Sturm, Ruger & Company, Inc. (NYSE-RGR) announced today that

for the first quarter of 2024, net sales were $136.8 million and

diluted earnings were 40¢ per share. For the corresponding period

in 2023, net sales were $149.5 million and diluted earnings were

81¢ per share.

The Company also announced today that its Board of Directors

declared a dividend of 16¢ per share for the first quarter for

stockholders of record as of May 20, 2024, payable on June 7, 2024.

This dividend varies every quarter because the Company pays a

percentage of earnings rather than a fixed amount per share. This

dividend is approximately 40% of net income.

Chief Executive Officer Christopher J. Killoy commented on the

first quarter of 2024, “Although the overall firearms market

declined in the first quarter, demand for several of our product

families remained strong, including many of our recently introduced

products:

- 75th Anniversary Mark IV Target pistol,

- 75th Anniversary 10/22 rifles,

- 75th Anniversary LCP MAX pistol,

- American Rifle Generation II family of rifles,

- Mini-14 Tactical with side-folding stock, and

- LC Carbine chambered in .45 Auto.

This drove our sales increase from the fourth quarter and the

strong distributor sell-through of our products to retail and

resulted in significant reductions in both our finished goods

inventory and the inventory of our products at distributors during

the first quarter. We will continue to shift resources to increase

production and better capitalize on these areas of demand.”

Mr. Killoy continued, “We recently executed a variety of

strategic moves aimed at ensuring our long-term success and

continued leadership in an ever-evolving firearms market. This

involved reorganizing specific aspects of our business to achieve

greater efficiency and productivity. Consequently, we undertook a

reduction in force that impacted about 80 of our employees,

approximately half of which were reassigned to manufacturing

positions. This reduction in force resulted in a severance expense

of $1.5 million in the first quarter and will result in annualized

savings of approximately $9 million. As we focus on these goals, we

will continue to pursue opportunities to consolidate functions and

reduce or eliminate investment where possible.”

Mr. Killoy made the following observations related to the

Company’s first quarter 2024 performance:

- The estimated unit sell-through of the Company’s products from

the independent distributors to retailers increased 1% in the first

quarter of 2024 compared to the prior year period. For the same

period, NICS background checks, as adjusted by the National

Shooting Sports Foundation, decreased 4%.

- Sales of new products, including the Security-380 pistol, Super

Wrangler revolver, Marlin lever-action rifles, LC Carbine,

Small-Frame Autoloading Rifle, and American Centerfire Rifle

Generation II represented $42 million or 32% of firearm sales in

the first quarter of 2024, an increase from $30 million or 21% of

sales in the first quarter of 2023. New product sales include only

major new products that were introduced in the past two years.

- Our profitability declined in the first quarter of 2024 from

the first quarter of 2023 as our gross margin decreased from 26% to

21%. The lower margin was driven by:

- a product mix shift toward products with relatively lower

margins that remain in relatively stronger demand,

- unfavorable deleveraging of fixed costs resulting from

decreased production and sales, and

- inflationary cost increases in materials, commodities,

services, energy, fuel and transportation.

- During the first quarter of 2024, the Company’s finished goods

inventory and distributor inventories of the Company’s products

decreased 30,900 units and 51,300 units, respectively.

- Cash provided by operations during the first quarter of 2024

was $7.3 million. At March 30, 2024, our cash and short-term

investments totaled $115.3 million. Our current ratio is 5.2 to 1

and we have no debt.

- In the first quarter of 2024, capital expenditures totaled $1.8

million related to new product introductions, upgrades to our

manufacturing equipment and facilities. We expect our 2024 capital

expenditures to approximate $15 million.

- In the first quarter of 2024, the Company returned $7.3 million

to its shareholders through;

- the payment of $4.1 million of quarterly dividend, and

- the repurchase of 75,024 shares of its common stock in the open

market at an average price of $42.89 per share, for a total of $3.2

million.

- At March 30, 2024, stockholders’ equity was $332.0 million,

which equates to a book value of $19.08 per share, of which $6.63

per share was cash and short-term investments.

Today, the Company filed its Quarterly Report on Form 10-Q for

the first quarter of 2024. The financial statements included in

this Quarterly Report on Form 10-Q are attached to this press

release.

Tomorrow, May 8, 2024, Sturm, Ruger will host a webcast at 9:00

a.m. ET to discuss the first quarter 2024 operating results.

Interested parties can listen to the webcast via this link or by

visiting Ruger.com/corporate. Those who wish to ask questions

during the webcast will need to pre-register prior to the

meeting.

The Quarterly Report on Form 10-Q for the first quarter of 2024

is available on the SEC website at SEC.gov and the Ruger website at

Ruger.com/corporate. Investors are urged to read the complete

Quarterly Report on Form 10-Q to ensure that they have adequate

information to make informed investment judgments.

About Sturm, Ruger & Co.,

Inc.

Sturm, Ruger & Co., Inc. is one of the nation's leading

manufacturers of rugged, reliable firearms for the commercial

sporting market. With products made in America, Ruger offers

consumers almost 800 variations of more than 40 product lines,

across both the Ruger and Marlin brands. For 75 years, Ruger has

been a model of corporate and community responsibility. Our motto,

“Arms Makers for Responsible Citizens®,” echoes our commitment to

these principles as we work hard to deliver quality and innovative

firearms.

The Company may, from time to time, make forward-looking

statements and projections concerning future expectations. Such

statements are based on current expectations and are subject to

certain qualifying risks and uncertainties, such as market demand,

sales levels of firearms, anticipated castings sales and earnings,

the need for external financing for operations or capital

expenditures, the results of pending litigation against the

Company, the impact of future firearms control and environmental

legislation, and accounting estimates, any one or more of which

could cause actual results to differ materially from those

projected. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

made. The Company undertakes no obligation to publish revised

forward-looking statements to reflect events or circumstances after

the date such forward-looking statements are made or to reflect the

occurrence of subsequent unanticipated events.

STURM, RUGER & COMPANY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(Dollars in thousands)

March 30, 2024

December 31, 2023

Assets

Current Assets

Cash

$

15,807

$

15,174

Short-term investments

99,486

102,485

Trade receivables, net

65,815

59,864

Gross inventories

139,876

150,192

Less LIFO reserve

(65,555

)

(64,262

)

Less excess and obsolescence reserve

(5,825

)

(6,120

)

Net inventories

68,496

79,810

Prepaid expenses and other current

assets

8,971

14,062

Total Current Assets

258,575

271,395

Property, plant and equipment

464,080

462,397

Less allowances for depreciation

(396,325

)

(390,863

)

Net property, plant and equipment

67,755

71,534

Deferred income taxes

15,092

11,976

Other assets

43,555

43,912

Total Assets

$

384,977

$

398,817

STURM, RUGER & COMPANY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED) (Continued)

(Dollars in thousands, except per share

data)

March 30, 2024

December 31, 2023

Liabilities and Stockholders’

Equity

Current Liabilities

Trade accounts payable and accrued

expenses

$

29,675

$

31,708

Contract liabilities with customers

30

149

Product liability

309

634

Employee compensation and benefits

14,002

24,660

Workers’ compensation

6,036

6,044

Total Current Liabilities

50,052

63,195

Employee compensation

871

1,685

Product liability accrual

60

46

Lease liability

2,038

2,170

Contingent liabilities

-

-

Stockholders’ Equity

Common Stock, non-voting, par value

$1:

Authorized shares 50,000; none issued

-

-

Common Stock, par value $1:

Authorized shares – 40,000,000

2024 – 24,454,628 issued,

17,401,204 outstanding

2023 – 24,437,020 issued,

17,458,620 outstanding

24,455

24,437

Additional paid-in capital

47,289

46,849

Retained earnings

421,054

418,058

Less: Treasury stock – at cost

2024 – 7,053,424 shares

2023 – 6,978,400 shares

(160,842

)

(157,623

)

Total Stockholders’ Equity

331,956

331,721

Total Liabilities and Stockholders’

Equity

$

384,977

$

398,817

STURM, RUGER & COMPANY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME AND COMPREHENSIVE INCOME (UNAUDITED)

(Dollars in thousands, except per share

data)

Three Months Ended

March 30, 2024

April 1, 2023

Net firearms sales

$

136,008

$

148,893

Net castings sales

812

560

Total net sales

136,820

149,453

Cost of products sold

107,417

110,967

Gross profit

29,403

38,486

Operating expenses:

Selling

9,706

9,225

General and administrative

12,166

12,240

Total operating expenses

21,872

21,465

Operating income

7,531

17,021

Other income:

Interest income

1,355

1,214

Interest expense

(17

)

(25

)

Other income, net

178

282

Total other income, net

1,516

1,471

Income before income taxes

9,047

18,492

Income taxes

1,963

4,142

Net income and comprehensive income

$

7,084

$

14,350

Basic earnings per share

$

0.41

$

0.81

Diluted earnings per share

$

0.40

$

0.81

Weighted average number of common shares

outstanding - Basic

17,434,178

17,678,686

Weighted average number of common shares

outstanding - Diluted

17,640,268

17,788,653

Cash dividends per share

$

0.23

$

5.42

STURM, RUGER & COMPANY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (UNAUDITED)

(Dollars in thousands

Three Months Ended

March 30, 2024

April 1, 2023

Operating Activities

Net income

$

7,084

$

14,350

Adjustments to reconcile net income to

cash provided by operating activities:

Depreciation and amortization

5,833

6,536

Stock-based compensation

1,082

1,134

Gain on sale of assets

-

(2

)

Deferred income taxes

(3,116

)

(79

)

Changes in operating assets and

liabilities:

Trade receivables

(5,951

)

223

Inventories

11,314

3,038

Trade accounts payable and accrued

expenses

(2,057

)

(2,908

)

Contract liability with customers

(119

)

82

Employee compensation and benefits

(11,480

)

(12,739

)

Product liability

(311

)

232

Prepaid expenses, other assets and other

liabilities

5,066

(6,766

)

Income taxes payable

-

2,183

Cash provided by operating activities

7,345

5,284

Investing Activities

Property, plant and equipment

additions

(1,788

)

(1,652

)

Proceeds from sale of assets

-

3

Purchases of short-term investments

(39,488

)

(54,976

)

Proceeds from maturities of short-term

investments

42,487

92,081

Cash provided by investing activities

1,211

35,456

Financing Activities

Remittance of taxes withheld from

employees related to

share-based compensation

(624

)

(2,103

)

Repurchase of common stock

(3,219

)

-

Dividends paid

(4,080

)

(95,758

)

Cash used for financing activities

(7,923

)

(97,861

)

Increase (decrease) in cash and cash

equivalents

633

(57,121

)

Cash and cash equivalents at beginning of

period

15,174

65,173

Cash and cash equivalents at end of

period

$

15,807

$

8,052

Non-GAAP Financial Measures

In an effort to provide investors with additional information

regarding its financial results, the Company refers to various

United States generally accepted accounting principles (“GAAP”)

financial measures and two non-GAAP financial measures, EBITDA and

EBITDA margin, which management believes provides useful

information to investors. These non-GAAP financial measures may not

be comparable to similarly titled financial measures being

disclosed by other companies. In addition, the Company believes

that the non-GAAP financial measures should be considered in

addition to, and not in lieu of, GAAP financial measures. The

Company believes that EBITDA and EBITDA margin are useful to

understanding its operating results and the ongoing performance of

its underlying business, as EBITDA provides information on the

Company’s ability to meet its capital expenditure and working

capital requirements, and is also an indicator of profitability.

The Company believes that this reporting provides better

transparency and comparability to its operating results. The

Company uses both GAAP and non-GAAP financial measures to evaluate

the Company’s financial performance.

EBITDA is defined as earnings before interest, taxes, and

depreciation and amortization. The Company calculates this by

adding the amount of interest expense, income tax expense, and

depreciation and amortization expenses that have been deducted from

net income back into net income, and subtracting the amount of

interest income that was included in net income from net income to

arrive at EBITDA. The Company calculates EBITDA margin by dividing

EBITDA by total net sales.

Non-GAAP Reconciliation –

EBITDA

EBITDA

(Unaudited, dollars in thousands)

Three Months Ended

March 30, 2024

April 1, 2023

Net income

$

7,084

$

14,350

Income tax expense

1,963

4,142

Depreciation and amortization expense

5,833

6,536

Interest income

(1,355

)

(1,214

)

Interest expense

17

25

EBITDA

$

13,542

$

23,839

EBITDA margin

9.9

%

16.0

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507531659/en/

Sturm, Ruger & Company, Inc. One Lacey Place Southport, CT

06890 www.ruger.com 203-259-7843

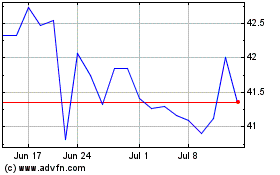

Sturm Ruger (NYSE:RGR)

Historical Stock Chart

From Apr 2024 to May 2024

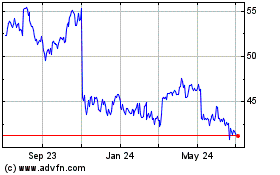

Sturm Ruger (NYSE:RGR)

Historical Stock Chart

From May 2023 to May 2024