NI Technology Research Updates Outlooks for Flextronics, Benchmark Electronics, Celestica, Jabil Circuit and Sanmina-SCI

June 29 2009 - 10:22AM

PR Newswire (US)

PRINCETON, N.J., June 29 /PRNewswire/ -- Next Inning Technology

Research (http://www.nextinning.com/), an online investment

newsletter focused on semiconductor and technology stocks,

announced it has updated outlooks for Flextronics (NASDAQ:FLEX),

Benchmark Electronics (NYSE:BHE), Celestica (NYSE:CLS), Jabil

Circuit (NYSE:JBL) and Sanmina-SCI (NASDAQ:SANM). Editor Paul

McWilliams has helped his subscribers generate huge returns on

undervalued tech stocks in 2009. Out of the 80 stocks highlighted

in his Undervalued Tech Stocks reports, 21 have produced returns in

excess of 70% year to date. All of these were ranked as either good

"strategic" or "speculative" buys. The average return for all

stocks ranked as either "speculative" or "strategic" buys was

40.7%, better than twice the return of stocks he thought readers

should avoid. McWilliams now turns his attention to his quarterly

State of Tech reports. In this exclusive series of reports,

McWilliams offers data, charts, and analysis that illustrate

important tech paradigms and highlight important trends that will

move stocks during the upcoming quarter. To read McWilliams' State

of Tech series that is designed to prepare investors for the July

earnings season, please accept our invitation to take a free

21-day, no risk test drive with Next Inning by visiting the

following link:

https://www.nextinning.com/subscribe/index.php?refer=prn840

McWilliams covers these topics and more in his most recent State of

Tech report: -- The price of Flextronics has nearly tripled since

McWilliams' bought shares for the Next Inning portfolio last

November. What are the three qualities that led McWilliams to

classify Flextronics as a "strategic" investment? Following this

sharp run higher, should investors hedge positions or take profits?

-- What does McWilliams view as a target for Flextronics in the

three to five year investment horizon? -- After moving higher by

31% since McWilliams highlighted the stock in March, is Benchmark

now fully valued? Does a balance sheet analysis imply that

Benchmark has significant upside potential or simply a downside

cushion? -- Celestica is up 37% from where McWilliams ranked it in

December as a good speculative investment. What are the primary

risks facing Celestica? Does Celestica have a good chance of

notably outperforming analyst expectations in the coming quarters?

-- What factors have led Jabil stock to lag the returns posted by

its peers over the last several months? Is Jabil likely to make up

that lost ground? -- When ranking the five largest players in the

EMS sector that are traded on U.S. stock exchanges, the only one

McWilliams flat out said investors should avoid was Sanmina. In

looking back on the performance of the five stocks since then,

Sanmina is the only one of the five that has posted a loss. Now

that it has lost nearly 30% of its value, does McWilliams think

investors should view it more favorably? After selling off assets,

has Sanmina become more or less likely to be a target of

consolidation in the coming months? Founded in September 2002, Next

Inning's model portfolio has returned 176% since its inception

versus 2% for the S&P 500. About Next Inning: Next Inning is a

subscription-based investment newsletter that provides regular

coverage on more than 150 technology and semiconductor stocks.

Subscribers receive intra-day analysis, commentary and

recommendations, as well as access to monthly semiconductor sales

analysis, regular Special Reports, and the Next Inning model

portfolio. Editor Paul McWilliams is a 30+ year semiconductor

industry veteran. NOTE: This release was published by Indie

Research Advisors, LLC, a registered investment advisor with CRD

#131926. Interested parties may visit adviserinfo.sec.gov for

additional information. Past performance does not guarantee future

results. Investors should always research companies and securities

before making any investments. Nothing herein should be construed

as an offer or solicitation to buy or sell any security. CONTACT:

Marcia Martin, Next Inning Technology Research, +1-888-278-5515

DATASOURCE: Indie Research Advisors, LLC CONTACT: Marcia Martin,

Next Inning Technology Research, +1-888-278-5515 Web Site:

http://www.nextinning.com/

Copyright

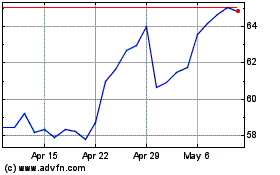

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From May 2024 to Jun 2024

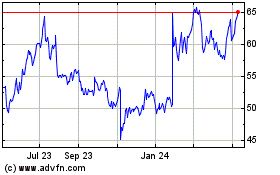

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From Jun 2023 to Jun 2024