U.S. Index Futures Dip, Bank of England Holds Interest Rates at 5.25%

May 09 2024 - 7:47AM

IH Market News

U.S. index futures are trading lower in pre-market trading on

Thursday, halting momentum after the Dow Jones had closed higher

for six consecutive sessions, the longest winning streak of 2024

for the index so far.

As of 7:05 AM, Dow Jones futures (DOWI:DJI) fell 81 points, or

-0.21%. S&P 500 futures fell -0.20%, and Nasdaq-100 futures

lost -0.25%. The yield on 10-year Treasury bonds stood at

4.512%.

In the commodities market, West Texas Intermediate crude for

June rose 0.87%, to $79.68 per barrel. Brent crude for July rose

0.78%, near $84.23 per barrel. Iron ore traded on the Dalian

exchange fell 1.65%, to $119.76 per metric ton.

On the economic agenda for this Thursday, the release of

unemployment insurance claims for the week ended last Saturday is

scheduled for 8:30 AM by the Department of Labor.

European markets are showing mixed performance in today’s

session. The Bank of England kept interest rates at 5.25% after the

May meeting, with a 7-2 vote against reduction. Despite signs of

persistent inflation, the market expects cuts starting in June, and

three or more cuts in 2024, in response to the forecast drop in

inflation due to reduced energy prices.

Stock markets in Asia and the Pacific closed mixed. In mainland

China and Hong Kong, the markets recorded notable gains, driven by

a surprisingly positive performance in China’s foreign trade. The

real estate and semiconductor sectors played a crucial role in this

rise, benefiting from the strength of recent economic indicators.

Specifically, China’s exports in April showed an annual growth of

1.5%, a result that exceeded expectations, especially after a

significant drop in the previous month. Additionally, an 8.4%

increase in imports signaled a more robust domestic demand than

expected. In contrast, the Nikkei in Japan and the Kospi in South

Korea ended the day with losses of -0.34% and -1.20%,

respectively.

Wall Street exhibited mixed performance on Wednesday. While the

Dow Jones advanced 0.44% for the sixth consecutive day, reaching

its highest level in more than a month, the S&P 500 closed flat

while the Nasdaq fell 0.18%. The president of the Minneapolis

Federal Reserve, Neel Kashkari, contributed to the instability by

suggesting that interest rates might remain high for an extended

period. However, the expectation is still for a possible rate cut

in the third quarter, with the CME Group’s FedWatch tool currently

indicating an 83.5% chance that rates will be lower by

September.

Scheduled to present quarterly reports before the market opens

are Roblox (NYSE:RBLX), Warner Bros

Discovery (NASDAQ:WBD), Viatris

(NASDAQ:VTRS), Canadian Solar (NASDAQ:CSIQ),

Cronos Group (NASDAQ:CRON),

Sundial (NASDAQ:SNDL), Constellation

Energy (NASDAQ:CEG), Plug Power

(NASDAQ:PLUG), GigaCloud Technology (NASDAQ:GCT),

Medical Property Trust (NYSE:MPW), among

others.

After the close, the numbers from Unity

Software (NYSE:U), CleanSpark

(NASDAQ:CLSK), SoundHound (NASDAQ:SOUN),

Marathon Digital (NASDAQ:MARA),

Vuzix (NASDAQ:VUZI), RCI Hospitality

Holdings (NASDAQ:RICK), Blink

(NASDAQ:BLNK), ADMA Biologics (NASDAQ:ADMA),

Indie Semiconductor (NASDAQ:INDI),

CaliberCos (NASDAQ:CWD), and more will be

awaited.

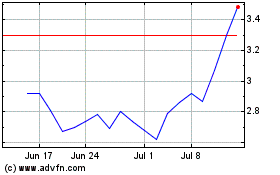

Blink Charging (NASDAQ:BLNK)

Historical Stock Chart

From Apr 2024 to May 2024

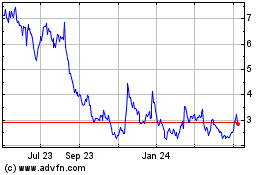

Blink Charging (NASDAQ:BLNK)

Historical Stock Chart

From May 2023 to May 2024