ATLANTA, Aug. 8 /PRNewswire-FirstCall/ -- Gray Television, Inc.

("Gray") (NYSE:GTN) today announced results from operations for the

three months ("second quarter") and six months ended June 30, 2005

as compared to the three months and six months ended June 30, 2004.

Significant items to note for the three months ended June 30, 2005:

Three Months Ended June 30, 2005 Change from Same Period of Prior

Year Net local broadcast advertising Increased 7% or $3.0 million

revenue, excluding political advertising revenue of $45.0 million

Net political advertising revenue Decreased $4.7 million reflecting

the of $687,000 "off-year" of the political election cycle Total

net revenue of $81.5 million Decreased 3%, or $2.6 million,

reflecting the decrease in net political revenues Broadcast net

revenue of Decreased 5%, or $3.2 million, $68.0 million reflecting

the decrease in net political revenues As of June 30, 2005 December

31, 2004 Cash on Hand $6.2 million $50.6 million Total Debt(1)

$635.5 million $655.9 million During the second quarter of 2005,

Gray repurchased approximately $21.5 million aggregate principal

amount of the company's 9-1/4% Senior Subordinated Notes due 2011

for a total cost of approximately $24.3 million including accrued

interest. Comments on Results of Operations for the Three Months

Ended June 30, 2005: Revenues. Total revenues for the three months

ended June 30, 2005 decreased 3% to $81.5 million as compared to

the same period of the prior year. * Local broadcasting advertising

revenues, excluding political advertising revenues, increased 7% to

$45.0 million from $42.0 million. Approximately 33% of this

increase is attributable to results from Gray's launch of four UPN

second channels in four of its existing television markets since

June 30, 2004, results of WCAV, Charlottesville, VA which began

operations in August 2004 and the acquisition of KKCO on January

31, 2005 offset in part by the sale of the Company's satellite

uplink operations on December 31, 2004. We attribute the remaining

increase in non-political local broadcasting advertising revenues

to a moderate increase in demand for commercial time by local

advertisers. National broadcasting advertising revenues were

unchanged at $18.8 million. Political advertising revenues

decreased to $687,000 from $5.4 million reflecting the cyclical

influence of the 2004 Presidential election. Network compensation

revenue decreased 44% to $1.4 million due to lower revenue from

newly renewed network affiliation agreements. However, under the

terms of the affiliation agreements, Gray's cash payments received

or receivable in excess of revenue recognized in accordance with

generally accepted accounting principles approximated $653,000 for

the three months ended June 30, 2005. In the prior period, the

network compensation revenue and the related cash payments received

or receivable were approximately equal in their respective amounts.

Total broadcasting revenues decreased 5% to $68.0 million. The

decrease in broadcasting revenues reflects decreased political

advertising revenues and network compensation partially offset by

increased non-political local broadcasting advertising revenues as

discussed above. * Publishing and other revenues consists primarily

of Gray's newspaper publishing and paging operations. Publishing

and other revenues increased 5% to $13.5 million. Classified

advertising revenue increased 9% to $3.6 million and retail

advertising increased 4% to $6.2 million. Operating expenses.

Operating expenses increased 11% to $60.0 million as compared to

the same period of the prior year. * Broadcasting expenses, before

depreciation, amortization and loss on disposal of assets increased

7% to $39.6 million. Approximately 50% of this increase, is

attributable to operating expenses relating to Gray's launch of

four UPN second channels in four of its existing television markets

since June 30, 2004, expenses of WCAV, Charlottesville, VA which

began operations in August 2004 and expenses of KKCO, acquired on

January 31, 2005, offset, in part, by the sale of the Company's

satellite uplink operations on December 31, 2004. We attribute the

remaining increase to routine increases in payroll and benefits

costs. Gray currently anticipates that for the television stations

continuously operated since January 1, 2004 the operating expenses

before depreciation, amortization, and other expenses for the third

quarter of 2005 will increase approximately 1% over the third

quarter of 2004 and that for the year ended December 31, 2005 such

expenses will be consistent with or slightly below the full year

results for 2004. * Publishing and other expenses, before

depreciation, amortization and loss on disposal of assets,

increased 9% to $9.8 million. The increase was primarily the result

of increased payroll expense reflecting the expansion of

circulation at the suburban Atlanta newspapers compared to the

prior period and to a lesser degree an increase in the cost of

newsprint reflecting both increases in pricing as well as

consumption due to the expanded circulation compared to the prior

period. * Corporate and administrative expenses, before

depreciation, amortization and loss on disposal of assets increased

89% to $4.1 million in the three months ended June 30, 2005. Legal

and other professional service fees increased approximately $1.5

million over the second quarter of 2004 and such increase is

primarily attributable to professional services associated with

Gray's previously announced proposed spin-off of its Publishing and

Paging businesses. In addition, consulting service fees increased

in the second quarter of 2005 reflecting approximately $163,000 of

audience research studies commissioned for various television

markets in which the company operates. The prior period did not

include similar expenses. Upon consummation of the spin-off

transactions Triple Crown Media will reimburse Gray for

approximately 75% of the professional service costs and expenses

incurred by Gray related to the spin-off transactions. Comments on

Results of Operations for the Six Months Ended June 30, 2005:

Revenues. Total revenues for the six months ended June 30, 2005

decreased 4% to $152.8 million as compared to the same period of

the prior year. * Local broadcasting advertising revenues,

excluding political advertising revenues, increased 6% to $84.1

million from $79.4 million. Approximately 35% of this increase is

attributable to results from Gray's launch of four UPN second

channels in four of its existing television markets since June 30,

2004, results of WCAV, Charlottesville, VA which began operations

in August 2004 and the acquisition of KKCO on January 31, 2005

offset in part by the sale of the Company's satellite uplink

operations on December 31, 2004. We attribute the remaining

increase in non-political local broadcasting advertising revenues

to a moderate increase in demand for commercial time by local

advertisers. National broadcasting advertising revenues decreased

3% to $34.1 million from $35.0 million due to a decrease in demand

from national advertisers. Political advertising revenues decreased

to $980,000 from $9.0 million reflecting the cyclical influence of

the 2004 Presidential election. Network compensation revenue

decreased 38% to $3.1 million due to lower revenue from newly

renewed network affiliation agreements. However, under the terms of

the affiliation agreements, Gray's cash payments received or

receivable in excess of revenue recognized in accordance with

generally accepted accounting principles approximated $1.1 million

for the six months ended June 30, 2005. In the prior period, the

network compensation revenue and the related cash payments received

or receivable were approximately equal in their respective amounts.

Total broadcasting revenues decreased 5% over the same period of

the prior year to $126.3 million. The decrease in broadcasting

revenues reflects decreased political advertising revenues,

national advertising revenues and network compensation, partially

offset by increased non-political local broadcasting advertising

revenues as discussed above. * Publishing and other revenues

consists primarily of Gray's newspaper publishing and paging

operations. Publishing and other revenues increased 5% to $26.5

million. Retail advertising increased 6% and classified advertising

revenue increased 10%. Operating expenses. Operating expenses

increased 8% to $117.0 million as compared to the same period of

the prior year. * Broadcasting expenses, before depreciation,

amortization and loss on disposal of assets increased 5% to $78.3

million. Approximately 52% of this increase, is attributable to

operating expenses relating to Gray's launch of four UPN second

channels in four of its existing television markets since June 30,

2004, expenses of WCAV, Charlottesville, VA which began operations

in August 2004 and expenses of KKCO, acquired on January 31, 2005,

offset, in part, by the sale of the Company's satellite uplink

operations on December 31, 2004. We attribute the remaining

increase to routine increases in payroll and benefits costs. Gray

currently anticipates that for the television stations continuously

operated since January 1, 2004 the operating expenses before

depreciation, amortization, and other expenses for the third

quarter of 2005 will increase approximately 1% over the third

quarter of 2004 and that for the year ended December 31, 2005 such

expenses will be consistent with or slightly below the full year

results for 2004. * Publishing and other expenses, before

depreciation, amortization and loss on disposal of assets,

increased 8% to $19.3 million. The increase was primarily the

result of increased payroll expense reflecting the expansion of

circulation at the suburban Atlanta newspapers compared to the

prior period and to a lesser degree an increase in the cost of

newsprint reflecting both increases in pricing as well as

consumption due to the expanded circulation compared to the prior

period. * Corporate and administrative expenses, before

depreciation, amortization and loss on disposal of assets increased

48% to $6.7 million in the six months ended June 30, 2005. Legal

and other professional service fees increased approximately $1.4

million over the first half of 2004 and such increase is primarily

attributable to professional services associated with Gray's

proposed spin-off of its Publishing and Paging businesses. Audit

fees increased approximately $425,000 over the comparable period of

2004. In addition, consulting service fees increased in the second

quarter of 2005 reflecting approximately $252,000 of audience

research studies commissioned for various television markets in

which the company operates. The prior period did not include

similar expenses. Upon consummation of the spin-off transactions

Triple Crown Media will reimburse Gray for approximately 75% of the

professional service costs and expenses incurred by Gray related to

the spin-off transactions. Balance Sheet: Gray's cash balance was

$6.2 million at June 30, 2005 compared to $50.6 million at December

31, 2004. The decrease in cash reflects $21.7 million of net cash

generated by Gray's operations during the six months of 2005

compared to $39.7 million for first six months of 2005. The 2005

net cash generated from operations was offset by the return of

$15.6 million of capital to Gray's common and preferred

shareholders through the payment of dividends and the purchase of

its common stock, as well as $17.1 million of cash used for capital

expenditures. Gray also used $13.8 million in the purchase of

KKCO-TV and $24.3 million to retire debt. Total debt outstanding at

June 30, 2005 and December 31, 2004 was $635.5 million and $655.9

million(1), respectively. Reclassifications: Portions of prior year

publishing revenue and expense in the accompanying condensed

consolidated financial statements have been reclassified to conform

to the 2005 presentation. For the three months and six months ended

June 30, 2004, $258,000 and $754,000, respectively, of publishing

revenue and expense that was previously recognized separately has

been presented on a net basis. The corresponding amounts

reclassified for the three and six months ended June 30, 2005

contained in Gray's previously issued guidance was $278,000 and

$573,000, respectively. The reclassification does not affect

operating income, net income or cash flows. Gray Television, Inc.

(in thousands, except per share data and percentages) Three Months

Ended Six Months Ended Selected operating June 30, June 30, data: %

% 2005 2004 Change 2005 2004 Change OPERATING REVENUES Broadcasting

(less agency commissions) $67,988 $71,235 (5)% $126,297 $133,144

(5)% Publishing and other 13,531 12,860 5 % 26,477 25,183 5 % TOTAL

OPERATING REVENUES 81,519 84,095 (3)% 152,774 158,327 (4)% EXPENSES

Operating expenses before depreciation, amortization and loss on

disposal of assets: Broadcasting 39,585 37,053 7 % 78,279 74,451 5

% Publishing and other 9,818 9,020 9 % 19,340 17,925 8 % Corporate

and administrative 4,082 2,163 89 % 6,728 4,536 48 % Depreciation

5,888 5,870 0 % 11,702 11,672 0 % Amortization of intangible assets

208 237 (12)% 417 519 (20)% Amortization of restricted stock awards

98 94 4 % 196 189 4 % (Gain) loss on disposal of assets, net 305

(626) (149)% 339 (622) (155)% TOTAL EXPENSES 59,984 53,811 11 %

117,001 108,670 8 % Operating income 21,535 30,284 (29)% 35,773

49,657 (28)% Miscellaneous income, net 158 262 (40)% 453 407 11 %

Interest expense (11,312) (10,474) 8 % (22,425) (20,935) 7 % Loss

on early extinguishment of debt (4,770) - 0 - NA (4,770) - 0 - NA

INCOME BEFORE INCOME TAX EXPENSE 5,611 20,072 (72)% 9,031 29,129

(69)% Income tax expense 2,218 7,875 (72)% 3,563 11,429 (69)% NET

INCOME 3,393 12,197 (72)% 5,468 17,700 (69)% Preferred dividends

814 821 (1)% 1,629 1,643 (1)% NET INCOME AVAILABLE TO COMMON

STOCKHOLDERS $2,579 $11,376 (77)% $3,839 $16,057 (76)% Diluted per

share information: Net income per share available to common

stockholders $0.05 $0.22 (77)% $0.08 $0.32 (75)% Weighted average

shares outstanding 48,851 50,588 (3)% 48,948 50,546 (3)% Political

revenue (less agency commission) $687 $5,422 (87)% $980 $8,956

(89)% Guidance for the Third Quarter of 2005 We currently

anticipate that Gray's results of operations for the three months

ended September 30, 2005 will approximate the ranges presented in

the table below (dollars in thousands). Three Months Ended

September 30, 2005 % 2005 % Guidance Change Guidance Change Low

From High From Actual Selected operating data: Range 2004 Range

2004 2004 OPERATING REVENUES Broadcasting (less agency commissions)

$61,000 -17% $62,250 -16% $73,658 Publishing and other 13,100 +1%

13,300 3% 12,961 TOTAL OPERATING REVENUES 74,100 -14% 75,550 -13%

86,619 OPERATING EXPENSES Operating expenses before depreciation,

amortization and other expenses: Broadcasting 40,000 4% 40,300 5%

38,311 Publishing and other 9,450 1% 9,525 2% 9,333 Corporate and

administrative 4,250 47% 4,500 56% 2,884 Depreciation and

amortization of intangibles 6,100 -4% 6,250 -1% 6,320 Amortization

of restricted stock 100 -25% 100 -25% 134 Loss on disposal of

assets 25 47% 100 488% 17 TOTAL OPERATING EXPENSES 59,925 5% 60,775

7% 56,999 OPERATING INCOME $14,175 -52% $14,775 50% $29,620 Other

Selected Data Political revenues (less agency commissions) $175

-99% $225 -98% $11,967 Revenue related to Olympic Broadcast $0

-100% $0 -100% $3,000 (less agency commissions) The above guidance

for Broadcasting revenue reflects the cyclical impact of political

and Olympic advertising spending. During the three months ended

September 30, 2004 Gray recorded approximately $12.0 million of net

political revenue and approximately $3.0 million of advertising

revenue related to the broadcast of the Olympics. In comparison,

Gray currently anticipates that for the three months ended

September 30, 2005 net political advertising will range between

$175,000 and $225,000 and the next Olympic broadcast will not be

until the first quarter of 2006 when Gray's eight NBC affiliated

stations will broadcast the Winter Olympics. The above guidance for

Broadcasting revenue also includes the current period impact of

Gray's launch of four UPN second channels in four of its existing

television markets since June 30, 2004, results of WCAV,

Charlottesville, VA which began operations in August 2004 and the

acquisition of KKCO on January 31, 2005 offset in part by the sale

of the Company's satellite uplink operations on December 31, 2004.

For television stations continuously operated since the beginning

of the third quarter of 2004, Gray currently anticipates that its

local revenue, excluding political revenue, will increase between

5% and 6% over the third quarter of 2004, national revenue,

excluding political revenue, is currently expected to decrease

between 5% and 6% due to weak demand for commercial time by

national advertisers. During the third quarter of 2005 Gray

currently anticipates recognizing network revenue of approximately

$1 million. Under the same network affiliation agreements, the

related cash payments to be received by Gray are currently

estimated to approximate $1.9 million for the third quarter of

2005. During 2004 the amounts recorded as network revenue and the

corresponding cash payments were approximately equal in amount. The

above guidance for Broadcasting operating expense before

depreciation, amortization, and other expenses also includes the

current period impact of Gray's launch of four UPN second channels

in four of its existing television markets since June 30, 2004,

results of WCAV, Charlottesville, VA which began operations in

August 2004 and the acquisition of KKCO on January 31, 2005 offset

in part by the sale of the Company's satellite uplink operations on

December 31, 2004. For television stations continuously operated

since the beginning of the third quarter of 2004, Gray currently

anticipates that operating expenses before depreciation,

amortization, and other expenses will increase approximately 1%

over the third quarter of 2004 and that for the year ended December

31, 2005 such expenses will be consistent with or slightly below

the full year results for 2004. Also included within the operating

expense estimates presented above, we currently estimate that

non-cash 401(k) plan expense will range between $475,000 and

$525,000 for the three months ended September 30, 2005 compared

with $490,000 for the same period of 2004. The anticipated increase

in corporate expenses for the three months ended September 30, 2005

compared to 2004 primarily reflect estimated costs of professional

service fees and expenses associated with Gray's previously

announced proposed spin-off of its Publishing and Paging businesses

into Triple Crown Media. Upon consummation of the spin-off

transactions Triple Crown Media will reimburse Gray for

approximately 75% of the professional service costs and expenses

incurred by Gray related to the spin-off transactions. Conference

Call Information Gray Television, Inc. will host a conference call

to discuss its second quarter operating results on August 8, 2005.

The call will begin at 1:00 PM Eastern Time. The live dial-in

number is 1-888-280-8349 and the reservation number is T579475G.

The call will be webcast live and available for replay at

http://www.gray.tv/. The taped replay of the conference call will

be available at 1-888-509-0081 until August 22, 2005.

Reconciliations: Reconciliation of Net Income to the Non-GAAP term

"Adjusted Media Cash Flow" ($ in thousands): Three Months Ended Six

Months Ended June 30, June 30, 2005 2004 2005 2004 Net income

$3,393 $12,197 $5,468 $17,700 Add (subtract): Income tax expense

2,218 7,875 3,563 11,429 Loss on early extinguishment of debt 4,770

-- 4,770 -- Interest expense 11,312 10,474 22,425 20,935

Miscellaneous (income) expense, net (158) (262) (453) (407) Loss

(gain) on disposal of assets, net 305 (626) 339 (622) Amortization

of restricted stock awards 98 94 196 189 Amortization of intangible

assets 208 237 417 519 Depreciation 5,888 5,870 11,702 11,672

Amortization of program license rights 2,842 2,759 5,657 5,515

Common Stock contributed to 401(k) Plan excluding corporate 401(k)

contributions 535 379 1,113 909 Network compensation revenue

recognized (1,407) n/a (3,050) n/a Network compensation per network

affiliation agreement 2,060 n/a 4,162 n/a Payments on program

broadcast obligations (2,853) (2,701) (5,668) (5,399) Adjusted

Media Cash Flow $29,211 $36,296 $50,641 $62,440 Adjusted Media Cash

Flow is non-GAAP term the Company uses as a measure of performance.

Adjusted Media Cash Flow is used by the Company to approximate the

amount used to calculate key financial performance covenants

including, but not limited to, limitations on debt, interest

coverage, and fixed charge coverage ratios as defined in the

Company's senior credit facility and/or subordinated note

indenture. Adjusted Media Cash Flow is defined as operating income,

plus depreciation and amortization (including amortization of

program broadcast rights), non-cash compensation and (gain) loss on

disposal of assets, and cash payments received or receivable under

network affiliation agreements less payments for program broadcast

obligations and less network compensation revenue. Accordingly, the

Company has provided a reconciliation of Adjusted Media Cash Flow

to net income. Notes (1) Total debt as of June 30, 2005 and

December 31, 2004 does not include $0.9 million and $1.0 million,

respectively, of unamortized debt discount on Gray's 91/4% Senior

Subordinated Notes due March 2011. The Company Gray Television,

Inc. is a communications company headquartered in Atlanta, Georgia,

and currently owns 31 television stations serving 27 television

markets. The stations include 16 CBS affiliates, eight NBC

affiliates and seven ABC affiliates. Gray Television, Inc. has 23

stations ranked #1 in local news audience and 22 stations ranked #1

in overall audience within their respective markets based on the

average results of the 2004 Nielsen ratings reports. The TV station

group reaches approximately 5.5% of total U.S. TV households. Gray

also owns five daily newspapers, four in Georgia and one in

Indiana. Cautionary Statements for Purposes of the "Safe Harbor"

Provisions of the Private Securities Litigation Reform Act The

following comments on Gray's current expectations of operating

results for the third quarter of 2005 are "forward looking" for

purposes of the Private Securities Litigation Reform Act of 1995.

Actual results of operations are subject to a number of risks and

may differ materially from the current expectations discussed in

this press release. See Gray's Annual Report on Form 10-K for a

discussion of risk factors that may affect its ability to achieve

the results contemplated by such forward looking statements.

DATASOURCE: Gray Television, Inc. CONTACT: Bob Prather, President

and Chief Operating Officer, +1-404-266-8333, or Jim Ryan, Senior

V. P. and Chief Financial Officer, +1-404-504-9828, both of Gray

Television, Inc. Web site: http://www.graytvinc.com/

Copyright

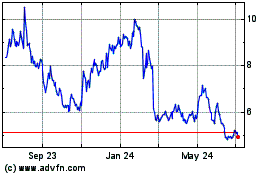

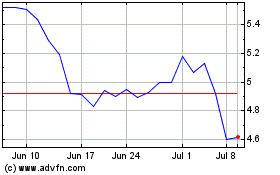

Gray Television (NYSE:GTN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Gray Television (NYSE:GTN)

Historical Stock Chart

From Nov 2023 to Nov 2024