Chemed Corporation (Chemed) (NYSE:CHE), which operates VITAS

Healthcare Corporation (VITAS), the nation�s largest provider of

end-of-life care, and Roto-Rooter, the nation�s largest commercial

and residential plumbing and drain cleaning services provider,

today reported financial results for its second quarter ended June

30, 2007, versus the comparable prior-year period, as follows:

Consolidated operating results from Continuing Operations: Revenue

increased 9.0% to $271 million Diluted EPS from Continuing

Operations of $.38 Adjusted diluted EPS from Continuing Operations,

which excludes early extinguishments of debt and certain other

items, of $.79 VITAS segment operating results from Continuing

Operations: Net Patient Revenue of $186 million, up 8.3% Average

Daily Census (ADC) of 11,406, up 6.6% Admissions of 13,658, an

increase of 5.2% Average Length of Stay in the quarter of 76.6 days

Net income of $14.2 million Adjusted EBITDA of $24.9 million

Roto-Rooter segment operating results: Revenue of $86 million, an

increase of 10.5% Job count of 201,939 up 1.6% Net Income of $10.7

million Adjusted EBITDA of $18.1 million VITAS VITAS generated

13,658 admissions in the quarter, which represents an increase of

5.2% over the prior year. Discharges totaled 13,359, an increase of

6.6%, and ADC in the quarter increased 6.6% to 11,406. VITAS�

Average Length of Stay (ALOS) for patients discharged in the

quarter was 76.6 days and Median Length of Stay (MLOS) was 13 days.

This compares to an ALOS of 76.9 days in the first quarter of 2007

and 68.0 days in the second quarter of 2006. VITAS recorded net

revenue of $186 million in the second quarter of 2007, which was an

increase of 8.3% over the prior-year period. The revenue growth

generated from the increase in ADC combined with the Medicare price

increase was partially offset by the continued shift in revenue mix

to routine home care. Routine homecare revenue increased 11.6% in

the quarter. This revenue growth was partially offset by a modest

decline in the higher acuity inpatient and continuous care revenue

of 0.9% in the quarter. Net income from continuing operations for

the second quarter was $14.2 million, an increase of 16.9%. VITAS

did not record any billing restrictions related to Medicare Cap in

the second quarter of 2007. As of June 30, 2007, VITAS has not

accrued any Medicare billing restrictions for the 2007 cap year.

The ability for VITAS to bill Medicare for 100% of the care

provided to terminally ill patients is a result of improved

admissions metrics, relatively low MLOS and the continued

combination of various hospice provider numbers. All of VITAS�

hospice programs currently have a cap cushion greater than 10% on a

trailing twelve-month basis, with the exception of two programs.

These two programs have a cap cushion of 5% and 8%, respectively.

The same analysis through the first eight months of the 2007 cap

year results in all of VITAS� Medicare provider numbers having a

cap cushion greater than 10% with the exception of two programs.

These programs have cap cushion of 7% and 8%, respectively. Gross

margin in the quarter was 22.1%, which is a 180 basis point

improvement over the prior year quarter. Approximately 90 basis

points of this improvement is a result of VITAS managing labor

costs to more historical levels. The remaining 90 basis points of

this improvement is the result of $1.6 million of expenses that had

been historically charged to cost of services and are now expensed

into central support. Effective October 1, 2006, management

realigned certain processes and expenses related to hospice program

support. These processes and related expenses were centralized

effective the beginning of the fourth quarter of 2006 and are now

incurred and controlled at VITAS corporate and classified as

selling, general and administrative expense. In the second quarter

of 2006, approximately $1.6 million of this type of expense was

classified as cost of services. These expenses were charged to

central support in the second quarter of 2007. Central support

costs for VITAS, which are classified as selling, general and

administrative expenses in the Consolidating Statement of Income,

totaled $16.3 million, which is an increase of 18.7% over the prior

year. Adjusting for the reclassification of expenses noted above,

second-quarter 2007 central support costs increased 6.3% over the

prior year. Roto-Rooter Roto-Rooter�s plumbing and drain cleaning

business generated sales of $86 million for the second quarter of

2007, 10.5% higher than the $78 million reported in the comparable

prior-year quarter. Net income for the quarter was $10.7 million,

an increase of 53% over the prior year. Adjusted EBITDA in the

second quarter of 2007 totaled $18.1 million, an increase of 42%

over the second quarter of 2006 and equated to an adjusted EBITDA

margin of 21.1%, an increase of 469 basis points over the

prior-year period. Job count in the second quarter of 2007

increased 1.6% over the prior-year period. Residential jobs

increased 6.0% and commercial jobs decreased 7.4%. Residential

plumbing jobs increased 14.7% and residential drain cleaning jobs

expanded 2.2% when compared to the second quarter of 2006.

Residential jobs represent approximately 70% of total job count.

Commercial plumbing job count decreased 3.8% and commercial drain

cleaning decreased 8.7% over the prior-year quarter. Guidance for

2007 VITAS is estimated to generate full-year revenue growth from

continuing operations, prior to Medicare Cap, of 9% to 11%. This

range is a 100 basis point decrease from the previous guidance to

reflect the revenue mix shift to routine home care noted earlier.

Admissions are estimated to increase 4% to 6%, increased ADC of 8%

to 10% and adjusted EBITDA margins, prior to Medicare Cap, of 13.5%

to 14.5%. This guidance assumes the hospice industry receives a

full Medicare basket price increase of 3.3% in the fourth quarter

of 2007. Full-year 2007 Medicare contractual billing limitations

are estimated at $2.5 million. Roto-Rooter is estimated to generate

an 8.5% to 9.5% increase in revenue in 2007, job count growth

between 0.5% and 1.5% and adjusted EBITDA margin in the range of

19.0% to 20.0%. Based upon these factors, an effective tax rate of

38.5% and an average diluted share count for the second half of

2007 of 24.5 million, our estimate is that full-year 2007 earnings

per diluted share from continuing operations, excluding early

extinguishment of debt, expense for stock options and other

long-term incentive compensation, gain on sale of building, or any

other charges or credits not indicative of ongoing operations, will

be in the range of $3.10 to $3.20. Conference Call Chemed will host

a conference call and webcast at 10 a.m., ET, on Thursday, August

2, 2007, to discuss the company's quarterly results and provide an

update on its business. The dial-in number for the conference call

is (800) 573-4842 for U.S. and Canadian participants and (617)

224-4327 for international participants. The participant passcode

is 85108295. A live webcast of the call can be accessed on Chemed's

website at www.chemed.com by clicking on Investor Relations Home. A

taped replay of the conference call will be available beginning

approximately two hours after the call's conclusion. It can be

accessed by dialing 888-286-8010 for U.S. and Canadian callers and

617-801-6888 for international callers and will be available for

one week following the live call. The replay passcode is 41816435.

An archived webcast will also be available at www.chemed.com and

will remain available for 14 days following the live call. Chemed

Corporation operates in the healthcare field through its VITAS

Healthcare Corporation subsidiary. VITAS provides daily hospice

services to over 11,000 patients with severe, life-limiting

illnesses. This type of care is focused on making the terminally

ill patient's final days as comfortable and pain-free as possible.

Chemed operates in the residential and commercial plumbing and

drain cleaning industry under the brand name Roto-Rooter.

Roto-Rooter provides plumbing and drain service through

company-owned branches, independent contractors and franchisees in

the United States and Canada. Roto-Rooter also has licensed master

franchisees in Indonesia, Singapore, Japan, and the Philippines.

This press release contains information about Chemed�s EBITDA and

Adjusted EBITDA, which are not measures derived in accordance with

generally accepted accounting principles and which exclude

components that are important to understanding Chemed�s financial

performance. Chemed provides EBITDA and Adjusted EBITDA to help

investors and others evaluate its operating results, compare its

operating performance with that of similar companies that have

different capital structures and evaluate its ability to meet its

future debt service, capital expenditures and working capital

requirements. Chemed�s EBITDA and Adjusted EBITDA should not be

considered in isolation or as a substitute for comparable measures

calculated and presented in accordance with GAAP. A reconciliation

of Chemed�s net income to its Adjusted EBITDA is presented in the

tables following the text of this press release. Forward-Looking

Statements Certain statements contained in this press release and

the accompanying tables are "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995.

The words "believe," "expect," "hope," "anticipate," "plan" and

similar expressions identify forward-looking statements, which

speak only as of the date the statement was made. Chemed does not

undertake and specifically disclaims any obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. These

statements are based on current expectations and assumptions and

involve various risks and uncertainties, which could cause Chemed's

actual results to differ from those expressed in such

forward-looking statements. These risks and uncertainties arise

from, among other things, possible changes in regulations governing

the hospice care or plumbing and drain cleaning industries;

periodic changes in reimbursement levels and procedures under

Medicare and Medicaid programs; difficulties predicting patient

length of stay and estimating potential Medicare reimbursement

obligations; challenges inherent in Chemed's growth strategy; the

current shortage of qualified nurses, other healthcare

professionals and licensed plumbing and drain cleaning technicians;

Chemed�s dependence on patient referral sources; and other factors

detailed under the caption "Description of Business by Segment" or

"Risk Factors" in Chemed�s most recent report on form 10-Q or 10-K

and its other filings with the Securities and Exchange Commission.

You are cautioned not to place undue reliance on such

forward-looking statements and there are no assurances that the

matters contained in such statements will be achieved. CHEMED

CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATED STATEMENT OF

INCOME (in thousands, except per share data)(unaudited) � � Three

Months EndedJune 30, Six Months EndedJune 30, 2007 2006 (cc) 2007

2006 (cc) Continuing Operations Service revenues and sales $

271,387 � $ 249,068 � $ 541,826 � $ 492,989 � Cost of services

provided and goods sold 188,716 179,103 376,963 355,138 Selling,

general and administrative expenses (aa) 46,090 38,621 94,160

77,075 Depreciation 4,962 4,082 9,677 8,214 Amortization 1,294

1,317 2,609 2,613 Other operating expense/(income)(aa) � - � � - �

� (1,138 ) � - � Total costs and expenses � 241,062 � � 223,123 � �

482,271 � � 443,040 � Income from operations 30,325 25,945 59,555

49,949 Interest expense (3,400 ) (4,300 ) (7,142 ) (9,645 ) Loss on

extinguishment of debt (aa) (13,715 ) - (13,715 ) (430 ) Other

income--net � 2,188 � � 524 � � 3,057 � � 2,019 � Income before

income taxes 15,398 22,169 41,755 41,893 Income taxes � (5,965 ) �

(8,619 ) � (16,101 ) � (16,305 ) Income from continuing operations

9,433 13,550 25,654 25,588 Discontinued Operations (bb) � - � �

(708 ) � - � � (531 ) Net Income $ 9,433 � $ 12,842 � $ 25,654 � $

25,057 � � � Earnings Per Share (aa) Income from continuing

operations $ 0.38 � $ 0.52 � $ 1.02 � $ 0.98 � Net income $ 0.38 �

$ 0.49 � $ 1.02 � $ 0.96 � Average number of shares outstanding �

24,506 � � 26,201 � � 25,108 � � 26,123 � � Diluted Earnings Per

Share (aa) Income from continuing operations $ 0.38 � $ 0.50 � $

1.00 � $ 0.95 � Net income $ 0.38 � $ 0.48 � $ 1.00 � $ 0.93 �

Average number of shares outstanding � 25,080 � � 26,846 � � 25,684

� � 26,815 � � � � � � � (aa) Included in the results of operations

are the following significant credits/(charges) which may not be

indicative of ongoing operations (in thousands): � Three Months

EndedJune 30, Six Months EndedJune 30, 2007 2006 2007 2006 Selling,

general and administrative expenses Long-term incentive

compensation $ (1,620 ) $ - $ (7,067 ) $ - Stock option expense

(897 ) (18 ) (1,482 ) (18 ) Legal costs associated with OIG

investigation (74 ) (342 ) (140 ) (474 ) Other - - 467 - Other

operating expense/(income) Gain on sale of property - - 1,138 -

Loss on extinguishment of debt � (13,715 ) � - � � (13,715 ) � (430

) Pretax impact on earnings (16,306 ) (360 ) (20,799 ) (922 )

Income tax benefit on the above � 5,951 � � 136 � � 7,638 � � 343 �

Aftertax impact on earnings $ (10,355 ) $ (224 ) $ (13,161 ) $ (579

) � (bb) Discontinued operations represents the results of

operations of VITAS' Phoenix operation � (cc) Reclassified to

conform to 2007 presentation. CHEMED CORPORATION AND SUBSIDIARY

COMPANIES CONSOLIDATED BALANCE SHEET (in thousands, except per

share data)(unaudited) � � June 30, 2007 2006 (cc) Assets Current

assets Cash and cash equivalents $ 7,469 $ 6,816 Accounts

receivable less allowances 99,867 93,003 Inventories 6,752 6,210

Current deferred income taxes 19,828 21,110 Prepaid income taxes

2,604 11,983 Current assets of discontinued operations - 3,555

Prepaid expenses and other current assets � 8,570 � � 9,254 � Total

current assets 145,090 151,931 Investments of deferred compensation

plans held in trust 29,360 23,731 Other investments - 1,445 Note

receivable 14,701 12,500 Properties and equipment, at cost less

accumulated depreciation 72,428 65,979 Identifiable intangible

assets less accumulated amortization 67,195 70,880 Goodwill 435,209

432,717 Noncurrent assets of discontinued operations - 7,513 Other

assets � 15,549 � � 20,693 � Total Assets $ 779,532 � $ 787,389 � �

Liabilities Current liabilities Accounts payable $ 46,366 $ 48,330

Current portion of long-term debt 10,162 207 Income taxes 837 4,409

Accrued insurance 37,084 39,310 Accrued compensation 33,046 27,840

Current liabilities of discontinued operations - 5,443 Other

current liabilities � 20,638 � � 26,702 � Total current liabilities

148,133 152,241 Deferred income taxes 3,846 26,418 Long-term debt

268,035 169,397 Deferred compensation liabilities 28,912 23,503

Other liabilities � 5,945 � � 3,440 � Total Liabilities � 454,871 �

� 374,999 � � Stockholders' Equity Capital stock 29,193 28,812

Paid-in capital 261,951 249,461 Retained earnings 242,905 193,089

Treasury stock, at cost (211,836 ) (61,340 ) Deferred compensation

payable in Company stock 2,448 2,422 Notes receivable for shares

sold � - � � (54 ) Total Stockholders' Equity � 324,661 � � 412,390

� Total Liabilities and Stockholders' Equity $ 779,532 � $ 787,389

� � Book Value Per Share $ 13.58 � $ 15.71 � � � � � � � � � � � �

� ����(cc) Reclassified to conform to 2007 presentation. CHEMED

CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATED STATEMENT OF CASH

FLOWS (in thousands)(unaudited) � Six Months Ended June 30, 2007

2006 (bb) Cash Flows from Operating Activities Net income $ 25,654

$ 25,057 Adjustments to reconcile net income to net cash provided

by operating activities: � Depreciation and amortization 12,286

10,827 Write-off of unamortized debt issuance costs 7,153 430

Noncash long-term incentive compensation 6,154 - Provision for

uncollectible accounts receivable 4,009 3,962 Amortization of debt

issuance costs 751 882 Provision for deferred income taxes 376

4,679 Discontinued operations - 531 Changes in operating assets and

liabilities, excluding amounts acquired in business combinations: �

Increase in accounts receivable (11,308 ) (5,924 )

Decrease/(increase) in inventories (174 ) 289 Decrease in prepaid

expenses and other current assets 1,377 514 Decrease in accounts

payable and other current liabilities (14,838 ) (18,089 ) Increase

in income taxes 69 1,932 Increase in other assets (3,932 ) (2,892 )

Increase in other liabilities 4,540 1,973 Excess tax benefit on

share-based compensation (2,370 ) (4,941 ) Other uses � 477 � � 551

� Net cash provided by continuing operations 30,224 19,781 Net cash

provided by discontinued operations � - � � 3,704 � Net cash

provided by operating activities � 30,224 � � 23,485 � Cash Flows

from Investing Activities Capital expenditures (13,908 ) (9,222 )

Net uses from the sale of discontinued operations (5,905 ) (2,990 )

Proceeds from sales of property and equipment 3,003 161 Business

combinations, net of cash acquired (62 ) (814 ) Other uses � (564 )

� (610 ) Net cash used by investing activities � (17,436 ) �

(13,475 ) Cash Flows from Financing Activities Proceeds from

issuance of long-term debt 300,000 - Repayment of long-term debt

(185,643 ) (84,499 ) Purchases of treasury stock (130,748 ) (3,992

) Purchase of note hedges (54,939 ) - Proceeds from issuance of

warrants 27,614 - Net increase in revolving line of credit 13,300

19,000 Debt issuance costs (6,395 ) (154 ) Dividends paid (2,997 )

(3,156 ) Excess tax benefit on share-based compensation 2,370 4,941

Issuance of capital stock 2,069 3,849 Increase in cash overdrafts

payable 166 3,397 Other sources � 610 � � 287 � Net cash used by

financing activities � (34,593 ) � (60,327 ) Decrease in Cash and

Cash Equivalents (21,805 ) (50,317 ) Cash and cash equivalents at

beginning of year � 29,274 � � 57,133 � Cash and cash equivalents

at end of period $ 7,469 � $ 6,816 � � (bb) Reclassified for

operations discontinued in November 2006. CHEMED CORPORATION AND

SUBSIDIARY COMPANIES CONSOLIDATING STATEMENT OF INCOME FOR THE

THREE MONTHS ENDED JUNE 30, 2007 AND 2006 (in thousands)(unaudited)

� � Chemed VITAS Roto-Rooter Corporate Consolidated �2007 � � �

Service revenues and sales $ 185,701 � $ 85,686 � $ - � $ 271,387 �

Cost of services provided and goods sold 144,639 44,077 - 188,716

Selling, general and administrative expenses (a) 16,260 24,191

5,639 46,090 Depreciation 2,776 2,109 77 4,962 Amortization � 996 �

� 13 � � 285 � � 1,294 � Total costs and expenses � 164,671 � �

70,390 � � 6,001 � � 241,062 � Income/(loss) from operations 21,030

15,296 (6,001 ) 30,325 Interest expense (31 ) (96 ) (3,273 ) (3,400

) Intercompany interest income/(expense) 1,731 1,183 (2,914 ) -

Loss on extinguishment of debt (a) - - (13,715 ) (13,715 ) Other

income�net � 57 � � 796 � � 1,335 � � 2,188 � Income/(loss) before

income taxes 22,787 17,179 (24,568 ) 15,398 Income taxes � (8,633 )

� (6,484 ) � 9,152 � � (5,965 ) Net income/(loss) $ 14,154 � $

10,695 � $ (15,416 ) $ 9,433 � � �2006 � � � Service revenues and

sales $ 171,527 � $ 77,541 � $ - � $ 249,068 � Cost of services

provided and goods sold 136,697 42,406 - 179,103 Selling, general

and administrative expenses 13,702 22,232 2,687 38,621 Depreciation

2,087 1,914 81 4,082 Amortization � 984 � � 20 � � 313 � � 1,317 �

Total costs and expenses � 153,470 � � 66,572 � � 3,081 � � 223,123

� Income/(loss) from operations 18,057 10,969 (3,081 ) 25,945

Interest expense (38 ) (109 ) (4,153 ) (4,300 ) Intercompany

interest income/(expense) 1,395 949 (2,344 ) - Other income�net �

45 � � (89 ) � 568 � � 524 � Income/(loss) before income taxes

19,459 11,720 (9,010 ) 22,169 Income taxes � (7,352 ) � (4,717 ) �

3,450 � � (8,619 ) Income/(loss) from continuing operations 12,107

7,003 (5,560 ) 13,550 Discontinued operations � (708 ) � - � � - �

� (708 ) Net income/(loss) $ 11,399 � $ 7,003 � $ (5,560 ) $ 12,842

� � The "Footnotes to Financial Statements" are integral parts of

this financial information. CHEMED CORPORATION AND SUBSIDIARY

COMPANIES CONSOLIDATING STATEMENT OF INCOME FOR THE SIX MONTHS

ENDED JUNE 30, 2007 AND 2006 (in thousands)(unaudited) � � Chemed

VITAS Roto-Rooter Corporate Consolidated �2007 � � � Service

revenues and sales $ 369,750 � $ 172,076 � $ - � $ 541,826 � Cost

of services provided and goods sold 286,734 90,229 - 376,963

Selling, general and administrative expenses (a) 32,164 47,951

14,045 94,160 Depreciation 5,314 4,210 153 9,677 Amortization 1,992

28 589 2,609 Other operating expense/(income) (a) � - � � - � �

(1,138 ) � (1,138 ) Total costs and expenses � 326,204 � � 142,418

� � 13,649 � � 482,271 � Income/(loss) from operations 43,546

29,658 (13,649 ) 59,555 Interest expense (67 ) (179 ) (6,896 )

(7,142 ) Intercompany interest income/(expense) 3,443 2,339 (5,782

) - Loss on extinguishment of debt (a) - - (13,715 ) (13,715 )

Other income�net � (31 ) � 968 � � 2,120 � � 3,057 � Income/(loss)

before income taxes 46,891 32,786 (37,922 ) 41,755 Income taxes �

(17,750 ) � (12,605 ) � 14,254 � � (16,101 ) Net income/(loss) $

29,141 � $ 20,181 � $ (23,668 ) $ 25,654 � � �2006 � � � Service

revenues and sales $ 337,584 � $ 155,405 � $ - � $ 492,989 � Cost

of services provided and goods sold 270,293 84,845 - 355,138

Selling, general and administrative expenses 26,917 44,774 5,384

77,075 Depreciation 4,144 3,883 187 8,214 Amortization � 1,968 � �

40 � � 605 � � 2,613 � Total costs and expenses � 303,322 � �

133,542 � � 6,176 � � 443,040 � Income/(loss) from operations

34,262 21,863 (6,176 ) 49,949 Interest expense (69 ) (282 ) (9,294

) (9,645 ) Intercompany interest income/(expense) 2,349 1,801

(4,150 ) - Loss on extinguishment of debt (b) - - (430 ) (430 )

Other income�net � 57 � � 273 � � 1,689 � � 2,019 � Income/(loss)

before income taxes 36,599 23,655 (18,361 ) 41,893 Income taxes �

(13,812 ) � (9,451 ) � 6,958 � � (16,305 ) Income/(loss) from

continuing operations 22,787 14,204 (11,403 ) 25,588 Discontinued

operations � (531 ) � - � � - � � (531 ) Net income/(loss) $ 22,256

� $ 14,204 � $ (11,403 ) $ 25,057 � � The "Footnotes to Financial

Statements" are integral parts of this financial information.

CHEMED CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATING SUMMARY

OF EBITDA FOR THE THREE MONTHS ENDED JUNE 30, 2007 AND 2006 (in

thousands)(unaudited) � � Chemed VITAS Roto-Rooter Corporate

Consolidated �2007 Net income/(loss) $ 14,154 $ 10,695 $ (15,416 )

$ 9,433 Add/(deduct): Interest expense 31 96 3,273 3,400 Income

taxes 8,633 6,484 (9,152 ) 5,965 Depreciation 2,776 2,109 77 4,962

Amortization � 996 � � 13 � � 285 � � 1,294 � EBITDA 26,590 19,397

(20,933 ) 25,054 Add/(deduct): Long-term incentive compensation - -

1,620 1,620 Stock option expense - - 897 897 Legal expenses of OIG

investigation 74 - - 74 Loss on extinguishment of debt - - 13,715

13,715 Advertising cost adjustment (c) - (99 ) - (99 ) Interest

income (66 ) (52 ) (826 ) (944 ) Intercompany interest

(income)/expense � (1,731 ) � (1,183 ) � 2,914 � � - � Adjusted

EBITDA $ 24,867 � $ 18,063 � $ (2,613 ) $ 40,317 � � �2006 Net

income/(loss) $ 11,399 $ 7,003 $ (5,560 ) $ 12,842 Add/(deduct):

Discontinued operations 708 - - 708 Interest expense 38 109 4,153

4,300 Income taxes 7,352 4,717 (3,450 ) 8,619 Depreciation 2,087

1,914 81 4,082 Amortization � 984 � � 20 � � 313 � � 1,317 � EBITDA

22,568 13,763 (4,463 ) 31,868 Add/(deduct): Stock option expense -

- 18 18 Legal expenses of OIG investigation 342 - - 342 Advertising

cost adjustment (c) - (87 ) - (87 ) Interest income (35 ) (17 )

(527 ) (579 ) Intercompany interest (income)/expense � (1,395 ) �

(949 ) � 2,344 � � - � Adjusted EBITDA $ 21,480 � $ 12,710 � $

(2,628 ) $ 31,562 � � The "Footnotes to Financial Statements" are

integral parts of this financial information. CHEMED CORPORATION

AND SUBSIDIARY COMPANIES CONSOLIDATING SUMMARY OF EBITDA FOR THE

SIX MONTHS ENDED JUNE 30, 2007 AND 2006 (in thousands)(unaudited) �

� Chemed VITAS Roto-Rooter Corporate Consolidated �2007 Net

income/(loss) $ 29,141 $ 20,181 $ (23,668 ) $ 25,654 Add/(deduct):

Discontinued operations - - - - Interest expense 67 179 6,896 7,142

Income taxes 17,750 12,605 (14,254 ) 16,101 Depreciation 5,314

4,210 153 9,677 Amortization � 1,992 � � 28 � � 589 � � 2,609 �

EBITDA 54,264 37,203 (30,284 ) 61,183 Add/(deduct): Long-term

incentive compensation - - 7,067 7,067 Stock option expense - -

1,482 1,482 Legal expenses of OIG investigation 140 - - 140 Gain on

sale of property - - (1,138 ) (1,138 ) Other - - (467 ) (467 ) Loss

on extinguishment of debt - - 13,715 13,715 Advertising cost

adjustment (c) - (396 ) - (396 ) Interest income (79 ) (111 )

(1,521 ) (1,711 ) Intercompany interest (income)/expense � (3,443 )

� (2,339 ) � 5,782 � � - � Adjusted EBITDA $ 50,882 � $ 34,357 � $

(5,364 ) $ 79,875 � � �2006 Net income/(loss) $ 22,256 $ 14,204 $

(11,403 ) $ 25,057 Add/(deduct): Discontinued operations 531 - -

531 Interest expense 69 282 9,294 9,645 Income taxes 13,812 9,451

(6,958 ) 16,305 Depreciation 4,144 3,883 187 8,214 Amortization �

1,968 � � 40 � � 605 � � 2,613 � EBITDA 42,780 27,860 (8,275 )

62,365 Add/(deduct): Stock option expense - - 18 18 Legal expenses

of OIG investigation 474 - - 474 Loss on extinguishment of debt - -

430 430 Advertising cost adjustment (c) - (581 ) - (581 ) Interest

income (76 ) (40 ) (1,435 ) (1,551 ) Intercompany interest

(income)/expense � (2,349 ) � (1,801 ) � 4,150 � � - � Adjusted

EBITDA $ 40,829 � $ 25,438 � $ (5,112 ) $ 61,155 � � The "Footnotes

to Financial Statements" are integral parts of this financial

information. CHEMED CORPORATION AND SUBSIDIARY COMPANIES

RECONCILIATION OF ADJUSTED NET INCOME FOR THE THREE AND SIX MONTHS

ENDED JUNE 30, 2007 AND 2006 (in thousands, except per share

data)(unaudited) � � Three Months Ended Six Months Ended June 30,

June 30, 2007 2006 2007 � 2006 Net income/(loss) as reported $

9,433 $ 12,842 $ 25,654 $ 25,057 � Add/(deduct): Discontinued

operations - 708 - 531 Aftertax cost of long-term incentive

compensation 1,013 - 4,427 - Aftertax stock option expense 570 12

941 12 Aftertax cost of legal expenses of OIG investigation 46 212

87 294 Aftertax other - - (296 ) - Gain on sale of property - -

(724 ) Aftertax cost of loss on extinguishment of debt � 8,726 � -

� 8,726 � � 273 � Adjusted income from continuing operations $

19,788 $ 13,774 $ 38,815 � $ 26,167 � � Earnings/(Loss) Per Share

As Reported Net income/(loss) $ 0.38 $ 0.49 $ 1.02 � $ 0.96 Average

number of shares outstanding � 24,506 � 26,201 � 25,108 � � 26,123

Diluted Earnings/(Loss) Per Share As Reported Net income/(loss) $

0.38 $ 0.48 $ 1.00 � $ 0.93 Average number of shares outstanding �

25,080 � 26,846 � 25,684 � � 26,815 � � Adjusted Earnings Per Share

Income from continuing operations $ 0.81 $ 0.53 $ 1.55 � $ 1.00

Average number of shares outstanding � 24,506 � 26,201 � 25,108 � �

26,123 Adjusted Diluted Earnings Per Share Income from continuing

operations $ 0.79 $ 0.51 $ 1.51 � $ 0.98 Average number of shares

outstanding � 25,080 � 26,846 � 25,684 � � 26,815 � The "Footnotes

to Financial Statements" are integral parts of this financial

information. CHEMED CORPORATION AND SUBSIDIARY COMPANIES OPERATING

STATISTICS FOR VITAS SEGMENT FOR THE THREE AND SIX MONTHS ENDED

JUNE 30, 2007 AND 2006 (unaudited) � � Three Months EndedJune 30,

Six Months EndedJune 30, 2007 � 2006 (f) 2007 2006 (f) OPERATING

STATISTICS Net revenue ($000) (d) Homecare $ 134,794 $ 120,768 $

266,341 $ 234,000 Inpatient 22,745 21,720 46,207 44,736 Continuous

care � 28,162 � � 29,638 � � 56,730 � � 59,447 � Total before

Medicare cap allowance 185,701 � 172,126 369,278 � 338,183 Medicare

cap allowance � - � � (599 ) � 472 � � (599 ) Total $ 185,701 � $

171,527 � $ 369,750 � $ 337,584 � Net revenue as a percent of total

before Medicare cap allowance � Homecare 72.6 % 70.2 % 72.0 % 69.2

% Inpatient 12.2 12.6 12.5 13.2 Continuous care � 15.2 � � 17.2 � �

15.4 � � 17.6 � Total before Medicare cap allowance 100.0 100.0

99.9 100.0 Medicare cap allowance � - � � (0.3 ) � 0.1 � � (0.2 )

Total � 100.0 � % � 99.7 � % � 100.0 � % � 99.8 � % Average daily

census ("ADC") (days) Homecare 6,915 6,275 6,851 6,104 Nursing home

� 3,574 � � 3,488 � � 3,574 � � 3,424 � Routine homecare 10,489

9,763 10,425 9,528 Inpatient 413 404 419 417 Continuous care � 504

� � 537 � � 514 � � 553 � Total � 11,406 � � 10,704 � � 11,358 � �

10,498 � � Total Admissions 13,658 12,987 27,768 26,760 Total

Discharges 13,359 12,528 27,416 25,825 Average length of stay

(days) 76.6 68.0 76.8 70.3 Median length of stay (days) 13.0 13.0

13.0 13.0 ADC by major diagnosis Neurological 33.0 % 33.1 % 33.2 %

33.1 % Cancer 19.7 20.0 19.7 20.2 Cardio 14.6 15.0 14.6 14.9

Respiratory 6.9 7.2 6.9 7.2 Other � 25.8 � � 24.7 � � 25.6 � � 24.6

� Total � 100.0 � % � 100.0 � % � 100.0 � % � 100.0 � % Admissions

by major diagnosis Neurological 18.0 % 19.6 % 18.6 % 20.1 % Cancer

35.9 35.0 35.0 34.4 Cardio 12.9 13.2 13.1 13.6 Respiratory 7.7 7.0

7.8 7.5 Other � 25.5 � � 25.2 � � 25.5 � � 24.4 � Total � 100.0 � %

� 100.0 � % � 100.0 � % � 100.0 � % Direct patient care margins (e)

Routine homecare 51.1 % 49.5 % 50.9 % 48.6 % Inpatient 18.9 20.9

19.5 22.0 Continuous care 17.7 20.3 18.9 19.3 Homecare margin

drivers (dollars per patient day) � Labor costs $ 48.96 $ 48.31 $

49.04 $ 49.77 Drug costs 7.82 8.39 7.99 7.90 Home medical equipment

5.78 5.51 5.77 5.52 Medical supplies 2.11 2.11 2.14 2.10 Inpatient

margin drivers (dollars per patient day) � Labor costs $ 262.37 $

258.32 $ 257.35 $ 252.87 Continuous care margin drivers (dollars

per patient day) � Labor costs $ 484.13 $ 463.62 $ 474.21 $ 458.96

Bad debt expense as a percent of revenues 0.9 % 0.9 % 0.9 % 0.9 %

Accounts receivable -- days of revenue outstanding 37.5 40.1 N.A.

N.A. � The "Footnotes to Financial Statements" are integral parts

of this financial information. CHEMED CORPORATION AND SUBSIDIARY

COMPANIES FOOTNOTES TO FINANCIAL STATEMENTS FOR THE THREE AND SIX

MONTHS ENDED JUNE 30, 2007 AND 2006 (unaudited) � � (a) Included in

the results of operations for the three and six months ended June

30, 2007 are the following significant credits/(charges) which may

not be indicative of on going operations (in thousands): � Three

Months Ended June 30, 2007 VITAS Corporate Consolidated Selling,

general and administrative expenses Long-term incentive

compensation $ - $ (1,620 ) $ (1,620 ) Costs associated with OIG

investigation (74 ) - (74 ) Stock option expense - (897 ) (897 )

Loss on extinguishment of debt � - � � (13,715 ) � (13,715 ) Pretax

impact on earnings (74 ) (16,232 ) (16,306 ) Income tax

benefit/(charge) on the above � 28 � � 5,923 � � 5,951 � Aftertax

impact on earnings $ (46 ) $ (10,309 ) $ (10,355 ) � Six Months

Ended June 30, 2007 VITAS Corporate Consolidated Selling, general

and administrative expenses Long-term incentive compensation $ - $

(7,067 ) $ (7,067 ) Costs associated with OIG investigation (140 )

- (140 ) Stock option expense - (1,482 ) (1,482 ) Other - 467 467

Other operating expenses/(income) Gain on sale of property - 1,138

1,138 Loss on extinguishment of debt � - � � (13,715 ) � (13,715 )

Pretax impact on earnings (140 ) (20,659 ) (20,799 ) Income tax

benefit/(charge) on the above � 53 � � 7,585 � � 7,638 � Aftertax

impact on earnings $ (87 ) $ (13,074 ) $ (13,161 ) � (b) Included

in the results of operations for the three and six months ended

June 30, 2006 are the following significant credits/(charges) which

may not be indicative of on going operations (in thousands): �

Three Months Ended June 30, 2006 VITAS Corporate Consolidated

Selling, general and administrative expenses Costs associated with

OIG investigation $ (342 ) $ - $ (342 ) Stock option expense � - �

� (18 ) � (18 ) Pretax impact on earnings (342 ) (18 ) (360 )

Income tax benefit on the above � 130 � � 6 � � 136 � Aftertax

impact on earnings $ (212 ) $ (12 ) $ (224 ) � Six Months Ended

June 30, 2006 VITAS Corporate Consolidated Selling, general and

administrative expenses Costs associated with OIG investigation $

(474 ) $ - $ (474 ) Stock option expense - (18 ) (18 ) Loss on

extinguishment of debt � - � � (430 ) � (430 ) Pretax impact on

earnings (474 ) (448 ) (922 ) Income tax benefit on the above � 180

� � 163 � � 343 � Aftertax impact on earnings $ (294 ) $ (285 ) $

(579 ) � � (c) Under Generally Accepted Accounting Principles

("GAAP"), the Roto-Rooter segment expenses all advertising,

including the cost of telephone directories, immediately upon the

initial release of the advertising. Telephone directories are

generally in circulation 12 months. If a directory is in

circulation for a time period greater or less than 12 months, the

publisher adjusts the directory billing for the change in billing

period. The timing of when a telephone directory is published can

and does fluctuate significantly on a quarterly basis. This "direct

expensing" results in significant fluctuations in quarterly

advertising expense. In the second quarters of 2007 and 2006, GAAP

advertising expense for Roto-Rooter totaled $5,449,000 and

$4,914,000, respectively. If the expense of the telephone

directories were spread over the periods they are in circulation,

advertising expense for the second quarters of 2007 and 2006 would

total $5,548,000 and $5,001,000, respectively. For the six months

ended June 30, 2007 and 2006, GAAP advertising expense for

Roto-Rooter totaled $10,642,000 and $9,338,000, respectively. If

the expense of the telephone directories were spread over the

periods they are in circulation, advertising expense for the six

months ended June 30, 2007 and 2006 would total $11,038,000 and

$9,919,000, respectively. � (d) VITAS has 6 large (greater than 450

ADC), 15 medium (greater than 200 but less than 450 ADC) and 23

small (less than 200 ADC) hospice programs. There are two programs

with Medicare cap cushion of less than 10% for the 2007 measurement

period. � (e) Amounts exclude indirect patient care and

administrative costs, as well as Medicare Cap billing limitation. �

(f) Reclassified for operations discontinued in November 2006.

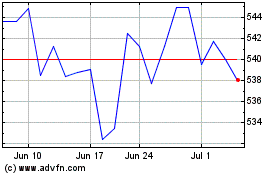

Chemed (NYSE:CHE)

Historical Stock Chart

From May 2024 to Jun 2024

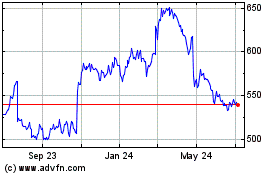

Chemed (NYSE:CHE)

Historical Stock Chart

From Jun 2023 to Jun 2024