Global growth in the consumer industry has slowed and talk of

recovery in the U.S. and Western Europe is premature, Reckitt

Benckiser PLC (RB.LN ) Chief Executive Bart Becht told Dow Jones

Newswires.

In a recent interview at the company's headquarters in Slough,

England, Becht, who shocked the markets last month when he

announced his retirement from the FTSE 100 group from this

September after 16 years at the helm, also said the household and

healthcare giant is ready to look at any transformational deal

opportunity alongside its ambitions to grow market share across its

brands portfolio, even as it continues to offset escalating input

pressures by paring costs.

Last month, the U.K.-based maker of Dettol disinfectant,

cleaning product Cillit Bang and Air Wick air fresheners, posted a

rise in first-quarter profit on higher sales, boosted by surging

demand for household and personal care items in emerging

economies.

Sales in Asia, Africa, Latin America, the Middle East and

Eastern Europe, where rising incomes and socio-economic improvement

have driven higher demand for its products, more than offset

weakness in Western Europe and North America. Still, like its

rivals, the company faces a challenging outlook in mature markets

where, in addition to cut-throat promotional competition from

suppliers and retailers, the disposable spending power of

cash-strapped shoppers is being hit by rising unemployment and

squeezed by government-backed austerity tax hikes and public

spending cuts.

Becht warned structural macro-economic weakness in major Western

economies has tapered the rate of growth, even as the globalized

industry gradually shifts to the East. "The overall global growth

clearly has come down somewhat because Western Europe and North

America are still a huge part of that picture," he said.

"In Europe, the situation continues to be very, very weak. In

North America, it also continues to be rather weak. It is

marginally better than it was maybe a couple of months ago, but it

is not good enough in order to call it that we have a recovery. It

is way too early for that."

Dutch national Becht, speaking at a breakfast bar in a dummy

'supermarket' showcasing the group's branded products, rejected

speculation that his surprise departure was the result of a split

at board level over the strategic direction of the company,

including involvement in a play for a transformational merger or

acquisition, such as with Unilever (ULVR.LN), Procter and Gamble

Co. (PG) or Colgate-Palmolive (CL). "That is complete rubbish.

There was one analyst who dreamt up this hypothesis. It is complete

nonsense."

Still, he added there is capacity for a major deal in the

industry and the group is ready to scrutinize such an opportunity.

"Transformational deals basically happen once every couple of

decades. When the opportunity, if ever, arises, I am sure we will

take a look at that. Yes, there is room for it. It might happen,

[but] I don't think it is very likely to happen."

The group delivered GBP11 million first-quarter cost synergies

from its GBP2.5 billion buy of SSL International PLC in 2010, which

owns the Durex and Scholl brands. It has recently focused on

bolt-on acquisitions in emerging markets to build portfolio and

brand equity. Last December, it acquired India-based Paras

Pharmaceuticals for GBP460 million.

The company, which also makes Lysol disinfectants, Clearasil

spot cream and Finish dishwasher powder, as well as French's Yellow

Mustard, is also being hit by rising commodity prices as the cost

of oil, palm oil, chemicals and plastics soars. To combat these

effects, it is ramping up savings by streamlining packaging and

paring logistics, sourcing and purchasing costs to stem profit

margin losses.

The CEO said long-contract hedging mitigates against daily price

movements. "We don't buy necessarily on a spot basis. We lock

prices in on raw and packaging materials, anywhere from three to 12

months, to make sure we have some stability in our cost

structure."

A week ago, global commodities prices including gold, silver and

oil crashed on fears of a global economic slowdown, resulting in

some of the biggest falls in a two-year period characterized by

upward pressure. Becht said it was a correction that should be

positively received. "The fact they are coming down is welcome news

because a lot of it has been very speculative."

In a bid to recover higher costs, the company invests in

innovation and product design, like replacing butane in aerosol

cans with compressed air, improving the ergonomic utility of toilet

fresheners and packing dishwasher tablets in cardboard packaging

rather than plastic. Becht said the real work begins once the new

product hits the shelves. "You always have to start your cost

optimization after you have launched. There is always stuff to be

done."

Still, Becht said shrinking the quantity of a household product

is a no-go area, unlike for food manufacturers. "[You can] take out

packaging materials, but not change the experience for the

consumer. Taking quantities away is taking away from the consumer."

Earlier this year, reports said U.S.-based Kraft Foods (KFT) cut

the size of its Cadbury Dairy Milk chocolate bar due to the rising

cost of ingredients.

In addition, while the group drives through selective price

increases in developing markets, Becht said it is a different story

for mature economies where highly-competitive supermarkets rely on

their value proposition to drive sales.

"We have not really taken price increases of any substance in

Europe or North America. I don't believe at this stage of the game

there is substantial room for material price increases because of

where the consumer sits today. I don't think [the promotional

environment] will change overnight."

Becht said there are further growth gains to be made for its

'powerbrands', including Calgon limescale tabs and Vanish stain

remover. "In 2000, right after the merger, we had less than 40% [of

our business] in our powerbrands and today we have close to 70%.

They are strong market leaders in categories which still have

substantial growth potential because they tend to be

under-penetrated, not just in developing markets but also in

developed markets."

"Automatic dishwashing is a classic example. Dishwashing machine

penetration, even in Western Europe and North America is somewhere

between 30% and 60%, when you have washing machine penetration at

90% plus. We drive [this] penetration together with [appliance

manufacturers] like Bosch Siemens and Whirlpool".

However, first-quarter group fabric care sales fell 6%, hit by

laundry detergent purchases in the struggling economies of

Portugal, Greece, Spain and Italy, while Europe overall was

relatively flat in dishwashing. Becht said the trend wouldn't

change in the short term.

"For dish, the overall market growth rate has come down

somewhat, [but] it is not a share issue. Fabric is a very different

story because our softeners are mostly driven by laundry detergents

in southern Europe. Volume is not fantastic and promotional spend

is very high. I don't see that changing in the next couple of

months." He said next year "we will see some better results."

Meanwhile, Reckitt Benckiser's pharmaceutical business is

delivering strong returns. Last month, it noted "very good"

progress on patent-protected Suboxone film -- a heroin dependency

treatment that dissolves under the tongue -- which had 37% volume

share in the U.S. by the end of 2010. New pipeline initiatives for

the drug will be revealed in the next 12 months. Suboxone tablets

were exposed to potential generic competition after its exclusivity

in the U.S. expired in October last year, but the company's move to

the patented film products should help protect it from

competitors.

Despite Suboxone's success, and apart from "one or two" possible

extensions into addiction treatments, Becht said the group has no

plans to greatly expand its pharmaceutical operations. "We are a

niche pharmaceutical company," with no intention to become a major

one, he said.

On his future and after taking a break, Becht, 54, said he

remains open to an external non-executive position once his tenure

ends, though he hasn't found one yet. "So far, I have not really

had the time".

However, he aims to shift direction. "I am mostly focused on

smaller businesses, not so much in an executive capacity. There

will be some private companies probably that I want to be involved

with," he said.

However, his extensive charity work will also take center stage,

which includes support for organizations including Save the

Children and Médecins Sans Frontières. "One of the reasons why I am

retiring is also to make sure we can spend some of the money on the

right causes. But that takes much more time that I ever

envisioned." In 2009, Becht transferred around GBP110 million in

stock options to his trust.

The announcement of his planned departure came less than five

months after Liz Doherty replaced Colin Day as chief financial

officer. Yet Becht, who will be replaced by executive

vice-president of global category development Rakesh Kapoor, said

concerns about the speed of management change at the company were

overdone.

"Colin's departure had nothing to do with my retirement. They

are completely unlinked events. It is a bit like praising or

killing the messenger. Since we have been bringing the good news

basically for the last 10 years, they think the news is directly

linked only to us. This is a team effort of nine people at the end

of the day".

Under Becht's leadership, the company's shares have soared more

than fivefold, from 600 pence in 1999 to more than 3000 pence

today.

"I have done this for 16 years, which is a long time. And I

think there comes a time when the company, as well as myself, are

ready for a change. There is never a perfect time, but it is about

as good a time as there can be for this transition to be made".

By Simon Zekaria, Dow Jones Newswires; +44 207 842-9410;

simon.zekaria@dowjones.com

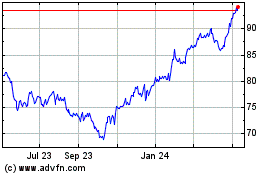

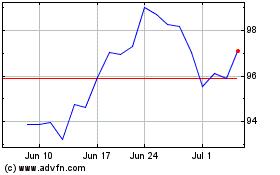

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Nov 2023 to Nov 2024