Long-term Treasury ETFs Back in Focus - ETF News And Commentary

January 28 2014 - 12:00PM

Zacks

After a lackluster 2013,

the fixed income world is finally gaining some traction this year.

In particular, investors are adding long-term Treasuries to their

portfolio as surprisingly weak jobs growth and low inflation for

December raised concerns about sustained economic improvement and

continuation of Fed taper plans.

The U.S. economy added just 74,000 jobs in December, much below

analysts’ expectation of 200,000 (as polled by Reuters). This

represents the slowest job growth rate in three years. However,

this weakness could be largely due to severe cold weather, which is

a temporary factor (read: 3 ETFs Surging on Weak Jobs Data).

Though annual inflation rate was at 1.5% in December — the largest

increase in six months — it is still far cry from the Fed’s target

of 2%. The combination of feeble job numbers and persistently low

inflation, boosted the appeal for the long duration bonds. This is

because low inflation will continue to keep interest rates at lower

levels for longer than expected, driving the yields down and bond

prices up.

Further, if inflation continues to fall or job numbers continue to

disappoint, the Fed might take a cautious stance on its plan to

curb QE3 by extending the timescale of its tapering process or

holding off reductions for longer than initially expected.

After months of speculation, the Fed finally decided to cut its

bond purchases by $10 billion starting this month. It also

reiterated that the scaling back of asset purchases wasn’t on a

preset course, and that future decisions on asset purchases would

be made based on upcoming data releases (read: Fed Tapers Bond

Purchases: 3 ETFs in Focus on the News).

All these factors are encouraging investors to enter into the bond

market. As such, long-term Treasury funds like iShares 20+

Year Treasury Bond ETF (TLT) and Vanguard Extended

Duration Treasury ETF (EDV) have witnessed strong momentum

to start the year.

TLT and EDV in Focus

TLT gathered more than $164 million this month, propelling its

total asset base to $2.33 billion. Meanwhile, EDV gathered nearly

$23 million in capital, bringing its total asset base to $157.5

million.

TLT is one of the most popular and liquid ETFs in the bond space.

It follows the Barclays Capital U.S. 20+ Year Treasury Bond Index.

Holdings 22 securities in its basket, the fund focuses on the top

credit rating bonds (AA+ and higher). The average maturity comes in

27.40 years and the effective duration is 16.38 years.

The ETF charges 0.15% in annual fees and has added 3.5% so far this

year. The fund has a decent Zacks ETF Rank of 3 or ‘Hold’ rating

(see: all the Government Bonds ETFs here).

On the other hand, EDV provides exposure to the long-term Treasury

STRIPS market by tracking the Barclays U.S. Treasury STRIPS 20–30

Year Equal Par Bond Index. The fund holds 66 bonds in total with

average maturity of 25.3 years and average duration of 24.8 years.

Expense ratio came in at 0.12%. The fund gained 5.5% in the

year-to-date time frame and has a Zacks ETF Rank of 4 or ‘Sell’

rating.

Bottom Line

Treasury bond ETFs were the worst hit last year on taper talks and

the resultant increase in interest rates. However, this year,

disappointing jobless claims and low inflation have spread

volatility in the equity stock markets, bringing the luster back

into these safe haven investments (read: Most Popular Bond ETFs of

2013).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

VANGD-EX DUR TR (EDV): ETF Research Reports

ISHARS-20+YTB (TLT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

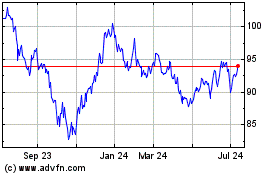

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From Apr 2024 to May 2024

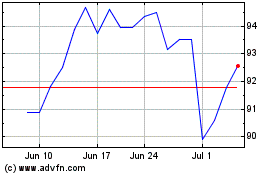

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From May 2023 to May 2024