NGCG - Potential Acquisition Candidate For Top Lithium Producers

April 06 2018 - 9:31AM

InvestorsHub NewsWire

NGCG – Potential Acquisition Candidate For Top Lithium

Producers

Vancouver, Canada -- April 6, 2018, www.penniesgonewild.com (via InvestorsHub

NewsWire) -- a leading independent micro cap media portal with an

extensive history of providing unparalleled content for undervalued

companies, reports on New Generation Consumer Group, Inc. (OTC Pink: NGCG).

Highlights:

NGCG specializes in Lithium

Potential Acquisition Candidate

NGCG may not be at these levels much

longer.

See the 2018 filing and more on New Generation Consumer Group,

Inc. (OTC Pink: NGCG) on

https://penniesgonewild.com/wild-picks-due-diligence

New Generation Consumer Group Inc. is a US based metal/minerals

company with a primary focus on the rare metals, headquartered in

Los Angeles, California. NGCG specializes in metals such as

Lithium, Gold and Silver. There will be a emphasis on niche based

metals such as Lithium due to the growing demand because of the new

energy storage technology.

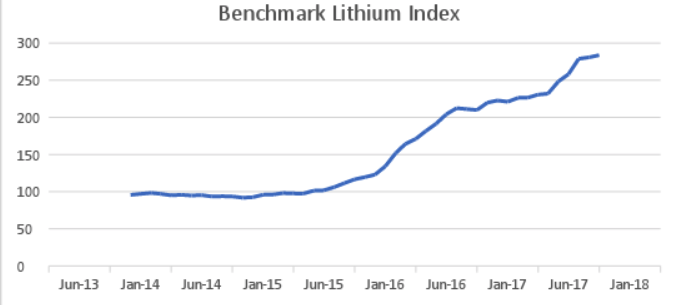

Look how Lithium prices performed in

2017 and it remain strong through out the year. Lithium has been

trend for the last few years as well. Looking ahead to 2018, supply

constraints look set to continue as the lithium demand forecast

rises. In terms of demand, analysts agree that the lithium space

will be led by battery production. “While most of the major battery

expansions are due to come into production closer to 2020, a lot of

battery producers will be looking to secure their raw material

supply chains ahead of these expansions,” Benchmark Mineral

Intelligence analyst Andrew Miller explained.

“The continued pricing strength in lithium has been a

surprise,” said Chris Berry of House Mountain Partners and the

Disruptive Discoveries Journal. He added that his previous demand

forecast out to 2025 for lithium ended up being too low.

“I thought the lithium market (on a LCE basis) would grow to

roughly 550,000 tonnes per year, [but] in the middle of the year I

adjusted this upwards to 617,000 tonnes by 2025. This still appears

too conservative based on potential gigafactory-scale expansion,”

he added.

In fact, Benchmark Mineral Intelligence is now tracking 26

megafactories, up from just three back in 2014. The combined

planned capacity of these plants is 344.5 GWh. To put that into

perspective, total lithium-ion cell demand in 2017 is estimated at

100 GWh. While that number might seem high, global

lithium-ion battery demand is expected to grow between six and

seven times by 2026, which will require a battery pipeline of

nearly double what exists today.

“We said a few years ago that the present lithium price run will

continue, and it has. It has, and it’s gone into a second phase

now,” Benchmark Mineral Intelligence Managing Director Simon Moores

told the Investing News Network at this year’s Cathodes

conference.

“Quite simply, there’s not enough supply to meet the demand, and

the demand is increasing quicker than the supply is. Much, much

quicker. Therefore, lithium’s price will remain strong for some

time,” he added.

For his part, lithium expert Joe Lowry said in his Lithium in

Review report that “2017 was a year when virtually all the positive

surprises were on the demand side and most of the negative

surprises were on the supply side.” The expert also recently

explained that the “Star Alliance of the lithium market” was one of

the major trends this past year.

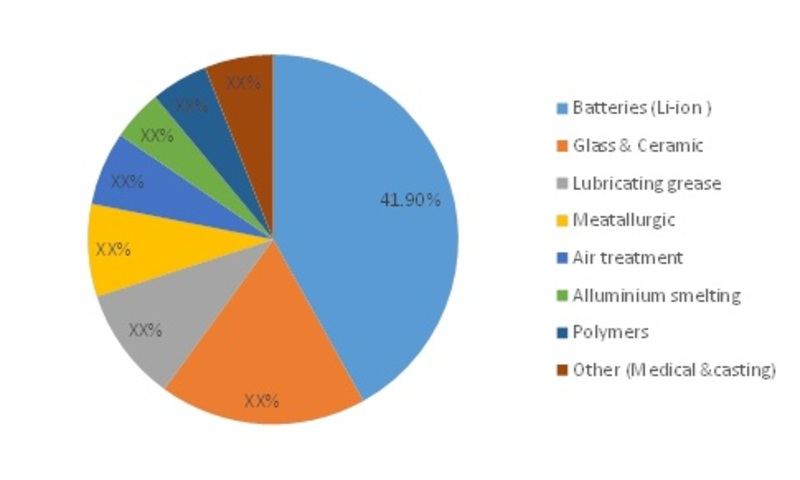

Lithium Demand

Lithium’s demand is rooted in the following applications Lubricant

Grease, Glass, Ceramics, Health Products, Batteries, Meatallurgic,

Air Treatment, Polymers and Others

Potential Acquisition Candidate

New Generation Consumer Group Inc. with only 750M AS, 470 OS and

total assets of $7.1M position itself for a potential buyout or to

be acquired by one of the following top lithium producers.

(NYSE:FMC), (NYSE:ALB),

(NYSE:SQM), (NSQ:TSLA), (NYSE:LAC), (TSE:NMX), (CVE:AAL)

NGCG may not be at these levels

much longer.

See the Filings and more on

New Generation Consumer Group Inc.

at https://penniesgonewild.com/wild-picks-due-diligence

(OTC Pink: NGCG)

About www.penniesgonewild.com

www.penniesgonewild.com is a leading independent micro cap media portal

with an extensive history of providing unparalleled content for

undervalued companies. www.penniesgonewild.com focus on micro cap stocks that Wall Street stock

traders have ignored or haven’t found out about yet. We look for

strong management, innovation, strategy, execution, and the overall

potential for long- term growth. We are well known for discovering

undervalued companies.

All information contained herein as

well as on the www.penniesgonewild.com

website is obtained from sources

believed to be reliable but not guaranteed to be accurate or

all-inclusive. All material is for informational purposes only, is

only the opinion of www.penniesgonewild.com and should not be construed as an offer or

solicitation to buy or sell securities. The information may include

certain forward-looking statements, which may be affected by

unforeseen circumstances and / or certain risks.

Please consult an investment

professional before investing in anything viewed within.

www.penniesgonewild.com has not been compensated for

this article. We may or may not have any shares in any companies

profiled by www.penniesgonewild.com

CONTACT:

Company: www.penniesgonewild.com

Contact Email: penniesgonewild@aol.com

SOURCE: www.penniesgonewild.com

Twitter: https://twitter.com/WildPennies

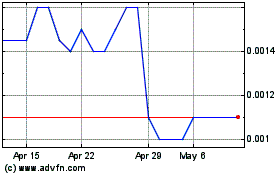

New Generation Consumer (PK) (USOTC:NGCG)

Historical Stock Chart

From Apr 2024 to May 2024

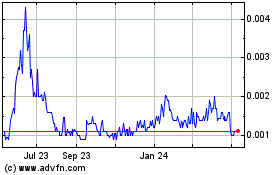

New Generation Consumer (PK) (USOTC:NGCG)

Historical Stock Chart

From May 2023 to May 2024