Centene Corporation (NYSE: CNC) today announced its net earnings

from continuing operations for the quarter ended March 31, 2009

were $18.9 million, or $0.43 per diluted share, compared to $24.9

million, or $0.56 per diluted share in the 2008 first quarter. The

prior year first quarter results include the benefit of the July 1

through December 31, 2007 rate increase for Georgia, amounting to

$12.6 million of earnings from continuing operations or $0.28 per

diluted share. The results of operations for University Health

Plans, or UHP, our New Jersey health plan, are classified as

discontinued operations. Unless specifically noted, the discussions

below are in the context of continuing operations and all financial

ratios are calculated using revenues excluding premium taxes and

investment income.

First Quarter Highlights

- Quarter-end managed care at-risk

membership of 1.25 million.

- Revenues of $932.4 million, or

$908.9 million net of premium taxes.

- Health Benefits Ratio (HBR),

which reflects medical costs as a percent of premium revenues, of

83.5%.

- General and administrative

(G&A) expense ratio of 13.5%.

- Cash flow from operations of

$23.4 million.

- Days in claims payable of

45.3.

- Diluted earnings per share from

continuing operations of $0.43.

Other Events

- In February 2009, we began

converting�non-risk managed care membership in Florida from Access

Health Solutions, LLC, or Access, to our wholly owned subsidiary,

Sunshine State Health Plan on an at-risk basis. We previously

accounted for our Florida investment using the equity method of

accounting. Beginning with the first quarter of 2009, we have

reported our investment in Access as a consolidated subsidiary in

our financial statements.

- In March 2009, we completed the

previously announced acquisition of certain assets of Amerigroup

Community Care of South Carolina.

- In March 2009,

our�Celtic�unit�was awarded�a contract in Massachusetts

to�serve�uninsured�individuals through a joint venture with�a

leading, local provider, Caritas Christi Health Care.�Effective

July 1, 2009, the joint venture will serve the Central, Northern,

Boston and Southern regions operating as CeltiCare Health Plan of

Massachusetts.

- We were awarded Silver Honors

for Best Practices in Health Management by URAC, a leading

healthcare accreditation organization, for Connections PLUS, a

free, pre-programmed cell phone program developed for high-risk

members who do not have steady access to a telephone.

Michael F. Neidorff, Centene�s Chairman and Chief Executive

Officer, stated, �Our first quarter results reflect favorably on

our�focus on fundamentals and teamwork. We will continue to work to

maintain this momentum going forward.�

The following table depicts membership in Centene�s managed care

organizations, by state, at March 31, 2009 and 2008:

� �

March 31, 2009 � �

2008 Arizona 15,500 �

Florida 29,100 � Georgia 289,300 282,700 Indiana 179,100 161,300

Ohio 137,000 131,100 South Carolina 48,500 2,200 Texas 421,100

365,500 Wisconsin 127,700 126,900 Total at-risk membership

1,247,300 1,069,700 Non-risk membership 96,000 30,600 Total

1,343,300 1,100,300

The following table depicts membership in Centene�s managed care

organizations, by member category, at March 31, 2009 and 2008:

� �

March 31, 2009 � �

2008 Medicaid 921,100

802,400 CHIP & Foster Care 256,900 206,300 ABD & Medicare

69,300 61,000

Total at-risk membership

1,247,300 1,069,700 Non-risk membership 96,000 30,600 Total

1,343,300 1,100,300

Statement of Operations

- For the 2009 first quarter,

revenues, net of premium taxes, increased 20.0% to $908.9 million

from $757.3 million in the 2008 first quarter. The increase was

primarily driven by membership growth, especially related to the

Foster Care contract in Texas, the commencement of our Arizona

acute care contract in October 2008, the consolidation of Access

and conversion of members to at-risk, premium rate increases and

the recent acquisition of Celtic in July 2008.

- The consolidated HBR, which

reflects medical costs as a percent of premium revenues, was 83.5%,

an increase from 82.7% in the 2008 first quarter. The retroactive

Georgia premium rate increase in the first quarter of 2008 had the

effect of decreasing the HBR for this period by 2.4%. Adjusting for

the impact due to the Georgia rate increase, our HBR decreased from

85.1% in 2008 to 83.5% in 2009. This is due to a decrease in

respiratory illness as a result of a lighter cold and flu season.

Sequentially, our consolidated HBR increased from 82.3% in the 2008

fourth quarter to 83.5% as a result of normal seasonality and the

addition of a new state and acquired members.

- Consolidated G&A expense as

a percent of premium and service revenues was 13.5% in the first

quarter of 2009, an increase from 12.6% in the first quarter of

2008. The retroactive Georgia premium rate increase in the first

quarter of 2008 had the effect of decreasing the G&A ratio for

this period by 0.4%. Adjusting for the impact due to the Georgia

rate increase, our G&A expense ratio increased from 13.0% in

2008 to 13.5% in 2009. G&A increased in the quarter ended March

31, 2009 compared to 2008 primarily due to the acquisition of

Celtic. Sequentially, our G&A ratio decreased from 13.8% in the

fourth quarter of 2008 to 13.5% in the first quarter of 2009.

Balance Sheet and Cash Flow

At March 31, 2009, the Company had cash and investments of

$845.7 million, including $816.8 million held by its regulated

entities and $28.9 million held by its unregulated entities.

Medical claims liabilities totaled $372.5 million, representing

45.3 days in claims payable, a decrease of 3.2 days from December

31, 2008. Total debt was $290.3 million and debt to capitalization

was 34.6%. Year to date cash flow from operations was $23.4

million.

A reconciliation of the Company�s change in days in claims

payable from the immediately preceding quarter-end is presented

below:

Days in claims payable, December 31, 2008 � � 48.5 Timing of claims

payments (1.4 ) Change in medical cost mix (1.0 ) High dollar

claims inventory reduction (0.7 ) Other (0.1 ) Days in claims

payable, March 31, 2009 * 45.3 �

* The Company has used a

consistent and conservative actuarial reserving methodology and the

decline in days in claims payable was not the result of a reserve

release.

Outlook

The table below depicts the Company�s annual guidance for

2009:

� �

Full Year 2009 Low � �

High Revenue (in

millions)1 $ 3,650 $ 3,775 Earnings per diluted share $ 1.84 $ 1.94

�

1 Revenue net of premium tax

The Company is adjusting the lower end of its earnings guidance

to reflect a lower effective tax rate which is partially offset by

the startup costs associated with the new Massachusetts CeltiCare

contract that commences July 1, 2009.

Conference Call

As previously announced, the Company will host a conference call

Tuesday, April 28, 2009, at 8:30 A.M. (Eastern Time) to review the

financial results for the first quarter ended March 31, 2009, and

to discuss its business outlook. Michael F. Neidorff and Eric R.

Slusser will host the conference call. Investors are invited to

participate in the conference call by dialing 800-273-1254 in the

U.S. and Canada, 973-638-3440 from abroad, or via a live internet

broadcast on the Company�s website at www.centene.com, under the

Investor Relations section. A replay will be available for

on-demand listening shortly after the completion of the call until

11:59 P.M. (Eastern Time) on May 12, 2009 at the aforementioned

URL, or by dialing 800-642-1687 in the U.S. and Canada, or

706-645-9291 from abroad, and entering access code 93132567.

About Centene Corporation

Centene Corporation is a leading multi-line healthcare

enterprise that provides programs and related services to

individuals receiving benefits under Medicaid, including the

Children�s Health Insurance Program (CHIP), as well as Aged, Blind,

or Disabled (ABD), Foster Care, Long-Term Care and Medicare

(Special Needs Plans). The Company operates local health plans and

offers a wide range of health insurance solutions to individuals

and the rising number of uninsured Americans. It also contracts

with other healthcare and commercial organizations to provide

specialty services including behavioral health, life and health

management, managed vision, telehealth services, pharmacy benefits

management and medication adherence. Information regarding Centene

is available via the Internet at www.centene.com.

The information provided in this press release contains

forward-looking statements that relate to future events and future

financial performance of Centene. Subsequent events and

developments may cause the Company�s estimates to change. The

Company disclaims any obligation to update this forward-looking

financial information in the future. Readers are cautioned that

matters subject to forward-looking statements involve known and

unknown risks and uncertainties, including economic, regulatory,

competitive and other factors that may cause Centene�s or its

industry�s actual results, levels of activity, performance or

achievements to be materially different from any future results,

levels of activity, performance or achievements expressed or

implied by these forward-looking statements. Actual results may

differ from projections or estimates due to a variety of important

factors, including Centene�s ability to accurately predict and

effectively manage health benefits and other operating expenses,

competition, changes in healthcare practices, changes in federal or

state laws or regulations, inflation, provider contract changes,

new technologies, reduction in provider payments by governmental

payors, major epidemics, disasters and numerous other factors

affecting the delivery and cost of healthcare. The expiration,

cancellation or suspension of Centene�s Medicaid Managed Care

contracts by state governments would also negatively affect

Centene.

�

CENTENE CORPORATION AND

SUBSIDIARIES

�

CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

data)

� � �

March 31,

2009

� �

December 31,

2008

(Unaudited) ASSETS Current assets: Cash and cash

equivalents of continuing operations $ 334,623 $ 370,999 Cash and

cash equivalents of discontinued operations � 7,606 � 8,100 Total

cash and cash equivalents 342,229 379,099 Premium and related

receivables, net of allowance for uncollectible accounts of $138

and $595, respectively 147,899 92,531 Short-term investments, at

fair value (amortized cost $74,780 and $108,469, respectively)

75,400 109,393 Other current assets 63,497 75,333 Current assets of

discontinued operations other than cash � 8,226 � 9,987 Total

current assets 637,251 666,343 Long-term investments, at fair value

(amortized cost $416,265 and $329,330, respectively) 422,873

332,411 Restricted deposits, at fair value (amortized cost $12,660

and $9,124, respectively) 12,774 9,254 Property, software and

equipment, net of accumulated depreciation of $80,742 and $74,194,

respectively 176,719 175,858 Goodwill 218,216 163,380 Intangible

assets, net 23,603 17,575 Other long-term assets 34,077 59,083

Long-term assets of discontinued operations � 27,317 � 27,248 Total

assets $ 1,552,830 $ 1,451,152

LIABILITIES AND STOCKHOLDERS�

EQUITY Current liabilities: Medical claims liability $ 372,522

$ 373,037 Accounts payable and accrued expenses 194,132 219,566

Unearned revenue 63,336 17,107 Current portion of long-term debt

20,608 255 Current liabilities of discontinued operations � 30,865

� 31,013 Total current liabilities 681,463 640,978 Long-term debt

269,711 264,637 Other long-term liabilities 51,434 43,539 Long-term

liabilities of discontinued operations � 700 � 726 Total

liabilities 1,003,308 949,880 � Commitments and contingencies �

Stockholders� equity: Common stock, $.001 par value; authorized

100,000,000 shares; issued and outstanding 43,159,131 and

42,987,764 shares, respectively 43 43 Additional paid-in capital

227,327 222,841 Accumulated other comprehensive income: Unrealized

gain on investments, net of tax 5,136 3,152 Retained earnings �

293,694 � 275,236 Total Centene stockholder�s equity 526,200

501,272 Non-controlling interest � 23,322 � � Total stockholders�

equity � 549,522 � 501,272 Total liabilities and stockholders�

equity $ 1,552,830 $ 1,451,152 �

CENTENE CORPORATION AND

SUBSIDIARIES

�

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except share

data)

� � �

Three Months Ended

March 31,

2009 � �

2008 (Unaudited) Revenues:

Premium $ 885,006 $ 736,814 Premium tax 23,580 21,884 Service �

23,849 � � 20,530 � Total revenues � 932,435 � � 779,228 �

Expenses: Medical costs 739,340 609,374 Cost of services

15,962 16,176 General and administrative expenses 122,279 95,493

Premium tax � 23,942 � � 21,884 � Total operating expenses �

901,523 � � 742,927 � Earnings from operations 30,912 36,301

Other income (expense): Investment and other income 3,613

7,582 Interest expense � (3,986 ) � (3,994 ) Earnings from

continuing operations, before income tax expense 30,539 39,889

Income tax expense � 10,845 � � 14,956 � Earnings from

continuing operations, net of income tax expense 19,694 24,933

Discontinued operations, net of income tax (benefit) expense of

$(160) and $264 � (449 ) � 690 � Net earnings 19,245 25,623

Less: Non-controlling interest � 787 � ?

Net earnings

attributable to Centene Corporation $ 18,458 � $ 25,623 � �

Amounts attributable to Centene Corporation common

shareholders: Earnings from continuing operations, net of

income tax expense 18,907 24,933 Discontinued operations, net of

income tax (benefit) expense � (449 ) � 690 � Net earnings $ 18,458

� $ 25,623 � �

Net earnings (loss) per share attributable to

Centene Corporation: Basic: Continuing operations $ 0.44 $ 0.57

Discontinued operations � (0.01 ) � 0.02 � Earnings per common

share $ 0.43 � $ 0.59 � Diluted: Continuing operations $ 0.43 $

0.56 Discontinued operations � (0.01 ) � 0.01 � Earnings per common

share $ 0.42 � $ 0.57 � �

Weighted average number of shares

outstanding: Basic 43,067,992 43,538,207 Diluted 44,238,863

44,742,893 �

CENTENE CORPORATION AND

SUBSIDIARIES

�

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(In thousands)

� � �

Three Months Ended March 31, 2009 � �

2008 (Unaudited) �

Cash flows from operating

activities: Net earnings $ 19,245 $ 25,623 Adjustments to

reconcile net earnings to net cash provided by operating activities

Depreciation and amortization 10,233 7,798 Stock compensation

expense 3,789 4,013 Loss on sale of investments, net 439 28

Deferred income taxes 2,282 9,472 Changes in assets and liabilities

� Premium and related receivables (39,396 ) 8,612 Other current

assets (1,397 ) (2,634 ) Other assets (497 ) (1,031 ) Medical

claims liabilities (1,232 ) 11,608 Unearned revenue 44,507 (41,788

) Accounts payable and accrued expenses (15,277 ) 4,489 Other

operating activities � 722 � � 526 � Net cash provided by operating

activities � 23,418 � � 26,716 �

Cash flows from investing

activities: Capital expenditures (11,157 ) (19,879 ) Purchases

of investments (292,964 ) (86,025 ) Sales and maturities of

investments 224,312 70,888 Investments in acquisitions, net of cash

acquired, and investment in equity method investee � (5,191 ) �

(2,194 ) Net cash used in investing activities � (85,000 ) �

(37,210 )

Cash flows from financing activities: Proceeds

from exercise of stock options 890 1,148 Proceeds from borrowings

108,000 26,005 Payment of long-term debt (82,573 ) (17,148 )

Dividend to non-controlling interest (1,181 ) ? Excess tax benefits

from stock compensation (17 ) 2,638 Common stock repurchases � (407

) � (6,953 ) Net cash provided by financing activities � 24,712 � �

5,690 � Net decrease in cash and cash equivalents � (36,870 ) �

(4,804 )

Cash and cash equivalents, beginning of period �

379,099 � � 268,584 �

Cash and cash equivalents, end of

period $ 342,229 � $ 263,780 � � Supplemental disclosures of cash

flow information: Interest paid $ 724 $ 463 Income taxes paid $

18,602 $ 792 �

CENTENE CORPORATION

�

CONTINUING OPERATIONS

SUPPLEMENTAL FINANCIAL DATA

� � �

Q1 � �

Q4 � �

Q3 � �

Q2 � �

Q1 2009 2008 2008 2008

2008 MEMBERSHIP Managed Care: Arizona 15,500 14,900 �

� � Florida 29,100 � � � � Georgia 289,300 288,300 283,900 278,800

282,700 Indiana 179,100 175,300 172,400 161,700 161,300 Ohio

137,000 133,400 132,500 137,300 131,100 South Carolina 48,500

31,300 26,600 22,500 2,200 Texas 421,100 428,000 433,200 423,700

365,500 Wisconsin � 127,700 � � 124,800 � � 122,500 � � 124,800 � �

126,900 � Total at-risk membership � 1,247,300 � � 1,196,000 � �

1,171,100 � � 1,148,800 � � 1,069,700 � Non-risk membership �

96,000 � � 3,700 � � 3,700 � � 3,500 � � 30,600 �

TOTAL �

1,343,300 � �

1,199,700 � �

1,174,800 � �

1,152,300 � �

1,100,300 � � Medicaid 921,100 877,400

850,500 828,700 802,400 SCHIP & Foster Care 256,900 257,300

261,800 256,900 206,300 ABD & Medicare � 69,300 � � 61,300 � �

58,800 � � 63,200 � � 61,000 � Total at-risk membership � 1,247,300

� � 1,196,000 � � 1,171,100 � � 1,148,800 � � 1,069,700 � Non-risk

membership � 96,000 � � 3,700 � � 3,700 � � 3,500 � � 30,600 �

TOTAL �

1,343,300 � �

1,199,700 � �

1,174,800 � �

1,152,300 � �

1,100,300 � �

Specialty Services(a): Cenpatico Behavioral Health Arizona 104,700

105,000 102,400 99,400 97,900 Kansas 40,600 41,100 40,100 40,000

39,400 Bridgeway Health Solutions Long-term Care � 2,300 � � 2,100

� � 1,900 � � 1,800 � � 1,700 �

TOTAL �

147,600 � �

148,200 � �

144,400 � �

141,200 � �

139,000 � �

(a) Includes external Specialty

Service membership only.

�

REVENUE PER MEMBER(b) $ 220.29 $ 218.52 $ 213.28 $

214.76 $ 215.39 �

CLAIMS(b) Period-end inventory

325,000

�

269,300

�

323,200

�

389,100

�

411,700

�

Average inventory 267,600 288,600 298,400 235,300 285,700

Period-end inventory per member 0.26 0.23 0.28 0.34 0.37 �

(b) Revenue per member and claims

information are presented for the Medicaid Managed Care segment for

at-risk members.

� �

Q1 � �

Q4 � �

Q3 � �

Q2 � �

Q1 2009 2008 2008 2008

2008 �

DAYS IN CLAIMS

PAYABLE(c)

45.3 48.5 47.9 47.8 48.3 � (c) Days in Claims Payable is a

calculation of Medical Claims Liabilities at the end of the period

divided by average claims expense per calendar day for such period.

�

CASH AND INVESTMENTS (in millions) Regulated $ 816.8 $

798.0 $ 692.6 $ 653.1 $ 627.1 Unregulated � 28.9 � � 24.1 � � 26.8

� � 29.0 � � 25.8 �

TOTAL $ 845.7 � $ 822.1 � $ 719.4 � $

682.1 � $ 652.9 � �

DEBT TO

CAPITALIZATION(d)

34.6 % 34.6 % 34.4 % 32.6 % 32.8 % � (d) Debt to Capitalization is

calculated as follows: total debt divided by (total debt + total

equity). �

OPERATING RATIOS:

� � �

Three Months Ended

March 31,

2009 � �

2008 Health Benefits Ratios Medicaid and

SCHIP 84.8 % 79.2 % ABD and Medicare 81.4 97.5 Specialty Services

78.3 84.1 Total 83.5 82.7 � General & Administrative Expense

Ratios Medicaid Managed Care 10.3 % 9.9 % Specialty Services 15.7

14.9 Total 13.5 12.6 �

MEDICAL CLAIMS LIABILITIES (In

thousands) Four rolling quarters of the changes in medical

claims liabilities are summarized as follows: �

Balance, March 31, 2008 � � $ 323,302 Acquisitions 15,398

Incurred related to: Current period 2,793,935 Prior period �

(23,634 ) Total incurred � 2,770,301 � Paid related to: Current

period 2,448,657 Prior period � 287,822 � Total paid � 2,736,479 �

Balance, March 31, 2009 $ 372,522 �

Centene�s claims reserving process utilizes a consistent

actuarial methodology to estimate Centene�s ultimate liability. Any

reduction in the �Incurred related to: Prior period� claims may be

offset as Centene actuarially determines �Incurred related to:

Current period.� As such, only in the absence of a consistent

reserving methodology would favorable development of prior period

claims liability estimates reduce medical costs. Centene believes

it has consistently applied its claims reserving methodology in

each of the periods presented.

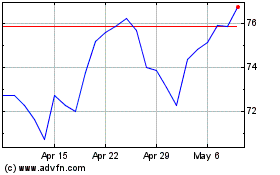

Centene (NYSE:CNC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Centene (NYSE:CNC)

Historical Stock Chart

From Jul 2023 to Jul 2024