JFrog and Akamai Drop Over 10% Despite Strong Profits; Sweetgreen, Array, SoundHound Surge, and More in Earnings

May 10 2024 - 7:58AM

IH Market News

Akamai Technologies (NASDAQ:AKAM) – Akamai

shares fell 10.8% in pre-market, influenced by a disappointing

projection for the second quarter. The company estimated adjusted

earnings between $1.51 and $1.56 per share, with revenues expected

between $967 million and $986 million. In contrast, analysts

surveyed by LSEG had expected earnings of $1.63 per share and

revenue of $1 billion. In the first quarter, Akamai posted revenue

of $987 million, marking an 8% increase from the previous year. Its

adjusted earnings reached $1.64 per share, at the upper end of the

company’s guidance range of $1.59 to $1.64 per share.

JFrog (NASDAQ:FROG) – JFrog shares fell 12.3%

in pre-market despite exceeding analysts’ expectations in earnings

and revenues in the first quarter. JFrog reported quarterly

earnings of $0.16 per share and revenue of $100.31 million,

surpassing the consensus estimate of $0.14 per share, while revenue

grew from the previous year when it recorded $79.82 million. The

software development company forecasts revenue between $103 million

and $104 million, with adjusted earnings between 13 and 15 cents

per share in the second quarter.

Sweetgreen (NYSE:SG) – Shares rose 16.7% in

pre-market after Sweetgreen reported revenue of $158 million in the

first quarter, surpassing the consensus estimate from LSEG of $152

million. Sweetgreen reported an EPS of $0.23, worse than the $0.18

estimate. Sweetgreen sees revenue for fiscal year 2024 of $660-675

million, against the consensus of $667 million.

Array Technologies (NASDAQ:ARRY) – Array

Technologies shares rose 15% in pre-market after reporting adjusted

earnings of 6 cents per share in the first quarter, with revenue

totaling $153.4 million. Analysts surveyed by FactSet had forecast

a loss of 4 cents per share on revenue of $141.2 million.

Dropbox (NASDAQ:DBX) – Dropbox shares rose 1.6%

in pre-market after reporting adjusted earnings of 58 cents per

share and revenue of $631 million. Analysts surveyed by LSEG had

expected earnings per share of 50 cents on revenues of $629

million.

Unity Software (NYSE:U) – Unity Software shares

fell 1.1% in pre-market. In the first quarter, the company reported

a loss of 75 cents per share, exceeding analysts’ forecast surveyed

by LSEG, which was a loss of 63 cents per share. However, the

company’s revenue reached $460 million, surpassing the consensus

estimate of $432 million.

SoundHound (NASDAQ:SOUN) – SoundHound shares

rose 14.5% in pre-market after exceeding revenue estimates,

although it still recorded a loss. The voice and speech recognition

AI company reported a net loss of $19.9 million, or 12 cents per

share. On an adjusted basis, it earned 7 cents per share. Revenue

increased to $11.6 million, up from $6.7 million the previous year.

The company projects revenues of $65 million to $77 million for the

full year.

Gen Digital (NASDAQ:GEN) – Gen Digital shares

are stable in pre-market after the company reported adjusted

earnings of 53 cents in the fourth fiscal quarter, showing a 15%

increase compared to the same period last year. Additionally,

revenue reached $967 million, representing a 2% increase.

Yelp (NYSE:YELP) – Yelp shares fell 7.1% in

pre-market after announcing a slight downward revision of revenue

projections for the second quarter. Although the company reported

earnings of 20 cents per share in the first quarter, surpassing

analysts’ predictions of 6 cents per share. The revenue for the

period remained in line with expectations, totaling $333

million.

Insulet (NASDAQ:PODD) – Insulet shares are

stable in pre-market. The company reported earnings of 23 cents per

share, below the consensus forecast from FactSet, which was 40

cents per share. However, Insulet’s revenue reached $441.7 million,

surpassing expectations of $424.1 million and representing a 23.3%

increase from the same quarter last year. For the second quarter,

the company projects revenue growth between 15% and 18%,

maintaining an expected gross margin between 68% and 69%, while

projections for the operating margin were adjusted to about

13.5%.

Victoria’s Secret (NYSE:VSCO) – Victoria’s

Secret reported that its preliminary sales and adjusted earnings

for the first quarter met or exceeded its previous projections,

despite a 3% to 4% drop in net sales, better than expected, driven

by robust online performance and positive reception to new

products. The company announced adjusted earnings per share in the

range of $0.07 to $0.12, surpassing the consensus estimate of

-$0.03. CEO Martin Waters highlighted that although sales trends

are improving, the U.S. retail market remains challenging, with

increased discounting and competition. The company maintained its

annual projection.

Honda Motor (NYSE:HMC) – Honda Motor achieved a

Return on Invested Capital (ROIC) of 9.1% and a Return on Equity

(ROE) of 9.3%. Its operating profit reached a record high of $1.96

billion. Honda projects an increase in operating profit for the

full year, estimated at $9.13 billion, with an operating profit

margin of 7%.

Marathon Digital (NASDAQ:MARA) – Marathon

Digital shares rose 1.2% in pre-market trading after announcing

record net income in the first quarter, reaching $337.2 million, or

$1.26 per share, compared to $118.7 million, or 72 cents per share,

in the previous year. Despite operational challenges, revenue rose

to $165.2 million. The company’s HODL strategy, holding large

amounts of Bitcoin, contributed to the positive results.

Bloom Energy Corp. (NYSE:BE) – Bloom Energy

shares rose 5.3% in pre-market despite a larger quarterly loss and

lower revenues. In the first quarter, Bloom Energy recorded a loss

of $57.5 million, or 25 cents per share, compared to a loss of

$71.6 million, or 35 cents per share, in the same period last year.

Revenue fell 15% to $235.3 million. Product and service revenues

totaled $209.8 million, a drop of 11%. The company announced a deal

with Intel (NASDAQ:INTC) for the largest fuel

cell-powered data center in Silicon Valley. The outlook for 2024

remains unchanged, with revenues between $1.4 billion and $1.6

billion.

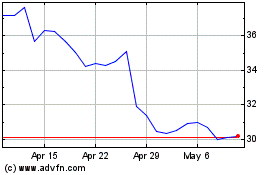

Intel (NASDAQ:INTC)

Historical Stock Chart

From Apr 2024 to May 2024

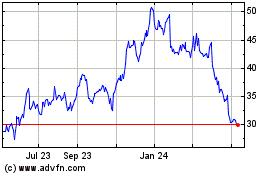

Intel (NASDAQ:INTC)

Historical Stock Chart

From May 2023 to May 2024