Camden Property Trust (NYSE: CPT) today announced operating

results for the three and six months ended June 30, 2009.

“We are pleased to report that Camden’s second quarter operating

results were better than expected,” said Richard J. Campo, Chairman

and Chief Executive Officer. “Funds from operations (“FFO”) for the

second quarter totaled $0.78 per diluted share, excluding a $0.06

per diluted share non-recurring charge related to early retirement

of secured debt which was not included in prior guidance. We are

also pleased to announce that we are maintaining the midpoint of

both our FFO and same-property net operating income (“NOI”)

guidance.”

Funds From

Operations

FFO for the second quarter of 2009 totaled $0.72 per diluted

share or $46.6 million, as compared to $0.94 per diluted share or

$54.9 million for the same period in 2008. FFO for the six months

ended June 30, 2009 totaled $1.60 per diluted share or $98.2

million, as compared to $1.83 per diluted share or $107.2 million

for the same period in 2008. FFO for the three and six months ended

June 30, 2009 included a $0.06 per diluted share impact from losses

related to early retirement of secured debt, partially offset by a

$0.02 per share impact from gains related to early retirement of

unsecured debt which was included in prior guidance. FFO for the

three and six months ended June 30, 2008 included a $0.04 per

diluted share impact from gains related to early retirement of

debt.

Net Income Attributable to

Common Shareholders (“EPS”)

The Company reported net income attributable to common

shareholders (“EPS”) of $18.3 million or $0.30 per diluted share

for the second quarter of 2009, as compared to $17.3 million or

$0.31 per diluted share for the same period in 2008. EPS for the

three months ended June 30, 2009 included a $0.27 per diluted share

impact from gain on sale of discontinued operations, and a $0.04

per diluted share impact from losses related to early retirement of

debt. EPS for the three months ended June 30, 2008 included a $0.15

per diluted share impact from gain on sale of discontinued

operations, and a $0.04 per diluted share impact from gains related

to early retirement of debt.

For the six months ended June 30, 2009, net income attributable

to common shareholders totaled $24.5 million or $0.41 per diluted

share, as compared to $32.2 million or $0.57 per diluted share for

the same period in 2008. EPS for the six months ended June 30, 2009

included a $0.29 per diluted share impact from gain on sale of

discontinued operations, and a $0.04 per diluted share impact from

losses related to early retirement of debt. EPS for the six months

ended June 30, 2008 included a $0.28 per diluted share impact from

gain on sale of properties including discontinued operations, and a

$0.04 per diluted share impact from gains related to early

retirement of debt.

A reconciliation of net income attributable to common

shareholders to FFO is included in the financial tables

accompanying this press release.

Same-Property

Results

For the 42,670 apartment homes included in consolidated

same-property results, second quarter 2009 same-property NOI

declined 7.7% compared to the second quarter of 2008, with revenues

declining 2.3% and expenses increasing 7.1%. On a sequential basis,

second quarter 2009 same-property NOI declined 2.4% compared to the

first quarter of 2009, with revenues declining 0.1% and expenses

increasing 3.8% compared to the prior quarter. On a year-to-date

basis, 2009 same-property NOI declined 5.8%, with revenues

declining 1.4% and expenses increasing 6.3% compared to the same

period in 2008. Same-property physical occupancy levels for the

portfolio averaged 94.2% during the second quarter of 2009,

compared to 94.6% in the second quarter of 2008 and 93.6% in the

first quarter of 2009.

The Company defines same-property communities as communities

owned and stabilized as of January 1, 2008, excluding properties

held for sale and communities under redevelopment. A reconciliation

of net income attributable to common shareholders to net operating

income and same-property net operating income is included in the

financial tables accompanying this press release.

Development

Activity

During the second quarter, the Company completed lease-up on

Camden Cedar Hill in Austin, TX. As of June 30, 2009, construction

had been completed on all of Camden’s wholly-owned development

projects, with no material obligations remaining to fund. The

Company currently has five wholly-owned apartment communities

completed and in lease-up: Camden Potomac Yard in Arlington, VA, a

$104.8 million project that is currently 84% leased; Camden

Summerfield in Landover, MD, a $62.6 million project that is

currently 93% leased; Camden Orange Court in Orlando, FL, a $45.5

million project that is currently 81% leased; Camden Whispering

Oaks in Houston, TX, a $27.4 million project that is currently 92%

leased; and Camden Dulles Station in Oak Hill, VA, a $72.2 million

project that is currently 67% leased. The Company also had two

joint venture communities which were completed and in lease-up:

Camden College Park in College Park, MD, a $127.9 million project

that is currently 84% leased; and Camden Amber Oaks in Austin, TX,

a $35.0 million project that is currently 62% leased.

The Company has one joint venture community currently under

construction and in lease-up: Braeswood Place in Houston, TX, a

$48.6 million joint venture project that is currently 43% leased.

Camden has two additional joint venture communities currently under

construction in Houston, TX: Camden Travis Street, a $39.0 million

project, and Belle Meade, a $33.2 million project. Both projects

are scheduled for initial occupancy later in 2009.

Disposition

Activity

On June 30, 2009, the Company disposed of Camden West Oaks, a

671-home apartment community in Houston, TX for a total of $28.7

million, resulting in a gain on sale of $16.9 million.

Equity Offering

During the second quarter, Camden completed a public offering of

10,350,000 common shares at a price of $27.50 per share. The

Company received approximately $272.1 million in net proceeds from

the offering after deducting the underwriting discount and expenses

of the offering.

Debt Repurchases &

Retirements

During the quarter, Camden repurchased a total of $182.3 million

of senior unsecured notes, resulting in a $1.1 million gain on

early retirement of debt. On June 30, 2009, the Company prepaid

$135.3 million of secured mortgage debt originally scheduled to

mature in 2010 and 2011, resulting in a $3.8 million loss on early

retirement of debt. Subsequent to quarter-end, the Company retired

$81.9 million of senior unsecured notes. Camden has no remaining

debt maturities in 2009 and $137.6 million of debt maturities in

2010.

Earnings

Guidance

Camden updated its earnings guidance for 2009 based on its

current and expected views of the apartment market and general

economic conditions. Full-year 2009 FFO is expected to be $2.91 to

$3.05 per diluted share, and full-year 2009 EPS is expected to be

$0.42 to $0.56 per diluted share. The Company’s previous FFO

guidance was $2.87 to $3.09 per diluted share. Third quarter 2009

earnings guidance is $0.67 to $0.73 per diluted share for FFO and

$0.02 to $0.08 per diluted share for EPS. Camden intends to update

its earnings guidance to the market on a quarterly basis.

The Company’s 2009 earnings guidance continues to be based on

projections of same-property NOI declines between 4.5% and 7.5%.

Same-property revenue is now expected to decline between 2.0% and

3.5%, compared to a prior estimated decline between 0.5% and 2.5%.

Same-property expense growth is projected between 2.5% and 4.0%,

compared to a prior range of 5.0% to 6.25%. A reconciliation of

expected net income attributable to common shareholders to expected

FFO is included in the financial tables accompanying this press

release.

Conference Call

The Company will hold a conference call on Friday, July 31, 2009

at 11:00 a.m. Central Time to review its second quarter 2009

results and discuss its outlook for future performance. To

participate in the call, please dial (866) 843-0890 (domestic) or

(412) 317-9250 (international) by 10:50 a.m. Central Time and enter

passcode: 9120864, or join the live webcast of the conference call

by accessing the Investor Relations section of the Company’s

website at camdenliving.com. Supplemental financial information is

available in the Investor Relations section of the Company’s

website under Earnings Releases or by calling Camden’s Investor

Relations Department at (800) 922-6336.

Forward-Looking

Statements

In addition to historical information, this press release

contains forward-looking statements under the federal securities

law. These statements are based on current expectations, estimates

and projections about the industry and markets in which Camden

operates, management's beliefs, and assumptions made by management.

Forward-looking statements are not guarantees of future performance

and involve certain risks and uncertainties which are difficult to

predict.

About Camden

Camden Property Trust, an S&P 400 Company, is a real estate

company engaged in the ownership, development, acquisition,

management and disposition of multifamily apartment communities.

Camden owns interests in and operates 182 properties containing

62,946 apartment homes across the United States. Upon completion of

three properties under development, the Company’s portfolio will

increase to 63,658 apartment homes in 185 properties. Camden was

recently named by FORTUNE® Magazine for the second consecutive year

as one of the “100 Best Companies to Work For” in America.

For additional information, please contact Camden’s Investor

Relations Department at (800) 922-6336 or (713) 354-2787 or access

our website at camdenliving.com.

CAMDEN OPERATING RESULTS (In thousands, except per

share and property data amounts)

(Unaudited)

Three Months Ended Six

Months Ended June 30, June 30,

OPERATING DATA

2009 2008 2009 2008

Property revenues Rental revenues $135,800 $136,555 $272,300

$270,818 Other property revenues 21,657 18,972

42,189 36,173 Total property revenues 157,457

155,527 314,489 306,991

Property expenses Property

operating and maintenance 44,562 40,218 86,845 79,397 Real estate

taxes 18,532 17,831 37,064

35,112 Total property expenses 63,094 58,049 123,909 114,509

Non-property income Fee and asset management income

2,244 2,131 4,275 4,543 Interest and other income 1,097 1,092 1,832

2,425 Income (loss) on deferred compensation plans 7,660

(639 ) 3,508 (9,180 ) Total non-property

income (loss) 11,001 2,584 9,615 (2,212 )

Other

expenses Property management 4,542 5,281 9,471 10,181 Fee and

asset management 1,303 1,696 2,438 3,421 General and administrative

7,246 8,414 15,478 16,374 Interest 34,002 33,286 66,247 65,859

Depreciation and amortization 43,888 43,190 87,868 84,706

Amortization of deferred financing costs 857 589 1,674 1,323

Expense (benefit) on deferred compensation plans 7,660

(639 ) 3,508 (9,180 ) Total other expenses

99,498 91,817 186,684 172,684

Income from continuing

operations before gain on sale of properties, including land, gain

(loss) on early retirement of debt, and equity in income (loss) of

joint ventures

5,866 8,245 13,511 17,586 Gain on sale

of properties, including land - - - 1,106 Gain (loss) on early

retirement of debt (2,716 ) 2,298 (2,550 ) 2,298 Equity in income

(loss) of joint ventures 222 (474 ) 630

(521 )

Income from continuing operations before income taxes

3,372 10,069 11,591 20,469 Income tax

expense - current (347 ) (160 ) (646 ) (433 )

Income from continuing operations 3,025 9,909

10,945 20,036 Income from discontinued operations 575

1,712 1,160 3,392 Gain on sale of discontinued operations 16,887

8,549 16,887 14,676

Net income 20,487 20,170 28,992

38,104 Less net income allocated to noncontrolling interests

(422 ) (1,126 ) (943 ) (2,395 ) Less income allocated to perpetual

preferred units (1,750 ) (1,750 ) (3,500 ) (3,500 )

Net income attributable to common shareholders

$18,315 $17,294 $24,549

$32,209

CONDENSED CONSOLIDATED STATEMENTS OF OTHER

COMPREHENSIVE INCOME

Net income $20,487 $20,170 $28,992

$38,104 Other comprehensive income (loss) Unrealized

gain (loss) on cash flow hedging activities 1,361 15,623 (1,574 )

(3,802 ) Reclassification of net losses on cash flow hedging

activities 5,469 2,640 10,744

3,970

Comprehensive income 27,317

38,433 38,162 38,272 Less net income allocated

to noncontrolling interests (422 ) (1,126 ) (943 ) (2,395 ) Less

income allocated to perpetual preferred units (1,750 )

(1,750 ) (3,500 ) (3,500 )

Comprehensive income

attributable to common shareholders $25,145

$35,557 $33,719

$32,377

PER SHARE DATA

Net income attributable to common shareholders - basic $0.30 $0.31

$0.42 $0.58 Net income attributable to common shareholders -

diluted 0.30 0.31 0.41 0.57 Income from continuing operations

attributable to common shareholders - basic 0.01 0.12 0.11 0.25

Income from continuing operations attributable to common

shareholders - diluted 0.01 0.12 0.11 0.25

Weighted

average number of common and common equivalent shares

outstanding: Basic 61,499 55,351 58,542 55,158 Diluted 61,499

56,033 59,025 55,829 Note: Please refer to the following

pages for definitions and reconciliations of all non-GAAP financial

measures presented in this document.

CAMDEN FUNDS FROM

OPERATIONS (In thousands, except per share and property data

amounts)

(Unaudited)

Three Months Ended Six Months Ended June 30,

June 30,

FUNDS FROM OPERATIONS

2009 2008 2009 2008

Net income attributable to common shareholders

$18,315 $17,294 $24,549 $32,209 Real

estate depreciation and amortization from continuing operations

42,863 42,295 85,873 82,948 Real estate depreciation from

discontinued operations - 1,114 - 2,399 Adjustments for

unconsolidated joint ventures 1,961 1,715 3,877 3,254 Income

allocated to noncontrolling interests 321 1,004 742 2,160 (Gain) on

sale of operating properties, net of taxes - - - (1,106 ) (Gain) on

sale of discontinued operations (16,887 ) (8,554 ) (16,887 )

(14,666 )

Funds from operations - diluted

$46,573 $54,868 $98,154

$107,198

PER SHARE DATA

Funds from operations - diluted $0.72 $0.94 $1.60 $1.83 Cash

distributions 0.45 0.70 1.15 1.40

Weighted average number

of common and common equivalent shares outstanding: FFO

- diluted 64,357 58,612 61,430 58,578

PROPERTY DATA

Total operating properties (end of period) (a) 182 182 182 182

Total operating apartment homes in operating properties (end of

period) (a) 62,946 63,612 62,946 63,612 Total operating apartment

homes (weighted average) 50,846 51,957 50,767 51,860 Total

operating apartment homes - excluding discontinued operations

(weighted average) 50,175 49,093 50,096 48,924

(a) Includes joint ventures and

properties held for sale.

Note: Please refer to the following pages for

definitions and reconciliations of all non-GAAP financial measures

presented in this document.

CAMDEN BALANCE SHEETS (In

thousands)

(Unaudited)

Jun 30, Mar 31, Dec 31, Sep 30, Jun

30, 2009 2009 2008

2008 2008 ASSETS Real estate assets, at

cost Land $746,936 $746,935 $744,059 $745,085 $755,200 Buildings

and improvements 4,473,906 4,466,296

4,447,587 4,442,067 4,474,749

5,220,842 5,213,231 5,191,646 5,187,152 5,229,949 Accumulated

depreciation (1,065,861 ) (1,023,466 ) (981,049 )

(952,883 ) (935,640 ) Net operating real estate

assets 4,154,981 4,189,765 4,210,597 4,234,269 4,294,309 Properties

under development and land 268,655 258,239 264,188 323,300 333,419

Investments in joint ventures 22,334 15,158 15,106 15,663 14,773

Properties held for sale, including land 6,732 20,696

20,653 9,495 36,152

Total real estate assets 4,452,702 4,483,858 4,510,544

4,582,727 4,678,653 Accounts receivable - affiliates 35,909 36,105

37,000 36,868 36,556 Notes receivable Affiliates 54,033 58,481

58,109 58,240 53,849 Other - - 8,710 8,710 8,710 Other assets, net

(a) 92,421 84,905 103,013 111,847 117,599 Cash and cash equivalents

157,665 7,256 7,407 29,517 1,242 Restricted cash 5,190

4,437 5,559 4,971

4,687 Total assets $4,797,920 $4,675,042

$4,730,342 $4,832,880

$4,901,296

LIABILITIES AND

SHAREHOLDERS' EQUITY Liabilities Notes payable Unsecured

$1,728,150 $2,151,492 $2,103,187 $2,096,285 $2,400,027 Secured

969,668 680,631 729,209 727,235 539,328 Accounts payable and

accrued expenses 65,012 73,250 82,575 86,668 77,441 Accrued real

estate taxes 30,154 19,113 23,600 40,664 30,664 Other liabilities

(b) 132,763 137,397 149,554 124,915 129,471 Distributions payable

33,050 43,136 42,936

42,968 42,965 Total liabilities 2,958,797

3,105,019 3,131,061 3,118,735 3,219,896 Commitments and

contingencies Perpetual preferred units 97,925 97,925 97,925

97,925 97,925 Shareholders' equity Common shares of

beneficial interest 769 666 660 660 660 Additional paid-in capital

2,517,788 2,242,940 2,237,703 2,232,436 2,230,119 Distributions in

excess of net income attributable to common shareholders (357,168 )

(345,481 ) (312,309 ) (238,301 ) (272,294 ) Notes receivable

secured by common shares (287 ) (291 ) (295 ) (298 ) (302 )

Treasury shares, at cost (462,751 ) (462,751 ) (463,209 ) (463,108

) (463,574 ) Accumulated other comprehensive loss (c) (41,886 )

(48,716 ) (51,056 ) (17,423 ) (15,955 )

Total common shareholders' equity 1,656,465 1,386,367 1,411,494

1,513,966 1,478,654 Noncontrolling interest 84,733

85,731 89,862 102,254

104,821 Total shareholders' equity 1,741,198

1,472,098 1,501,356 1,616,220

1,583,475 Total liabilities and shareholders' equity

$4,797,920 $4,675,042 $4,730,342

$4,832,880 $4,901,296

(a) includes: net deferred charges of: $12,108 $10,061

$10,505 $11,388 $9,434 (b) includes: deferred revenues of:

$3,183 $2,402 $2,640 $2,940 $2,747 distributions in excess of

investments in joint ventures of: $30,287 $31,318 $30,105 $27,977

$26,022 fair value adjustment of derivative instruments: $41,797

$48,693 $51,068 $17,511 $15,955 (c) Represents the fair

value adjustment of derivative instruments and gain on post

retirement obligations.

CAMDEN NON-GAAP FINANCIAL

MEASURES DEFINITIONS & RECONCILIATIONS (In

thousands, except per share amounts)

(Unaudited)

This document contains certain

non-GAAP financial measures management believes are useful in

evaluating an equity REIT's performance. Camden's definitions and

calculations of non-GAAP financial measures may differ from those

used by other REITs, and thus may not be comparable. The non-GAAP

financial measures should not be considered as an alternative to

net income as an indication of our operating performance, or to net

cash provided by operating activities as a measure of our

liquidity.

FFO

The National Association of Real

Estate Investment Trusts (“NAREIT”) currently defines FFO as net

income attributable to common shares computed in accordance with

generally accepted accounting principles (“GAAP”), excluding gains

or losses from depreciable operating property sales, plus real

estate depreciation and amortization, and after adjustments for

unconsolidated partnerships and joint ventures. Camden’s definition

of diluted FFO also assumes conversion of all dilutive convertible

securities, including minority interests, which are convertible

into common equity. The Company considers FFO to be an appropriate

supplemental measure of operating performance because, by excluding

gains or losses on dispositions of operating properties and

excluding depreciation, FFO can help one compare the operating

performance of a company's real estate between periods or as

compared to different companies. A reconciliation of net income

attributable to common shareholders to FFO is provided below:

Three Months Ended Six Months Ended June

30, June 30, 2009 2008 2009

2008 Net income attributable to common shareholders

$18,315 $17,294 $24,549 $32,209 Real estate depreciation and

amortization from continuing operations 42,863 42,295 85,873 82,948

Real estate depreciation from discontinued operations - 1,114 -

2,399 Adjustments for unconsolidated joint ventures 1,961 1,715

3,877 3,254 Income allocated to noncontrolling interests 321 1,004

742 2,160 (Gain) on sale of operating properties, net of taxes - -

- (1,106 ) (Gain) on sale of discontinued operations (16,887 )

(8,554 ) (16,887 ) (14,666 ) Funds from operations -

diluted $46,573 $54,868 $98,154

$107,198

Weighted average number of common

and common equivalent shares outstanding:

EPS diluted 61,499 56,033 59,025 55,829 FFO diluted 64,357 58,612

61,430 58,578 Net income attributable to common shareholders

- diluted $0.30 $0.31 $0.41 $0.57 FFO per common share - diluted

$0.72 $0.94 $1.60 $1.83

Expected FFO

Expected FFO is calculated in a

method consistent with historical FFO, and is considered an

appropriate supplemental measure of expected operating performance

when compared to expected net income attributable to common

shareholders (EPS). A reconciliation of the ranges provided for

expected net income attributable to common shareholders per diluted

share to expected FFO per diluted share is provided below:

3Q09 Range 2009 Range Low

High Low High Expected net

income attributable to common shareholders per share - diluted

$0.02 $0.08 $0.42 $0.56 Expected difference between EPS and fully

diluted FFO shares 0.00 0.00 (0.02 ) (0.02 ) Expected real estate

depreciation 0.62 0.62 2.62 2.62 Expected adjustments for

unconsolidated joint ventures 0.03 0.03 0.13 0.13 Expected income

allocated to noncontrolling interests 0.00 0.00 0.02 0.02 Expected

(gain) on sale of properties and properties held for sale 0.00

0.00 (0.26 ) (0.26 ) Expected FFO per

share - diluted 0.67 0.73 $2.91 $3.05

Note: This table contains forward-looking statements.

Please see the paragraph regarding forward-looking statements

earlier in this document.

CAMDEN

NON-GAAP FINANCIAL

MEASURES

DEFINITIONS &

RECONCILIATIONS

(In thousands, except per share

amounts)

(Unaudited)

Net Operating Income (NOI)

NOI is defined by the Company as

total property income less property operating and maintenance

expenses less real estate taxes. The Company considers NOI to be an

appropriate supplemental measure of operating performance to net

income attributable to common shareholders because it reflects the

operating performance of our communities without allocation of

corporate level property management overhead or general and

administrative costs. A reconciliation of net income attributable

to common shareholders to net operating income is provided

below:

Three Months Ended Six Months Ended June

30, June 30, 2009 2008 2009

2008 Net income attributable to common shareholders

$18,315 $17,294 $24,549 $32,209 Fee and asset management income

(2,244 ) (2,131 ) (4,275 ) (4,543 ) Interest and other income

(1,097 ) (1,092 ) (1,832 ) (2,425 ) Income (loss) on deferred

compensation plans (7,660 ) 639 (3,508 ) 9,180 Property management

expense 4,542 5,281 9,471 10,181 Fee and asset management expense

1,303 1,696 2,438 3,421 General and administrative expense 7,246

8,414 15,478 16,374 Interest expense 34,002 33,286 66,247 65,859

Depreciation and amortization 43,888 43,190 87,868 84,706

Amortization of deferred financing costs 857 589 1,674 1,323

Expense (benefit) on deferred compensation plans 7,660 (639 ) 3,508

(9,180 ) Gain on sale of properties, including land - - - (1,106 )

Gain (loss) on early retirement of debt 2,716 (2,298 ) 2,550 (2,298

) Equity in income (loss) of joint ventures (222 ) 474 (630 ) 521

Less income allocated to perpetual preferred units 1,750 1,750

3,500 3,500 Net income allocated to noncontrolling interests 422

1,126 943 2,395 Income tax expense - current 347 160 646 433 Income

from discontinued operations (575 ) (1,712 ) (1,160 ) (3,392 ) Gain

on sale of discontinued operations (16,887 ) (8,549 ) (16,887 )

(14,676 ) Income from discontinued operations allocated to common

units - - - - Net

Operating Income (NOI) $94,363 $97,478 $190,580 $192,482

"Same Property" Communities $78,905 $85,497 $159,777 $169,581

Non-"Same Property" Communities 11,197 9,647 23,048 18,610

Development and Lease-Up Communities 2,996 124 5,548 68

Redevelopment Communities 690 772 1,394 1,531 Dispositions / Other

575 1,438 813 2,692 Net

Operating Income (NOI) $94,363 $97,478 $190,580 $192,482

EBITDA

EBITDA is defined by the Company

as earnings before interest, taxes, depreciation and amortization,

including net operating income from discontinued operations,

excluding equity in income of joint ventures, gain on sale of real

estate assets, and net income allocated to noncontrolling

interests. The Company considers EBITDA to be an appropriate

supplemental measure of operating performance to net income

attributable to common shareholders because it represents income

before non-cash depreciation and the cost of debt, and excludes

gains or losses from property dispositions. A reconciliation of net

income attributable to common shareholders to EBITDA is provided

below:

Three Months Ended Six Months Ended June

30, June 30, 2009 2008 2009

2008 Net income attributable to common shareholders

$18,315 $17,294 $24,549 $32,209 Interest expense 34,002 33,463

66,247 66,239 Amortization of deferred financing costs 857 589

1,674 1,323 Depreciation and amortization 43,888 43,190 87,868

84,706 Less income allocated to perpetual preferred units 1,750

1,750 3,500 3,500 Net income allocated to noncontrolling interests

422 1,126 943 2,395 Income tax expense - current 347 160 646 433

Real estate depreciation and amortization from discontinued

operations - 1,121 - 2,414 Gain on sale of properties, including

land - - - (1,106 ) Gain (loss) on early retirement of debt 2,716

(2,298 ) 2,550 (2,298 ) Equity in income (loss) of joint ventures

(222 ) 474 (630 ) 521 Gain on sale of discontinued operations

(16,887 ) (8,549 ) (16,887 ) (14,676 ) EBITDA $85,188

$88,320 $170,460 $175,660

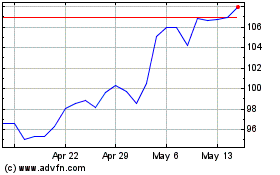

Camden Property (NYSE:CPT)

Historical Stock Chart

From Jun 2024 to Jul 2024

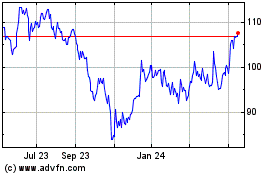

Camden Property (NYSE:CPT)

Historical Stock Chart

From Jul 2023 to Jul 2024