Methode Electronics, Inc. Announces U.S. Restructuring

January 24 2008 - 9:04AM

Business Wire

Methode Electronics, Inc. (NYSE:MEI), today announced a

restructuring at its U.S.-based automotive operations in Carthage

and Golden, IL. It will also discontinue producing legacy

electronic connector products in Rolling Meadows, IL. At their

peak, these automotive plants produced nearly sixty percent of

Methode�s sales. Today with offshore manufacturing being a

necessity to compete in the global automotive market, revenue

produced at these facilities has been severely diminished. The

Company has previously moved several programs to its foreign

operations and announced its decision to begin exiting several low

profit and unprofitable programs earlier this fiscal year. As a

result of fewer programs remaining for these plants and anticipated

continued reduction in customer production volumes, Methode is

taking this action to transfer the remaining programs from its U.S.

facilities. The automotive restructuring process is expected to be

completed by the end of this calendar year. The legacy electronic

connector exit should conclude in the next three to four months.

Once complete, these actions will result in the elimination of

approximately 700 jobs with only limited production and support

staff remaining in Carthage and Rolling Meadows. Affected employees

will be offered severance and outplacement support. Methode will

begin immediate discussions with customers affected by these

actions. Mr. Donald W. Duda, President and Chief Executive Officer

of Methode Electronics stated, �The decision to initiate this

restructuring was made with great difficulty as we are cognizant of

the number of Methode employees being affected by this action. It

is imperative, however, that we address this situation as these

operations are becoming unprofitable.� Continuing, Mr. Duda said,

�Our operations have made massive efforts to control costs. Despite

these efforts, U.S. economic conditions, coupled with volume

reductions from Methode�s legacy automotive customers, have become

too great an obstacle to overcome.� Methode estimates that it will

record a pre-tax charge during the fiscal years 2008 and 2009

between $19.0 million and $25.0 million ($11.0 million and $15.0

million net of tax), or between $0.30 to $0.40 earnings per share.

The cash portion of this charge will be between $11.0 million and

$14.0 million. Fiscal year 2008 guidance for�sales between $500.0

million and $515.0 million is reaffirmed. Previous earnings per

share guidance between $0.80 and $0.87 did not reflect any charge

for restructuring that will be recorded in Methode�s third or

fourth quarter of fiscal 2008. About Methode Electronics Methode

Electronics, Inc. (NYSE:MEI) is a global manufacturer of component

and subsystem devices with manufacturing, design and testing

facilities in the United States, Malta, Mexico, United Kingdom,

Germany, Czech Republic, China and Singapore. We design,

manufacture and market devices employing electrical, electronic,

wireless, sensing and optical technologies to control and convey

signals through sensors, interconnections and controls. We manage

our business on a segment basis, with those segments being

Automotive, Interconnect, Power Distribution and Other. Our

components are in the primary end markets of the automobile,

computer, information processing and networking equipment, voice

and data communication systems, consumer electronics, appliances,

aerospace vehicles and industrial equipment industries. Further

information can be found at Methode's website at www.methode.com.

Forward-Looking Statements This press release contains certain

forward-looking statements, which reflect management�s expectations

regarding future events and operating performance and speak only as

of the date hereof. These forward-looking statements are subject to

the safe harbor protection, provided under the securities laws.

Methode undertakes no duty to update any forward-looking statement

to conform the statement to actual results or changes in Methode�s

expectations on a quarterly basis or otherwise. The forward-looking

statements in this press release involve a number of risks and

uncertainties. The factors that could cause actual results to

differ materially from our expectations are detailed in Methode�s

filings with the Securities and Exchange Commission, such as our

annual and quarterly reports. Such factors may include, without

limitation, the following: (1) dependence on the automotive

industry; (2) dependence on a small number of large customers

within the automotive industry; (3) intense pricing pressures in

the automotive industry; (4) customary risks related to conducting

global operations; (5) increases in raw materials prices; (6) the

successful integration of acquired businesses; (7) dependence on

the appliance, computer and communications industries; (8) the

marketability of our intellectual property; (9) the seasonal and

cyclical nature of some of our businesses; and (10) our ability to

execute the above-mentioned restructuring as planned.

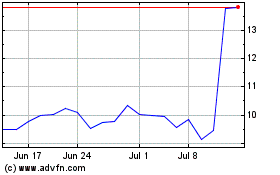

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From May 2024 to Jun 2024

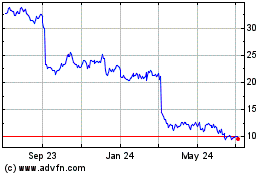

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From Jun 2023 to Jun 2024