As filed with the Securities and Exchange Commission

on January 5, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________

FORM S-8

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

________________________________

COMMUNITY HEALTHCARE TRUST INCORPORATED

(Exact name of registrant as specified in its

charter)

________________________________

| Maryland |

|

46-5212033 |

| (State or other jurisdiction of |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Identification No.) |

| |

|

|

| 3326 Aspen Grove Drive, Suite 150 |

|

|

| Franklin, Tennessee |

|

37067 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

________________________________

2014 Incentive Plan, as amended

(Full Title of Plan)

________________________________

David H. Dupuy

Community Healthcare Trust Incorporated

3326 Aspen Grove Drive, Suite 150

Franklin, Tennessee 37067

(Name and address of agent for service)

(615) 771-3052

(Telephone number, including area code, of agent

for service)

________________________________

With a copy to:

Tonya Mitchem Grindon

Nathanael P. Kibler

Baker, Donelson, Bearman, Caldwell &

Berkowitz, PC

1600 West End Avenue, Suite 2000

Nashville, TN 37203

(615) 726-5600

(615) 744-5607 (fax)

________________________________

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definitions of “large accelerated filer,”

“accelerated filer” and smaller reporting company in Rule 12b-2 of the Exchange Act:

| Large accelerated filer |

x |

Accelerated filer |

¨ |

| Non-accelerated filer |

¨ |

Smaller reporting company |

¨ |

| |

|

Emerging growth company |

¨ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

EXPLANATORY NOTE

Pursuant to General Instruction

E to Form S-8 under the Securities Act of 1933, as amended, this Registration Statement is filed by Community Healthcare Trust Incorporated,

a Maryland corporation (the “Registrant”), for the purpose of registering additional shares of the Registrant’s common

stock, par value $0.01 per share (the “Common Stock”), under the Registrant’s 2014 Incentive Plan, as amended (the “2014

Plan”). The number of shares of Common Stock available for issuance under the 2014 Plan is subject to an automatic annual increase

on January 1 of each year beginning in 2017 and ending on (and including) March 31, 2024, equal to seven percent (7%) of the

total number of shares of Common Stock outstanding on December 31 of the preceding calendar year. This Registration Statement registers

an aggregate of 120,069 additional shares of Common Stock available for issuance under the 2014 Plan, which represents 7% of the increase

in outstanding shares of Common Stock from December 31, 2022 to December 31, 2023.

The shares of Common

Stock registered pursuant to this Registration Statement are of the same class of securities as (i) the 525,782 shares of

Common Stock previously registered for issuance under the 2014 Plan pursuant to the currently effective Registration

Statement on Form S-8 (File No. 333-206286), filed with the Securities and Exchange Commission (“SEC”) on

August 10, 2015, (ii) the 500,000 shares of Common Stock previously registered for issuance pursuant to the Alignment

of Interest Program under the 2014 Plan pursuant to the currently effective Registration Statement on Form S-8 (File No. 333-214951), filed with the SEC on December 7, 2016, (iii) the 383,411 shares of Common Stock previously

registered for issuance under the 2014 Plan pursuant to the currently effective Registration Statement on Form S-8 (File No. 333-218366) filed with the SEC on May 31, 2017, (iv) the 356,812 shares of Common Stock previously registered for

issuance under the 2014 Plan pursuant to the currently effective Registration Statement on Form S-8 (File No. 333-222399) filed with the SEC on January 3, 2018, (v) the 38,410 shares of Common Stock previously registered for issuance under the

2014 Plan pursuant to the currently effective Registration Statement on Form S-8 (File No. 333-229121) filed with the SEC on January 3, 2019, (vi) the 194,325 shares of Common Stock previously registered for issuance under the 2014 Plan

pursuant to the currently effective Registration Statement on Form S-8 (File No. 333-235833) filed with the SEC on January 7, 2020, (vii) the 173,426 shares of Common Stock previously registered for issuance under the 2014 Plan pursuant

to the currently effective Registration Statement on Form S-8 (File No. 333-251981) filed with the SEC on January 8, 2021, (viii) the 76,609 shares of Common Stock previously registered for issuance under the 2014 Plan pursuant to the currently

effective Registration Statement on Form S-8 (File No. 333-262017) filed with the SEC on January 5, 2022,

(ix) the 500,000 shares of Common Stock previously registered for issuance pursuant to the Alignment of Interest Program under

the 2014 Plan pursuant to the currently effective Registration Statement on Form S-8 (File No. 333-264689) filed with the SEC on May 5, 2022, and (x) the 64,047 shares of Common Stock previously registered for issuance under the 2014 Plan

pursuant to the currently effective Registration Statement on Form S-8 (File No. 333-269133) filed with the SEC on January 5, 2023. The information contained in the Registrant’s Registration Statements on Form S-8 (File Nos.

333-206286, 333-214951, 333-218366, 333-222399, 333-229121, 333-235833, 333-251981, 333-262017, 333-264689, and 333-269133) is

hereby incorporated by reference pursuant to General Instruction E.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. | Incorporation of Documents by Reference. |

The Registrant hereby incorporates

by reference into this Registration Statement the following documents previously filed with the SEC:

(1) The

contents of the earlier registration statements on Forms S-8 relating to the 2014 Plan and the Alignment of Interest Program filed with

the SEC on August 10, 2015 (File No. 333-206286), on December 7, 2016 (File No. 333-214951), on May 31, 2017 (File No. 333-218366), on January 3, 2018 (File No. 333-222399), on January 3, 2019 (File No. 333-229121),

on January 7, 2020 (File No. 333-235833), on January 8, 2021 (File No. 333-251981), on January 5, 2022 (File No. 333-262017), on May 2, 2022 (File No. 333-264689), and on January 5, 2023 (File No. 333-269133),

respectively.

(2) The

description of the Registrant’s Common Stock contained in a registration statement on Form 8-A, filed with the SEC on May 19, 2015 (File No. 001-37401) under the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), including any amendment or report filed for the purpose of updating such description.

(3) The

Registrant’s Annual Report on Form 10-K (File No. 001-37401) for the year ended December 31, 2022, filed with the

SEC on February 14, 2023.

(4) The

information specifically incorporated by reference into the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2022 from its definitive proxy statement on Schedule 14A (File No. 001-37401) for the 2023 Annual Meeting of Stockholders, filed with the SEC on March 16, 2023.

(5) The

Registrant’s Quarterly Reports on Form 10-Q (File No. 001-37401) for the quarters ended March 31, 2023, June 30,

2023, and September 30, 2023, filed with the SEC on May 2, 2023, August 1, 2023, and October 31, 2023, respectively.

(6) The

Registrant’s Current Reports on Form 8-K (File No. 001-37401), filed with the SEC, excluding the items furnished as exhibits

to such reports, on January 4, 2023, February 13, 2023, March 6, 2023, March 7, 2023, April 10, 2023, May 4, 2023, May 17, 2023, January 3, 2024, and January 4, 2024.

All documents that the Registrant

subsequently files pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date of this Registration Statement

(except for any portions of the Registrant’s Current Reports on Form 8-K furnished pursuant to Item 2.02 or Item 7.01 thereof

and any corresponding exhibits thereto not filed with the SEC), and prior to the filing of a post-effective amendment to this Registration

Statement indicating that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed

to be incorporated by reference into this Registration Statement and to be a part hereof from the date of filing of such documents.

Any statement contained in

a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of

this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is

or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded

shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

| Item 6. | Indemnification of Directors and Officers. |

Maryland law permits a Maryland

corporation to include in its charter a provision eliminating the liability of its directors and officers to the corporation and its stockholders

for money damages except for liability resulting from (a) actual receipt of an improper benefit or profit in money, property or services

or (b) active and deliberate dishonesty that is established by a final judgment and is material to the cause of action. Our charter

contains a provision which eliminates our directors’ and officers’ liability to the maximum extent permitted by Maryland law.

Maryland law requires a Maryland

corporation (unless its charter provides otherwise, which our charter does not) to indemnify a director or officer who has been successful,

on the merits or otherwise, in the defense of any proceeding to which he or she is made, or threatened to be made, a party by reason of

his or her service in that capacity. Maryland law permits a Maryland corporation to indemnify its present and former directors and officers,

among others, against judgments, penalties, fines, settlements and reasonable expenses actually incurred by them in connection with any

proceeding to which they may be made or threatened to be made a party by reason of their service in those or other capacities unless it

is established that: (a) the act or omission of the director or officer was material to the matter giving rise to the proceeding

and (i) was committed in bad faith or (ii) was the result of active and deliberate dishonesty; (b) the director or officer

actually received an improper personal benefit in money, property or services; or (c) in the case of any criminal proceeding, the

director or officer had reasonable cause to believe that the act or omission was unlawful. However, under Maryland law, a Maryland corporation

may not indemnify for an adverse judgment in a suit by or in the right of the corporation or for a judgment of liability on the basis

that personal benefit was improperly received, unless in either case a court orders indemnification and then only for expenses. In addition,

Maryland law permits a Maryland corporation to advance reasonable expenses to a director or officer upon the corporation’s receipt

of (a) a written affirmation by the director or officer of his or her good faith belief that he or she has met the standard of conduct

necessary for indemnification and (b) a written undertaking by him or her or on his or her behalf to repay the amount paid or reimbursed

by the corporation if it is ultimately determined that the standard of conduct was not met.

Our charter authorizes us

to obligate ourselves and our bylaws obligate us, to the maximum extent permitted by Maryland law, to indemnify any present or former

director or officer or any individual who, while a director or officer of our company and at our request, serves or has served as a director,

officer, partner, member, manager, employee, or agent of another REIT, corporation, limited liability company, partnership, joint venture,

trust, employee benefit plan or other enterprise and who is made or threatened to be made a party to the proceeding by reason of his or

her service in that capacity from and against any claim or liability to which that individual may become subject or which that individual

may incur by reason of his or her service in any of the foregoing capacities and to pay or reimburse his or her reasonable expenses in

advance of final disposition of a proceeding.

We have entered into indemnification

agreements with each of our officers and directors whereby we agree to indemnify such officers and directors to the fullest extent permitted

by Maryland law against all expenses and liabilities, subject to limited exceptions. These indemnification agreements also provide that

upon an application for indemnity by an officer or director to a court of appropriate jurisdiction, such court may order us to indemnify

such officer or director.

Insofar as the foregoing provisions

permit indemnification of directors, officers or persons controlling us for liability arising under the Securities Act, we have been informed

that in the opinion of the SEC, this indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

A list of exhibits filed with the registration

statement or incorporated by reference is set forth in the Exhibit Index hereto and is incorporated herein by reference.

EXHIBIT INDEX

| | |

|

| 4.1 | |

Corporate Charter

of Community Healthcare Trust Incorporated, as amended (incorporated by reference to Exhibit 3.1 to the Registrant’s Registration

Statement on Form S-11/A (File No. 333-203210) filed with the SEC on May 6, 2015). |

| | |

|

| 4.2 | |

Amended and Restated Bylaws

of Community Healthcare Trust Incorporated (incorporated by reference to Exhibit 3.2 to the Registrant’s Quarterly Report

on Form 10-Q (File No. 333-203210) filed with the SEC on November 3, 2020). |

| | |

|

| 4.3 | |

Form of Certificate of

Common Stock of Community Healthcare Trust Incorporated (incorporated by reference to Exhibit 4.1 to the Registrant’s

Registration Statement on Form S-11 (File No. 333-203210) filed with the SEC on April 2, 2015). |

| | |

|

| 4.4 | |

Community Healthcare Trust Incorporated

2014 Incentive Plan (incorporated by reference to Exhibit 10.3 to the Registrant’s Registration Statement on Form S-11

(File No. 333-203210) filed with the SEC on April 2, 2015). |

| | |

|

| 4.5 | |

Amendment No. 1 to Community

Healthcare Trust Incorporated 2014 Incentive Plan (incorporated by reference to Exhibit 10.12 to the Registrant’s Registration

Statement on Form S-11/A (File No. 333-203210) filed with the SEC on May 6, 2015). |

| | |

|

| 4.6 | |

Amendment No. 2 to Community

Healthcare Trust Incorporated 2014 Incentive Plan (incorporated by reference to Exhibit 10.1 to the Registrant’s Current

Report on Form 8-K (File No. 001-37401) filed with the SEC on July 17, 2017). |

| | |

|

| 4.7 | |

Amendment No. 3 to Community

Healthcare Trust Incorporated 2014 Incentive Plan (incorporated by reference to Exhibit 10.2 to the Registrant’s Current

Report on Form 8-K (File No. 001-37401) filed with the SEC on July 17, 2017). |

| | |

|

| 4.8 | |

Amendment No. 4 to Community

Healthcare Trust Incorporated 2014 Incentive Plan (incorporated by reference to Exhibit 10.3 to the Registrant’s Current

Report on Form 8-K (File No. 001-37401) filed with the SEC on January 4, 2024). |

| | |

|

| 4.9 | |

Community Healthcare Trust Incorporated

Third Amended and Restated Alignment of Interest Program (incorporated by reference to Exhibit 10.1 to the Registrant’s

Current Report on Form 8-K (File No. 001-37401) filed with the SEC on January 4, 2024). |

| | |

|

| 4.10 | |

Third Amended and Restated Executive

Officer Incentive Program (incorporated by reference to Exhibit 10.2 to the Registrant’s Current Report on Form 8-K

(File No. 001-37401) filed with the SEC on January 4, 2024). |

| | |

|

| 4.11 | |

Community Healthcare Trust Incorporated

Amended and Restated Non-Executive Officer Incentive Program (incorporated by reference to Exhibit 10.6 to the Registrant’s

Annual Report on Form 10-K (File No. 001-37401) filed with the SEC on February 25, 2020). |

| | |

|

| 5.1* | |

Legal Opinion of Baker, Donelson,

Bearman, Caldwell & Berkowitz, PC. |

| | |

|

| 23.1* | |

Consent of Independent Registered

Public Accounting Firm, BDO USA, P.C. |

| | |

|

| 23.2* | |

Consent of Baker, Donelson,

Bearman, Caldwell & Berkowitz, PC (included as part of Exhibit 5.1). |

| | |

|

| 24.1* | |

Power of Attorney (included

as part of the signature page hereto). |

| | |

|

| 107* | |

Filing Fee Table. |

_____________________

* Filed herewith

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets the requirements

for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly

authorized, in the City of Franklin, State of Tennessee, on January 5, 2024.

| |

COMMUNITY HEALTHCARE TRUST INCORPORATED |

| |

|

| |

By: |

/s/

David H. Dupuy |

| |

Name: |

David H. Dupuy |

| |

Title: |

Chief Executive Officer

and President |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS,

each person whose signature appears below hereby constitutes and appoints David H. Dupuy his or her true and lawful attorney-in-fact and

agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities,

to sign any and all amendments and post-effective amendments to this Registration Statement and any registration statement filed pursuant

to Rule 462(b) under the Securities Act of 1933, as amended, and to file the same with the SEC, granting unto said attorney-in-fact

and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the

premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said

attorney-in-fact and agents, or their substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ David H. Dupuy |

|

Chief Executive Officer, President |

January 5, 2024. |

| David H. Dupuy |

|

and Director (Principal Executive Officer) |

|

| |

|

|

|

| /s/ William G. Monroe IV |

|

Executive Vice President and Chief Financial |

January 5, 2024. |

| William G. Monroe IV |

|

Officer (Principal Financial Officer) |

|

| |

|

|

|

| /s/ Leigh Ann Stach |

|

Executive Vice President and Chief Accounting |

January 5, 2024. |

| Leigh Ann Stach |

|

Officer (Principal Accounting Officer) |

|

| |

|

|

|

| /s/ Cathrine Cotman |

|

Director |

January 5, 2024. |

| Cathrine Cotman |

|

|

|

|

| |

|

|

|

|

| /s/ Alan Gardner |

|

Director |

January 5, 2024. |

| Alan Gardner |

|

|

|

|

| |

|

|

|

|

| /s/ Claire Gulmi |

|

Director |

January 5, 2024. |

| Claire Gulmi |

|

|

|

|

| |

|

|

|

|

| /s/ Robert Hensley |

|

Director |

January 5, 2024. |

| Robert Hensley |

|

|

|

|

| |

|

|

|

|

| /s/ R. Lawrence Van Horn |

|

Director |

January 5, 2024. |

| R. Lawrence Van Horn |

|

|

|

|

| |

|

|

|

|

Exhibit 5.1

|

1600

West End Ave. • Suite 2000 • NASHVILLE,

TENNESSEE 37203 •

615.726.5600

• bakerdonelson.com |

Tonya Mitchem Grindon, Shareholder

Direct Dial: 615.726.5607

Direct Fax: 615.744.5607

E-Mail Address: tgrindon@bakerdonelson.com

January 5, 2024

Community Healthcare Trust Incorporated

3326 Aspen Grove Drive, Suite 150

Franklin, TN 37067

Re: Registration

Statement on Form S-8

Ladies and Gentlemen:

We have served as Maryland

counsel to Community Healthcare Trust Incorporated, a Maryland corporation (the “Company”), in connection with certain matters

of Maryland law arising out of the issuance of up to an additional 120,069 shares (the “Shares”) of common stock, $0.01 par

value per share (the “Common Stock”), of the Company, pursuant to the Community Healthcare Trust Incorporated 2014 Incentive

Plan, as amended (the “Plan”), covered by the above-referenced Registration Statement (the “Registration Statement”),

filed by the Company with the United States Securities and Exchange Commission (the “Commission”) under the Securities Act

of 1933, as amended (the “1933 Act”), on the date hereof.

In connection with our representation

of the Company, and as a basis for the opinion hereinafter set forth, we have examined originals, or copies certified or otherwise identified

to our satisfaction, of the following documents (hereinafter collectively referred to as the “Documents”):

1.

The Registration Statement;

2. The

charter of the Company (the “Charter”), certified as of a recent date by the State Department of Assessments and Taxation

of Maryland (the “SDAT”);

3. The

bylaws of the Company, certified as of the date hereof by an officer of the Company;

4. A

certificate of the SDAT as to the good standing of the Company, dated as of a recent date;

5. Resolutions

adopted by the Compensation Committee (the “Compensation Committee”) of the Board of Directors (the “Board”)

of the Company and resolutions adopted by, and minutes of, the Board, both of which relate to, among other matters, the Plan and the

issuance of the Shares (collectively, the “Resolutions”), certified as of the date hereof by an officer of the Company;

6. The

Plan, certified as of the date hereof by an officer of the Company;

ALABAMA

• FLORIDA • GEORGIA • LOUISIANA • MARYLAND • MISSISSIPPI •

SOUTH CAROLINA • TENNESSEE •

TEXAS

• VIRGINIA • WASHINGTON, D.C. |

Community Healthcare Trust Incorporated

January 5, 2024

Page 2

7. A

certificate executed by an officer of the Company, dated as of the date hereof; and

8. Such

other documents and matters as we have deemed necessary or appropriate to express the opinion set forth below, subject to the assumptions,

limitations and qualifications stated herein.

In expressing the opinion

set forth below, we have assumed the following:

i. Each

individual executing any of the Documents, whether on behalf of such individual or another person, is legally competent to do so.

ii. Each

individual executing any of the Documents on behalf of a party (other than the Company) is duly authorized to do so.

iii. Each

of the parties (other than the Company) executing any of the Documents has duly and validly executed and delivered each of the Documents

to which such party is a signatory, and such party’s obligations set forth therein are legal, valid and binding and are enforceable

in accordance with all stated terms.

iv. All

Documents submitted to us as originals are authentic. The form and content of all Documents submitted to us as unexecuted drafts do not

differ in any respect relevant to this opinion from the form and content of such Documents as executed and delivered. All Documents submitted

to us as certified or photostatic copies conform to the original documents. All signatures on all Documents are genuine. All public records

reviewed or relied upon by us or on our behalf are true and complete. All representations, warranties, statements and information contained

in the Documents are true and complete. There has been no oral or written modification of or amendment to any of the Documents, and there

has been no waiver of any provision of any of the Documents, by action or omission of the parties or otherwise.

v. The

Shares will not be issued in violation of any restriction or limitation contained in Article VI of the Charter or in the Plan.

vi. Upon

the issuance of any Shares, the total number of shares of Common Stock issued and outstanding will not exceed the total number of shares

of Common Stock that the Company is then authorized to issue under the Charter.

vii. Each

stock award, right or other security granted under the Plan pursuant to which Shares may be issued (each, an “Award”), will

be duly authorized and validly granted in accordance with the Plan, and any such Shares will be so issued in accordance with the terms

of the Plan and any applicable rights agreement or other award agreement entered into in connection with the grant of such Award (each,

an “Award Agreement”).

Based upon the foregoing,

and subject to the assumptions, limitations and qualifications stated herein, it is our opinion that:

1. The

Company is a corporation duly incorporated and existing under and by virtue of the laws of the State of Maryland and is in good standing

with the SDAT.

Community

Healthcare Trust Incorporated

January 5,

2024

Page 3

2. The

issuance of the Shares has been duly authorized and, when and if delivered against payment therefore in accordance with the Registration

Statement, the Resolutions and any other resolutions of the Board or the Compensation Committee relating thereto, the Plan, and any applicable

Award Agreement, the Shares will be validly issued, fully paid and nonassessable.

The foregoing opinion is

limited to the laws of the State of Maryland, and we do not express any opinion herein concerning any other law. We express no opinion

as to the applicability or effect of federal or state securities laws, including the securities laws of the State of Maryland, or as

to federal or state laws regarding fraudulent transfers. To the extent that any matter as to which our opinion is expressed herein would

be governed by the laws of any jurisdiction other than the State of Maryland, we do not express any opinion on such matter. The opinion

expressed herein is subject to the effect of any judicial decision which may permit the introduction of parol evidence to modify the

terms or the interpretation of agreements.

The opinion expressed herein

is limited to the matters specifically set forth herein and no other opinion shall be inferred beyond the matters expressly stated. We

assume no obligation to supplement this opinion if any applicable law changes after the date hereof or if we become aware of any fact

that might change the opinion expressed herein after the date hereof.

This opinion is being furnished

to you for submission to the Commission as an exhibit to the Registration Statement. We hereby consent to the filing of this opinion

as Exhibit 5.1 to the Registration Statement. In giving this consent, we do not admit that we are within the category of persons

whose consent is required by Section 7 of the 1933 Act.

| |

Best regards, |

| |

|

| |

BAKER, DONELSON, BEARMAN,

CALDWELL &

BERKOWITZ, PC |

| |

|

| |

/s/ Tonya Mitchem Grindon |

| |

|

| |

Tonya Mitchem Grindon, Shareholder |

Exhibit 23.1

Consent of Independent Registered Public Accounting

Firm

Community Healthcare Trust Incorporated

Franklin, Tennessee

We hereby consent to the incorporation by reference

in this Registration Statement on Form S-8 of our reports dated February 14, 2023, relating to the consolidated financial statements

and financial statement schedules and the effectiveness of internal control over financial reporting of Community Healthcare Trust Incorporated

appearing in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

/s/ BDO USA, P.C.

Nashville, Tennessee

January 5, 2024

Exhibit 107

Calculation of Filing Fee Table

Form S-8

(Form Type)

Community Healthcare Trust Incorporated

(Exact Name of Registrant as Specified in its Charter)

Newly Registered Securities

| Security Type |

Security Class Title |

Fee

Calculation Rule |

Amount Registered(1) |

Proposed Maximum Offering Price Per Unit(2) |

Maximum Aggregate Offering Price |

Fee Rate |

Amount of Registration Fee |

| Equity |

Common Stock, $0.01 par value per share, reserved for issuance pursuant to the 2014 Incentive Plan, as amended |

Rule 457(h) |

120,069 |

$26.06 |

$3,128,998.14 |

0.00014760 |

$461.84 |

| Total Offering Amounts |

|

|

|

$461.84 |

| Total Fee Offsets |

|

|

|

$— |

| Net Fee Due |

|

|

|

$461.84 |

(1) Pursuant to Rule 416(a)

of the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall cover any additional securities

as may be issuable under the Registrant’s 2014 Incentive Plan, as amended, by reason of any stock splits, stock dividends, recapitalizations

or similar transactions.

(2) Estimated solely for

purposes of calculating the registration fee pursuant to Rule 457(h) of the Securities Act based on the average of the high and low prices

of the Registrant’s common stock on the New York Stock Exchange on January 3, 2024.

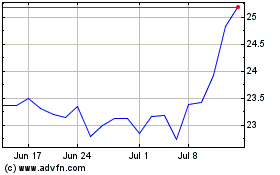

Commmunity Healthcare (NYSE:CHCT)

Historical Stock Chart

From Apr 2024 to May 2024

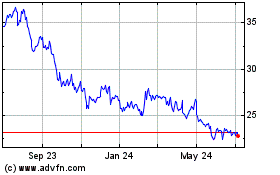

Commmunity Healthcare (NYSE:CHCT)

Historical Stock Chart

From May 2023 to May 2024