false

0000890447

0000890447

2024-05-09

2024-05-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934

Date of Report (Date of Earliest Event Reported): May

9, 2024

VERTEX ENERGY, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

001-11476 |

94-3439569 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

1331 Gemini Street

Suite 250

Houston,

Texas |

77058 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (866) 660-8156

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

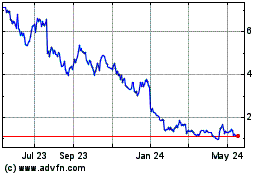

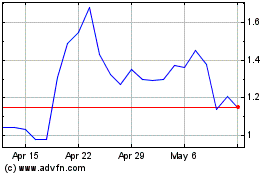

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Common

Stock,

$0.001 Par Value Per Share |

VTNR |

The NASDAQ

Stock Market LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On May 9, 2024, Vertex

Energy, Inc. (“Vertex” or the “Company”) issued a press release and will hold a conference call

regarding its financial results for the three months ended March 31, 2024. A copy of the press release, which includes information on

the conference call and a summary of such financial results is furnished as Exhibit 99.1 to this Form 8-K and incorporated

herein by reference. Additionally, a copy of a presentation which will be discussed on the earnings call is furnished as Exhibit 99.2 to

this Form 8-K and is incorporated herein by reference, and has also been posted to the Company’s website at https://www.vertexenergy.com/presentation,

although the Company reserves the right to discontinue that availability at any time.

The information contained

in this Current Report and Exhibits 99.1 and 99.2 hereto shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject

to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933,

as amended or the Exchange Act, except as expressly set forth by specific reference in such a filing.

The Company is making reference

to non-GAAP financial information in the press release, presentation, and the conference call. A reconciliation of these non-GAAP financial

measures to the comparable GAAP financial measures is contained in the attached press release and presentation.

| Item 9.01 |

Financial Statements and Exhibits. |

| Exhibit No. |

|

Description |

|

| |

|

|

|

| 99.1* |

|

Press Release of Vertex Energy, Inc., dated May 9, 2024 |

| 99.2* |

|

First Quarter 2024 Earnings Call Presentation |

| 104 |

|

Inline XBRL for the cover page of this Current Report on Form 8-K |

* Furnished herewith.

The inclusion of any website

address in this Form 8-K, and any exhibit thereto, is intended to be an inactive textual reference only and not an active hyperlink. The

information contained in, or that can be accessed through, such website is not part of or incorporated into this Form 8-K.

Forward-Looking Statements

This Current Report on

Form 8-K, including the press release and presentation furnished as Exhibits 99.1 and 99.2, respectively,

to this Current Report on Form 8-K, contains forward-looking statements within the meaning of the federal securities laws,

including the Private Securities Litigation Reform Act of 1995, and, as such, may involve known and unknown risks, uncertainties

and assumptions. You can identify these forward-looking statements by words such as “may,” “should,”

“expect,” “anticipate,” “believe,” “estimate,” “intend,”

“plan” and other similar expressions. These forward-looking statements relate to the Company’s current

expectations and are subject to the limitations and qualifications set forth in the press release and presentation as well as in the

Company’s other filings with the Securities and Exchange Commission, including, without limitation, that actual events and/or results

may differ materially from those projected in such forward-looking statements. These statements also involve known and unknown risks,

which may cause the results of the Company, its divisions and concepts to be materially different than those expressed or implied

in such statements, including those referenced in the press release and presentation. Accordingly, readers should not place undue

reliance on any forward-looking statements. Forward-looking statements may include comments as to the Company’s beliefs and expectations

as to future financial performance, events and trends affecting its business and are necessarily subject to uncertainties, many of which

are outside the Company’s control. More information on potential factors that could affect the Company’s financial results

is included from time to time in the “Cautionary Statement Regarding Forward-Looking Statements,” “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the

Company’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings with the SEC and available at www.sec.gov and

in the “Investor Relations” – “SEC Filings” section of the Company’s website at www.vertexenergy.com. Forward-looking

statements speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise that occur after that date, except as otherwise provided

by law.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

VERTEX ENERGY, INC. |

| |

|

| Date: May 9, 2024 |

By: |

/s/ Chris Carlson |

|

|

Chris Carlson |

| |

|

Chief Financial Officer |

Vertex Energy, Inc. 8-K

Exhibit 99.1

VERTEX ENERGY ANNOUNCES FIRST QUARTER 2024 RESULTS AND OPTIMIZATION

OF HYDROCRACKING CAPACITY FROM RENEWABLES TO CONVENTIONAL PRODUCTION

HOUSTON, TX (Business Wire) – May 9, 2024 – Vertex Energy, Inc. (NASDAQ:VTNR)

(“Vertex” or the “Company”), a leading specialty refiner and marketer of high-quality refined products and renewable

fuels, today announced its operational and financial results for the first quarter of 2024. The Company also announced that it plans to

optimize its hyrdrocracking capacity between conventional production and renewables production moving forward.

The Company will host a conference call to discuss first quarter 2024 results today,

at 9:00 A.M. Eastern Time. Details regarding the conference call are included at the end of this release.

Highlights for the first quarter of 2024 and through the date of this press release

include:

| · | Continued safe operation of the Company’s Mobile, Alabama refinery (the “Mobile Refinery”)

with first quarter 2024 conventional throughput of 64,065 barrels per day (bpd), above the high end of prior guidance; |

| · | Reduced net loss attributable to the Company to ($17.7) million, or ($0.19) per fully-diluted share

compared to the fourth quarter 2023; |

| · | Increased Adjusted EBITDA to $18.6 million driven by 28% improvement in crack spreads compared to the

fourth quarter of 2023; |

| · | Decreased direct operating expense by 11% and capital expenditures by 29% compared to previous guidance

midpoints; |

| · | Achieved renewable diesel (“RD”) throughput of 4,090 bpd, in line with previous guidance;

and |

| · | Reported total cash and cash equivalents of $65.7 million, including restricted cash of $3.6 million. |

Highlights for the strategic redirection of the Company’s renewable business:

| · | Announced a production pause and pivot regarding the Company’s renewable business; |

| o | Optimizing the Mobile Refinery hydrocracker capacity from renewable diesel to conventional fuels; |

| o | Expect to deplete Company inventories of renewable feedstocks prior to the conversion; |

| o | Conversion will be timed with a planned catalyst change and maintenance turnaround that was already

scheduled for 2024, after which hydrocracker production is expected to contribute additional upgraded conventional product volumes

in Q4 2024; and |

| o | Opportunity to optimize hydrocracker production in conventional service while maintaining the proven

renewable diesel production flexibility when market conditions warrant. |

Note: Schedules reconciling the Company’s generally accepted accounting principles in the United States (“GAAP”)

and non-GAAP financial results, including Adjusted EBITDA and certain key performance indicators, are included later in this release (see

also “Non-GAAP Financial Measures and Key Performance Indicators”, below).

Mr. Benjamin P. Cowart, Vertex’s Chief

Executive Officer, stated, “We had a strong operational and financial quarter, as we maintained our commitment to operating safely

and reliably. We saw an improved crack spread environment, which drove our Adjusted EBITDA higher by over $50 million compared to the

fourth quarter of 2023. Additionally, we saw conventional throughput above our guidance and managed direct operating costs and capital

expenditures below our guidance.”

“Over the past few years, we have

made material advancements and strategic decisions to grow Vertex. For the past two years we have operated safely and efficiently

while investing capital into upgrading the Mobile Refinery. We built in flexibility with our capital spend to allow us to redeploy

our renewable equipment back into conventional production if our strategy required adjustment. Due to the significant macroeconomic

headwinds over the past 12 months, many of which we believe will continue to occur over the next 18 months and potentially beyond, we have

decided to strategically pause our renewable diesel business and pivot to producing conventional fuels from the hydrocracker unit.

We plan to reconfigure the hydrocracker in conjunction with a planned turnaround on the unit.”

Mr. Cowart continued, “I am appreciative of the team for their work in proving

the hydrocracker in renewables service, obtaining multiple pathway approvals, and successfully incorporating a wide variety of renewable

feedstocks. In the future, based on economics and macro conditions, we expect to optimize our hydrocracker capacity between conventional

and renewables service. We believe this flexibility to produce based on market demand materially enhances our unit’s long-term value

potential. Our engineering and operations teams have worked diligently to preserve our optionality for the unit and to not degrade our

ability to produce conventional products. We now have a more robust hydrocracking unit in either service mode. Relative to what’s

currently available for renewables, we believe that this shift will allow us to optimize available returns through higher yield capabilities

and higher margin opportunities for conventional products. When modeling the unit in conventional service against first quarter 2024 historical

data, we estimate the unit could have significantly improved our results providing an additional fuel gross margin contribution of roughly

$40 million on conventional fuels.”

Mr. Cowart concluded, “Our strategic priorities remain focused on increasing

our cash position, reducing our operating costs, and improving margins. We believe that this decision [to allow for more optionality in

the hydrocracking unit] is not only prudent but a necessary step toward accomplishing these for the remainder of 2024 and into 2025.”

MOBILE REFINERY OPERATIONS

Total conventional throughput at the Mobile

Refinery was 64,065 bpd in the first quarter of 2024. Total production of finished high-value, light products, such as gasoline, diesel,

and jet fuel, represented approximately 64% of total production in the first quarter of 2024, vs. 66% in the fourth quarter of 2023,

and in line with management’s original expectations, reflecting a continued successful yield optimization initiative at the Mobile

conventional refining facility.

The Mobile Refinery’s conventional

operations generated a gross profit of $37.5 million and $73.6 million of fuel gross margin (a key performance indicator (KPI) discussed

below) or $12.63 per barrel during the first quarter of 2024, versus generating a gross profit of $7.3 million, and fuel gross margin

of $29.6 million, or $4.79 per barrel in the fourth quarter of 2023.

Total renewable throughput at the Mobile

Renewable Diesel facility was 4,090 bpd in the first quarter of 2024. Total production of renewable diesel was 4,003 bpd reflecting a

product yield of 98%.

The Mobile Renewable Diesel facility operations

generated a gross loss of $(10.5) million and $3.8 million of fuel gross margin (a KPI discussed below) or $10.29 per barrel during the

first quarter of 2024.

Renewable Business Pause and Pivot

During the second quarter of 2024, Vertex

is pausing renewable fuels production and redirecting the hydrocracking unit to conventional fuels and products. The Company had a previously

planned catalyst and maintenance turnaround scheduled for 2024. It will use that planned turnaround to load conventional catalyst and

bring the unit out of turnaround in conventional service. In addition, the total cost of about $10 million was previously budgeted as

part of the planned catalyst and maintenance turnaround and does not represent a material change to our forecasted capital spend. During

the second quarter, Vertex is running the remaining Company inventories of renewable feedstock, which is expected to allow the Company

to improve its working capital and margins in the second quarter from the renewable business.

First Quarter 2024 Mobile Refinery Results

Summary ($/millions unless otherwise noted)

| Conventional Fuels Refinery | |

| 4Q23 | | |

| TTM | | |

| 1Q24 | |

| | |

| | | |

| | | |

| | |

| Total Throughput (bpd) | |

| 67,083 | | |

| 71,922 | | |

| 64,065 | |

| Total Throughput (MMbbl) | |

| 6.17 | | |

| 26.32 | | |

| 5.83 | |

| Conventional Facility Capacity Utilization1 | |

| 89.4 | % | |

| 95.9 | % | |

| 85.4 | % |

| | |

| | | |

| | | |

| | |

| Direct Opex Per Barrel ($/bbl) | |

$ | 2.46 | | |

$ | 2.74 | | |

$ | 2.75 | |

| Fuel Gross Margin ($/MM) | |

$ | 29.6 | | |

$ | 288.5 | | |

$ | 73.6 | |

| Fuel Gross Margin Per Barrel ($/bbl) | |

$ | 4.79 | | |

$ | 10.96 | | |

$ | 12.63 | |

| | |

| | | |

| | | |

| | |

| Production Yield | |

| | | |

| | | |

| | |

| Gasoline (bpd) | |

| 17,826 | | |

| 17,388 | | |

| 14,678 | |

| % Production | |

| 25.9 | % | |

| 24.0 | % | |

| 22.9 | % |

| ULSD (bpd) | |

| 14,510 | | |

| 15,014 | | |

| 13,441 | |

| % Production | |

| 21.1 | % | |

| 21.6 | % | |

| 21.0 | % |

| Jet (bpd) | |

| 12,937 | | |

| 13,735 | | |

| 12,595 | |

| % Production | |

| 18.8 | % | |

| 19.8 | % | |

| 19.6 | % |

| Total Finished Fuel Products | |

| 45,273 | | |

| 46,137 | | |

| 40,714 | |

| % Production | |

| 65.9 | % | |

| 63.7 | % | |

| 63.5 | % |

| Other2 | |

| 23,457 | | |

| 26,300 | | |

| 23,428 | |

| % Production | |

| 34.1 | % | |

| 37.9 | % | |

| 36.5 | % |

| Total Production (bpd) | |

| 68,730 | | |

| 72,437 | | |

| 64,142 | |

| Total Production (MMbbl) | |

| 6.32 | | |

| 26.51 | | |

| 5.84 | |

| | |

| | | |

| | | |

| | |

| Renewable Fuels Refinery | |

| 4Q23 | | |

| TTM | | |

| 1Q24 | |

| | |

| | | |

| | | |

| | |

| Total Renewable Throughput (bpd) | |

| 3,926 | | |

| 3,980 | | |

| 4,090 | |

| Total Renewable Throughput (MMbbl) | |

| 0.36 | | |

| 1.46 | | |

| 0.37 | |

| Renewable Diesel Facility Capacity Utilization3 | |

| 49.1 | % | |

| 49.8 | % | |

| 51.1 | % |

| | |

| | | |

| | | |

| | |

| Direct Opex Per Barrel ($/bbl) | |

$ | 27.32 | | |

$ | 25.93 | | |

$ | 25.20 | |

| Renewable Fuel Gross Margin | |

$ | 4.4 | | |

$ | 7.5 | | |

$ | 3.8 | |

| Renewable Fuel Gross Margin Per Barrel ($/bbl) | |

$ | 12.11 | | |

$ | 5.13 | | |

$ | 10.29 | |

| | |

| | | |

| | | |

| | |

| Renewable Diesel Production (bpd) | |

| 3,786 | | |

| 3,822 | | |

| 4,003 | |

| Renewable Diesel Production (MMbbl) | |

| 0.35 | | |

| 1.40 | | |

| 0.36 | |

| Renewable Diesel Production Yield (%) | |

| 96.4 | % | |

| 96.0 | % | |

| 97.9 | % |

1) Assumes 75,000 barrels per day of conventional operational capacity 2) Other includes

naphtha, intermediates, and LNG 3) Assumes 8,000 barrels per day of renewable fuels operational capacity

First Quarter 2024 Financial Update

Vertex reported first quarter 2024 net loss attributable to the Company of ($17.7)

million, or ($0.19) per fully-diluted share, versus net loss attributable to the Company of ($63.9) million, or ($0.68) per fully-diluted

share for the fourth quarter of 2023. Adjusted EBITDA was $18.6 million for the first quarter of 2024, compared to Adjusted EBITDA of

($35.1) million in the fourth quarter of 2023. The improvement in quarter-over-quarter results was primarily driven by improved crack

spread pricing, in Vacuum Gas Oil (“VGO”) and gasoline finished products.

Balance Sheet and Liquidity Update

As of March 31, 2024, Vertex had total debt outstanding of $284 million, including

$15.2 million in 6.25% Senior Convertible Notes, $196.0 million outstanding on the Company’s Term Loan, finance lease obligations

of $68.1 million, and $5.0 million in other obligations. The Company had total cash and equivalents of $65.7 million, including $3.6 million

of restricted cash on the balance sheet as of March 31, 2024, for a net debt position of $218.5 million.

As previously announced on January 2, 2024, the Company reached

an agreement with its existing lending group to modify certain terms and conditions of the current term loan agreement. The amended term

loan provided an incremental $50.0 million in borrowings, the full amount of which was borrowed upon closing on December 29, 2023 and

therefore was reflected in Vertex’s year end 2023 cash position.

Vertex management continuously monitors current market conditions

to assess expected cash generation and liquidity needs against its available cash position, using the forward crack spreads in the market.

Additionally, the Company continues to evaluate strategic financial opportunities seeking further enhancements to its current liquidity

position.

Management Outlook

All guidance presented below is current as of the time of this

release and is subject to change. All prior financial guidance should no longer be relied upon.

| Conventional Fuels | |

2Q 2024 |

| Operational: | |

|

Low |

| |

|

High |

|

| Mobile Refinery Conventional Throughput Volume (Mbpd) | |

| 68.0 | | |

| 72.0 | |

| Capacity Utilization | |

| 91 | % | |

| 96 | % |

| Production Yield Profile: | |

| | | |

| | |

| Percentage Finished Products1 | |

| 64 | % | |

| 68 | % |

| Intermediate & Other Products2 | |

| 36 | % | |

| 32 | % |

| | |

| | | |

| | |

| Renewable Fuels | |

| 2Q 2024 |

| Operational: | |

| Low | | |

| High | |

| Mobile Refinery Renewable Throughput Volume (Mbpd) | |

| 2.0 | | |

| 4.0 | |

| Capacity Utilization | |

| 25 | % | |

| 50 | % |

| Production Yield | |

| 96 | % | |

| 98 | % |

| Yield Loss | |

| 4 | % | |

| 2 | % |

| | |

| | | |

| | |

| Consolidated | |

| 2Q 2024 |

| Operational: | |

| Low | | |

| High | |

| Mobile Refinery Total Throughput Volume (Mbpd) | |

| 70.0 | | |

| 76.0 | |

| Capacity Utilization | |

| 84 | % | |

| 92 | % |

| | |

| | | |

| | |

| Financial Guidance: | |

| | | |

| | |

| Direct Operating Expense ($/bbl) | |

$ | 4.11 | | |

$ | 4.46 | |

| Capital Expenditures ($/MM) | |

$ | 20.00 | | |

$ | 25.00 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| 1.) Finished products include gasoline, ULSD, and Jet A | |

| | | |

| | |

| 2.) Intermediate & Other products include Vacuum Gas Oil (VGO), Liquified Petroleum Gases (LPGs), | |

| | | |

| | |

| and Vacuum Tower Bottoms (VTBs) | |

| | | |

| | |

CONFERENCE CALL AND WEBCAST DETAILS

A conference call will be held today, May 9,2024 at 9:00 A.M. Eastern Time

to review the Company’s financial results, discuss recent events and conduct a question-and-answer session. An audio webcast of

the conference call and accompanying presentation materials will also be available in the “Events and Presentation” section

of Vertex’s website at www.vertexenergy.com. To listen to a live broadcast, visit the site

at least 15 minutes prior to the scheduled start time in order to register, download, and install any necessary audio software.

To participate in the live teleconference:

Domestic: (888) 350-3870

International: (646) 960-0308

Conference ID: 8960754

A replay of the teleconference will be available in the “Events and Presentation”

section of Vertex’s website at www.vertexenergy.com for up to one year following the conference

call.

ABOUT VERTEX ENERGY

Vertex Energy is a leading energy transition company that specializes in producing

high purity fuels and products from conventional, sustainable, and renewable feedstocks. The Company’s innovative solutions are

designed to enhance the performance of our customers and partners while also prioritizing sustainability, safety, and operational excellence.

With a commitment to providing superior products and services, Vertex Energy is dedicated to shaping the future of the energy industry.

FORWARD-LOOKING STATEMENTS

Certain of the matters discussed in this communication which are

not statements of historical fact constitute forward-looking statements within the meaning of the securities laws, including the Private

Securities Litigation Reform Act of 1995, that involve a number of risks and uncertainties. Words such as “strategy,” “expects,”

“continues,” “plans,” “anticipates,” “believes,” “would,” “will,”

“estimates,” “intends,” “projects,” “goals,” “targets” and other words of

similar meaning are intended to identify forward-looking statements but are not the exclusive means of identifying these statements. Any

statements made in this news release other than those of historical fact, about an action, event or development, are forward-looking statements.

The important factors that may cause actual results and outcomes to differ materially from those contained in such forward-looking statements

include, without limitation, the Company’s projected Outlook for the second quarter of 2024, the costs associated with, and outcome

of the Company’s plans to optimize conventional fuel and renewable diesel production moving forward, as discussed above; statements

concerning: the Company’s engagement of BofA Securities, Inc., as previously disclosed; the review and evaluation of potential joint

ventures, divestitures, acquisitions, mergers, business combinations, or other strategic transactions, the outcome of such review, and

the impact on any such transactions, or the review thereof, and their impact on shareholder value; the process by which the Company engages

in evaluation of strategic transactions; the Company’s ability to identify potential partners; the outcome of potential future strategic

transactions and the terms thereof; the future production of the Company’s Mobile Refinery; anticipated and unforeseen events which

could reduce future production at the refinery or delay future capital projects, and changes in commodity and credit values; throughput

volumes, production rates, yields, operating expenses and capital expenditures at the Mobile Refinery; the timing of, and outcome of,

the evaluation and associated carbon intensity scoring of the Company’s feedstock blends by officials in the state of California;

the ability of the Company to obtain low carbon fuel standard (LCFS) credits, and the amounts thereof; the need for additional capital

in the future, including, but not limited to, in order to complete capital projects and satisfy liabilities, the Company’s ability

to raise such capital in the future, and the terms of such funding, including dilution caused thereby; the timing of capital projects

at the Company’s refinery located in Mobile, Alabama (the “Mobile Refinery”) and the outcome of such projects; the future

production of the Mobile Refinery, including but not limited to, renewable diesel and conventional production and the breakdown between

the two; estimated and actual production and costs associated with the renewable diesel capital project; estimated revenues, margins and

expenses, over the course of the agreement with Idemitsu; anticipated and unforeseen events which could reduce future production at the

Mobile Refinery or delay planned and future capital projects; changes in commodity and credits values; certain early termination rights

associated with third party agreements and conditions precedent to such agreements; certain mandatory redemption provisions of the outstanding

senior convertible notes, the conversion rights associated therewith, and dilution caused by conversions and/or the exchanges of convertible

notes; the Company’s ability to comply with required covenants under outstanding senior notes and a term loan and to pay amounts

due under such senior notes and term loan, including interest and other amounts due thereunder; the ability of the Company to retain and

hire key personnel; the level of competition in the Company’s industry and its ability to compete; the Company’s ability to

respond to changes in its industry; the loss of key personnel or failure to attract, integrate and retain additional personnel; the Company’s

ability to protect intellectual property and not infringe on others’ intellectual property; the Company’s ability to scale

its business; the Company’s ability to maintain supplier relationships and obtain adequate supplies of feedstocks; the Company’s

ability to obtain and retain customers; the Company’s ability to produce products at competitive rates; the Company’s ability

to execute its business strategy in a very competitive environment; trends in, and the market for, the price of oil and gas and alternative

energy sources; the impact of inflation on margins and costs; the volatile nature of the prices for oil and gas caused by supply and demand,

including volatility caused by the ongoing Ukraine/Russia conflict and/or the Israel/Hamas conflict, changes in interest rates and inflation,

and potential recessions; the Company’s ability to maintain relationships with partners; the outcome of pending and potential future

litigation, judgments and settlements; rules and regulations making the Company’s operations more costly or restrictive; volatility

in the market price of compliance credits (primarily Renewable Identification Numbers (RINs) needed to comply with the Renewable Fuel

Standard (“RFS”)) under renewable and low-carbon fuel programs and emission credits needed under other environmental emissions

programs, the requirement for the Company to purchase RINs in the secondary market to the extent it does not generate sufficient RINs

internally, liabilities associated therewith and the timing, funding and costs of such required purchases, if any; changes in environmental

and other laws and regulations and risks associated with such laws and regulations; economic downturns both in the United States and globally,

changes in inflation and interest rates, increased costs of borrowing associated therewith and potential declines in the availability

of such funding; risk of increased regulation of the Company’s operations and products; disruptions in the infrastructure that the

Company and its partners rely on; interruptions at the Company’s facilities; unexpected and expected changes in the Company’s

anticipated capital expenditures resulting from unforeseen and expected required maintenance, repairs, or upgrades; the Company’s

ability to acquire and construct new facilities; the Company’s ability to effectively manage growth; decreases in global demand

for, and the price of, oil, due to inflation, recessions or other reasons, including declines in economic activity or global conflicts;

expected and unexpected downtime at the Company’s facilities; the Company’s level of indebtedness, which could affect its

ability to fulfill its obligations, impede the implementation of its strategy, and expose the Company’s interest rate risk; dependence

on third party transportation services and pipelines; risks related to obtaining required crude oil supplies, and the costs of such supplies;

counterparty credit and performance risk; unanticipated problems at, or downtime effecting, the Company’s facilities and those operated

by third parties; risks relating to the Company’s hedging activities or lack of hedging activities; and risks relating to planned

and future divestitures, asset sales, joint ventures and acquisitions.

Other important factors that may cause actual

results and outcomes to differ materially from those contained in the forward-looking statements included in this communication are described

in the Company’s publicly filed reports, including, but not limited to, the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023, and the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, and future

Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q. These reports are available at www.sec.gov.

The Company cautions that the foregoing list of important factors is not complete. All subsequent written and oral forward-looking statements

attributable to the Company or any person acting on behalf of the Company are expressly qualified in their entirety by the cautionary

statements referenced above. Other unknown or unpredictable factors also could have material adverse effects on Vertex’s future

results. The forward-looking statements included in this press release are made only as of the date hereof. Vertex cannot guarantee future

results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance on these forward-looking statements.

Finally, Vertex undertakes no obligation to update these statements after the date of this release, except as required by law, and takes

no obligation to update or correct information prepared by third parties that are not paid for by Vertex. If we update one or more forward-looking

statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

PROJECTIONS

The financial projections (the “Projections”) included

herein were prepared by Vertex in good faith using assumptions believed to be reasonable. A significant number of assumptions about the

operations of the business of Vertex were based, in part, on economic, competitive, and general business conditions prevailing at the

time the Projections were developed. Any future changes in these conditions, may materially impact the ability of Vertex to achieve the

financial results set forth in the Projections. The Projections are based on numerous assumptions, including realization of the operating

strategy of Vertex; industry performance; no material adverse changes in applicable legislation or regulations, or the administration

thereof, or generally accepted accounting principles; general business and economic conditions; competition; retention of key management

and other key employees; absence of material contingent or unliquidated litigation, indemnity, or other claims; minimal changes in current

pricing; static material and equipment pricing; no significant increases in interest rates or inflation; and other matters, many of which

will be beyond the control of Vertex, and some or all of which may not materialize. The Projections also assume the continued uptime of

the Company’s facilities at historical levels and the successful funding of, timely completion of, and successful outcome of, planned

capital projects. Additionally, to the extent that the assumptions inherent in the Projections are based upon future business decisions

and objectives, they are subject to change. Although the Projections are presented with numerical specificity and are based on reasonable

expectations developed by Vertex’s management, the assumptions and estimates underlying the Projections are subject to significant

business, economic, and competitive uncertainties and contingencies, many of which will be beyond the control of Vertex. Accordingly,

the Projections are only estimates and are necessarily speculative in nature. It is expected that some or all of the assumptions in the

Projections will not be realized and that actual results will vary from the Projections. Such variations may be material and may increase

over time. In light of the foregoing, readers are cautioned not to place undue reliance on the Projections. The projected financial information

contained herein should not be regarded as a representation or warranty by Vertex, its management, advisors, or any other person that

the Projections can or will be achieved. Vertex cautions that the Projections are speculative in nature and based upon subjective decisions

and assumptions. As a result, the Projections should not be relied on as necessarily predictive of actual future events.

NON-GAAP FINANCIAL MEASURES AND KEY PERFORMANCE INDICATORS

In addition to our results calculated under generally accepted accounting principles

in the United States (“GAAP”), in this news release we also present certain non-U.S. GAAP financial measures and key

performance indicators. Non-U.S. GAAP financial measures include Adjusted Gross Margin, Fuel Gross Margin and Adjusted EBITDA, for the

Company’s Legacy Refining and Marketing segment, and the total Refining and Marketing segment, as a whole, and Net Long-Term Debt

and Ratio of Net Long-Term Debt (collectively, the “Non-U.S. GAAP Financial Measures”). Key performance indicators

include Adjusted Gross Margin, Fuel Gross Margin and Adjusted EBITDA for Conventional, Renewable and the Mobile Refinery as a whole, and

Fuel Gross Margin Per Barrel of Throughput and Adjusted Gross Margin Per Barrel of Throughput for Conventional, Renewable and the Mobile

Refinery as a whole (collectively, the “KPIs”). EBITDA represents net income before interest, taxes, depreciation and

amortization, for continued and discontinued operations. Adjusted EBITDA represents EBITDA from operations plus or minus unrealized gain

or losses on hedging activities, Renewable Fuel Standard (RFS) costs (mainly related to Renewable Identification Numbers (RINs), and inventory

adjustments, acquisition costs, gain on change in value of derivative warrant liability, environmental clean-up, stock-based compensation,

(gain) loss on sale of assets, and certain other unusual or non-recurring charges included in selling, general, and administrative expenses.

Adjusted Gross Margin is defined as gross profit (loss) plus or minus unrealized gain or losses on hedging activities and inventory valuation

adjustments. Fuel Gross Margin is defined as Adjusted Gross Margin, plus production costs, operating expenses and depreciation attributable

to cost of revenues and other non-fuel items included in costs of revenues including realized and unrealized gain or losses on hedging

activities, RFS costs (mainly related to RINs), fuel financing costs and other revenues and cost of sales items. Fuel Gross Margin Per

Barrel of Throughput is calculated as fuel gross margin divided by total throughput barrels for the period

presented. Operating Expenses Per Barrel of Throughput is defined as total operating expenses divided by total barrels of throughput.

RIN Adjusted Fuel Gross Margin is defined as Fuel Gross Margin minus RIN expense divided by total barrels of throughput. RIN Adjusted

Fuel Gross Margin Per Barrel of Throughput is calculated as RIN Adjusted Fuel Gross Margin divided by total throughput barrels for the

period presented. Net Long-Term Debt is long-term debt and lease obligations, adjusted for unamortized discount and deferred financing

costs, insurance premiums financed, less cash and cash equivalents and restricted cash. Ratio of Net Long-Term Debt is defined as Long-Term

Debt divided by Adjusted EBITDA.

Each of the Non-U.S. GAAP Financial Measures and KPIs are discussed

in greater detail below. The (a) Non-U.S. GAAP Financial Measures are “non-U.S. GAAP financial measures”, and (b) the

KPIs are, presented as supplemental measures of the Company’s performance. They are not presented in accordance with U.S. GAAP.

We use the Non-U.S. GAAP Financial Measures and KPIs as supplements to U.S. GAAP measures of performance to evaluate the effectiveness

of our business strategies, to make budgeting decisions, to allocate resources and to compare our performance relative to our peers. Additionally,

these measures, when used in conjunction with related U.S. GAAP financial measures, provide investors with an additional financial analytical

framework which management uses, in addition to historical operating results, as the basis for financial, operational and planning decisions

and present measurements that third parties have indicated are useful in assessing the Company and its results of operations. The Non-U.S.

GAAP Financial Measures and KPIs are presented because we believe they provide additional useful information to investors due to the various

noncash items during the period. Non-U.S. GAAP financial information and KPIs similar to the Non-U.S. GAAP Financial Measures and KPIs

are also frequently used by analysts, investors and other interested parties to evaluate companies in our industry. The Non-U.S. GAAP

Financial Measures and KPIs are unaudited, and have limitations as analytical tools, and you should not consider them in isolation, or

as a substitute for analysis of our operating results as reported under U.S. GAAP. Some of these limitations are: the Non-U.S. GAAP Financial

Measures and KPIs do not reflect cash expenditures, or future requirements for capital expenditures, or contractual commitments; the Non-GAAP

Financial Measures and KPIs do not reflect changes in, or cash requirements for, working capital needs; the Non-GAAP Financial Measures

and KPIs do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments,

on debt or cash income tax payments; although depreciation and amortization are noncash charges, the assets being depreciated and amortized

will often have to be replaced in the future, the Non-U.S. GAAP Financial Measures and KPIs do not reflect any cash requirements for such

replacements; the Non-U.S. GAAP Financial Measures and KPIs represent only a portion of our total operating results; and other companies

in this industry may calculate the Non-U.S. GAAP Financial Measures and KPIs differently than we do, limiting their usefulness as a comparative

measure. You should not consider the Non-U.S. GAAP Financial Measures and KPIs in isolation, or as substitutes for analysis of the Company’s

results as reported under U.S. GAAP. The Company’s presentation of these measures should not be construed as an inference that future

results will be unaffected by unusual or nonrecurring items. We compensate for these limitations by providing a reconciliation of each

of these non-U.S. GAAP Financial Measures and KPIs to the most comparable U.S. GAAP measure below. We encourage investors and others to

review our business, results of operations, and financial information in their entirety, not to rely on any single financial measure,

and to view these non-U.S. GAAP Financial Measures and KPIs in conjunction with the most directly comparable U.S. GAAP financial measure.

For more information on these non-GAAP financial measures and

KPIs, please see the sections titled “Unaudited Reconciliation of Gross Profit (Loss) From Continued and Discontinued Operations

to Adjusted Gross Margin, Fuel Gross Margin, Fuel Gross Margin Per Barrel of Throughput and Operating Expenses Per Barrel of Throughput”,

“Unaudited Reconciliation of Adjusted EBITDA to Net loss from Continued and Discontinued Operations”, and “Unaudited

Reconciliation of Long-Term Debt to Net Long-Term Debt and Net Leverage”, at the end of this release.

| VERTEX ENERGY, INC. |

| CONSOLIDATED BALANCE SHEETS |

| (in thousands, except number of shares and par value) |

| (UNAUDITED) |

| |

| | |

March 31,

2024 | |

December 31,

2023 |

| ASSETS | |

| |

|

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 62,140 | | |

$ | 76,967 | |

| Restricted cash | |

| 3,609 | | |

| 3,606 | |

| Accounts receivable, net | |

| 41,559 | | |

| 36,164 | |

| Inventory | |

| 198,979 | | |

| 182,120 | |

| Prepaid expenses and other current assets | |

| 38,673 | | |

| 53,174 | |

| Total current assets | |

| 344,960 | | |

| 352,031 | |

| | |

| | | |

| | |

| Fixed assets, net | |

| 332,949 | | |

| 326,111 | |

| Finance lease right-of-use assets | |

| 63,524 | | |

| 64,499 | |

| Operating lease right-of use assets | |

| 78,802 | | |

| 96,394 | |

| Intangible assets, net | |

| 10,789 | | |

| 11,541 | |

| Other assets | |

| 4,029 | | |

| 4,048 | |

| TOTAL ASSETS’ | |

$ | 835,053 | | |

$ | 854,624 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 69,796 | | |

$ | 75,004 | |

| Accrued expenses and other current liabilities | |

| 69,240 | | |

| 73,636 | |

| Finance lease liability-current | |

| 2,497 | | |

| 2,435 | |

| Operating lease liability-current | |

| 13,281 | | |

| 20,296 | |

| Current portion of long-term debt, net | |

| 12,524 | | |

| 16,362 | |

| Obligations under inventory financing agreements, net | |

| 169,656 | | |

| 141,093 | |

| Total current liabilities | |

| 336,994 | | |

| 328,826 | |

| | |

| | | |

| | |

| Long-term debt, net | |

| 177,772 | | |

| 170,701 | |

| Finance lease liability-long-term | |

| 65,576 | | |

| 66,206 | |

| Operating lease liability-long-term | |

| 64,345 | | |

| 74,444 | |

| Deferred tax liabilities | |

| 2,776 | | |

| 2,776 | |

| Derivative warrant liability | |

| 3,249 | | |

| 9,907 | |

| Other liabilities | |

| 1,377 | | |

| 1,377 | |

| Total liabilities | |

| 652,089 | | |

| 654,237 | |

| | |

| | | |

| | |

| EQUITY | |

| | | |

| | |

Common stock, $0.001 par value per share;

750,000,000 shares authorized; 93,514,346 and 93,514,346 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively. | |

| 94 | | |

| 94 | |

| Additional paid-in capital | |

| 384,063 | | |

| 383,632 | |

| Accumulated deficit | |

| (205,113 | ) | |

| (187,379 | ) |

| Total Vertex Energy, Inc. shareholders’ equity | |

| 179,044 | | |

| 196,347 | |

| Non-controlling interest | |

| 3,920 | | |

| 4,040 | |

| Total equity | |

| 182,964 | | |

| 200,387 | |

| TOTAL LIABILITIES AND EQUITY | |

$ | 835,053 | | |

$ | 854,624 | |

VERTEX ENERGY, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(UNAUDITED)

| | |

Three Months Ended March 31, |

| | |

2024 | |

2023 |

| Revenues | |

$ | 695,326 | | |

$ | 691,142 | |

| Cost of revenues (exclusive of depreciation and amortization shown separately below) | |

| 652,034 | | |

| 619,352 | |

| Depreciation and amortization attributable to costs of revenues | |

| 8,186 | | |

| 4,337 | |

| Gross profit | |

| 35,106 | | |

| 67,453 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Selling, general and administrative expenses (exclusive of depreciation and amortization shown separately below) | |

| 39,782 | | |

| 41,942 | |

| Depreciation and amortization attributable to operating expenses | |

| 1,104 | | |

| 1,016 | |

| Total operating expenses | |

| 40,886 | | |

| 42,958 | |

| Income (loss) from operations | |

| (5,780 | ) | |

| 24,495 | |

| Other income (expense): | |

| | | |

| | |

| Other income (expenses) | |

| (1,049 | ) | |

| 1,653 | |

| Gain (loss) on change in value of derivative warrant liability | |

| 6,658 | | |

| (9,185 | ) |

| Interest expense | |

| (17,683 | ) | |

| (12,477 | ) |

| Total other expense | |

| (12,074 | ) | |

| (20,009 | ) |

| Income (loss) from continuing operations before income tax | |

| (17,854 | ) | |

| 4,486 | |

| Income tax expense | |

| — | | |

| (1,013 | ) |

| Income (loss) from continuing operations | |

| (17,854 | ) | |

| 3,473 | |

| Income from discontinued operations, net of tax (see note 22) | |

| — | | |

| 50,340 | |

| Net income (loss) | |

| (17,854 | ) | |

| 53,813 | |

| Net loss attributable to non-controlling interest from continuing operations | |

| (120 | ) | |

| (50 | ) |

| Net income (loss) attributable to Vertex Energy, Inc. | |

| (17,734 | ) | |

| 53,863 | |

| | |

| | | |

| | |

| Net income (loss) attributable to common shareholders from continuing operations | |

| (17,734 | ) | |

| 3,523 | |

| Net income attributable to common shareholders from discontinued operations, net of tax | |

| — | | |

| 50,340 | |

| Net income (loss) attributable to common shareholders | |

$ | (17,734 | ) | |

$ | 53,863 | |

| | |

| | | |

| | |

| Basic income (loss) per common share | |

| | | |

| | |

| Continuing operations | |

$ | (0.19 | ) | |

$ | 0.05 | |

| Discontinued operations, net of tax | |

| — | | |

| 0.66 | |

| Basic income (loss) per common share | |

$ | (0.19 | ) | |

$ | 0.71 | |

| | |

| | | |

| | |

| Diluted income (loss) per common share | |

| | | |

| | |

| Continuing operations | |

$ | (0.19 | ) | |

$ | 0.04 | |

| Discontinued operations, net of tax | |

| — | | |

| 0.64 | |

| Diluted income (loss) per common share | |

$ | (0.19 | ) | |

$ | 0.68 | |

| | |

| | | |

| | |

| Shares used in computing earnings per share | |

| | | |

| | |

| Basic | |

| 93,514 | | |

| 75,689 | |

| Diluted | |

| 93,514 | | |

| 78,996 | |

VERTEX ENERGY, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS EQUITY

(in thousands, except par value)

(UNAUDITED)

| Three Months Ended March 31, 2024 |

| | |

| Common Stock | | |

| | | |

| | | |

| | | |

| | |

| | |

| Shares | | |

| $0.001 Par | | |

| Additional Paid-In Capital | | |

| Accumulated Deficit | | |

| Non-controlling Interest | | |

| Total Equity | |

| Balance on January 1, 2024 | |

| 93,515 | | |

$ | 94 | | |

$ | 383,632 | | |

$ | (187,379 | ) | |

$ | 4,040 | | |

$ | 200,387 | |

| Stock based compensation expense | |

| — | | |

| — | | |

| 431 | | |

| — | | |

| — | | |

| 431 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (17,734 | ) | |

| (120 | ) | |

| (17,854 | ) |

| Balance on March 31, 2024 | |

| 93,515 | | |

$ | 94 | | |

$ | 384,063 | | |

$ | (205,113 | ) | |

$ | 3,920 | | |

$ | 182,964 | |

| Three Months Ended March 31, 2023 |

| | |

| Common Stock | | |

| | | |

| | | |

| | | |

| | |

| | |

| Shares | | |

| $0.001 Par | | |

| Additional Paid-In Capital | | |

| Accumulated Deficit | | |

| Non-controlling Interest | | |

| Total Equity | |

| Balance on January 1, 2023 | |

| 75,670 | | |

$ | 76 | | |

$ | 279,552 | | |

$ | (115,893 | ) | |

$ | 1,685 | | |

$ | 165,420 | |

| Exercise of options | |

| 166 | | |

| — | | |

| 209 | | |

| — | | |

| — | | |

| 209 | |

| Stock based compensation expense | |

| — | | |

| — | | |

| 365 | | |

| — | | |

| — | | |

| 365 | |

| Non-controlling shareholder contribution | |

| — | | |

| — | | |

| — | | |

| — | | |

| 980 | | |

| 980 | |

| Net income (loss) | |

| — | | |

| — | | |

| — | | |

| 53,863 | | |

| (50 | ) | |

| 53,813 | |

| Balance on March 31, 2023 | |

| 75,836 | | |

$ | 76 | | |

$ | 280,126 | | |

$ | (62,030 | ) | |

$ | 2,615 | | |

$ | 220,787 | |

VERTEX ENERGY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(UNAUDITED)

| | |

Three Months Ended |

| | |

March 31,

2024 | |

March 31,

2023 |

| Cash flows from operating activities | |

| | | |

| | |

| Net income (loss) | |

$ | (17,854 | ) | |

$ | 53,813 | |

| Income from discontinued operations, net of tax | |

| — | | |

| 50,340 | |

| Income (loss) from continuing operations | |

| (17,854 | ) | |

| 3,473 | |

| Adjustments to reconcile net loss from continuing operations

to cash used in operating activities | |

| | | |

| | |

| Stock based compensation expense | |

| 431 | | |

| 365 | |

| Depreciation and amortization | |

| 9,290 | | |

| 5,353 | |

| Deferred income tax expense | |

| — | | |

| 1,013 | |

| Loss on lease modification | |

| 35 | | |

| — | |

| Loss on sale of assets | |

| 691 | | |

| 3 | |

| Increase in allowance for credit losses | |

| 19 | | |

| 882 | |

| Increase (decrease) in fair value of derivative warrant liability | |

| (6,658 | ) | |

| 9,185 | |

| (Gain) loss on commodity derivative contracts | |

| 1,322 | | |

| (1,516 | ) |

| Net cash settlements on commodity derivatives | |

| (2,292 | ) | |

| 3,519 | |

| Amortization of debt discount and deferred costs | |

| 4,758 | | |

| 4,572 | |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Accounts receivable and other receivables | |

| (4,180 | ) | |

| (26,291 | ) |

| Inventory | |

| (16,859 | ) | |

| (52,553 | ) |

| Prepaid expenses and other current assets | |

| 14,710 | | |

| (18,103 | ) |

| Accounts payable | |

| (5,250 | ) | |

| 11,005 | |

| Accrued expenses | |

| (7,308 | ) | |

| 22,486 | |

| Other assets | |

| 19 | | |

| (44 | ) |

| Net cash used in operating activities from continuing operations | |

| (29,126 | ) | |

| (36,651 | ) |

| Cash flows from investing activities | |

| | | |

| | |

| Purchase of fixed assets | |

| (14,726 | ) | |

| (73,936 | ) |

| Proceeds from sale of discontinued operation | |

| — | | |

| 87,238 | |

| Proceeds from sale of fixed assets | |

| 2,576 | | |

| — | |

| Net cash provided by (used in) investing activities from continuing operations | |

| (12,150 | ) | |

| 13,302 | |

| Cash flows from financing activities | |

| | | |

| | |

| Payments on finance leases | |

| (586 | ) | |

| (310 | ) |

| Proceeds from exercise of options and warrants to common stock | |

| — | | |

| 209 | |

| Contributions received from noncontrolling interest | |

| — | | |

| 980 | |

| Net change on inventory financing agreements | |

| 28,313 | | |

| (11,284 | ) |

| Proceeds from note payable | |

| 3,175 | | |

| — | |

| Payments on note payable | |

| (4,450 | ) | |

| (17,165 | ) |

| Net cash provided by (used in) financing activities from continuing operations | |

| 26,452 | | |

| (27,570 | ) |

| | |

| | | |

| | |

| Discontinued operations: | |

| | | |

| | |

| Net cash provided by (used in) operating activities | |

| — | | |

| (150 | ) |

| Net cash provided by (used in) discontinued operations | |

| — | | |

| (150 | ) |

| | |

| | | |

| | |

| Net decrease in cash, cash equivalents and restricted cash | |

| (14,824 | ) | |

| (51,069 | ) |

| Cash, cash equivalents, and restricted cash at beginning of the period | |

| 80,573 | | |

| 146,187 | |

| Cash, cash equivalents, and restricted cash at end of period | |

$ | 65,749 | | |

$ | 95,118 | |

The following table provides a reconciliation of cash and cash

equivalents and restricted cash reported within the consolidated balance sheets to the same amounts shown in the consolidated statements

of cash flows (in thousands).

VERTEX ENERGY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(UNAUDITED)

(Continued)

| | |

Three Months Ended |

| | |

March 31,

2024 | |

March 31,

2023 |

| | |

| |

|

| Cash and cash equivalents | |

$ | 62,140 | | |

$ | 86,689 | |

| Restricted cash | |

| 3,609 | | |

| 8,429 | |

| Cash and cash equivalents and restricted cash as shown in the consolidated statements of cash flows | |

$ | 65,749 | | |

$ | 95,118 | |

| | |

| | | |

| | |

| SUPPLEMENTAL INFORMATION | |

| | | |

| | |

| Cash paid for interest | |

$ | 4,811 | | |

$ | 10,124 | |

| Cash paid for taxes | |

$ | — | | |

$ | — | |

| | |

| | | |

| | |

| NON-CASH INVESTING AND FINANCING TRANSACTIONS | |

| | | |

| | |

| ROU assets obtained from new finance leases | |

$ | 18 | | |

$ | 15,024 | |

| ROU assets obtained from new operating leases | |

$ | 74 | | |

$ | 15,078 | |

| ROU assets disposed under operating leases | |

$ | (17,666 | ) | |

$ | — | |

Unaudited segment information for the three months ended March 31, 2024 and 2023

is as follows (in thousands):

| THREE MONTHS ENDED MARCH 31, 2024 |

| | |

Refining

&

Marketing | |

Black Oil & Recovery | |

Corporate and Eliminations | |

Total |

| Revenues: | |

| |

| |

| |

|

| Refined products | |

$ | 650,759 | | |

$ | 31,724 | | |

$ | (1,022 | ) | |

$ | 681,461 | |

| Re-refined products | |

| 3,867 | | |

| 5,215 | | |

| — | | |

| 9,082 | |

| Services | |

| 3,081 | | |

| 1,702 | | |

| — | | |

| 4,783 | |

| Total revenues | |

| 657,707 | | |

| 38,641 | | |

| (1,022 | ) | |

| 695,326 | |

| Cost of revenues (exclusive of depreciation and amortization shown separately below) | |

| 622,974 | | |

| 30,082 | | |

| (1,022 | ) | |

| 652,034 | |

| Depreciation and amortization attributable to costs of revenues | |

| 6,541 | | |

| 1,645 | | |

| — | | |

| 8,186 | |

| Gross profit | |

| 28,192 | | |

| 6,914 | | |

| — | | |

| 35,106 | |

| Selling, general and administrative expenses | |

| 26,147 | | |

| 5,397 | | |

| 8,238 | | |

| 39,782 | |

| Depreciation and amortization attributable to operating expenses | |

| 793 | | |

| 72 | | |

| 239 | | |

| 1,104 | |

| Income (loss) from operations | |

| 1,252 | | |

| 1,445 | | |

| (8,477 | ) | |

| (5,780 | ) |

| Other income (expenses) | |

| | | |

| | | |

| | | |

| | |

| Other expense | |

| (685 | ) | |

| (359 | ) | |

| (5 | ) | |

| (1,049 | ) |

| Gain on change in derivative liability | |

| — | | |

| — | | |

| 6,658 | | |

| 6,658 | |

| Interest expense | |

| (4,747 | ) | |

| (96 | ) | |

| (12,840 | ) | |

| (17,683 | ) |

| Total other expense | |

| (5,432 | ) | |

| (455 | ) | |

| (6,187 | ) | |

| (12,074 | ) |

| Income (loss) from continuing operations before income tax | |

$ | (4,180 | ) | |

$ | 990 | | |

$ | (14,664 | ) | |

$ | (17,854 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Capital expenditures | |

$ | 11,299 | | |

$ | 3,427 | | |

$ | — | | |

$ | 14,726 | |

| THREE MONTHS ENDED MARCH 31, 2023 |

| | |

Refining

&

Marketing | |

Black Oil & Recovery | |

Corporate and Eliminations | |

Total |

| Revenues: | |

| |

| |

| |

|

| Refined products | |

$ | 653,042 | | |

$ | 29,423 | | |

$ | (2,733 | ) | |

$ | 679,732 | |

| Re-refined products | |

| 4,353 | | |

| 4,411 | | |

| — | | |

| 8,764 | |

| Services | |

| 1,933 | | |

| 713 | | |

| — | | |

| 2,646 | |

| Total revenues | |

| 659,328 | | |

| 34,547 | | |

| (2,733 | ) | |

| 691,142 | |

| Cost of revenues (exclusive of depreciation and amortization shown separately below) | |

| 589,812 | | |

| 30,418 | | |

| (878 | ) | |

| 619,352 | |

| Depreciation and amortization attributable to costs of revenues | |

| 3,294 | | |

| 1,043 | | |

| — | | |

| 4,337 | |

| Gross profit | |

| 66,222 | | |

| 3,086 | | |

| (1,855 | ) | |

| 67,453 | |

| Selling, general and administrative expenses | |

| 26,486 | | |

| 4,799 | | |

| 10,657 | | |

| 41,942 | |

| Depreciation and amortization attributable to operating expenses | |

| 808 | | |

| 38 | | |

| 170 | | |

| 1,016 | |

| Income (loss) from operations | |

| 38,928 | | |

| (1,751 | ) | |

| (12,682 | ) | |

| 24,495 | |

| Other income (expenses) | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| — | | |

| 1,655 | | |

| (2 | ) | |

| 1,653 | |

| Loss on change in derivative liability | |

| — | | |

| — | | |

| (9,185 | ) | |

| (9,185 | ) |

| Interest expense | |

| (3,876 | ) | |

| (57 | ) | |

| (8,544 | ) | |

| (12,477 | ) |

| Total other income (expense) | |

| (3,876 | ) | |

| 1,598 | | |

| (17,731 | ) | |

| (20,009 | ) |

| Income (loss) from continuing operations before income tax | |

$ | 35,052 | | |

$ | (153 | ) | |

$ | (30,413 | ) | |

$ | 4,486 | |

| | |

| | | |

| | | |

| | | |

| | |

| Capital expenditures | |

$ | 69,908 | | |

$ | 4,028 | | |

$ | — | | |

$ | 73,936 | |

Unaudited Reconciliation of Gross Profit (Loss) From Continued

and Discontinued Operations to Adjusted Gross Margin, Fuel Gross Margin, Fuel Gross Margin Per Barrel of Throughput and Operating Expenses

Per Barrel of Throughput.

| Three Months Ended March 31, 2024 |

| In thousands | |

Conventional | |

Renewable | |

Mobile Refinery Total |

| Gross profit | |

$ | 37,508 | | |

$ | (10,462 | ) | |

$ | 27,047 | |

| Unrealized (gain) loss on hedging activities | |

| (555 | ) | |

| 934 | | |

| 379 | |

| Inventory valuation adjustments | |

| 9,657 | | |

| 4,592 | | |

| 14,249 | |

| Adjusted gross margin | |

$ | 46,610 | | |

$ | (4,936 | ) | |

$ | 41,674 | |

| Variable production costs attributable to cost of revenues | |

| 25,651 | | |

| 6,846 | | |

| 32,497 | |

| Depreciation and amortization attributable to cost of revenues | |

| 2,558 | | |

| 3,932 | | |

| 6,490 | |

| RINs | |

| (857 | ) | |

| — | | |

| (857 | ) |

| Realized (gain) loss on hedging activities | |

| 2,577 | | |

| (1,783 | ) | |

| 794 | |

| Financing costs | |

| (172 | ) | |

| 132 | | |

| (40 | ) |

| Other revenues | |

| (2,719 | ) | |

| (362 | ) | |

| (3,081 | ) |

| Fuel gross margin | |

$ | 73,648 | | |

$ | 3,829 | | |

$ | 77,477 | |

| Throughput (bpd) | |

| 64,065 | | |

| 4,090 | | |

| 68,155 | |

| Fuel gross margin per barrel of throughput | |

$ | 12.63 | | |

$ | 10.29 | | |

$ | 12.49 | |

| Total OPEX | |

$ | 16,061 | | |

$ | 9,382 | | |

$ | 25,443 | |

| Operating expenses per barrel of throughput | |

$ | 2.75 | | |

$ | 25.21 | | |

$ | 4.10 | |

| Three Months Ended December 31, 2023 |

| In thousands | |

Conventional | |

Renewable | |

Mobile Refinery Total |

| Gross profit | |

$ | 7,283 | | |

$ | (17,557 | ) | |

$ | (10,273 | ) |

| Unrealized (gain) loss on hedging activities | |

| 4,892 | | |

| 77 | | |

| 4,969 | |

| Inventory valuation adjustments | |

| (3,400 | ) | |

| 2,152 | | |

| (1,248 | ) |

| Adjusted gross margin | |

$ | 8,775 | | |

$ | (15,328 | ) | |

$ | (6,553 | ) |

| Variable production costs attributable to cost of revenues | |

| 19,770 | | |

| 19,497 | | |

| 39,267 | |

| Depreciation and amortization attributable to cost of revenues | |

| 2,492 | | |

| 3,997 | | |

| 6,489 | |

| RINs | |

| 6,662 | | |

| — | | |

| 6,662 | |

| Realized (gain) loss on hedging activities | |

| (3,751 | ) | |

| (3,587 | ) | |

| (7,338 | ) |

| Financing costs | |

| 1,989 | | |

| 157 | | |

| 2,146 | |

| Other revenues | |

| (6,361 | ) | |

| (361 | ) | |

| (6,722 | ) |

| Fuel gross margin | |

$ | 29,576 | | |

$ | 4,375 | | |

$ | 33,951 | |

| Throughput (bpd) | |

| 67,083 | | |

| 3,926 | | |

| 71,009 | |

| Fuel gross margin per barrel of throughput | |

$ | 4.79 | | |

$ | 12.11 | | |

$ | 5.20 | |

| Total OPEX | |

$ | 15,162 | | |

$ | 9,868 | | |

$ | 25,030 | |

| Operating expenses per barrel of throughput | |

$ | 2.46 | | |

$ | 27.32 | | |

$ | 3.83 | |

| Twelve Months Ended March 31, 2024 |

| In thousands | |

Conventional | |

Renewable | |

Mobile Refinery Total |

| Gross profit | |

$ | 137,519 | | |

$ | (49,540 | ) | |

$ | 87,979 | |

| Unrealized (gain) loss on hedging activities | |

| 566 | | |

| 302 | | |

| 868 | |

| Inventory valuation adjustments | |

| 15,236 | | |

| 6,638 | | |

| 21,874 | |

| Adjusted gross margin | |

$ | 153,321 | | |

$ | (42,600 | ) | |

$ | 110,721 | |

| Variable production costs attributable to cost of revenues | |

| 100,954 | | |

| 39,378 | | |

| 140,332 | |

| Depreciation and amortization attributable to cost of revenues | |

| 11,383 | | |

| 13,267 | | |

| 24,650 | |

| RINs | |

| 38,273 | | |

| — | | |

| 38,273 | |

| Realized (gain) loss on hedging activities | |

| 530 | | |

| (1,681 | ) | |

| (1,151 | ) |

| Financing costs | |

| 3,502 | | |

| 552 | | |

| 4,054 | |

| Other revenues | |

| (19,494 | ) | |

| (1,437 | ) | |

| (20,931 | ) |

| Fuel gross margin | |

$ | 288,469 | | |

$ | 7,479 | | |

$ | 295,948 | |

| Throughput (bpd) | |

| 71,922 | | |

| 3,980 | | |

| 75,901 | |

| Fuel gross margin per barrel of throughput | |

$ | 10.96 | | |

$ | 5.13 | | |

$ | 10.65 | |

| Total OPEX | |

$ | 72,242 | | |

$ | 37,771 | | |

$ | 110,013 | |

| Operating expenses per barrel of throughput | |

$ | 2.74 | | |

$ | 25.93 | | |

$ | 3.96 | |

Unaudited Reconciliation of Adjusted EBITDA to Net loss from Continued and Discontinued

Operations.

| In thousands | |

Three Months Ended | |

Twelve Months Ended |

| | |

March 31, 2024 | |

March 31, 2023 | |

March 31, 2024 | |

March 31, 2023 |

| Net income (loss) | |

$ | (17,854 | ) | |

$ | 53,813 | | |

$ | (143,641 | ) | |

$ | 56,619 | |

| Depreciation and amortization | |

| 9,290 | | |

| 5,498 | | |

| 35,102 | | |

| 22,527 | |

| Income tax expense (benefit) | |

| — | | |

| 18,759 | | |

| (13,462 | ) | |

| 16,269 | |

| Interest expense | |

| 17,683 | | |

| 12,477 | | |

| 124,773 | | |

| 88,192 | |

| EBITDA | |

$ | 9,119 | | |

$ | 90,547 | | |

$ | 2,772 | | |

$ | 183,607 | |

| Unrealized (gain) loss on hedging activities | |

| 445 | | |

| (255 | ) | |

| 448 | | |

| (133 | ) |

| Inventory valuation adjustments | |

| 14,249 | | |

| (1,532 | ) | |

| 21,874 | | |

| 49,234 | |

| Gain on change in value of derivative warrant liability | |

| (6,658 | ) | |

| 9,185 | | |

| (23,835 | ) | |

| (2,215 | ) |

| Stock-based compensation | |

| 430 | | |

| 365 | | |

| 2,350 | | |

| 1,689 | |

| (Gain) loss on sale of assets | |

| 691 | | |

| (67,741 | ) | |

| (2,446 | ) | |

| (67,325 | ) |

| Acquisition costs | |

| — | | |

| 4,308 | | |

| — | | |

| 16,275 | |

| Environmental clean-up reserve | |

| — | | |

| — | | |

| — | | |

| 1,428 | |

| Other | |

| 358 | | |

| 0 | | |

| (276 | ) | |

| 280 | |

| Adjusted EBITDA | |

$ | 18,634 | | |

$ | 34,877 | | |

$ | 887 | | |

$ | 182,841 | |

| | |

Three Months Ended March 31, 2024 |

| | |

Mobile Refinery | |

Legacy Refining & Marketing | |

Total Refining & Marketing | |

Black Oil and Recovery | |

Corporate | |

Consolidated |

| In thousands | |

Conventional | |

Renewable | |

| |

| |

| |

| |

|

| Net income (loss) | |

$ | 17,535 | | |

$ | (22,157 | ) | |

$ | 442 | | |

$ | (4,180 | ) | |

$ | 990 | | |

$ | (14,664 | ) | |

$ | (17,854 | ) |

| Depreciation and amortization | |

| 3,330 | | |

| 3,953 | | |

| 51 | | |

| 7,334 | | |

| 1,717 | | |

| 239 | | |

| 9,290 | |

| Income tax expense (benefit) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Interest expense | |

| 2,455 | | |

| 2,292 | | |

| — | | |

| 4,747 | | |

| 96 | | |

| 12,840 | | |

| 17,683 | |

| EBITDA | |

$ | 23,320 | | |

$ | (15,912 | ) | |

$ | 493 | | |

$ | 7,901 | | |

$ | 2,803 | | |

$ | (1,585 | ) | |

$ | 9,119 | |

| Unrealized (gain) loss on hedging activities | |

| (555 | ) | |

| 934 | | |

| 20 | | |

| 399 | | |

| 46 | | |

| — | | |

| 445 | |

| Inventory valuation adjustments | |

| 9,657 | | |

| 4,592 | | |

| — | | |

| 14,249 | | |

| — | | |

| — | | |

| 14,249 | |

| Gain on change in value of derivative warrant liability | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (6,658 | ) | |

| (6,658 | ) |

| Stock-based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 430 | | |

| 430 | |

| (Gain) loss on sale of assets | |

| 685 | | |

| — | | |

| — | | |

| 685 | | |

| 5 | | |

| 1 | | |

| 691 | |

| Other | |

| — | | |

| — | | |

| — | | |

| — | | |

| 354 | | |

| 4 | | |

| 358 | |

| Adjusted EBITDA | |

$ | 33,107 | | |

$ | (10,386 | ) | |

$ | 513 | | |

$ | 23,234 | | |

$ | 3,208 | | |

$ | (7,808 | ) | |

$ | 18,634 | |

| | |

Three Months Ended December 31, 2023 |

| | |

Mobile Refinery | |

Legacy Refining & Marketing | |

Total Refining & Marketing | |

Black Oil and Recovery | |

Corporate | |

Consolidated |

| In thousands | |

Conventional | |

Renewable | |

| |

| |

| |

| |

|

| Net income (loss) | |

$ | (11,112 | ) | |

$ | (30,266 | ) | |

$ | (2,424 | ) | |

$ | (43,801 | ) | |

$ | (1,670 | ) | |

$ | (18,395 | ) | |

$ | (63,865 | ) |

| Depreciation and amortization | |

| 3,252 | | |

| 4,017 | | |

| 313 | | |

| 7,582 | | |

| 1,476 | | |

| 167 | | |

| 9,225 | |

| Income tax expense (benefit) | |

| — | | |

| — | | |

| — | | |

| — | | |

| (517 | ) | |

| 2,060 | | |

| 1,543 | |

| Interest expense | |

| 2,473 | | |

| 2,820 | | |

| — | | |

| 5,293 | | |

| 62 | | |

| 10,675 | | |

| 16,029 | |

| EBITDA | |

$ | (5,387 | ) | |

$ | (23,429 | ) | |

$ | (2,111 | ) | |

$ | (30,926 | ) | |

$ | (649 | ) | |

$ | (5,493 | ) | |

$ | (37,068 | ) |

| Unrealized (gain) loss on hedging activities | |

| 4,892 | | |

| 77 | | |

| (7 | ) | |

| 4,962 | | |

| 19 | | |

| — | | |

| 4,981 | |

| Inventory valuation adjustments | |

| (3,400 | ) | |

| 2,152 | | |

| — | | |

| (1,248 | ) | |

| — | | |

| — | | |

| (1,248 | ) |

| Gain on change in value of derivative warrant liability | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (2,956 | ) | |

| (2,956 | ) |

| Stock-based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 783 | | |

| 783 | |

| (Gain) loss on sale of assets | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 3 | | |

| 3 | |

| Acquisition costs | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Other | |

| — | | |

| — | | |

| — | | |

| — | | |

| 389 | | |

| (1 | ) | |

| 388 | |

| Adjusted EBITDA | |

$ | (3,895 | ) | |

$ | (21,200 | ) | |

$ | (2,118 | ) | |

$ | (27,212 | ) | |

$ | (241 | ) | |

$ | (7,664 | ) | |

$ | (35,117 | ) |

| | |

Twelve Months Ended March 31, 2024 |

| | |

Mobile Refinery | |

Legacy Refining & Marketing | |

Total Refining & Marketing | |

Black Oil and Recovery | |

Corporate | |

Consolidated |

| In thousands | |

Conventional | |

Renewable | |

| |

| |

| |

| |

|

| Net income (loss) | |

$ | 49,932 | | |

$ | (94,694 | ) | |

$ | (4,782 | ) | |

$ | (49,544 | ) | |

$ | 48,246 | | |

$ | (142,343 | ) | |

$ | (143,641 | ) |

| Depreciation and amortization | |

| 14,387 | | |

| 13,343 | | |

| 932 | | |

| 28,662 | | |

| 5,700 | | |

| 740 | | |

| 35,102 | |

| Income tax expense (benefit) | |

| — | | |

| — | | |

| — | | |

| — | | |

| 18,682 | | |

| (32,144 | ) | |

| (13,462 | ) |

| Interest expense | |

| 11,656 | | |

| 7,307 | | |

| — | | |

| 18,963 | | |

| 227 | | |

| 105,583 | | |

| 124,773 | |

| EBITDA | |

$ | 75,975 | | |

$ | (74,044 | ) | |

$ | (3,850 | ) | |

$ | (1,919 | ) | |

$ | 72,855 | | |

$ | (68,164 | ) | |

$ | 2,772 | |

| Unrealized (gain) loss on hedging activities | |

| 566 | | |

| 302 | | |

| (2 | ) | |

| 866 | | |

| (418 | ) | |

| — | | |

| 448 | |

| Inventory valuation adjustments | |