MicroStrategy® Incorporated (Nasdaq: MSTR), a leading worldwide

provider of enterprise analytics and mobility software, today

announced financial results for the three-month period ended

June 30, 2018 (the second quarter of its 2018 fiscal

year).

MicroStrategy adopted Accounting Standards Update No. 2014-09,

Revenue from Contracts with Customers (Topic 606) and its

subsequent amendments (“ASU 2014-09”), effective January 1, 2018,

and has adjusted its prior period consolidated financial statements

to reflect full retrospective adoption.

Second quarter 2018 revenues were $120.6 million versus $119.2

million for the second quarter of 2017, a 1.2% increase. Product

licenses and subscription services revenues for the second quarter

of 2018 were $26.9 million versus $26.1 million for the second

quarter of 2017, a 3.1% increase. Product support revenues for the

second quarter of 2018 were $73.7 million versus $70.8 million for

the second quarter of 2017, a 4.1% increase. Other services

revenues for the second quarter of 2018 were $20.1 million versus

$22.4 million for the second quarter of 2017, a 10.4% decrease.

Foreign currency effects had a favorable impact on revenues for the

second quarter of 2018.

Operating expenses for the second quarter of 2018 were $97.4

million versus $80.8 million for the second quarter of 2017, a

20.5% increase, reflecting MicroStrategy’s previously announced

strategy to seek to take greater advantage of the opportunities in

the market by increasing its sales and marketing expenditures and

increasing its research and development expenditures as it invests

in its technology products and personnel. MicroStrategy did not

capitalize any software development costs during the second quarter

of 2018 or 2017.

Loss from operations for the second quarter of 2018 was $1.8

million versus income from operations of $14.1 million for the

second quarter of 2017. Net income for the second quarter of 2018

was $4.8 million, or $0.42 per share on a diluted basis, as

compared to net income of $10.0 million, or $0.86 per share on a

diluted basis, for the second quarter of 2017. Contributing to net

income for the second quarter of 2018 was $4.5 million in other

income, net, comprised primarily of foreign currency transaction

gains, and $3.2 million in interest income, net.

Non-GAAP income from operations, which excludes share-based

compensation expense, was $1.6 million for the second quarter of

2018 versus $17.9 million for the second quarter of 2017. The

tables at the end of this press release include a reconciliation of

(loss) income from operations to non-GAAP income from operations

for the three months ended June 30, 2018 and 2017. An

explanation of this non-GAAP measure is also included under the

heading “Non-GAAP Financial Measure” below.

As of June 30, 2018, MicroStrategy had cash and cash

equivalents and short-term investments of $699.6 million, as

compared to $675.2 million as of December 31, 2017, an

increase of $24.4 million. As of June 30, 2018, MicroStrategy

had 9.4 million shares of class A common stock and 2.0 million

shares of class B common stock outstanding.

MicroStrategy uses its own software across the Company and has

created an interactive dossier with quarterly financial performance

data. Anyone can access the MSTR Financials dossier via a web

browser, or by downloading the MicroStrategy Library™ app on an iOS

or Android device. To download the native apps, visit MicroStrategy

Library for iPad, MicroStrategy Library for iPhone, or

MicroStrategy Library for Android tablet and smartphone.

Conference Call

MicroStrategy will be discussing its second quarter 2018

financial results on a conference call today beginning at

approximately 5:00 p.m. EDT. To access the conference call, dial

(844) 824-7425 (domestically) or (716) 220-9429 (internationally)

and use conference ID 8369038. A live webcast and replay of the

conference call will be available under the “Events” section on

MicroStrategy’s investor relations website at

http://ir.microstrategy.com/events.cfm. The replay will be

available beginning approximately two hours after the call

concludes until August 2, 2018 at (855) 859-2056 (domestically) or

(404) 537-3406 (internationally) using the passcode 8369038. An

archived webcast will also be available under the “Events” section

on MicroStrategy’s investor relations website at

http://ir.microstrategy.com/events.cfm.

Recent Business Highlights:

- MicroStrategy received the highest

product scores for 3 of 5 use cases in the “Critical Capabilities

for Analytics and Business Intelligence Platforms” report1 by

Gartner, Inc., the leading provider of research and analysis on the

global information technology industry. According to the findings,

the Gartner report has scored MicroStrategy:

- First in Governed Data Discovery,

scoring a 4.22 (out of 5)

- First in Agile, Centralized BI

Provisioning, scoring a 4.37

- First in Decentralized Analytics,

scoring a 4.19

- Second in Extranet Deployment, scoring

a 4.16

- MicroStrategy introduced three new

gateways with its MicroStrategy 10.11™ release that enable

MicroStrategy users to easily visualize, analyze and distribute

data using Microsoft Azure. Built in collaboration with Microsoft,

these gateways establish integrations and workflows between the

MicroStrategy 10™ platform and Azure data and analytics services.

These gateways expand on MicroStrategy’s existing integrations with

other Microsoft solutions, including Azure IoT, Machine Learning

and Power BI.

- MicroStrategy won a 2018 NetworkWorld

Asia Information Management award in the Advanced Analytics

Solution category. After a review of numerous analytics vendors in

the market, MicroStrategy was selected the winner by a panel of

Questex Media editors and regional CIOs, CISOs, IT directors, and

data center heads representing organizations across a variety of

industries. MicroStrategy, which secured the top spot for the only

award related to analytics, was honored at the 7th annual

NetworkWorld Asia Information Management Awards in Singapore.

- MicroStrategy announced that Kasasa, an

Austin, Texas-based fintech and martech provider, integrated

MicroStrategy 10 into Insight, its BI platform, enabling an even

higher performing analytics solution for its customers. In

addition, MicroStrategy announced that Vibes, a leading mobile

engagement platform for enterprises, integrated the MicroStrategy

10 platform into its new product, Advanced Analytics, a performance

management solution.

- MicroStrategy announced that The

University of Auckland’s ICT Graduate School and the University of

Colorado Denver School of Business are providing its students and

faculty with free MicroStrategy software licenses, technical

support and training through the MicroStrategy Academic

Program.

1

Gartner, Critical Capabilities for Analytics and Business

Intelligence Platforms, James Laurence Richardson, Joao Tapadinhas,

et al., May 7, 2018. Gartner does not endorse any vendor, product

or service depicted in its research publications, and does not

advise technology users to select only those vendors with the

highest ratings or other designation. Gartner research publications

consist of the opinions of Gartner's research organization and

should not be construed as statements of fact. Gartner disclaims

all warranties, expressed or implied, with respect to this

research, including any warranties of merchantability or fitness

for a particular purpose.

Non-GAAP Financial Measure

MicroStrategy is providing a supplemental financial measure for

income from operations that excludes the impact of share-based

compensation arrangements. This financial measure is not a

measurement of financial performance under generally accepted

accounting principles in the United States (“GAAP”) and, as a

result, this financial measure may not be comparable to similarly

titled measures of other companies. Management uses this non-GAAP

financial measure internally to help understand, manage and

evaluate business performance and to help make operating decisions.

MicroStrategy believes that this non-GAAP financial measure is also

useful to investors and analysts in comparing its performance

across reporting periods on a consistent basis because it excludes

a significant non-cash expense that MicroStrategy believes is not

reflective of its general business performance. In addition,

accounting for share-based compensation arrangements requires

significant management judgment and the resulting expense could

vary significantly in comparison to other companies. Therefore,

MicroStrategy believes the use of this non-GAAP financial measure

can also facilitate comparison of MicroStrategy’s operating results

to those of its competitors.

About MicroStrategy Incorporated

MicroStrategy (Nasdaq: MSTR) is a worldwide leader in enterprise

analytics and mobility software. A pioneer in the BI and analytics

space, MicroStrategy delivers innovative software that empowers

people to make better decisions and transform the way they do

business. We provide our enterprise customers with world-class

software and expert services so they can deploy unique intelligence

applications. To learn more, visit MicroStrategy online, and follow

us on LinkedIn, Twitter and Facebook.

MicroStrategy, MicroStrategy 10, MicroStrategy 10.11, and

MicroStrategy Library are either trademarks or registered

trademarks of MicroStrategy Incorporated in the United States and

certain other countries. Other product and company names mentioned

herein may be the trademarks of their respective owners.

This press release may include statements that may constitute

“forward-looking statements,” including estimates of future

business prospects or financial results and statements containing

the words “believe,” “estimate,” “project,” “expect” or similar

expressions. Forward-looking statements inherently involve risks

and uncertainties that could cause actual results of MicroStrategy

Incorporated and its subsidiaries (collectively, the “Company”) to

differ materially from the forward-looking statements. Factors that

could contribute to such differences include: the extent and timing

of market acceptance of MicroStrategy’s new offerings, including

MicroStrategy 10.11; the Company’s ability to recognize revenue or

deferred revenue through delivery of products or satisfactory

performance of services; continued acceptance of the Company’s

other products in the marketplace; fluctuations in tax benefits or

provisions, including as a result of changes to U.S. federal tax

laws; the timing of significant orders; delays in or the inability

of the Company to develop or ship new products; competitive

factors; general economic conditions, including economic

uncertainty in the retail industry, in which the Company has a

significant number of customers; currency fluctuations; and other

risks detailed in the Company’s registration statements and

periodic reports filed with the Securities and Exchange Commission.

By making these forward-looking statements, the Company undertakes

no obligation to update these statements for revisions or changes

after the date of this release.

MSTR-F

MICROSTRATEGY INCORPORATED

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per share

data)

Three Months Ended

Six Months Ended June 30, June 30, 2018

2017 2018 2017 (unaudited)

(as adjusted,unaudited)

(unaudited)

(as adjusted,unaudited)

Revenues Product licenses $ 19,292 $ 17,728 $ 36,593 $

40,374 Subscription services 7,584 8,346

15,246 16,118 Total product licenses and subscription

services 26,876 26,074 51,839 56,492 Product support 73,676 70,766

148,091 141,278 Other services 20,050 22,380

43,639 43,682

Total revenues 120,602

119,220 243,569 241,452

Cost of revenues Product licenses 1,667 1,747 3,878

3,419 Subscription services 3,445 3,400 6,694

6,439 Total product licenses and subscription services 5,112

5,147 10,572 9,858 Product support 4,810 4,542 9,606 8,876 Other

services 15,118 14,686 30,047 28,773

Total cost of revenues 25,040

24,375 50,225 47,507

Gross profit 95,562 94,845

193,344 193,945 Operating

expenses Sales and marketing 50,978 41,626 102,313 81,208

Research and development 25,082 19,561 48,642 37,987 General and

administrative 21,299 19,582 43,471

39,839

Total operating expenses 97,359

80,769 194,426 159,034

(Loss) income from operations (1,797 )

14,076 (1,082 ) 34,911 Interest income,

net 3,223 1,163 5,257 2,000 Other income (expense), net

4,461 (2,618 ) 2,867 (4,474 )

Income before

income taxes 5,887 12,621 7,042

32,437 Provision for income taxes 1,059 2,668

541 6,927

Net income $ 4,828

$ 9,953 $ 6,501 $ 25,510

Basic earnings per share (1): $ 0.42

$ 0.87 $ 0.57 $ 2.23

Weighted average shares outstanding used in computing basic

earnings per share

11,459 11,444

11,453 11,441 Diluted earnings per

share (1): $ 0.42 $ 0.86 $

0.57 $ 2.20 Weighted average shares

outstanding used in computing diluted earnings per share

11,493 11,592 11,488

11,593 (1) Basic and fully

diluted earnings per share for class A and class B common stock are

the same.

MICROSTRATEGY INCORPORATED

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share

data)

June 30, December

31, 2018 2017 (unaudited)

(as adjusted,unaudited)

Assets Current assets Cash and cash equivalents $ 90,427 $

420,244 Restricted cash 964 938 Short-term investments 609,167

254,927 Accounts receivable, net 125,115 165,364 Prepaid expenses

and other current assets 27,863 19,180 Total current

assets 853,536 860,653 Property and equipment, net 51,918

53,359 Capitalized software development costs, net 0 2,499 Deposits

and other assets 7,112 7,411 Deferred tax assets, net 14,761

9,297

Total Assets $ 927,327 $

933,219 Liabilities and Stockholders' Equity

Current liabilities Accounts payable and accrued expenses $ 22,670

$ 30,711 Accrued compensation and employee benefits 38,617 41,498

Deferred revenue and advance payments 175,358 198,734

Total current liabilities 236,645 270,943 Deferred revenue

and advance payments 5,816 6,400 Other long-term liabilities 64,503

50,146 Deferred tax liabilities 4 4

Total

Liabilities 306,968 327,493

Stockholders' Equity Preferred stock undesignated, $0.001

par value; 5,000 shares authorized; no shares issued or outstanding

0 0 Class A common stock, $0.001 par value; 330,000 shares

authorized; 15,837 shares issued and 9,432 shares outstanding, and

15,817 shares issued and 9,412 shares outstanding, respectively 16

16 Class B convertible common stock, $0.001 par value; 165,000

shares authorized; 2,035 shares issued and outstanding, and 2,035

shares issued and outstanding, respectively 2 2 Additional paid-in

capital 570,502 559,918 Treasury stock, at cost; 6,405 shares

(475,184 ) (475,184 ) Accumulated other comprehensive loss (8,111 )

(5,659 ) Retained earnings 533,134 526,633

Total

Stockholders' Equity 620,359

605,726 Total Liabilities and Stockholders' Equity

$ 927,327 $ 933,219

MICROSTRATEGY INCORPORATED

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(in thousands)

Six Months Ended June 30,

2018 2017 (unaudited)

(as adjusted,unaudited)

Operating activities: Net income $ 6,501 $ 25,510

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 3,870 8,540 Bad

debt expense 948 1,835 Deferred taxes (5,758 ) (3,654 ) Share-based

compensation expense 8,121 6,889 Changes in operating assets and

liabilities: Accounts receivable 5,044 16,033 Prepaid expenses and

other current assets 453 (992 ) Deposits and other assets (344 )

(275 ) Accounts payable and accrued expenses (7,775 ) (15,472 )

Accrued compensation and employee benefits (3,015 ) (10,712 )

Deferred revenue and advance payments 10,502 11,058 Other long-term

liabilities 4,780 (1,647 ) Net cash provided by

operating activities 23,327 37,113

Investing activities: Proceeds from redemption of short-term

investments 245,680 151,860 Purchases of property and equipment

(2,644 ) (1,467 ) Purchases of short-term investments

(596,376 ) (216,602 ) Net cash used in investing activities

(353,340 ) (66,209 )

Financing

activities: Proceeds from sale of class A common stock under

exercise of employee stock options 2,471 1,677 Payments on capital

lease obligations and other financing arrangements (9 )

(12 ) Net cash provided by financing activities 2,462

1,665

Effect of foreign exchange rate changes on

cash, cash equivalents, and restricted cash (2,240 )

5,246

Net decrease in cash, cash equivalents, and

restricted cash (329,791 ) (22,185 )

Cash, cash equivalents,

and restricted cash, beginning of period 421,182

402,712

Cash, cash equivalents, and restricted cash, end of

period $ 91,391 $ 380,527

MICROSTRATEGY INCORPORATED

REVENUE AND COST OF REVENUE

DETAIL

(in thousands)

Three Months Ended

Six Months Ended June 30, June 30, 2018

2017 2018 2017

(unaudited)

(as adjusted,unaudited)

(unaudited)

(as adjusted,unaudited)

Revenues Product licenses and subscription services: Product

licenses $ 19,292 $ 17,728 $ 36,593 $ 40,374 Subscription services

7,584 8,346 15,246 16,118 Total product

licenses and subscription services 26,876 26,074

51,839 56,492 Product support 73,676 70,766 148,091

141,278 Other services: Consulting 17,710 19,791 38,997 38,837

Education 2,340 2,589 4,642 4,845 Total

other services 20,050 22,380 43,639

43,682

Total revenues 120,602

119,220 243,569 241,452

Cost of revenues Product licenses and subscription services:

Product licenses 1,667 1,747 3,878 3,419 Subscription services

3,445 3,400 6,694 6,439 Total product

licenses and subscription services 5,112 5,147

10,572 9,858 Product support 4,810 4,542 9,606 8,876 Other

services: Consulting 13,542 12,867 26,863 25,284 Education

1,576 1,819 3,184 3,489 Total other services

15,118 14,686 30,047 28,773

Total

cost of revenues 25,040 24,375

50,225 47,507 Gross

profit $ 95,562 $ 94,845 $

193,344 $ 193,945

MICROSTRATEGY INCORPORATED

DEFERRED REVENUE DETAIL

(in thousands)

June 30,

December 31, June 30, 2018

2017 2017 (unaudited)

(as adjusted,unaudited)

(as adjusted,unaudited)

Current: Deferred product licenses revenue $ 1,819 $ 3,760 $

2,320 Deferred subscription services revenue 13,847 17,324 17,741

Deferred product support revenue 151,909 168,185 156,984 Deferred

other services revenue 7,783 9,465 8,681 Total

current deferred revenue and advance payments $ 175,358 $ 198,734 $

185,726

Non-current: Deferred product licenses

revenue $ 794 $ 820 $ 620 Deferred subscription services revenue 9

126 784 Deferred product support revenue 3,950 4,826 7,211 Deferred

other services revenue 1,063 628 856 Total

non-current deferred revenue and advance payments $ 5,816 $ 6,400 $

9,471

Total current and non-current: Deferred product

licenses revenue $ 2,613 $ 4,580 $ 2,940 Deferred subscription

services revenue 13,856 17,450 18,525 Deferred product support

revenue 155,859 173,011 164,195 Deferred other services revenue

8,846 10,093 9,537 Total current and

non-current deferred revenue and advance payments $ 181,174 $

205,134 $ 195,197

MICROSTRATEGY INCORPORATED

RECONCILIATION OF GAAP TO NON-GAAP

MEASURES

(in thousands)

Three Months Ended

Six Months Ended June 30, June 30, 2018

2017 2018 2017 (unaudited)

(as adjusted,unaudited)

(unaudited)

(as adjusted,unaudited)

Reconciliation of non-GAAP income from operations: (Loss)

income from operations $ (1,797 ) $ 14,076 $ (1,082 ) $ 34,911

Share-based compensation expense 3,378 3,774

8,121 6,889 Non-GAAP income from operations $ 1,581 $ 17,850

$ 7,039 $ 41,800

MICROSTRATEGY INCORPORATED

WORLDWIDE EMPLOYEE HEADCOUNT

June 30, March

31, December 31,

September 30, June 30, 2018

2018 2017 2017 2017 Subscription

services 54 57 53 50 49 Product

support 184 182 172 163 176 Consulting 443 441 441 447 448

Education 39 42 41 41 42 Sales and marketing 687 667 652 635 642

Research and development 651 604 559 539 526 General and

administrative 322 313 298 303

301 Total headcount 2,380 2,306 2,216

2,178 2,184

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180726005907/en/

MicroStrategy IncorporatedInvestor RelationsClaudia Cahill,

703-848-8600ir@microstrategy.com

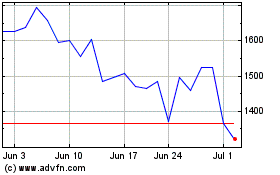

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Sep 2024 to Oct 2024

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Oct 2023 to Oct 2024