Spotify Adds Subscribers, Swings to Loss as It Invests in Podcasts

February 05 2020 - 6:36AM

Dow Jones News

By Anne Steele

Spotify Technology SA posted better-than-expected growth in

users and said its investment in podcasts is helping convert people

who use its free tier into paying subscribers.

At the end of the fourth quarter, Spotify had 271 million

monthly active users, topping the company's expectations. The

company had 124 million paying subscribers, its most lucrative type

of customer, which was at the high end of its guidance.

Average revenue per user for the paid-subscription business fell

5%, or 6% excluding foreign-exchange-rate effects, to EUR4.65

($5.14), mostly due to an extended free trial period in the

quarter, but also owing to new subscribers coming in via discounted

plans through family and student accounts, and lower pricing power

in international markets. Promotional activity helped reduce

monthly churn, or the number of users who end a subscription,

compared to the year earlier, the company said.

Spotify's revenue from subscriptions rose a

better-than-anticipated 24% to EUR1.64 billion ($1.81 billion).

Ad-supported revenue--an area of recent growth for the company as

it builds out its podcasting business--rose 23% to EUR217 million,

but fell short of expectations. The company blamed a slow start to

the period on technical issues with a new advertising-order

system.

More than 16% of Spotify users now listen to podcasts, the

company said, and consumption hours nearly tripled in the quarter

from a year earlier. Spotify, which has been investing heavily in

making acquisitions and creating a slate of original and exclusive

podcasts, has said people who listen to both music and podcasts are

more likely to become paying subscribers than people who listen

only to music.

In a letter to investors, the company indicated 2020 would be

another investment year for podcasts. The Wall Street Journal

reported last month Spotify is in talks to buy sports and

pop-culture outlet the Ringer, according to people familiar with

the matter, a deal that would let the audio streaming giant break

into broader digital media and bring more than 30 podcasts under

its roof. Spotify--which last year spent $400 million to snap up

three podcast companies and struck more than two dozen deals for

exclusive or original content--is in the market for more, according

to one of the people, and the potential Ringer acquisition is just

one of many possible transactions under consideration.

Meanwhile, Spotify has made moves to build out its "two-sided

marketplace," selling tools and services to artists and their

teams. Late last year, the company acquired SoundBetter, a

music-production service for artists and producers, and introduced

sponsored recommendations, which let labels pay to promote new

music to specific listeners. The company said it expects that

business to help it become more profitable in the coming years.

Spotify swung to a loss of EUR209 million, or EUR1.14 a share,

for the period as it invested in podcasts and other parts of its

business. It had reported a profit of EUR442 million, or 36

European cents a share, in the prior-year quarter. Revenue jumped

24% to EUR1.86 billion, in line with guidance.

Free cash flow--a measure of the cash a company generates from

operations, and a gauge that many investors view as a proxy for

performance--was EUR169 million, up from EUR84 million a year

ago.

For the current quarter, the company guided for monthly active

users to grow to between 279 million and 289 million. Paying

subscribers are projected to rise to between 126 million and 131

million and revenue is projected between EUR1.71 billion to EUR1.91

billion.

Dow Jones & Co., publisher of the Journal, has a content

partnership with Gimlet Media, a unit of Spotify.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 05, 2020 06:21 ET (11:21 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

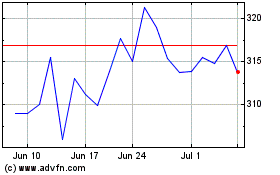

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Oct 2024 to Nov 2024

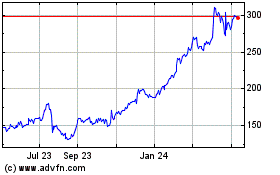

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Nov 2023 to Nov 2024