Risk, Reward Balance Telus - Analyst Blog

October 04 2011 - 5:23AM

Zacks

We remain on the sidelines on Telus

Corporation’s (TU) owing to the continued decline in

access line, an increasingly competitive domestic wireless market

and reduced wireless data plans.

The second largest Canadian telecommunications company faces

fierce wireless competition from Rogers

Communication (RCI) and BCE Inc. (BCE).

The entry of cable TV operators such as Shaw Communications into

the wireline market has intensified competition further.

Additionally, we believe the reduction in roaming call rates will

lower the company’s data revenues going forward.

In the recently concluded second quarter, earnings per share

missed the Zacks Consensus Estimate but was above the year-ago

earnings. The improved year-over-year growth were driven by

continued wireless subscriber growth, accelerated wireless data

services, increased smartphone sales and growing wireline networks.

These positive attributes also raise optimism on Telus’ 2011

results.

The company expects consolidated revenue and EBITDA to increase

4% to 6% and 1% to 6%, respectively, from 2010 levels. Earnings per

share are expected to grow in the range of 7% to 19% on improved

operating profits and a significant reduction in both taxes and

financing costs.

We remain encouraged by Telus’ prospects in wireless data growth

given new devices, technology upgrades, strong adoption of

smartphones, deployment of HSPA+ Dual Cell technology and the

expected launch of the 4G+ LTE network in 2012, which are expected

to fuel wireless revenue growth. But the potential roll-out of the

4G+ LTE wireless service in rural Canada depends on the ability to

acquire the 700 MHz band from the expected auction in 2012 or

2013.

In the Wireline business, Telus’ continued investments to widen

the footprint of its fiber optic network i.e. Optik TV and High

Speed Internet services across British Columbia, Alberta, and

Eastern Quebec will boost profitability.

Moreover, the company remains committed to deliver attractive

returns to shareholders in the form of higher dividend payouts.

Additionally, over the long term, the company’s balance sheet is

expected to be sound as it is develeraging its balance sheet.

Consequently, we are maintaining our long-term Neutral

recommendation on Telus supported by the Zacks #3 Rank (Hold).

BCE INC (BCE): Free Stock Analysis Report

ROGERS COMM CLB (RCI): Free Stock Analysis Report

TELUS CORP (TU): Free Stock Analysis Report

Zacks Investment Research

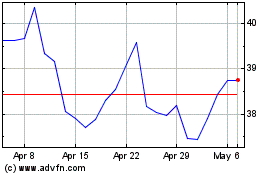

Rogers Communications (NYSE:RCI)

Historical Stock Chart

From Apr 2024 to May 2024

Rogers Communications (NYSE:RCI)

Historical Stock Chart

From May 2023 to May 2024