UPDATE: Trading Community Operating As Normal After Quake

August 23 2011 - 3:55PM

Dow Jones News

Exchanges' trading operations and electronic market systems were

unaffected by the magnitude-6.0 earthquake that struck Virginia

early Tuesday afternoon, according to officials.

U.S. stocks came off their session highs following the quake but

the pullback was brief. The market has since resumed its rally and

is up about 305 points on the Dow Jones Industrial Average.

Gold, which had already settled for the day, took another leg

down in response to stocks rising. Recently, gold futures were 3%

lower in after-hours trading and recently hit an intraday low of

$1,830 an ounce. Oil and other industrial commodities dipped but

quickly recovered. Oil ended $1.02 higher at $85.44 a barrel.

Currencies showed little reaction to the earthquake. The dollar

slipped a few ticks against the yen in the seconds after the

earthquake, but within minutes regained those small losses. The

dollar was most recently trading at Y76.67, just above the Y76.65

level seen in the moments before the earthquake.

Treasurys initially got a boost from the quake but the bid has

faded as U.S. stocks rallied back again. The 10-year benchmark

Treasury note recently traded 14/32 lower to yield 2.139%. The

30-year bond was 1 10/32 lower to yield 3.47%.

Representatives for NYSE Euronext (NYX), Nasdaq OMX Group Inc.

(NDAQ) and BATS Global Markets said that dealing in securities and

stock options continued unabated following the earthquake.

The New York Stock Exchange's downtown New York trading floor

wasn't evacuated, nor was Nasdaq's Philadelphia options-trading

floor, though NYSE floor officials warned of potential

aftershocks.

"It felt like there was a subway train going underneath the

building," said Jonathan Corpina, senior managing partner of

Meridian Equity Partners, a broker on the NYSE floor.

He said everyone paused for about 20 seconds before it was

"business as usual" again.

Keith Bliss, senior vice president at Cuttone & Co., a

brokerage on the NYSE floor, said some traders on the floor felt

their monitors shake, but there was no damage. "We're trading away

now," he said.

Some traders departed the New York Mercantile Exchange floor,

but no official evacuation notice was given by the exchange and

trading continued as per normal, according to a spokesman for

parent CME Group Inc. (CME).

"Screens were shaking, booths were moving," said Peter Donovan,

vice president of Vantage Trading and a broker on the Nymex

floor.

The quake was a test for the high-tech infrastructure supporting

stock and derivatives markets that are now heavily electronic. New

York-area data centers run by NYSE Euronext and specialist firms

such as Equinix Inc. (EQIX) and Telx Group Inc. reported no issues

affecting the trades and messages among exchanges, brokers and

proprietary trading firms, according to spokespersons.

Spread Networks, which runs a high-speed corridor between the

New York and Chicago financial hubs, said its connections were

unaffected by the temblor.

Facilities housing exchanges' matching engines and the servers

used by traders to send orders into the market are built to

withstand catastrophes such as earthquakes, fires, floods and

lengthy power outages. NYSE Euronext over the past two years has

spent about $500 million constructing facilities in New Jersey and

the United Kingdom, with backup generators ensuring power continues

to flow in the event of a blackout.

Representatives for Citigroup Inc. (C) and J.P. Morgan Chase

& Co. (JPM) said their trading operations were operating as

normal and there were no major disruptions. J.P. Morgan said it

allowed employees to leave its New York buildings voluntarily, but

there were no forced evacuations and operations continued as

normal.

Tomasz Lesyk, a Citi employee in Stamford, Conn., said his

building on 750 Washington Blvd. was evacuated shortly after

employees felt vibrations. A few employees outside UBS AG's (UBS,

UBSN.VX) North American headquarters in Stamford said they weren't

evacuated, though some went outside on their own accord.

The quake's strength rating was upgraded from an initial 5.8 to

6.0 by the U.S. Geological Survey.

-By Jacob Bunge, Dow Jones Newswires; 312-750-4117;

jacob.bunge@dowjones.com

--Steve Russolillo, David Benoit and Daniel Strumpf contributed

to this article.

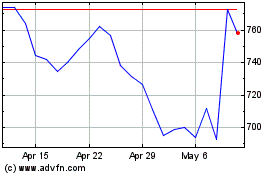

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Apr 2024 to May 2024

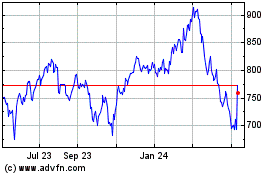

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From May 2023 to May 2024