Stress Free Wells Fargo Ups Dividend - Analyst Blog

March 14 2012 - 8:33AM

Zacks

Wells Fargo & Company (WFC) has passed the

stress test of the Federal Reserve with flying colors. The company

is also enhancing its shareholder wealth by almost doubling its

dividend.

Wells Fargo’s capital plan including dividend increase and other

capital actions were submitted to the Fed in January this year. The

Fed did not object to its capital plan and therefore, the company

could increase its quarterly dividend by 10 cents.

Earlier in January, the company announced a dividend of 12 cents

for the first quarter. With this 10 cent increase, the dividend now

stands at 22 cents for the first quarter. It is payable on March

30, 2012, to stockholders of record on March 26, 2012.

Moreover, the capital plan of Wells Fargo that passed the Fed’s

stress test also includes an increase in share repurchase activity

in 2012 compared with the prior year. It also incorporates

selective redemptions of trust preferred securities that no longer

count as Tier 1 Capital under the Dodd-Frank Act.

Notably, this represents the second consecutive year of dividend

increase for Wells Fargo. Last year in March, following the stress

test results, the company had enhanced its dividend to 12 cents

from 5 cents paid earlier. Besides Wells Fargo, JPMorgan

Chase & Co. (JPM) and U.S. Bancorp

(USB) also cleared the stress test requirements and therefore

increased their capital redeploying efforts through dividend

increases and share buybacks.

However, Citigroup Inc. (C) and three other

banks have failed to prove their capital strength, and their plans

to return capital to shareholders have faced objections from the

Fed.

In total, 15 of the 19 largest banks in U.S. passed the stress

test. In fact, these companies had to justify that their capital

plans were adequate to help them maintain sufficient financial

strength and continue business even in adverse economic scenarios.

Passing of such a large number of banks in the stress test inspires

our confidence on the banking sector and we believe that the sector

is progressing well.

For Wells Fargo, its business model is an impressive one that

allows it to generate sufficient capital, grow its balance sheet

and help return capital to shareholders. Moreover, we believe that

strategic acquisitions will expand Wells Fargo’s business and

improve its profitability over time.

The company’s diversified revenue stream, strong capital

position and expanded business through the Wachovia acquisition

along with its integration, expected expense management as well as

improved credit quality will also support its profit figures. Yet,

a sluggish economic recovery in addition to regulatory issues might

limit its growth to some extent.

Wells Fargo currently retains its Zacks #3 Rank, which

translates into a short-term Hold rating.

CITIGROUP INC (C): Free Stock Analysis Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

US BANCORP (USB): Free Stock Analysis Report

WELLS FARGO-NEW (WFC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

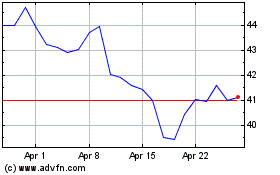

US Bancorp (NYSE:USB)

Historical Stock Chart

From Apr 2024 to May 2024

US Bancorp (NYSE:USB)

Historical Stock Chart

From May 2023 to May 2024