For the Three-Month and Six-Month Periods Ended June 30, 2009

ATLANTA, Aug. 7 /PRNewswire-FirstCall/ -- Gray Television, Inc.

("Gray," "we" or "us") (NYSE:GTN) today announced results from

operations for the three-month period (the "second quarter") and

six-month period ended June 30, 2009 as compared to the three-month

and six-month periods ended June 30, 2008. Highlights: Three Months

Ended June 30, -------- 2009 2008 % Change ---- ---- -------- (in

thousands except for percentages) Revenues (less agency

commissions) $65,057 $78,743 (17)% Broadcast expense (before

depreciation, amortization and gain on disposal of assets) $45,167

$48,460 (7)% The current economic recession continues to challenge

the television broadcast industry. We are committed to operating

our stations in a manner that generates maximum revenue while

minimizing operating expenses during these difficult times.

Although our operating results are down compared to the prior year,

we believe that our operating results compare favorably to other

television broadcast companies. Comments on Results of Operations

for the Three-Month Period Ended June 30, 2009: Revenue. Total net

revenue decreased $13.7 million, or 17%, to $65.1 million due

primarily to decreased local, national, political and internet

advertising revenue and decreased production and other revenue.

These decreases were partially offset by increased retransmission

consent revenue in the current period. Retransmission consent

revenue reflects the more profitable terms of our recently renewed

contracts. Local and national advertising revenue decreased due to

reduced spending by advertisers in the current economic recession.

Historically, our industry's largest advertiser category has been

the automotive industry. The current recession has significantly

reduced the automotive industry's advertising expenditures. Our

automotive advertising revenue decreased approximately 48% compared

to the prior year. Internet advertising revenue decreased due to

the same factors that affected our local and national advertising

revenue but to a lesser extent. Political advertising revenue

decreased reflecting decreased advertising from political

candidates during the "off year" of the two-year political

advertising cycle. Local advertising revenue decreased $6.2

million, or 13%, to $43.3 million. National advertising revenue

decreased $6.1 million, or 33%, to $12.4 million. Internet

advertising revenue decreased $0.3 million, or 11%, to $2.7

million. Political advertising revenue decreased $4.0 million, or

81%, to $0.9 million. Retransmission consent revenue increased $3.2

million, or 394%, to $4.0 million. Production and other revenue

decreased $0.1 million, or 8%, to $1.6 million. Operating expenses.

Broadcast expenses (before depreciation, amortization and gain on

disposal of assets) decreased $3.3 million, or 7%, to $45.2

million. This decrease was primarily due to a reduction in

compensation expense of $2.3 million, facility fees of $0.3 million

and professional services of $0.3 million partially offset by an

increase in bad debt expense of $0.6 million. Payroll expense

decreased primarily due to a reduction in the number of employees.

As of June 30, 2009 and 2008, we employed 2,216 and 2,331 total

employees, respectively, in our broadcast operations which included

full-time and part-time employees. Professional services decreased

primarily due to lower national representation fees which are paid

based upon a percentage of our lower national revenue. Facility

fees decreased primarily due to lower electricity expense resulting

from the discontinuance of our analog broadcasts. Bad debt expense

increased primarily due to an increased reserve for receivables due

from Chrysler LLC. Corporate and administrative expenses (before

depreciation, amortization and gain on disposal of assets)

increased $0.9 million, or 32%, to $3.6 million due primarily to an

increase in compensation expense of $0.6 million and an increase in

professional services expense of $0.4 million. This increase in

compensation expense was primarily due to increased incentive

compensation related expenses. During the first five months of

2008, we accrued compensation expense for executive officer

bonuses. During the three-month period ended June 30, 2008, we

determined that these executive bonuses would not be paid and as a

result the associated accrued expenses were reversed which resulted

in a reduction of compensation expense of $780,000. Executive

bonuses have not been accrued in 2009 and as a result we did not

have a reduction in 2009 which was similar to that of 2008.

Professional services increased primarily due to an increase in

legal expenses of $145,000 and an increase in consulting expenses

of $100,000 resulting from a consulting agreement with our former

Chairman. We recorded non-cash stock-based compensation expense

during the three-month periods ended June 30, 2009 and 2008 of

$345,000 and $395,000, respectively. Comments on Results of

Operations for the Six-Month Period Ended June 30, 2009: Revenue.

Total net revenue decreased $23.3 million, or 16%, to $126.4

million due primarily to decreased local, national, political and

internet advertising revenue and decreased production and other

revenue. These decreases were partially offset by increased

retransmission consent revenue in the current period.

Retransmission consent revenue reflects the more profitable terms

of our recently renewed contracts. Local and national advertising

revenue decreased due to reduced spending by advertisers in the

current economic recession. Historically, our industry's largest

advertiser category has been the automotive industry. The current

recession has significantly reduced the automotive industry's

advertising expenditures. Our automotive advertising revenue

decreased approximately 45% compared to the prior year. The

negative effects of the recession were partially offset by

increased advertising during the 2009 Super Bowl. Net advertising

revenue associated with the broadcast of the 2009 Super Bowl on our

ten NBC affiliated stations approximated $750,000 which is an

increase from the approximate $130,000 of Super Bowl revenue earned

in 2008 on our then six Fox affiliated channels. Internet

advertising revenue decreased due to the same factors that affected

our local and national advertising revenue but to a lesser extent.

Political advertising revenue decreased due to reduced advertising

from political candidates during the "off year" of the two-year

political advertising cycle. Local advertising revenue decreased

$12.7 million, or 13%, to $82.6 million. National advertising

revenue decreased $9.6 million, or 27%, to $25.2 million. Internet

advertising revenue decreased $0.4 million, or 7%, to $5.3 million.

Political advertising revenue decreased $6.1 million, or 76%, to

$2.0 million. Retransmission consent revenue increased $6.2

million, or 425%, to $7.6 million. Production and other revenue

decreased $0.7 million, or 17%, to $3.5 million. Operating

expenses. Broadcast expenses (before depreciation, amortization and

gain on disposal of assets) decreased $7.7 million, or 8%, to $90.8

million. This decrease was primarily due to a reduction in

compensation expense of $4.5 million, professional services of $0.7

million, facility fees of $0.2 million and supply fees of $0.4

million partially offset by an increase in bad debt expense of $0.1

million. Compensation expense decreased primarily due to a

reduction in the number of employees. As of June 30, 2009 and 2008,

we employed 2,216 and 2,331 total employees, respectively, in our

broadcast operations which included full-time and part-time

employees. Professional services decreased primarily due to lower

national representation fees which are paid based upon a percentage

of our lower national revenue. Facility fees decreased primarily

due to lower electricity expense resulting from the discontinuance

of our analog broadcasts. Supply fees decreased due to lower

gasoline costs and controls on supply purchases. Bad debt expense

increased primarily due to an increased reserve for receivables due

from Chrysler LLC. Corporate and administrative expenses (before

depreciation, amortization and gain on disposal of assets)

increased $1.4 million, or 22%, to $7.6 million. The increase was

due primarily to increases in compensation expense and professional

service expense. This increase in compensation expense was

primarily due to an increase in severance expense of $135,000 and

an increase in relocation expense of $350,000. Professional

services increased primarily due to an increase in legal expenses

of $547,000 and an increase in consulting expense of $200,000

resulting from a consulting agreement with our former Chairman. We

recorded non-cash stock-based compensation expense during the

six-month periods ended June 30, 2009 and 2008 of $698,000 and

$689,000, respectively. Internet Initiatives: We have continued to

expand our internet initiatives in each of our markets. Our focus

has been to expand local content to attract traffic to our websites

as illustrated below by the aggregate page views reported by our

websites in the three-month and six-month periods ended June 30,

2009 compared to the three-month and six-month periods ended June

30, 2008. Gray Websites - Aggregate Page Views Three Months Ended

June 30, -------- % 2009 2008 Change ---- ---- ------ (in millions)

Total Aggregate Page Views (including video plays and cell phone

page views) 181.3 150.3 21% Six Months Ended June 30, -------- %

2009 2008 Change ---- ---- ------ (in millions) Total Aggregate

Page Views (including video plays and cell phone page views) 366.8

312.5 17% We attribute the increase in our website traffic to

increased posting of local content and public awareness of our

websites as the result of our on-air promotion of our websites. The

aggregate internet revenues discussed above are derived from two

sources. The first source is advertising or sponsorship

opportunities directly on our websites. We call this "direct

internet revenue." The other source is television advertising time

purchased by our clients to directly promote their involvement in

our websites. We refer to this internet revenue source as "internet

related commercial time sales." In the future we anticipate our

direct internet revenue will grow at a faster pace relative to our

internet related commercial time sales. Detailed table of operating

results: Gray Television, Inc. Selected Operating Data (Unaudited)

(in thousands except for per share data and percentages) Three

Months Ended June 30, -------- % 2009 2008 Change ---- ---- ------

Revenues (less agency commissions) $65,057 $78,743 (17)% Operating

expenses before depreciation, amortization and gain on disposal of

assets, net: Broadcast 45,167 48,460 (7)% Corporate and

administrative 3,592 2,722 32 % Depreciation and amortization of

intangible assets 8,398 8,907 (6)% Gain on disposals of assets, net

(1,098) (84) 1207 % ------ --- 56,059 60,005 (7)% ------ ------

Operating income 8,998 18,738 (52)% Other income (expense):

Miscellaneous income, net 1 63 (98)% Interest expense (20,007)

(13,402) 49 % ------- ------- (Loss) income before income tax

(11,008) 5,399 Income tax (benefit) expense (4,360) 2,184 ------

----- Net (loss) income (6,648) 3,215 Preferred dividends (includes

accretion of issuance cost of $301 and $0, respectively) 4,051 125

3141 % ----- --- Net (loss) income available to common stockholders

$(10,699) $3,090 ======== ====== Basic per share information: Net

(loss) income available to common stockholders $(0.22) $0.06 ======

===== Weighted-average shares outstanding 48,506 48,235 1 % ======

====== Diluted per share information: Net (loss) income available

to common stockholders $(0.22) $0.06 ====== ===== Weighted-average

shares outstanding 48,506 48,273 0 % ====== ====== Political

revenue (less agency commission) $942 $4,951 (81)% Gray Television,

Inc. Selected Operating Data (Unaudited) (in thousands except for

per share data and percentages) Six Months Ended June 30, --------

% 2009 2008 Change ---- ---- ------ Revenues (less agency

commissions) $126,411 $149,742 (16)% Operating expenses before

depreciation, amortization and gain on disposal of assets, net:

Broadcast 90,821 98,476 (8)% Corporate and administrative 7,638

6,261 22 % Depreciation and amortization of intangible assets

16,808 17,991 (7)% Gain on disposals of assets, net (2,620) (1,005)

161 % ------- ------- 112,647 121,723 (7)% ------- -------

Operating income 13,764 28,019 (51)% Other income (expense):

Miscellaneous income, net 13 90 (86)% Interest expense (30,120)

(29,201) 3 % Loss on early extinguishment of debt (8,352) - -------

--- Loss before income tax benefit (24,695) (1,092) Income tax

benefit (9,127) (457) ------- ---- Net loss (15,568) (635)

Preferred dividends (includes accretion of issuance cost of $602

and $0, respectively) 8,101 125 6381% ----- --- Net loss available

to common stockholders $(23,669) $(760) ======== ===== Basic per

share information: Net loss available to common stockholders

$(0.49) $(0.02) ======= ======= Weighted-average shares outstanding

48,498 48,194 1 % ====== ====== Diluted per share information: Net

loss available to common stockholders $(0.49) $(0.02) =======

======= Weighted-average shares outstanding 48,498 48,194 1 %

====== ====== Political revenue (less agency commission) $1,951

$8,024 (76)% Other Financial Data: --------------------- June 30,

2009 December 31, 2008 ------------- ----------------- (in

thousands) Cash and cash equivalents $9,786 $30,649 Long-term debt

including current portion $795,849 $800,380 Preferred stock $92,785

$92,183 Borrowing ability under our senior credit facility $27,134

$12,262 Six Months Ended June 30, ------------------------- 2009

2008 ---- ---- (in thousands) Net cash provided by operating

activities $377 $17,237 Net cash used in investing activities

(9,598) (6,277) Net cash used in financing activities (11,642)

(3,730) ------- ------ Net (decrease) increase in cash and cash

equivalents $(20,863) $7,230 ======== ====== Guidance for the Third

Quarter of 2009 We currently anticipate that our broadcast results

of operations for the three months ending September 30, 2009 (the

"third quarter of 2009") will approximate the ranges presented in

the table below. % % 2009 Change 2009 Change Guidance From Guidance

From Low Actual High Actual Actual Selected operating data: Range

2008 Range 2008 2008 ------------------------ -------- ------

-------- ------ ------ (dollars in thousands) OPERATING REVENUE:

Revenue (less agency commissions) $63,000 (24)% $64,000 (23)%

$82,631 OPERATING EXPENSES: (before depreciation, amortization and

other expenses) Broadcast $46,000 (8)% $46,500 (7)% $49,907

Corporate and administrative $3,300 (12)% $3,600 (4)% $3,754 OTHER

SELECTED DATA: Broadcast political revenues (less agency

commissions) $500 $600 $13,065 Expense for corporate non-cash

stock-based compensation $325 $350 $399 Comments on Guidance: Net

Revenue: The current national economic recession has severely

impacted our short-term revenue generation and has made revenue

forecasting more difficult than in prior periods. Based on

advertising orders received to date, pending advertising orders and

advertising orders expected to be received in the future, we

currently believe our third quarter 2009 local revenue and national

revenue, excluding political revenue, will decrease from 2008

results by approximately 9% and 30%, respectively. The decline is

expected to be reflected in most advertising categories. Political

revenues reflect the off-year of the political cycle. We anticipate

that our retransmission consent revenues during the third quarter

of 2009 will increase approximately $3.0 million, to a total of

approximately $3.8 million, reflecting the successful

retransmission negotiations concluded in December 2008. For the

full year 2009, we currently anticipate retransmission consent

revenues will range between $15.0 million and $16.0 million

compared to $3.0 million for full year 2008. Broadcast Operating

Expense (before depreciation, amortization and gain/loss on

disposal of assets) The anticipated decline in third quarter 2009

broadcast expense reflects an approximate $1.2 million, or 4%,

reduction in payroll and related expenses reflecting in part the

staff reductions discussed above. At this time it is unclear as to

how the bankruptcy filings by Chrysler LLC and General Motors Corp.

will affect our accounts receivable bad debt reserves. Therefore,

our anticipated third quarter 2009 broadcast expenses do not

include additional expenses for increased bad debt reserves for

either company's bankruptcy. For the full year 2009, we currently

anticipate that our broadcast operating expenses will decrease by

approximately $16.0 million, or 8.0%, compared to 2008. Corporate

Expense (before depreciation, amortization and gain/loss on

disposal of assets) The anticipated decrease in corporate expense

for the third quarter of 2009 compared to the third quarter of 2008

is due primarily to a reduction in research expense and

compensation expense. Net Revenue By Category: The table below

presents our net revenue by type for the three-month and six-month

periods ended June 30, 2009 and 2008, respectively (dollars in

thousands): Three Months Ended June 30, ---------------------------

2009 2008 ---- ---- Percent Percent Amount of Total Amount of Total

------ -------- ------ -------- Broadcasting net revenues: Local

$43,272 66.5% 49,495 62.9% National 12,373 19.0% 18,479 23.4%

Internet 2,711 4.2% 3,048 3.9% Political 942 1.4% 4,951 6.3%

Retransmission consent 3,959 6.1% 801 1.0% Production and other

1,628 2.5% 1,763 2.2% Network compensation 172 0.3% 206 0.3% ---

--- --- --- Total $65,057 100.0% $78,743 100.0% ======= =====

======= ===== Six Months Ended June 30, -------------------------

2009 2008 ---- ---- Percent Percent Amount of Total Amount of Total

------ -------- ------ -------- Broadcasting net revenues: Local

$82,558 65.3% 95,214 63.6% National 25,248 20.0% 34,816 23.2%

Internet 5,275 4.2% 5,677 3.8% Political 1,951 1.5% 8,024 5.4%

Retransmission consent 7,599 6.0% 1,447 1.0% Production and other

3,470 2.7% 4,184 2.8% Network compensation 310 0.3% 380 0.2% ---

--- --- --- Total $126,411 100.0% $149,742 100.0% ======== =====

======== ===== The aggregate internet revenues presented above are

derived from two sources: (i) direct internet revenue and (ii)

internet related commercial time sales. Conference Call Information

We will host a conference call to discuss our second quarter

operating results on August 7, 2009. The call will begin at 1:00 PM

Eastern Time. The live dial-in number is 1 (888) 215-7030 and the

confirmation code is 9007245. The call will be webcast live and

available for replay at http://www.gray.tv/. The taped replay of

the conference call will be available at 1 (888) 203-1112,

Confirmation Code: 9007245 until September 5, 2009.

Reconciliations: Reconciliation of net income (loss) to the

non-GAAP terms (in thousands): As Reported Three Months Ended June

30, -------- 2009 2008 ---- ---- Net (loss) income $(6,648) $3,215

Adjustments to reconcile to Broadcast Cash Flow Less Cash Corporate

Expenses: Depreciation and amortization of intangible assets 8,398

8,907 Amortization of non-cash stock based compensation 345 395

Gain on disposals of assets, net (1,098) (84) Miscellaneous

(income) expense, net (1) (63) Interest expense 20,007 13,402 Loss

on early extinguishment of debt - - Income tax (benefit) expense

(4,360) 2,184 Amortization of program broadcast rights 3,761 3,821

Common stock contributed to 401(k) plan excluding corporate 401(k)

contributions 7 641 Network compensation revenue recognized (172)

(206) Network compensation per network affiliation agreement (30)

30 Payments for program broadcast rights (3,801) (2,666) ------

------ Broadcast Cash Flow Less Cash Corporate Expenses 16,408

29,576 Corporate and administrative expenses excluding amortization

of non-cash stock-based compensation 3,247 2,327 ----- -----

Broadcast Cash Flow $19,655 $31,903 ======= ======= As Reported Six

Months Ended June 30, -------- 2009 2008 ---- ---- Net loss

$(15,568) $(635) Adjustments to reconcile to Broadcast Cash Flow

Less Cash Corporate Expenses: Depreciation and amortization of

intangible assets 16,808 17,991 Amortization of non-cash stock

based compensation 698 689 Gain on disposals of assets, net (2,620)

(1,005) Miscellaneous (income) expense, net (13) (90) Interest

expense 30,120 29,201 Loss on early extinguishment of debt 8,352 -

Income tax benefit (9,127) (457) Amortization of program broadcast

rights 7,531 7,672 Common stock contributed to 401(k) plan

excluding corporate 401(k) contributions (34) 1,267 Network

compensation revenue recognized (310) (380) Network compensation

per network affiliation agreement - 60 Payments for program

broadcast rights (7,656) (6,441) ------ ------ Broadcast Cash Flow

Less Cash Corporate Expenses 28,181 47,872 Corporate and

administrative expenses excluding amortization of non-cash

stock-based compensation 6,940 5,572 ----- ----- Broadcast Cash

Flow $35,121 $53,444 ======= ======= Non-GAAP Terms This press

release includes the non-GAAP financial measure of Broadcast Cash

Flow and Broadcast Cash Flow Less Cash Corporate Expenses. These

non-GAAP amounts are used by us to approximate the amount used to

calculate a key financial performance covenant as defined in our

senior credit facility. Broadcast Cash Flow is defined as operating

income, plus corporate expense, depreciation and amortization

(including amortization of program broadcast rights), impairment,

non-cash compensation and (gain) loss on disposal of assets and

cash payments received or receivable under network affiliation

agreements, less payments for program broadcast obligations and

less network compensation revenue, net of income taxes. Corporate

expenses (excluding depreciation, amortization and non-cash

stock-based compensation) are deducted from Broadcast Cash Flow to

calculate "Broadcast Cash Flow Less Cash Corporate Expenses." These

non-GAAP terms are used in addition to and in conjunction with

results presented in accordance with GAAP and should be considered

as supplements to, and not as substitutes for, net loss calculated

in accordance with GAAP. Gray Television, Inc. Gray Television,

Inc. is a television broadcast company headquartered in Atlanta,

GA. We currently operate 36 television stations serving 30 markets.

Each of the stations are affiliated with either CBS (17 stations),

NBC (10 stations), ABC (8 stations) or FOX (1 station). In

addition, we currently operate 38 digital second channels including

1 ABC, 4 Fox, 7 CW, 16 MyNetworkTV and 1 Universal Sports Network

affiliates plus 8 local news/weather channels and 1 "independent"

channel in certain of our existing markets. Cautionary Statements

for Purposes of the "Safe Harbor" Provisions of the Private

Securities Litigation Reform Act The comments on our current

expectations of operating results for the third quarter of 2009 and

other future events are "forward-looking statements" for purposes

of the Private Securities Litigation Reform Act of 1995. Actual

results of operations are subject to a number of risks and

uncertainties and may differ materially from the current

expectations discussed in this press release. All information set

forth in this release and its attachments is as of August 7, 2009.

We do not intend, and undertake no duty, to update this information

to reflect future events or circumstances. Information about

potential factors that could affect our business and financial

results and cause actual results to differ materially from those in

the forward-looking statements are included under the captions,

"Risk Factors" and "Management's Discussion and Analysis of

Financial Condition and Results of Operations," in our Annual

Report on Form 10-K for the year ended December 31, 2008 which is

on file with the SEC and available at the SEC's website at

http://www.sec.gov/. DATASOURCE: Gray Television, Inc. CONTACT: Bob

Prather, President and Chief Operating Officer, +1-404-266-8333, or

Jim Ryan, Senior V. P. and Chief Financial Officer, +1-404-504-9828

Web Site: http://www.gray.tv/

Copyright

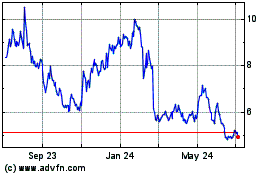

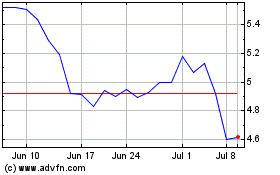

Gray Television (NYSE:GTN)

Historical Stock Chart

From Sep 2024 to Oct 2024

Gray Television (NYSE:GTN)

Historical Stock Chart

From Oct 2023 to Oct 2024