Crescent Energy Company Announces Pricing of Secondary Public Offering of Common Stock and Agreement to Repurchase OpCo Units

March 06 2024 - 8:52PM

Business Wire

Crescent Energy Company (“Crescent” or the “Company”) (NYSE:

CRGY) today announced the pricing of an underwritten public

offering of 12,000,000 shares of its Class A common stock, par

value $0.0001 per share (“common stock”), at a price to the public

of $10.50 per share, pursuant to a registration statement on Form

S-3 (the “Registration Statement”) filed on March 6, 2024 with the

U.S. Securities and Exchange Commission (the “SEC”). The common

stock is being offered by Independence Energy Aggregator L.P. (the

“Selling Stockholder”), the direct owner of the shares being

offered and the entity through which certain unaffiliated limited

partners and affiliated entities hold their interests in the

Company and its subsidiary Crescent Energy OpCo LLC. The Company

will not sell any shares of its common stock in the offering and

will not receive any proceeds therefrom. In connection with the

offering, the Selling Stockholder also granted the underwriters a

30-day option to purchase up to an additional 1,800,000 shares of

common stock at the public offering price, less the underwriting

discounts and commissions.

Wells Fargo Securities, LLC, Evercore Group L.L.C. and Raymond

James & Associates, Inc. are serving as joint book-running

managers for the offering. Mizuho Securities USA LLC and Truist

Securities, Inc. are also serving as joint book-running managers

for the offering. Stephens Inc., TPH&Co., the energy business

of Perella Weinberg Partners, and Piper Sandler & Co. are

serving as co-managers for the offering. The offering is expected

to close on March 11, 2024, subject to customary closing

conditions.

Concurrently with the closing of the offering, the Company has

agreed to purchase from the Selling Stockholder an aggregate of

2,000,000 units of Crescent Energy OpCo LLC (“OpCo Units”) at a

price per share equal to the price per share at which the

underwriters purchase shares of common stock in the offering and

cancel a corresponding number of shares of the Company’s Class B

common stock, par value $0.0001 per share (“Class B common stock”)

(the “OpCo Unit Purchase”). If the underwriters exercise their

option to purchase additional shares from the Selling Stockholder

in the offering, the Company intends to purchase a number of

additional OpCo Units from the Selling Stockholder and to cancel a

corresponding number of shares of Class B common stock held by the

Selling Stockholder in equal proportion to the number of additional

shares of common stock sold pursuant to the underwriters’ option.

The offering of common stock is not conditioned upon the completion

of the OpCo Unit Purchase, but the OpCo Unit Purchase is

conditioned upon the completion of the offering.

The offering is being made only by means of a prospectus and

prospectus supplement. Copies of the preliminary prospectus

supplement and accompanying base prospectus relating to the

offering and final prospectus supplement, when available, may be

obtained from: Wells Fargo Securities, LLC, 90 South 7th Street,

5th Floor, Minneapolis, MN 55402, at 800-645-3751 (option #5) or

email a request to WFScustomerservice@wellsfargo.com, or Evercore

Group L.L.C., Attention: Equity Capital Markets, 55 East 52nd

Street, 35th Floor, New York, New York 10055, by telephone at

1-888-474-0200 or by email at ecm.prospectus@evercore.com, or

Raymond James & Associates, Inc., 880 Carillon Parkway, St.

Petersburg, FL, 33716, by telephone at 800-248-8863 or by email at

prospectus@raymondjames.com, or by accessing the SEC’s website at

www.sec.gov.

The offering is being conducted pursuant to a registration

statement, filed with the SEC on March 6, 2024 that became

automatically effective upon filing, and corresponding prospectus

included therein. A preliminary prospectus supplement thereto will

be filed with the SEC. The Registration Statement may be obtained

free of charge at the SEC’s website at www.sec.gov under “Crescent

Energy Company.” This press release shall not constitute an offer

to sell or the solicitation of an offer to buy the shares of common

stock or any other securities, nor shall there be any sale of such

shares of common stock or any other securities in any state or

other jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of any such state or other jurisdiction.

About Crescent Energy Company

Crescent Energy Company is a U.S. energy company with a

portfolio of assets concentrated in Texas and the Rockies.

Cautionary Note Regarding

Forward-Looking Statements

This communication contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act and Section 21E of

the Securities Exchange Act of 1934, as amended, and the rules and

regulations promulgated thereunder. These forward-looking

statements include any statements regarding the proposed offering

of the Company’s Class A common stock. These forward-looking

statements are identified by their use of terms and phrases such as

“may,” “expect,” “estimate,” “project,” “plan,” “believe,”

“intend,” “achievable,” “anticipate,” “will,” “continue,”

“potential,” “should,” “could,” and similar terms and phrases.

Although the Company believes that the expectations reflected in

these forward-looking statements are reasonable, they do involve

certain assumptions, risks and uncertainties. Actual results could

differ materially from those anticipated in these forward-looking

statements as a result of certain factors, including, but not

limited to, those set forth in the Company’s filings with the SEC,

including its registration statement on Form S-3, the prospectus

supplement relating to the offering and its Annual Report on Form

10-K for the fiscal year ended December 31, 2023 under the caption

“Risk Factors,” as may be updated from time to time in the

Company’s periodic filings with the SEC. Any forward-looking

statement in this press release speaks only as of the date of this

release. The Company undertakes no obligation to publicly update or

review any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as may be

required by any applicable securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240306869334/en/

Brandi Kendall IR@crescentenergyco.com

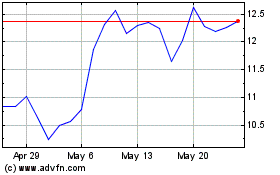

Crescent Energy (NYSE:CRGY)

Historical Stock Chart

From Oct 2024 to Nov 2024

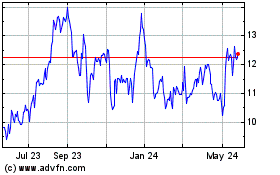

Crescent Energy (NYSE:CRGY)

Historical Stock Chart

From Nov 2023 to Nov 2024