networks (DePIN), with a

total of $100 million. The fund aims to invest in blockchain

projects focused on building and maintaining global physical

infrastructure. Led by Álvaro Gracia and Sean Carey, the fund has

the support of Peaq, Solana Foundation, Jump Crypto, and IoTeX.

DePIN allows individuals to contribute resources to decentralized

networks and be rewarded with tokens, promising to revolutionize

critical infrastructure.

Dragonfly Capital seeks $500 million for new crypto-focused fund

Dragonfly Capital, a cryptocurrency venture capital firm, aims

to raise $500 million for its fourth fund, focusing on early-stage

projects. Dragonfly has already secured $250 million and plans to

double that amount by early 2025. Although the goal is smaller than

that of the previous fund, the move reflects ongoing optimism in

the sector, even after recent challenges in the crypto market.

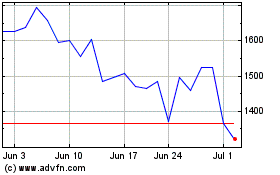

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Aug 2024 to Sep 2024

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Sep 2023 to Sep 2024