Mortgage Market Halts Regional Banking Recovery

May 25 2011 - 8:16AM

Marketwired

Companies in the regional banking sector have posted better numbers

of late as most firms are finally setting aside less money to cover

loan losses. More thorough and cautious credit checks have led to

fewer delinquent loans and greater financial stability. While the

improving margins helped narrow losses, long-term growth worries

still loom. The Bedford Report examines the outlook for companies

in the Regional Banking Sector and provides research reports on

Regions Financial Corporation (NYSE: RF) and Fifth Third Bancorp

(NASDAQ: FITB). Access to the full company reports can be found at:

www.bedfordreport.com/2011-05-RF

www.bedfordreport.com/2011-05-FITB

Although employment numbers are improving, analysts argue loan

demand remains low due to the average American's weaker appetite

for debt following the financial crisis. It is believed that many

banks will not see much revenue growth because of this, but that

instead declining credit costs will be the primary driver of

profits moving forward.

Several Banks in the industry have warned that the increased

role of government-owned companies in the mortgage market may weigh

on results moving forward. Housing market reform could create

opportunities for companies in the savings and loans industry with

marginal debt issues. Smaller banks may be able to originate more

housing loans as Washington mulls its options regarding government

sponsored enterprises.

The Bedford Report releases regular market updates on the

Regional Banking Industry so investors can stay ahead of the crowd

and make the best investment decisions to maximize their returns.

Take a few minutes to register with us free at

www.bedfordreport.com and get exclusive access to our numerous

analyst reports and industry newsletters.

In order to offset a poor mortgage market, Regions Financial has

begun to diversify its loan portfolio by lending to defense and

technology companies. Regions Financial posted a surprise first

quarter net income of $17 million, or 1 cent per share, compared

with a loss of $255 million, or 21 cents per share, in the year-ago

quarter. Regions' chief executive, Grayson Hall, believes the bank

is making "solid headwind towards sustainable profitability and key

credit metrics continue to improve."

Fifth Third Bancorp reported first quarter net income available

to common shareholders of $88 million or 10 cents per share. The

results compared favorably with net loss of $72 million or 9 cents

in the prior-year quarter.

The Bedford Report provides Analyst Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above mentioned publicly traded companies. The Bedford Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.bedfordreport.com/disclaimer.

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

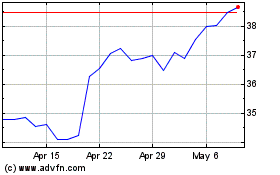

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Oct 2024 to Nov 2024

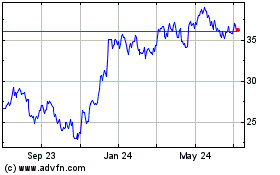

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Nov 2023 to Nov 2024