Intercontinental Exchange 3Q Profit Falls as Company Focuses On Ellie Mae Deal

October 29 2020 - 8:19AM

Dow Jones News

By Micah Maidenberg

Intercontinental Exchange Inc. reported a weaker profit as it

worked to absorb Ellie Mae, a cloud-based platform for lenders

originating mortgages.

Intercontinental, which operates stock exchanges and clearing

houses and provides data for various markets, on Thursday reported

its profit slipped to $390 million, or 71 cents a share, from $529

million, or 94 cents a share, for the year-earlier period.

Compensation costs rose 14% year over year, the company said.

Intercontinental recorded $76 million in acquisition and

integration costs in the quarter, weighing on earnings. The company

purchased Ellie Mae Sept. 4.

Its adjusted profit of $1.03 a share was ahead of expectations

from analysts by 4 cents, according to FactSet.

Revenue at the owner of the New York Stock Exchange rose to

$1.41 billion from $1.34 billion, less transaction-based expenses,

and was more than the $1.38 billion consensus estimate for the

latest period. Third-quarter revenue included $75 million related

to Ellie Mae.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

October 29, 2020 08:04 ET (12:04 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

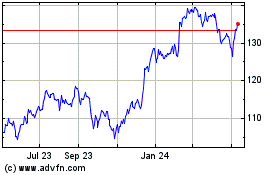

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Aug 2024 to Sep 2024

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Sep 2023 to Sep 2024