Q3 Revenues $163.9 Million, Up 42.7% Year Over Year HAVANT, United

Kingdom, Sept. 21 /PRNewswire-FirstCall/ -- Xyratex Ltd

(NASDAQ:XRTX), a leading provider of modular enterprise class data

storage subsystems and storage process technology, today announced

results for the third fiscal quarter, ended August 31, 2005.

Revenues for the quarter were $163.9 million, an increase of 42.7%

compared to revenues of $114.9 million for the same period last

year. For the third fiscal quarter, GAAP net income was $7.9

million, or $0.27 per diluted share. Non-GAAP net income was $8.5

million, or a diluted earnings per share of $0.29, compared to

non-GAAP net income of $7.0 million in the same quarter a year ago.

A reconciliation between net income on a GAAP basis and net income

on a non-GAAP basis is provided in a table immediately following

the "Consolidated Statements of Cash Flows" below. Gross profit

margin in the third quarter was 20.2%, compared to 22.7% in the

same period last year and 22% in the prior quarter. The decrease in

gross margin is primarily due to business revenue and product mix.

"With 43% revenue growth, we continue to execute and expand our

market at a significant pace. We expanded our technology and

product portfolio with the acquisition of nStor Technologies, and

we increased our customer base with a number of new design wins in

the quarter," said Steve Barber, CEO of Xyratex. "Our priority

continues to be superb execution on meeting the demands of our

customers and investing resources to develop leading technologies

and products that will expand our market opportunities and improve

our margins." Business Highlights * Subsequent to the quarter end

Xyratex acquired nStor Technologies, a developer of data storage

solutions that are ideally suited for both large enterprises as

well as small to mid-sized businesses. nStor's flagship controller

technology and StorView software form the foundation for the

OneStor and NexStor family of solutions that support Microsoft

Windows, Linux, UNIX and Macintosh operating environments. For

Xyratex, the acquisition of nStor augments the company's already

strong portfolio of storage technology and platform solutions. The

acquisition of nStor will combine Xyratex's industry-leading

expertise in high volume, high availability storage system

enclosure design with nStor's extensive experience and value-added

RAID Controller and Storage Solution software to provide a highly

scalable set of offerings to meet customer requirements. * As a

leading provider of capital equipment to Seagate's manufacturing

sites, Xyratex was honored as Seagate's Outstanding Supplier in the

Manufacturing Capital Equipment category. * Xyratex continued to

strengthen its relationship with its largest Storage and Network

Systems customer, broadening the range of products in support of

their expanding channel to market, and winning a number of new

development and operational programs. Business Outlook The

following statements are based on current expectations. These

statements are forward-looking, and actual results may differ

materially. These statements include the effect of the acquisition

of nStor Technologies on September 8, 2005, but do not include the

potential impact of any further future acquisitions or

divestitures. * Revenue in the fourth fiscal quarter of 2005 is

projected to be in the range $189 to $199 million. Revenue for

fiscal year 2005 is expected to increase to a range of $665 to $675

million. * Fully diluted earnings per share is anticipated to be

between $0.41 and $0.48 on a GAAP basis in the fourth quarter. On a

non-GAAP basis fully diluted earnings per share is anticipated to

be between $0.45 and $0.52, which includes the dilutive impact of

the acquisition of nStor Technologies. * Fully diluted earnings per

share for fiscal year 2005 is expected to be between $1.38 and

$1.45 on a GAAP basis. On a non-GAAP basis fully diluted earnings

per share is expected to be between $1.53 and $1.60, including the

dilution impact of the acquisition of nStor Technologies. *

Non-GAAP earnings per share excludes non-cash equity compensation,

amortization of intangible assets, certain other acquisition

related charges and related taxation expense. Conference

Call/Webcast Information Xyratex quarterly results conference call

will be broadcast live via the internet at

http://www.xyratex.com/investors on Wednesday, September 21, 2005

at 2:00 p.m. Pacific Time/5:00 p.m. Eastern Time. You can also

access the conference call by dialing (800) 259-0251 in the United

States and (617) 614-3671 outside of the United States, passcode

28309687. The press release will be posted to the company web site

http://www.xyratex.com/. A replay will be available through

September 28, 2005 following the live call by dialing (888)

286-8010 in the United States and (617) 801-6888 outside the United

States, replay code 26718479. Safe Harbor Statement This press

release contains forward-looking statements that involve risks and

uncertainties. These forward-looking statements include projected

revenue and fully diluted earnings per share data (on a GAAP and

non-GAAP basis) for the fourth quarter and fiscal year 2005,

statements regarding future results or financial performance of

Xyratex, including statements relating to the acquisition of nStor,

strengthening Xyratex's position in the storage market and enabling

Xyratex to build future storage and disk cleaning products. Such

statements are only predictions and involve risks and uncertainties

such that actual results and performance may differ materially.

Factors that might cause such a difference include successful

integration of NStor's assets and employees into Xyratex, building

future disk cleaning products, Xyratex's inability to compete

successfully in the competitive and rapidly changing marketplace,

failure to retain key employees, cancellation or delay of projects

and continued adverse general economic conditions in the U.S. and

internationally. These risks and other factors include those listed

under "Risk Factors" and elsewhere in Xyratex's Annual Report on

Form 20-F as filed with the Securities and Exchange Commission

(File No. 000-50799). In some cases, you can identify

forward-looking statements by terminology such as "may," "will,"

"should," "expects," "intends," "plans," "anticipates," "believes,"

"estimates," "predicts," "potential," "continue," or the negative

of these terms or other comparable terminology. Although we believe

that the expectations reflected in the forward-looking statements

are reasonable, we cannot guarantee future results, levels of

activity, performance or achievements. About Xyratex Xyratex is a

leading provider of enterprise class data storage subsystems and

network technology. The company designs and manufactures enabling

technology that provides OEM and disk drive manufacturer customers

with data storage products to support high-performance storage and

data communication networks. Xyratex has over 20 years of

experience in research and development relating to disk drives,

storage systems and high-speed communication protocols. Founded in

1994 in a management buy-out from IBM, and with its headquarters in

the UK, Xyratex has an established global base with R&D and

operational facilities in Europe, the United States and South East

Asia. For more information, visit http://www.xyratex.com/.

Contacts: Xyratex Investor Relations Brad Driver Tel: +1 (408)

325-7260 Email: Website: http://www.xyratex.com/ Xyratex Public

Relations Curtis Chan CHAN & ASSOCIATES, INC. Tel: +1 (714)

447-4993 Email: XYRATEX LTD UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS Three Months Ended, Nine Months Ended

August 31, August 31, August 31, August 31, 2005 2004 2005 2004 (US

dollars in thousands, except per share amounts) Revenues $163,918

$114,906 $476,045 $342,313 Cost of revenues - non cash equity

compensation -- 7,791 -- 7,791 Cost of revenues - other 130,788

88,848 375,981 264,107 Total cost of revenues 130,788 96,639

375,981 271,898 Gross profit 33,130 18,267 100,064 70,415 Operating

expenses: Research and development - development arrangement -- --

-- (6,000) Research and development - non cash equity compensation

-- 23,876 -- 23,876 Research and development - other 14,062 9,660

37,482 26,832 Total research and development 14,062 33,536 37,482

44,708 Selling, general and administrative - non cash equity

compensation 240 135,885 621 135,885 Selling, general and

administrative - other 9,164 7,538 26,483 20,121 Total selling,

general and administrative 9,404 143,423 27,104 156,006

Amortization of intangible assets 834 378 1,560 772 In process

research and development -- -- 2,230 -- Other costs -- 726 -- 2,589

Total operating expenses 24,300 178,063 68,376 204,075 Operating

income (loss) 8,830 (159,796) 31,688 (133,660) Interest income, net

351 77 1,020 905 Income (loss) from continuing operations before

income taxes 9,181 (159,719) 32,708 (132,755) Provision (benefit)

for income taxes 1,324 (6,338) 4,358 (2,302) Net income (loss) from

continuing operations 7,857 (153,381) 28,350 (130,453) Loss from

discontinued operations (net of taxes of zero) -- (12,924) --

(12,924) Net income (loss) $7,857 $(166,305) $28,350 $(143,377) Net

earnings (loss) per share - basic: Net income (loss) from

continuing operations $0.28 $(6.80) $1.00 $(8.74) Loss from

discontinued operations, net of income tax -- (0.57) -- (0.87) Net

earnings (loss) per share $0.28 $(7.37) $1.00 $(9.61) Net earnings

(loss) per share - diluted: Net income (loss) from continuing

operations $0.27 $(6.80) $0.98 $(8.74) Loss from discontinued

operations, net of income tax - (0.57) -- (0.87) Net earnings

(loss) per share $0.27 $(7.37) $0.98 $(9.61) Weighted average

common shares and class B preferred ordinary shares (in thousands),

used in computing net earnings (loss) per share: Basic 28,413

22,565 28,302 14,921 Diluted 29,079 22,565 29,052 14,921 Pro forma

net earnings (loss) per common share from continuing operations (a)

Basic $0.28 $(5.67) $1.00 $(5.26) Diluted $0.27 $(5.67) $0.98

$(5.26) Weighted-average common shares (in thousands), used in

computing the pro forma net earnings (loss) per share: Basic 28,413

27,060 28,302 24,797 Diluted 29,079 27,060 29,052 24,797 (a) Pro

forma net income per share reflects the conversion of Xyratex Group

Limited class A and class B preferred ordinary shares and class C

ordinary shares to common shares of Xyratex Ltd on completion of

its initial public offering, on June 29, 2004. XYRATEX LTD

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS August 31, November

30, 2005 2004 (US dollars and amounts in thousands) ASSETS Current

assets: Cash and cash equivalents $62,440 $63,495 Accounts

receivable, net 61,558 49,656 Inventories 79,731 43,014 Prepaid

expenses 3,027 2,594 Deferred income taxes 9,451 6,774 Other

current assets 6,264 2,855 Total current assets 222,471 168,388

Property, plant and equipment, net 19,646 14,495 Intangible assets,

net 28,453 7,911 Deferred income taxes 9,070 14,448 Total assets

$279,640 $205,242 LIABILITIES AND SHAREHOLDERS' EQUITY Current

liabilities: Accounts payable $65,988 $47,067 Acquisition note

payable 3,000 2,000 Short-term borrowings 4,000 4,000 Employee

compensation and benefits payable 11,054 10,811 Deferred revenue

24,598 1,887 Income taxes payable 279 462 Deferred income taxes 865

536 Other accrued liabilities 14,177 10,778 Total current

liabilities 123,961 77,541 Long-term debt 8,000 11,000 Total

liabilities 131,961 88,541 Shareholders' equity Common shares of

Xyratex Ltd (in thousands), par value $0.01 per share 70,000

authorized, 28,425 and 28,043 issued and outstanding 284 280

Additional paid-in capital 333,515 329,267 Accumulated other

comprehensive income (loss) (869) 755 Accumulated deficit (185,251)

(213,601) Total shareholders' equity 147,679 116,701 Total

liabilities and shareholders' equity $279,640 $205,242 XYRATEX LTD

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS Nine

Months Ended August 31, August 31, 2005 2004 (US dollars in

thousands) Cash flows from operating activities: Net income $28,350

$(130,453) Adjustments to reconcile net income to net cash provided

by operating activities: Depreciation 4,952 3,890 Amortization of

intangible assets 1,560 773 Non-cash equity compensation 621

167,552 Bonus paid by trust 144 -- Gain on sale of assets -- (36)

Supplier note receivable -- (6,000) Changes in assets and

liabilities, net of impact of acquisitions and divestitures

Accounts receivable (11,376) (7,314) Inventories (26,689) (5,009)

Prepaid expenses and other current assets (2,648) (2,686) Accounts

payable 14,113 7,775 Customer advance -- (1,073) Employee

compensation and benefits payable 189 (3,587) Deferred revenue

5,604 (9,806) Income taxes payable (183) 225 Deferred income taxes

5,172 (3,510) Amount payable to related party -- 339 Other accrued

liabilities 734 940 Net cash provided by operating activities

20,543 12,020 Cash flows from investing activities: Investments in

property, plant and equipment (9,666) (6,403) Dispositions of

property, plant and equipment -- 36 Loan to acquiree (2,500) --

Acquisition of business, net of cash received (6,473) (6,015)

Repayment of supplier note receivable -- 6,000 Net cash used in

investing activities (18,639) (6,382) Cash flows from financing

activities: Net payments of short-term borrowings -- (133) Payment

of acquisition note payable (2,000) -- Payments of long-term

borrowings (3,000) (3,000) Proceeds from issuance of shares 2,041

52,984 Net cash provided by (used in) financing activities (2,959)

49,851 Change in cash and cash equivalents (1,055) 55,489 Cash and

cash equivalents at beginning of period 63,495 2,008 Cash and cash

equivalents at end of period $62,440 $57,497 XYRATEX LTD UNAUDITED

RECONCILIATION OF GAAP NET INCOME FROM CONTINUING OPERATIONS TO

NON-GAAP NET INCOME Three Months Ended GAAP Non-GAAP Non-GAAP

August 31, Adjustment August 31, 2005 (a) 2005 (US dollars in

thousands, except per share amounts) Revenues $163,918 $163,918

Cost of revenues 130,788 130,788 Gross profit 33,130 33,130

Operating expenses: Research and development - other 14,062 14,062

Total research and development 14,062 14,062 Selling, general and

administrative - non cash equity compensation 240 (240) -- Selling,

general and administrative - other 9,164 9,164 Total selling,

general and administrative 9,404 9,164 Amortization of intangible

assets 834 (834) -- In process research and development -- -- Total

operating expenses 24,300 23,226 Operating income 8,830 9,904

Interest income, net 351 351 Income before income taxes 9,181

10,255 Provision for income taxes 1,324 459 1,783 Net income $7,857

$8,472 Pro forma net earnings per common share Basic $0.28 $0.30

Diluted $0.27 $0.29 Weighted-average common shares (in thousands),

used in computing the pro forma net earnings per share: Basic

28,413 28,413 Diluted 29,079 29,079 XYRATEX LTD UNAUDITED

RECONCILIATION OF GAAP NET INCOME FROM CONTINUING OPERATIONS TO

NON-GAAP NET INCOME Nine Months Ended GAAP Non-GAAP Non-GAAP August

31, Adjustment August 31, 2005 (a) 2005 (US dollars in thousands,

except per share amounts) Revenues $476,045 $476,045 Cost of

revenues 375,981 375,981 Gross profit 100,064 100,064 Operating

expenses: Research and development - other 37,482 37,482 Total

research and development 37,482 37,482 Selling, general and

administrative - non cash equity compensation 621 (621) -- Selling,

general and administrative - other 26,483 26,483 Total selling,

general and administrative 27,104 26,483 Amortization of intangible

assets 1,560 (1,560) -- In process research and development 2,230

(2,230) -- Total operating expenses 68,376 63,965 Operating income

31,688 36,099 Interest income, net 1,020 1,020 Income before income

taxes 32,708 37,119 Provision for income taxes 4,358 1,346 5,704

Net income $28,350 $31,415 Pro forma net earnings per common share

Basic $1.00 $1.11 Diluted $0.98 $1.08 Weighted-average common

shares (in thousands), used in computing the pro forma net earnings

per share: Basic 28,302 28,302 Diluted 29,052 29,052 XYRATEX LTD

UNAUDITED RECONCILIATION OF GAAP NET INCOME FROM CONTINUING

OPERATIONS TO NON-GAAP NET INCOME Three Months Ended GAAP Non-GAAP

Non-GAAP August 31, Adjustment August 31, 2004 (a) 2004 (US dollars

in thousands, except per share amounts) Revenues $114,906 $114,906

Cost of revenues - non cash equity compensation 7,791 (7,791) --

Cost of revenues - other 88,848 88,848 Total cost of revenues

96,639 88,848 Gross profit 18,267 26,058 Operating expenses:

Research and development - non cash equity compensation 23,876

(23,876) -- Research and development - other 9,660 9,660 Total

research and development 33,536 9,660 Selling, general and

administrative - non cash equity compensation 135,885 (135,885) --

Selling, general and administrative - other 7,538 7,538 Total

selling, general and administrative 143,423 7,538 Amortization of

intangible assets 378 (378) -- Other costs 726 (726) -- Total

operating expenses 178,063 17,198 Operating income (loss) (159,796)

8,860 Interest income, net 77 77 Income (loss) from continuing

operations before income taxes (159,719) 8,937 Provision (benefit)

for income taxes (6,338) 8,287 1,949 Net income (loss) from

continuing operations $(153,381) $6,988 Pro forma net earnings per

common share Basic $(5.67) $0.26 Diluted $(5.67) $0.25

Weighted-average common shares (in thousands), used in computing

pro forma net earnings per share: Basic 27,060 27,060 Diluted

27,060 27,625 XYRATEX LTD UNAUDITED RECONCILIATION OF GAAP NET

INCOME FROM CONTINUING OPERATIONS TO NON-GAAP NET INCOME Nine

Months Ended GAAP Non-GAAP Non-GAAP August 31, Adjustment August

31, 2004 (a) 2004 (US dollars in thousands, except per share

amounts) Revenues $342,313 $342,313 Cost of revenues - non cash

equity compensation 7,791 (7,791) -- Cost of revenues - other

264,107 264,107 Total cost of revenues 271,898 264,107 Gross profit

70,415 78,206 Operating expenses: Research and development -

development arrangement (6,000) 6,000 -- Research and development -

non cash equity compensation 23,876 (23,876) -- Research and

development - other 26,832 26,832 Total research and development

44,708 26,832 Selling, general and administrative - non cash equity

compensation 135,885 (135,885) -- Selling, general and

administrative - other 20,121 20,121 Total selling, general and

administrative 156,006 20,121 Amortization of intangible assets 772

(772) -- Other costs 2,589 (2,589) -- Total operating expenses

204,075 46,953 Operating income (loss) (133,660) 31,253 Interest

income (expense), net 905 (933) (28) Income (loss) from continuing

operations before income taxes (132,755) 31,225 Provision (benefit)

for income taxes (2,302) 8,125 5,823 Net income (loss) from

continuing operations $(130,453) $25,402 Pro forma net earnings per

common share Basic $(5.26) $1.02 Diluted $(5.26) $1.00

Weighted-average common shares (in thousands), used in computing

pro forma net earnings per share: Basic 24,797 24,797 Diluted

24,797 25,458 (a) Non-GAAP Adjustment for the three and nine month

periods ended August 31, 2005 includes non-cash equity compensation

expense and non-cash amortization of intangible assets and the

related tax effect. Non-GAAP adjustment for the nine months ended

August 31, 2005 also includes in process research and development

expense and the related tax effect. Non-GAAP Adjustment for the

three and nine month periods ended August 31, 2004 includes non

cash equity compensation expense and the related tax effect,

expenses recorded in connection with our preparation for our

initial public offering and non-cash amortization of intangible

assets and the related tax effect. Non-GAAP Adjustment for the nine

months ended August 31, 2004 also includes elimination of the bad

debt allowance on a supplier loan of $6,000,000 and accrued

interest of $933,000 together with the related tax on the accrued

interest. We believe these Non-GAAP measures are useful to

investors because they provide an alternative method of measuring

the operating performance of our business by excluding certain

expenses, gains and losses which we believe are not indicative of

our core operating results. (b) Pro forma earnings per share

reflects the conversion of Xyratex Group Limited class A and class

B preferred ordinary shares and class C ordinary shares to common

shares of Xyratex Ltd on completion of its initial public offering,

on June 29, 2004. DATASOURCE: Xyratex Ltd CONTACT: Investor

Relations, Brad Driver of Xyratex, +1-408-325-7260, ; or Public

Relations, Curtis Chan of CHAN & ASSOCIATES, INC.,

+1-714-447-4993, , for Xyratex Ltd Web site:

http://www.xyratex.com/investors Web site: http://www.xyratex.com/

Copyright

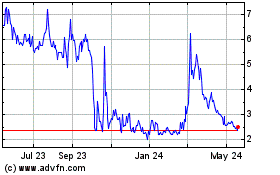

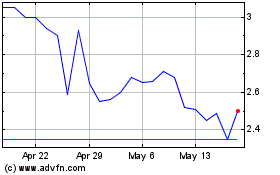

XORTX Therapeutics (NASDAQ:XRTX)

Historical Stock Chart

From Jul 2024 to Aug 2024

XORTX Therapeutics (NASDAQ:XRTX)

Historical Stock Chart

From Aug 2023 to Aug 2024