UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 12(g)

OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2015

Commission file number: 333-156832

I.R.S. Employer I.D. #: 56-2646829

WRIT MEDIA GROUP, INC.

a Delaware corporation

8200 Wilshire Boulevard,

Suite 200

Beverly Hills, CA 90211

310.461.3737

Indicate by check mark if the registrant is

a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [x] No

Indicate by check mark if the registrant is not required to file reports pursuant

to Section 13 or Section 15(d) of the Exchange Act from their obligations under those Sections. [ ] Yes [x] No

Indicate by check mark whether the registrant

has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports). [x] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted

on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required

to submit and post such files). [x] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation

S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge,

in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this

Form 10-K. [X]

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer |

[ ] |

|

Accelerated filer |

[ ] |

| Non-accelerated filer |

[ ] |

(Do not check if a smaller reporting company) |

Smaller reporting company |

[x] |

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). [ ] Yes [x] No

The aggregate market value of the voting common

equity held by non-affiliates, computed by reference to the average bid and asked price of such common equity, as of the last

business day of our most recently completed fiscal year, was approximately $457,864.

The number of shares outstanding of our Common

Stock is 2,309,056 as of December 14, 2015.

The number of shares outstanding of our Preferred

Stock is 7,500 as of December 14, 2015.

There are no other classes of stock.

TABLE OF CONTENTS

| | |

| |

Page |

| PART I | |

| | |

| |

| | |

| ITEM 1. | |

Business. | |

| 3 | |

| | |

| |

| | |

| ITEM 1A. | |

Risk factors. | |

| 3 | |

| | |

| |

| | |

| ITEM 1B. | |

Unresolved staff comments. | |

| 6 | |

| | |

| |

| | |

| ITEM 2. | |

Properties. | |

| 6 | |

| | |

| |

| | |

| ITEM 3. | |

Legal proceedings. | |

| 6 | |

| | |

| |

| | |

| PART II | |

| | |

| |

| | |

| ITEM 5. | |

Market for registrant's common equity, related Stockholder matters and issuer purchases of equity securities. | |

| 7 | |

| | |

| |

| | |

| ITEM 6. | |

Selected Financial Data | |

| 9 | |

| | |

| |

| | |

| ITEM 7. | |

Management's discussion and analysis of financial condition and results of operations. | |

| 9 | |

| | |

| |

| | |

| ITEM 7A | |

Quantitative and qualitative disclosures about market risk. | |

| 15 | |

| | |

| |

| | |

| ITEM 8 | |

Financial statements and supplementary data | |

| 16 | |

| | |

Consolidated Balance Sheets | |

| 17 | |

| | |

Consolidated Statements of Operations | |

| 18 | |

| | |

Consolidated Statements of Changes in Shareholders’ Deficit | |

| 19 | |

| | |

Consolidated Statements of Cash Flows | |

| 20 | |

| | |

Note to Consolidated Financial Statements | |

| 21 | |

| | |

| |

| | |

| ITEM 9 | |

Changes in and disagreements with accountants on accounting and financial disclosure. | |

| 33 | |

| | |

| |

| | |

| ITEM 9A. | |

Controls and Procedures. | |

| 33 | |

| | |

| |

| | |

| ITEM 9B. | |

Other Information | |

| 34 | |

| | |

| |

| | |

| PART III |

| | |

| |

| | |

| ITEM 10. | |

Directors, executive officers, and corporate governance | |

| 35 | |

| | |

| |

| | |

| ITEM 11. | |

Executive compensation. | |

| 36 | |

| | |

| |

| | |

| ITEM 12. | |

Security ownership of certain beneficial owners and management and related stockholder matters. | |

| 37 | |

| | |

| |

| | |

| ITEM 13. | |

Certain relationships and related transactions, and director independence | |

| 38 | |

| | |

| |

| | |

| ITEM 14. | |

Principal accountant fees and services. | |

| 39 | |

| | |

| |

| | |

| ITEM 15. | |

Exhibits and financial statement schedules. | |

| 39 | |

PART I

ITEM 1. BUSINESS.

Writ Media Group, Inc.

(“we”, “us”, “our”, “WRIT”, or the “Company”) (formerly Writers’

Group Film Corp.) was incorporated in Delaware on March 9, 2007 to produce films, television programs and similar entertainment

programs for various media formats.

Front Row Networks (“FRN”)

was incorporated on July 27, 2010 in the State of Nevada. The Company is a content creation company which intends to produce,

acquire, license, and distribute music-related content in 3D and ultra-high definition (4K) for initial worldwide digital broadcast

into digitally-enabled movie theaters. Through the distribution of music-related “alternative content,” the Company

intends to present live concerts, music documentaries, and other music-related content at affordable prices, to a massive fan

base worldwide in a cost-effective manner. Following an initial theatrical run, or as an initial distribution window, the content

will be licensed, in both 2D, 4K and 3D formats, to DVD and Blu-Ray retailers, Free TV broadcasters, cable and emerging 3D cable

channels, and mobile streaming providers. In some cases, Front Row Networks will also sell merchandising and other products, bolstered

by both in-theater and in-App advertising, tailored around each Artist and/or event, to maximize potential merchandising and sponsorship

revenues.

In February 2011, FRN

completed a reverse acquisition transaction through a share exchange with WRIT, whereby WRIT acquired 100% of the issued and outstanding

capital stock of FRN in exchange for 100,000 shares of the Common Stock of WRIT. As a result of the reverse acquisition, FRN became

WRIT’s wholly-owned subsidiary and the former FRN’s shareholders became controlling stockholders of WRIT. The share

exchange transaction with WRIT was treated as a reverse acquisition, with FRN as the accounting acquirer and WRIT as the acquired

party.

Consequently, the assets

and liabilities and the historical operations were reflected in the consolidated financial statements for periods prior to the

Share Exchange Agreement were those of FRN and will be recorded at the historical cost basis. After the completion of the Share

Exchange Agreement, the Company’s consolidated financial statements included the assets and liabilities of both FRN and

WRIT, the historical operations of FRN and the operations of WRIT from the closing date of the Share Exchange Agreement.

On July 7, 2011, we modified

our February 2011 Share Exchange Agreement and agreed to assume $100,000 in new debt which is shown as a reduction of our Paid-In

Capital.

While the core business

of Front Row Networks remains the licensing, production, acquisition and distribution of music-related content and programming,

the core business is dependent upon negotiating and financing projects with schedules that are solely determined by third parties,

such as Artists and rights owners. In order to secure less cyclical entertainment product, the Company sought to license or purchase

entertainment content that could be easily secured and distributed through the multiple distribution arrangements already established

by the Company and via the rapidly growing marketplace represented by consumers of mobile, internet, and TV set-top devices. To

reach this goal during the fiscal year, the Company set out to acquire exclusive branded content and entertainment programming,

and achieved this goal through the acquisition of Amiga Games Inc.

On August 19, 2013, the

Company completed an acquisition transaction through a share exchange with Amiga Games Inc., whereby WRIT acquired 100% of the

issued and outstanding capital stock, assets, and trademarks of Amiga Games Inc. in exchange for 500,000 shares of the Common

Stock of WRIT. As a result of the acquisition, Amiga Games Inc. became WRIT’s wholly-owned subsidiary.

Amiga Games Inc. licenses

classic pre-Windows computer game libraries and adapts and republishes the most popular titles for smartphones, modern game consoles,

PCs, tablets, and other television streaming devices. WRIT also established a new company, Retro Infinity Inc., to publish and

brand games that were not originally released for Amiga brand computers. The two companies tap into the growing “retro gaming”

marketplace, building on the "Amiga", “Atari”, and “MS-DOS” brands, delivering retro-gaming

titles adapted for modern devices as well as merchandise featuring brands and characters from the games.

During the 2014 fiscal

year, Amiga Games Inc. and Retro Infinity Inc. entered several marketing and distribution agreements, including those with Microsoft

Corporation and Roku Inc. Both agreements include minimum guarantees, defined as advances against future sales. Additionally,

the Retro Infinity Inc. licensed dozens of classic games for distribution via the Windows 8, Roku player, iOS (Apple), and Android

platforms. Although it was the Company’s strategic goal to distribute a broad range of video game titles on the Windows

8 and iOS platforms in the 4th quarter of 2014, lack of operating capital caused the Company to temporarily halt software

development funding, which delayed the Company’s overall gaming product release schedule. This temporary reduction in operating

capital was due to mainly to regulatory delays encountered in structuring WRIT’s equity-line financing, and the Company’s

difficulty in raising alternative investment capital, due to its sub-penny share price at the time.

On January 22, 2014, the Company changed the name of the corporation to WRIT Media

Group, Inc., and authorized a 1 for 1,000 reverse split of the Company’s issued and outstanding shares of Common

Stock. The name change was authorized to encompass the Company's broadened

activities, including additional business plans and models, and the acquisition and formation of new subsidiaries. The equity

restructuring was authorized to achieve the following: (a) price per share -- the rollback will increase the price per share

to above $0.01, sub-penny markets are getting harder to trade and next to impossible to finance; (b) funding -- with a sub

penny share price the Company was unable to fund because of dilution, post rollback the share price should be well above

$0.01 and allow management to close on numerous funding opportunities that have been presented; (c) larger potential audience

-- with a higher share price the Company will have access to investors who do not trade sub penny stocks such as institutions

and Europeans; (d) listing in Europe -- the Company will now be able to list its common shares for trading on a European

Stock Exchange, as co-listings in Europe are not accepted with a sub penny share price; and (e) acquisitions -- the Company

will be able to use common shares to acquire larger assets and other industry related companies.

On January 16, 2014 WRIT’s

Equity Line Financing (“ELF”) agreement with Dutchess Opportunity Fund II, and its corresponding S1 registration statement,

was declared effective by the SEC. The ELF agreement, executed in September 2013, allows but does not require WRIT to sell up

to US$10,000,000 of common stock to Dutchess at a 5% discount to market price, during the 36 month term.

Compared to the Company’s convertible debt financing, ELFs provide a lower discount to market that minimize dilution

while increasing operating capital. This additional financing source allowed the company to reduce debt and reduce the balance

of the more expensive convertible notes that were outstanding during the last quarter of the fiscal year. As of March 31, 2014,

21,829 common shares were sold generating a net amount to the company of $4,023.

On February 4, 2014 the

Company completed its administrative and legal work with the Depository Trust & Clearing Corporation ("DTCC") and

the DTCC's long-standing "Administrative Chill" on clearing WRIT stock certificates was removed. DTCC resumed accepting

deposits of the Company's common stock for book entry transfer services. As a result, shareholders with online brokerage accounts

at firms such as Scottrade, ETRADE, TD Ameritrade and other full service brokerage firms are allowed to deposit new shares of

WRIT's common stock in the electronic system that controls clearance and settlement. The reinstatement of the DTC depository services

is an instrumental and enormous accomplishment for WRIT, which greatly reduced the costs and expenses associated with private

equity investments in the Company.

In September 2014 the

Company launched two online point of sale platforms; www.RetroInfinity.com and www.AmigaGamesInc.com to market its “retro”

gaming titles directly to consumers. Both sales platforms initially offer only downloads for windows based computers. The online

store launch was completed in conjunction with an initial marketing program which featured NASCAR, the RWR Retro Infinity NASCAR

race team, and the “Drive to Championship Weekend” branding program. In December 2014 the Company intended to launch

additional titles on additional mobile platforms, such as Windows phone, iOS, and Android platforms, so that the video game titles

can be downloaded as Apps on various mobile devices, the Company experienced additional financing delays which interrupted software

development and caused the Company to reschedule the anticipated release on mobile platforms into 2015. The online store launch

generated an increase in consumer traffic to the Company’s websites and created awareness in the Company’s product,

but generated minimal sales, most consumers were interested only in the mobile versions of the gaming titles, which were not yet

available and still in development.

The websites are currently

being modified to accept payment for crowdfunding transactions, and we launched the Retro Infinity/Amiga Games crowdfunding platform,

supported by a social marketing campaign, in the 3rd quarter of 2015. The initial crowdfunding campaign was not successful, so

the Company is seeking additional financing from strategic partners that will allow the Company to resume and complete software

development, and commence product marketing activities.

On June 25, 2015, the

Company authorized a 1 for 200 reverse split of the Company’s issued and outstanding shares of Common Stock. The equity

restructuring was authorized to achieve the following: (a) price per share -- the rollback will increase the price per share to

above $0.01, sub-penny markets are getting harder to trade and next to impossible to finance; (b) funding -- with a sub penny

share price the Company was unable to fund because of dilution, post rollback the share price should be well above $0.01 and allow

management to close on numerous funding opportunities that have been presented; (c) larger potential audience -- with a higher

share price the Company will have access to investors who do not trade sub penny stocks such as institutions and Europeans; (d)

listing in Europe -- the Company will now be able to list its common shares for trading on a European Stock Exchange, as co-listings

in Europe are not accepted with a sub penny share price; and (e) acquisitions -- the Company will be able to use common shares

to acquire larger assets and other industry related companies.

We believe WRIT is well

positioned to benefit from the market growth and increased demand for mobile gaming content, and intend to continue to look for

opportunities to finance and complete its software development so that it can distribute both music and video game content, though

acquisitions and licensing arrangements. Throughout the year, the Company also intends to continue to explore business relationships

with entities that have the resources to offer financing, distribution and marketing of WRIT’s product.

ITEM 1A. RISK FACTORS.

1. Our auditor has expressed

substantial doubt regarding our ability to continue as a going concern.

We continue to incur losses in our operations. While we expect to generate revenues

within the next fiscal year, there is no assurance that we will be successful.

2. The creation of content

for the entertainment industry is highly competitive and we will be competing with companies with much greater resources than

we have.

The business in which

we engage is significantly competitive. Each of our primary business operations is subject to competition from companies

which, in some instances, have greater development, production, and distribution and capital resources than us. We compete for

relationships with a limited supply of facilities and talented creative personnel to produce our films. We will compete

with major entertainment companies, such as Sony, Warner Brothers, Disney, AEG, Live Nation, Electronic Arts, Ubisoft, and others

for content. We also anticipate that we will compete with a large number of United States-based and international distributors

and sub-distributors of alternative content including divisions of Sony/MGM, Cinedigm Digital Cinema Corp., NCM Fathom, and Screenvision

in the production of music-related and event content that may be expected to appeal to national and international audiences. Additionally,

our video games will compete with thousands of other “Apps” which are available in the App stores of Apple, Samsung,

Microsoft and other mobile stores. More generally, we anticipate we will compete with various other leisure-time activities, such

as home videos, movie theaters, personal computers and other alternative sources of entertainment.

The production and distribution

of music-content and mobile Apps are significantly competitive businesses, as they compete with each other, in addition to other

forms of entertainment and leisure activities. There will be a proliferation of free TV broadcasters, cable and emerging

HD cable channels, and mobile streaming providers looking to acquire content, which may not include music-related content or video

games.

There is also active competition among all companies in the entertainment and related

industries for services of software developers, producers, directors, musicians and other Artists, and for the acquisition of

entertainment properties. The increased number of entertainment offerings in the United States and abroad has resulted

in increased competition for audience attention and may have an effect on the Company’s ability to acquire and produce product.

Revenues for any entertainment products depend in part on general economic conditions, but the competitive situation of an entertainment

product offering is still greatly affected by the quality of, and public response to, the entertainment product that the artist

makes available to the marketplace.

There is strong competition

throughout the converging mobile device and television industries, from cable providers, handset and tablet manufactures, major

motion picture studios, video game publishers, and other independent technology companies, as well as from new entertainment content

and viewing opportunities that have not yet reached the market.

3. Audience acceptance

of our content will determine our success, and the prediction of such acceptance is inherently risky.

We believe that our live concert theatrical success will be dependent upon general

public acceptance, marketing, advertising and the quality of the production. The Company's production will compete

with numerous independent and foreign productions, in addition to productions produced and distributed by a number of major

domestic companies, many of which are divisions of conglomerate corporations with assets and resources substantially greater

than that of ours. Our management believes that in recent years with the current promotion of 3D and 4K movies and

equipment, and with the rapid growth rate in available mobile apps, that there has been an increase in competition in

virtually all facets of our business. The growth of mobile content, pay-per-view television, and home video streaming

products may have an effect upon theater attendance and non-theatrical motion picture distribution. As we may distribute

productions to all of these markets, it is not possible to determine how our business will be affected by the developments,

and accordingly, the resultant impact on our financial statements. Moreover, audience acceptance can be affected

by any number of things over which we cannot exercise control, such as a shift in leisure time activities or audience

acceptance of a particular style of music or artist.

4. The competition for

booking screens may have an adverse effect on theatrical revenues.

In the distribution of

motion pictures, there is very active competition to obtain bookings of pictures in theaters and television networks and stations

throughout the world. A number of major motion picture companies have acquired motion picture theaters. Such

acquisitions may have an adverse effect on our distribution endeavors and our ability to book certain theaters which, due to their

prestige, size and quality of facilities, are deemed to be especially desirable for motion picture bookings.

5. The competition for securing premier

placement of mobile apps may have an adverse effect on video gaming revenues.

In the distribution of

mobile apps, including the Company’s video games, there is very active competition to obtain premiere placement and advertising

dollars from mobile manufacturers and service providers throughout the world. A number of major software publishers

have acquired such relationships and opportunities with the major carriers and handset manufacturers. Such agreements

may have an adverse effect on our sales, marketing and distribution endeavors, and our ability to obtain premier App store placement,

due to the prestige, size and quality of the established companies’ product lines.

6. We have limited financial

resources and there are risks we may be unable to acquire financing when needed.

To achieve and maintain

competitiveness, we may be required to raise substantial funds. Our forecast for the period for which our financial

resources will be adequate to support our operations involves risks and uncertainties and actual results could fail as a result

of a number of factors. We anticipate that we may need to raise additional capital to develop, promote and distribute our

product and to acquire property rights of the artists or publishers. Such additional capital may be raised through

public or private financing as well as borrowings and other sources. Public or private offerings may dilute the ownership

interests of our stockholders. Additional funding may not be available under favorable terms, if at all. If

adequate funds are not available, we may be required to limit our operations significantly or to obtain funds through entering

into arrangements with collaborative partners or others that may require us to relinquish rights to certain products and services

that we would not otherwise relinquish and thereby reduce revenues to the company.

7. We are at the risk

of mobile telephone and internet competition which may develop and the effects of which we cannot predict.

The mobile phone application

and internet market is new, rapidly evolving and intensely competitive. We believe that the principal competitive factors

in maintaining a mobile telephone application and an internet business are selection, convenience of download and other features,

price, speed and accessibility, customer service, quality of image and site content, and reliability and speed of fulfillment. Although

we intend to be able to compete in this market, when new technology is further developed, many potential competitors have longer

operating histories, more customers, greater brand recognition, and significantly greater financial, marketing and other resources. In

addition, larger, well-established and well-financed entities may acquire, invest in, or form joint ventures as the Internet,

and e-commerce in general, continue to become more widely accepted.

In addition, we will face

competition on any sale of merchandise that is tailored to an artist, video game publisher, or sponsor. Many of our

existing competitors, in addition to a number of potential new competitors, have significantly greater financial, technical and

marketing resources than we do.

8. We are at risk of technological

changes to which we may be unable to adapt as swiftly as our competition.

We believe that our future

success will be partially affected by continued growth in the use of digital, 3D, and ultra-HD broadcasting. The production,

acquisition and distribution of music-related content to movie theaters and by home video retailers, free TV broadcasters,

cable, 3D and ultra-HD cable channels, and mobile streaming providers are still relatively new, and predicting the extent of further

growth, if any, is difficult. The market for this content is characterized by rapid technological developments, evolving industry

standards and customer demands, and frequent new product introductions and enhancements. Our failure to adapt to any

technological developments effectively could adversely affect our business, operating results, and financial condition.

9. The distribution of

entertainment content and related materials is at a high risk for piracy which may affect our earnings.

The entertainment content

distribution industry, including us, may continue to lose an indeterminate amount of revenue as a result of piracy due to unauthorized

copying of our product at post production houses, copies of prints in circulation to theaters, unauthorized videotaping at theaters

and other illegal means of acquiring our copyrighted material. The USTR has placed Argentina, Brazil, Egypt, Indonesia, Israel,

Kuwait, Lebanon, Pakistan, the Philippines, Russia, Ukraine and Venezuela on the 301 Special Watch List for excessive rates of

piracy of motion pictures and optical disks. The USTR has placed Azerbaijan, Bahamas, Belarus, Belize, Bolivia, Bulgaria, Colombia,

the Dominican Republic, Ecuador, Hungary, Italy, Korea, Latvia, Lithuania, Mexico, Peru, Romania, Taiwan, Tajikistan, Thailand,

and Uzbekistan on the watch list for excessive piracy.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

We have no unresolved

comments from the Securities and Exchange Commission.

ITEM 2. PROPERTIES.

We utilize an executive

office at 8200 Wilshire Boulevard, Suite 200, Beverly Hills, California 90211. This space is located near

the major production studios in Los Angeles County. Our rent consists of 200 square feet at $199.00 per month pursuant

to a lease for one year.

ITEM 3. LEGAL PROCEEDINGS.

There is no litigation pending or threatened by or against the Company.

PART II

ITEM 5. MARKET FOR REGISTRANT'S

COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

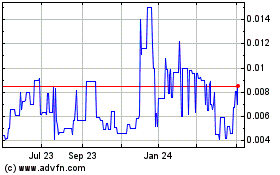

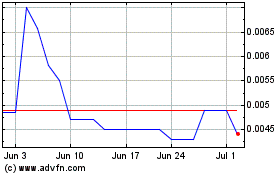

(a) Market Price.

The Company's common stock

is publicly traded in the over-the-counter market in the OTC Markets Group Inc. System under the ticker symbol WRIT. The following

table sets forth the reported high and low prices of our common stock for each quarter during the fiscal year ended March 31,

2015 and 2014. The prices reflect inter-dealer prices without mark-ups mark-downs, or commissions, and may not necessarily

reflect actual transactions.

Fiscal Year Ended March 31, 2015

| Quarter |

|

High |

|

|

Low |

|

| |

|

|

|

|

|

|

|

| First |

|

|

84.00 |

|

|

|

8.00 |

|

| Second |

|

|

19.00 |

|

|

|

3.00 |

|

| Third |

|

|

10.00 |

|

|

|

1.20 |

|

| Fourth |

|

|

1.90 |

|

|

|

0.48 |

|

Fiscal Year Ended March 31, 2014

| Quarter |

|

High |

|

|

Low |

|

| |

|

|

|

|

|

|

| First |

|

|

260.00 |

|

|

|

80.00 |

|

| Second |

|

|

160.00 |

|

|

|

40.00 |

|

| Third |

|

|

60.00 |

|

|

|

20.00 |

|

| Fourth |

|

|

78.00 |

|

|

|

14.00 |

|

The Securities and Exchange Commission adopted Rule 15g-9, which established the definition

of a "penny stock," for purposes relevant to the Company, as any equity security that has a market price of less than

$5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving

a penny stock, unless exempt, the rules require: (i) that a broker or dealer approve a person's account for transactions in penny

stocks; and (ii) the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity

and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny stocks, the

broker or dealer must (i) obtain financial information and investment experience and objectives of the person; and (ii) make a

reasonable determination that the transactions in penny stocks are suitable for that person and that person has sufficient knowledge

and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer

must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the

penny stock market, which, in highlight form, (i) sets forth the basis on which the broker or dealer made the suitability determination;

and (ii) that the broker or dealer received a signed, written agreement from the investor prior to the transaction. Disclosure

also has to be made about the risks of investing in penny stock in both public offering and in secondary trading, and about commissions

payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and

remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing

recent price information for the penny stock held in the account and information on the limited market in penny stocks.

(b) Holders.

There are 6,408 holders of record of the Company's

Common Stock, of which 137 are active holders.

Currently, a certain number of our issued and outstanding shares of Common Stock held

by non-affiliates are eligible for sale under Rule 144 promulgated under the Securities Act of 1933, as amended, subject to certain

limitations included in said Rule. In general, under Rule 144, a person (or persons whose shares are aggregated), who has satisfied

a six month holding period, under certain circumstances, has unlimited public resale under said Rule if the seller complies with

said Rule.

In summary, Rule 144 applies

to affiliates (that is, control persons) and non-affiliates when they resell restricted securities (those purchased from the issuer

or an affiliate of the issuer in nonpublic transactions) issued by a shell company. Non-affiliates reselling restricted securities,

as well as affiliates selling restricted or non-restricted securities, are not considered to be engaged in a distribution and,

therefore, are not deemed to be underwriters as defined in Section 2(11) if the seller complies with said Rule.

(c) Dividends.

We have declared no stock

or cash dividends and we do not intend to declare or pay any dividends in the future.

(d) Application of California law.

Section 2115 of the California

General Corporation law provides that a corporation incorporated under the laws of a jurisdiction other than California, but which

has more than one-half of its "outstanding voting securities" and which has a majority of its property, payroll and

sales in California, based on the factors used in determining its income allocable to California on its franchise tax returns,

may be required to provide cumulative voting until such time as the Company has its shares listed on certain national securities

exchanges, or designated as a national market security on NASDAQ (subject to certain limitations). Accordingly, holders of our

Common Stock may be entitled to one vote for each share of Common Stock held and may have cumulative voting rights in the election

of directors. This means that holders are entitled to one vote for each share of Common Stock held, multiplied by the number of

directors to be elected, and the holder may cast all such votes for a single director, or may distribute them among any number

of all of the directors to be elected.

(e) Purchases of Equity Securities.

We (and affiliated purchasers)

have made no purchases or repurchases of any securities of the Company or any other issuer.

(f) Securities Authorized for Issuance

under an Equity Compensation Plan.

We have not authorized

the issuance of any of our securities in connection with any form of equity compensation plan.

(g) Recent Sale of Unregistered

Securities

During the year ended

March 31, 2015, the Company issued 17,641 shares for cash totaling $226,781 and issued 95,148 shares of common stock to employees

and third party consultants as compensation, with the fair value of the shares determined to be $640,625. The sale and issuance

of the shares was exempt from registration under the Securities Act of 1933, as amended, by virtue of section 4(2) as a transaction

not involving a public offering. Each shareholder had acquired the shares for investment and not with a view to distribution

to the public. All of these shares had been issued for investment purposes in a "private transaction" and were "restricted"

shares as defined in Rule 144 under the Securities Act of 1933, as amended.

ITEM 6. SELECTED FINANCIAL

DATA.

Not applicable to smaller

reporting companies.

ITEM 7. MANAGEMENT'S DISCUSSION

AND ANALYSIS OF FINANCIAL CONDITION and RESULTS OF OPERATIONS.

Special Note Regarding Forward Looking

Statements

In addition to historical

information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We use words such as “believe,” “expect,”

“anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,”

“aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements

include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products;

any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives

of management for future operations; any statements regarding future economic conditions or performance; as well as all assumptions,

expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements

are not guarantees of future performance and involve risks and uncertainties, including those identified in Item 1A “Risk

Factors” in our annual report on Form 10-K for fiscal year ended March 31, 2015, as well as assumptions, which, if they

were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed

or implied by such forward-looking statements. Forward-looking statements made by penny stock issuers are excluded from the safe

harbors in Section 27A of the Securities Act of 1933 and in Section 21E of the Securities Exchange Act of 1934.

Readers are urged to carefully

review and consider the various disclosures made by us in this report and our other filings with the Security and Exchange Commission

(“SEC”). These reports attempt to advise interested parties of the risks and factors that may affect our business,

financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as

of the date hereof and we disclaim any obligation, except as required by law, to provide updates, revisions or amendments to any

forward-looking statements to reflect changes in our expectations or future events.

Overview

WRIT Media Group, Inc.

(“we”, “us”, “our”, “WRIT”, or the “Company”) was incorporated as

Writers’ Group Film Corp. in Delaware on March 9, 2007 to produce films, television programs and similar entertainment programs

for various media formats.

Front Row Networks (“FRN”)

was incorporated on July 27, 2010 in the State of Nevada. The Company is a content creation company which intends to produce,

acquire, license, and distribute music-related content in 3D and ultra-high definition (4K) for initial worldwide digital broadcast

into digitally-enabled movie theaters. Through the distribution of music-related “alternative content,” the Company

intends to present live concerts, music documentaries, and other music-related content at affordable prices, to a massive fan

base worldwide in a cost-effective manner. Following an initial theatrical run, or as an initial distribution window, the content

will be licensed, in both 2D, 4K and 3D formats, to DVD and Blu-Ray retailers, Free TV broadcasters, cable and emerging 3D cable

channels, and mobile streaming providers. In some cases, Front Row Networks will also sell merchandising and other products, bolstered

by both in-theater and in-App advertising, tailored around each Artist and/or event, to maximize potential merchandising and sponsorship

revenues.

In February 2011, FRN

completed a reverse acquisition transaction through a share exchange with WRIT, whereby WRIT acquired 100% of the issued and outstanding

capital stock of FRN in exchange for 100,000 shares of the Common Stock of WRIT. As a result of the reverse acquisition, FRN became

WRIT’s wholly-owned subsidiary and the former FRN’s shareholders became controlling stockholders of WRIT. The share

exchange transaction with WRIT was treated as a reverse acquisition, with FRN as the accounting acquirer and WRIT as the acquired

party.

Consequently, the assets and liabilities and the historical operations were

reflected in the consolidated financial statements for periods prior to the Share Exchange Agreement were those of FRN and

will be recorded at the historical cost basis. After the completion of the Share Exchange Agreement, the Company’s

consolidated financial statements included the assets and liabilities of both FRN and WRIT, the historical operations of FRN

and the operations of WRIT from the closing date of the Share Exchange Agreement.

On July 7, 2011, we modified

our February 2011 Share Exchange Agreement and agreed to assume $100,000 in new debt which is shown as a reduction of our Paid-In

Capital.

While the core business

of Front Row Networks remains the licensing, production, acquisition and distribution of music-related content and programming,

the core business is dependent upon negotiating and financing projects with schedules that are solely determined by third parties,

such as Artists and rights owners. In order to secure less cyclical entertainment product, the Company sought to license or purchase

entertainment content that could be easily secured and distributed through the multiple distribution arrangements already established

by the Company and via the rapidly growing marketplace represented by consumers of mobile, internet, and TV set-top devices. To

reach this goal during the fiscal year, the Company set out to acquire exclusive branded content and entertainment programming,

and achieved this goal through the acquisition of Amiga Games Inc.

On August 19, 2013, the

Company completed an acquisition transaction through a share exchange with Amiga Games Inc., whereby WRIT acquired 100% of the

issued and outstanding capital stock, assets, and trademarks of Amiga Games Inc. in exchange for 500,000 shares of the Common

Stock of WRIT. As a result of the acquisition, Amiga Games Inc. became WRIT’s wholly-owned subsidiary.

Amiga Games Inc. licenses

classic pre-Windows computer game libraries and adapts and republishes the most popular titles for smartphones, modern game consoles,

PCs, tablets, and other television streaming devices. WRIT also established a new company, Retro Infinity Inc., to publish and

brand games that were not originally released for Amiga brand computers. The two companies tap into the growing “retro gaming”

marketplace, building on the "Amiga", “Atari”, and “MS-DOS” brands, delivering retro-gaming

titles adapted for modern devices as well as merchandise featuring brands and characters from the games.

During the fiscal year,

Amiga Games Inc. and Retro Infinity Inc. entered several marketing and distribution agreements, including those with Microsoft

Corporation and Roku Inc. Both agreements include minimum guarantees, defined as advances against future sales. Additionally,

the Retro Infinity Inc. licensed dozens of classic games for distribution via the Windows 8, Roku player, iOS (Apple), and Android

platforms. Although it was the Company’s strategic goal to distribute a broad range of video game titles on the Windows

8 and iOS platforms during the 4th quarter of 2014, lack of operating capital caused the Company to temporarily halt

software development funding, which delayed the Company’s overall gaming product release schedule. This temporary reduction

in operating capital was due to mainly to regulatory delays encountered in structuring WRIT’s equity-line financing, and

the Company’s difficulty in raising alternative investment capital, due to its sub-penny share price at the time.

On January 22, 2014, the

Company changed the name of the corporation to WRIT Media Group, Inc., and authorized a 1 for 1,000 reverse split of the Company’s

issued and outstanding shares of Common Stock. The name change was authorized to encompass the Company's broadened activities,

including additional business plans and models, and the acquisition and formation of new subsidiaries. The equity restructuring

was authorized to achieve the following: (a) price per share -- the rollback will increase the price per share to above $0.01,

sub-penny markets are getting harder to trade and next to impossible to finance; (b) funding -- with a sub penny share price the

Company was unable to fund because of dilution, post rollback the share price should be well above $0.01 and allow management

to close on numerous funding opportunities that have been presented; (c) larger potential audience -- with a higher share price

the Company will have access to investors who do not trade sub penny stocks such as institutions and Europeans; (d) listing in

Europe -- the Company will now be able to list its common shares for trading on a European Stock Exchange, as co-listings in Europe

are not accepted with a sub penny share price; and (e) acquisitions -- the Company will be able to use common shares to acquire

larger assets and other industry related companies.

On January 16, 2014 WRIT’s Equity Line Financing (“ELF”) agreement

with Dutchess Opportunity Fund II, and its corresponding S1 registration statement, was declared effective by the SEC. The ELF

agreement, executed in September 2013, allows but does not require WRIT to sell up to US$10,000,000 of common stock to Dutchess

at a 5% discount to market price, during the 36 month term. Compared to the Company’s convertible debt financing, ELFs provide

a lower discount to market that minimize dilution while increasing operating capital. This additional financing source allowed

the company to reduce debt and reduce the balance of the more expensive convertible notes that were outstanding during the last

quarter of the fiscal year.

On February 4, 2014 the

Company completed its administrative and legal work with the Depository Trust & Clearing Corporation ("DTCC") and

the DTCC's long-standing "Administrative Chill" on clearing WRIT stock certificates was removed. DTCC resumed accepting

deposits of the Company's common stock for book entry transfer services. As a result, shareholders with online brokerage accounts

at firms such as Scottrade, ETRADE, TD Ameritrade and other full service brokerage firms are allowed to deposit new shares of

WRIT's common stock in the electronic system that controls clearance and settlement. The reinstatement of the DTC depository services

is an instrumental and enormous accomplishment for WRIT, which greatly reduced the costs and expenses associated with private

equity investments in the Company.

In September 2014 the

Company launched two online point of sale platforms; www.RetroInfinity.com and www.AmigaGamesInc.com to market its “retro”

gaming titles directly to consumers. Both sales platforms initially offer only downloads for windows based computers. The online

store launch was completed in conjunction with an initial marketing program which featured NASCAR, the RWR Retro Infinity NASCAR

race team, and the “Drive to Championship Weekend” branding program. In December 2014 the Company intended to launch

additional titles on additional mobile platforms, such as Windows phone, iOS, and Android platforms, so that the video game titles

can be downloaded as Apps on various mobile devices, the Company experienced additional financing delays which interrupted software

development and caused the Company to reschedule the anticipated release on mobile platforms into 2015. The online store launch

generated an increase in consumer traffic to the Company’s websites and created awareness in the Company’s product,

but generated minimal sales, most consumers were interested only in the mobile versions of the gaming titles, which were not yet

available.

The websites are currently

being modified to accept payment for crowdfunding transactions, and we launched the Retro Infinity/Amiga Games crowdfunding platform,

supported by a social marketing campaign, in the 3rd quarter of 2015. The initial crowdfunding campaign was not successful, so

the Company is seeking additional financing from strategic partners that will allow the Company to resume and complete software

development, and commence product marketing activities.

On June 25, 2015, the

Company authorized a 1 for 200 reverse split of the Company’s issued and outstanding shares of Common Stock. The equity

restructuring was authorized to achieve the following: (a) price per share -- the rollback will increase the price per share to

above $0.01, sub-penny markets are getting harder to trade and next to impossible to finance; (b) funding -- with a sub penny

share price the Company was unable to fund because of dilution, post rollback the share price should be well above $0.01 and allow

management to close on numerous funding opportunities that have been presented; (c) larger potential audience -- with a higher

share price the Company will have access to investors who do not trade sub penny stocks such as institutions and Europeans; (d)

listing in Europe -- the Company will now be able to list its common shares for trading on a European Stock Exchange, as co-listings

in Europe are not accepted with a sub penny share price; and (e) acquisitions -- the Company will be able to use common shares

to acquire larger assets and other industry related companies.

We believe WRIT is well

positioned to benefit from the market growth and increased demand for mobile gaming content, and intend to continue to look for

opportunities to finance and complete its software development so that it can distribute both music and video game content, though

acquisitions and licensing arrangements. Throughout the year, the Company also intends to continue to explore new technologies

and business relationships with entities that have the resources to offer financing, distribution and marketing of WRIT’s

product.

Financial Performance Highlights

The following summarizes

certain key financial information for the fiscal year ended March 31, 2015 and for the fiscal year ended March 31, 2014:

| • | | Revenues: Our revenues were $0 and $11,000 for the fiscal years ended

March 31, 2015 and 2014. |

| • | | Net income (loss): Net income (loss) was $(2,203,576) and $1,044,284

for the fiscal years ended March 31, 2015 and 2014. |

Results of Operations

The

following table sets forth key components of our results of operations for the fiscal years ended March 31, 2015 and 2014.

| | |

For the Year Ended 03/31/2015 | |

For the Year Ended 03/31/2014 |

| | |

| | | |

| | |

| Total Revenue | |

$ | — | | |

$ | 11,000 | |

| Operating Expenses: | |

| | | |

| | |

| Wages and benefits | |

| 258,447 | | |

| 210,578 | |

| Audit and accounting | |

| 57,485 | | |

| 34,989 | |

| Legal fee | |

| 38,436 | | |

| 2,915 | |

| Other general and administrative | |

| 1,641,013 | | |

| 249,768 | |

| Loss from operations | |

| (1,995,381 | ) | |

| (487,250 | ) |

| Other income | |

| — | | |

| (3,000 | ) |

| Gain (loss) on derivative liability | |

| — | | |

| 1,715,954 | |

| Interest expense | |

| (208,195 | ) | |

| (187,420 | ) |

| Net income (loss) | |

$ | (2,203,576 | ) | |

$ | 1,044,284 | |

Fiscal

Year Ended March 31, 2015 Compared to Fiscal Year Ended March 31, 2014

Revenues. Revenues

decreased to $0 for the fiscal year ended March 31, 2015 from $11,000 for the fiscal year ended March 31, 2014, due to a decrease

in content delivered to customers, due to delays in software development, as compared to the available produced and acquired content

available for distribution for the prior year.

Wages

and benefits. Wages and benefits expenses increased 22.7% to $258,447 for the fiscal year ended March 31, 2015

from $210,578 for the fiscal year ended March 31, 2014. The increase is mainly due to an increase in personnel costs during the

year. The wages and benefits expenses for the fiscal year ended March 31, 2015 and 2014 include employee stock compensation in

the amount of $60,334 and $165,104, respectively.

Audit and accounting. Audit

and accounting expenses increased 64% to $57,485 for the fiscal year ended March 31, 2015, from $34,989 for the fiscal year ended

March 31, 2014 . The increase in the audit and accounting expense is mainly related to increase in pricing for audit services.

Legal

fees. Legal Fees increased 1218.6% to $38,436 for the fiscal year ended March 31, 2015 from $2,915 for the

fiscal year ended March 31, 2014. The increase in legal fees was related to an increase in legal expenses related to financing

and other transactions for the Company.

Other

general and administrative expenses. Other general and administrative expenses increased to $1,641,013 for

the fiscal year ended March 31, 2015 from $249,768 for the fiscal year ended March 31, 2014.

Those expenses consist primarily of company’s increase in business development, consulting fees and other expenses

incurred in connection with general operations of Amiga Games Inc., and an intangible asset impairment expense of $821,235.

Loss

from operations. Our loss from operations was $1,995,381 for the fiscal year ended March 31, 2015 and $487,250 for the

fiscal year ended March 31, 2014.

Gain or loss from derivative liability.

We recorded no gain or loss from derivative liability for the fiscal year ended March 31, 2015 and $1,715,954 for the

fiscal year ended March 31, 2014, which is discussed in more detail in Note 5 “Derivative

Liabilities” to our consolidated financial statements.

Interest expense. We incurred

$208,195 in interest expense for the fiscal year ended March 31, 2015, and $187,420 in interest expense for the fiscal year ended

March 31, 2014. The increase in interest expense is mainly due to an increase in additional borrowings, extinguished debt, and

debt discount amortization.

Net

income (loss). As a result of the foregoing factors, we generated a net loss of $2,203,576 and net income of $1,044,284

for the fiscal years ended March 31, 2015 and 2014, respectively.

Liquidity and Capital

Resources

As reflected in the accompanying

consolidated financial statements, the Company has accumulated deficits of $1,783,553 at March 31, 2015 that includes losses of

$2,203,576 for the fiscal year ended March 31, 2015, and had retained earnings $420,023 at March 31, 2014 that includes net income

of $1,044,284 for the fiscal year ended March 31, 2014. The Company also had

a working capital deficiency of $620,060 as of March 31, 2015 and $181,109 as of March 31, 2014. These factors raise

substantial doubt about the ability of the Company to continue as a going concern. Although management is currently attempting

to implement its business plan, and is seeking additional sources of equity or debt financing, there is no assurance these activities

will be successful.

As of March 31, 2015 and March 31, 2014, we have $255 and $25,810 respectively in cash

and cash equivalents. The following table provides detailed information about our net cash flow for all financial statement periods

presented in this report. To date, we have financed our operations primarily through cash flows from operations, sale of restricted

stock through private placements, and borrowings from third and related parties.

| | |

For the Year Ended 3/31/2015 | |

For the Year Ended 03/31/2014 |

| | |

| | | |

| | |

| Net cash used in operating activities | |

$ | (345,616 | ) | |

$ | (175,463 | ) |

| Net cash used in investing activities | |

| (191,230 | ) | |

| (89,125 | ) |

| Net cash provided by financing activities | |

| 511,291 | | |

| 289,255 | |

| Net increase (decrease) in cash and cash equivalents | |

| (25,555 | ) | |

| 24,667 | |

| Cash and cash equivalents at beginning of the period | |

| 25,810 | | |

| 1,143 | |

| Cash and cash equivalents at end of the period | |

$ | 255 | | |

$ | 25,810 | |

Operating

activities

Cash used in operating activities of $345,616 for the fiscal year ending March 31, 2015

which reflected our net loss of $2,203,576 adjusted for non-cash expenses, consisting primarily of $821,235 of impairment of intangible

asset, $632,152 of stock based compensation to employees, consultants and other services, $552 of depreciation, and $177,119 of

amortization of debt discount. Additional major sources of cash include an increase in accounts payable of $112,900, decrease

in accounts receivable of $354, decrease in prepaid expense and other assets of $4,938, and an increase in accrued expenses of

$108,710.

Cash used in operating activities of $175,463 for the fiscal year ending March 31, 2014

reflected our net income of $1,044,284, adjusted for non-cash expenses, consisting primarily of $1,715,954 of gain on derivative

liability, $258,418 of stock based compensation to employees, consultants and other services, $173,376 of amortization of debt

discount, $7,312 of amortization of deferred financing costs and gain on settlement of $28,468. Additional major sources of cash

include increases in accounts payable of $23,885, increase in accrued expenses of $8,629, and an increase in deferred revenue

of $55,395. Uses of cash included an increase in accounts receivables of $300 and an increase in prepaid expenses and other assets

of $2,040.

Investing

activities

The net cash used in investing

activities is for the fiscal year ended March 31, 2015 was $191,230 and is primarily due to funds invested in software development

costs of $146,170 and cash paid for prior year software development costs of $45,060. During the fiscal year ended March 31, 2014

there was $89,125 net cash used by our investing activities, primarily due to funds invested in software development costs of

$87,461 and purchases of technology hardware of $1,664.

Financing

activities

Net

cash provided by financing activities of $511,291 and $289,255 for the fiscal years ended March 31, 2015 and March 31,

2014, respectively. During the fiscal year ended March 31, 2015 there were funds borrowed on short term notes payable of $12,500,

borrowing on convertible debt of $242,500, cash received from subscription receivable of $25,000, advances from related party

of $9,510 and proceeds from shares issued for cash of $226,781 offset by payments of short term notes of $5,000. During the fiscal

year ended March 31, 2014 there were funds borrowed on short term notes payable of $61,500, borrowing on convertible debt of $80,077

and proceeds from shares issued for cash of $222,774 offset by payments to related parties of $2,896, payments of short term notes

of $6,000, payments of convertible debt of $61,200 and payments of $5,000 for deferred financing costs.

Loan Commitments

Borrowings from Related Parties

During the year ended

March 31, 2015, $9,510 was advanced by Eric Mitchell and the advance is due on demand with 0% interest.

Borrowings from Third Parties

Falmouth Street Holdings,

LLC

On March 2, 2015, the

Company borrowed $7,500 from Falmouth Street Holdings, LLC. The maturity date of this note is August 29, 2015 and this loan bears

an interest rate of 12% per annum from the issuance date. The note is still outstanding as of March 31, 2015. As of today the

debt is still outstanding and therefore is in default.

SCHU Mortgage &

Capital, Inc.

On February 18, 2014,

the Company borrowed $15,000 from SCHU Mortgage & Capital, Inc. The maturity date of this note is August 18, 2014 and this

loan bears an interest rate of 8% per annum from the issuance date. On July 10, 2014, SCHU Mortgage & Capital, Inc. sold and

assigned its $15,000 note to Magna Group LLC, along with accrued interest of $465. See discussion on the new Magna note in note

4.

SFH Capital LLC

On October 22, 2013, the

Company borrowed $14,000 from SFH Capital LLC. The maturity date of this note was October 22, 2014 and this loan bears an interest

rate of 12% per annum from the issuance date. On June 6, 2014 the Company entered into a debt modification agreement with the

debt holder. The modified note was convertible into common stock at a price of $10.00, with an extend maturity date of January

6, 2015, and there were no other changes to the original terms of the promissory note. The principal amount of the modified note

was $15,045 on June 6, 2014, with the accrued interest owed on the old debt included in the principal of the new debt.

On October 29, 2013, the

Company borrowed $4,000 from SFH Capital LLC. The maturity date of this note was October 29, 2014 and this loan bears an interest

rate of 8% per annum from the issuance date. On June 6, 2014 the Company entered into a debt modification agreement with the debt

holder. The modified note was convertible into common stock at a price of $10.00, bears an extend maturity date of January 6,

2015, and there were no other changes to the original terms of the promissory note. The principal amount of the modified note

was $4,193 on June 6, 2014, with the accrued interest owed on the old debt included in the principal of the new debt.

On December 11, 2013,

the Company borrowed $12,500 from SFH Capital LLC. The maturity date of this note was December 11, 2014 and this loan bears an

interest rate of 8% per annum from the issuance date. On June 6, 2014 the Company entered into a debt modification agreement with

the debt holder. The modified note was convertible into common stock at a price of $10.00, bears an extend maturity date of January

6, 2015, and there were no other changes to the original terms of the promissory note. The principal amount of the modified note

was $12,985 on June 6, 2014, with the accrued interest owed on the old debt included in the principal of the new debt.

Mr. J. Shaw

On April 1, 2014, the

Company borrowed $5,000 from J. Shaw. The maturity date of this note is May 1, 2014, and this loan bears an interest rate of 0%

per annum from the issuance date. On April 23, 2014, the principal balance of the note was paid in its entirety and the note has

been surrendered to the Company.

KBM Worldwide Inc.

On June 3, 2014, the Company

borrowed $53,000 from KBM Worldwide Inc. The maturity date of this note is March 5, 2015. This loan bears an interest rate of

8% per annum. Interest on overdue principal after default accrues at an annual rate of 22%. After 180 days following the date

of the note, KBM Worldwide Inc. has the right to convert all or a portion of the remaining outstanding principal amount of this

note into shares of the Company’s Common Stock. The conversion price will be 55% multiplied by the lowest three trading

prices for the Common Stock during the 10 trading day period ending on the latest complete trading day prior to the conversion

date. The conversion price has a floor price of $.008 per share. As of March 31, 2015, KBM Worldwide Inc. converted debt principal

of $5,735 into 8,193 common shares, bringing the note balance to $47,265. As of today the debt is still outstanding and therefore

is in default.

On July 29, 2014, the

Company borrowed a convertible promissory note of $32,500 from KBM Worldwide, Inc. The maturity date of this note is May 1, 2015.

This loan bears an interest rate of 8% per annum. Interest on overdue principal after default accrues at an annual rate of 22%.

After 180 days following the date of the note, KBM Worldwide Inc. has the right to convert all or a portion of the remaining outstanding

principal amount of this note into shares of the Company’s Common Stock. The conversion price is 55% multiplied by the average

of the lowest 3 trading day prices for the Common Stock during the 10 trading day period ending on the latest complete trading

day prior to the conversion date. On July 30, 2014, an amendment to the note defined a floor to the conversion price to be $.008

per share. As of March 31, 2015, the note is not converted yet and is still outstanding. As of today the debt is still outstanding

and therefore is in default.

On September 15, 2014, the Company borrowed a convertible promissory note of

$63,000 from KBM Worldwide, Inc. The maturity date of this note is June 17, 2015. This loan bears an interest rate of 8% per

annum. Interest on overdue principal after default accrues at an annual rate of 22%. After 180 days following the date of the

note, KBM Worldwide Inc. has the right to convert all or a portion of the remaining outstanding principal amount of this note

into shares of the Company’s Common Stock. The conversion price is 55% multiplied by the average of the lowest 3

trading day prices for the Common Stock during the 10 trading day period ending on the latest complete trading day prior to

the conversion date. The conversion price has a floor price of $.008 per share. As of March 31, 2015, the note is not

converted yet and is still outstanding. As of today the debt is still outstanding and therefore is in default.

Magna Group LLC

On March 17, 2014, the

Company borrowed a convertible promissory note of $10,500 from Magna Group, LLC. The maturity date of this note is March 17, 2015.

This loan bears an interest rate of 12% per annum. Interest on overdue principal after default accrues at an annual rate of 22%.

The conversion price is 55% multiplied by the lowest value weighted average price (VWAP) for the Common Stock during the 5 trading

day period ending on the latest complete trading day prior to the conversion date. The conversion price has a floor price of $.008

per share. The principal amount of the note was converted into common shares. As of March 31, 2015, the note was paid off in full

and the note has been surrendered to the Company.

On March 17, 2014, the

Company borrowed a convertible promissory note of $13,077 from Magna Group, LLC. The maturity date of this note is March 17, 2015.

This loan bears an interest rate of 12% per annum. Interest on overdue principal after default accrues at an annual rate of 22%.

The conversion price is 55% multiplied by the lowest value weighted average price (VWAP) for the Common Stock during the 5 trading

day period ending on the latest complete trading day prior to the conversion date. The conversion price has a floor price of $.008

per share. The principal amount of the note was converted into common shares. As of March 31, 2015, the note was paid off in full

and the note has been surrendered to the Company.

On July 10, 2014, SCHU

Mortgage & Capital, Inc. sold and assigned its $15,000 note to Magna Group LLC, along with accrued interest of $465. On that

same date, the Company amended the related debt agreement with the note holder. The maturity date of this amended note is July

10, 2015. This loan bears an interest rate of 12% per annum. The note is convertible into common stock at a price of 55% multiplied

by the lowest volume weighted average price (VWAP) for the Common Stock during the 5 trading day period ending on the latest complete

trading day prior to the conversion date. The conversion price has a floor price of $.008 per share. As of March 31, 2015, this

note has been converted in its entirety and has been surrendered to the Company.

On July 10, 2014, the

Company borrowed a convertible promissory note of $22,000 from Hanover Holdings I, LLC. The maturity date of this note is July

10, 2015. This loan bears an interest rate of 12% per annum. Interest on overdue principal after default accrues at an annual

rate of 22%. The conversion price is 55% multiplied by the lowest value weighted average price (VWAP) for the Common Stock during

the 5 trading day period ending on the latest complete trading day prior to the conversion date. The conversion price has a floor

price of $.008 per share. An amount equal to $2,500 of the principal balance of the note was converted into 4,545 common shares

on February 4, 2015, leaving a principal balance of $19,500 as of March 31, 2015. As of today the debt is still outstanding and

therefore is in default.

On September 10, 2014,

the Company borrowed a convertible promissory note of $33,000 from Magna Equities II, LLC. The maturity date of this note is September

10, 2015. This loan bears an interest rate of 12% per annum. Interest on overdue principal after default accrues at an annual

rate of 22%. The conversion price is 55% multiplied by the lowest value weighted average price (VWAP) for the Common Stock during

the 5 trading day period ending on the latest complete trading day prior to the conversion date. The conversion price has a floor

price of $.008 per share. As of March 31, 2015, the note is not converted yet and is still outstanding. As of today the debt is

still outstanding and therefore is in default.

On October 28, 2014, the

Company borrowed a convertible promissory note of $25,000 from Magna Equities II, LLC. The maturity date of this note is October

28, 2015. This loan bears an interest rate of 12% per annum. Interest on overdue principal after default accrues at an annual

rate of 22%. The conversion price is 55% multiplied by the lowest value weighted average price (VWAP) for the Common Stock during

the 5 trading day period ending on the latest complete trading day prior to the conversion date. The conversion price has a floor

price of $.008 per share. As of March 31, 2015, the note is not converted yet and is still outstanding. As of today the debt is

still outstanding and therefore is in default.

On December 17, 2014,

the Company borrowed a convertible promissory note of $14,000 from Magna Equities II, LLC. The maturity date of this note is December

17, 2015. This loan bears an interest rate of 12% per annum. Interest on overdue principal after default accrues at an annual

rate of 22%. The conversion price is 55% multiplied by the lowest value weighted average price (VWAP) for the Common Stock during

the 5 trading day period ending on the latest complete trading day prior to the conversion date. The conversion price has a floor

price of $.008 per share. As of March 31, 2015, the note is not converted yet and is still outstanding. As of today the debt is

still outstanding and therefore is in default.

Other Notes

Convertible debts were

issued September 2009, bearing interest at a rate of 8% per annum, due in one year, and are convertible at $2.00 per share, and

the total balance outstanding as of March 31, 2014 was $3,130. The note is in default. During the year ended March 31, 2015, debt

principal of $2,470 and interest of $104 reclassified into note principal were converted into 6,427 common shares. As of March

31, 2015, other convertible notes have a principal balance of $660.

Obligations under Material Contracts

Except with respect to

the loan obligations disclosed above, we have no obligations to pay cash or deliver cash to any other party.

Inflation

Inflation and changing

prices have not had a material effect on our business and we do not expect that inflation or changing prices will materially affect

our business in the foreseeable future. However, our management will closely monitor price changes in our industry and continually

maintain effective cost controls in operations.

Off Balance Sheet Arrangements

We do not have any off

balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes

in financial condition, revenues or expenses, results of operations, liquidity or capital expenditures or capital resources that

is material to an investor in our securities.

Seasonality

Our operating results

and operating cash flows historically have not been subject to seasonal variations. This pattern may change, however, as a result

of new market opportunities or new product introduction.

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles

generally accepted in the United States requires our management to make assumptions, estimates and judgments that affect the

amounts reported, including the notes thereto, and related disclosures of commitments and contingencies, if any. We have

identified certain accounting policies that are significant to the preparation of our financial statements. These accounting

policies are important for an understanding of our financial condition and results of operation. Critical accounting policies

are those that are most important to the portrayal of our financial conditions and results of operations and require

management’s difficult, subjective, or complex judgment, often as a result of the need to make estimates about the

effect of matters that are inherently uncertain and may change in subsequent periods. Certain accounting estimates are

particularly sensitive because of their significance to financial statements and because of the possibility that future

events affecting the estimate may differ significantly from management’s current judgments. We believe the following

critical accounting policies involve the most significant estimates and judgments used in the preparation of our financial

statements:

| • | | Accounts Receivable: Accounts receivable are recorded at the net invoice

value and are not interest bearing. We consider receivables past due based on the contractual payment terms. We perform ongoing

credit evaluations of our customers, and generally we do not require collateral on our accounts receivable. We estimate the need

for allowances for potential credit losses based on historical collection activity and the facts and circumstances relevant to

specific customers and we record a provision for uncollectible accounts when collection is uncertain. To date, we have not experienced

significant credit related losses. |

The Company follows revenue recognition in two industries, technology and film.

Revenue is measured at the fair value of the consideration received or receivable net of sales tax, trade discounts and customer

returns.

Sale of Technology Gaming

Revenue from sale of technology gaming applications is recognized when the following

conditions are satisfied:

| • | | Persuasive evidence of an arrangement exists |

| • | | Delivery has occurred or services have been rendered |

| • | | The seller’s price to the buyer is fixed or determinable |

| • | | Collectability is reasonably assured |

Film

Sales

Based on Revenue Recognition Requirement for Film Sales (ASC 926-605-25), we recognize

film license revenues when all of the following conditions are met:

| - | | Persuasive evidence of a sale or licensing arrangement with a customer exists |

| - | | The film is complete and, in accordance with the terms of the arrangement, has been

delivered or is available for immediate and unconditional delivery |

| - | | The license period of the arrangement has begun and the customer can begin its exploitation,

exhibition, or sale |

| - | | The arrangement fee is fixed or determinable - Collection of the arrangement fee is

reasonably assured |

Recent Accounting Pronouncements

See Note 1. “Organization, Business Operations

and Significant Accounting Policies” to our audited consolidated financial statements included elsewhere in this report.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK.

Not applicable to smaller reporting companies.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

REPORT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

To The Board of Directors

WRIT Media Group, Inc.

Beverly Hills, California

We have audited the accompanying consolidated