2nd UPDATE: Anadarko, Korea National Oil In Oil-Shale Joint Venture

March 21 2011 - 2:58PM

Dow Jones News

U.S. oil company Anadarko Petroleum Corp. (APC) said Monday it

has signed a $1.55 billion joint-venture agreement with state-run

Korea National Oil Corp., or KNOC, for one-third of its Maverick

Basin assets in southwest Texas.

The long-awaited deal includes acreage in South Texas's Eagle

Ford shale, underscoring the rising interest of Asian oil companies

to participate in the U.S. oil-shale boom. The move follows

Chesapeake Energy Corp.'s (CHK) agreement in January to sell part

of its oil-rich assets in the Niobrara Shale formation in northeast

Colorado and southeast Wyoming for $1.3 billion to China's biggest

offshore oil producer, Cnooc Ltd. (CEO, 0883.HK)

"We are very pleased to welcome KNOC as our partner in this

development and hope we will be able to pursue other investments

together in the future," Anadarko President and Chief Operating

Officer Al Walker said in a statement.

Under the agreement, which was hinted at by Anadarko months ago

during a conference call with analysts, KNOC will get about 80,000

net acres in the oil-rich Eagle Ford shale and about 16,000

additional acres in the gas-rich Pearsall Shale, Anadarko said in a

press release.

KNOC's $1.55 billion investment will be dedicated to funding the

entirety of Anadarko's 2011 post-closing capital costs in the

Maverick basin, and up to 90% thereafter until the carry is

exhausted, which is expected to occur by the end of 2013.

KNOC will also reimburse Anadarko for net cash outflows,

relative to their acquired interest, which are expected to be

approximately $50 million.

"This is a very good deal for Anadarko because the price per

acre is very high," said Fadel Gheit, an analyst with Oppenheimer

& Co.

Anadarko's shares were trading recently at $79.14 up 2.4%.

Analysts with Raymond James estimated the deal implies KNOC is

paying about $15,000 per acre, which represents the highest price

per acre paid to date in the Eagle Ford, where recent deals were

completed for up to $12,000 per acre. The value obtained by

Anadarko is also outstanding because a portion of the assets were

purchased out of bankruptcy by Anadarko only a year ago for less

than $1,000 per acre, Raymond James said.

UBS analyst William Featherston said in a note to clients that

the transaction is likely to be positive for other companies that

have acreage nearby, such as SM Energy Co. (SM) and Rosetta

Resources, Inc. (ROSE).

Anadarko said it plans to increase the number of rigs in the

Eagle Ford shale to 10 from nine early in the second quarter.

The transaction, which is expected to close in the second

quarter, also gives KNOC the opportunity to participate as a

partner with an approximate 25% working interest by paying its

share in the associated gathering systems and facilities.

The South Korean government said in a statement that, by

cooperating with Anadarko, which has advanced technology in the

area of shale oil, the country "has secured a bridgehead for more

business [opportunities] in unconventional oil development in North

America."

Separately, KNOC said it has acquired a 95% stake in

Kazakhstan's Altius for $515 million. Altius has four oil

blocks--three in production and one in development--with a total

reserve of 56.9 million barrels, from which KNOC plans to produce

54.1 million barrels, it said.

Through the two new oil-asset purchases, South Korea will be

able to secure production of 16,500 barrels a day, bringing the

nation's self-sufficiency ratio for oil and gas up by approximately

0.5 percentage point, it added. The ratio was last at 10.8%.

-By Isabel Ordonez, Dow Jones Newswires; 713-547-9207;

isabel.ordonez@dowjones.com

--Min-Jeong Lee in Seoul contributed to this article.

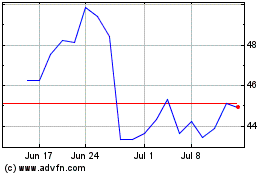

SM Energy (NYSE:SM)

Historical Stock Chart

From May 2024 to Jun 2024

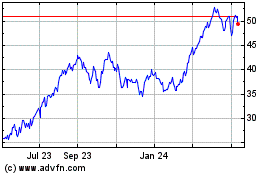

SM Energy (NYSE:SM)

Historical Stock Chart

From Jun 2023 to Jun 2024