|

CUSIP NO. 44980X 10 9

|

Page of __

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 3)*

IPG Photonics Corporation

(Name of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

(CUSIP Number)

Angelo P. Lopresti

IPG Photonics Corporation

50 Old Webster Road

Oxford, MA 01540

508-373-1100

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

o

Note

: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP NO. 44980X 10 9

|

Page of __

|

|

|

1.

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only).

|

|

|

|

The Valentin Gapontsev Trust I

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

o

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6.

|

Citizenship or Place of Organization:

Massachusetts

|

|

|

|

|

7.

|

Sole Voting Power

0

|

|

|

|

8.

|

Shared Voting Power

15,284,002

|

|

|

|

9.

|

Sole Dispositive Power

0

|

|

|

|

10.

|

Shared Dispositive Power

15,284,002

|

|

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

15,284,002

|

|

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

29.81%

|

|

|

|

|

14.

|

Type of Reporting Person (See Instructions)

OO

|

|

CUSIP NO. 44980X 10 9

|

Page of __

|

|

|

1.

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only).

|

|

|

|

Angelo P. Lopresti, individually and as trustee of The Valentin Gapontsev Trust I

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

o

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6.

|

Citizenship or Place of Organization:

United States

|

|

|

|

|

7.

|

Sole Voting Power

77,065

|

|

|

|

8.

|

Shared Voting Power

17,264,002

|

|

|

|

9.

|

Sole Dispositive Power

77,065

|

|

|

|

10.

|

Shared Dispositive Power

17,264,002

|

|

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

17,341,067

|

|

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

33.80%

|

|

|

|

|

14.

|

Type of Reporting Person (See Instructions)

IN

|

|

CUSIP NO. 44980X 10 9

|

Page of __

|

|

|

1.

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only).

|

|

|

|

Nikolai Platonov, individually and as trustee of The Valentin Gapontsev Trust I

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

o

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6.

|

Citizenship or Place of Organization: United States and Russia

|

|

|

|

|

7.

|

Sole Voting Power

3,000

|

|

|

|

8.

|

Shared Voting Power

16,264,002

|

|

|

|

9.

|

Sole Dispositive Power

3,000

|

|

|

|

10.

|

Shared Dispositive Power

16,264,002

|

|

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

16,267,002

|

|

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

31.73%

|

|

|

|

|

14.

|

Type of Reporting Person (See Instructions)

IN

|

|

CUSIP NO. 44980X 10 9

|

Page of __

|

|

|

1.

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only).

|

|

|

|

Alexander Ovtchinnikov, individually and as trustee of The Valentin Gapontsev Trust I

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

o

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6.

|

Citizenship or Place of Organization: United States and Russia

|

|

|

|

|

7.

|

Sole Voting Power

112,350

|

|

|

|

8.

|

Shared Voting Power

17,264,002

|

|

|

|

9.

|

Sole Dispositive Power

112,350

|

|

|

|

10.

|

Shared Dispositive Power

17,264,002

|

|

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

17,376,352

|

|

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

33.89%

|

|

|

|

|

14.

|

Type of Reporting Person (See Instructions)

IN

|

|

CUSIP NO. 44980X 10 9

|

Page of __

|

|

|

1.

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only).

|

|

|

|

Eugene Scherbakov, individually and as trustee of The Valentin Gapontsev Trust I

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

o

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6.

|

Citizenship or Place of Organization: United States and Russia

|

|

|

|

|

7.

|

Sole Voting Power

33,085

|

|

|

|

8.

|

Shared Voting Power

17,264,002

|

|

|

|

9.

|

Sole Dispositive Power

33,085

|

|

|

|

10.

|

Shared Dispositive Power

17,264,002

|

|

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

17,297,087

|

|

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

33.72%

|

|

|

|

|

14.

|

Type of Reporting Person (See Instructions)

IN

|

|

CUSIP NO. 44980X 10 9

|

Page of __

|

Introductory Note:

On December 13, 2012, Valentin P. Gapontsev, the founder, Chief Executive Officer and Chairman of IPG Photonics Corporation, a Delaware corporation (the “Issuer”), established The Valentin Gapontsev Trust III, an irrevocable trust (“Trust III”), for estate planning purposes. Dr. Gapontsev established the trust as an estate planning vehicle for the primary benefit of his family to hold shares previously owned by him. Also on December 13, 2012, Dr. Gapontsev transferred to Trust III for estate planning purposes (a) 1,000,000 shares of common stock, $0.0001 par value per share, of the Issuer (“Common Stock”) owned by Dr. Gapontsev and (b) a 2.0% interest in IP Fibre Devices (UK) Ltd. (“IPFD”) owned by him. IPFD owns 7,354,002 shares of the Issuer.

After the transfers to the Trust, Dr. Gapontsev continues to be the managing director of IPFD, and continues to beneficially own, for purposes of Section 13(d) of the Securities Exchange Act of 1934 (the “Exchange Act”), the 7,354,002 shares of Common Stock owned of record by IPFD.

After the transfers to the Trust, Dr. Gapontsev continues to beneficially own 7,981,933 shares of Common Stock of the Issuer, or 15.6% of the Issuer’s outstanding shares, comprised of 627,931 shares of Common Stock owned of record by Dr. Gapontsev and 7,354,002 shares of Common Stock owned of record by IPFD, of which is Dr. Gapontsev is the sole managing director.

This Amendment No. 3 to Schedule 13D amends and supplements the Schedule 13D originally filed by certain of the Reporting Persons on December 21, 2010, as amended on January 24, 2011 and May 23, 2011 (as amended, the “Schedule 13D”). Except as expressly set forth herein, there have been no changes in the information set forth in Amendment No. 2 to Schedule 13D filed on May 23, 2011.

|

Item 3.

|

Source and Amount of Funds or Other Consideration

|

Item 3 of the Schedule 13D is supplemented as follows:

The shares of Common Stock beneficially owned by Angelo P. Lopresti, Alexander Ovtchinnikov and Eugene Scherbakov by virtue of their positions as trustees of Trust III were acquired by such Reporting Persons in connection with (a) the purchase of 890,000 shares of Common Stock by Trust III from Dr. Gapontsev and (b) the gift of 110,000 shares of Common Stock to Trust III by Dr. Gapontsev. The shares of Common Stock of the Issuer were purchased by Trust III in a privately negotiated transaction. Dr. Gapontsev also sold to Trust III a 2.0% interest in IPFD, also in a privately negotiated transaction. The funds to purchase the 890,000 shares of Common Stock and the 2.0% interest in IPFD were borrowed by Trust III from Dr. Gapontsev. The borrowed funds are represented by an unsecured promissory note. No consideration was paid for the shares of Common Stock acquired by Trust III by gift from Dr. Gapontsev

.

|

Item 4.

|

Purpose of Transaction

|

Item 4 of the Schedule 13D is supplemented as follows:

On December 13, 2012, in connection with an estate planning transaction, Dr. Gapontsev, the founder, Chief Executive Officer and Chairman of the Issuer, established Trust III. The trustees of Trust III are Angelo P. Lopresti, Alexander Ovtchinnikov and Eugene Scherbakov, each of whom is an individual Reporting Persons named in Item 2 of this Schedule 13D, and Valentin Fomin, an employee of a subsidiary of the Issuer. Trust III was funded on December 13, 2012 with 1,000,000 shares of the Issuer, 142,140 shares of which were gifted to Trust III for no consideration, 890,000 shares of which were sold to Trust III, and a 2.0% interest in IPFD that was sold to Trust III. The consideration for the shares of the Issuer and the interest in IPFD purchased by Trust III was $53,264,275.

The acquisition of the shares of Common Stock by Trust III and its trustees was made for investment purposes.

Trust III and its trustees may purchase additional shares of the Issuer’s Common Stock or similar securities from time to time, either in brokerage transactions or in privately negotiated transactions. Any decision by any of the trustees, for their own account or on behalf of Trust III, to increase their respective holdings of the Issuer’s Common Stock will depend on various factors, including, but not limited to, the price of the Common Stock, the terms and conditions of the transaction, and prevailing market conditions. Trust III also may acquire beneficial ownership of additional shares of Common Stock from time to time in connection with any future gifts by Dr. Gapontsev.

Trust III and its trustees also may, at any time, subject to compliance with applicable securities laws, dispose of some or all of their shares of Common Stock depending on various factors, including, but not limited to, the price of the Common Stock, the terms and conditions of the transaction, and prevailing market conditions, as well as liquidity, estate planning and diversification objectives. In addition, Trust III and its trustees may make gifts of Common Stock from time to time.

Trust III and its trustees intend to participate in and influence the affairs of the Issuer through the exercise of their voting rights with respect to their shares of the Issuer’s Common Stock. In addition, each of the trustees is an officer or employee of the Issuer or an affiliate or subsidiary of the Issuer, and may, in connection with his duties and responsibilities to the Issuer, in the ordinary course or otherwise, take actions to influence the management, business and affairs of the Issuer.

Other than as set forth in this Item 4, the Reporting Persons do not have any current plans or proposals that relate to or would result in any of the matters referred to in paragraphs (a) through (j) of Item 4 of the initial Schedule 13D.

The filing of this Schedule 13D and any future amendment by the Reporting Persons, and the inclusion of information herein and therein, shall not be considered an admission that any of such persons, for the purpose of Section 16(b) of the Exchange Act, are the beneficial owners of any shares in which such persons do not have a pecuniary interest. Each of the Reporting Persons disclaims any beneficial ownership of the Shares covered by this Schedule 13D that he or it does not directly own.

|

Item 5.

|

Interest in Securities of the Issuer

|

|

(a)-(b)

|

Incorporated by reference to Items (7) - (11) and (13) of the cover page relating to each filing person. The individual Reporting Persons named in Item 2, above, by virtue of being trustees of the Valentin Gapontsev Trust I, the Valentin Gapontsev Trust II and/or the Valentin Gapontsev Trust III may be deemed to have the power to direct the voting and disposition of the shares of the Issuer’s common stock owned by the respective Trust, including the 7,354,002 shares of Common Stock beneficially owned by IPFD, in which the Valentin Gapontsev Trust I, holds a 48.0% interest and the Valentin Gapontsev Trust III holds a 2.0% interest.

|

|

(c)

|

On November 29, 2012, Reporting Person Alexander Ovtchinnikov sold 688 shares of the Issuer’s common stock at an average price of $61.00 per share, in brokerage transactions.

On October 17, 2012, Reporting Person Alexander Ovtchinnikov sold 687 shares of the Issuer’s common stock at an average price of $61.02 per share, in brokerage transactions.

|

|

(d)

|

Not applicable.

|

|

Item 7.

|

Material to Be Filed as Exhibits

|

|

99.1

|

|

Promissory Note of Valentin Gapontsev Trust III, dated December 13, 2012

|

|

|

|

|

|

CUSIP NO. 44980X 10 9

|

Page of __

|

Signatures

After reasonable inquiry and to the best of its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated this 17th day of December 2012.

THE VALENTIN GAPONTSEV TRUST I

By:

/s/ Angelo P. Lopresti

Angelo P. Lopresti

Trustee

By:

/s/ Alexander Ovtchinnikov

Alexander Ovtchinnikov

Trustee

By:

/s/ Nikolai Platonov

Nikolai Platonov

Trustee

By:

/s/ Eugene Scherbakov

Eugene Scherbakov

Trustee

ANGELO P. LOPRESTI

/s/ Angelo P. Lopresti

ALEXANDER OVTCHINNIKOV

/s/ Alexander Ovtchinnikov

NIKOLAI PLATONOV

/s/ Nikolai Platonov

EUGENE SCHERBAKOV

/s/ Eugene Scherbakov

|

CUSIP NO. 44980X 10 9

|

Page of __

|

Exhibits

|

|

99.1

|

Promissory Note of Valentin Gapontsev Trust III, dated December 13, 2012

|

|

|

|

|

|

CUSIP NO. 44980X 10 9

|

Page of __

|

Exhibit 99.1

PROMISSORY NOTE

$

53,264,275.00 Oxford, Massachusetts

December 13, 2012

FOR VALUE RECEIVED, Angelo P. Lopresti, Alexander Ovtchinnikov, Eugene Shcherbakov and Valentin Fomin , as Trustees of THE VALENTIN GAPONSTEV TRUST III, created by trust agreement dated _December 13, 2012, and not individually or in any other capacity (the "

Maker

"), hereby promise to pay to the order of Valentin P. Gapontsev, of Worcester, Massachusetts (the “

Holder

”), on the ninth (9

th

) anniversary of this Note, the principal sum of Fifty-Three Million, Two Hundred and Sixty-Four Thousand, Two Hundred and Seventy-Five Dollars ($53,264,275.00) (or so much thereof as shall not have been prepaid) and to pay interest on the entire unpaid balance hereof on each anniversary of this Note at the rate of

ninety-five hundredths

percent (

0.95%

) per annum. Said principal and interest payments shall be paid, in cash, by wire transfer or by check, at such address or to such bank account as Holder shall designate in writing.

This Note may be prepaid, in whole or in part, at any time and from time to time at the option of the undersigned, with interest accrued on the amount to be prepaid, without premium or penalty. Any amount of principal or interest not paid when due shall bear interest from such due date until paid.

This Note shall become immediately due and payable without demand or notice if (1) any court of competent jurisdiction shall enter a decree or order not vacated or stayed within sixty (60) days from the date of entry (a) appointing a receiver of the Maker or (b) approving a petition for the adjudication of the Maker as a bankrupt or insolvent, or (2) the Maker shall itself file any such petition or take or consent to any other action seeking any such judicial order or shall make an assignment for the benefit of its creditors or shall admit in writing its inability to pay its debts generally as they become due, or (3) the Maker shall fail to pay any installment of interest within (30) days after receipt of notice of demand for payment. Any delay or failure to enforce any of these provisions shall not waive or change any of the Holder’s rights in enforcing the same.

In the event of the default in the payment of this Note, the Maker hereby promises to pay all costs, charges and expenses, including reasonable attorney’s fees, incurred by the Holder.

This Note shall be binding upon Maker and their legal representatives, successors and assigns, and shall inure to the benefit of Holder and his legal representatives, heirs and assigns. Notwithstanding the foregoing, the Maker is entering into this Note solely in their capacity as Trustees and not individually or in any other capacity, and this Note is without recourse under any circumstances to the personal or corporate assets of any Trustee.

This Note shall be governed by and construed in accordance with the laws of the Commonwealth of Massachusetts without giving effect to its principles of conflicts of law. The Maker hereby consents to service of process, and to be sued, in the Commonwealth of Massachusetts and consents to the jurisdiction of the courts of the Commonwealth of Massachusetts and the United States District Court for the District of Massachusetts, for the purpose of any suit, action or other proceeding arising hereunder, and expressly waives any and all objections they may have to venue in any such courts.

|

CUSIP NO. 44980X 10 9

|

Page of __

|

MAKER:

THE VALENTIN GAPONSTEV TRUST III

|

|

By:

/s/Angelo P. Lopresti

_______________

|

|

|

ANGELO P. LOPRESTI, as Trustee and not individually or in any other capacity

|

|

|

By:

/s/ Alexander Ovtchinnikov

__________

|

|

|

ALEXANDER OVTCHINNIKOV, as Trustee and not individually or in any other capacity

|

|

|

EUGENE SCHERBAKOV, as Trustee and not individually or in any other capacity

|

|

|

VALENTIN FOMIN, as Trustee and not individually or in any other capacity

|

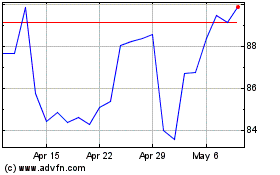

IPG Photonics (NASDAQ:IPGP)

Historical Stock Chart

From Oct 2024 to Nov 2024

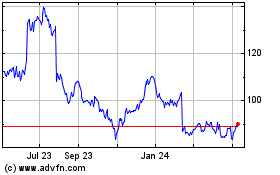

IPG Photonics (NASDAQ:IPGP)

Historical Stock Chart

From Nov 2023 to Nov 2024