0000890447

false

0000890447

2024-05-23

2024-05-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 23, 2024

VERTEX ENERGY, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

001-11476 |

94-3439569 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

1331 Gemini Street

Suite 250

Houston, Texas |

77058 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s

telephone number, including area code: (866) 660-8156

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common

Stock,

$0.001 Par Value Per Share |

VTNR |

The NASDAQ

Stock Market LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.01 |

Entry

into a Material Definitive Agreement. |

On

May 23, 2024, Vertex Refining Alabama LLC (“Vertex Refining”), a wholly-owned subsidiary of Vertex Energy, Inc. (the

“Company”, “we” and “us”), Macquarie Energy North America Trading Inc. (“Macquarie”),

the Company and Vertex Renewables Alabama LLC, the Company’s wholly-owned subsidiary (“Vertex Renewables”),

entered into Amendment No. 5 to Supply and Offtake Agreement (“Amendment No. 5”).

Amendment

No. 5 amended that certain April 1, 2022 Supply and Offtake Agreement entered into between Vertex Refining and Macquarie (as amended

from time to time, the “Supply and Offtake Agreement”), to, among other things, confirm the terms of the guaranty

agreement discussed below in Item 1.02 and confirm existing security. The Company and Vertex Renewables were party to Amendment No. 5

solely for the purposes of confirming the terms thereof in connection with a guaranty in favor of Macquarie, whereby each of such parties

agreed to guaranty the obligations of Vertex Refining under the Supply and Offtake Agreement.

The

foregoing description of Amendment No. 5 does not purport to be complete and is qualified in its entirety by reference to the full text

of Amendment No. 5, which is filed as Exhibit 10.1 to this Current Report on Form 8-K, and is incorporated into

this Item 1.01 by reference in its entirety.

Item

1.02 Termination of a Material Definitive Agreement.

On

May 23, 2024, Vertex Refining, Macquarie, the Company and Vertex Renewables, entered into a Termination

and Release Agreement (the “Termination and Release Agreement”).

Macquarie

and Vertex Renewables entered into a supply and offtake agreement dated May 26, 2023, as amended from time to time (the “Supply

and Offtake Agreement”) and certain other Transaction Documents (as defined in the Supply and Offtake Agreement).

The

Company and Macquarie entered into a guaranty agreement dated May 26, 2023 in favor of Macquarie (the “Parent Guaranty”)

and Vertex Refining and Macquarie entered into a guaranty agreement dated May 26, 2023 in favor of Macquarie (the “Vertex Refining

Guaranty” and together with the Parent Guaranty, the “Guaranties” and each a “Guaranty”),

in each case, with respect to the Company’s obligations under the Supply and Offtake Agreement.

Vertex

Renewables and Macquarie agreed to terminate the Supply and Offtake Agreement and all Transaction Documents (excluding the Guaranties)

with effect from (and including) May 24, 2024 but subject to and in accordance with the terms of the Termination and Release Agreement

(the “Renewables Early Termination”).

The

parties to the Termination and Release Agreement agreed that on May 24, 2024 (such date, the “Renewables Early Termination Date”):

| (A) | the

Supply and Offtake Agreement, and related agreements entered into therewith (the “Transaction

Documents”) entered into between the parties shall immediately be terminated

and cease to be in force and effect; |

| (B) | each

party will be irrevocably and unconditionally released and discharged from all its present

and future obligations, claims and liabilities (both actual and contingent (including, without limitation, guarantee obligations) and

whether as primary obligor or guarantor, as surety or in any other capacity whatsoever) under, pursuant to or in connection with the

Transaction Documents; and |

| (C) | any

power of attorney granted by any party to the other party

under, pursuant to or in connection with any of the Transaction Documents will be irrevocably and unconditionally cancelled, terminated

and revoked. |

No

material termination penalties were incurred by the Company, Vertex Refining, and Vertex Renewables in connection with the Termination

and Release Agreement.

The

foregoing description of the Termination and Release Agreement does not purport to be complete and is qualified in its entirety by reference

to the full text of the Termination and Release Agreement, which is filed as Exhibit 10.2 to this Current Report

on Form 8-K, and is incorporated into this Item 1.02 by reference in its entirety.

| Item

9.01 |

Financial

Statements and Exhibits. |

| Exhibit

No. |

|

Description |

|

| |

|

|

|

| 10.1* |

|

Amendment

No. 5 to Supply and Offtake Agreement dated and effective May 23, 2024, between Vertex Refining Alabama LLC, Vertex Energy, Inc.,

Vertex Renewables Alabama LLC and Macquarie Energy North America Trading Inc. |

| 10.2*+ |

|

Termination

and Release Agreement |

| 104 |

|

Inline

XBRL for the cover page of this Current Report on Form 8-K |

| |

+ |

Certain

schedules, annexes and similar attachments have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted

schedule or exhibit will be furnished supplementally to the Securities and Exchange Commission upon request; provided, however that

Vertex Energy, Inc. may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended,

for any schedule or exhibit so furnished. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

VERTEX

ENERGY, INC. |

| |

|

| Date:

May 30, 2024 |

By: |

/s/

Chris Carlson |

| |

|

Chris

Carlson |

| |

|

Chief

Financial Officer |

VERTEX ENERGY, INC. 8-K

Exhibit 10.1

EXECUTION

VERSION

| (1) | MACQUARIE

ENERGY NORTH AMERICA TRADING INC. |

| (2) | VERTEX

REFINING ALABAMA LLC |

| (3) | Vertex

Renewables Alabama llc |

amendment

agreement No. 5

in

respect of a supply and offtake agreement dated april 1, 2022 and certain other transaction documents

CONTENTS

SECTION

| 1 |

interpretation |

1 |

| 2 |

amendment of the Transaction Documents |

2 |

| 3 |

confirmation of guaranty |

2 |

| 4 |

confirmation of EXISTING SECURITY |

2 |

| 5 |

Representations |

3 |

| 6 |

continuity and RATIFICATION |

3 |

| 7 |

MISCELLANEOUS |

3 |

| 8 |

Governing law and jurisdiction |

3 |

Schedule

| Schedule

1 |

5 |

| |

Amendment to Supply and Offtake Agreement |

5 |

CONTENTS PAGE 1

| THIS AGREEMENT (this “Agreement”)

is dated |

May 23,

2024 |

BETWEEN:

| (1) | MACQUARIE

ENERGY NORTH AMERICA TRADING INC., a Delaware corporation, located at 500 Dallas

Street, Suite 3300 Houston, Texas 77002 (“Macquarie”); |

| (2) | VERTEX

REFINING ALABAMA LLC, Delaware limited liability company, located at 1331 Gemini

Street, Suite 250, Houston, Texas, TX 77058-2764 United States (the “Company”); |

| (3) | VERTEX

ENERGY, INC., a Nevada corporation, located at 1331 Gemini Street, Suite 250, Houston,

Texas, TX 77058-2764 United States (the “Parent”); and |

| (4) | VERTEX

RENEWABLES ALABAMA LLC, Delaware limited liability company, located at 1331 Gemini

Street, Suite 250, Houston, Texas, TX 77058-2764 United States (“Vertex Renewables”); |

each

referred to individually as a “Party” and collectively as the “Parties”.

RECITALS

| (A) | WHEREAS,

Macquarie and the Company entered into a supply and offtake agreement dated April 1,

2022, as amended on May 26, 2023, September 1, 2023, December 8, 2023 and May 17, 2024

(as so amended, the “Supply and Offtake Agreement”) and certain other

Transaction Documents (as defined in the Supply and Offtake Agreement). |

| (B) | WHEREAS,

the Macquarie and Vertex Renewables entered into a supply and offtake agreement dated

May 26, 2023 (the “Vertex Renewables Supply and Offtake Agreement”).

The Parties have entered into a termination and release agreement dated May 23, 2024

pursuant to which the Vertex Renewables Supply and Offtake Agreement and certain other

“Transaction Documents” (as defined therein) will be terminated. In connection

with the termination of the Vertex Renewables Supply and Offtake Agreement, the Company

and Macquarie wish to make certain amendments to the terms of the Supply and Offtake

Agreement. |

| (C) | WHEREAS,

the Parent and Macquarie entered into a guaranty agreement dated April 1, 2022 in

favour of Macquarie (the “Parent Guaranty”) and Vertex Renewables

and Macquarie entered into a guaranty dated May 26, 2023 (the “Vertex Renewables

Guaranty” and together with the Parent Guaranty, the “Guaranties”

and each a “Guaranty”), in each case, with respect to the Company’s

obligations under the Supply and Offtake Agreement. |

| (D) | WHEREAS,

in connection with the amendments to be made to the Supply and Offtake Agreement

and certain other Transaction Documents, the Parent and Vertex Renewables are a party

to this Agreement solely for the purpose of confirming its obligations under the Guaranty

to which it is a party, which will remain in full force and effect notwithstanding the

amendments made to the Supply and Offtake Agreement and such other Transaction Documents. |

| (E) | NOW,

THEREFORE, in exchange for good and valuable consideration (the receipt and sufficiency

of which are hereby acknowledged and confirmed), the Parties hereto agree as follows. |

In

this Agreement:

“Amended

Supply and Offtake Agreement” means the Supply and Offtake Agreement as amended by this Agreement.

“Effective

Date” means the date of this Agreement.

“Guaranties”

and “Guaranty” has the meaning given to those terms in Recital (C).

“Supply

and Offtake Agreement” has the meaning given to that term in Recital (A).

| (a) | Unless

a contrary indication appears, terms defined in or construed for the purposes of the

Supply and Offtake Agreement have the same meanings when used in this Agreement. |

| (b) | The

principles of construction as set out in section 1.2 (Construction of Agreement)

of the Supply and Offtake Agreement shall have effect as though they were set out in

full in this Agreement but so that each reference in that section to “this Agreement”

shall be read as a reference to this Agreement. |

| (c) | In

this Agreement any reference to an Article, Section or Schedule is, unless the context

otherwise requires, a reference to an article, section or schedule of this Agreement. |

No

Person other than the Parties shall have any rights hereunder or be entitled to rely on this Agreement and all third-party beneficiary

rights are hereby expressly disclaimed.

Macquarie

and the Company agree that this Agreement shall be a Transaction Document for the purposes of the Supply and Offtake Agreement.

Each

of the Parent and Vertex Renewables is entering into this Agreement solely for the purposes set out in Section 3 (Confirmation

of Guaranty) and Section 5.1(c) (Representations).

| 2 | amendment

of the Transaction Documents |

| 2.1 | Macquarie

and the Company agree that, on and from the Effective Date, the Supply and Offtake Agreement

shall be amended on the terms set out in Schedule 1 to this Agreement. |

| 2.2 | On

and from the Effective Date the rights and obligations of the parties to the Supply and

Offtake Agreement shall be governed by and construed in accordance with the provisions

of the Supply and Offtake Agreement as amended by this Agreement, and all references

in any of the Transaction Documents to the Supply and Offtake Agreement (howsoever described)

shall mean the Supply and Offtake Agreement as amended hereby. |

| 3 | confirmation

of guaranty |

| 3.1 | By

executing this Agreement, the Parent and Vertex Renewables: |

| (a) | consents

to the Company entering into this Agreement; and |

| (b) | confirms

and restates that its obligations under the Guaranty to which it is a party shall continue

in full force and effect as a continuing security for the payment and discharge of the

Guaranteed Obligations (as defined in the Guaranty to which it is a party), including

without limitation, all amounts owing by the Company to Macquarie in relation to the

Transaction Documents and the Transaction Obligations. |

| 4 | confirmation

of EXISTING SECURITY |

| (a) | The

Company confirms that each of the existing Lien Documents that it has executed in favour

of Macquarie shall continue in full force and effect as a continuing security for the

obligations of the Company pursuant to the Amended Supply and Offtake Agreement and the

other Transaction Documents. |

| (b) | Each

of Macquarie and the Company acknowledge and agree that the Liens granted in favour of

Macquarie pursuant to the Pledge and Security Agreement are not intended to (and do not)

secure the obligations owed by the Company to Macquarie pursuant to the guaranty dated

as of May 26, 2023 from the Company and provided to Macquarie in connection with the

Vertex Renewables Transaction Documents (as defined in the Vertex Renewables SOA). |

| 5.1 | Without

prejudice to the rights of Macquarie which have arisen on or before the Effective Date: |

| (a) | the

Company and Macquarie each repeat the representations and warranties set out in section

19.1 (Mutual Representations) of the Amended Supply and Offtake Agreement; |

| (b) | the

Company repeats the representations and warranties set out in section 19.2 (Company’s

Representations) of the Amended Supply and Offtake Agreement; and |

| (c) | each

of the Parent and Vertex Renewables repeats the representations and warranties set out

in section 5.1 (Representations and Warranties) of the Guaranty to which it is

a party, |

in

each case on the date of this Agreement and by reference to the facts and circumstances then existing.

| 6 | continuity

and RATIFICATION |

| 6.1 | The

provisions of the Transaction Documents shall, save as amended by this Agreement, continue

in full force and effect. |

| 6.2 | The

execution, delivery and effectiveness of this Agreement shall not operate as a waiver

of any right, power or remedy of Macquarie or any of its assignees under the Amended

Supply and Offtake Agreement or any other Transaction Document, instrument, or agreement

executed in connection therewith, nor constitute a waiver of any provision contained

therein. |

The

Company agrees to take all further actions and execute all further documents (and to procure the doing of all acts and things

and the execution of all documents) as Macquarie may from time to time reasonably request to carry out the transactions contemplated

by this Agreement and all other agreements executed and delivered in connection herewith.

| 7.2 | Incorporation

of Terms |

The

provisions of section 22.5 (Indemnification; Expenses), section 25 (Confidentiality) and sections 27 (Assignment)

to 32 (Miscellaneous) (inclusive) of the Amended Supply and Offtake Agreement shall apply to this Agreement as if set out

in full in this Agreement and as if references in those sections to “this Agreement”, “either Party” and

“neither Party” are references to this Agreement, “each Party” and “no Party”, respectively.

| 8 | Governing

law and jurisdiction |

| 8.1 | THIS

AGREEMENT SHALL BE GOVERNED BY, CONSTRUED AND ENFORCED UNDER THE LAWS OF THE STATE OF

NEW YORK WITHOUT GIVING EFFECT TO ITS CONFLICT OF LAWS PRINCIPLES THAT WOULD REQUIRE

THE APPLICATION OF THE LAWS OF ANOTHER STATE. |

| 8.2 | EACH

OF THE PARTIES HEREBY IRREVOCABLY SUBMITS TO THE EXCLUSIVE JURISDICTION OF ANY FEDERAL

OR STATE COURT OF COMPETENT JURISDICTION SITUATED IN THE CITY OF NEW YORK, (WITHOUT RECOURSE

TO ARBITRATION UNLESS BOTH PARTIES AGREE IN WRITING), AND TO SERVICE OF PROCESS BY CERTIFIED

MAIL, DELIVERED TO THE PARTY AT THE ADDRESS INDICATED IN ARTICLE 28 OF THE SUPPLY AND

OFFTAKE AGREEMENT. EACH PARTY HEREBY IRREVOCABLY WAIVES, TO THE |

| | FULLEST EXTENT PERMITTED

BY APPLICABLE LAW, ANY OBJECTION TO PERSONAL JURISDICTION, WHETHER ON GROUNDS OF VENUE,

RESIDENCE OR DOMICILE. |

| 8.3 | EACH

PARTY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE

TO A TRIAL BY JURY IN RESPECT OF ANY PROCEEDINGS RELATING TO THIS AGREEMENT. |

[Remainder

of page intentionally left blank.]

Schedule

1

Amendment

to Supply and Offtake Agreement

The

Supply and Offtake Agreement shall be amended as follows:

| 1 | The

definition of “Base Agreements” in Clause 1.1 (Definitions)

shall be deleted in its entirety and replaced with the following: |

““Base

Agreements” means (a) the BWC Agreements (but only from (and including) the BWC Inclusion Date); (b) the Center Point

Agreements (but only from (and including) the Center Point Inclusion Date); (c) the Plains Agreements; (d) any agreements hereafter

entered into between the Company and any third party pursuant to which the Company acquires any rights to use storage tanks or

pipelines that the Company elects to be treated as, or that are, Crude Storage Tanks, Included Crude Pipelines, Included Product

Pipelines, the Included Product Tanks or Company Storage Locations, and (e) any agreement entered into by Company with Parent

or any of Parent’s Subsidiaries, relating to the Refinery and/or the operation or maintenance of the Refinery, including

any related agreements related to Crude Oil and Products in connection with the Refinery, provided, however, that the Vertex

Renewables SOA and the Vertex Renewables Transaction Documents entered into in connection therewith shall not constitute “Base

Agreements” for the purposes of this Agreement.”.

| 2. | The

following new definitions are inserted in Clause 1.1 (Definitions) in alphabetical

order as follows: |

“Vertex

Renewables Guarantor” means:

| (a) | in

respect of the Vertex Refining Guaranty, the Company; and |

| (b) | in

respect of the Parent Renewables Guaranty, the Parent, |

(collectively,

the “Vertex Renewables Guarantors”).”.

“Vertex

Renewables SOA Guaranties” means (a) the Vertex Refining Guaranty; and (b) the guaranty entered into between Macquarie

and the Company on or around the “Effective Date” (as defined in the Vertex Renewables SOA) and pursuant to which

the Parent guarantees the obligations of Vertex Renewables under the Vertex Renewables Transaction Documents (the “Parent

Renewables Guaranty”) (each, a “Vertex Renewables SOA Guaranty”“.

| 3. | Section

3.2(a) (Early Termination Rights) shall be deleted in its entirety and replaced

with the following: |

| “(a) | Either

Party may elect to terminate this Agreement by providing the other Party notice of any

such election pursuant to Article 28; provided that no such election shall be

effective until the day falling 180 calendar days following the date on which such notice

is delivered (the “Optional Early Termination Date”). For the avoidance

of doubt, the Termination Amount for any early termination pursuant to this paragraph

shall be calculated in accordance with Section 21.2.”. |

| 4. | Section

20.1(o) (Guarantor) is deleted in its entirety and replaced with the following: |

| “(o) | Guarantor.

Any of the following: (i) a Guarantor or a Vertex Renewables Guarantor fails to perform

or otherwise defaults in any payment obligation under the Guaranty or Vertex Renewables

SOA Guaranty to which it is a party, (ii) a Guarantor or a Vertex Renewables Guarantor

becomes Bankrupt, (iii) any Guaranty or any Vertex Renewables SOA Guaranty expires (other

than in accordance with its terms or pursuant to any mutually agreed termination arrangement)

or terminates or ceases to be in full force and effect prior to (x) in the case of the

Guaranties, the satisfaction of all obligations of the Company to Macquarie under this

Agreement and the other Transaction Documents; or (y) in the case of the Vertex Renewables

Guaranties, Macquarie determining that are no further actual or potential liabilities

of Vertex Renewables to Macquarie that could arise after the termination of the Vertex

Renewables SOA, or (iv) a Guarantor or a Vertex Renewables Guarantor disaffirms, disclaims,

repudiates or rejects, in whole or in part, or challenges the validity of |

| | the

Guaranty or Vertex Renewables SOA Guaranty to which it is a party or any of the Intercreditor Provisions (as defined below); or”. |

| 5. | Section

20.1(t) (Intercreditor Provisions) is amended by deleting the words “; or”

immediately at the end of sub-paragraph (ii) thereof and replacing them with a full stop. |

| 6. | Section

20.1(u) (Vertex Renewables SOA) and Section 20.3(iv) (Vertex Renewables SOA)

are deleted in their entirety. |

| 7. | Sub-section

(5) of Schedule O (Form of Included Storage Locations) is amended by deleting

the word “Terminalling” at the beginning thereof; and replacing them with

the words “From and after the BWC Inclusion Date, the terminalling”. |

| |

EXECUTION

PAGES

Executed

by MACQUARIE ENERGY NORTH AMERICA TRADING INC. acting by:

|

| /s/

Brian Houstoun |

and |

/s/

Travis McCullough |

| Name:

Brian Houstoun |

|

Name:

Travis McCullough |

| Title:

Senior Managing Director |

|

Title:

Division Director |

| Executed

by VERTEX REFINING ALABAMA LLC acting by: |

| |

| /s/

Benjamin P. Cowart |

|

|

Name:

Benjamin P. Cowart

Title:

President and CEO |

|

|

| Executed

by VERTEX ENERGY, INC. acting by: |

| |

| /s/

Benjamin P. Cowart |

|

|

Name:

Benjamin P. Cowart

Title:

President and CEO |

|

|

| |

|

|

| Executed

by VERTEX RENEWABLES ALABAMA LLC acting by: |

| |

| /s/

Benjamin P. Cowart |

|

|

Name:

Benjamin P. Cowart

Title:

President and CEO |

|

|

[Signature

Page to Amendment Agreement No. 5]

VERTEX ENERGY, INC. 8-K

Exhibit

10.2

EXECUTION VERSION

| (1) | MACQUARIE

ENERGY NORTH AMERICA TRADING INC. |

| (2) | Vertex

Renewables Alabama llc |

| (3) | VERTEX

REFINING ALABAMA LLC |

tERMINATION

AND Release agreement

in

respect of a supply and offtake agreement dated mAY 26, 2023 and certain other transaction documents

CONTENTS

SECTION

| 1 |

interpretation |

1 |

| 2 |

RENEWABLES EARLY TERMINATION |

2 |

| 3 |

Termination of certain contractual arrangements |

4 |

| 4 |

confirmation of guaranty |

5 |

| 5 |

Representations |

5 |

| 6 |

MISCELLANEOUS |

5 |

| 7 |

Governing law and jurisdiction |

6 |

| THIS AGREEMENT

(this “Agreement”) is dated | |

May 23, 2024 |

BETWEEN:

| (1) | MACQUARIE

ENERGY NORTH AMERICA TRADING INC., a Delaware corporation, located at 500 Dallas

Street, Suite 3300 Houston, Texas 77002 (“Macquarie”); |

| (2) | VERTEX

RENEWABLES ALABAMA LLC, a Delaware limited liability company, located at 1331 Gemini

Street, Suite 250, Houston, Texas, TX 77058-2764 United States (the “Company”); |

| (3) | VERTEX

REFINING ALABAMA LLC, a Delaware limited liability company, located at 1331 Gemini

Street, Suite 250, Houston, Texas, TX 77058-2764 United States (“Vertex Refining”); |

| (4) | VERTEX

ENERGY, INC., a Nevada corporation, located at 1331 Gemini Street, Suite 250, Houston,

Texas, TX 77058-2764 United States (the “Parent”); and |

each

referred to individually as a “Party” and collectively as the “Parties”.

RECITALS

| (A) | WHEREAS,

Macquarie and the Company entered into a supply and offtake agreement dated May 26, 2023,

as amended from time to time (the “Supply and Offtake Agreement”) and

certain other Transaction Documents (as defined in the Supply and Offtake Agreement). |

| (B) | WHEREAS,

the Parent and Macquarie entered into a guaranty agreement dated May 26, 2023 in

favour of Macquarie (the “Parent Guaranty”) and Vertex Refining and

Macquarie entered into a guaranty agreement dated May 26, 2023 in favour of Macquarie

(the “Vertex Refining Guaranty” and together with the Parent Guaranty,

the “Guaranties” and each a “Guaranty”), in each case,

with respect to the Company’s obligations under the Supply and Offtake Agreement. |

| (C) | WHEREAS,

the Company and Macquarie have agreed to terminate the Supply and Offtake Agreement and

all Transaction Documents with effect from (and including) May 24, 2024 but subject to

and in accordance with the terms of this Agreement (the “Renewables Early Termination”). |

| (D) | NOW,

THEREFORE, in exchange for good and valuable consideration (the receipt and sufficiency

of which are hereby acknowledged and confirmed), the Parties hereto agree as follows. |

In

this Agreement:

“C.T.”

means the prevailing time in the Central time zone of the United States of America.

“Effective

Date” means the date of this Agreement.

“Guaranties”

and “Guaranty” has the meaning given to those terms in Recital (B).

“Renewables

Early Termination Pricing Date” means May 23, 2024.

“Storage

Rights Agreement” means, collectively, the BWC Storage Rights Agreement and the

Center Point Storage Rights Agreement.

“Supply

and Offtake Agreement” has the meaning given to that term in Recital (A).

| (a) | Unless

a contrary indication appears, terms defined in or construed for the purposes of the

Supply and Offtake Agreement have the same meanings when used in this Agreement. |

| (b) | The

principles of construction as set out in section 1.3 (Construction of Agreement)

of the Supply and Offtake Agreement shall have effect as though they were set out in

full in this Agreement but so that each reference in that section to “this Agreement”

shall be read as a reference to this Agreement. |

| (c) | In

this Agreement any reference to an Article, Section, paragraph, sub-paragraph, Recital

or Schedule is, unless the context otherwise requires, a reference to an article, section,

paragraph, sub-paragraph, recital or schedule of this Agreement. |

No

Person other than the Parties shall have any rights hereunder or be entitled to rely on this Agreement and all third-party beneficiary

rights are hereby expressly disclaimed.

Macquarie

and the Company agree that this Agreement shall be a Transaction Document for the purposes of the Supply and Offtake Agreement.

Each

of the Parent and Vertex Renewables is entering into this Agreement solely for the purposes set out in Section 4 (Confirmation

of Guaranty) and Section 5.1(c) (Representations).

| 2 | RENEWABLES

EARLY TERMINATION |

| 2.1 | Subject

to Section 2.3 and Section 3.6 below and notwithstanding anything to the contrary in

Transaction Documents, the Parties hereby irrevocably and unconditionally (without representation,

warranty or recourse, whether express or implied) agree that, with effect from (and including)

May 24, 2024 or, if later, the date on which all amounts payable in connection with the

Renewables Early Termination have been paid in full (such date, the “Renewables

Early Termination Date”): |

| (a) | the

Supply and Offtake Agreement, the Storage and Services Agreement, the Fee Letter, the

Independent Amount Letter, the Lien Documents, the Master Agreement, the BWC Storage

Rights Agreement and the Center Point Storage Rights Agreement shall immediately be terminated

and cease to be in force and effect; |

| (b) | each

Party will be irrevocably and unconditionally released and discharged from all its present

and future obligations, claims and liabilities (both actual and contingent (including,

without limitation, guarantee obligations) and whether as primary obligor or guarantor,

as surety or in any other capacity whatsoever) under, pursuant to or in connection with

the Transaction Documents; and |

| (c) | any

power of attorney granted by any Party to the other Party under, pursuant to or in connection

with any of the Transaction Documents will be irrevocably and unconditionally cancelled,

terminated and revoked. |

| 2.2 | In

order to give effect to the Renewables Early Termination: |

| (a) | solely

for the purposes of determining the Daily Permitted Feedstock Sales and the Daily Permitted

Renewable Product Sales on the Renewables Early Termination Pricing Date (and all amounts

payable in connection therewith) and without double-counting: |

| (i) | Daily

Permitted Feedstock Sales will be deemed to occur on the Renewables Early Termination

Pricing Date in respect of all Macquarie Permitted Feedstock Inventory in situ

at each applicable Included Permitted Feedstock Location; and |

| (ii) | Daily

Renewable Product Sales will be deemed to occur on the Renewables Early Termination Pricing

Date in respect of all Macquarie Renewable Product Inventory in situ at each Included

Renewable Product Location, |

in

each case, using, for these purposes, the Best Available Inventory Data as of the Renewables Early Termination Pricing Date and

accordingly, the Measured Permitted Feedstock Quantity for each Included Permitted Feedstock Location and the Measured Renewable

Product Quantity in each Included Renewable Product Tank shall be deemed to be zero on each day from (and including) the Renewables

Early Termination Pricing Date to (and including) the Renewables Early Termination Date;

| (b) | notwithstanding

anything to the contrary in the Supply and Offtake Agreement: |

| (i) | the

price used to determine the amount payable in connection with each Daily Permitted Feedstock

Sale and each Daily Renewable Product Sale shall be the Current Month Pricing Benchmark

for the applicable Pricing Group as of the Renewables Early Termination Pricing Date; |

| (ii) | no

Permitted Feedstock Monthly Handling Fee will be owed in respect of the sales contemplated

by Section 2.2(a) above and this Section 2.2(b); |

| (iii) | the

date that would (but for this sub-paragraph (iii)) have been the Monthly Determination

Date immediately following the Renewables Early Termination Pricing Date shall be accelerated

to the Renewables Early Termination Pricing Date and for the purposes of performing all

calculations required to be performed as of that deemed Monthly Determination Date (including,

without limitation, the Monthly True-Up Amount), the Delivery Month shall be deemed to

end on (and include) the Renewables Early Termination Pricing Date and for purposes of

such calculations, any fee, cost or expense ordinarily calculated on a monthly basis

without regard to days elapsed will be pro-rated to reflect the number of days in such

deemed Delivery Month, calculated on the basis of a 30-day month; and |

| (iv) | Macquarie

shall use commercially reasonable efforts to (x) notify the Company by e-mail of all

amounts payable in connection with the Daily Permitted Feedstock Sales, the Daily Renewable

Product Sales, the Monthly True-Up Amount and all other amounts payable in connection

with the Renewables Early Termination (the net amount being, the “Renewables

Early Termination Amount”) by no later than the end of the Renewables Early

Termination Pricing Date; and (y) deliver an invoice to the Company in respect of the

Renewables Early Termination Amount (or, to the extent that the Renewables Early Termination

Amount is payable by Macquarie, self invoice) by no later than 10 a.m. (CT) on the date

falling one (1) Business Day after the Renewables Early Termination Pricing Date, and,

in each case, Macquarie shall include a breakdown of the relevant calculation(s) by Pricing

Group; and |

| (v) | the

Renewables Early Termination Amount shall become due and payable on the later of (x)

the date falling one (1) Business Day after the Renewables Early Termination Pricing

Date; and (y) the date on which Macquarie has delivered an invoice to the Company (or,

if the Renewables Early Termination Amount is payable by Macquarie, submitted a self-invoice)

in respect of the Renewables Early Termination Amount (such date being, the “Renewables

Early Termination Payment Date”) and the provisions of Section 12.5 (Payment

Netting) of the Supply and Offtake Agreement shall apply; and |

| (c) | on

the Renewables Early Termination Payment Date, Macquarie shall either pay to the Company,

or apply towards satisfaction of all amounts due and payable by the Company on such date,

an amount equal to the balance of the Independent Amount held by Macquarie as of the

Renewables Early Termination Payment Date. |

| 2.3 | Notwithstanding

anything to the contrary in the contrary in this Agreement or the Transaction Documents,

Macquarie shall retain title to any Permitted Feedstock or Renewable Product held in

an Included Storage Location on and after the Renewables Early Termination Pricing Date

until the Renewables Early Termination Date has occurred. Macquarie shall be deemed to

certify, for the |

| | purposes of the Storage and Services Agreement and the Storage Rights

Agreement, either (x) if the Renewables Early Termination Amount is payable by Macquarie,

on the Renewables Early Termination Payment Date; or (y) if the Renewables Early Termination

Amount is payable by the Company, upon receipt by Macquarie of such Renewables Early

Termination Amount, that there is no Permitted Feedstock or Renewable Product to which

Macquarie has title within the Facilities (as defined in the Storage and Services Agreement)

or the Storage Facilities (as defined in the Storage Rights Agreement). |

| 3 | Termination

of certain contractual arrangements |

| 3.1 | As

soon as reasonably practicable following the entry into of this Agreement, Macquarie

and the Company shall deliver a notice to Idemitsu in writing (in substantially the form

appended to this Agreement as Schedule 1 (Form of Notice to Idemitsu)) and in

accordance with the terms of the Idemtisu Tripartite Agreement, notifying Idemitsu that

Macquarie and the Company (a) have agreed to terminate the Supply and Offtake Agreement

with effect from (and including) the Renewables Early Termination Date; and (b) are exercising

their right pursuant to section 6.1(c) of the Idemitsu Tripartite Agreement to terminate

the Idemitsu Tripartite Agreement with effect from (and including) the Renewables Early

Termination Date. |

| 3.2 | On

or promptly following (and, in any event, within five (5) Business Days of) the earlier

of (i) the Renewables Early Termination Date; and (ii) the date on which Macquarie determines,

acting in good faith and in a commercially reasonable manner, that it no longer has title

to any Permitted Feedstock or Renewable Product stored: |

| (a) | at

the Center Point Storage Facilities and/or the BWC Storage Facilities, Macquarie shall

deliver a notice to the Center Point Operator or the BWC Operator, as applicable, in

substantially the form appended hereto as Schedule 2 (Form of Notice to Third Party

Storage Provider) notifying them that the Contractual Arrangements (as defined in

the BWC Consent Letter or the Center Point Consent Letter, as applicable) have been terminated;

or |

| (b) | on

an Included Permitted Feedstock Barge, the Company shall, promptly following a request

by Macquarie, deliver a notice in writing to the relevant Barge Operator and the relevant

Barge Owner, in substantially the form appended hereto as Schedule 3 (Form of Notice

to each Barge Owner or Barge Operator) notifying them that such Barge Operator or

Barge Owner, as applicable, shall be released from their obligation to comply with the

terms of the irrevocable notices delivered to them by the Company. |

| 3.3 | Macquarie

agrees and acknowledges that all Liens granted to or held by Macquarie as security for

the Obligations (as defined in the Pledge and Security Agreement) under and in accordance

with the terms of the Pledge and Security Agreement shall be forever and irrevocably

satisfied, released and discharged on (x) if the Renewables Early Termination Amount

is payable by Macquarie, the Renewables Early Termination Payment Date; or (y) if the

Renewables Early Termination Amount is payable by the Company, the Renewables Early Termination

Date. Accordingly, on or promptly following the Renewables Early Termination Date and,

in any event, within one (1) Business Day following the Renewables Early Termination

Date: |

| (a) | Macquarie

shall deliver such documents and agreements as the Company (or its designee) may reasonably

request to evidence release of Macquarie’s Liens under the Pledge and Security Agreement

on either (x) the Renewables Early Termination Payment Date (if the Renewables Early

Termination Amount is payable by Macquarie; or (y) the Renewables Early Termination Date

(if the Renewables Early Termination Amount is payable by the Company), including, but

not limited to, in each case, any terminations and releases as may be reasonably requested

by the Company; |

| (b) | pursuant

to and in accordance with the terms of the Intercreditor Agreement, Macquarie shall agree

and acknowledge that the Discharge of Renewables Intermediation Facility Obligations

(as defined in the Intercreditor Agreement) has occurred, and therefore Macquarie (in

its capacity as Renewables Intermediation Facility Representative) shall notify the other

Representatives (as defined in the Intercreditor Agreement) that the Renewables Early

Termination Date has occurred; and |

| (c) | the

Company hereby authorizes Macquarie (or its designee) to file the UCC-3 termination statement(s)

with respect to the UCC-1 financing statement(s) filed in favor of Macquarie evidencing

such Liens, provided that the Company and its advisors shall have a reasonable

opportunity to review such UCC-3 termination statement(s) prior to filing. |

| 3.4 | By

no later than the date falling two (2) Business Days after the Renewables Early Termination

Date, Macquarie shall deliver a notice in writing to the Deposit Account Bank (in substantially

the form appended hereto as Schedule 4 (Form of Notice to the Deposit Account Bank))

notifying it that the Liens granted in favor of Macquarie pursuant to the Pledge and

Security Agreement have been released and accordingly, that the Deposit Account Control

Agreement shall be terminated with effect from the date of the notice; |

| 3.5 | Each

Party agrees to take all further actions and execute all further documents (and to procure

the doing of all acts and things and the execution of all documents) as any other Party

may from time to time reasonably request to carry out the transactions contemplated by

this Agreement and all other agreements executed and delivered in connection herewith

(including the provision of a pay-off letter to the extent required by any lender under

the Existing Financing Agreements or any other lender of any Vertex Party). |

| 3.6 | Neither

Section 2.1 above nor any other provision of this Agreement shall affect any rights,

remedies, obligations or liabilities of the Parties under the Transaction Documents that

have accrued prior to the date of this Agreement or which are expressed to survive termination

of any of the Transaction Documents. |

| 4 | confirmation

of guaranty |

| 4.1 | By

executing this Agreement, each of the Parent and Vertex Refining: |

| (a) | consents

to the Company entering into this Agreement; and |

| (b) | confirms

and restates that its obligations under the Guaranty to which it is a party shall, notwithstanding

the termination of each other Transaction Document, continue in full force and effect

as a continuing security for the payment and discharge of any actual or contingent Guaranteed

Obligations (as defined in the Guaranty to which it is a party and including, without

limitation, all amounts owing by the Company to Macquarie in relation to the Transaction

Obligations) to the extent that such Guaranteed Obligations relate to rights, remedies,

obligations or liabilities that have accrued prior to the date of this Agreement or which

are expressed to survive termination of any of the Transaction Documents. |

| 5.1 | Without

prejudice to the rights of Macquarie which have arisen on or before the Effective Date: |

| (a) | the

Company and Macquarie each repeat the representations and warranties set out in section

20.1 (Mutual Representations) of the Supply and Offtake Agreement; |

| (b) | the

Company repeats the representations and warranties set out in section 20.2 (Company’s

Representations) of the Supply and Offtake Agreement; and |

| (c) | each

of the Parent and Vertex Renewables repeats the representations and warranties set out

in section 5.1 (Representations and Warranties) of the Guaranty to which it is

a party, |

in

each case on the date of this Agreement and by reference to the facts and circumstances then existing.

| 6.1 | Incorporation

of Terms |

The

provisions of section 24 (Indemnification; Expenses), section 25 (Confidentiality) and sections 29 (Assignment)

to 34 (Miscellaneous) (inclusive) of the Supply and Offtake Agreement shall apply

to this Agreement as if set out in full

in this Agreement and as if references in those sections to “this Agreement”, “either Party” and “neither

Party” are references to this Agreement, “each Party” and “no Party”, respectively.

In

the event of any inconsistency between the terms of this Agreement and the Fee Letter or Independent Amount Letter, this Agreement

shall prevail but only to the extent of such inconsistency.

| 7 | Governing

law and jurisdiction |

| 7.1 | THIS

AGREEMENT SHALL BE GOVERNED BY, CONSTRUED AND ENFORCED UNDER THE LAWS OF THE STATE OF

NEW YORK WITHOUT GIVING EFFECT TO ITS CONFLICT OF LAWS PRINCIPLES THAT WOULD REQUIRE

THE APPLICATION OF THE LAWS OF ANOTHER STATE. |

| 7.2 | EACH

OF THE PARTIES HEREBY IRREVOCABLY SUBMITS TO THE EXCLUSIVE JURISDICTION OF ANY FEDERAL

OR STATE COURT OF COMPETENT JURISDICTION SITUATED IN THE CITY OF NEW YORK, (WITHOUT RECOURSE

TO ARBITRATION UNLESS BOTH PARTIES AGREE IN WRITING), AND TO SERVICE OF PROCESS BY CERTIFIED

MAIL, DELIVERED TO THE PARTY AT THE ADDRESS INDICATED IN ARTICLE 30 OF THE SUPPLY AND

OFFTAKE AGREEMENT. EACH PARTY HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED

BY APPLICABLE LAW, ANY OBJECTION TO PERSONAL JURISDICTION, WHETHER ON GROUNDS OF VENUE,

RESIDENCE OR DOMICILE. |

| 7.3 | EACH

PARTY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE

TO A TRIAL BY JURY IN RESPECT OF ANY PROCEEDINGS RELATING TO THIS AGREEMENT. |

[Remainder

of page intentionally left blank.]

EXECUTION PAGES

Executed by MACQUARIE ENERGY

NORTH AMERICA TRADING INC. acting by:

| /s/ Brian Houstoun |

and |

/s/ Travis McCullough |

| Name: Brian Houstoun |

|

Name: Travis McCullough |

| Title: Senior Managing Director |

|

Title: Division Director |

| Executed by VERTEX REFINING ALABAMA LLC acting by: |

| |

| /s/ Benjamin P. Cowart |

|

|

|

Name: Benjamin P. Cowart

Title: CEO and President |

|

|

| Executed

by VERTEX ENERGY, INC. acting by: |

| |

| /s/

Benjamin P. Cowart |

|

|

Name:

Benjamin P. Cowart

Title:

CEO and President |

|

|

| Executed

by VERTEX RENEWABLES ALABAMA LLC acting by: |

| |

| /s/

Benjamin P. Cowart |

|

|

Name:

Benjamin P. Cowart

Title:

CEO and President |

|

|

v3.24.1.1.u2

Cover

|

May 23, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 23, 2024

|

| Entity File Number |

001-11476

|

| Entity Registrant Name |

VERTEX ENERGY, INC.

|

| Entity Central Index Key |

0000890447

|

| Entity Tax Identification Number |

94-3439569

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

1331 Gemini Street

|

| Entity Address, Address Line Two |

Suite 250

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77058

|

| City Area Code |

(866)

|

| Local Phone Number |

660-8156

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock,

|

| Trading Symbol |

VTNR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

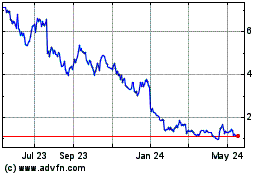

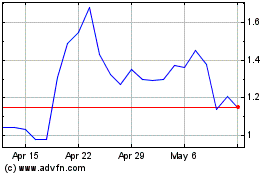

Vertex Energy (NASDAQ:VTNR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Vertex Energy (NASDAQ:VTNR)

Historical Stock Chart

From Nov 2023 to Nov 2024