1934 Act Registration No. 1-31731

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Dated October 11, 2023

Chunghwa Telecom Co., Ltd.

(Translation of Registrant’s Name into English)

21-3 Xinyi Road Sec. 1,

Taipei, Taiwan, 100 R.O.C.

(Address of Principal Executive Office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of form 20-F or Form 40-F.)

Form 20-F ☒ Form 40-F ☐

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ☐ No ☒

(If “Yes” is marked, indicated below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable )

1

EXHIBIT INDEX

|

|

|

Exhibit |

Description |

|

99.1 |

Announcement on 2023/10/02 |

Honghwa International Corporation, the Company's subsidiary announces the acquisition of right-of-use assets from the Company |

99.2 |

Announcement on 2023/10/11 |

Chunghwa Telecom announces its operating results for September 2023 |

99.3 |

Announcement on 2023/10/11 |

September 2023 sales |

99.4 |

Announcement on 2023/10/11 |

The Company to participate in investor conference held by TAIWAN COOPERATIVE SECURITIES |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant Chunghwa Telecom Co., Ltd. has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Date: October 11, 2023 |

|

|

|

|

Chunghwa Telecom Co., Ltd. |

|

|

|

|

|

By: /s/Yu-Shen Chen |

|

Name: Yu-Shen Chen |

|

Title: Chief Financial Officer |

3

EXHIBIT 99.1

Honghwa International Corporation, the Company's subsidiary announces the acquisition of right-of-use assets from the Company

Date of events: 2023/10/02

Contents:

1.Name and nature of the underlying asset (e.g., land located at Sublot XX, Lot XX, North District, Taichung City):

283ores leased in total, such as No. 3*1, Ren 1st Rd., Ren’ai Dist., Keelung City, Taiwan

2.Date of occurrence of the event: 2023/10/02

3.Transaction unit amount (e.g. XX square meters, equivalent to XX ping), unit price, and total transaction price:

Transaction volume: 17,269.59 pings

Unit price: average NT$513 per ping per month

Total transaction amount: NT$124,011,666

Right-of-use asset: NT$116,135,697

4.Trading counterparty and its relationship with the Company (if the trading counterparty is a natural person and furthermore is not a related party of the Company, the name of the trading counterparty is not required to be disclosed):

Trading counterparty: Chunghwa Telecom Co., Ltd.

Relationship with the company: parent company

5.Where the trading counterparty is a related party, announcement shall also be made of the reason for choosing the related party as trading counterparty and the identity of the previous owner, its relationship with the Company and the trading counterparty, and the previous date and monetary amount of transfer:

Reason for choosing the related party as trading counterparty: Because the company undertakes the store telecom business of the parent company, it leases the original sites from the parent company to serve local customers.

The identity of the previous owner, its relationship with the Company and the trading counterparty, and the previous date and monetary amount of transfer: N/A

6.Where an owner of the underlying assets within the past five years has been a related party of the Company, the announcement shall also include the date and price of acquisition and disposal by the related party, and its relationship with the Company at the time of the transaction: N/A

7.Projected gain (or loss) through disposal (not applicable for acquisition of assets; those with deferral should provide a table explaining recognition): N/A

4

8.Terms of delivery or payment (including payment period and monetary amount), restrictive covenants in the contract, and other important terms and conditions:

Payment terms: monthly payment

Payment period: fourteen months

Restrictive covenants in the contract and other important terms and conditions: None

9.The manner of deciding on this transaction (such as invitation to tender, price comparison, or price negotiation), the reference basis for the decision on price, and the decision-making unit:

Price reference basis: Price negotiation

Decision-making unit: Board of Directors

10.Name of the professional appraisal firm or company and its appraisal price: N/A

11.Name of the professional appraiser: N/A

12.Practice certificate number of the professional appraiser: N/A

13.The appraisal report has a limited price, specific price, or special price: N/A

14.An appraisal report has not yet been obtained: N/A

15.Reason for an appraisal report not being obtained: N/A

16.Reason for any significant discrepancy with the appraisal reports and opinion of the CPA: N/A

17.Name of the CPA firm: N/A

19.Practice certificate number of the CPA: N/A

20.Broker and broker's fee: N/A

21.Concrete purpose or use of the acquisition or disposal:

Building a complete channel to provide consumers with faster and better telecom services.

22.Any dissenting opinions of directors to the present transaction: No

23.Whether the counterparty of the current transaction is a related party: Yes

24.Date of the board of directors resolution: 2023/10/02

25.Date of ratification by supervisors or approval by the audit committee: 2023/10/02

26.The transaction is to acquire a real property or right-of-use asset from a related party: Yes

27.The price assessed in accordance with the Article 16 of the Regulations Governing the Acquisition and Disposal of Assets by Public Companies: N/A

28.Where the above assessed price is lower than the transaction price, the price assessed in accordance with the Article 17 of the same regulations: N/A

29.Any other matters that need to be specified: None

5

EXHIBIT 99.2

Chunghwa Telecom announces its operating results for September 2023

Date of events: 2023/10/11

Contents:

1.Date of occurrence of the event: 2023/10/11

2.Company name: Chunghwa Telecom Co., Ltd.

3.Relationship to the Company (please enter "head office" or "subsidiaries"): Head office

4.Reciprocal shareholding ratios: N/A

Chunghwa Telecom announced its unaudited operating results on a consolidated basis for September 2023:

The Company’s revenue was approximately NT$18.50 billion, income from operation was approximately NT$3.55 billion, net income attributable to stockholders of the parent was approximately NT$2.86 billion, EBITDA was approximately NT$6.86 billion and earnings per share was NT$0.37 for September 2023.

The Company’s revenue was approximately NT$161.33 billion, income from operation was approximately NT$35.90 billion, net income attributable to stockholders of the parent was approximately NT$28.65 billion, EBITDA was approximately NT$65.62 billion and earnings per share was NT$3.69 for the nine months ended September 30, 2023.

7.Any other matters that need to be specified: None

6

EXHIBIT 99.3

Chunghwa Telecom

October 11, 2023

This is to report the changes or status of 1) Sales volume 2) Funds lent to other parties 3) Endorsements and guarantees 4) Financial derivative transactions for the period of January 2023.

1) Sales volume (NT$ Thousand)

|

|

|

|

|

|

|

|

|

|

|

|

Period |

|

Items |

|

2023 |

|

2022 |

|

Changes |

|

% |

|

Sep. |

|

Net sales |

|

18,501,054 |

|

18,985,868 |

|

(-) 484,814 |

|

(-)2.55 % |

|

Jan.-Sep. |

|

Net sales |

|

161,332,502 |

|

157,238,260 |

|

(+)4,094,242 |

|

(+)2.60 % |

|

2) Funds lent to other parties (NT$ thousand)

|

|

|

|

Lending Company |

Current Month |

Last Month |

Specified Amount |

Parent Company |

0 |

0 |

0 |

Subsidiaries |

0 |

0 |

0 |

3) Endorsements and guarantees (NT$ thousand)

|

|

|

|

Guarantor |

Increase (Decrease) |

Accumulated |

Limited Amount |

Parent Company |

0 |

0 |

0 |

Subsidiaries |

0 |

500,000 |

3,054,027 |

4) Financial derivative transactions accumulated from January to the reporting month (NT$ thousand)

a-1 Non-trading purpose (that does not meet the criteria for hedge accounting)

|

|

|

|

|

Forward Contract |

Margins Paid |

|

0 |

Premiums Received (Paid) |

|

0 |

|

|

|

Outstanding Position |

Total amount of contract |

238,665 |

Fair Value |

-2,485 |

The amount of unrealized gain(loss) recognized this year |

-5,999 |

|

|

|

Settled Position |

Total amount of contract |

482,365 |

The amount of realized gain(loss) recognized this year |

19,334 |

|

|

|

7

a-2 Non-trading purpose (that meets the criteria for hedge accounting)

|

|

|

|

|

Forward Contract |

Margins Paid |

|

0 |

Premiums Received (Paid) |

|

0 |

|

|

|

Outstanding Position |

Total amount of contract |

273,456 |

Fair Value |

-3,535 |

The amount of unrealized gain(loss) recognized this year |

-16,426 |

|

|

|

Settled Position |

Total amount of contract |

1,300,679 |

The amount of realized gain(loss) recognized this year |

35,437 |

|

|

|

b Trading purpose : None

8

EXHIBIT 99.4

The Company to participate in investor conference held by TAIWAN COOPERATIVE SECURITIES

Date of events: 2023/10/13

Contents:

1.Date of institutional investor conference: 2023/10/13

2.Time of institutional investor conference: 14:00 pm (Taipei time)

3.Location of institutional investor conference: Teleconference

4.Outline of institutional investor conference: Please refer to http://mops.twse.com.tw and https://www.cht.com.tw/chtir for the presentation of the investor conference.

5.Any other matters that need to be specified: None

9

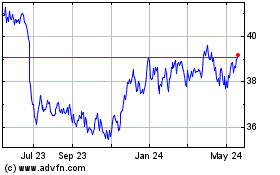

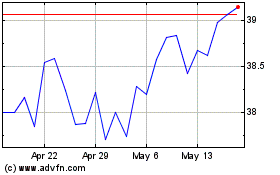

Chunghwa Telecom (NYSE:CHT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Chunghwa Telecom (NYSE:CHT)

Historical Stock Chart

From Nov 2023 to Nov 2024