Lithia Motors, Inc. (NYSE:LAD), today reported 2009 third

quarter income from continuing operations, net of income taxes, of

$7.0 million, or $0.32 cents per diluted share, compared to

year-ago income from continuing operations of $2.5 million, or

$0.12 per diluted share. After adjusting for certain items

disclosed in the attached financial tables, income from continuing

operations for the 2009 third quarter was $0.33 cents per share,

compared to $0.07 per share in the prior year.

Third quarter 2009 revenue from continuing operations totaled

$458 million, compared to $507 million in the year-ago period,

driven primarily by lower new vehicle sales. Same store new vehicle

sales declined 14.3% while used vehicle retail sales increased 3.9%

when compared to the prior year. Service, body and parts same store

sales declined 2.8% compared to the prior year.

Other Third Quarter Operating Highlights:

- Gross profit margin improved 190

basis points over the prior year to 18.7%. New vehicle margin

improved 110 basis points to 8.8%, used vehicle retail margin

improved 490 basis points to 15.3%, and used vehicle wholesale

margin improved 510 basis points to 0.4%.

- SG&A expense as a percentage

of gross profit decreased by 730 basis points over the prior year

to 75.1%. This was also a reduction of 360 basis points compared to

the second quarter of 2009. This improvement was driven in part by

the elimination of approximately $65 million in annualized fixed

costs.

- Lithia improved same store used

vehicle retail sales 3.9% while maintaining used vehicle inventory

of $67 million, a 15% reduction from September 30, 2008.

Sid DeBoer, Lithia’s Chairman and CEO, commented, “We continue

to produce solid gross margins and strong used vehicle retail

sales. Our third quarter results also benefited from the CARS

program. This incremental boost in revenue demonstrates our

earnings potential as new vehicle sales levels recover and we

leverage our lower cost structure. We continue to right-size to

match industry sales volumes and our internal performance

metrics.”

At the end of the third quarter and before the equity offering

completed in October, Lithia had approximately $34 million in cash

and credit availability and remained well within the limits of the

financial covenants in its debt agreements.

Jeff DeBoer, Senior Vice President and CFO, said, “Adjusted cash

flows from operations were $80.9 million for the year-to-date

period. In October 2009, we completed a follow-on stock offering

raising $43.5 million, net of underwriting commissions, and have

executed an amendment to our revolving line of credit to provide

$50 million in borrowing capacity. These sources of cash allow us

to pursue acquisition opportunities and capitalize on current

market conditions.”

For the nine-month period ending September 30, 2009, total sales

declined 21% to $1.2 billion, as compared to $1.6 billion in the

same period last year. Same store new vehicle sales decreased

30.3%, retail used vehicle sales decreased 1.6% and service, body

and parts sales decreased 4.6%. For the first nine months, income

from continuing operations was $0.53 per share, compared to a loss

of $9.90 per share in 2008. After adjusting for certain items

disclosed in the attached financial tables, including the non-cash

impairment of goodwill, Lithia’s adjusted income from continuing

operations was $0.53 per share, as compared to $0.19 per share in

the prior year.

The third quarter conference call may be accessed at 2:00 p.m.

Pacific Time today by phone at 800-254-5933, Conference ID:

35111411. A playback of the conference call will be available after

5 p.m. Pacific Time October 29, 2009, through November 5, 2009, by

calling 800-642-1687, access code: 35111411.

About Lithia

Lithia Motors, Inc., is a Fortune 700 Company, selling 27 brands

of new and all brands of used vehicles at 87 stores, which are

located in 12 states. Internet sales are centralized at

www.Lithia.com. Lithia also sells used vehicles; arranges finance,

warranty, and credit insurance contracts; and provides vehicle

parts, maintenance, and repair services at all of its

locations.

Additional

Information

For additional information on Lithia Motors, contact the

Investor Relations Department: 541-776-6591 or log on to:

www.lithia.com – go to Investor Relations.

Forward-Looking

Statements

This press release includes forward-looking statements within

the meaning of the “Safe-Harbor” provisions of the Private

Securities Litigation Reform Act of 1995, which management believes

are a benefit to shareholders. These statements are necessarily

subject to risk and uncertainty and actual results could differ

materially due to certain risk factors, including, without

limitation, future economic conditions and others set forth from

time to time in the Company’s filings with the SEC.

Non-GAAP Financial

Measures

The attached financial tables contain certain non-GAAP financial

measures as defined under SEC rules, such as net income and diluted

earnings per share from continuing operations, adjusted to exclude

certain items disclosed in the attached financial tables. As

required by SEC rules, the Company has provided reconciliations of

these measures to the most directly comparable GAAP measures, which

are set forth in the attachments to this release. The Company

believes that each of the foregoing non-GAAP financial measures

improves the transparency of the Company's disclosure, provides a

meaningful presentation of the Company's results from its core

business operations excluding the impact of items not related to

the Company's ongoing core business operations, and improves the

period-to-period comparability of the Company's results from its

core business operations.

LITHIA MOTORS, INC.

(In thousands except per share

data)

Unaudited

Three Months Ended % September 30,

Increase Increase 2009 2008

(Decrease) (Decrease) New vehicle sales $241,577

$282,669 $(41,092) (14.5) % Used vehicle sales 136,164 137,230

(1,066) (0.8) Finance and insurance 14,685 19,400 (4,715) (24.3)

Service, body and parts 64,960 66,728 (1,768) (2.6) Fleet and other

revenues 814 846 (32) (3.8)

Total revenues 458,200

506,873 (48,673) (9.6)

Cost of sales 372,367 421,834 (49,467) (11.7) Gross profit

85,833 85,039 794 0.9 SG&A expense 64,492 70,079 (5,587) (8.0)

Depreciation and amortization 3,923 4,073 (150) (3.7)

Income

from operations 17,418 10,887 6,531

60.0 Floorplan interest expense (2,886) (4,300)

1,414

32.9

Other interest expense (2,943) (4,070)

1,127

27.7

Other income, net 24 1,881 (1,857) (98.7)

Income from continuing

operations before income taxes 11,613 4,398

7,215 164.1 Income tax expense 4,631 1,911

2,720 142.3 Income tax rate 39.9% 43.5%

Income

from continuing operations 6,982 2,487

4,495 180.7 % Loss from discontinued

operations,

net of income tax

(1,269) (4,850) 3,581 73.8

%

Net income (loss) $5,713 $(2,363)

$8,076

NM

Diluted net income (loss) per share: Continuing

operations 0.32 0.12 0.20 166.7 % Discontinued operations (0.06)

(0.24) 0.18 75.0 Net income (loss) per share $0.26 $(0.12) $0.38

NM

Diluted shares outstanding 21,573 20,371 1,202 5.9 %

NM – not meaningful

LITHIA MOTORS, INC.

(Continuing operations)

Unaudited

Three Months Ended

September 30,

Increase

%

Increase

2009 2008 (Decrease) (Decrease)

Unit

sales:

New vehicle 8,364 9,450 (1,086) (11.5) % Used - retail vehicle

7,156 7,059 97 1.4 Used - wholesale 3,817 3,884 (67) (1.7) Total

units sold 19,337 20,393 (1,056) (5.2)

Average

selling price: New vehicle $ 28,883 $ 29,912 $ (1,029)

(3.4) % Used - retail vehicle 16,445 16,166 279 1.7 Used -

wholesale 4,843 5,951 (1,108) (18.6)

Gross

margin/profit data New vehicle retail 8.8 % 7.7 % 110

bps Used vehicle retail 15.3 % 10.4 % 490 bps Used vehicle

wholesale 0.4 % (4.7) % 510 bps Service, body & parts 48.4 %

49.2 % (80) bps Finance & insurance 100.0 % 100.0 % - Gross

profit margin 18.7 % 16.8 % 190 bps New retail gross profit/unit

$2,550 $2,291 $259 Used retail gross profit/unit 2,519 1,678 841

Used wholesale gross profit/unit 18 (279) 297 Finance &

insurance/retail unit 946 1,175 (229)

Revenue

mix: New vehicles 52.7 % 55.8 % Used retail vehicles

25.7 % 22.5 % Used wholesale vehicles 4.0 % 4.6 % Finance and

insurance, net 3.2 % 3.8 % Service and parts 14.2 % 13.2 % Fleet

and other 0.2 % 0.1 % LITHIA MOTORS, INC.

(Continuing operations)

Unaudited

Three Months Ended

September 30,

2009 2008 New vehicle unit sales

brand mix: Chrysler Brands 27.3 % 30.3 % General Motors

& Saturn 16.1 % 20.5 % Toyota 15.9 % 15.6 % Honda 9.3 % 8.7 %

Ford 4.4 % 3.4 % BMW 4.8 % 5.9 % Hyundai 6.2 % 3.7 % Nissan 4.9 %

3.9 % Volkswagen, Audi 3.7 % 3.1 % Subaru 5.2 % 3.2 % Mercedes 0.6

% 0.6 % Other 1.6 % 1.1 %

(Selected Same Store

Data)

Unaudited

Three Months Ended September 30,

2009

vs.

2008

2008

vs.

2007

Same store revenue: New vehicle retail sales

(14.3) % (24.9) % Chrysler Brands (21.3) % (37.2) % General Motors

& Saturn (29.0) % (5.3) % Toyota (14.8) % (17.8) % All other

brands 1.8 % (23.8) % Used vehicle retail sales 3.9 % (14.5) % Used

wholesale sales (19.1) % (37.3) % Total vehicle sales (excluding

fleet) (9.6) % (23.2) % Finance & insurance sales (23.3) %

(21.5) % Service, body and parts sales (2.8) % (0.4) % Total sales

(excluding fleet) (9.2) % (20.7) % Total gross profit (excluding

fleet) 1.4 % (20.4) %

LITHIA MOTORS, INC.

(In thousands except per share

data)

Unaudited

Nine Months Ended % September 30,

Increase Increase 2009 2008

(Decrease) (Decrease) New vehicle sales $612,138

$881,116 $(268,978) (30.5) % Used vehicle sales 382,242 413,163

(30,921) (7.5) Finance and insurance 41,255 59,735 (18,480) (30.9)

Service, body and parts 190,051 199,349 (9,298) (4.7) Fleet and

other revenues 1,947 3,188 (1,241) (38.9)

Total revenues

1,227,633 1,556,551 (328,918) (21.1)

Cost of sales 992,708 1,293,755

(301,047) (23.3) Gross profit 234,925 262,796 (27,871) (10.6) Asset

impairment charges - 294,075 (294,075) (100.0) SG&A expense

188,286 222,381 (34,095) (15.3) Depreciation and amortization

11,988 12,632 (644) (5.1)

Income (loss) from operations

34,651 (266,292) 300,943 113.0

Floorplan interest expense (8,008) (13,758) 5,750 41.8 Other

interest expense (9,545) (12,490) 2,945 23.6 Other income, net

1,447 3,004 (1,557) (51.8)

Income (loss) from continuing

operations before income taxes 18,545 (289,536)

308,081 NM Income tax expense (benefit) 7,429

(90,720) 98,149 NM Income tax (benefit) rate 40.1% (31.3)%

Income (loss) from continuing operations

11,116 (198,816) 209,932 NM

Loss from discontinued operations,

net of income tax

(411) (49,492) 49,081 NM

Net income (loss)

$10,705 $(248,308)

$259,013

NM

Diluted net income (loss) per share: Continuing

operations 0.53 (9.90) 10.43 NM

Discontinued operations (0.02) (2.46) 2.44 NM Net income (loss) per

share $0.51 $(12.36) $12.87 NM Diluted shares outstanding 21,595

20,086 1,509 7.5 %

NM – not meaningful

LITHIA MOTORS, INC.

(Continuing Operations)

Unaudited

Nine Months Ended

September 30,

Increase

%

Increase

2009 2008 (Decrease) (Decrease)

Unit sales: New vehicle 20,746 30,167 (9,421)

(31.2) % Used - retail vehicle 20,568 19,970 598 3.0 Used -

wholesale 9,557 12,153 (2,596) (21.4) Total units sold 50,871

62,290 (11,419) (18.3)

Average selling

price: New vehicle $ 29,506 $ 29,208 $ 298 1.0 % Used -

retail vehicle 16,146 16,951 (805) (4.7) Used - wholesale 5,249

6,143 (894) (14.6)

Gross margin/profit

data New vehicle retail 8.6 % 7.8 % 80 bps Used vehicle

retail 14.3 % 11.5 % 280 bps Used vehicle wholesale 0.9 % (2.8) %

370 bps Service, body & parts 48.6 % 48.5 % 10 bps Finance

& insurance 100.0 % 100.0 % - Gross profit margin 19.1 % 16.9 %

220 bps New retail gross profit/unit $2,523 $2,266 $257 Used retail

gross profit/unit 2,310 1,949 361 Used wholesale gross profit/unit

48 (173) 221 Finance & insurance/retail unit 999 1,191 (192)

Revenue mix: New vehicles 49.9 % 56.6 %

Used retail vehicles 27.0 % 21.7 % Used wholesale vehicles 4.1 %

4.8 % Finance and insurance, net 3.4 % 3.8 % Service and parts 15.5

% 12.8 % Fleet and other 0.1 % 0.3 % LITHIA MOTORS,

INC.

(Continuing operations)

Unaudited

Nine Months Ended

September 30,

2009 2008 New vehicle

unit sales brand mix: Chrysler Brands 29.5 % 31.1 %

General Motors & Saturn 16.4 % 18.8 % Toyota 15.2 % 16.0 %

Honda 9.4 % 9.1 % Ford 4.6 % 3.9 % BMW 5.2 % 5.1 % Hyundai 5.0 %

3.7 % Nissan 4.3 % 4.6 % Volkswagen, Audi 3.7 % 2.9 % Subaru 4.6 %

2.8 % Mercedes 0.7 % 0.6 % Other 1.4 % 1.4 %

(Selected same store

data)

Unaudited

Nine Months Ended September 30,

2009

vs.

2008

2008

vs.

2007

Same store revenue: New vehicle retail sales

(30.3 ) %

(19.9

) % Chrysler Brands (34.4 ) %

(29.5

) % General Motors & Saturn (36.4 ) %

(6.8

) % Toyota (35.5 ) %

(9.3

) % All other brands (20.6 ) %

(20.3

) % Used vehicle retail sales (1.6 ) %

(15.5

) % Used wholesale sales (33.2 ) %

(23.0

) % Total vehicle sales (excluding fleet) (23.0 ) %

(19.0

) % Finance & insurance sales (30.2 ) %

(18.1

) % Service, body and parts sales (4.6 ) %

0.7

% Total sales (excluding fleet) (20.8 ) %

(16.9

) % Total gross profit (excluding fleet) (10.0 ) %

(18.2

) %

LITHIA MOTORS, INC.

Balance sheet highlights (dollars in thousands)

Unaudited September 30, 2009 December 31, 2008

Cash & cash equivalents $4,382 $10,874 Trade receivables*

49,687 69,615 Inventory 255,036 422,812 Assets held for sale

124,845 161,423 Other current assets 8,948 31,828

Total current

assets 442,898 696,552 Real estate, net

274,435 284,088 Equipment & other, net 48,836 62,188 Other

assets 91,052 90,631

Total assets $857,221

$1,133,459 Flooring notes payable $179,420 $337,700

Liabilities related to assets held for sale 74,723 108,172 Current

maturities of senior subordinated convertible notes -

42,500

Other current liabilities 95,821 108,656

Total current

liabilities 349,964 597,028 Real estate

debt 181,718 163,708 Other long-term debt 32,196 101,476 Other

liabilities 29,588 22,904

Total liabilities $593,466

$885,116 Shareholders' equity 263,755 248,343

Total liabilities & shareholders' equity

$857,221 $1,133,459 *Note: Includes

contracts-in-transit of $18,899 and $27,799 for 2009 and 2008,

respectively

Other balance sheet data Lt

debt/total cap (excludes real estate) 11% 29% Book value per basic

share $12.56 $12.30

Debt covenant ratios

Requirement As of September 30, 2009 Minimum

net worth Not less than $183 million $263.8 million Fixed charge

coverage ratio Not less than 1.00 to 1 1.30 to 1 Cash flow leverage

ratio Not more than 3.25 to 1 0.94 to 1 Minimum current ratio Not

less than 1.05 to 1 1.27 to 1

The following table reconciles reported GAAP income (loss) per

the income statement to non-GAAP income (loss):

Unaudited Three Months Ended September 30,

Net Income / (Loss)

Diluted earnings per

share

Continuing Operations 2009

2008 2009 2008 As reported $6,982

$2,487 $0.32 $0.12 Asset impairments 227 75 0.01 - Gain on

extinguishment of debt - (1,111) - (0.05) Adjusted $7,209 $1,451

$0.33 $0.07

Discontinued Operations As

reported $(1,269) $(4,850) $(0.06) $(0.24) Impairments and disposal

loss 1,668 3,103 0.08 0.15 Adjusted $399 $(1,747) 0.02 $(0.09)

Consolidated Operations As reported

$5,713 $(2,363) $0.26 $(0.12) Adjusted $7,608 $(296) $0.35 $(0.02)

Nine Months Ended September 30, Net Income /

(Loss)

Diluted earnings per

share

Continuing Operations 2009

2008 2009 2008 As reported

$11,116 $(198,816) $0.53 $(9.90) Asset impairments 572 203,920 0.03

10.15 Gain on extinguishment of debt (700) (1,111) (0.03) (0.06)

Adjusted $10,988 $3,993 $0.53 $0.19

Discontinued

Operations As reported $(411) $(49,492) $(0.02) $(2.46)

Impairments and disposal (gain) loss (715) 42,658 (0.03) 2.12

Adjusted $(1,126) $(6,834) $(0.05) $(0.34)

Consolidated Operations As reported $10,705

$(248,308) $0.51 $(12.36) Adjusted $9,862 $(2,841) $0.48 $(0.15)

The following table reconciles GAAP cash flows from operations

per the statement of cash flows to non-GAAP cash flows from

operations:

Consolidated Statement of Cash

Flows

Nine Months Ended

September 30, 2009

As reported Cash flows from Operations $73,483 Flooring notes

payable: non-trade 7,384 Adjusted $80,867

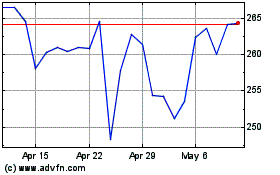

Lithia Motors (NYSE:LAD)

Historical Stock Chart

From Jun 2024 to Jul 2024

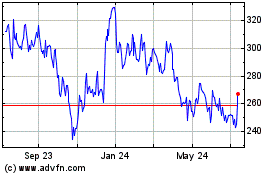

Lithia Motors (NYSE:LAD)

Historical Stock Chart

From Jul 2023 to Jul 2024