Atmos Energy Corporation (NYSE:ATO) today reported consolidated

results for its fiscal 2007 second quarter and six months ended

March 31, 2007. For the fiscal 2007 second quarter, net income

increased 20 percent to $106.5 million, or $1.20 per diluted share,

compared with net income of $88.8 million, or $1.10 per diluted

share in the prior-year quarter. The utility business contributed

$76.3 million of net income, or $0.86 per diluted share in the

fiscal 2007 second quarter, largely due to increased throughput

from 22 percent colder weather in the current quarter, compared to

the same period last year. Nonutility businesses contributed $30.2

million of net income, or $0.34 per diluted share in the fiscal

2007 second quarter. Natural gas marketing net income for the

current quarter was adversely impacted by temporary unrealized

losses, which should reverse in future periods. For the six months

ended March 31, 2007, net income increased 17 percent to $187.8

million, or $2.18 per diluted share, compared with net income of

$159.8 million, or $1.98 per diluted share for the same period last

year. Diluted earnings per share increased 10 percent year over

year, despite a 6.4 percent increase in weighted average shares

outstanding, primarily associated with the company�s December 2006

equity offering. For the current six-month period, the utility

business contributed $108.2 million of net income, or $1.26 per

diluted share, and the nonutility businesses contributed $79.6

million of net income, or $0.92 per diluted share. �Our unwavering

commitment to redesigning our utility rates is paying off this

winter heating season,� said Bob Best, chairman, president and

chief executive officer of Atmos Energy Corporation. �With the

recent decoupling of our margins from weather in both the Mid-Tex

and Louisiana divisions, we have been better able to stabilize our

utility margins and solidify the earnings potential of our utility

segment going forward.� Best continued: �The nonutility businesses

continue to exceed our expectations. The marketing business is

adding incremental customers and volumes and has been successful in

capturing very favorable arbitrage opportunities in its storage

assets. And, the pipeline and storage businesses have benefited

from increased margins and throughput, including the incremental

margin from the pipeline projects we completed last year. We remain

confident that we are on track to meet our goal of growing

consolidated earnings in the 4 to 6 percent range.� Results for the

2007 Second Quarter Ended March 31, 2007 Consolidated gross profit

for the three months ended March 31, 2007, was $428.7 million,

compared with $405.4 million for the three months ended March 31,

2006. The $23.3 million increase in consolidated gross profit

reflects significantly improved results in the company�s utility

operations, as well as its pipeline and storage operations,

partially offset by lower natural gas marketing margins. Utility

gross profit increased $30.5 million to $346.2 million in the

current quarter, compared with $315.7 million in the same period

last year, before intersegment eliminations. The improvement in

utility gross profit margin was primarily the result of a 21

percent increase in throughput, which increased gross profit margin

by $25.7 million, a $4.3 million increase associated with the

favorable impact of the implementation of Weather Normalization

Adjustment (WNA) in the company�s Mid-Tex and Louisiana divisions

and a $9.6 million increase resulting from the company�s 2004 and

2005 GRIP filings and the Rate Stabilization Clause in the

company�s LGS service area in Louisiana in August 2006. These

increases were partially offset by the $2.3 million GRIP refund

(inclusive of interest) ordered by the Railroad Commission of Texas

(RRC) in March 2007 and a $4.2 million reduction arising from the

Tennessee Regulatory Authority�s decision in October 2006 to reduce

annual rates in Tennessee. Natural gas marketing gross profit

decreased $20.9 million to $23.1 million for the three months ended

March 31, 2007, compared with $44.0 million in the same quarter

last year, before intersegment eliminations. The decrease reflects

an $81.3 million decrease in unrealized margins during the

current-year quarter compared with the prior-year quarter offset by

a $60.4 million increase in realized margins. The increase in

realized margins is primarily attributable to Atmos Energy

Marketing�s (AEM) ability to capture more favorable arbitrage

opportunities in its storage activities, partially offset by

reduced marketing margins earned in a less volatile market during

the current-year quarter. The fiscal 2007 second quarter decrease

in unrealized margins was primarily due to a negative $68.9 million

mark-to-market impact, which resulted from the change in value of

the physical/financial portfolio from December 31, 2006. The fiscal

2006 second quarter gross profit included a positive $12.4 million

mark-to-market impact, which resulted from the change in value of

the physical/financial portfolio from December 31, 2005. As of

March 31, 2007, the physical storage position was 19.6 billion

cubic feet (Bcf) with equal and offsetting financial hedges,

compared to a physical storage position of 23.6 Bcf at March 31,

2006. Pipeline and storage gross profit was $59.1 million for the

three months ended March 31, 2007, compared with $45.3 million for

the three months ended March 31, 2006, before intersegment

eliminations. The $13.8 million increase in gross profit was

primarily attributable to increased margins associated with

increased throughput including $2.9 million of incremental margin

received from the company�s North Side Loop and other compression

projects completed in fiscal 2006 and a $6.8 million increase in

asset management fees earned by Atmos Pipeline & Storage, LLC.

Consolidated operation and maintenance expense for the three months

ended March 31, 2007, was $111.9 million, compared with $112.7

million for the three months ended March 31, 2006. Excluding the

provision for doubtful accounts, operation and maintenance expense

for the three months ended March 31, 2007, increased $2.4 million

compared with the prior-year quarter, primarily due to higher

employee and other administrative costs. The increases were

partially offset by the deferral of $4.3 million of operation and

maintenance expense resulting from the Louisiana Public Service

Commission�s decision to permit the company to recover its

incremental fiscal 2005 and 2006 operation and maintenance expense

incurred in connection with its Hurricane Katrina recovery efforts.

The provision for doubtful accounts decreased from $7.3 million for

the three months ended March 31, 2006, to $4.1 million for the

three months ended March 31, 2007. The $3.2 million decrease was

largely due to reduced collection risk in the company�s utility

segment associated with lower natural gas prices, where the average

cost of natural gas for the three months ended March 31, 2007, was

$8.33 per thousand cubic feet (Mcf), compared with $10.13 per Mcf

for the three months ended March 31, 2006. Taxes, other than income

taxes, for the three months ended March 31, 2007, were $56.7

million, compared with $64.8 million for the prior-year quarter.

The $8.1 million decrease primarily reflects lower franchise fees

and state gross receipts taxes, both of which are calculated as a

percentage of revenue and are paid by utility customers as a

component of their monthly bills. Although these amounts are

included as a component of revenue in accordance with the company�s

tariffs, timing differences between when these amounts are billed

to customers and when the company recognizes the associated expense

may favorably or unfavorably affect net income; however, they

should offset over time with no permanent impact on net income.

Miscellaneous income for the three months ended March 31, 2007, was

$1.8 million compared to miscellaneous expense for the prior-year

quarter of $2.4 million. The $4.2 million increase was primarily

due to the absence in the current-year quarter of a $3.3 million

charge recorded during the prior-year quarter associated with an

adverse regulatory ruling in Tennessee related to the calculation

of a performance-based rate mechanism associated with gas

purchases, coupled with increased interest income on short-term

cash investments. Results for the Six Months Ended March 31, 2007

Consolidated gross profit for the six months ended March 31, 2007,

was $804.3 million, compared with $752.0 million for the same

period last year, reflecting improvements across all business

segments, largely due to weather that was 10 percent colder than

the prior-year period. Utility gross profit increased to $608.8

million for the six months ended March 31, 2007, compared with

$595.9 million in the same period last year, before intersegment

eliminations. The $12.9 million increase in utility gross profit

margin reflects a nine percent increase in throughput, which

increased gross profit margin by $15.1 million, an $11.8 million

increase resulting from the implementation of WNA in the company�s

Mid-Tex and Louisiana divisions and an $18.3 million increase due

to rate adjustments associated with the company�s 2004 and 2005

GRIP filings and its LGS Rate Stabilization Clause compared to the

prior-year six months. These increases were partially offset by the

adverse impacts arising from the Tennessee and Texas rate rulings,

which reduced margins by $8.5 million. Natural gas marketing gross

profit was $86.2 million for the six months ended March 31, 2007,

compared with $70.3 million in the same period last year, before

intersegment eliminations. The $15.9 million improvement reflects

an $18.8 million increase in realized margins due to AEM�s ability

to capture more favorable arbitrage opportunities in its storage

activities coupled with increased sales volumes, partially offset

by reduced marketing margins earned in a less volatile market

during the current-year period. This increase was partially offset

by a $2.9 million reduction in unrealized margin. For the six

months ended March 31, 2007, the storage and marketing margin

included a negative $20.1 million mark-to-market impact, which

resulted from the change in value of the physical/financial

portfolio from September 30, 2006. For the six months ended March

31, 2006, the storage and marketing margin included a negative

$17.2 million mark-to-market impact, which resulted from the change

in value of the physical/financial portfolio from September 30,

2005. Pipeline and storage gross profit was $108.8 million for the

six months ended March 31, 2007, compared with $85.0 million for

the six months ended March 31, 2006, before intersegment

eliminations. The $23.8 million increase in gross profit was

primarily attributable to increased margins associated with

increased throughput and higher demand for storage services,

including $5.9 million of incremental margin received from the

company�s North Side Loop and other compression projects completed

in fiscal 2006, a $9.0 million increase in asset management fees

earned by Atmos Pipeline & Storage, LLC and a $1.4 million

increase due to rate adjustments resulting from the company�s 2005

GRIP filing. Consolidated operation and maintenance expense for the

six months ended March 31, 2007, was $227.2 million, compared with

$220.9 million for the same period last year. Excluding the

provision for doubtful accounts, operation and maintenance expense

for the six months ended March 31, 2007, increased $11.5 million

compared with the same period in 2006. The increase was mostly due

to increased employee and other administrative costs. However,

these increases were partially offset by the $4.3 million deferral

of operation and maintenance expense in the Louisiana division and

the absence of a $2.0 million charge for losses related to

Hurricane Katrina that was recorded in the prior-year period. The

provision for doubtful accounts decreased $5.2 million to $10.8

million for the six months ended March 31, 2007, compared with

$16.0 million in the prior-year period. The decrease was mainly

attributable to reduced collection risk in the utility segment as a

result of lower natural gas prices, where the average cost of

natural gas for the six months ended March 31, 2007, was $8.25 per

Mcf, compared with $10.91 per Mcf for the six months ended March

31, 2006. Taxes, other than income taxes, for the six months ended

March 31, 2007, were $96.8 million, compared with $110.2 million

for the prior-year period. The $13.4 million decrease was primarily

related to franchise fees and state gross receipts taxes, which do

not have a permanent effect on net income, as explained above.

Interest charges for the six months ended March 31, 2007, were

$74.8 million, compared with $71.7 million for the six months ended

March 31, 2006. The $3.1 million increase was primarily

attributable to increased interest rates on the company�s $300

million unsecured floating rate senior notes due October 2007 due

to an increase in the three-month LIBOR rate, partially offset by

reduced interest expense associated with lower average outstanding

short-term debt balances in the current-year period compared with

the prior-year period. Miscellaneous income for the six months

ended March 31, 2007, was $3.4 million, compared with miscellaneous

expense of $2.0 million for the six months ended March 31, 2006.

The $5.4 increase in miscellaneous income was attributable to the

previously mentioned absence of a $3.3 million charge in Tennessee

during the fiscal 2006 second quarter coupled with increased

interest income on short-term cash investments. For the six months

ended March 31, 2007, cash flow generated from operating activities

provided cash of $511.9 million, compared with $148.4 million for

the same period last year. Period over period, operating cash flow

was favorably impacted by increased earnings, increased sales

volumes attributable to colder weather in the current-year period

and significantly lower natural gas prices compared to the

prior-year period. Capital expenditures decreased to $172.8 million

for the six months ended March 31, 2007, from $213.2 million for

the six months ended March 31, 2006. The $40.4 million decrease in

capital spending primarily reflects the absence of capital

expenditures associated with the company�s North Side Loop and

other pipeline compression projects, which were completed in the

third quarter of fiscal 2006. Outlook Atmos Energy said its

leadership remains focused on enhancing shareholder value by

delivering consistent earnings growth and providing a sound and

attractive dividend. As a result of the strong nonutility financial

performance through the six months ended March 31, 2007, Atmos

Energy continues to expect fiscal 2007 earnings to be in the range

of $1.90 to $2.00 per diluted share. However, the mark-to-market

impact on the marketing company�s physical storage inventory at

September 30, 2007, and changes in events or other circumstances

that the company cannot currently anticipate, could result in

earnings for fiscal 2007 that are significantly above or below this

outlook. Capital expenditures for fiscal 2007 are expected to be in

the range of $365 to $385 million. The company�s debt

capitalization ratio improved to 51.9 percent at March 31, 2007,

from 60.9 percent as of September 30, 2006. The improvement was

primarily attributable to increased equity from the successful

public offering completed in December 2006 and strong

period-to-date earnings, as well as the positive effect of using

operating cash flow to repay all outstanding short-term debt as of

March 31, 2007. Atmos Energy remains committed to maintaining the

debt capitalization ratio in a targeted range of 50 to 55 percent.

With its $300 million unsecured floating rate senior notes maturing

in October 2007, the company is evaluating alternatives to

refinance the notes prior to their maturity and expects these

efforts to be successful. In addition, Atmos Energy expects that

internally generated funds, access to its credit facilities,

including its commercial paper program, and access to the public

debt and equity markets will provide the necessary working capital

and liquidity for its operations, capital expenditures and other

cash needs for the remainder of fiscal 2007. Conference Call to be

Webcast May 3, 2007 Atmos Energy will host a conference call with

financial analysts to discuss the financial results for the second

quarter and first six months of fiscal 2007 on Thursday, May 3,

2007, at 10 a.m. EDT. The telephone number is 800-366-7640. The

conference call will be webcast live on the Atmos Energy Web site

at www.atmosenergy.com. A slide presentation and a playback of the

call will be available on the Web site later that day. Atmos Energy

officers who will participate in the conference call include: Bob

Best, chairman, president and chief executive officer; Pat Reddy,

senior vice president and chief financial officer; Kim Cocklin,

senior vice president, utility operations; Mark Johnson, senior

vice president, nonutility operations; Fred Meisenheimer, vice

president and controller; Laurie Sherwood, vice president,

corporate development, and treasurer; and Susan Giles, vice

president, investor relations. Other Highlights and Recent

Developments Mid-Tex Division Rate Case Order Issued In March 2007,

the RRC issued an order in the company�s Mid-Tex Division rate

case, which prospectively increased annual revenues by

approximately $4.8 million and established a permanent WNA based

upon a 10-year average effective for the months of November through

April. However, the order also reduced the Mid-Tex Division�s total

return to 7.903 percent from 8.258 percent and required an

immediate $2.3 million GRIP refund. Gas Gathering Project Update In

May 2006, Atmos Energy announced plans to form a joint venture and

construct a natural gas gathering system in Eastern Kentucky,

referred to as the Straight Creek Project. In order to better serve

the needs of the local producers in the area and to meet the

company�s economic requirements, the original project is currently

being redesigned, and will likely be marginally smaller in both

size and scope. Accordingly, the in-service date is expected to be

delayed into the second half of fiscal 2008. Missouri Rate Case

Finalized In April 2006, Atmos Energy filed a rate case in its

Missouri service area seeking a rate increase of $3.4 million, the

consolidation of rates for its Missouri properties into three sets

of regional rates and the current purchased gas adjustment (PGA)

into one statewide PGA and a WNA mechanism. The Missouri Commission

issued an order in March 2007 approving a settlement with favorable

rate design changes, including revenue decoupling through the

recovery of all non-gas cost revenues through fixed monthly

charges, with no overall increase in rates. Forward-Looking

Statements The matters discussed in this news release may contain

�forward-looking statements� within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements other than statements of

historical fact included in this news release are forward-looking

statements made in good faith by the company and are intended to

qualify for the safe harbor from liability established by the

Private Securities Litigation Reform Act of 1995. When used in this

news release or in any of the company�s other documents or oral

presentations, the words �anticipate,� �believe,� �estimate,�

�expect,� �forecast,� �goal,� �intend,� �objective,� �plan,�

�projection,� �seek,� �strategy� or similar words are intended to

identify forward-looking statements. Such forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially from those discussed in this

news release, including the risks and uncertainties relating to

regulatory trends and decisions, the company�s ability to continue

to access the capital markets and the other factors discussed in

the company�s SEC filings. These factors include the risks and

uncertainties discussed in the company�s Annual Report on Form 10-K

for the fiscal year ended September 30, 2006. Although the company

believes these forward-looking statements to be reasonable, there

can be no assurance that they will approximate actual experience or

that the expectations derived from them will be realized. The

company undertakes no obligation to update or revise

forward-looking statements, whether as a result of new information,

future events or otherwise. About Atmos Energy Atmos Energy

Corporation, headquartered in Dallas, is the country�s largest

natural gas-only distributor, serving about 3.2 million gas utility

customers. Atmos Energy�s utility operations serve more than 1,500

communities in 12 states from the Blue Ridge Mountains in the East

to the Rocky Mountains in the West. Atmos Energy�s nonutility

operations, organized under Atmos Energy Holdings, Inc., operate in

22 states. They provide natural gas marketing and procurement

services to industrial, commercial and municipal customers and

manage company-owned natural gas pipeline and storage assets,

including one of the largest intrastate natural gas pipeline

systems in Texas. Atmos Energy is a Fortune 500 company. For more

information, visit www.atmosenergy.com. � Atmos Energy Corporation

Financial Highlights (Unaudited) � Statements of Income Three

Months EndedMarch 31 Percentage (000s except per share) 2007� 2006�

Change � Operating revenues: Utility segment $ 1,461,033� $

1,447,620� Natural gas marketing segment 795,041� 818,629� Pipeline

and storage segment 59,362� 45,483� Other nonutility segment 783�

1,595� Intersegment eliminations (240,637) (279,481) 2,075,582�

2,033,846� Purchased gas cost: Utility segment 1,114,787�

1,131,885� Natural gas marketing segment 771,988� 774,652� Pipeline

and storage segment 229� 211� Other nonutility segment �� ��

Intersegment eliminations (240,108) (278,305) 1,646,896� 1,628,443�

Gross profit 428,686� 405,403� 6% � Operation and maintenance

expense 111,862� 112,698� (1)% Depreciation and amortization

51,066� 47,076� 8% Taxes, other than income 56,746� 64,796� (12)%

Total operating expenses 219,674� 224,570� (2)% � Operating income

209,012� 180,833� 16% � Miscellaneous income (expense) 1,838�

(2,439) 175% Interest charges 35,262� 35,492� (1)% � Income before

income taxes 175,588� 142,902� 23% Income tax expense 69,083�

54,106� 28% Net income $ 106,505� $ 88,796� 20% � Basic net income

per share $ 1.21� $ 1.10� Diluted net income per share $ 1.20� $

1.10� � Cash dividends per share $ .320� $ .315� � Weighted average

shares outstanding: Basic 88,078� 80,573� Diluted 88,735� 81,040�

Three Months EndedMarch 31 Percentage Summary Net Income (Loss) by

Segment (000s) 2007� 2006� Change � Utility $ 76,320� $ 54,628� 40%

Natural gas marketing 11,031� 21,932� (50)% Pipeline and storage

19,309� 12,087� 60% Other nonutility (155) 149� (204)% Consolidated

net income $ 106,505� $ 88,796� 20% Atmos Energy Corporation

Financial Highlights, continued (Unaudited) � Statements of Income

Six Months EndedMarch 31 Percentage (000s except per share) 2007�

2006� Change � Operating revenues: Utility segment $ 2,425,277� $

2,852,630� Natural gas marketing segment 1,506,735� 1,920,474�

Pipeline and storage segment 109,214� 85,195� Other nonutility

segment 2,136� 3,087� Intersegment eliminations (365,147) (543,720)

3,678,215� 4,317,666� Purchased gas cost: Utility segment

1,816,463� 2,256,714� Natural gas marketing segment 1,420,548�

1,850,178� Pipeline and storage segment 454� 211� Other nonutility

segment �� �� Intersegment eliminations (363,528) (541,430)

2,873,937� 3,565,673� Gross profit 804,278� 751,993� 7% � Operation

and maintenance expense 227,232� 220,915� 3% Depreciation and

amortization 100,061� 90,336� 11% Taxes, other than income 96,813�

110,212� (12)% Total operating expenses 424,106� 421,463� 1 % �

Operating income 380,172� 330,530� 15% � Miscellaneous income

(expense) 3,417� (1,991) 272% Interest charges 74,794� 71,681� 4% �

Income before income taxes 308,795� 256,858� 20% Income tax expense

121,029� 97,035� 25% Net income $ 187,766� $ 159,823� 17% � Basic

net income per share $ 2.20� $ 1.99� Diluted net income per share $

2.18� $ 1.98� � Cash dividends per share $ .640� $ .630� � Weighted

average shares outstanding: Basic 85,404� 80,444� Diluted 86,061�

80,911� Six Months EndedMarch 31 Percentage Summary Net Income

(Loss) by Segment (000s) 2007� 2006� Change � Utility $ 108,154� $

103,041� 5% Natural gas marketing 45,978� 33,384� 38% Pipeline and

storage 33,909� 23,254� 46% Other nonutility (275) 144� (291)%

Consolidated net income $ 187,766� $ 159,823� 17% Atmos Energy

Corporation Financial Highlights, continued (Unaudited) � �

Condensed Balance Sheets March 31, September 30, (000s) 2007� 2006�

� Net property, plant and equipment $ 3,711,830� $ 3,629,156� �

Cash and cash equivalents 176,280� 75,815� Cash held on deposit in

margin account 40,763� 35,647� Accounts receivable, net 721,058�

374,629� Gas stored underground 364,478� 461,502� Other current

assets 126,838� 169,952� � Total current assets 1,429,417�

1,117,545� � Goodwill and intangible assets 738,217� 738,521�

Deferred charges and other assets 229,634� 234,325� � $ 6,109,098�

$ 5,719,547� � � � Shareholders� equity $ 2,021,953� $ 1,648,098�

Long-term debt 1,878,331� 2,180,362� � Total capitalization

3,900,284� 3,828,460� � Accounts payable and accrued liabilities

665,212� 345,108� Other current liabilities 421,386� 388,451�

Short-term debt �� 382,416� Current maturities of long-term debt

303,232� 3,186� � Total current liabilities 1,389,830� 1,119,161� �

Deferred income taxes 342,328� 306,172� Deferred credits and other

liabilities 476,656� 465,754� � $ 6,109,098� $ 5,719,547� Atmos

Energy Corporation Financial Highlights, continued (Unaudited) �

Condensed Statements of Cash Flows Six Months EndedMarch 31 (000s)

2007� 2006� � Cash flows from operating activities � Net income $

187,766� $ 159,823� Depreciation and amortization 100,179� 90,670�

Deferred income taxes 72,755� 58,199� Changes in assets and

liabilities 141,755� (167,888) Other 9,472� 7,587� Net cash

provided by operating activities 511,927� 148,391� � Cash flows

from investing activities � Capital expenditures (172,792)

(213,230) Other, net (3,749) (2,842) Net cash used in investing

activities (176,541) (216,072) � Cash flows from financing

activities � Net increase (decrease) in short-term debt (382,416)

117,506� Repayment of long-term debt (2,206) (2,162) Cash dividends

paid (54,640) (50,933) Net proceeds from equity offering 191,913�

�� Issuance of common stock 12,428� 12,053� Net cash provided by

(used in) financing activities (234,921) 76,464� � Net increase in

cash and cash equivalents 100,465� 8,783� Cash and cash equivalents

at beginning of period 75,815� 40,116� Cash and cash equivalents at

end of period $ 176,280� $ 48,899� Three Months EndedMarch 31 Six

Months EndedMarch 31 Statistics 2007� 2006� 2007� 2006� Heating

degree days a 1,575� 1,330� 2,710� 2,387� Percent of normal a 100%

84% 101% 88% Consolidated utility gas throughput (MMcf as metered)

173,423� 142,873� 292,517� 268,663� Consolidated natural gas

marketing sales volumes (MMcf) 101,386� 69,450� 178,912� 140,946�

Consolidated pipeline transportation volumes (MMcf) 119,057�

85,957� 238,012� 177,552� Natural gas meters in service 3,218,678�

3,228,708� 3,218,678� 3,228,708� Utility average cost of gas $8.33�

$10.13� $8.25� $10.91� � a Adjusted for weather-normalized

operations.

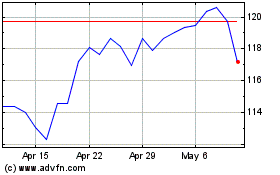

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From May 2024 to Jun 2024

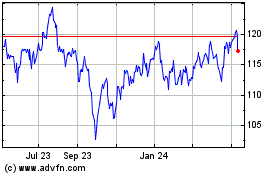

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Jun 2023 to Jun 2024