Reddit (NYSE:RDDT) – Reddit has partnered with

OpenAI to integrate its content with ChatGPT, boosting the

platform’s shares. This initiative aims to diversify beyond

advertising, following a similar collaboration with Alphabet to

train AI models. Investors see significant revenue potential in

data for AI. Reddit’s shares rose 13.7% in pre-market trading.

Microsoft (NASDAQ:MSFT), Advanced Micro

Devices (NASDAQ:AMD) – Microsoft unveiled plans to offer

cloud computing customers an AMD artificial intelligence chip

platform, directly competing with Nvidia

(NASDAQ:NVDA). The MI300X AI clusters will be available through

Azure, offering an alternative to Nvidia’s GPUs, while the Cobalt

100 processors will also be launched. In other news, the UK’s

second-largest grocery store, Sainsbury’s, has entered a five-year

partnership with Microsoft, using AI to enhance online shopping

experiences, improve search functions, and streamline processes in

physical stores.

Qualcomm (NASDAQ:QCOM) – Ampere Computing

revealed on Thursday a partnership with Qualcomm to produce chips

aimed at energy efficiency in artificial intelligence operations.

The collaboration seeks to optimize data center servers. This

action does not directly compete with Nvidia but aims for

efficiency after training AI models.

Taiwan Semiconductor Manufacturing Co

(NYSE:TSM) – The success of TSMC’s shares may face challenges due

to investment restrictions, leading some investors to seek

alternatives in the artificial intelligence field. Although the

stock has risen 42% this year, investment limitations may lead to a

search for rising tech companies.

Meta Platforms (NASDAQ:META) – EU regulators

announced on Thursday that they will investigate Facebook and

Instagram, both owned by Meta Platforms, for possible violations of

child safety rules. The European Commission has expressed concerns

about the risks to children and the influence of the platforms’

algorithms. Another Meta network, Threads, is testing its version

of TweetDeck, allowing users to pin up to 100 feeds on their

homepages, facilitating content viewing. Similar to TweetDeck, the

new experience is only available on the web and has no additional

cost.

Alphabet (NASDAQ:GOOGL) – Google, represented

by Alphabet, seeks a non-jury trial in the U.S. Department of

Justice’s lawsuit over anti-competitive practices in online

advertising. The department accuses the giant of abusing its market

dominance, seeking to force it to sell its ad management

bundle.

Amazon (NASDAQ:AMZN) – Amazon’s new cloud

chief, Matt Garman, will take over a $100 billion per year

business, more profitable than ever. He faces the challenge of

maintaining AWS’s leadership in the era of artificial intelligence,

succeeding Adam Selipsky, who will step down in June.

Disney (NYSE:DIS), Warner Bros

Discovery (NASDAQ:WBD), Fox Corporation

(NASDAQ:FOX) – Disney, Warner Bros Discovery, and Fox are joining

forces to launch the sports streaming service Venu Sports this

year, revealed Pete Distad, CEO of the venture. Venu Sports will be

accessible through a new app and can be bundled with Disney+, Hulu,

or Max. The joint venture awaits regulatory approval and the

finalization of definitive agreements, aiming to reach 5 million

subscribers in the first five years. The potential market is

estimated at 50 to 60 million users.

Spotify (NYSE:SPOT) – Spotify is at the center

of controversy with songwriters due to changes in its contractual

classification, now self-styled as a “bundle,” which may reduce

royalties for songwriters. The National Music Publishers’

Association (NMPA) sent a letter demanding the removal of

unlicensed songs in podcasts hosted on the platform.

Tesla (NASDAQ:TSLA) – Tesla is planning to use

Chinese data to train algorithms to develop its advances in

autonomous driving, including the possibility of a data center in

China. CEO Elon Musk is seeking approvals to transfer data and

discusses licensing the FSD. Additionally, Tesla received approval

from the local board to expand its factory in Germany despite

protests. The expansion aims to double the capacity to 100

gigawatt-hours of battery production and 1 million cars per

year.

Xpeng (NYSE:XPEV) – Xpeng expressed concerns

about new U.S. tariffs on Chinese electric vehicles, highlighting

obstacles to carbon neutrality. Additionally, the company plans to

expand into European markets despite barriers. The EU’s

anti-subsidy investigation and the U.S.-China trade war also affect

its global expansion strategies.

General Motors (NYSE:GM) – General Motors and

LG Energy Solution agreed to establish a $150 million fund to

compensate owners affected by the recall of defective Chevrolet

Bolt EV batteries. Eligible owners who received battery

replacements or software updates may receive up to $1,400.

Toyota Motor (NYSE:TM) – Toyota Motor faced

repeated shutdowns at its Tijuana factory in Mexico due to local

labor shortages and technical issues, halting production for 19

days in February and March.

Ford Motor (NYSE:F) – Ford has asked its

electric vehicle suppliers to cut costs, citing the need for

profitability. Liz Door, director of the supply chain, emphasized

the importance of affordable products, encouraging cost efficiency.

The company aims to reduce operational losses and focus on hybrids

before fully electric cars.

Boeing (NYSE:BA) – At today’s annual general

meeting, Boeing shareholders will vote on whether the outgoing CEO,

Dave Calhoun, should remain on the board, while the new president,

Steve Mollenkopf, will face his first public appearance. The

company’s crisis, including investigations and production declines,

makes the choice of the next leader crucial.

Spirit AeroSystems (NYSE:SPR) – Spirit

AeroSystems is reducing its workforce in Wichita, Kansas, due to a

slowdown in Boeing’s production. Although no exact number was

announced, an internal memo mentioned about 400 layoffs, with the

company committed to conducting the transition compassionately,

according to KSN.

United Airlines (NASDAQ:UAL) – On Thursday, the

Federal Aviation Administration (FAA) denied approval for United

Airlines to expand routes or fleets and required its supervision

during final inspections of new aircraft. The FAA is reviewing

safety following incidents, with the timeline depending on the

ongoing safety assessment.

Lockheed Martin (NYSE:LMT) – Lockheed Martin

faces delays in the F-35 fighter due to a problematic $1.8 billion

upgrade, postponing advanced missions until 2025, reported by the

Government Accountability Office. Additionally, problems with

software and hardware delay the delivery of TR-3 jets, while the

Pentagon withholds payments.

Hess (NYSE:HES), Chevron

(NYSE:CVX) – At a special meeting on May 28, Hess shareholders will

vote on Chevron’s $53 billion offer, stated Glass Lewis. While they

consider the offer reasonable, they note uncertainties regarding

arbitration between Hess and partners in Guyana. The merger awaits

regulatory approval. Additionally, Chevron plans to sell its

remaining North Sea oil and gas assets, marking its exit after more

than 55 years.

ABB Ltd (NYSE:ABB) – ABB agreed to acquire

Siemens’ wiring accessories business in China, expanding its market

reach and complementing its offerings in smart buildings. The deal,

whose price was not disclosed, includes a company that manufactures

wiring accessories and home automation products.

GSK (NYSE:GSK) – British GSK raised $1.52

billion (£1.25 billion) by selling its remaining stake in the

consumer health company, Haleon, to institutional investors. This

will allow GSK to reinforce its focus on vaccines, cancer, and

infectious diseases, aligned with CEO Emma Walmsley’s plans to

boost profits.

Johnson & Johnson (NYSE:JNJ) – J&J

announced the acquisition of Proteologix for $850 million in cash,

aiming to access experimental treatments for atopic dermatitis.

Proteologix’s antibodies PX128 and PX130 are in development for

moderate to severe eczema and asthma, complementing J&J’s

efforts. The transaction awaits regulatory approval and other

closing conditions.

JPMorgan Chase (NYSE:JPM) – Investors eagerly

await JPMorgan Chase’s succession plans after a year of record

profits, seeking insights into artificial intelligence and

opportunities beyond traditional banking. CEO Jamie Dimon will

highlight growth strategies and financial goals next Monday, as the

bank seeks innovation and leadership in a diverse market.

Goldman Sachs (NYSE:GS), United Parcel

Service (NYSE:UPS) – UPS has hired Goldman Sachs to manage

its pension fund assets in the U.S. and Canada, valued at $43.4

billion. This move reflects Goldman’s pursuit of growth in asset

management and allows UPS to focus on its core business.

Bank of America (NYSE:BAC) – Bank of America

strategists predict that long-term bonds will return at the end of

2024, driven by softer macroeconomic conditions. Michael Hartnett

and his team note a possible reversal of the “everything but bonds”

trade due to weak economic signals.

New York Community Bancorp (NYSE:NYCB) – NYCB

announced on Thursday the resignation of its chief operating

officer, Julie-Ann Signorille-Browne, effective from May 24.

Jefferies Financial Group (NYSE:JEF) – A

Jefferies risk manager, Jennifer Miranda, questioned the urgency of

withdrawing large sums from the Archegos Capital Management

account. She testified about the rush by Becker, the former head of

risk management at Archegos, to withdraw money, unaware of the

company’s frenzied trading campaign.

Mizuho Financial Group (NYSE:MFG) – Andy Laszlo

has been promoted to head of investment in technology, media, and

telecommunications and corporate banking at Mizuho Financial Group.

He succeeds Rich Gallivan, who will take over as the bank’s

technology president for the Americas, reporting to Laszlo.

Additionally, Mizuho recently completed the acquisition of

Greenhill & Co.

Blackstone (NYSE:BX) – Blackstone agreed to

acquire a majority stake in Priority Software, an Israeli

enterprise software company, for $800 million. Current investors,

Fortissimo Capital and TA Associates, will retain stakes. The

acquisition highlights the growing technological activity in

Israel, despite the ongoing conflict with Hamas in Gaza.

Carlyle Group (NASDAQ:CG) – Carlyle Group

agreed to acquire about $450 million in loans from Sungage

Financial, as traditional banks retreat. This includes a minority

stake in Sungage, helping diversify its financing. Sungage offers

financing for solar energy, roofing, and batteries.

Under Armour (NYSE:UAA) – Under Armour Inc. is

undergoing restructuring, focusing on men’s apparel and staff cuts,

as founder Kevin Plank retakes control.

Unilever (NYSE:UL) – Unilever will continue to

produce Cornetto and Carte D’Or in Russia, despite selling its

global ice cream unit. The Russian ice cream division will remain

intact, while the company faces pressures to exit the country due

to the Ukraine invasion. Unilever’s sales in Russia increased last

year.

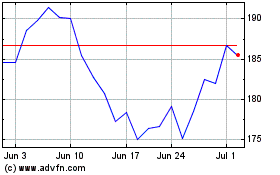

Boeing (NYSE:BA)

Historical Stock Chart

From May 2024 to Jun 2024

Boeing (NYSE:BA)

Historical Stock Chart

From Jun 2023 to Jun 2024