0001559998

false

0001559998

2023-10-04

2023-10-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report:

October

4, 2023

Gaucho

Group Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40075 |

|

52-2158952 |

| State

of |

|

Commission

|

|

IRS

Employer |

| Incorporation |

|

File

Number |

|

Identification

No. |

112

NE 41st Street, Suite 106

Miami,

FL 33137

Address

of principal executive offices

212-739-7700

Telephone

number, including area code

Former

name or former address if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

VINO |

|

The

Nasdaq Stock Market LLC |

Item

3.02 Unregistered Sales of Equity Securities.

As

previously reported on our Current Report on Form 8-K filed on February 21, 2023, Gaucho Group Holdings, Inc. (the “Company,”

“we,” “us” or “our”), and an institutional investor (the “Holder”) entered into that

certain Securities Purchase Agreement, dated as of February 21, 2023 (the “Securities Purchase Agreement”) and the Company

issued to the Holder a senior secured convertible note, as amended (the “Note”) and warrant to purchase 3,377,099 shares

of common stock of the Company (the “Warrant” and together with the Securities Purchase Agreement and the Note, the “Note

Documents”). For the full description of the Note Documents, please refer to our Current Report on Form 8-K and the exhibits attached

thereto as filed with the SEC on February 21, 2023.

On

October 4, 2023, the investor elected to convert a total of $2,063,816 of principal, $136,444 of interest, $330,039 of premium, and $1,016,228

of cash true up pursuant to the Note into 937,157 shares of common stock of the Company at a conversion price of $2.70 per share.

On

October 5, 2023, the investor elected to convert a total of $210,732 of principal and $31,610 of premium pursuant to the Note into 150,000

shares of common stock of the Company at a conversion price of $1.62 per share.

On

October 9, 2023, the investor elected to convert a total of $73,046 of principal and $12,600 of premium pursuant to the Note into 95,000

shares of common stock of the Company at a conversion price of $0.88 per share.

The

shares of common stock that have been and may be issued under the Note Documents are being offered and sold in a transaction exempt from

registration under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on Section 4(a)(2) thereof

and/or Rule 506(b) of Regulation D thereunder. The Company filed a Form D with the SEC on or about March 3, 2023.

Also,

on October 5, 2023, pursuant to the Common Stock Purchase Agreement with Tumim Capital dated November 8, 2022, the Company requested

a draw-down and issued shares of common stock and received gross proceeds as follows: 39,000 shares of common stock to Tumim for gross

proceeds of $76,449. No general solicitation was used, and a commission of 8% of the total gross proceeds was paid to Benchmark Investments,

Inc. pursuant to the Underwriting Agreement between the Company and Kingswood Capital Markets, a division of Benchmark Investments, Inc.,

f/k/a EF Hutton, dated February 16, 2021. The Company relied on the exemptions from registration available under Section 4(a)(2) and/or

Rule 506(b) of Regulation D of the Securities Act, in connection with the sales. A Form D was filed with the SEC on November 21, 2022.

Item 8.01 Other Events.

On October 10, 2023, the Company made a press

release announcing the conversion of select vineyards to organic cultivation. The full text of the press release is furnished hereto

as Exhibit 99.1 and incorporated herein by reference.

Also on October 10, 2023, the Company posted

an article on its website. The full text of the article is furnished hereto as Exhibit 99.2 and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized, on the 10th day of October 2023.

| |

Gaucho

Group Holdings, Inc. |

| |

|

|

| |

By:

|

/s/

Scott L. Mathis |

| |

|

Scott

L. Mathis, President & CEO |

Exhibit

99.1

SUSTAINABILITY

MEETS LUXURY: GAUCHO HOLDINGS BEGINS PROCESS TO CONVERT SELECT VINEYARDS IN ITS PORTFOLIO TO ORGANIC CULTIVATION

Gaucho’s

Algodon Wine Estates Embarks on Organic Journey, Amplifying Wine Excellence and Stockholder Value

MIAMI,

FL / October 10, 2023 / Gaucho Group Holdings, Inc. (NASDAQ:VINO), a company that includes a growing collection of e-commerce platforms

with a concentration on fine wines, luxury real estate, and leather goods and accessories (the “Company” or “Gaucho

Holdings”), announced today its journey towards organic cultivation for select sections of its renowned Pinot Noir and Cabernet

Sauvignon vineyards. Anticipated to unfold over 24 to 36 months, this shift represents a pivotal move in the Company’s commitment

to sustainability and eco-friendly methods. By including premium organic products from its expansive 4,138-acre residential vineyard

estate, the Company aims to draw a broader global clientele to its real estate offerings, thereby enhancing stockholder value.

The

decision to adopt organic cultivation reflects Gaucho Holdings’ pursuit of excellence and innovation. By transitioning to organic

vineyard practices for some of its wines, the Company believes it stands to gain several key advantages: Recognizing the increasing demand

for organic wines among health-conscious and environmentally aware consumers, the move can expand the company’s market reach to

this growing demographic. Moreover, the organic label typically allows for premium pricing, presenting an opportunity to enhance profitability

with each export and domestic sale. While Algodon Wine Estates has long practiced eco-friendly cultivation, the pursuit of an official

organic certification underlines the company’s commitment to sustainable operations and transparency.

This

transition to organic practices is a strategic step in Gaucho Holdings’ long-term vision for growth. In the near future, the company

plans further develop the organic garden supporting Algodon Wine Estates’ Argentine farm-to-table restaurant, Chez Gaston. Alongside

this, the estate is undertaking infrastructure enhancements, such as the implementation of new water wells, with the aim of bolstering

water self-reliance. These endeavors are part of a broader initiative to adopt sustainable practices, all with an eye towards enhancing

stockholder value.

“Algodon

Wine Estates has always taken pride in its eco-friendly approach to winemaking. This strategic shift towards organic cultivation underscores

our dedication to offering exceptional products while staying attuned to market trends and the evolving preferences of our valued consumers,”

said Scott Mathis, Founder, Chief Executive Officer, and Chairman of the Board of Directors of Gaucho Group Holdings, Inc. “Argentina,

often overlooked in the global investment landscape, is a land brimming with untapped potential. Our contrarian vision recognizes the

opportunities this vibrant nation presents. Gaucho Holdings stands out as one of the few US companies diving deep into Argentina’s

offerings. We’re not just here for the moment; we have a slew of initiatives lined up, each designed to further enhance value for

our stockholders. Argentina’s great potential, combined with our vision, sets the stage for what we believe can be a very exciting

trajectory.”

Gaucho

Holdings invites its stockholders and wine enthusiasts worldwide to stay tuned for more updates on this exciting journey towards organic

certification and the continued evolution of its prestigious wine portfolio.

About

Gaucho Group Holdings, Inc.

For

more than ten years, Gaucho Group Holdings, Inc.’s (gauchoholdings.com) mission has been to source and develop opportunities in

Argentina’s undervalued luxury real estate and consumer marketplace. Our company has positioned itself to take advantage of the

continued and fast growth of global e-commerce across multiple market sectors, with the goal of becoming a leader in diversified luxury

goods and experiences in sought after lifestyle industries and retail landscapes. With a concentration on fine wines (algodonfinewines.com

& algodonwines.com.ar), hospitality (algodonhotels.com), and luxury real estate (algodonwineestates.com) associated with our proprietary

Algodon brand, as well as the leather goods, ready-to-wear and accessories of the fashion brand Gaucho – Buenos Aires®

(gaucho.com), these are the luxury brands in which Argentina finds its contemporary expression.

Cautionary

Note Regarding Forward-Looking Statements

The

information discussed in this press release includes “forward looking statements” within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts,

included herein concerning, among other things, changes to exchange rates and their impact on the Company, planned capital expenditures,

future cash flows and borrowings, pursuit of potential acquisition opportunities, our financial position, business strategy and other

plans and objectives for future operations, are forward looking statements. Although we believe that the expectations reflected in these

forward-looking statements are reasonable, they do involve certain assumptions, risks and uncertainties and are not (and should not be

considered to be) guarantees of future performance. Refer to our risk factors set forth in our reports filed on Edgar. The Company disclaims

any obligation to update any forward-looking statement made here.

Exhibit

99.2

Gaucho

Group Holdings, Inc.: The Case for Investing in Argentina

A

Glimpse into Argentina’s Economic Potential

Despite

often finding itself amidst negative headlines, Argentina’s stock market stands tall, representing one of the globe’s best

performers. This not only defies the general skepticism surrounding the country but also underscores the immense confidence international

investors place in Argentina’s prospective growth.

A

Contrarian Investment Strategy: Diversify with Argentinean Assets

The

present socio-economic atmosphere in regions like the US and EU calls for innovative financial strategies. At Gaucho Holdings, we champion

the idea of contrarian investments. Specifically, we urge investors to step beyond the traditional realm of USD-based assets. One of

the notable sectors we’re bullish about? Land in Argentina.

Land

prices in Argentina, currently at an accessible rate, present an enticing proposition. We’re of the firm conviction that such attractive

valuations might not linger for long. The underlying value of Argentinean land and real estate assets, teeming with potential for noteworthy

growth and appreciation, is something astute investors shouldn’t overlook.

Political

Winds of Change: Argentina’s Upcoming Elections

A

pivotal transition is imminent in Argentina with the presidential elections just around the corner. Gaucho Holdings is optimistic about

this political shift. We anticipate that the administration set to take office in 2024 will usher in a wave of economic reforms, fostering

a business-friendly environment and strengthening bonds with the global financial diaspora. This can rejuvenate investor trust and pull

in billions in fresh financing.

The

Doug Casey Perspective: A New Dawn for Argentina

Doug

Casey, a recognized authority in offshore investing, recently shared an intriguing take on Argentina’s potential future.

He remarked, “It could be the most dramatic thing that’s happened politically since at least World War II. Anywhere. Why?

Because he’s an AnCap libertarian who’d like to abolish the State—or come as close as possible. If he’s elected

in October, he’ll make every move possible to eliminate—not just reduce—as many government departments as possible

as quickly as possible. And most people seem oblivious to it.”

Gaucho

Holdings echoes Casey’s sentiments. We believe we’re on the brink of a transformative era that might very well redefine Argentina’s

economic trajectory. It’s an opportune moment that promises lucrative rewards for those who invest judiciously.

Investment

decisions should always be made with careful consideration of individual financial circumstances, goals, and risk tolerance. Always consult

with a financial advisor before making investment decisions.

Cautionary

Note Regarding Forward-Looking Statements

The

information discussed in this article includes “forward looking statements” within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, included

herein concerning, among other things, changes to exchange rates and their impact on the Company, planned capital expenditures, future

cash flows and borrowings, pursuit of potential acquisition opportunities, our financial position, business strategy and other plans

and objectives for future operations, are forward looking statements. Although we believe that the expectations reflected in these forward-looking

statements are reasonable, they do involve certain assumptions, risks and uncertainties and are not (and should not be considered to

be) guarantees of future performance. Refer to our risk factors set forth in our reports filed on Edgar. The Company disclaims any obligation

to update any forward-looking statement made here.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

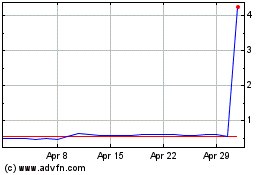

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From Jul 2023 to Jul 2024