Q1 Revenues $190.5 Million, Up 33.7% Year Over Year HAVANT, United

Kingdom, March 22 /PRNewswire-FirstCall/ -- Xyratex Ltd

(NASDAQ:XRTX), a leading provider of modular enterprise class data

storage subsystems and storage process technology, today announced

results for the first fiscal quarter ended February 28, 2006.

Revenues for the first quarter were $190.5 million, an increase of

33.7% compared to revenues of $142.5 million for the same period

last year. For the first quarter, GAAP net income was $6.4 million,

or $0.22 per diluted share, compared to GAAP net income of $9.4

million, or $0.33 per diluted share, in the same period last year.

Non-GAAP net income from continuing operations declined 14.7% to

$8.3 million, or a diluted earnings per share of $0.28, compared to

non-GAAP net income of $9.9 million, or $0.34 per diluted share, in

the same quarter a year ago. A reconciliation between net income on

a GAAP basis and net income on a non-GAAP basis is provided in a

table immediately following the "Consolidated Statements of Cash

Flows", below. Gross profit margin in the first quarter was 19.7%,

compared to 20.8% in the same period last year, primarily due to

business segment mix and customer mix, particularly related to an

increased proportion of Storage and Network Systems revenues and an

increased proportion of sales to our largest customer within our

Storage and Network Systems business. Revenues from sales of our

Storage and Network Systems products were $128.8 million as

compared to $88.8 million in the same quarter a year ago, an

increase of 45%. Gross profit margin in the Storage and Network

Systems business was 15.1% as compared to 15.9% a year ago.

Revenues from sales of our Storage Infrastructure products were

$61.7 million as compared to $53.7 million in the same quarter a

year ago, an increase of 14.9%. Gross profit margin in the Storage

Infrastructure business was 29.4% as compared to 28.9% a year ago.

"With strong demand for our products, our first quarter results

demonstrate our continued progress in executing our strategic plan,

as we continue to grow our portfolio of offerings and build on a

solid customer base," said Steve Barber, CEO of Xyratex. "After a

very strong fiscal 2005, we enter 2006 with continued momentum in

the markets that our two business segments serve and we feel we are

well positioned to capitalize on the positive industry dynamics

that are creating significant demand for our storage products."

Business Highlights * We were the first storage subsystem

manufacturer to qualify and integrate Seagate's 146GB Cheetah

15K.4, 4Gb/sec Fibre Channel (FC), disc drives. * We demonstrated

the F5402E, a 4G FC-SAS/SATA solution that utilizes reliable and

backward compatible Fibre Channel connectivity together with

high-performing SAS drives and low-cost SATA drives in a single

expandable solution at CeBIT. This new solution also features

StorView(TM), Xyratex's latest system configuration and management

software. * We secured new design wins with Terrascale

Technologies, Disk Array and System Design, Inc., Storage Engine,

Globalstor and Nimbus Data Systems, as well as with a number of

other Tier 2 and Tier 3 customers. * We shipped our first seven

module precision disc cleaning system with additional sonic and

cascade scrubbing capabilities, aimed at meeting the increased

requirements of media cleanliness driven by increasing areal

density and reduced fly heights in disc drive design. Business

Outlook The following statements are based on current expectations.

These statements are forward-looking, and actual results may differ

materially. These statements do not include the potential impact of

any future acquisitions or divestitures. * Revenue in the second

quarter of 2006 is projected to be in the range $268 to $283

million. * Fully diluted earnings per share is anticipated to be

between $0.80 and $0.90 on a GAAP basis in the second quarter. On a

non-GAAP basis, fully diluted earnings per share is anticipated to

be between $0.83 and $0.93. Non-GAAP earnings per share excludes

non-cash equity compensation, amortization of intangible assets,

certain non-recurring benefits and related taxation expense.

Conference Call/Webcast Information Xyratex quarterly results

conference call will be broadcast live via the internet at

http://www.xyratex.com/investors on Wednesday, March 22, 2006 at

2:00 p.m. Pacific Time/5:00 p.m. Eastern Time. You can also access

the conference call by dialing +1 (888) 396-2386 in the United

States and +1 (617) 847-8712 outside of the United States, passcode

25537395. The press release will be posted to the company web site

http://www.xyratex.com/. A replay will be available through March

29, 2006 following the live call by dialing +1 (888) 286-8010 in

the United States and +1 (617) 801-6888 outside the United States,

replay code 30510771. Safe Harbor Statement This press release

contains forward-looking statements. These statements relate to

future events or our future financial performance, including our

projected revenue and fully diluted earnings per share data (on a

GAAP and non-GAAP basis) for the second quarter. These statements

are only predictions and involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

levels of activity, performance or achievements to differ

materially from any future results, levels of activity, performance

or achievements expressed or implied by these forward looking

statements. Factors that might cause such a difference include our

inability to compete successfully in the competitive and rapidly

changing marketplace in which we operate, failure to retain key

employees, cancellation or delay of projects and adverse general

economic conditions in the United States and internationally. These

risks and other factors include those listed under "Risk Factors"

and elsewhere in our Annual Report on Form 20-F as filed with the

Securities and Exchange Commission (File No. 000-50799). In some

cases, you can identify forward-looking statements by terminology

such as "may," "will," "should," "expects," "intends," "plans,"

"anticipates," "believes," "estimates," "predicts," "potential,"

"continue," or the negative of these terms or other comparable

terminology. Although we believe that the expectations reflected in

the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements.

About Xyratex Xyratex is a leading provider of enterprise class

data storage subsystems and network technology. The company designs

and manufactures enabling technology that provides OEM and disk

drive manufacturer customers with data storage products to support

high-performance storage and data communication networks. Xyratex

has over 20 years of experience in research and development

relating to disk drives, storage systems and high-speed

communication protocols. Founded in 1994 in a management buy-out

from IBM, and with its headquarters in the UK, Xyratex has an

established global base with R&D and operational facilities in

Europe, the United States and South East Asia. For more

information, visit http://www.xyratex.com/. XYRATEX LTD UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS Three Months Ended,

February 28, February 28, 2006 2005 (US dollars in thousands,

except per share amounts) Revenues: Storage and Network Systems

$128,830 $88,831 Storage Infrastructure 61,687 53,692 Total

revenues 190,517 142,523 Cost of revenues 152,948 112,840 Gross

profit: Storage and Network Systems 19,511 14,169 Storage

Infrastructure 18,166 15,514 Equity compensation (108) -- Total

gross profit 37,569 29,683 Operating expenses: Research and

development 16,462 10,562 Selling, general and administrative

12,868 8,595 Amortization of intangible assets 1,185 398 Total

operating expenses 30,515 19,555 Operating income 7,054 10,128

Interest income, net 205 349 Income before income taxes 7,259

10,477 Provision for income taxes 822 1,034 Net income 6,437 9,443

Net earnings per share: Basic $0.23 $0.34 Diluted $0.22 $0.33

Weighted average common shares (in thousands), used in computing

net earnings per share: Basic 28,509 28,121 Diluted 29,172 28,900

XYRATEX LTD UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

February 28, November 30, 2006 2005 (US dollars and amounts in

thousands) ASSETS Current assets: Cash and cash equivalents $41,426

$41,240 Accounts receivable, net 87,805 82,449 Inventories 97,317

71,543 Prepaid expenses 3,042 2,244 Deferred income taxes 7,570

6,480 Other current assets 3,325 3,236 Total current assets 240,485

207,192 Property, plant and equipment, net 29,035 25,643 Intangible

assets, net 50,397 50,904 Deferred income taxes 15,818 17,551 Total

assets $335,735 $301,290 LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities: Accounts payable $104,888 $79,927 Acquisition

note payable 3,000 3,000 Short-term borrowings 4,000 4,000 Employee

compensation and benefits payable 9,271 13,620 Deferred revenue

22,540 16,434 Income taxes payable 324 421 Other accrued

liabilities 14,017 15,506 Total current liabilities 158,040 132,908

Long-term debt 6,000 7,000 Total liabilities 164,040 139,908

Shareholders' equity Common shares of Xyratex Ltd (in thousands),

par value $0.01 per share 70,000 authorized, 28,625 and 28,437

issued and outstanding 286 284 Additional paid-in capital 337,052

333,886 Accumulated other comprehensive loss (648) (1,356)

Accumulated deficit (164,995) (171,432) Total shareholders' equity

171,695 161,382 Total liabilities and shareholders' equity $335,735

$301,290 XYRATEX LTD UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS Three Months Ended February 28, February 28, 2006 2005

(US dollars in thousands) Cash flows from operating activities: Net

income from continuing operations $6,437 $9,443 Adjustments to

reconcile net income to net cash used in operating activities:

Depreciation 1,998 1,588 Amortization of intangible assets 1,185

398 Non-cash equity compensation 1,369 190 Bonus paid by trust --

144 Changes in assets and liabilities, net of impact of

acquisitions and divestitures Accounts receivable (5,356) (29,353)

Inventories (25,774) (7,726) Prepaid expenses and other current

assets (887) (117) Accounts payable 24,961 22,122 Employee

compensation and benefits payable (4,349) (2,734) Deferred revenue

6,106 2,580 Income taxes payable (97) (167) Deferred income taxes

790 2,464 Amount payable to related party -- 137 Other accrued

liabilities 407 (1,234) Net cash provided by (used in) operating

activities 6,790 (2,265) Cash flows from investing activities:

Investments in property, plant and equipment (5,390) (2,168)

Acquisition of business, net of cash received (2,013) (253) Net

cash used in investing activities (7,403) (2,421) Cash flows from

financing activities: Net payments of long-term borrowings (1,000)

(1,000) Payment of acquisition note payable -- (2,000) Proceeds

from issuance of shares 1,799 631 Net cash provided by (used in)

financing activities 799 (2,369) Change in cash and cash

equivalents 186 (7,055) Cash and cash equivalents at beginning of

period 41,240 63,495 Cash and cash equivalents at end of period

$41,426 $56,440 XYRATEX LTD UNAUDITED RECONCILIATION OF GAAP NET

INCOME TO NON-GAAP NET INCOME Three Months Ended GAAP Non-GAAP

Non-GAAP February 28, Adjustment February 28, 2006 (a) 2006 (US

dollars in thousands, except per share amounts) Revenues: Storage

and Network Systems $128,830 $128,830 Storage Infrastructure 61,687

61,687 Total revenues 190,517 190,517 Cost of revenues 152,948

(108) 152,840 Gross profit: Storage and Network Systems 19,511

19,511 Storage Infrastructure 18,166 18,166 Equity compensation

(108) 108 -- Total gross profit 37,569 37,677 Operating expenses:

Research and development 16,462 (285) 16,177 Selling, general and

administrative 12,868 (976) 11,892 Amortization of intangible

assets 1,185 (1,185) -- Total operating expenses 30,515 28,069

Operating income 7,054 9,608 Interest income, net 205 205 Income

before income taxes 7,259 9,813 Provision for income taxes 822 698

1,520 Net income 6,437 8,293 Net earnings per share: Basic $0.23

$0.29 Diluted $0.22 $0.28 Weighted average common shares (in

thousands), used in computing net earnings per share: Basic 28,509

28,509 Diluted 29,172 254 29,426 XYRATEX LTD UNAUDITED

RECONCILIATION OF GAAP NET INCOME FROM CONTINUING OPERATIONS TO

NON-GAAP NET INCOME Three Months Ended GAAP Non-GAAP Non-GAAP

February 28, Adjustment February 28, 2005 (a) 2005 (US dollars in

thousands, except per share amounts) Revenues: Storage and Network

Systems $88,831 $88,831 Storage Infrastructure 53,692 53,692 Total

revenues 142,523 142,523 Cost of revenues 112,840 112,840 Gross

profit: Storage and Network Systems 14,169 14,169 Storage

Infrastructure 15,514 15,514 Total gross profit 29,683 29,683

Operating expenses: Research and development 10,562 10,562 Selling,

general and administrative 8,595 (190) 8,405 Amortization of

intangible assets 398 (398) -- Total operating expenses 19,555

18,967 Operating income 10,128 10,716 Interest income, net 349 349

Income before income taxes 10,477 11,065 Provision for income taxes

1,034 119 1,153 Net income 9,443 9,912 Net earnings per share:

Basic $0.34 $0.35 Diluted $0.33 $0.34 Weighted average common

shares (in thousands), used in computing net earnings per share:

Basic 28,121 28,121 Diluted 28,900 28,900 (a) Non-GAAP Adjustment

for the three month periods ended February 28, 2006 and February

28, 2005 includes non-cash amortization of intangible assets and

non-cash equity compensation expense, together with the related tax

effects. We believe these Non-GAAP measures are useful to investors

because they provide an alternative method of measuring the

operating performance of our business by excluding certain

expenses, gains and losses which we believe are not indicative of

our core operating results. DATASOURCE: Xyratex Ltd CONTACT:

Investors, Brad Driver of Xyratex Ltd, +1-408-325-7260, ; or Media,

Curtis Chan of CHAN & ASSOCIATES, INC., +1-714-447-4993, , for

Xyratex Ltd Web site: http://www.xyratex.com/investors Web site:

http://www.xyratex.com/

Copyright

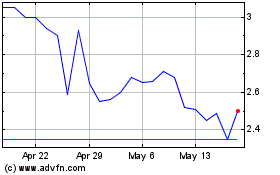

XORTX Therapeutics (NASDAQ:XRTX)

Historical Stock Chart

From Sep 2024 to Oct 2024

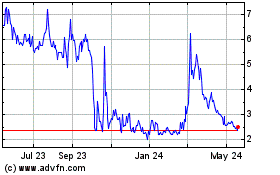

XORTX Therapeutics (NASDAQ:XRTX)

Historical Stock Chart

From Oct 2023 to Oct 2024