0000107263false00001072632024-08-052024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 5, 2024

The Williams Companies, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-4174 | 73-0569878 |

(State or other jurisdiction of

incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

| One Williams Center | |

Tulsa, Oklahoma | 74172-0172 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 800-945-5426 (800-WILLIAMS)

NOT APPLICABLE

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

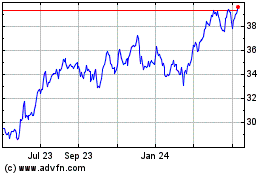

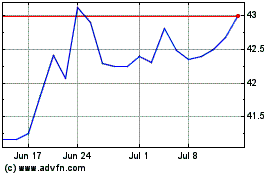

| Common Stock, $1.00 par value | WMB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On August 5, 2024, The Williams Companies, Inc. (the "Company") issued a press release announcing its financial results for the quarter ended June 30, 2024. A copy of the press release and accompanying financial highlights and operating statistics and reconciliation schedules are furnished herewith as Exhibit 99.1 and are incorporated herein in their entirety by reference.

The press release and accompanying financial highlights and operating statistics and reconciliation schedules are being furnished pursuant to Item 2.02, Results of Operations and Financial Condition. The information furnished is not deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits

(a) None

(b) None

(c) None

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File. The cover page XBRL tags are embedded within the inline XBRL document (contained in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | THE WILLIAMS COMPANIES, INC. |

| | | (Registrant) |

| | | |

| Dated: | August 5, 2024 | By: | /s/ JOHN D. PORTER |

| | | John D. Porter |

| | | Senior Vice President and Chief Financial Officer (Principal Financial Officer) |

| | | | | | | | |

| News Release | Williams (NYSE: WMB) One Williams Center Tulsa, OK 74172 800-Williams www.williams.com | |

| |

DATE: Monday, August 5, 2024

| | | | | | | | | | | |

| MEDIA CONTACT: | INVESTOR CONTACTS: | | |

media@williams.com

(800) 945-8723 | Danilo Juvane

(918) 573-5075 | Caroline Sardella

(918) 230-9992 | |

Williams Delivers Strong Second-Quarter Results

TULSA, Okla. – Williams (NYSE: WMB) today announced its unaudited financial results for the three and six months ended June 30, 2024.

Financial results build on track record of year-over-year consecutive growth

•GAAP net income of $401 million, or $0.33 per diluted share (EPS)

•Adjusted net income of $521 million, or $0.43 per diluted share (Adj. EPS)

•Record 2Q Adjusted EBITDA of $1.667 billion – up $56 million or 3% vs. 2Q 2023

•Cash flow from operations (CFFO) of $1.279 billion

•Available funds from operations (AFFO) of $1.250 billion – up $35 million or 3% vs. 2Q 2023

•Dividend coverage ratio of 2.16x (AFFO basis)

•On track to achieve top half of 2024 financial guidance

Crisp project execution and accelerating natural gas demand drive strong financial outlook

•Optimized portfolio by exiting Aux Sable joint venture position and consolidating ownership interest in Gulf of Mexico Discovery system

•Placed Transco's Regional Energy Access into full service ahead of schedule on Aug. 1

•Placed Marcellus South and MountainWest's Uinta Basin expansions in-service

•Significant emissions reductions and cost savings accomplished in replacing 57 Transco and Northwest Pipeline compressor units to date

•Initiated construction activities on Louisiana Energy Gateway gathering, treating and carbon capture & sequestration project

•Began construction on Transco's Texas to Louisiana Energy Pathway expansion

•Signed precedent agreement on Transco's Gillis West expansion

•Published 2023 Sustainability Report; set 2028 methane intensity goal for OGMP 2.0

CEO Perspective

Alan Armstrong, president and chief executive officer, made the following comments:

“Our record second quarter Adjusted EBITDA was driven primarily by the strong performance of our transmission and storage business. Even in this environment of low gas prices, we continue to deliver and are on track to achieve the top half of financial guidance this year and even higher levels of growth in 2025 with an expected five-year compound annual growth rate of over 12 percent on our Adjusted EPS, 2020 to 2025.

“Our teams have continued to execute on our strategy across all fronts, including placing projects into service in the Northeast, the West and the Deepwater Gulf of Mexico. In addition to bringing Transco’s Regional Energy Access expansion fully online ahead of schedule, we have initiated construction activities on the Louisiana Energy Gateway gathering, treating and carbon capture & sequestration project as well as Transco’s Texas to Louisiana Energy Pathway expansion. We also continued to optimize our portfolio by selling our stake in the Aux Sable joint venture at an attractive premium and consolidated our ownership interest in the Gulf of Mexico Discovery system at an attractive value, which allows us to improve efficiencies in this commercially active and growing region.”

Armstrong added, “We’ve been delivering consecutive year-over-year growth for more than a decade at Williams, and all signals indicate that the future will be even stronger as demand for natural gas accelerates due to increasing electrification and LNG exports. With our powerful backlog of projects and outstanding track record of execution, no other company is better positioned than Williams to convert these opportunities into compounding returns for our shareholders.”

| | | | | | | | | | | | | | | | | |

| Williams Summary Financial Information | 2Q | | Year to Date |

| Amounts in millions, except ratios and per-share amounts. Per share amounts are reported on a diluted basis. Net income amounts are from continuing operations attributable to The Williams Companies, Inc. available to common stockholders. | 2024 | 2023 | | 2024 | 2023 |

| | | | | |

| GAAP Measures | | | | | |

| Net Income | $401 | | $547 | | | $1,032 | | $1,473 | |

| Net Income Per Share | $0.33 | | $0.45 | | | $0.84 | | $1.20 | |

| Cash Flow From Operations | $1,279 | | $1,377 | | | $2,513 | | $2,891 | |

| | | | | |

| Non-GAAP Measures (1) | | | | | |

| Adjusted EBITDA | $1,667 | | $1,611 | | | $3,601 | | $3,406 | |

| Adjusted Net Income | $521 | | $515 | | | $1,240 | | $1,199 | |

| Adjusted Earnings Per Share | $0.43 | | $0.42 | | | $1.01 | | $0.98 | |

| Available Funds from Operations | $1,250 | | $1,215 | | | $2,757 | | $2,660 | |

| Dividend Coverage Ratio | 2.16 | x | 2.23 | x | | 2.38 | x | 2.44 | x |

| | | | | |

| Other | | | | | |

| Debt-to-Adjusted EBITDA at Quarter End (2) | 3.76 | x | 3.50 | x | | | |

| Capital Investments (Excluding Acquisitions) (3) (4) | $663 | | $715 | | | $1,226 | | $1,240 | |

| | | | | |

(1) Schedules reconciling Adjusted Net Income, Adjusted EBITDA, Available Funds from Operations and Dividend Coverage Ratio (non-GAAP measures) to the most comparable GAAP measure are available at www.williams.com and as an attachment to this news release. |

(2) Does not represent leverage ratios measured for WMB credit agreement compliance or leverage ratios as calculated by the major credit ratings agencies. Debt is net of cash on hand, and Adjusted EBITDA reflects the sum of the last four quarters. |

(3) Capital Investments include increases to property, plant, and equipment (growth & maintenance capital), purchases of and contributions to equity-method investments and purchases of other long-term investments. |

| (4) Year-to-date 2024 capital excludes $1.844 billion for the acquisition of the Gulf Coast Storage assets, which closed in January 2024. Year-to-date 2023 capital excludes $1.053 billion for the acquisition of MountainWest, which closed in February 2023. |

GAAP Measures

Second-quarter 2024 net income decreased by $146 million compared to the prior year reflecting an unfavorable change of $214 million in net unrealized gains/losses on commodity derivatives, higher net interest expense from recent debt issuances and retirements, as well as higher operating costs, depreciation and interest expense resulting from recent acquisitions. These unfavorable changes were partially offset by a $89 million increase in service revenues driven by acquisitions and expansion projects, as well as higher equity allowance for funds used during construction (equity AFUDC) associated with ongoing capital projects at our regulated natural gas pipelines. The tax provision decreased primarily due to lower pretax income.

Year-to-date 2024 net income decreased by $441 million compared to the prior year reflecting an unfavorable change of $633 million in net unrealized gains/losses on commodity derivatives, higher net

interest expense from recent debt issuances and retirements, lower realized hedge gains in the West, as well as higher operating costs, depreciation and interest expense resulting from recent acquisitions. These unfavorable changes were partially offset by a $300 million increase in service revenues driven by acquisitions and expansion projects, higher commodity margins, and higher equity AFUDC. The tax provision decreased primarily due to lower pretax income.

Second-quarter and year-to-date 2024 cash flow from operations decreased compared to the prior year primarily due to unfavorable net changes in both working capital and derivative collateral requirements, partially offset by higher operating results exclusive of non-cash items.

Non-GAAP Measures

Second-quarter 2024 Adjusted EBITDA increased by $56 million over the prior year, driven by the previously described favorable net contributions from acquisitions and expansion projects. Year-to-date 2024 Adjusted EBITDA increased by $195 million over the prior year, similarly reflecting favorable net contributions from acquisitions and expansion projects, as well as higher commodity margins.

Second-quarter and year-to-date 2024 Adjusted Net Income improved by $6 million and $41 million, respectively, over the prior year, driven by the previously described impacts to net income, adjusted primarily to remove the effects of net unrealized gains/losses on commodity derivatives and the related income tax effects.

Second-quarter and year-to-date Available Funds From Operations (AFFO) increased by $35 million and $97 million, respectively, compared to the prior year primarily due to higher results from continuing operations exclusive of non-cash items.

Business Segment Results & Form 10-Q

Williams' operations are comprised of the following reportable segments: Transmission & Gulf of Mexico, Northeast G&P, West and Gas & NGL Marketing Services, as well as Other. For more information, see the company's second-quarter 2024 Form 10-Q.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Second Quarter | | Year to Date |

| Amounts in millions | Modified EBITDA | | Adjusted EBITDA | | Modified EBITDA | | Adjusted EBITDA |

| 2Q 2024 | 2Q 2023 | Change | | 2Q 2024 | 2Q 2023 | Change | | 2024 | 2023 | Change | | 2024 | 2023 | Change |

| Transmission & Gulf of Mexico | $808 | | $731 | | $77 | | | $812 | | $748 | | $64 | | | $1,637 | | $1,446 | | $191 | | | $1,651 | | $1,476 | | $175 | |

| Northeast G&P | 481 | | 515 | | (34) | | | 479 | | 515 | | (36) | | | 985 | | 985 | | — | | | 983 | | 985 | | (2) | |

| West | 318 | | 312 | | 6 | | | 319 | | 312 | | 7 | | | 645 | | 616 | | 29 | | | 647 | | 598 | | 49 | |

| Gas & NGL Marketing Services | (126) | | 68 | | (194) | | | (14) | | (16) | | 2 | | | (25) | | 635 | | (660) | | | 175 | | 215 | | (40) | |

| Other | 47 | | 41 | | 6 | | | 71 | | 52 | | 19 | | | 123 | | 115 | | 8 | | | 145 | | 132 | | 13 | |

| Total | $1,528 | | $1,667 | | ($139) | | | $1,667 | | $1,611 | | $56 | | | $3,365 | | $3,797 | | ($432) | | | $3,601 | | $3,406 | | $195 | |

| | | | | | | | | | | | | | | |

| Note: Williams uses Modified EBITDA for its segment reporting. Definitions of Modified EBITDA and Adjusted EBITDA and schedules reconciling to net income are included in this news release. |

Transmission & Gulf of Mexico

Second-quarter 2024 Modified and Adjusted EBITDA improved compared to the prior year driven by favorable net contributions from the Gulf Coast Storage acquisition and the Regional Energy Access expansion project, as well as higher equity AFUDC. Year-to-date 2024 Modified and Adjusted EBITDA also benefited from the MountainWest acquisition. Modified EBITDA for all periods was impacted by one-time acquisition costs, which are excluded from Adjusted EBITDA.

Northeast G&P

Second-quarter 2024 Modified and Adjusted EBITDA decreased compared to the prior year driven by lower gathering volumes, partially offset by higher rates at Susquehanna Supply Hub and Bradford. For the year-to-date comparison, both metrics were largely unchanged as these higher rates offset the lower gathering volumes.

West

Second-quarter 2024 Modified and Adjusted EBITDA increased compared to the prior year benefiting from the DJ Basin Acquisitions and higher volumes on the Overland Pass Pipeline, partially offset by lower gathering volumes and lower realized gains on natural gas hedges. Both metrics also improved for the year-to-date period reflecting similar drivers, as well as improved commodity margins reflecting favorable changes in shrink prices related to the absence of a short-term gas price spike at Opal in 2023. The year-to-date Modified EBITDA was also impacted by the absence of a first-quarter 2023 favorable contract settlement, which is excluded from Adjusted EBITDA.

Gas & NGL Marketing Services

Second-quarter 2024 Modified EBITDA decreased from the prior year primarily reflecting a $200 million net unfavorable change in unrealized gains/losses on commodity derivatives, which is excluded from Adjusted EBITDA. Year-to-date 2024 Modified EBITDA also decreased from the prior year reflecting a decline in gas marketing margins and a $628 million net unfavorable change in unrealized gains/losses on commodity derivatives, which is excluded from Adjusted EBITDA.

Strategic Transactions

Williams recently closed two strategic transactions to further derisk its portfolio from commodity price volatility and enhance the performance of commercially active and growing Gulf of Mexico assets.

Williams sold its 14 percent stake in a joint venture with Aux Sable for $160 million. The non-operated joint venture assets include a processing and fractionation facility near Chicago and a rich gas gathering pipeline and conditioning plant in North Dakota. Williams’ ownership in the joint venture was subject to cash flow volatility because the keep-whole arrangement made distributions sensitive to commodity prices.

Separately, Williams purchased from Phillips 66 for $170 million its 40 percent stake in Discovery pipeline in the Gulf of Mexico, bringing Williams’ ownership interest to 100 percent, as well as Phillips 66's Dauphin Island Gathering Partners system. Discovery's assets include approximately 600 miles of offshore gas pipelines, a 600 MMcf/d gas processing plant and a 35 Mbbls/d fractionator, both in Louisiana.

2024 Financial Guidance

Williams continues to expect Adjusted EBITDA at the top half of its 2024 guidance range of $6.8 billion and $7.1 billion. In addition, the company continues to expect 2024 growth capex between $1.45 billion and $1.75 billion and maintenance capex between $1.1 billion and $1.3 billion, which includes capital of $350 million for emissions reduction and modernization initiatives. For 2025, the company continues to expect Adjusted EBITDA between $7.2 billion and $7.6 billion with growth capex between $1.65 billion and $1.95 billion and maintenance capex between $750 million and $850 million, which includes capital of $100 million based on midpoint for emissions reduction and modernization initiatives. Williams continues to anticipate a leverage ratio midpoint for 2024 of 3.85x and increased the dividend by 6.1% on an annualized basis to $1.90 in 2024 from $1.79 in 2023.

Williams' Second-Quarter 2024 Materials to be Posted Shortly; Q&A Webcast Scheduled for Tomorrow

Williams' second-quarter 2024 earnings presentation will be posted at www.williams.com. The company's second-quarter 2024 earnings conference call and webcast with analysts and investors is scheduled for Tuesday, Aug. 6, at 9:30 a.m. Eastern Time (8:30 a.m. Central Time). Participants who wish to join the call by phone must register using the following link: https://register.vevent.com/register/BI8cf6dbf9f06f47fabd194ab9f38a7eb8

A webcast link to the conference call will be provided on Williams' Investor Relations website. A replay of the webcast will also be available on the website for at least 90 days following the event.

About Williams

Williams (NYSE: WMB) is a trusted energy industry leader committed to safely, reliably, and responsibly meeting growing energy demand. We use our 33,000-mile pipeline infrastructure to move a third of the

nation’s natural gas to where it's needed most, supplying the energy used to heat our homes, cook our food and generate low-carbon electricity. For over a century, we’ve been driven by a passion for doing things the right way. Today, our team of problem solvers is leading the charge into the clean energy future – by powering the global economy while delivering immediate emissions reductions within our natural gas network and investing in new energy technologies. Learn more at www.williams.com.

The Williams Companies, Inc.

Consolidated Statement of Income

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | |

| (Millions, except per-share amounts) |

| Revenues: | | | | | | | | | | |

| Service revenues | | $ | 1,837 | | | $ | 1,748 | | | $ | 3,742 | | | $ | 3,442 | | | |

| Service revenues – commodity consideration | | 18 | | | 27 | | | 48 | | | 63 | | | |

| Product sales | | 610 | | | 593 | | | 1,455 | | | 1,438 | | | |

| Net gain (loss) from commodity derivatives | | (129) | | | 115 | | | (138) | | | 621 | | | |

| Total revenues | | 2,336 | | | 2,483 | | | 5,107 | | | 5,564 | | | |

| Costs and expenses: | | | | | | | | | | |

| Product costs | | 424 | | | 421 | | | 950 | | | 974 | | | |

| Net processing commodity expenses | | 17 | | | 44 | | | 22 | | | 98 | | | |

| Operating and maintenance expenses | | 522 | | | 481 | | | 1,033 | | | 944 | | | |

| Depreciation and amortization expenses | | 540 | | | 515 | | | 1,088 | | | 1,021 | | | |

| Selling, general, and administrative expenses | | 164 | | | 161 | | | 350 | | | 337 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other (income) expense – net | | (27) | | | (9) | | | (44) | | | (40) | | | |

| Total costs and expenses | | 1,640 | | | 1,613 | | | 3,399 | | | 3,334 | | | |

| Operating income (loss) | | 696 | | | 870 | | | 1,708 | | | 2,230 | | | |

| Equity earnings (losses) | | 147 | | | 160 | | | 284 | | | 307 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other investing income (loss) – net | | 18 | | | 13 | | | 42 | | | 21 | | | |

| Interest expense | | (339) | | | (306) | | | (688) | | | (600) | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other income (expense) – net | | 33 | | | 19 | | | 64 | | | 39 | | | |

| Income (loss) before income taxes | | 555 | | | 756 | | | 1,410 | | | 1,997 | | | |

| Less: Provision (benefit) for income taxes | | 129 | | | 175 | | | 322 | | | 459 | | | |

| Income (loss) from continuing operations | | 426 | | | 581 | | | 1,088 | | | 1,538 | | | |

| Income (loss) from discontinued operations) | | — | | | (87) | | | — | | | (87) | | | |

| Net income (loss) | | 426 | | | 494 | | | 1,088 | | | 1,451 | | | |

| Less: Net income (loss) attributable to noncontrolling interests | | 25 | | | 34 | | | 55 | | | 64 | | | |

| Net income (loss) attributable to The Williams Companies, Inc. | | 401 | | | 460 | | | 1,033 | | | 1,387 | | | |

| Less: Preferred stock dividends | | — | | | — | | | 1 | | | 1 | | | |

| Net income (loss) available to common stockholders | | $ | 401 | | | $ | 460 | | | $ | 1,032 | | | $ | 1,386 | | | |

| Amounts attributable to The Williams Companies, Inc. available to common stockholders: | | | | | | | | | | |

| Income (loss) from continuing operations | | $ | 401 | | | $ | 547 | | | $ | 1,032 | | | $ | 1,473 | | | |

| Income (loss) from discontinued operations | | — | | | (87) | | | — | | | (87) | | | |

| Net income (loss) available to common stockholders | | $ | 401 | | | $ | 460 | | | $ | 1,032 | | | $ | 1,386 | | | |

| Basic earnings (loss) per common share: | | | | | | | | | | |

| Income (loss) from continuing operations | | $ | .33 | | | $ | .45 | | | $ | .85 | | | $ | 1.21 | | | |

| Income (loss) from discontinued operations | | — | | | (.07) | | | — | | | (.07) | | | |

| Net income (loss) available to common stockholders | | $ | .33 | | | $ | .38 | | | $ | .85 | | | $ | 1.14 | | | |

| Weighted-average shares (thousands) | | 1,219,367 | | | 1,217,673 | | | 1,218,761 | | | 1,218,564 | | | |

| Diluted earnings (loss) per common share: | | | | | | | | | | |

| Income (loss) from continuing operations | | $ | .33 | | | $ | .45 | | | $ | .84 | | | $ | 1.20 | | | |

| Income (loss) from discontinued operations | | — | | | (.07) | | | — | | | (.07) | | | |

| Net income (loss) available to common stockholders | | $ | .33 | | | $ | .38 | | | $ | .84 | | | $ | 1.13 | | | |

| Weighted-average shares (thousands) | | 1,222,236 | | | 1,219,915 | | | 1,222,229 | | | 1,223,429 | | | |

The Williams Companies, Inc.

Consolidated Balance Sheet

(Unaudited)

| | | | | | | | | | | | | | |

| | |

| | June 30, | | December 31, |

| | 2024 | | 2023 |

| | (Millions, except per-share amounts) |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 55 | | | $ | 2,150 | |

Trade accounts and other receivables (net of allowance of $4 at June 30, 2024 and $3 at December 31, 2023) | | 1,398 | | | 1,655 | |

| Inventories | | 274 | | | 274 | |

| Derivative assets | | 218 | | | 239 | |

| Other current assets and deferred charges | | 170 | | | 195 | |

| Total current assets | | 2,115 | | | 4,513 | |

| | | | |

| Investments | | 4,612 | | | 4,637 | |

Property, plant, and equipment | | 54,930 | | | 51,842 | |

| Accumulated depreciation and amortization | | (18,228) | | | (17,531) | |

| Property, plant, and equipment – net | | 36,702 | | | 34,311 | |

| Intangible assets – net of accumulated amortization | | 7,402 | | | 7,593 | |

| Regulatory assets, deferred charges, and other | | 1,578 | | | 1,573 | |

| Total assets | | $ | 52,409 | | | $ | 52,627 | |

| | | | |

| LIABILITIES AND EQUITY | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 1,192 | | | $ | 1,379 | |

| Derivative liabilities | | 109 | | | 105 | |

| Accrued and other current liabilities | | 1,229 | | | 1,284 | |

| Commercial paper | | 630 | | | 725 | |

| Long-term debt due within one year | | 1,536 | | | 2,337 | |

| Total current liabilities | | 4,696 | | | 5,830 | |

| | | | |

| Long-term debt | | 24,096 | | | 23,376 | |

| Deferred income tax liabilities | | 4,107 | | | 3,846 | |

| Regulatory liabilities, deferred income, and other | | 4,764 | | | 4,684 | |

| Contingent liabilities and commitments | | | | |

| | | | |

| Equity: | | | | |

| Stockholders’ equity: | | | | |

Preferred stock ($1 par value; 30 million shares authorized at June 30, 2024 and December 31, 2023; 35 thousand shares issued at June 30, 2024 and December 31, 2023) | | 35 | | | 35 | |

Common stock ($1 par value; 1,470 million shares authorized at June 30, 2024 and December 31, 2023; 1,258 million shares issued at June 30, 2024 and 1,256 million shares issued at December 31, 2023) | | 1,258 | | | 1,256 | |

| Capital in excess of par value | | 24,589 | | | 24,578 | |

| Retained deficit | | (12,419) | | | (12,287) | |

| Accumulated other comprehensive income (loss) | | 13 | | | — | |

Treasury stock, at cost (39 million shares at June 30, 2024 and December 31, 2023 of common stock) | | (1,180) | | | (1,180) | |

| Total stockholders’ equity | | 12,296 | | | 12,402 | |

| Noncontrolling interests in consolidated subsidiaries | | 2,450 | | | 2,489 | |

| Total equity | | 14,746 | | | 14,891 | |

| Total liabilities and equity | | $ | 52,409 | | | $ | 52,627 | |

The Williams Companies, Inc.

Consolidated Statement of Cash Flows

(Unaudited)

| | | | | | | | | | | | | | | | |

| | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | |

| | (Millions) |

| OPERATING ACTIVITIES: | | | | | | |

| Net income (loss) | | $ | 1,088 | | | $ | 1,451 | | | |

| Adjustments to reconcile to net cash provided (used) by operating activities: | | | | | | |

| Depreciation and amortization | | 1,088 | | | 1,021 | | | |

| Provision (benefit) for deferred income taxes | | 258 | | | 427 | | | |

| Equity (earnings) losses | | (284) | | | (307) | | | |

| Distributions from equity-method investees | | 394 | | | 418 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Net unrealized (gain) loss from commodity derivative instruments | | 223 | | | (410) | | | |

| | | | | | |

| Inventory write-downs | | 6 | | | 23 | | | |

| Amortization of stock-based awards | | 48 | | | 40 | | | |

| Cash provided (used) by changes in current assets and liabilities: | | | | | | |

| Accounts receivable | | 270 | | | 1,423 | | | |

| Inventories | | (3) | | | 41 | | | |

| Other current assets and deferred charges | | 12 | | | 24 | | | |

| Accounts payable | | (219) | | | (1,220) | | | |

| Accrued and other current liabilities | | (76) | | | (72) | | | |

| Changes in current and noncurrent commodity derivative assets and liabilities | | (141) | | | 119 | | | |

| Other, including changes in noncurrent assets and liabilities | | (151) | | | (87) | | | |

| Net cash provided (used) by operating activities | | 2,513 | | | 2,891 | | | |

| FINANCING ACTIVITIES: | | | | | | |

| Proceeds from (payments of) commercial paper – net | | (95) | | | (352) | | | |

| Proceeds from long-term debt | | 2,100 | | | 1,503 | | | |

| Payments of long-term debt | | (2,274) | | | (14) | | | |

| Payments for debt issuance costs | | (18) | | | (13) | | | |

| Proceeds from issuance of common stock | | 5 | | | 4 | | | |

| Purchases of treasury stock | | — | | | (130) | | | |

| Common dividends paid | | (1,158) | | | (1,091) | | | |

| Dividends and distributions paid to noncontrolling interests | | (130) | | | (112) | | | |

| Contributions from noncontrolling interests | | 36 | | | 18 | | | |

| Other – net | | (18) | | | (17) | | | |

| Net cash provided (used) by financing activities | | (1,552) | | | (204) | | | |

| INVESTING ACTIVITIES: | | | | | | |

| Property, plant, and equipment: | | | | | | |

| Capital expenditures (1) | | (1,123) | | | (1,155) | | | |

| Dispositions - net | | (27) | | | (21) | | | |

| | | | | | |

| | | | | | |

| Purchases of businesses, net of cash acquired | | (1,844) | | | (1,053) | | | |

| Purchases of and contributions to equity-method investments | | (82) | | | (69) | | | |

| Other – net | | 20 | | | 10 | | | |

| Net cash provided (used) by investing activities | | (3,056) | | | (2,288) | | | |

| Increase (decrease) in cash and cash equivalents | | (2,095) | | | 399 | | | |

| Cash and cash equivalents at beginning of year | | 2,150 | | | 152 | | | |

| Cash and cash equivalents at end of period | | $ | 55 | | | $ | 551 | | | |

| _________ | | | | | | |

| (1) Increases to property, plant, and equipment | | $ | (1,141) | | | $ | (1,168) | | | |

| Changes in related accounts payable and accrued liabilities | | 18 | | | 13 | | | |

| Capital expenditures | | $ | (1,123) | | | $ | (1,155) | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Transmission & Gulf of Mexico | |

| (UNAUDITED) | |

| 2023 | | 2024 | |

| (Dollars in millions) | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | Year | | 1st Qtr | 2nd Qtr | | | Year | |

Regulated interstate natural gas transportation, storage, and other revenues (1) | $ | 774 | | $ | 786 | | $ | 794 | | $ | 822 | | $ | 3,176 | | | $ | 836 | | $ | 805 | | | | $ | 1,641 | | |

| Gathering, processing, storage and transportation revenues | 100 | | 104 | | 114 | | 100 | | 418 | | | 137 | | 147 | | | | 284 | | |

Other fee revenues (1) | 6 | | 8 | | 5 | | 4 | | 23 | | | 12 | | 9 | | | | 21 | | |

| Commodity margins | 10 | | 8 | | 7 | | 8 | | 33 | | | 9 | | 5 | | | | 14 | | |

| | | | | | | | | | | | |

Operating and administrative costs (1) | (254) | | (254) | | (257) | | (270) | | (1,035) | | | (254) | | (261) | | | | (515) | | |

Other segment income (expenses) - net (1) | 26 | | 31 | | 36 | | 26 | | 119 | | | 43 | | 54 | | | | 97 | | |

| | | | | | | | | | | | |

| Gain on sale of business | — | | — | | 130 | | (1) | | 129 | | | — | | — | | | | — | | |

Proportional Modified EBITDA of equity-method investments | 53 | | 48 | | 52 | | 52 | | 205 | | | 46 | | 49 | | | | 95 | | |

| Modified EBITDA | 715 | | 731 | | 881 | | 741 | | 3,068 | | | 829 | | 808 | | | | 1,637 | | |

| Adjustments | 13 | | 17 | | (127) | | 11 | | (86) | | | 10 | | 4 | | | | 14 | | |

| Adjusted EBITDA | $ | 728 | | $ | 748 | | $ | 754 | | $ | 752 | | $ | 2,982 | | | $ | 839 | | $ | 812 | | | | $ | 1,651 | | |

| | | | | | | | | | | | |

| Statistics for Operated Assets | | | | | | | | | | | | |

Natural Gas Transmission (2) | | | | | | | | | | | | |

| Transcontinental Gas Pipe Line | | | | | | | | | | | | |

| Avg. daily transportation volumes (MMdth) | 14.3 | | 13.2 | | 14.0 | | 14.0 | | 13.9 | | | 14.6 | | 12.9 | | | | 13.8 | | |

| Avg. daily firm reserved capacity (MMdth) | 19.5 | | 19.4 | | 19.4 | | 19.3 | | 19.4 | | | 20.3 | | 19.7 | | | | 20.0 | | |

| Northwest Pipeline LLC | | | | | | | | | | | | |

| Avg. daily transportation volumes (MMdth) | 3.1 | | 2.3 | | 2.3 | | 2.8 | | 2.6 | | | 3.1 | | 2.2 | | | | 2.7 | | |

| Avg. daily firm reserved capacity (MMdth) | 3.8 | | 3.8 | | 3.8 | | 3.8 | | 3.8 | | | 3.8 | | 3.7 | | | | 3.8 | | |

MountainWest (3) | | | | | | | | | | | | |

| Avg. daily transportation volumes (MMdth) | 4.2 | | 3.2 | | 3.8 | | 4.2 | | 3.9 | | | 4.3 | | 3.2 | | | | 3.8 | | |

| Avg. daily firm reserved capacity (MMdth) | 7.8 | | 7.5 | | 7.5 | | 7.9 | | 7.7 | | | 8.4 | | 8.0 | | | | 8.2 | | |

| Gulfstream - Non-consolidated | | | | | | | | | | | | |

| Avg. daily transportation volumes (MMdth) | 1.0 | | 1.2 | | 1.4 | | 1.1 | | 1.2 | | | 1.0 | | 1.2 | | | | 1.1 | | |

| Avg. daily firm reserved capacity (MMdth) | 1.4 | | 1.4 | | 1.4 | | 1.4 | | 1.4 | | | 1.4 | | 1.4 | | | | 1.4 | | |

Gathering, Processing, and Crude Oil Transportation | | | | | | | | | | | | |

Consolidated (4) | | | | | | | | | | | | |

| Gathering volumes (Bcf/d) | 0.28 | | 0.23 | | 0.27 | | 0.27 | | 0.26 | | | 0.25 | | 0.23 | | | | 0.24 | | |

| Plant inlet natural gas volumes (Bcf/d) | 0.43 | | 0.40 | | 0.46 | | 0.46 | | 0.44 | | | 0.45 | | 0.27 | | | | 0.36 | | |

| NGL production (Mbbls/d) | 28 | | 24 | | 28 | | 26 | | 27 | | | 28 | | 17 | | | | 22 | | |

| NGL equity sales (Mbbls/d) | 7 | | 5 | | 6 | | 5 | | 6 | | | 5 | | 3 | | | | 4 | | |

| Crude oil transportation volumes (Mbbls/d) | 119 | | 111 | | 134 | | 130 | | 123 | | | 118 | | 114 | | | | 116 | | |

Non-consolidated (5) | | | | | | | | | | | | |

| Gathering volumes (Bcf/d) | 0.36 | | 0.30 | | 0.36 | | 0.33 | | 0.34 | | | 0.27 | | 0.35 | | | | 0.31 | | |

| Plant inlet natural gas volumes (Bcf/d) | 0.36 | | 0.30 | | 0.36 | | 0.33 | | 0.34 | | | 0.27 | | 0.35 | | | | 0.31 | | |

| NGL production (Mbbls/d) | 28 | | 21 | | 30 | | 28 | | 27 | | | 15 | | 26 | | | | 20 | | |

| NGL equity sales (Mbbls/d) | 8 | | 3 | | 8 | | 7 | | 7 | | | 3 | | 7 | | | | 5 | | |

| | | | | | | | | | | | |

| (1) Excludes certain amounts associated with revenues and operating costs for tracked or reimbursable charges. | |

(2) Tbtu converted to MMdth at one trillion British thermal units = one million dekatherms. | |

| (3) Includes 100% of the volumes associated with the MountainWest Acquisition transmission assets after the purchase on February 14, 2023, including 100% of the volumes associated with the operated equity-method investment White River Hub, LLC. Average volumes were calculated over the period owned. | |

| (4) Excludes volumes associated with equity-method investments that are not consolidated in our results. | |

| (5) Includes 100% of the volumes associated with operated equity-method investments, including Discovery Producer Services. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Northeast G&P | |

| (UNAUDITED) | |

| 2023 | | 2024 | |

| (Dollars in millions) | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | Year | | 1st Qtr | 2nd Qtr | | | Year | |

| Gathering, processing, transportation, and fractionation revenues | $ | 391 | | $ | 431 | | $ | 417 | | $ | 411 | | $ | 1,650 | | | $ | 411 | | $ | 398 | | | | $ | 809 | | |

Other fee revenues (1) | 32 | | 27 | | 27 | | 28 | | 114 | | | 34 | | 35 | | | | 69 | | |

| Commodity margins | 5 | | (1) | | 7 | | 1 | | 12 | | | 11 | | — | | | | 11 | | |

Operating and administrative costs (1) | (101) | | (101) | | (115) | | (107) | | (424) | | | (108) | | (108) | | | | (216) | | |

| Other segment income (expenses) - net | — | | — | | (1) | | (9) | | (10) | | | (1) | | 3 | | | | 2 | | |

| | | | | | | | | | | | |

| Proportional Modified EBITDA of equity-method investments | 143 | | 159 | | 119 | | 153 | | 574 | | | 157 | | 153 | | | | 310 | | |

| Modified EBITDA | 470 | | 515 | | 454 | | 477 | | 1,916 | | | 504 | | 481 | | | | 985 | | |

| Adjustments | — | | — | | 31 | | 8 | | 39 | | | — | | (2) | | | | (2) | | |

| Adjusted EBITDA | $ | 470 | | $ | 515 | | $ | 485 | | $ | 485 | | $ | 1,955 | | | $ | 504 | | $ | 479 | | | | $ | 983 | | |

| | | | | | | | | | | | |

| Statistics for Operated Assets | | | | | | | | | | | | |

Gathering and Processing | | | | | | | | | | | | |

Consolidated (2) | | | | | | | | | | | | |

| Gathering volumes (Bcf/d) | 4.42 | | 4.61 | | 4.41 | | 4.37 | | 4.45 | | | 4.33 | | 4.11 | | | | 4.22 | | |

| Plant inlet natural gas volumes (Bcf/d) | 1.92 | | 1.79 | | 1.93 | | 1.93 | | 1.89 | | | 1.76 | | 1.77 | | | | 1.77 | | |

| NGL production (Mbbls/d) | 144 | | 135 | | 144 | | 133 | | 139 | | | 133 | | 136 | | | | 135 | | |

| NGL equity sales (Mbbls/d) | 1 | | 1 | | — | | 1 | | 1 | | | 1 | | 1 | | | | 1 | | |

Non-consolidated (3) | | | | | | | | | | | | |

| Gathering volumes (Bcf/d) | 6.97 | | 7.03 | | 6.83 | | 6.85 | | 6.92 | | | 6.79 | | 6.42 | | | | 6.61 | | |

| Plant inlet natural gas volumes (Bcf/d) | 0.77 | | 0.93 | | 0.99 | | 1.01 | | 0.93 | | | 0.98 | | 0.94 | | | | 0.96 | | |

| NGL production (Mbbls/d) | 54 | | 64 | | 71 | | 69 | | 65 | | | 72 | | 70 | | | | 71 | | |

| NGL equity sales (Mbbls/d) | 4 | | 5 | | 4 | | 4 | | 4 | | | 3 | | 6 | | | | 5 | | |

| | | | | | | | | | | | |

| (1) Excludes certain amounts associated with revenues and operating costs for reimbursable charges. | |

| (2) Includes volumes associated with Susquehanna Supply Hub, the Northeast JV, and Utica Supply Hub, all of which are consolidated. | |

| (3) Includes 100% of the volumes associated with operated equity-method investments, including the Laurel Mountain Midstream partnership, Blue Racer Midstream, and the Bradford Supply Hub and the Marcellus South Supply Hub within the Appalachia Midstream Services partnership. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| West | |

| (UNAUDITED) | |

| 2023 | | 2024 | |

| (Dollars in millions) | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | Year | | 1st Qtr | 2nd Qtr | | | Year | |

| Net gathering, processing, transportation, storage, and fractionation revenues | $ | 382 | | $ | 373 | | $ | 371 | | $ | 397 | | $ | 1,523 | | | $ | 421 | | $ | 397 | | | | $ | 818 | | |

Other fee revenues (1) | 5 | | 7 | | 4 | | 8 | | 24 | | | 8 | | 5 | | | | 13 | | |

| Commodity margins | (24) | | 18 | | 21 | | 19 | | 34 | | | 12 | | 30 | | | | 42 | | |

| | | | | | | | | | | | |

Operating and administrative costs (1) | (115) | | (122) | | (122) | | (144) | | (503) | | | (139) | | (148) | | | | (287) | | |

| Other segment income (expenses) - net | 23 | | (7) | | (4) | | (14) | | (2) | | | — | | (2) | | | | (2) | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Proportional Modified EBITDA of equity-method investments | 33 | | 43 | | 45 | | 41 | | 162 | | | 25 | | 36 | | | | 61 | | |

| Modified EBITDA | 304 | | 312 | | 315 | | 307 | | 1,238 | | | 327 | | 318 | | | | 645 | | |

| Adjustments | (18) | | — | | — | | 16 | | (2) | | | 1 | | 1 | | | | 2 | | |

| Adjusted EBITDA | $ | 286 | | $ | 312 | | $ | 315 | | $ | 323 | | $ | 1,236 | | | $ | 328 | | $ | 319 | | | | $ | 647 | | |

| | | | | | | | | | | | |

| Statistics for Operated Assets | | | | | | | | | | | | |

| Gathering and Processing | | | | | | | | | | | | |

Consolidated (2) | | | | | | | | | | | | |

Gathering volumes (Bcf/d) (3) | 5.47 | | 5.51 | | 5.60 | | 6.03 | | 6.02 | | | 5.75 | | 5.25 | | | | 5.50 | | |

| Plant inlet natural gas volumes (Bcf/d) | 0.92 | | 1.06 | | 1.12 | | 1.63 | | 1.54 | | | 1.52 | | 1.48 | | | | 1.50 | | |

| NGL production (Mbbls/d) | 25 | | 40 | | 61 | | 99 | | 91 | | | 87 | | 91 | | | | 89 | | |

| NGL equity sales (Mbbls/d) | 6 | | 16 | | 22 | | 14 | | 14 | | | 6 | | 8 | | | | 7 | | |

| Non-consolidated | | | | | | | | | | | | |

| Gathering volumes (Bcf/d) | 0.32 | | 0.33 | | 0.33 | | — | | — | | | — | | — | | | | — | | |

| Plant inlet natural gas volumes (Bcf/d) | 0.32 | | 0.32 | | 0.32 | | — | | — | | | — | | — | | | | — | | |

| NGL production (Mbbls/d) | 37 | | 38 | | 38 | | — | | — | | | — | | — | | | | — | | |

NGL and Crude Oil Transportation volumes (Mbbls/d) (4) | 161 | | 217 | | 244 | | 250 | | 218 | | | 220 | | 292 | | | | 256 | | |

| | | | | | | | | | | | |

| (1) Excludes certain amounts associated with revenues and operating costs for reimbursable charges. | |

| (2) Excludes volumes associated with equity-method investments that are not consolidated in our results. | |

| (3) Includes 100% of the volumes associated with the Cureton Acquisition gathering assets after the purchase on November 30, 2023. Average volumes were calculated over the period owned. | |

| (4) Includes 100% of the volumes associated with Overland Pass Pipeline Company (an operated equity-method investment), RMM (during the first three quarters of 2023), as well as volumes for our consolidated Bluestem pipeline. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gas & NGL Marketing Services | |

| (UNAUDITED) | |

| 2023 | | 2024 | |

| (Dollars in millions) | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | Year | | 1st Qtr | 2nd Qtr | | | Year | |

| Commodity margins | $ | 265 | | $ | (2) | | $ | 38 | | $ | 88 | | $ | 389 | | | $ | 236 | | $ | 3 | | | | $ | 239 | | |

| Other fee revenues | 1 | | — | | — | | — | | 1 | | | — | | — | | | | — | | |

| Net unrealized gain (loss) from derivative instruments | 333 | | 94 | | 24 | | 208 | | 659 | | | (95) | | (106) | | | | (201) | | |

| Operating and administrative costs | (32) | | (24) | | (19) | | (24) | | (99) | | | (40) | | (23) | | | | (63) | | |

| | | | | | | | | | | | |

| Modified EBITDA | 567 | | 68 | | 43 | | 272 | | 950 | | | 101 | | (126) | | | | (25) | | |

| Adjustments | (336) | | (84) | | (27) | | (203) | | (650) | | | 88 | | 112 | | | | 200 | | |

| Adjusted EBITDA | $ | 231 | | $ | (16) | | $ | 16 | | $ | 69 | | $ | 300 | | | $ | 189 | | $ | (14) | | | | $ | 175 | | |

| | | | | | | | | | | | |

| Statistics | | | | | | | | | | | | |

| Product Sales Volumes | | | | | | | | | | | | |

| Natural Gas (Bcf/d) | 7.24 | | 6.56 | | 7.31 | | 7.11 | | 7.05 | | | 7.53 | | 6.98 | | | | 7.25 | | |

| NGLs (Mbbls/d) | 234 | | 239 | | 245 | | 173 | | 223 | | | 170 | | 162 | | | | 166 | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other | |

| (UNAUDITED) | |

| 2023 | | 2024 | |

| (Dollars in millions) | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | Year | | 1st Qtr | 2nd Qtr | | | Year | |

| Service revenues | $ | 3 | | $ | 5 | | $ | 4 | | $ | 4 | | $ | 16 | | | $ | 4 | | $ | 4 | | | | $ | 8 | | |

| Net realized product sales | 120 | | 97 | | 127 | | 145 | | 489 | | | 113 | | 109 | | | | 222 | | |

| | | | | | | | | | | | |

| Net unrealized gain (loss) from derivative instruments | (6) | | (11) | | (1) | | 19 | | 1 | | | 3 | | (25) | | | | (22) | | |

| Operating and administrative costs | (48) | | (54) | | (58) | | (65) | | (225) | | | (51) | | (50) | | | | (101) | | |

| Other segment income (expenses) - net | 5 | | 5 | | 10 | | 8 | | 28 | | | 7 | | 9 | | | | 16 | | |

| Net gain from Energy Transfer litigation judgment | — | | — | | — | | 534 | | 534 | | | — | | — | | | | — | | |

Proportional Modified EBITDA of equity-method investments | — | | (1) | | (1) | | — | | (2) | | | — | | — | | | | — | | |

| Modified EBITDA | 74 | | 41 | | 81 | | 645 | | 841 | | | 76 | | 47 | | | | 123 | | |

| Adjustments | 6 | | 11 | | 1 | | (553) | | (535) | | | (2) | | 24 | | | | 22 | | |

| Adjusted EBITDA | $ | 80 | | $ | 52 | | $ | 82 | | $ | 92 | | $ | 306 | | | $ | 74 | | $ | 71 | | | | $ | 145 | | |

| | | | | | | | | | | | |

| Statistics | | | | | | | | | | | | |

| Net Product Sales Volumes | | | | | | | | | | | | |

| Natural Gas (Bcf/d) | 0.26 | | 0.29 | | 0.31 | | 0.30 | | 0.29 | | | 0.28 | | 0.24 | | | | 0.26 | | |

| NGLs (Mbbls/d) | 3 | | 6 | | 9 | | 10 | | 7 | | | 8 | | 8 | | | | 8 | | |

| Crude Oil (Mbbls/d) | 1 | | 3 | | 5 | | 7 | | 4 | | | 5 | | 5 | | | | 5 | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capital Expenditures and Investments | |

| (UNAUDITED) | |

| 2023 | | 2024 | |

| (Dollars in millions) | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | Year | | 1st Qtr | 2nd Qtr | | | Year | |

| | | | | | | | | | | | |

| Capital expenditures: | | | | | | | | | | | | |

| Transmission & Gulf of Mexico | $ | 205 | | $ | 263 | | $ | 382 | | $ | 404 | | $ | 1,254 | | | $ | 310 | | $ | 397 | | | | $ | 707 | | |

| Northeast G&P | 99 | | 74 | | 115 | | 71 | | 359 | | | 71 | | 46 | | | | 117 | | |

| West | 169 | | 197 | | 141 | | 121 | | 628 | | | 120 | | 90 | | | | 210 | | |

| Other | 72 | | 76 | | 52 | | 75 | | 275 | | | 43 | | 46 | | | | 89 | | |

Total (1) | $ | 545 | | $ | 610 | | $ | 690 | | $ | 671 | | $ | 2,516 | | | $ | 544 | | $ | 579 | | | | $ | 1,123 | | |

| | | | | | | | | | | | |

| Purchases of and contributions to equity-method investments: | | | | | | | | | | | | |

| Transmission & Gulf of Mexico | $ | 8 | | $ | 18 | | $ | 6 | | $ | 9 | | $ | 41 | | | $ | 27 | | $ | 10 | | | | $ | 37 | | |

| Northeast G&P | 31 | | 12 | | 4 | | 52 | | 99 | | | 25 | | 19 | | | | 44 | | |

| West | — | | — | | 1 | | — | | 1 | | | — | | 1 | | | | 1 | | |

| Other | — | | — | | — | | — | | — | | | — | | — | | | | — | | |

| Total | $ | 39 | | $ | 30 | | $ | 11 | | $ | 61 | | $ | 141 | | | $ | 52 | | $ | 30 | | | | $ | 82 | | |

| | | | | | | | | | | | |

| Summary: | | | | | | | | | | | | |

| Transmission & Gulf of Mexico | $ | 213 | | $ | 281 | | $ | 388 | | $ | 413 | | $ | 1,295 | | | $ | 337 | | $ | 407 | | | | $ | 744 | | |

| Northeast G&P | 130 | | 86 | | 119 | | 123 | | 458 | | | 96 | | 65 | | | | 161 | | |

| West | 169 | | 197 | | 142 | | 121 | | 629 | | | 120 | | 91 | | | | 211 | | |

| Other | 72 | | 76 | | 52 | | 75 | | 275 | | | 43 | | 46 | | | | 89 | | |

| Total | $ | 584 | | $ | 640 | | $ | 701 | | $ | 732 | | $ | 2,657 | | | $ | 596 | | $ | 609 | | | | $ | 1,205 | | |

| | | | | | | | | | | | |

| Capital investments: | | | | | | | | | | | | |

| Increases to property, plant, and equipment | $ | 484 | | $ | 684 | | $ | 792 | | $ | 604 | | $ | 2,564 | | | $ | 509 | | $ | 632 | | | | $ | 1,141 | | |

| Purchases of businesses, net of cash acquired | 1,056 | | (3) | | (29) | | 544 | | 1,568 | | | 1,851 | | (7) | | | | 1,844 | | |

| Purchases of and contributions to equity-method investments | 39 | | 30 | | 11 | | 61 | | 141 | | | 52 | | 30 | | | | 82 | | |

| Purchases of other long-term investments | 2 | | 1 | | 2 | | 1 | | 6 | | | 2 | | 1 | | | | 3 | | |

| Total | $ | 1,581 | | $ | 712 | | $ | 776 | | $ | 1,210 | | $ | 4,279 | | | $ | 2,414 | | $ | 656 | | | | $ | 3,070 | | |

| | | | | | | | | | | | |

(1) Increases to property, plant, and equipment | $ | 484 | | $ | 684 | | $ | 792 | | $ | 604 | | $ | 2,564 | | | $ | 509 | | $ | 632 | | | | $ | 1,141 | | |

| Changes in related accounts payable and accrued liabilities | 61 | | (74) | | (102) | | 67 | | (48) | | | 35 | | (53) | | | | (18) | | |

| Capital expenditures | $ | 545 | | $ | 610 | | $ | 690 | | $ | 671 | | $ | 2,516 | | | $ | 544 | | $ | 579 | | | | $ | 1,123 | | |

| | | | | | | | | | | | |

| Contributions from noncontrolling interests | $ | 3 | | $ | 15 | | $ | — | | $ | — | | $ | 18 | | | $ | 26 | | $ | 10 | | | | $ | 36 | | |

| Contributions in aid of construction | $ | 11 | | $ | 7 | | $ | 2 | | $ | 8 | | $ | 28 | | | $ | 10 | | $ | 13 | | | | $ | 23 | | |

| Proceeds from sale of business | $ | — | | $ | — | | $ | 348 | | $ | (2) | | $ | 346 | | | $ | — | | $ | — | | | | $ | — | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Non-GAAP Measures

This news release and accompanying materials may include certain financial measures – adjusted EBITDA, adjusted income (“earnings”), adjusted earnings per share, available funds from operations and dividend coverage ratio – that are non-GAAP financial measures as defined under the rules of the SEC.

Our segment performance measure, modified EBITDA, is defined as net income (loss) before income (loss) from discontinued operations, income tax expense, interest expense, equity earnings from equity-method investments, other net investing income, impairments of equity investments and goodwill, depreciation and amortization expense, and accretion expense associated with asset retirement obligations for nonregulated operations. We also add our proportional ownership share (based on ownership interest) of modified EBITDA of equity-method investments.

Adjusted EBITDA further excludes items of income or loss that we characterize as unrepresentative of our ongoing operations. Such items are excluded from net income to determine adjusted income and adjusted earnings per share. Management believes this measure provides investors meaningful insight into results from ongoing operations.

Available funds from operations (AFFO) is defined as net income (loss) excluding the effect of certain noncash items, reduced by distributions from equity-method investees, net distributions to noncontrolling interests, and preferred dividends. AFFO may also be adjusted to exclude certain items that we characterize as unrepresentative of our ongoing operations.

This news release is accompanied by a reconciliation of these non-GAAP financial measures to their nearest GAAP financial measures. Management uses these financial measures because they are accepted financial indicators used by investors to compare company performance. In addition, management believes that these measures provide investors an enhanced perspective of the operating performance of assets and the cash that the business is generating.

Neither adjusted EBITDA, adjusted income, nor available funds from operations are intended to represent cash flows for the period, nor are they presented as an alternative to net income or cash flow from operations. They should not be considered in isolation or as substitutes for a measure of performance prepared in accordance with United States generally accepted accounting principles.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Income (Loss) from Continuing Operations Attributable to The Williams Companies, Inc. to Non-GAAP Adjusted Income | |

| (UNAUDITED) | |

| 2023 | | 2024 | |

| (Dollars in millions, except per-share amounts) | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | Year | | 1st Qtr | 2nd Qtr | | | Year | |

| | | | | | | | | | | | |

| Income (loss) from continuing operations attributable to The Williams Companies, Inc. available to common stockholders | $ | 926 | | $ | 547 | | $ | 654 | | $ | 1,146 | | $ | 3,273 | | | $ | 631 | | $ | 401 | | | | $ | 1,032 | | |

| | | | | | | | | | | | |

Income (loss) from continuing operations - diluted earnings (loss) per common share (1) | $ | .76 | | $ | .45 | | $ | .54 | | $ | .94 | | $ | 2.68 | | | $ | .52 | | $ | .33 | | | | $ | .84 | | |

| Adjustments: | | | | | | | | | | | | |

| Transmission & Gulf of Mexico | | | | | | | | | | | | |

| MountainWest acquisition and transition-related costs* | $ | 13 | | $ | 17 | | $ | 3 | | $ | 9 | | $ | 42 | | | $ | — | | $ | 1 | | | | $ | 1 | | |

| Gulf Coast Storage acquisition and transition-related costs* | — | | — | | — | | 1 | | 1 | | | 10 | | 3 | | | | 13 | | |

| Gain on sale of business | — | | — | | (130) | | 1 | | (129) | | | — | | — | | | | — | | |

| Total Transmission & Gulf of Mexico adjustments | 13 | | 17 | | (127) | | 11 | | (86) | | | 10 | | 4 | | | | 14 | | |

| Northeast G&P | | | | | | | | | | | | |

| Accrual for loss contingency* | — | | — | | — | | 10 | | 10 | | | — | | (3) | | | | (3) | | |

| Our share of operator transition costs at Blue Racer Midstream* | — | | — | | — | | — | | — | | | — | | 1 | | | | 1 | | |

| Our share of accrual for loss contingency at Aux Sable Liquid Products LP | — | | — | | 31 | | (2) | | 29 | | | — | | — | | | | — | | |

| Total Northeast G&P adjustments | — | | — | | 31 | | 8 | | 39 | | | — | | (2) | | | | (2) | | |

| West | | | | | | | | | | | | |

| Cureton acquisition and transition-related costs* | — | | — | | — | | 6 | | 6 | | | 1 | | 1 | | | | 2 | | |

| Gain from contract settlement | (18) | | — | | — | | — | | (18) | | | — | | — | | | | — | | |

| Impairment of assets held for sale | — | | — | | — | | 10 | | 10 | | | — | | — | | | | — | | |

| Total West adjustments | (18) | | — | | — | | 16 | | (2) | | | 1 | | 1 | | | | 2 | | |

| Gas & NGL Marketing Services | | | | | | | | | | | | |

Impact of volatility on NGL linefill transactions* | (3) | | 10 | | (3) | | 5 | | 9 | | | (6) | | 5 | | | | (1) | | |

Net unrealized (gain) loss from derivative instruments | (333) | | (94) | | (24) | | (208) | | (659) | | | 94 | | 107 | | | | 201 | | |

| Total Gas & NGL Marketing Services adjustments | (336) | | (84) | | (27) | | (203) | | (650) | | | 88 | | 112 | | | | 200 | | |

| Other | | | | | | | | | | | | |

Net unrealized (gain) loss from derivative instruments | 6 | | 11 | | 1 | | (19) | | (1) | | | (2) | | 24 | | | | 22 | | |

| Net gain from Energy Transfer litigation judgment | — | | — | | — | | (534) | | (534) | | | — | | — | | | | — | | |

| Total Other adjustments | 6 | | 11 | | 1 | | (553) | | (535) | | | (2) | | 24 | | | | 22 | | |

| Adjustments included in Modified EBITDA | (335) | | (56) | | (122) | | (721) | | (1,234) | | | 97 | | 139 | | | | 236 | | |

| Adjustments below Modified EBITDA | | | | | | | | | | | | |

| Gain on remeasurement of RMM investment | — | | — | | — | | (30) | | (30) | | | — | | — | | | | — | | |

| Imputed interest expense on deferred consideration obligations* | — | | — | | — | | — | | — | | | 12 | | 12 | | | | 24 | | |

| Amortization of intangible assets from Sequent acquisition | 15 | | 14 | | 15 | | 15 | | 59 | | | 7 | | 7 | | | | 14 | | |

| 15 | | 14 | | 15 | | (15) | | 29 | | | 19 | | 19 | | | | 38 | | |

| Total adjustments | (320) | | (42) | | (107) | | (736) | | (1,205) | | | 116 | | 158 | | | | 274 | | |

| Less tax effect for above items | 78 | | 10 | | 25 | | 178 | | 291 | | | (28) | | (38) | | | | (66) | | |

Adjustments for tax-related items (2) | — | | — | | (25) | | — | | (25) | | | — | | — | | | | — | | |

| Adjusted income from continuing operations available to common stockholders | $ | 684 | | $ | 515 | | $ | 547 | | $ | 588 | | $ | 2,334 | | | $ | 719 | | $ | 521 | | | | $ | 1,240 | | |

Adjusted income from continuing operations - diluted earnings per common share (1) | $ | .56 | | $ | .42 | | $ | .45 | | $ | .48 | | $ | 1.91 | | | $ | .59 | | $ | .43 | | | | $ | 1.01 | | |

| Weighted-average shares - diluted (thousands) | 1,225,781 | | 1,219,915 | | 1,220,073 | | 1,221,894 | | 1,221,616 | | | 1,222,222 | | 1,222,236 | | | | 1,222,229 | | |

| |

| (1) The sum of earnings per share for the quarters may not equal the total earnings per share for the year due to changes in the weighted-average number of common shares outstanding. | |

| (2) The third quarter of 2023 includes an adjustment associated with a decrease in our estimated deferred state income tax rate. | |

| *Amounts for the 2024 periods are included in Additional adjustments on the Reconciliation of Cash Flow from Operating Activities to Non-GAAP Available Funds from Operations (AFFO). | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of "Net Income (Loss)" to “Modified EBITDA” and Non-GAAP “Adjusted EBITDA” | |

| (UNAUDITED) | |

| 2023 | | 2024 | |

| (Dollars in millions) | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | Year | | 1st Qtr | 2nd Qtr | | | Year | |

| | | | | | | | | | | | |

| Net income (loss) | $ | 957 | | $ | 494 | | $ | 684 | | $ | 1,168 | | $ | 3,303 | | | $ | 662 | | $ | 426 | | | | $ | 1,088 | | |

| Provision (benefit) for income taxes | 284 | | 175 | | 176 | | 370 | | 1,005 | | | 193 | | 129 | | | | 322 | | |

| Interest expense | 294 | | 306 | | 314 | | 322 | | 1,236 | | | 349 | | 339 | | | | 688 | | |

| Equity (earnings) losses | (147) | | (160) | | (127) | | (155) | | (589) | | | (137) | | (147) | | | | (284) | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Other investing (income) loss - net | (8) | | (13) | | (24) | | (63) | | (108) | | | (24) | | (18) | | | | (42) | | |

Proportional Modified EBITDA of equity-method investments | 229 | | 249 | | 215 | | 246 | | 939 | | | 228 | | 238 | | | | 466 | | |

Depreciation and amortization expenses | 506 | | 515 | | 521 | | 529 | | 2,071 | | | 548 | | 540 | | | | 1,088 | | |

Accretion expense associated with asset retirement obligations for nonregulated operations | 15 | | 14 | | 14 | | 16 | | 59 | | | 18 | | 21 | | | | 39 | | |

| (Income) loss from discontinued operations, net of tax | — | | 87 | | 1 | | 9 | | 97 | | | — | | — | | | | — | | |

| Modified EBITDA | $ | 2,130 | | $ | 1,667 | | $ | 1,774 | | $ | 2,442 | | $ | 8,013 | | | $ | 1,837 | | $ | 1,528 | | | | $ | 3,365 | | |

| | | | | | | | | | | | |

| Transmission & Gulf of Mexico | $ | 715 | | $ | 731 | | $ | 881 | | $ | 741 | | $ | 3,068 | | | $ | 829 | | $ | 808 | | | | $ | 1,637 | | |

| Northeast G&P | 470 | | 515 | | 454 | | 477 | | 1,916 | | | 504 | | 481 | | | | 985 | | |

| West | 304 | | 312 | | 315 | | 307 | | 1,238 | | | 327 | | 318 | | | | 645 | | |

| Gas & NGL Marketing Services | 567 | | 68 | | 43 | | 272 | | 950 | | | 101 | | (126) | | | | (25) | | |

| Other | 74 | | 41 | | 81 | | 645 | | 841 | | | 76 | | 47 | | | | 123 | | |

| Total Modified EBITDA | $ | 2,130 | | $ | 1,667 | | $ | 1,774 | | $ | 2,442 | | $ | 8,013 | | | $ | 1,837 | | $ | 1,528 | | | | $ | 3,365 | | |

| | | | | | | | | | | | |

Adjustments (1): | | | | | | | | | | | | |

| Transmission & Gulf of Mexico | $ | 13 | | $ | 17 | | $ | (127) | | $ | 11 | | $ | (86) | | | $ | 10 | | $ | 4 | | | | $ | 14 | | |

| Northeast G&P | — | | — | | 31 | | 8 | | 39 | | | — | | (2) | | | | (2) | | |

| West | (18) | | — | | — | | 16 | | (2) | | | 1 | | 1 | | | | 2 | | |

| Gas & NGL Marketing Services | (336) | | (84) | | (27) | | (203) | | (650) | | | 88 | | 112 | | | | 200 | | |

| Other | 6 | | 11 | | 1 | | (553) | | (535) | | | (2) | | 24 | | | | 22 | | |

| Total Adjustments | $ | (335) | | $ | (56) | | $ | (122) | | $ | (721) | | $ | (1,234) | | | $ | 97 | | $ | 139 | | | | $ | 236 | | |

| | | | | | | | | | | | |

| Adjusted EBITDA: | | | | | | | | | | | | |

| Transmission & Gulf of Mexico | $ | 728 | | $ | 748 | | $ | 754 | | $ | 752 | | $ | 2,982 | | | $ | 839 | | $ | 812 | | | | $ | 1,651 | | |

| Northeast G&P | 470 | | 515 | | 485 | | 485 | | 1,955 | | | 504 | | 479 | | | | 983 | | |

| West | 286 | | 312 | | 315 | | 323 | | 1,236 | | | 328 | | 319 | | | | 647 | | |

| Gas & NGL Marketing Services | 231 | | (16) | | 16 | | 69 | | 300 | | | 189 | | (14) | | | | 175 | | |

| Other | 80 | | 52 | | 82 | | 92 | | 306 | | | 74 | | 71 | | | | 145 | | |

| Total Adjusted EBITDA | $ | 1,795 | | $ | 1,611 | | $ | 1,652 | | $ | 1,721 | | $ | 6,779 | | | $ | 1,934 | | $ | 1,667 | | | | $ | 3,601 | | |

| | | | | | | | | | | | |

| |

| (1) Adjustments by segment are detailed in the "Reconciliation of Income (Loss) from Continuing Operations Attributable to The Williams Companies, Inc. to Non-GAAP Adjusted Income," which is also included in these materials. | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Cash Flow from Operating Activities to Non-GAAP Available Funds from Operations (AFFO) | |

| (UNAUDITED) | |

| 2023 | | 2024 | |

| (Dollars in millions, except coverage ratios) | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | Year | | 1st Qtr | 2nd Qtr | | | Year | |

| | | | | | | | | | | | |

| Net cash provided (used) by operating activities | $ | 1,514 | | $ | 1,377 | | $ | 1,234 | | $ | 1,813 | | $ | 5,938 | | | $ | 1,234 | | $ | 1,279 | | | | $ | 2,513 | | |

| Exclude: Cash (provided) used by changes in: | | | | | | | | | | | | |

| Accounts receivable | (1,269) | | (154) | | 128 | | 206 | | (1,089) | | | (314) | | 44 | | | | (270) | | |

| Inventories, including write-downs | (45) | | (19) | | 7 | | 14 | | (43) | | | (38) | | 35 | | | | (3) | | |

| Other current assets and deferred charges | 4 | | (28) | | 29 | | (65) | | (60) | | | (9) | | (3) | | | | (12) | | |

| Accounts payable | 1,017 | | 203 | | (148) | | (63) | | 1,009 | | | 309 | | (90) | | | | 219 | | |

| Accrued and other current liabilities | 318 | | (246) | | 42 | | (95) | | 19 | | | 218 | | (142) | | | | 76 | | |

| Changes in current and noncurrent commodity derivative assets and liabilities | (82) | | (37) | | (53) | | (28) | | (200) | | | 68 | | 73 | | | | 141 | | |

| Other, including changes in noncurrent assets and liabilities | 40 | | 47 | | 53 | | 106 | | 246 | | | 61 | | 90 | | | | 151 | | |

| Preferred dividends paid | (1) | | — | | (1) | | (1) | | (3) | | | (1) | | — | | | | (1) | | |

| Dividends and distributions paid to noncontrolling interests | (54) | | (58) | | (62) | | (39) | | (213) | | | (64) | | (66) | | | | (130) | | |

| Contributions from noncontrolling interests | 3 | | 15 | | — | | — | | 18 | | | 26 | | 10 | | | | 36 | | |

| Adjustment to exclude litigation-related charges in discontinued operations | — | | 115 | | 1 | | 9 | | 125 | | | — | | — | | | | — | | |

| Adjustment to exclude net gain from Energy Transfer litigation judgment | — | | — | | — | | (534) | | (534) | | | — | | — | | | | — | | |

| Additional Adjustments * | — | | — | | — | | — | | — | | | 17 | | 20 | | | | 37 | | |

| Available funds from operations | $ | 1,445 | | $ | 1,215 | | $ | 1,230 | | $ | 1,323 | | $ | 5,213 | | | $ | 1,507 | | $ | 1,250 | | | | $ | 2,757 | | |

| | | | | | | | | | | | |

| Common dividends paid | $ | 546 | | $ | 545 | | $ | 544 | | $ | 544 | | $ | 2,179 | | | $ | 579 | | $ | 579 | | | | $ | 1,158 | | |

| | | | | | | | | | | | |

| Coverage ratio: | | | | | | | | | | | | |

| Available funds from operations divided by Common dividends paid | 2.65 | | 2.23 | | 2.26 | | 2.43 | | 2.39 | | | 2.60 | | 2.16 | | | | 2.38 | | |

| | | | | | | | | | | | |

* See detail on Reconciliation of Income (Loss) from Continuing Operations Attributable to The Williams Companies, Inc. to Non-GAAP Adjusted Income. | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Income (Loss) from Continuing Operations to Modified EBITDA, Non-GAAP Adjusted EBITDA and Cash Flow from Operating Activities to Non-GAAP Available Funds from Operations (AFFO) | | | | | |

| | | | | | | | | | | |

| | 2024 Guidance | | 2025 Guidance | | | | | |

| (Dollars in millions, except per-share amounts and coverage ratio) | | Low | | Mid | | High | | Low | | Mid | | High | | | | | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) from continuing operations | | $ | 2,094 | | | $ | 2,219 | | | $ | 2,344 | | | $ | 2,373 | | | $ | 2,523 | | | $ | 2,673 | | | | | | |

| Provision (benefit) for income taxes | | 670 | | 695 | | | 720 | | 735 | | 785 | | | 835 | | | | | |

| Interest expense | | | | 1,380 | | | | | | | 1,390 | | | | | | | | |

| Equity (earnings) losses | | | | (535) | | | | | | | (610) | | | | | | | | |

Proportional Modified EBITDA of equity-method investments | | | | 895 | | | | | | | 990 | | | | | | | | |

Depreciation and amortization expenses and accretion for asset retirement obligations associated with nonregulated operations | | | | 2,270 | | | | | | | 2,325 | | | | | | | | |

| Other | | | | (6) | | | | | | | (8) | | | | | | | | |

| Modified EBITDA | | $ | 6,768 | | | $ | 6,918 | | | $ | 7,068 | | | $ | 7,195 | | | $ | 7,395 | | | $ | 7,595 | | | | | | |

| EBITDA Adjustments | | | | 32 | | | | | | | 5 | | | | | | | | |

| Adjusted EBITDA | | $ | 6,800 | | | $ | 6,950 | | | $ | 7,100 | | | $ | 7,200 | | | $ | 7,400 | | | $ | 7,600 | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) from continuing operations | | $ | 2,094 | | | $ | 2,219 | | | $ | 2,344 | | | $ | 2,373 | | | $ | 2,523 | | | $ | 2,673 | | | | | | |

| Less: Net income (loss) attributable to noncontrolling interests and preferred dividends | | | | 115 | | | | | | | 115 | | | | | | | | |

| Net income (loss) from continuing operations attributable to The Williams Companies, Inc. available to common stockholders | | $ | 1,979 | | | $ | 2,104 | | | $ | 2,229 | | | $ | 2,258 | | | $ | 2,408 | | | $ | 2,558 | | | | | | |

| | | | | | | | | | | | | | | | | |

| Adjustments: | | | | | | | | | | | | | | | | | |

Adjustments included in Modified EBITDA (1) | | | | 32 | | | | | | | 5 | | | | | | | | |

Adjustments below Modified EBITDA (2) | | | | 29 | | | | | | | 18 | | | | | | | | |

| Allocation of adjustments to noncontrolling interests | | | | — | | | | | | | — | | | | | | | | |

| Total adjustments | | | | 61 | | | | | | | 23 | | | | | | | | |

| Less tax effect for above items | | | | (15) | | | | | | | (6) | | | | | | | | |

| Adjusted income from continuing operations available to common stockholders | | $ | 2,025 | | | $ | 2,150 | | | $ | 2,275 | | | $ | 2,275 | | | $ | 2,425 | | | $ | 2,575 | | | | | | |

| Adjusted income from continuing operations - diluted earnings per common share | | $ | 1.65 | | | $ | 1.76 | | | $ | 1.86 | | | $ | 1.85 | | | $ | 1.97 | | | $ | 2.10 | | | | | | |

| Weighted-average shares - diluted (millions) | | | | 1,224 | | | | | | | 1,228 | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Available Funds from Operations (AFFO): | | | | | | | | | | | | | | | | | |

| Net cash provided by operating activities (net of changes in working capital, changes in current and noncurrent derivative assets and liabilities, and changes in other, including changes in noncurrent assets and liabilities) | | $ | 5,125 | | | $ | 5,250 | | | $ | 5,375 | | | $ | 5,295 | | | $ | 5,445 | | | $ | 5,595 | | | | | | |

| Preferred dividends paid | | | | (3) | | | | | | | (3) | | | | | | | | |

| Dividends and distributions paid to noncontrolling interests | | | | (215) | | | | | | | (235) | | | | | | | | |

| Contributions from noncontrolling interests | | | | 18 | | | | | | | 18 | | | | | | | | |

| Available funds from operations (AFFO) | | $ | 4,925 | | | $ | 5,050 | | | $ | 5,175 | | | $ | 5,075 | | | $ | 5,225 | | | $ | 5,375 | | | | | | |

| AFFO per common share | | $ | 4.02 | | | $ | 4.13 | | | $ | 4.23 | | | $ | 4.13 | | | $ | 4.25 | | | $ | 4.38 | | | | | | |

| Common dividends paid | | | | $ | 2,320 | | | | | 5%-7% Dividend growth | | | | | |

| Coverage Ratio (AFFO/Common dividends paid) | | 2.12x | | 2.18x | | 2.23x | | | | ~2.12x | | | | | | | |

| | | | | | | | | | | | | | | | | |

| (1) Adjustments reflect transaction and transition costs of acquisitions | | | | | | | | | | | |

| (2) Adjustments reflect amortization of intangible assets from Sequent acquisition | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Forward-Looking Statements

The reports, filings, and other public announcements of The Williams Companies, Inc. (Williams) may contain or incorporate by reference statements that do not directly or exclusively relate to historical facts. Such statements are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act). These forward-looking statements relate to anticipated financial performance, management’s plans and objectives for future operations, business prospects, outcomes of regulatory proceedings, market conditions, and other matters. We make these forward-looking statements in reliance on the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995.

All statements, other than statements of historical facts, included in this report that address activities, events, or developments that we expect, believe, or anticipate will exist or may occur in the future, are forward-looking statements. Forward-looking statements can be identified by various forms of words such as “anticipates,” “believes,” “seeks,” “could,” “may,” “should,” “continues,” “estimates,” “expects,” “forecasts,” “intends,” “might,” “goals,” “objectives,” “targets,” “planned,” “potential,” “projects,” “scheduled,” “will,” “assumes,” “guidance,” “outlook,” “in-service date,” or other similar expressions. These forward-looking statements are based on management’s beliefs and assumptions and on information currently available to management and include, among others, statements regarding:

•Levels of dividends to Williams stockholders;

•Future credit ratings of Williams and its affiliates;

•Amounts and nature of future capital expenditures;

•Expansion and growth of our business and operations;

•Expected in-service dates for capital projects;

•Financial condition and liquidity;

•Business strategy;

•Cash flow from operations or results of operations;

•Seasonality of certain business components;

•Natural gas, natural gas liquids, and crude oil prices, supply, and demand;

•Demand for our services.

Forward-looking statements are based on numerous assumptions, uncertainties, and risks that could cause future events or results to be materially different from those stated or implied in this report. Many of the factors that will determine these results are beyond our ability to control or predict. Specific factors that could cause actual results to differ from results contemplated by the forward-looking statements include, among others, the following:

•Availability of supplies, market demand, and volatility of prices;

•Development and rate of adoption of alternative energy sources;

•The impact of existing and future laws and regulations, the regulatory environment, environmental matters, and litigation, as well as our ability and the ability of other energy companies with whom we conduct or seek to conduct business, to obtain necessary permits and approvals, and our ability to achieve favorable rate proceeding outcomes;

•Our exposure to the credit risk of our customers and counterparties;

•Our ability to acquire new businesses and assets and successfully integrate those operations and assets into existing businesses as well as successfully expand our facilities, and consummate asset sales on acceptable terms;

•Whether we are able to successfully identify, evaluate, and timely execute our capital projects and investment opportunities;

•The strength and financial resources of our competitors and the effects of competition;

•The amount of cash distributions from and capital requirements of our investments and joint ventures in which we participate;

•Whether we will be able to effectively execute our financing plan;

•Increasing scrutiny and changing expectations from stakeholders with respect to our environmental, social, and governance practices;

•The physical and financial risks associated with climate change;

•The impacts of operational and developmental hazards and unforeseen interruptions;

•The risks resulting from outbreaks or other public health crises;

•Risks associated with weather and natural phenomena, including climate conditions and physical damage to our facilities;

•Acts of terrorism, cybersecurity incidents, and related disruptions;

•Our costs and funding obligations for defined benefit pension plans and other postretirement benefit plans;

•Changes in maintenance and construction costs, as well as our ability to obtain sufficient construction-related inputs, including skilled labor;

•Inflation, interest rates, and general economic conditions (including future disruptions and volatility in the global credit markets and the impact of these events on customers and suppliers);

•Risks related to financing, including restrictions stemming from debt agreements, future changes in credit ratings as determined by nationally recognized credit rating agencies, and the availability and cost of capital;

•The ability of the members of the Organization of Petroleum Exporting Countries and other oil exporting nations to agree to and maintain oil price and production controls and the impact on domestic production;

•Changes in the current geopolitical situation, including the Russian invasion of Ukraine and conflicts in the Middle East, including between Israel and Hamas and conflicts involving Iran and its proxy forces;

•Changes in U.S. governmental administration and policies;

•Whether we are able to pay current and expected levels of dividends;

•Additional risks described in our filings with the Securities and Exchange Commission (SEC).

Given the uncertainties and risk factors that could cause our actual results to differ materially from those contained in any forward-looking statement, we caution investors not to unduly rely on our forward-looking statements. We disclaim any obligations to, and do not intend to, update the above list or announce publicly the result of any revisions to any of the forward-looking statements to reflect future events or developments.

In addition to causing our actual results to differ, the factors listed above and referred to below may cause our intentions to change from those statements of intention set forth in this report. Such changes in our intentions may also cause our results to differ. We may change our intentions, at any time and without notice, based upon changes in such factors, our assumptions, or otherwise.

Because forward-looking statements involve risks and uncertainties, we caution that there are important factors, in addition to those listed above, that may cause actual results to differ materially from those contained in the forward-looking statements. For a detailed discussion of those factors, see Part I, Item 1A. Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on February 21, 2024, and as may be supplemented by disclosures in Part II, Item 1A. Risk Factors in subsequent Quarterly Reports on Form 10-Q.

###

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |