Jabil Beats on Lower Costs - Analyst Blog

September 29 2011 - 6:00AM

Zacks

Jabil Circuit Inc.

(JBL) reported fourth quarter 2011

earnings of 54 cents per share, beating the Zacks Consensus

Estimate by a nickel.

Earnings per share (EPS) increased

81.9% year over year from 30 cents (including stock-based

compensation but excluding amortization) reported in the year-ago

quarter. The strong results were primarily driven by solid top-line

growth and operating margin expansion in the quarter.

Operating

Performance

Gross profit was $329.2 million, up

14.5% year over year and gross margin increased 30 basis points to

7.7% from the year-ago quarter. This was primarily driven by the

favourable product mix.

Operating income (including

stock-based compensation) shot up 56.7% year over year to $170.8

million in the reported quarter. Operating margin was 4.0% compared

with 2.8% in the year-earlier quarter. Segment wise, Diversified

manufacturing operating margin was 6.7% in the quarter. Core

operating margin for the Enterprise and Infrastructure segment was

2.6%. High velocity posted a margin of 3.1% in the quarter.

The strong growth in operating

margin was primarily attributable to significant decreases in both

selling, general and administrative (SG&A) expense and research

and development (R&D) expense in the quarter.

SG&A expense decreased 5.2% year

over year to $152.2 million, while R&D was down 6.4% year over

year to $6.2 million in the quarter.

Net income increased 1.6% year over

year to $219.5 million. Net margin was 2.8% in the quarter versus

1.7% in the year-ago period.

Revenue

Revenue increased 11.0% year over

year to $4.28 billion in the fourth quarter of 2011 and was in line

with the high end of management’s guided range of $4.1 billion to

$4.3 billion. This was well above the Zacks Consensus Estimate of

$4.18 billion. Higher quarterly revenues were attributable to

market share gains, new customer wins and strong growth from

emerging markets.

Diversified manufacturing segment

revenue (40.0% of the total revenue) increased 10.0% sequentially.

Enterprise and Infrastructure segment revenue (32.0% of the total

revenue) was up 1.0% quarter over quarter. However, high velocity

segment (28.0% of the total revenue) decreased 9.0%

sequentially.

Balance Sheet & Cash

Flow

Exiting the fourth quarter,

cash and cash equivalents were $888.6 million, down from $911.1

million in the prior quarter.

Jabil’s debt level remained flat

sequentially in the fourth quarter. Total debt, as of August 31,

2011, was $1.19 billion.

The company’s net cash balance (cash

less debt including the current portion) was a deficit of $298.1

million or $1.36 per share in the fourth quarter of 2011, compared

with $276.5 million or $1.24 per share in the third quarter of

2011.

Cash flow from operations was $303.6

million in the quarter. The sales cycle was 8 days while annualized

inventory turns were 7 in the quarter. Capital expenditures were

$138.0 million, while depreciation was $84.9 million. Core return

on invested capital was 30.0% in the reported quarter.

Guidance

Jabil expects net revenue in the

range of $4.3 billion to $4.5 billion for the first quarter of

2012. Diversified Manufacturing is expected to grow 3.0%

sequentially, Enterprise and Infrastructure is anticipated to

remain flat year over year, while High Velocity is forecasted to

increase 6.0% on a sequential basis in the first quarter.

Jabil forecasts operating income for

the first quarter of 2012 (excluding stock-based compensation) in

the $185.0 million to $205.0 million range (4.3% to 4.5% of the

total revenue).

Jabil expects non-GAAP earnings per

share to be between 62 cents and 70 cents for the first quarter.

The Zacks Consensus Estimate is currently pegged at 55 cents (Zacks

Consensus Estimate includes stock-based compensation).

Recommendation

Jabil provided a robust first

quarter outlook, anticipating strong top-line growth on the back of

a mix shift toward high-margin diversified manufacturing systems.

We believe Jabil remains well positioned to grow from the

increasing adoption of clean technology and alternative energy.

Moreover, the lean cost structure, increasing cash flow generation

capabilities and an improving balance sheet are positives for the

stock.

However, the company faces strong

competition from Flextronics Inc.

(FLEX) and Sanmina-SCI Corp.

(SANM), which along with the worsening

economic conditions in Europe and the U.S. may hurt its

profitability going forward.

We maintain an Outperform rating on

Jabil over the long term (6–12 months). Currently, Jabil has a

Zacks #4 Rank, which implies a Sell rating on a short-term

basis.

FLEXTRONIC INTL (FLEX): Free Stock Analysis Report

JABIL CIRCUIT (JBL): Free Stock Analysis Report

SANMINA-SCI CP (SANM): Free Stock Analysis Report

Zacks Investment Research

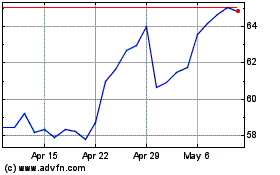

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From May 2024 to Jun 2024

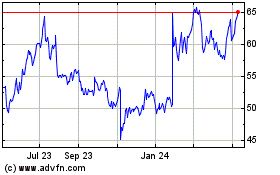

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From Jun 2023 to Jun 2024