- Current report filing (8-K)

January 10 2011 - 5:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant To Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 10, 2011 (January 10, 2011)

HEALTHCARE REALTY TRUST INCORPORATED

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

MARYLAND

|

|

001-11852

|

|

62-1507028

|

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File

Number)

|

|

(I.R.S. Employer

Identification No.)

|

3310 West End Ave. Suite 700 Nashville, Tennessee 37203

(Address of principal executive offices) (Zip Code)

(615) 269-8175

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions (

see

General

Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

TABLE OF CONTENTS

Item 8.01. Other Events

In accordance with Rule 3-14 of Regulation S-X of the Securities and Exchange Commission,

Healthcare Realty Trust Incorporated (the “Company”) is providing combined historical statements of

revenues and certain direct operating expenses of the properties discussed below, which represent a

majority (by dollar value) of the real estate properties acquired by the Company during the fiscal

year ended December 31, 2010 or probable of being acquired.

The audited combined historical statements of revenues and certain direct operating expenses are

not necessarily representative of the entire results of the properties for the periods presented as

certain expenses as described in the notes thereto have been excluded, and may not be indicative of

future operations. In addition, in accordance with Article 11 of Regulation S-X of the Securities

and Exchange Commission, the Company is providing pro forma financial information to demonstrate

the impact of the acquisition of these properties on the Company’s historical financial statements

as if the acquisitions had occurred as of an earlier date. These items are described below and in

Item 9.01 which is incorporated by reference herein.

|

|

•

|

|

On August 31, 2010, the Company acquired two medical office buildings (the “Lowry

Properties”) from Lowry Medical Center, LLC and Lowry Two Medical Center, LLC for an

aggregate of approximately $30.0 million. The Company also assumed a $15.2 million

mortgage loan, which bears interest at 6.75% and matures in April 2013, with a 30-year

amortization. These two off-campus properties, located in Denver, Colorado, included over

112,000 square feet and were 89% leased at the time of the acquisition. The lease

expirations in the Lowry Properties ranged from 2010 through 2020.

|

|

|

|

|

•

|

|

On December 29, 2010, the Company acquired two medical office buildings, a 68-bed acute

care hospital, and two parcels of unimproved land (the “Frisco Properties”) from Frisco

Surgery Center Limited, Frisco POB I Limited, Frisco POB II Limited, and Medland L.P. for

an aggregate of approximately $133.9 million. The Frisco Properties are located on the

Baylor Medical Center campus in Frisco, Texas. The Frisco Properties included an

aggregate of approximately 311,710 square feet, including 155,465 square feet in the two

medical office buildings, and were approximately 85% leased at the time of the acquisition.

The Frisco Properties are located on 23 acres of land, including 4.3 undeveloped acres,

providing room for additional expansion.

|

Item 9.01. Financial Statements and Exhibits

|

(a)

|

|

Financial Statements of Businesses Acquired.

|

|

|

|

|

|

(1)

Combined Historical Statements of Revenues and Certain Direct Operating Expenses for

the Lowry Properties.

The Lowry Properties were acquired from unrelated third parties. The

Company is not aware, after reasonable inquiry, of any material factors relating to the

operations of the Lowry Properties, other than as disclosed herein, that would cause the

reported historical financial information not to be necessarily indicative of future

operating results. Material factors considered by the Company relating to the operations of

the properties in assessing the acquisition of the Lowry Properties are described elsewhere

in this Current Report on Form 8-K.

|

|

|

|

|

(i) Report of Independent Auditors.

|

2

|

|

|

|

(ii) Combined Historical Statements of Revenues and Certain Direct Operating

Expenses for the Year Ended December 31, 2009 and the Six Months Ended June 30, 2010

and 2009 (unaudited).

|

|

|

|

|

|

|

(iii) Notes to Combined Historical Statements of Revenues and Certain Direct

Operating Expenses.

|

|

|

|

(2)

Combined Historical Statements of Revenues and Certain Direct Operating Expenses for

the Frisco Properties.

The Frisco Properties were acquired from unrelated third parties.

The Company is not aware, after reasonable inquiry, of any material factors relating to the

operations of the Frisco Properties, other than as disclosed herein, that would cause the

reported historical financial information not to be necessarily indicative of future

operating results. Material factors considered by the Company relating to the operations of

the properties in assessing the acquisition of the Frisco Properties are described elsewhere

in this Current Report on Form 8-K.

|

|

|

|

|

(i) Report of Independent Auditors.

|

|

|

|

|

|

|

(ii) Combined Historical Statements of Revenues and Certain Direct Operating

Expenses for the Year Ended December 31, 2009 and the Nine Months Ended September 30,

2010 and 2009 (unaudited).

|

|

|

|

|

|

|

(iii) Notes to Combined Historical Statements of Revenues and Certain Direct

Operating Expenses.

|

|

(b)

|

|

Pro Forma Financial Information.

|

|

|

|

|

(1) Introduction to Unaudited Pro Forma Condensed Consolidated Financial Statements

of the Company.

|

|

|

|

|

|

|

(2) Unaudited Pro Forma Condensed Consolidated Balance Sheet of the Company as of

September 30, 2010.

|

|

|

|

|

|

|

(3) Unaudited Pro Forma Condensed Consolidated Statement of Income for the Company

for the nine months ended September 30, 2010.

|

|

|

|

|

|

|

(4) Unaudited Pro Forma Condensed Consolidated Statement of Income of the Company

for the year ended December 31, 2009.

|

|

|

|

|

|

|

(5) Notes to Unaudited Pro Forma Condensed Consolidated Financial Statements of the

Company.

|

|

|

|

|

99.1 Consent of Independent Registered Public Accounting Firm.

|

|

|

|

|

|

|

99.2 Consent of Independent Registered Public Accounting Firm.

|

3

|

(a)

|

|

Financial Statements of Businesses Acquired.

|

Lowry Properties

Combined Historical Statements of Revenues and Certain Direct Operating Expenses

For the Year ended December 31, 2009 and

the Six Months ended June 30, 2010 and 2009 (unaudited)

4

Report of Independent Auditors

Board of Directors and Stockholders

Healthcare Realty Trust Incorporated

Nashville, Tennessee

We have audited the accompanying Combined Historical Statement of Revenues and Certain Direct

Operating Expenses for the year ended December 31, 2009 of the two medical office buildings (the

“Properties”) acquired pursuant to the purchase agreement dated June 16, 2010 between HR Lowry

Medical Center SPE, LLC, an affiliate of Healthcare Realty Trust Incorporated, and Lowry Medical

Center, LLC and Lowry Two Medical Center, LLC (collectively, “Lowry”). This financial statement is

the responsibility of Lowry management. Our responsibility is to express an opinion on the

financial statement based on our audit.

We conducted our audit in accordance with auditing standards generally accepted in the United

States of America. Those standards require that we plan and perform the audit to obtain reasonable

assurance about whether the financial statement is free of material misstatement. An audit

includes consideration of internal control over financial reporting as a basis for designing audit

procedures that are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of Lowry’s internal control over financial reporting. Accordingly, we

express no such opinion. An audit also includes examining, on a test basis, evidence supporting

the amounts and disclosures in the financial statement, assessing the accounting principles used

and significant estimates made by management, as well as evaluating the overall presentation of the

financial statement. We believe that our audit provides a reasonable basis for our opinion.

The accompanying financial statement was prepared for the purpose of complying with the rules and

regulations of the United States Securities and Exchange Commission as described in Note 2 and is

not intended to be a complete presentation of the Properties’ revenues and expenses.

In our opinion, the Combined Historical Statement of Revenues and Certain Direct Operating Expenses

referred to above presents fairly, in all material respects, the revenues and certain direct

operating expenses described in Note 2 to the financial statement for the year ended December 31,

2009, in conformity with accounting principles generally accepted in the United States of America.

/s/ BDO USA, LLP

Nashville, Tennessee

September 3, 2010

5

Lowry Properties

Combined Historical Statements of Revenues and Certain Direct Operating Expenses

For the Year ended December 31, 2009 and

the Six Months ended June 30, 2010 and 2009

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the

|

|

For the

|

|

|

|

For the

|

|

Six Months

|

|

Six Months

|

|

|

|

Year Ended

|

|

Ended

|

|

Ended

|

|

|

|

Dec. 31, 2009

|

|

June 30, 2010

|

|

June 30, 2009

|

|

|

|

|

|

|

|

(unaudited)

|

|

(unaudited)

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income

|

|

$

|

2,084

|

|

|

$

|

1,170

|

|

|

$

|

1,040

|

|

|

Other rental revenue

|

|

|

808

|

|

|

|

461

|

|

|

|

419

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

|

2,892

|

|

|

|

1,631

|

|

|

|

1,459

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certain direct operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Utilities

|

|

|

327

|

|

|

|

178

|

|

|

|

150

|

|

|

Property taxes

|

|

|

283

|

|

|

|

154

|

|

|

|

145

|

|

|

General and administrative

|

|

|

197

|

|

|

|

110

|

|

|

|

91

|

|

|

Repairs and maintenance

|

|

|

159

|

|

|

|

95

|

|

|

|

77

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total certain direct operating expenses

|

|

|

966

|

|

|

|

537

|

|

|

|

463

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues in excess of certain direct operating expenses

|

|

$

|

1,926

|

|

|

$

|

1,094

|

|

|

$

|

996

|

|

|

|

|

|

See accompanying notes to combined financial statements.

6

Lowry Properties

Notes to Combined Historical Statements of Revenues and Certain Direct Operating Expenses

(Dollars in thousands)

|

(1)

|

|

Business

|

|

|

|

|

|

The portfolio of two medical office buildings (the “Properties”) acquired from Lowry Medical

Center, LLC and Lowry Two Medical Center, LLC (collectively, “Lowry”) includes off-campus

properties which are located in Denver, Colorado.

|

|

|

|

(2)

|

|

Basis of Presentation

|

|

|

|

|

|

The accompanying Combined Historical Statements of Revenues and Certain Direct Operating

Expenses have been prepared for the purpose of complying with Rule 3-14 of the Securities and

Exchange Commission Regulation S-X and are not intended to be a complete presentation of the

Properties’ revenues and expenses. The financial statements have been prepared on the

accrual basis of accounting and require management of the Properties to make estimates and

assumptions that affect the reported amounts of the revenues and expenses during the

reporting period. Actual results may differ from those estimates.

|

|

|

|

(3)

|

|

Unaudited Interim Information

|

|

|

|

|

|

In the opinion of Lowry’s management, all adjustments, consisting only of normal and

recurring adjustments, necessary for a fair presentation (in accordance with Basis of

Presentation as described in Note 2) have been made to the accompanying unaudited amounts for

the six months ended June 30, 2010 and 2009.

|

|

|

|

(4)

|

|

Revenues

|

|

|

|

|

|

The Properties contain medical office space occupied under various lease agreements with

tenants. All leases are accounted for as operating leases. Rental income is recognized as

earned over the life of the lease agreements on a straight-line basis. Some of the leases

include provisions under which the Properties are reimbursed for common area maintenance and

other operating costs, real estate taxes, and insurance. Revenue related to these reimbursed

costs is recognized in the period the applicable costs are incurred and billed to tenants

pursuant to the lease agreements. Certain leases contain renewal options at various periods

at various rental rates.

|

|

|

|

|

|

Future minimum lease payments due under the non-cancelable operating leases at December 31,

2009 were as follows (in thousands):

|

|

|

|

|

|

|

|

2010

|

|

$

|

2,255

|

|

|

2011

|

|

|

2,313

|

|

|

2012

|

|

|

2,374

|

|

|

2013

|

|

|

2,341

|

|

|

2014

|

|

|

2,406

|

|

|

2015 and thereafter

|

|

|

11,119

|

|

|

|

|

|

|

|

|

|

$

|

22,808

|

|

|

|

|

|

|

7

|

(5)

|

|

Certain Direct Operating Expenses

|

|

|

|

|

|

Certain direct operating expenses include only those costs expected to be comparable to the

proposed future operations of the Properties. Utilities expense includes electricity, gas,

water, and telephone expense. General and administrative expense includes janitorial,

security, landscaping, insurance, supplies, leasing fees, and other general costs associated

with operating the properties. Repairs and maintenance expenses are charged to operations as

incurred. Costs such as depreciation, amortization, and professional fees are excluded from

the financial statements.

|

8

Frisco Properties

Combined Historical Statements of Revenues and Certain Direct Operating Expenses

For the Year ended December 31, 2009 and

the Nine Months ended September 30, 2010 and 2009 (unaudited)

9

Report of Independent Auditors

Board of Directors and Stockholders

Healthcare Realty Trust Incorporated

Nashville, Tennessee

We have audited the accompanying Combined Historical Statement of Revenues and Certain Direct

Operating Expenses for the year ended December 31, 2009 of the two medical office buildings, one

hospital, and two tracts of undeveloped parcels of land (the “Properties”) acquired pursuant to the

purchase agreement between Healthcare Realty Trust Incorporated, and Frisco Surgery Center Limited,

Frisco POB I Limited, Frisco POB II Limited, and Medland L.P. (collectively referred to as

“Frisco”). This financial statement is the responsibility of Frisco management. Our responsibility

is to express an opinion on the financial statement based on our audit.

We conducted our audit in accordance with auditing standards generally accepted in the United

States of America. Those standards require that we plan and perform the audit to obtain reasonable

assurance about whether the financial statement is free of material misstatement. An audit

includes consideration of internal control over financial reporting as a basis for designing audit

procedures that are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of Frisco’s internal control over financial reporting. Accordingly,

we express no such opinion. An audit also includes examining, on a test basis, evidence supporting

the amounts and disclosures in the financial statement, assessing the accounting principles used

and significant estimates made by management, as well as evaluating the overall presentation of the

financial statement. We believe that our audit provides a reasonable basis for our opinion.

The accompanying financial statement was prepared for the purpose of complying with the rules and

regulations of the United States Securities and Exchange Commission as described in Note 2 and is

not intended to be a complete presentation of the Properties’ revenues and expenses.

In our opinion, the Combined Historical Statement of Revenues and Certain Direct Operating Expenses

referred to above presents fairly, in all material respects, the revenues and certain direct

operating expenses described in Note 2 to the financial statement for the year ended December 31,

2009, in conformity with accounting principles generally accepted in the United States of America.

/s/ BDO USA, LLP

Nashville, Tennessee

December 28, 2010

10

Frisco Properties

Combined Historical Statements of Revenues and Certain Direct Operating Expenses

For the Year Ended December 31, 2009

and the Nine Months Ended September 30, 2010 and 2009

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the

|

|

For the

|

|

|

|

For the

|

|

Nine Months

|

|

Nine Months

|

|

|

|

Year Ended

|

|

Ended

|

|

Ended

|

|

|

|

Dec. 31, 2009

|

|

Sept. 30, 2010

|

|

Sept. 30, 2009

|

|

|

|

|

|

|

|

(unaudited)

|

|

(unaudited)

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income

|

|

$

|

10,133

|

|

|

$

|

7,550

|

|

|

$

|

7,702

|

|

|

Other rental revenue

|

|

|

1,589

|

|

|

|

1,268

|

|

|

|

1,295

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

|

11,722

|

|

|

|

8,818

|

|

|

|

8,997

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certain direct operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Utilities

|

|

|

342

|

|

|

|

267

|

|

|

|

329

|

|

|

Property taxes

|

|

|

922

|

|

|

|

692

|

|

|

|

692

|

|

|

General and administrative

|

|

|

405

|

|

|

|

285

|

|

|

|

265

|

|

|

Repairs and maintenance

|

|

|

147

|

|

|

|

132

|

|

|

|

90

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total certain direct operating expenses

|

|

|

1,816

|

|

|

|

1,376

|

|

|

|

1,376

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues in excess of certain direct operating expenses

|

|

$

|

9,906

|

|

|

$

|

7,442

|

|

|

$

|

7,621

|

|

|

|

|

|

See accompanying notes to combined financial statements.

11

Frisco Properties

Notes to Combined Historical Statements of Revenues and Certain Direct Operating Expenses

(Dollars in thousands)

|

(1)

|

|

Business

|

|

|

|

|

|

The portfolio of one hospital, two medical office buildings, and two tracts of undeveloped

land (the “Properties”) acquired from Frisco Surgery Center Limited, Frisco POB I Limited,

POB II Limited, and Medland L.P. (collectively, “Frisco”) includes on-campus properties which

are located in Frisco, Texas.

|

|

|

|

(2)

|

|

Basis of Presentation

|

|

|

|

|

|

The accompanying Combined Historical Statements of Revenues and Certain Direct Operating

Expenses have been prepared for the purpose of complying with Rule 3-14 of the Securities and

Exchange Commission Regulation S-X and are not intended to be a complete presentation of the

Properties’ revenues and expenses. The financial statements have been prepared on the

accrual basis of accounting and require management of the Properties to make estimates and

assumptions that affect the reported amounts of the revenues and expenses during the

reporting period. Actual results may differ from those estimates. The financial statements

do not include expenses related to the two undeveloped tracts of land as they are not

operational.

|

|

|

|

(3)

|

|

Unaudited Interim Information

|

|

|

|

|

|

In the opinion of Frisco’s management, all adjustments, consisting only of normal and

recurring adjustments, necessary for a fair presentation (in accordance with Basis of

Presentation as described in Note 2) have been made to the accompanying unaudited amounts for

the nine months ended September 30, 2010 and 2009.

|

|

|

|

(4)

|

|

Revenues

|

|

|

|

|

|

The Properties contain medical office space occupied under various lease agreements with

tenants. All leases are accounted for as operating leases. Rental income is recognized as

earned over the life of the lease agreements on a straight-line basis. Some of the leases

include provisions under which the Properties are reimbursed for common area maintenance and

other operating costs, real estate taxes, and insurance. Revenue related to these reimbursed

costs is recognized in the period the applicable costs are incurred and billed to tenants

pursuant to the lease agreements. Certain leases contain renewal options at various periods

at various rental rates.

|

|

|

|

|

|

Future minimum lease payments due under the non-cancelable operating leases at December 31,

2009 were as follows (in thousands).

|

|

|

|

|

|

|

|

2010

|

|

$

|

8,330

|

|

|

2011

|

|

|

8,526

|

|

|

2012

|

|

|

8,744

|

|

|

2013

|

|

|

7,962

|

|

|

2014

|

|

|

7,931

|

|

|

2015 and thereafter

|

|

|

110,578

|

|

|

|

|

|

|

|

|

|

$

|

152,071

|

|

|

|

|

|

|

12

|

(5)

|

|

Certain Direct Operating Expenses

|

|

|

|

|

|

Certain direct operating expenses include only those costs expected to be comparable to the

proposed future operations of the Properties. Utilities expense includes electricity, gas,

and water. General and administrative expense includes security, cleaning, landscaping,

insurance, and other general costs associated with operating the properties. Repairs and

maintenance expenses are charged to operations as incurred. Costs such as depreciation,

amortization, management fees, and professional fees are excluded from the financial

statements.

|

13

|

(b)

|

|

Pro Forma Financial Information.

|

|

|

|

|

|

The Unaudited Pro Forma Condensed Consolidated Financial Statements (including notes thereto)

are qualified in their entirety by reference to and should be read in conjunction with the

Company’s Quarterly Report on Form 10-Q for the nine months ended September 30, 2010, the

Company’s Annual Report on Form 10-K for the year ended December 31, 2009, and the financial

statements included in Item 9.01(a) of this Current Report on Form 8-K.

|

|

|

|

|

|

The accompanying Unaudited Pro Forma Condensed Consolidated Balance Sheet as of September 30,

2010, reflects the financial position of the Company as if the Frisco Properties’ acquisition

described in the Notes to the Unaudited Pro Forma Condensed Consolidated Financial Statements

had been completed on September 30, 2010. The Lowry Properties’ transaction closed in August

2010 and is, therefore, already included in the Company’s historical Condensed Consolidated

Balance Sheet as of September 30, 2010.

|

|

|

|

|

|

The accompanying Unaudited Pro Forma Condensed Consolidated Statements of Income for the nine

months ended September 30, 2010 and the twelve months ended December 31, 2009, present the

results of operations of the Company as if the transactions described in the Notes to the

Unaudited Pro Forma Condensed Consolidated Financial Statements had been completed on January

1, 2009.

|

|

|

|

|

|

These accompanying Unaudited Pro Forma Condensed Consolidated Financial Statements are subject

to a number of estimates, assumptions, and other uncertainties, and do not purport to be indicative

of the actual results of operations that would have occurred had the acquisitions reflected therein

in fact occurred on the dates specified, nor do such financial statements purport to be indicative

of the results of operations that may be achieved in the future. In addition, the Unaudited Pro

Forma Condensed Consolidated Financial Statements include pro forma allocations of the purchase

price of the properties discussed in the accompanying notes based upon preliminary estimates of the

fair value of the assets acquired and liabilities assumed in connection with the acquisitions and

are subject to change.

|

14

Healthcare Realty Trust Incorporated

Unaudited Pro Forma Condensed Consolidated Balance Sheet

As of September 30, 2010

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro Forma

|

|

|

|

|

|

Historical

|

|

Adjustments

|

|

Pro Forma

|

|

|

|

(1)

|

|

(2)

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real estate properties:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Land

|

|

$

|

148,356

|

|

|

$

|

11,142

|

|

|

$

|

159,498

|

|

|

Buildings, improvements and lease intangibles

|

|

|

2,172,818

|

|

|

|

120,255

|

|

|

|

2,293,073

|

|

|

Personal property

|

|

|

17,974

|

|

|

|

—

|

|

|

|

17,974

|

|

|

Construction in progress

|

|

|

58,070

|

|

|

|

2,500

|

|

|

|

60,570

|

|

|

|

|

|

|

|

|

|

2,397,218

|

|

|

|

133,897

|

|

|

|

2,531,115

|

|

|

Less accumulated depreciation

|

|

|

(474,120

|

)

|

|

|

—

|

|

|

|

(474,120

|

)

|

|

|

|

|

|

Total real estate properties, net

|

|

|

1,923,098

|

|

|

|

133,897

|

|

|

|

2,056,995

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

11,177

|

|

|

|

—

|

|

|

|

11,177

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage notes receivable

|

|

|

27,134

|

|

|

|

—

|

|

|

|

27,134

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets held for sale and discontinued operations, net

|

|

|

17,592

|

|

|

|

—

|

|

|

|

17,592

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other assets, net

|

|

|

90,862

|

|

|

|

37

|

|

|

|

90,899

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

2,069,863

|

|

|

$

|

133,934

|

|

|

$

|

2,203,797

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes and bonds payable

|

|

$

|

1,138,200

|

|

|

$

|

133,934

|

|

|

$

|

1,272,134

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

|

61,400

|

|

|

|

—

|

|

|

|

61,400

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities of discontinued operations

|

|

|

1,229

|

|

|

|

—

|

|

|

|

1,229

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other liabilities

|

|

|

46,025

|

|

|

|

—

|

|

|

|

46,025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

1,246,854

|

|

|

|

133,934

|

|

|

|

1,380,788

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

641

|

|

|

|

—

|

|

|

|

641

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional paid-in capital

|

|

|

1,602,078

|

|

|

|

—

|

|

|

|

1,602,078

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated other comprehensive loss

|

|

|

(4,628

|

)

|

|

|

—

|

|

|

|

(4,628

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative net income attributable to common

stockholders

|

|

|

795,785

|

|

|

|

—

|

|

|

|

795,785

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative dividends

|

|

|

(1,574,586

|

)

|

|

|

—

|

|

|

|

(1,574,586

|

)

|

|

|

|

|

|

Total stockholders’ equity

|

|

|

819,290

|

|

|

|

—

|

|

|

|

819,290

|

|

|

Noncontrolling interests

|

|

|

3,719

|

|

|

|

—

|

|

|

|

3,719

|

|

|

|

|

|

|

Total equity

|

|

|

823,009

|

|

|

|

—

|

|

|

|

823,009

|

|

|

|

|

|

|

Total liabilities and equity

|

|

$

|

2,069,863

|

|

|

$

|

133,934

|

|

|

$

|

2,203,797

|

|

|

|

|

|

See accompanying notes.

15

Healthcare Realty Trust Incorporated

Unaudited Pro Forma Condensed Consolidated Statement of Income

For The Nine Months Ended September 30, 2010

(Dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition

|

|

|

|

|

|

|

|

|

|

|

Company

|

|

|

Properties

|

|

|

Pro Forma Adjustments

|

|

|

Company

|

|

|

|

|

Historical

|

|

|

Historical

|

|

|

Acquisitions

|

|

|

Financing

|

|

|

Pro Forma

|

|

|

|

|

(1)

|

|

|

(2) (3)

|

|

|

(2) (4)

|

|

|

(6)

|

|

|

|

|

|

|

REVENUES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Master lease rent

|

|

$

|

43,309

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

43,309

|

|

|

Property operating

|

|

|

140,000

|

|

|

|

9,897

|

|

|

|

(43

|

)

|

|

|

—

|

|

|

|

149,854

|

|

|

Straight-line rent

|

|

|

1,952

|

|

|

|

1,389

|

|

|

|

96

|

|

|

|

—

|

|

|

|

3,437

|

|

|

Mortgage interest

|

|

|

1,708

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,708

|

|

|

Other operating

|

|

|

6,399

|

|

|

|

7

|

|

|

|

(3

|

)

|

|

|

—

|

|

|

|

6,403

|

|

|

|

|

|

|

|

|

|

193,368

|

|

|

|

11,293

|

|

|

|

50

|

|

|

|

—

|

|

|

|

204,711

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

12,513

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

12,513

|

|

|

Property operating

|

|

|

75,089

|

|

|

|

2,924

|

|

|

|

(524

|

)

|

|

|

—

|

|

|

|

77,489

|

|

|

Bad debt, net

|

|

|

(438

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(438

|

)

|

|

Depreciation

|

|

|

50,000

|

|

|

|

2,664

|

|

|

|

487

|

|

|

|

—

|

|

|

|

53,151

|

|

|

Amortization

|

|

|

3,869

|

|

|

|

118

|

|

|

|

578

|

|

|

|

—

|

|

|

|

4,565

|

|

|

|

|

|

|

|

|

|

141,033

|

|

|

|

5,706

|

|

|

|

541

|

|

|

|

—

|

|

|

|

147,280

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on extinguishment of debt

|

|

|

(480

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(480

|

)

|

|

Interest expense

|

|

|

(47,803

|

)

|

|

|

(4,672

|

)

|

|

|

4,094

|

|

|

|

(6,342

|

)

|

|

|

(54,723

|

)

|

|

Interest and other income, net

|

|

|

1,800

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,800

|

|

|

|

|

|

|

|

|

|

(46,483

|

)

|

|

|

(4,672

|

)

|

|

|

4,094

|

|

|

|

(6,342

|

)

|

|

|

(53,403

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM CONTINUING OPERATIONS

|

|

$

|

5,852

|

|

|

$

|

915

|

|

|

$

|

3,603

|

|

|

$

|

(6,342

|

)

|

|

$

|

4,028

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM CONTINUING OPERATIONS

PER COMMON SHARE — BASIC

|

|

$

|

0.10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

0.07

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM CONTINUING OPERATIONS

PER COMMON SHARE — DILUTED

|

|

$

|

0.10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

0.06

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING — BASIC

|

|

|

61,232,810

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

61,232,810

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING — DILUTED

|

|

|

62,269,413

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

62,269,413

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes.

16

Healthcare Realty Trust Incorporated

Unaudited Pro Forma Condensed Consolidated Statement of Income

For The Twelve Months Ended December 31, 2009

(Dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition

|

|

|

|

|

|

|

|

|

|

|

Company

|

|

|

Properties

|

|

|

Pro Forma Adjustments

|

|

|

Company

|

|

|

|

|

Historical

|

|

|

Historical

|

|

|

Acquisitions

|

|

|

Financing

|

|

|

Pro Forma

|

|

|

|

|

(1)

|

|

|

(2) (3)

|

|

|

(2) (5)

|

|

|

(6)

|

|

|

|

|

|

|

REVENUES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Master lease rent

|

|

$

|

57,648

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

57,648

|

|

|

Property operating

|

|

|

180,024

|

|

|

|

13,053

|

|

|

|

(98

|

)

|

|

|

—

|

|

|

|

192,979

|

|

|

Straight-line rent

|

|

|

2,027

|

|

|

|

1,724

|

|

|

|

118

|

|

|

|

—

|

|

|

|

3,869

|

|

|

Mortgage interest

|

|

|

2,646

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

2,646

|

|

|

Other operating

|

|

|

10,959

|

|

|

|

10

|

|

|

|

(5

|

)

|

|

|

—

|

|

|

|

10,964

|

|

|

|

|

|

|

|

|

|

253,304

|

|

|

|

14,787

|

|

|

|

15

|

|

|

|

—

|

|

|

|

268,106

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

22,493

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

22,493

|

|

|

Property operating

|

|

|

95,141

|

|

|

|

3,587

|

|

|

|

(729

|

)

|

|

|

—

|

|

|

|

97,999

|

|

|

Bad debt, net of recoveries

|

|

|

537

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

537

|

|

|

Depreciation

|

|

|

62,447

|

|

|

|

3,710

|

|

|

|

577

|

|

|

|

—

|

|

|

|

66,734

|

|

|

Amortization

|

|

|

5,259

|

|

|

|

183

|

|

|

|

775

|

|

|

|

—

|

|

|

|

6,217

|

|

|

|

|

|

|

|

|

|

185,877

|

|

|

|

7,480

|

|

|

|

623

|

|

|

|

—

|

|

|

|

193,980

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Re-measurement gain of equity interest upon

acquisition

|

|

|

2,701

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

2,701

|

|

|

Interest expense

|

|

|

(43,080

|

)

|

|

|

(6,317

|

)

|

|

|

5,451

|

|

|

|

(8,550

|

)

|

|

|

(52,496

|

)

|

|

Interest and other income, net

|

|

|

1,173

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,173

|

|

|

|

|

|

|

|

|

|

(39,206

|

)

|

|

|

(6,317

|

)

|

|

|

5,451

|

|

|

|

(8,550

|

)

|

|

|

(48,622

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM CONTINUING OPERATIONS

|

|

$

|

28,221

|

|

|

$

|

990

|

|

|

$

|

4,843

|

|

|

$

|

(8,550

|

)

|

|

$

|

25,504

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM CONTINUING OPERATIONS

PER COMMON SHARE — BASIC

|

|

$

|

0.48

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

0.44

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM CONTINUING OPERATIONS

PER COMMON SHARE- DILUTED

|

|

$

|

0.48

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

0.43

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING — BASIC

|

|

|

58,199,592

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

58,199,592

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING — DILUTED

|

|

|

59,047,314

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

59,047,314

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes.

17

Healthcare Realty Trust Incorporated

Notes to Unaudited Pro Forma Condensed Consolidated Financial Statements

The unaudited pro forma financial information reflects pro forma adjustments that are

described in the notes below and are based on available information and certain assumptions that

management of the Company believes are reasonable under the circumstances. The actual results

could differ materially from the results presented. The Company believes that all adjustments that

are necessary to present fairly the unaudited pro forma condensed consolidated data have been made.

The unaudited pro forma information is presented for informational purposes only and does not

purport to be indicative of what would have occurred had the Lowry Properties and Frisco Properties

acquisitions actually been consummated at the beginning of the period presented, nor is it

necessarily indicative of the Company’s future consolidated operating results.

|

1)

|

|

Represents the historical condensed consolidated financial statements of the Company, except

that the Unaudited Pro Forma Condensed Consolidated Statements of Income include only the

results of operations from continuing operations of the Company for each period presented. In

accordance with Article 11 of Regulation S-X of the Securities and Exchange Commission,

revenues and expenses related to property operations classified as discontinued operations

have been excluded. The impact of the Lowry Properties, acquired on August 31, 2010, is

already reflected in the historical column of the Company’s Condensed Consolidated Balance

Sheet, and one month of its results of operations and resulting financing activities,

September 2010, are already reflected in the historical column of the Company’s Condensed

Consolidated Income Statement for the nine months ended September 30, 2010.

|

|

|

|

2)

|

|

The unaudited pro forma adjustments to the Company’s Condensed Consolidated Balance Sheet

represent the impact of the Company’s acquisition of the Frisco Properties on December 29,

2010 and assume the transaction had been completed on September 30, 2010. The Company has

estimated and allocated the value of its investment in the real estate properties acquired to

land, land held for development, building, and lease intangibles and has assumed the

transaction was funded with proceeds received from senior notes issued by the Company in

December 2010 at a contractual rate of 5.75%.

|

|

|

|

|

|

The unaudited pro forma adjustments to the Company’s Condensed Consolidated Statements of

Income for the nine months ended September 30, 2010 and the twelve months ended December 31,

2009 assume that the acquisition of the Lowry Properties and Frisco Properties had been

completed on January 1, 2009.

|

|

|

|

|

|

The Company’s estimates and valuations included in these Unaudited Pro Forma Condensed

Financial Statements are based on preliminary estimates and assumptions as of the date of this

report, which may change.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of

|

|

|

|

|

|

|

|

Number of

|

|

Real Estate

|

|

Acquisition

|

|

Location

|

|

|

|

|

|

Buildings

|

|

Investment

|

|

|

|

|

8/31/10

|

|

|

Lowry Properties — Denver, CO

|

|

|

|

|

|

|

2

|

|

|

$

|

30.0 million

|

(a)

|

|

|

12/29/10

|

|

|

Frisco Properties — Frisco, TX

|

|

|

|

|

|

|

3

|

|

|

$

|

133.9 million

|

(

b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals

|

|

|

5

|

|

|

$

|

163.9 million

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a)

|

|

Includes land of approximately $3.0 million and debt assumed, secured by the

properties, of approximately $15.7 million, including a $0.5 million fair value premium

adjustment, with a contractual interest rate of approximately 6.75%.

|

|

|

|

b)

|

|

This acquisition also included the acquisition of two undeveloped parcels of land, in which the

Company allocated a fair value amount of $2.5 million and classified the parcels as land held for

future development.

|

18

|

3)

|

|

Represents the historical consolidated results of operations of the Lowry Properties and

Frisco Properties for each period presented.

|

|

|

|

4)

|

|

The Company made certain pro forma adjustments related to the historical revenues and

expenses of the Lowry Properties and Frisco Properties for the nine months ended September 30,

2010 in order to derive condensed consolidated pro forma results of operations from continuing

operations for the Company for the nine months ended September 30, 2010. These pro forma

adjustments include, but are not limited to, the following:

|

|

|

•

|

|

An increase to property operating income due to the amortization of net below-market

lease intangibles totaling approximately $32 thousand recorded as part of the

acquisitions as an adjustment to property operating income;

|

|

|

|

|

•

|

|

Operating expense reimbursement income decrease totaling approximately $12 thousand

related to reduced expenses estimated for insurance, property taxes and management

fees;

|

|

|

|

|

•

|

|

A reduction to property operating income and property operating expense for ground

lease income/expense totaling approximately $63 thousand between two of the Frisco

properties. The income/expense is reflected in the historical amounts for the

properties, but is being eliminated in the consolidated pro forma amounts;

|

|

|

|

|

•

|

|

Straight-line rent adjustments for in-place leases based on a January 1, 2009

acquisition date;

|

|

|

|

|

•

|

|

Reduced expenses related to third party management, which was assumed by the Company

upon acquisition; as well as certain estimated reductions in property insurance,

property taxes, and certain allocated overhead, included in the properties’ historical

financial statements;

|

|

|

|

|

•

|

|

Depreciation and amortization expense based on the Company’s allocation of the

purchase price to land, building, and lease intangibles. Depreciation and amortization

are calculated on a straight-line basis using the estimated remaining useful life of

the assets. The estimated remaining lives for the buildings acquired ranged from 29

years to 37 years and a range of 36 months to 197 months was estimated for the other

lease intangibles acquired. These estimates, allocations and valuations are subject to

change; therefore, the actual depreciation and amortization expense recognized by the

Company may not agree with the estimates included in these pro forma financial

statements; and

|

|

|

|

|

•

|

|

Interest expense for the properties was reduced to reflect the repayment of three

mortgage notes payable upon acquisition of the properties by the Company. Also,

interest expense was adjusted for the amortization of the debt premium recognized by

the Company upon acquisition of the mortgage note payable on the Lowry Properties. The

Company estimated the fair value of the mortgage note payable at the date of

acquisition, resulting in a premium that the Company will amortize through the date of

the note payable maturity.

|

|

5)

|

|

The Company made certain pro forma adjustments related to the historical revenues and

expenses of the Lowry Properties and Frisco Properties for the twelve months ended December

31, 2009 in order to derive condensed consolidated pro forma results of operations from

continuing operations for the Company for the twelve months ended December 31, 2009. These

pro forma adjustments include, but are not limited to, the following:

|

|

|

•

|

|

A decrease to property operating income due to the amortization of certain

above-market lease intangibles totaling approximately $4 thousand recorded as part of

the Frisco Properties’ acquisition as an adjustment to property operating income;

|

|

|

|

|

•

|

|

Operating expense reimbursement adjustments totaling approximately $10 thousand

related to reduced expenses estimated for insurance and management fees included in

property operating income;

|

19

|

|

•

|

|

A reduction to property operating income and property operating expense for ground

lease income/expense totaling approximately $84 thousand between two of the Frisco

Properties. The income/expense is reflected in the historical amounts for the

properties, but is being eliminated in the consolidated pro forma amounts;

|

|

|

|

|

•

|

|

Straight-line rent adjustments for in-place leases based on a January 1, 2009

acquisition date;

|

|

|

|

|

•

|

|

Reduced expenses related to third party management, which was assumed by the Company

upon acquisition; as well as certain estimated reductions in property insurance,

property taxes, and certain allocated overhead, included in the properties’ historical

financial statements;

|

|

|

|

|

•

|

|

Depreciation and amortization expense based on the Company’s allocation of the

purchase price to land, building, and lease intangibles. Depreciation and amortization

are calculated on a straight-line basis using the estimated remaining life of the

assets. The estimated remaining lives for the buildings acquired ranged from 29 years

to 37 years and a range of 36 months to 197 months was estimated for the other lease

intangibles acquired. These estimates, allocations and valuations are subject to

change; therefore, the actual depreciation and amortization expense recognized by the

Company may not agree with the estimates included in these pro forma financial

statements; and

|

|

|

|

|

•

|

|

Interest expense for the properties was reduced to reflect the repayment of three

mortgage notes payable upon acquisition of the properties by the Company. Also,

interest expense was adjusted for the amortization of the debt premium recognized by

the Company upon acquisition of the mortgage note payable on the Lowry Properties. The

Company estimated the fair value of the mortgage note payable at the date of

acquisition, resulting in a premium that the Company will amortize through the date of

the note payable maturity.

|

|

6)

|

|

The Company assumed that the acquisitions of the Lowry Properties and Frisco Properties were

completed on January 1, 2009 and were funded with $148.7 million in proceeds from long-term

senior notes issued by the Company in December 2010 bearing an interest rate of 5.75%.

Typically, the Company will temporarily fund its acquisitions with proceeds from its unsecured

credit facility, but will from time to time repay the outstanding balance on the unsecured

credit facility with proceeds from a long-term debt or equity offering. As such, the Company

has used the interest rate of its senior notes issued in December 2010, rather than the rate

on the unsecured credit facility, to show the pro forma effect on interest expense of

financing these acquisitions.

|

20

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused

this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

HEALTHCARE REALTY TRUST INCORPORATED

|

|

|

|

By

|

/s/ Scott W. Holmes

|

|

|

|

|

Scott W. Holmes

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

|

|

|

Date: January 10, 2011

21

(d) Exhibits.

EXHIBIT INDEX

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

|

99.1

|

|

Consent of Independent Registered Public Accounting Firm.

|

|

99.2

|

|

Consent of Independent Registered Public Accounting Firm.

|

22

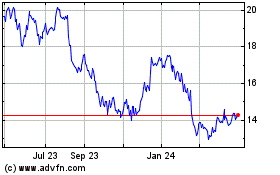

Healthcare Realty (NYSE:HR)

Historical Stock Chart

From Feb 2025 to Mar 2025

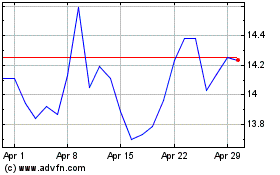

Healthcare Realty (NYSE:HR)

Historical Stock Chart

From Mar 2024 to Mar 2025