0001581990

false

--12-31

PLAINS GP HOLDINGS LP

DE

0001581990

2023-08-17

2023-08-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

PLAINS GP HOLDINGS LP

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported) – August 17, 2023

Plains GP Holdings, L.P.

(Exact name of registrant as specified in its charter)

|

DELAWARE

(State or other jurisdiction of

incorporation) |

1-36132

(Commission File Number) |

90-1005472

(IRS Employer Identification No.) |

333 Clay Street, Suite

1600, Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

713-646-4100

(Registrant's telephone number, including area

code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Class A Shares |

|

PAGP |

|

Nasdaq |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. o

| Item 5.03. | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On August 17, 2023, Amendment No. 3 (the

“AAP Amendment”) to the Eighth Amended and Restated Limited Partnership Agreement of Plains AAP, L.P. (“AAP”)

dated November 15, 2016 (as amended by Amendment No. 1 thereto dated September 26, 2018 and Amendment No. 2 thereto

dated May 23, 2019, the “AAP LP Agreement”) was executed by its general partner, Plains All American GP LLC, to revise

the definition of the term “Permitted Transfer” thereunder to allow KAFU Holdings (QP), L.P. (“KAFU”) to make

transfers of its Partnership Group Interests (consisting of an equal number of Class A Units of AAP, Class B Shares of Plains

GP Holdings, L.P. and Holdings GP Units of PAA GP Holdings LLC) to one or more of its limited partners, provided that any such transfer,

when considered together with contemporaneous transfers by KAFU of any portion of its Partnership Group Interests to affiliates of such

limited partner, involves an aggregate of no less than 125,000 Partnership Group Interests.

The foregoing description is qualified in its entirety

by reference to the full text of the AAP Amendment, which is filed as Exhibit 3.1 hereto and is incorporated herein by reference.

| ITEM 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PLAINS GP HOLDINGS,

L.P. |

| |

|

| Date: August 21, 2023 |

By: |

PAA GP Holdings

LLC, its general partner |

| |

|

| |

By: |

/s/

Richard McGee |

| |

|

Name: |

Richard McGee |

| |

|

Title: |

Executive Vice President |

Exhibit 3.1

AMENDMENT NO. 3 TO THE

EIGHTH AMENDED AND RESTATED

LIMITED PARTNERSHIP AGREEMENT OF

PLAINS AAP, L.P.

This Amendment No. 3

(this “Amendment”) to the Eighth Amended and Restated Limited Partnership Agreement of Plains AAP, L.P., a Delaware limited

partnership (the “Company”), dated as of November 15, 2016 (as amended by Amendment No. 1 dated September 26,

2018 and Amendment No. 2 dated May 23, 2019, the “LP Agreement”), is made and entered into as of August 17,

2023. Capitalized terms used but not defined herein shall have the meaning given such terms in the LP Agreement.

WHEREAS,

Section 11.2(a) of the LP Agreement provides that, except as otherwise expressly provided, the LP Agreement may not be amended,

modified, superseded or restated without the approval of the General Partner, subject to specified exceptions that are not applicable

to the changes contemplated by this Amendment; and

WHEREAS,

the Board of Directors of Holdings GP, acting on behalf of the General Partner, has approved this Amendment;

NOW,

THEREFORE, pursuant to Section 11.2(a) of the Agreement, the Agreement is hereby amended as follows:

Section 1. The

definition of Permitted Transfer in Article 1 of the LP Agreement is hereby amended and restated to read as follows:

“Permitted Transfer”

shall mean:

(a) with

respect to a Partnership Group Interest, a Transfer by any Partner who is a natural person to (i) such Partner’s spouse, children

(including legally adopted children and stepchildren), spouses of children or grandchildren or spouses of grandchildren; (ii) a

trust for the benefit of the Partner and/or any of the Persons described in clause (i); or (iii) a limited partnership or limited

liability company whose sole partners or members, as the case may be, are the Partner and/or any of the Persons described in clause (i) or

clause (ii); provided, that in any of clauses (i), (ii) or (iii), the Partner transferring such Partnership Group Interest

retains exclusive power to exercise all rights under this Agreement;

(b) a

Transfer of a Partnership Group Interest by any Partner to the Partnership;

(c) with

respect to a Partnership Group Interest, a Transfer by a Partner to any Affiliate of such Partner; provided, however, that such

transfer shall be a Permitted Transfer only so long as such Partnership Group Interest or is held by such Affiliate or is otherwise transferred

in another Permitted Transfer;

(d) with

respect to Class B Units, a Transfer permitted under the applicable Class B Restricted Unit Agreement and any Transfer of Vested

Units in accordance with applicable securities laws;

(e) with

respect to a Partnership Group Interest, (i) a Transfer by either of EMG or Kayne Anderson to one of its members or partners, as

applicable or (ii) a Transfer by a Partner that has been approved by the Board and is being made in order to facilitate a bona fide

charitable contribution or estate planning transaction; provided, in each case that such transferee agrees as a condition to such

Transfer to effect, and actually effects, a substantially concurrent Exchange of such Partnership Group Interest;

(f) a

Transfer by PAGP of Class A Units to an Affiliate of PAGP;

(g) a

Transfer by PAA Management, L.P. of Partnership Group Interests to its partners or a Transfer by PAA Management, LLC of Partnership Group

Interests to its members, in each case, pursuant to a voluntary dissolution and winding up process;

(h) a

Transfer by a De Minimis Qualifying Partner of all or any portion of such De Minimis Qualifying Partner’s Partnership Group Interest

to (i) in the case of a De Minimis Qualifying Partner who is a natural person, the individuals and entities described in clauses

(a)(i)-(iii) immediately above (it being understood that the term “spouse” shall include an ex-spouse if such Transfer

is being made in connection with a divorce proceeding or settlement), and (ii) in the case of a De Minimis Qualifying Partner who

is not a natural person, a Person who is a beneficial owner of such De Minimis Qualifying Partner and who is receiving such Transfer

in respect of such beneficial ownership interest; provided, in each case, that such Transfer has been approved by the Board (as used

herein, the term “De Minimis Qualifying Partner” shall mean any Partner that is a natural person and any Partner that is

not a natural person who owns less than 0.50% of the total number of issued and outstanding Partnership Group Interests at such time);

(i) a

Transfer by EMG of a portion of its Partnership Group Interest to one or more of its members, provided that any such Transfer, when considered

together with contemporaneous Transfers by EMG of any portion of its Partnership Group Interest to Affiliates of such member, involves

an aggregate of no less than 125,000 Partnership Group Interests;

(j) a

Transfer by KAFU Holdings (QP), L.P. (“KAFU”) of a portion of its Partnership Group Interest to one or more of its limited

partners, provided that any such Transfer, when considered together with contemporaneous Transfers by KAFU of any portion of its Partnership

Group Interest to Affiliates of such limited partner, involves an aggregate of no less than 125,000 Partnership Group Interests; and

(k) a

Transfer in accordance with the provisions of Section 7.8, Section 7.9, Section 7.10 or Section 7.11;

provided,

however, that no Permitted Transfer shall be effective unless and until the transferee of the Partnership Group Interest or

Class B Units so Transferred complies with Section 7.1(b). Except in the case of a Permitted Transfer pursuant to clause

(a) and (b) above, and subject to compliance with Section 7.3, a Permitted Transferee of the Partnership Group

Interest or Class B Units subject to a Permitted Transfer shall become a substitute Limited Partner as described in Section 7.4.

No Permitted Transfer shall conflict with or result in any violation of any judgment, order, decree, statute, law, ordinance, rule or

regulation or require the Partnership, if not currently subject, to become subject, or if currently subject, to become subject to a greater

extent, to any statute, law, ordinance, rule or regulation, excluding matters of a ministerial nature that are not materially burdensome

to the Partnership.

Section 2. Except

as hereby amended, the LP Agreement shall remain in full force and effect.

Section 3. This

Amendment shall be governed by, and interpreted in accordance with, the laws of the State of Delaware, all rights and remedies being

governed by such laws without regard to principles of conflicts of laws.

Section 4. If

any provision of this Amendment is or becomes invalid, illegal or unenforceable in any respect, the validity, legality and enforceability

of the remaining provisions contained herein shall not be effected thereby.

IN

WITNESS WHEREOF, this Amendment has been executed by the General Partner as of August 17, 2023.

| |

PLAINS ALL AMERICAN GP LLC |

| |

|

| |

By: |

/s/ Richard K. McGee |

| |

Name: |

Richard K. McGee |

| |

Title: |

Executive Vice President |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

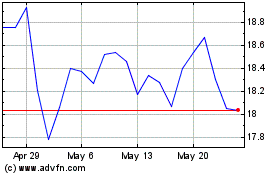

Plains GP (NASDAQ:PAGP)

Historical Stock Chart

From Apr 2024 to May 2024

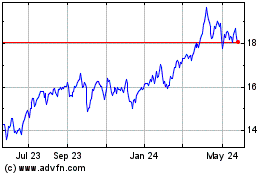

Plains GP (NASDAQ:PAGP)

Historical Stock Chart

From May 2023 to May 2024