Texas Instruments Trims Guidance - Analyst Blog

March 13 2012 - 11:32AM

Zacks

Recently, Texas Instruments (TXN), or "TI,"

slashed its revenue and earnings expectations for the first quarter

of 2012.

The chipmaker now expects sales of $2.99 billion to $3.11

billion, below its previous guidance range of $3.02 billion to

$3.28 billion. The earnings outlook has been lowered to 5 cents

to19 cents per share from the previous guidance of 16 cents to 24

cents.

We believe that management had previously projected revenues to

decline as a result of macro weakness and hard disk drive shortages

from the Thailand flood.

Now, the company also expects the demand for its OMAP

application processor, which is used in wireless devices like

smartphones and tablets to take a tumble, thereby causing a further

decline in the first quarter.

As the fourth quarter progressed, TI saw strong demand in the

month of December, which pushed up orders during the month. Hence,

management expects inventory correction to end very soon and orders

to improve going forward. Additionally, TI expects automotive and

communications infrastructure end markets to improve and demand to

pick up from the second quarter of 2012.

Texas Instruments is one of the largest suppliers of analog and

DSP integrated circuits. The company reported revenues of $3.42

billion in the fourth quarter of 2011, down 0.8% sequentially and

3.0% year over year. Earnings were also down 25.8% sequentially and

31.4% year over year.

The company’s compelling product line-up, the increased

differentiation in its business, restructuring activities and

lower-cost 300mm capacity should drive earnings in the longer term.

In the fourth quarter, TI unveiled plans to close two older

semiconductor-manufacturing plants in Japan and Texas over the next

18 months to reduce costs and in turn improve profitability.

Texas Instruments is expected to report first quarter results on

April 23, 2012. We do not expect a significant improvement before

the second half of 2012.

Increasing competition from Maxim Integrated

Products (MXIM), Analog Devices (ADI),

Broadcom (BRCM), and Intel (INTC)

are concerns.

Currently, TI has a Zacks #3 Rank, which translates into a

short-term Hold rating.

ANALOG DEVICES (ADI): Free Stock Analysis Report

BROADCOM CORP-A (BRCM): Free Stock Analysis Report

INTEL CORP (INTC): Free Stock Analysis Report

MAXIM INTG PDTS (MXIM): Free Stock Analysis Report

TEXAS INSTRS (TXN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

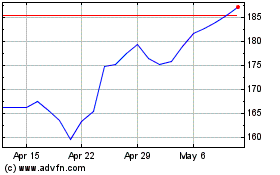

Texas Instruments (NASDAQ:TXN)

Historical Stock Chart

From Apr 2024 to May 2024

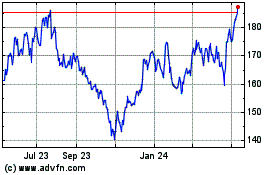

Texas Instruments (NASDAQ:TXN)

Historical Stock Chart

From May 2023 to May 2024