Current Report Filing (8-k)

March 05 2020 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of earliest event reported: February

28, 2020

TSR, Inc.

(Exact Name of Registrant as Specified in

Charter)

|

Delaware

|

00-8656

|

13-2635899

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

400 Oser Avenue, Suite 150, Hauppauge, NY 11788

(Address of Principal Executive Offices)

(Zip Code)

(631) 231-0333

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

|

Trading

Symbol(s)

|

|

Name

of Each Exchange On Which Registered

|

|

Common

Stock, par value $0.01 per share

|

|

TSRI

|

|

NASDAQ

Capital Market

|

|

Preferred

Share Purchase Rights1

|

|

—

|

|

—

|

1Registered pursuant to Section 12(b) of the

Act pursuant to a Form 8-A filed by the registrant on March 15, 2019. Until the Distribution Date (as defined in the registrant’s

Rights Agreement dated August 29, 2018), the Preferred Share Purchase rights will be transferred only with the share of the registrant’s

Common Stock to with the Preferred Share Purchase Rights are attached.

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 1.02

|

Termination of a Material Definitive Agreement

|

On February 28, 2019, we

provided oral notice, and on February 29, 2019, we provided written notice to our President, Chief Executive Officer and Treasurer,

Mr. Christopher Hughes, that his employment with TSR, Inc. (the “Company”) was terminated for “Cause” as

defined in Section 6(a) of his Amended and Restated Employment Agreement (the “Employment Agreement”), dated August

9, 2018.

The Employment Agreement

provides that Mr. Hughes was to be paid a base salary of $400,000 per annum, an annual discretionary bonus with advance payments

on a quarterly basis based on the amount of the bonus that would have been earned through the end of each quarter according to

standards established by the Company’s Compensation Committee and approved by the Board of Directors, participation in any

employee benefit plan generally available to the Company’s executives, executive medical benefits and a car (leased or owned

at the sole discretion of the Company). Under the Employment Agreement, the Company has the right to immediately terminate Mr.

Hughes’ employment for “Cause”, in which event Mr. Hughes shall be entitled to receive his base salary for the

month in which the termination is effective.

On March 2, 2020, the Company

received a letter from Mr. Hughes, providing notice of his intent to resign for “Good Reason” as defined in Section

7(c) of the Employment Agreement pursuant to which he claims to be entitled to the “Enhanced Severance Amount” under

the Employment Agreement. This amount which would be equal to the sum of (a) his base salary through the date of termination or

resignation plus his bonus pro-rated through such date, (b) an amount equal to two times his base salary plus two times his bonus

for the then-current fiscal year, or if such bonus amount cannot be determined, two times the bonus paid to him in the prior fiscal

year, (c) continued group health insurance benefits (including both group health insurance benefits generally offered to all eligible

employees of the Company and supplemental executive health insurance benefits) until the earlier of the second anniversary of termination

or such time as Mr. Hughes is eligible for comparable coverage under the group health insurance plans of another employer and (d)

reimbursement for the monthly cost of his car lease until the second anniversary of the termination of his employment; provided

that, as a condition to his right to receive the payments and benefits in clauses (b), (c) and (d), Mr. Hughes executes, delivers

and does not revoke a release of all claims against the Company and its affiliates.

A copy of the Employment

Agreement is attached as Exhibit 10.1 to the Current Report on Form 8-K that we filed with the Securities and Exchange Commission

on August 14, 2018, and is incorporated herein by reference. The foregoing description of the Employment Agreement is qualified

in its entirety by reference to the full text of the Employment Agreement.

The Employment Agreement

incorporates the terms and provisions of a Maintenance of Confidence and Non-Compete Agreement between the Company and Mr. Hughes

dated as of August 9, 2018. The Maintenance of Confidence and Non-Compete Agreement sets forth Mr. Hughes’ covenants against

the disclosure of confidential information, covenants against the solicitation of customers, employees and independent contractors

and a covenant against competition (all in accordance with the terms set forth therein) and supercedes any prior agreements entered

into by Mr. Hughes pertaining to such covenants. A copy of the Maintenance of Confidence and Non-Compete Agreement between the

Company is attached as Exhibit 10.2 to the Current Report on Form 8-K that we filed with the Securities and Exchange Commission

on August 14, 2018, and is incorporated herein by reference. The foregoing description is qualified in its entirety by reference

to the full text of the Maintenance of Confidence and Non-Compete Agreement.

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers

|

(b) On

February 28, 2019, we provided oral notice, and on February 29, 2019, we provided written notice Mr. Christopher Hughes that effective

as of February 29, 2019, he had been terminated from his positions as President, Chief Executive Officer (principal executive

officer) and Treasurer of the Company and as President of TSR Consulting Services, Inc., a wholly-owned subsidiary of the Company.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

TSR, Inc.

|

|

|

|

|

|

|

By:

|

|

/s/ John G. Sharkey

|

|

|

|

|

John G. Sharkey

|

|

|

|

|

Senior Vice President and Chief Financial Officer

|

Dated: March 5, 2020

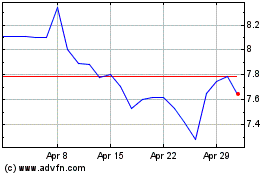

TSR (NASDAQ:TSRI)

Historical Stock Chart

From Apr 2024 to May 2024

TSR (NASDAQ:TSRI)

Historical Stock Chart

From May 2023 to May 2024