Cooperative Bankshares, Inc. Reports Earnings

October 31 2008 - 4:51PM

Business Wire

Cooperative Bankshares, Inc. (NASDAQ: COOP) (the �Company�), the

parent company of Cooperative Bank (the �Bank�), reported a net

loss for the nine months ended September 30, 2008 of $8.5 million,

or $1.30 per diluted share. Net income for the nine months ended

September 30, 2007 was $6.3 million, or $0.95 per diluted share.

The net loss for the quarter ended September 30, 2008 was $8.9

million, or $1.36 per diluted share, compared to net income of $2.1

million, or $0.32 per diluted share, for the quarter ended

September 30, 2007. The decreases in net income for the three and

nine months ended September 30, 2008 from the prior year periods

were mainly due to an other-than-temporary impairment charge on

investments, an increase in the provision for loan losses, and a

decrease in net interest income. As previously announced, the Bank

recorded a non-cash, other-than-temporary impairment charge in the

third quarter of 2008 of $9.1 million, partially offset by a

related tax benefit of $1.8 million. This loss on the Bank�s

investments in the preferred stock of the Federal National Mortgage

Association (�Fannie Mae�) and the Federal Home Loan Mortgage

Corporation (�Freddie Mac�) is a result of the U.S. government�s

actions, including placing Fannie Mae and Freddie Mac under

conservatorship, giving�control of their management to their

regulator, the Federal Housing Finance Agency, and prohibiting

Fannie Mae and Freddie Mac from paying dividends on their existing

common and preferred stock. As a result of a change in tax law

enacted in October 2008, the Company expects to record a related

tax benefit of $1.7 million in the fourth quarter of 2008. No

similar loss was recorded in 2007. For additional information

regarding this other-than-temporary impairment charge, see the

Company�s Current Report on Form 8-K filed with the Securities and

Exchange Commission (the �SEC�) on September 12, 2008. The

provision for loan losses increased to $7.5 million for the nine

months ended September 30, 2008 compared to $1.0 million for the

nine months ended September 30, 2007. The provision for loan losses

increased to $4.2 million for the three months ended September 30,

2008 compared to $350,000 for the three months ended September 30,

2007. The increases in the provision for loan losses during the

three and nine-month periods were primarily the result of an

increase in valuation allowances for the recorded investment in

nonperforming loans. At September 30, 2008 and 2007, the recorded

investment in impaired loans was $23.4 million and $8.3 million,

respectively, with corresponding valuation allowances of $5.2

million and $431,000, respectively. The provision for loan losses

was also affected by an increase in the valuation allowance

allocated to the remainder of the portfolio, primarily due to an

increase in loans and upward adjustments in qualitative factors

used in the allowance model. The decrease in net interest income

for the three and nine months ended September 30, 2008 from the

prior year periods was primarily caused by a reduction in the

interest rate spread of 53 and 60 basis points, respectively. These

decreases are primarily attributable to action taken by the Federal

Reserve to reduce interest rates by 225 basis points during the

first nine months of 2008 and an additional 100 basis points during

the last four months of 2007. As a result of these rate reductions,

the Bank�s loan portfolio has repriced faster than deposits,

causing a decline in net interest income. �The third quarter of

2008 has been marked with further turbulence and uncertainty in the

housing market. The current housing market, compounded with the

economic downturn, has resulted in additional increases to our

nonperforming assets. We have diligently worked to address this

rise and evaluate the banking environment and, as such, have

adjusted our allowance for loan losses to what we believe is an

appropriate level,� said Frederick Willetts, III, the Company�s

Chairman, President, and Chief Executive Officer. Total assets

increased to $982.4 million at September 30, 2008 compared to

$926.8 million at December 31, 2007. Asset growth was primarily the

result of continued loan growth during the first nine months of

2008, which was funded by increased borrowings. Loans increased to

$882.8 million at September 30, 2008 compared to $820.1 million at

December 31, 2007. For the nine-month period ended September 30,

2008, the bulk of the increase in the loan portfolio occurred in

one-to-four family loans, which grew $62.0 million (15.6%), and

multi-family residential loans, which grew $13.6 million (85.3%),

partially offset by a reduction in construction and land

development loans of $9.6 million (4.3%). Borrowings at September

30, 2008 increased $69.3 million to $211.2 million, partially

offset by a reduction in deposits of $5.4 million, because

borrowings were a more cost effective means of funding loan growth.

Loan growth was primarily attributable to the Bank�s improved

branch network and the Bank�s emphasis on increasing mortgage,

consumer, and line of credit loan production. Due to the current

economic environment, the Company�s nonperforming assets, which

consist of loans ninety days or more delinquent, non-accrual loans,

troubled-debt restructurings, nonperforming investments, and

foreclosed real estate owned, increased to $30.9 million at

September 30, 2008 compared to $11.6 million at December 31, 2007.

All foreclosed real estate owned has been appraised and is recorded

at the estimated fair value of the property less estimated costs to

sell. At September 30, 2008, stockholders� equity was $55.2

million, or $8.37 per share, and represented 5.62% of assets,

compared to $65.2 million, or $9.94 per share, representing 7.03%

of assets at December 31, 2007. Stockholders� equity for the nine

months ended September 30, 2008 was affected by the adoption of

EITF 06-4 on January 1, 2008. The adoption of EITF 06-4 resulted in

an adjustment to the carrying value of liabilities with an

offsetting adjustment to the opening balance of retained earnings

of $1.0 million, as discussed in the Company�s Annual Report on

Form 10-K for the fiscal year ended December 31, 2007. Chartered in

1898, Cooperative Bank provides a full range of financial services

through twenty-two offices in Eastern North Carolina and three

offices in South Carolina. The Bank�s subsidiary, Lumina Mortgage,

Inc., is a mortgage banking firm, originating and selling

residential mortgage loans through five offices in North Carolina.

Statements in this news release that are not historical facts are

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements,

which contain words such as �expects,� �intends,� �believes� or

words of similar import, are subject to numerous risks and

uncertainties disclosed from time to time in documents the Company

files with the SEC, which could cause actual results to differ

materially from the results currently anticipated. Undue reliance

should not be placed on such forward-looking statements. The

Company has filed a Form 8-K with the SEC containing additional

financial information regarding the three-month period and nine-

month period ended September 30, 2008.

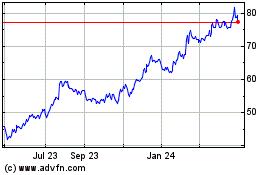

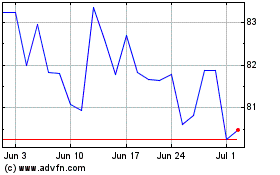

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Sep 2024 to Oct 2024

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Oct 2023 to Oct 2024