- Same-Store Net Sales: Dollar Tree +6.3%; Family Dollar

-1.2%; Enterprise +3.0%

- Comparable Transaction Count: Dollar Tree +7.1%; Family

Dollar +0.7%

- Diluted Loss per Share of $7.85

- Results Include a $594.4 Million Charge for Portfolio

Optimization Review, a $1.07 Billion Goodwill Impairment Charge,

and a $950 Million Trade Name Intangible Asset Impairment

Charge.

- Adjusted Earnings per Share (EPS) of $2.55, Including $0.17

of Costs Primarily Related to General Liability Claims.

- Quarter and Annual Results Reflect Extra Week as Fiscal 2023

was a 53-Week Year.

- Portfolio Optimization Review Identifies Approximately 600

Family Dollar Stores for Closure in First Half of Fiscal 2024 and

Approximately 370 Additional Stores as Their Leases

Expire.

- Fiscal 2024 Net Sales Outlook Range of $31.0 Billion to

$32.0 Billion

- Fiscal 2024 Diluted EPS Outlook Range of $6.70 to

$7.30

Dollar Tree, Inc. (NASDAQ: DLTR) today reported financial

results for its fourth quarter ended February 3, 2024.

“We finished the year strong, with fourth quarter results

reflecting positive traffic trends, market share gains, and

adjusted margin improvement across both segments,” said Rick

Dreiling, Chairman and Chief Executive Officer. “While we are still

in the early stages of our transformation journey, I am proud of

what our team accomplished in 2023 and see a long runway of growth

ahead of us. As we look forward in 2024, we are accelerating our

multi-price rollout at Dollar Tree and taking decisive action to

improve profitability and unlock value at Family Dollar.”

Chief Financial Officer Jeff Davis added, “As an organization,

we continue to execute at a high level. Our core operating

performance was strong in the fourth quarter, despite some

unanticipated developments related to general liability

claims.”

Additional Business

Highlights

- Opened 219 new stores in the fourth quarter, bringing full-year

new store openings to 641

- $3 and $5 center-store merchandise available at approximately

5,000 Dollar Tree stores

- $3, $4, and $5 frozen and refrigerated items available at more

than 6,500 Dollar Tree stores

- Net cash provided by operating activities increased $1.07

billion in FY 2023

- Increased free cash flow by $217.2 million compared to FY

2022

Fourth Quarter and Fiscal 2023

Key Operating Results (unaudited)

(Compared to same period fiscal 2022)

Q4

Fiscal 2023

Change

Fiscal 2023

Change

Consolidated Net Sales

$8.63B

11.9

%

$30.6B

8.0

%

Same-Store Net Sales Growth:

Dollar Tree Segment

6.3

%

5.8

%

Family Dollar Segment

(1.2

%)

3.2

%

Enterprise

3.0

%

4.6

%

Operating Income

($1.89B

)

NM

($882M

)

NM

Diluted EPS

($7.85

)

NM

($4.55

)

NM

Adjusted Operating Income1

$749M

21.2

%

$1.79B

(20.0

%)

Adjusted Diluted EPS1

$2.55

25.0

%

$5.89

(18.3

%)

1Adjustments are due to charges

related to legal reserves, store optimization review, and annual

impairment testing of goodwill and non-amortizing intangible

assets. See “Reconciliation of Non-GAAP Financial Measures” below

for detailed schedules of these charges.

Fourth Quarter Results

Unless otherwise noted, all comparisons are between the 14 weeks

ended February 3, 2024, and the 13 weeks ended January 28,

2023.

Consolidated net sales increased 11.9% to $8.63 billion.

Enterprise same-store net sales increased 3.0%, driven by a 4.6%

increase in traffic, partially offset by a 1.5% decline in average

ticket. Dollar Tree same-store net sales increased 6.3%, driven by

a 7.1% increase in traffic, partially offset by a 0.7% decline in

average ticket. Family Dollar’s same-store net sales decreased

1.2%, driven by a 0.7% increase in traffic, partially offset by a

2.0% decline in average ticket.

Gross profit increased 16.2% to $2.77 billion and gross margin

expanded 120 basis points to 32.1%. Gross margin expansion was

driven by lower freight costs, sales leverage, the impact of the

53rd week in fiscal 2023, and higher allowances, offset by product

cost inflation, unfavorable sales mix, elevated shrink, and higher

distribution and markdown costs. On a non-GAAP basis, which

excludes distribution and markdown costs related to the store

portfolio optimization review, adjusted gross profit increased

19.8% to $2.86 billion and adjusted gross margin expanded 220 basis

points to 33.1%.

Selling, general and administrative expenses were 54.0% of total

revenue, compared to 22.9%. The increase was due to a non-cash

goodwill impairment charge, a non-cash trade name impairment

charge, a non-cash store asset impairment charge, a litigation

charge, unfavorable development of general liability claims, labor

investments in store and field payroll, investments in repairs and

maintenance, and higher depreciation and amortization, partially

offset by sales leverage, the impact of the 53rd week in fiscal

2023, and lower utility costs. On a non-GAAP basis, which excludes

the impairment and litigation charges, adjusted selling, general

and administrative costs were 24.4% of total revenue.

Operating loss was $1.89 billion and operating margin was

-21.9%. On a non-GAAP basis, adjusted operating income increased

21.2% to $749.1 million and adjusted operating margin expanded 70

basis points to 8.7%.

The Company’s effective tax rate was 10.8%. On a non-GAAP basis,

the adjusted effective tax rate was 23.1% compared to 23.4%.

Net loss was $1.71 billion and diluted loss per share was $7.85.

On a non-GAAP basis, adjusted net income was $555.7 million and

adjusted diluted EPS was $2.55. Adjusted diluted EPS reflects

approximately $0.17 of net negative impact, primarily related to

unfavorable development of general liability insurance claims.

Given the portfolio review process, the Company did not

repurchase any shares during the quarter.

Year-to-Date Results

Unless otherwise noted, all comparisons are between the 53 weeks

ended February 3, 2024, and the 52 weeks ended January 28,

2023.

Consolidated net sales increased 8.0% to $30.6 billion.

Enterprise same-store net sales increased 4.6%. Dollar Tree

same-store net sales increased 5.8%, driven by a 7.4% increase in

traffic, partially offset by a 1.5% decline in average ticket.

Family Dollar’s 3.2% same-store net sales increase was comprised of

a 2.5% increase in traffic along with a 0.7% increase in average

ticket.

Gross profit increased 4.3% to $9.31 billion and gross margin

declined 110 basis points to 30.4%. The decline in gross margin was

driven by elevated shrink, product cost inflation, unfavorable

sales mix, and higher distribution and markdown costs, partially

offset by lower freight costs, sales leverage, and the impact of

the 53rd week in fiscal 2023. On a non-GAAP basis, which excludes

distribution and markdown costs related to the store portfolio

optimization review, adjusted gross profit increased 5.3% to $9.40

billion and adjusted gross margin declined 80 basis points to

30.7%.

Selling, general and administrative expenses were 33.4% of total

revenue, compared to 23.6%. The increase was due to a non-cash

goodwill impairment charge, a non-cash trade name impairment

charge, a non-cash store asset impairment charge, a litigation

charge, labor investments in store and field payroll, unfavorable

development of general liability claims, investments in repairs and

maintenance, and higher depreciation and amortization, partially

offset by sales leverage and the impact of the 53rd week in fiscal

2023. On a non-GAAP basis, which excludes the impairment and

litigation charges, adjusted selling, general and administrative

costs were 24.9% of total revenue.

Operating loss was $881.8 million and operating margin decreased

1,080 basis points to -2.9%. On a non-GAAP basis, adjusted

operating income decreased 20.0% to $1.79 billion and adjusted

operating margin decreased 210 basis points to 5.8%.

The Company’s effective tax rate was -1.0%. On a non-GAAP basis,

the adjusted effective tax rate was 23.1% compared to 23.5%.

Net loss was $998.4 million and diluted loss per share was

$4.55. On a non-GAAP basis, adjusted net income was $1.29 billion

and adjusted diluted EPS was $5.89. Adjusted diluted EPS reflects

approximately $0.24 of net negative impact, primarily related to

unfavorable development of general liability claims.

The Company repurchased 3,905,599 shares for $504.3 million,

including applicable excise tax.

Portfolio Optimization Review and

Impairments

During the fourth quarter of fiscal 2023, the Company announced

that it had initiated a comprehensive store portfolio optimization

review which involved identifying stores for closure, relocation,

or re-bannering based on an evaluation of current market conditions

and individual store performance, among other factors. As a result

of this review, we plan on closing approximately 600 Family Dollar

stores in the first half of fiscal 2024. Additionally,

approximately 370 Family Dollar and 30 Dollar Tree stores will

close over the next several years at the end of each store’s

current lease term. In the fourth quarter of 2023, we incurred

$594.4 million of charges in connection with the store portfolio

review. Additionally, we incurred a goodwill impairment charge of

$1.07 billion and a trade name intangible asset impairment charge

of $950 million. Details of these charges are provided in the

Reconciliation of Non-GAAP Financial Measures at the end of this

release.

First Quarter and Fiscal 2024

Outlook

“We are introducing an initial fiscal 2024 EPS outlook of $6.70

to $7.30. While we expect current shrink and mix levels to be a

headwind in the first half of the year, we are expecting to benefit

from favorable freight rates and moderating headwinds from reduced

SNAP benefits throughout the year. We are making solid progress on

our key growth initiatives and are encouraged by the early results

of our business transformation efforts,” Davis added.

Consolidated net sales for full-year fiscal 2024 are expected to

range from $31.0 billion to $32.0 billion. The Company expects to

deliver a low-to-mid-single digit comparable store net sales

increase for the year, comprised of a mid-single-digit increase in

the Dollar Tree segment and a low-single-digit increase in the

Family Dollar segment. Diluted EPS is expected to range from $6.70

to $7.30.

Our fiscal 2024 outlook reflects approximately $0.15 of EPS

benefit from the anticipated Family Dollar store closures, mostly

in the second half of the year as we close underperforming stores

throughout the first half of fiscal 2024.

The Company expects consolidated net sales for the first quarter

will range from $7.6 billion to $7.9 billion, based on a

low-to-mid-single digit increase in same-store sales for the

enterprise and the Dollar Tree segment and approximately flat

same-store sales growth for the Family Dollar segment. Diluted EPS

for the quarter is estimated to be in the range of $1.33 to

$1.48.

While share repurchases are not included in the outlook, the

Company has $1.35 billion remaining under its share repurchase

authorization as of February 3, 2024.

Conference Call

Information

On Wednesday, March 13, 2024, the Company will host a conference

call to discuss its earnings results at 8:00 a.m. Eastern Time. The

telephone number for the call is 877-407-3943. A recorded version

of the call will be available for seven days after the call and may

be accessed by dialing 877-660-6853. The access code is 13744543. A

webcast of the call is also accessible through the Investor

Relations portion of the Company’s website.

Supplemental financial information for the Fourth Quarter is

available on the Investor Relations portion of the Company’s

website, at https://corporate.dollartree.com/investors.

Dollar Tree, a Fortune 200 Company, operated 16,774 stores

across 48 states and five Canadian provinces as of February 3,

2024. Stores operate under the brands of Dollar Tree, Family

Dollar, and Dollar Tree Canada. To learn more about the Company,

visit www.DollarTree.com.

Use of Non-GAAP Financial

Measures

The Company reports its financial results in accordance with

accounting principles generally accepted in the United States

(“GAAP”). From time-to-time, the Company supplements the reporting

of its financial information determined under GAAP with certain

non-GAAP financial information. The non-GAAP financial measures we

have disclosed include adjusted gross profit; adjusted gross

margin; adjusted selling, general and administrative expenses;

adjusted selling, general and administrative expense rate; adjusted

operating income (loss); adjusted operating income (loss) margin;

adjusted net income; adjusted effective tax rate; adjusted diluted

earnings per share; and free cash flow.

Reconciliations of the non-GAAP financial measures to the

corresponding amounts prepared in accordance with GAAP appears in

the tables under the heading “Reconciliation of Non-GAAP Financial

Measures” below. These tables provide additional information

regarding the adjusted measures.

A WARNING ABOUT FORWARD-LOOKING STATEMENTS: Our press release

contains "forward-looking statements" as that term is used in the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by the fact that they address future

events, developments or results and do not relate strictly to

historical facts. Any statements contained in this press release

that are not statements of historical fact may be deemed to be

forward-looking statements. Forward-looking statements include,

without limitation, statements preceded by, followed by or

including words such as: “believe”, “anticipate”, “expect”,

“intend”, “plan”, “view”, “target” or “estimate”, “may”, “will”,

“should”, “predict”, “possible”, “potential”, “continue”,

“strategy”, and similar expressions. For example, our

forward-looking statements include statements relating to our

business and financial outlook for fiscal 2024, including without

limitation our expectations regarding net sales, comparable store

sales and diluted earnings per share for the first fiscal quarter

and full fiscal year 2024, and various factors that are expected to

impact our quarterly and annual results of operations for fiscal

2024; our selling square footage for fiscal 2024; our plans and

expectations regarding our business, including the impact of

various initiatives, investments, and reviews on the company’s

performance and prospects for long-term growth; and our other

plans, objectives, expectations (financial and otherwise) and

intentions. These statements are subject to risks and

uncertainties. For a discussion of the risks, uncertainties and

assumptions that could affect our future events, developments or

results, you should carefully review the "Risk Factors," "Business"

and "Management's Discussion and Analysis of Financial Condition

and Results of Operations" sections in our Annual Report on Form

10-K filed March 10, 2023, our Form 10-Q for the most recently

ended fiscal quarter and other filings we make from time to time

with the Securities and Exchange Commission. We are not obligated

to release publicly any revisions to any forward-looking statements

contained in this press release to reflect events or circumstances

occurring after the date of this report and you should not expect

us to do so.

DOLLAR TREE, INC. Condensed Consolidated Statements of

Operations (In millions, except per share data)

14 WeeksEnded 13 WeeksEnded 53 WeeksEnded

52 WeeksEnded February 3,2024 January 28,2023

February 3,2024 January 28,2023 (Unaudited)

(Unaudited) (Unaudited) Revenues Net sales

$

8,632.9

$

7,716.2

$

30,581.6

$

28,318.2

Other revenue

7.0

4.5

22.2

13.5

Total revenue

8,639.9

7,720.7

30,603.8

28,331.7

Expenses Cost of sales

5,861.4

5,330.7

21,272.0

19,396.3

Selling, general and administrative expenses, excluding Goodwill

impairment

3,600.5

1,771.9

9,144.6

6,699.1

Goodwill impairment

1,069.0

-

1,069.0

-

Selling, general and administrative expenses

4,669.5

1,771.9

10,213.6

6,699.1

Operating income (loss)

(1,891.0

)

618.1

(881.8

)

2,236.3

Interest expense, net

26.3

28.0

106.8

125.3

Other (income) expense, net

(0.1

)

0.1

0.1

0.4

Income (loss) before income taxes

(1,917.2

)

590.0

(988.7

)

2,110.6

Provision for income taxes

(207.4

)

137.8

9.7

495.2

Net income (loss)

$

(1,709.8

)

$

452.2

$

(998.4

)

$

1,615.4

Net earnings (loss) per share: Basic

$

(7.85

)

$

2.05

$

(4.55

)

$

7.24

Weighted average number of shares

217.9

221.1

219.5

223.2

Diluted

$

(7.85

)

$

2.04

$

(4.55

)

$

7.21

Weighted average number of shares

217.9

221.9

219.5

224.1

Selling, general and administrative expense rate

54.0

%

22.9

%

33.4

%

23.6

%

Operating income (loss) margin

(21.9

%)

8.0

%

(2.9

%)

7.9

%

Income (loss) before income taxes as percentage of total revenue

(22.2

%)

7.6

%

(3.2

%)

7.4

%

Effective tax rate

10.8

%

23.4

%

(1.0

%)

23.5

%

Net income (loss) margin

(19.8

%)

5.9

%

(3.3

%)

5.7

%

The information for the year ended January 28, 2023 was derived

from the audited consolidated financial statements as of that date.

The selling, general and administrative expense rate, operating

income (loss) margin and net income (loss) margin are calculated by

dividing the applicable amount by total revenue.

DOLLAR TREE,

INC. Segment Information (In millions)

14 WeeksEnded 13 WeeksEnded 53 WeeksEnded

52 WeeksEnded February 3,2024 January 28,2023

February 3,2024 January 28,2023 (Unaudited)

(Unaudited) (Unaudited) Net sales: Dollar Tree

$

4,961.4

$

4,296.7

$

16,770.3

$

15,405.7

Family Dollar

3,671.5

3,419.5

13,811.3

12,912.5

Total net sales

$

8,632.9

$

7,716.2

$

30,581.6

$

28,318.2

Gross profit: Dollar Tree

$

1,933.2

39.0

%

$

1,577.6

36.7

%

$

6,008.9

35.8

%

$

5,775.5

37.5

%

Family Dollar

838.3

22.8

%

807.9

23.6

%

3,300.7

23.9

%

3,146.4

24.4

%

Total gross profit

$

2,771.5

32.1

%

$

2,385.5

30.9

%

$

9,309.6

30.4

%

$

8,921.9

31.5

%

Operating income (loss): Dollar Tree

$

862.6

17.4

%

$

721.3

16.8

%

$

2,278.8

13.6

%

$

2,536.0

16.5

%

Family Dollar

(2,617.8

)

(71.2

%)

1.4

0.0

%

(2,663.5

)

(19.3

%)

127.5

1.0

%

Corporate, support and other

(135.8

)

(1.6

%)

(104.6

)

(1.4

%)

(497.1

)

(1.6

%)

(427.2

)

(1.5

%)

Total operating income (loss)

$

(1,891.0

)

(21.9

%)

$

618.1

8.0

%

$

(881.8

)

(2.9

%)

$

2,236.3

7.9

%

The information for the year ended January 28, 2023 was derived

from the audited consolidated financial statements as of that date.

DOLLAR TREE, INC. Condensed Consolidated Balance

Sheets (In millions) February 3,

2024 January 28, 2023 (Unaudited) ASSETS

Current Assets: Cash and cash equivalents

$

684.9

$

642.8

Merchandise inventories

5,112.8

5,449.3

Other current assets

335.0

275.0

Total current assets

6,132.7

6,367.1

Restricted cash

72.3

68.5

Property, plant and equipment, net

6,144.1

4,972.2

Operating lease right-of-use assets

6,488.3

6,458.0

Goodwill

913.8

1,983.1

Trade name intangible asset

2,150.0

3,100.0

Deferred tax asset

9.0

15.0

Other assets

113.3

58.2

Total assets

$

22,023.5

$

23,022.1

LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities:

Current portion of operating lease liabilities

$

1,513.0

$

1,449.6

Accounts payable

2,063.8

1,899.8

Income taxes payable

52.7

58.1

Other current liabilities

1,067.2

817.7

Total current liabilities

4,696.7

4,225.2

Long-term debt, net

3,426.3

3,421.6

Operating lease liabilities, long-term

5,447.6

5,255.3

Deferred income taxes, net

841.1

1,105.7

Income taxes payable, long-term

22.0

17.4

Other liabilities

276.7

245.4

Total liabilities

14,710.4

14,270.6

Shareholders' equity

7,313.1

8,751.5

Total liabilities and shareholders' equity

$

22,023.5

$

23,022.1

The January 28, 2023 information was derived from the audited

consolidated financial statements as of that date.

DOLLAR TREE,

INC. Condensed Consolidated Statements of Cash Flows

(In millions) 53 Weeks Ended 52 Weeks

Ended February 3, 2024 January 28, 2023

(Unaudited) Cash flows from operating activities: Net income

(loss)

$

(998.4

)

$

1,615.4

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: Goodwill impairment

1,069.0

-

Depreciation and amortization

841.0

767.9

Provision for deferred income taxes

(258.6

)

123.0

Stock-based compensation expense

96.7

110.4

Impairments, excluding goodwill

1,461.5

40.0

Other non-cash adjustments to net income (loss)

20.7

23.7

Changes in operating assets and liabilities

452.6

(1,065.6

)

Total adjustments

3,682.9

(0.6

)

Net cash provided by operating activities

2,684.5

1,614.8

Cash flows from investing activities: Capital expenditures

(2,101.3

)

(1,248.8

)

Payments for fixed asset disposition

(6.3

)

(5.0

)

Net cash used in investing activities

(2,107.6

)

(1,253.8

)

Cash flows from financing activities: Proceeds from

revolving credit facility

-

555.0

Repayments of revolving credit facility

-

(555.0

)

Proceeds from commercial paper notes

1,067.9

-

Repayments of commercial paper notes

(1,067.9

)

-

Proceeds from stock issued pursuant to stock-based compensation

plans

10.0

9.3

Cash paid for taxes on exercises/vesting of stock-based

compensation

(40.0

)

(48.6

)

Payments for repurchase of stock

(500.0

)

(647.5

)

Net cash used in financing activities

(530.0

)

(686.8

)

Effect of exchange rate changes on cash, cash equivalents and

restricted cash

(1.0

)

(1.2

)

Net increase (decrease) in cash, cash equivalents and restricted

cash

45.9

(327.0

)

Cash, cash equivalents and restricted cash at beginning of period

711.3

1,038.3

Cash, cash equivalents and restricted cash at end of period

$

757.2

$

711.3

The information for the year ended January 28, 2023 was derived

from the audited consolidated financial statements as of that date.

DOLLAR TREE, INC. Segment Information

(Unaudited) 14 Weeks Ended 13 Weeks

Ended February 3, 2024 January 28, 2023

Dollar Family Dollar Family Tree

Dollar Total Tree Dollar Total

Store Count: Beginning

8,272

8,350

16,622

8,114

8,179

16,293

New stores

146

73

219

34

89

123

Re-bannered stores (a)

10

(5

)

5

-

1

1

Closings

(13

)

(59

)

(72

)

(14

)

(63

)

(77

)

Ending

8,415

8,359

16,774

8,134

8,206

16,340

Selling Square Footage (in millions)

73.1

63.7

136.8

70.5

61.6

132.1

Growth Rate (Square Footage)

3.7

%

3.4

%

3.6

%

1.1

%

4.1

%

2.5

%

53 Weeks Ended 52 Weeks Ended

February 3, 2024 January 28, 2023 Dollar

Family Dollar Family Tree Dollar

Total Tree Dollar Total Store

Count: Beginning

8,134

8,206

16,340

8,061

8,016

16,077

New stores

333

308

641

131

333

464

Re-bannered stores (a)

15

(15

)

-

(5

)

9

4

Closings

(67

)

(140

)

(207

)

(53

)

(152

)

(205

)

Ending

8,415

8,359

16,774

8,134

8,206

16,340

Selling Square Footage (in millions)

73.1

63.7

136.8

70.5

61.6

132.1

Growth Rate (Square Footage)

3.7

%

3.4

%

3.6

%

1.1

%

4.1

%

2.5

%

(a) Stores are included as re-banners when they close or open,

respectively.

53 Weeks Ended 52 Weeks Ended

February 3, 2024 January 28, 2023 Dollar

Family Dollar Family Tree Dollar

Total Tree Dollar Total Sales per

Square Foot (b)

$

234

$

220

$

227

$

220

$

214

$

217

(b) Sales per square foot is calculated based on total net sales

for the reporting period divided by the average selling square

footage during the period.

DOLLAR TREE, INC.

Reconciliation of Non-GAAP Financial Measures (In

millions, except per share data) (Unaudited) From

time-to-time, the Company discloses certain financial measures not

derived in accordance with GAAP. These non-GAAP financial measures

should not be used as a substitute for GAAP financial measures, or

considered in isolation, for the purposes of analyzing operating

performance, financial position, liquidity, or cash flows. The

non-GAAP financial measures we have disclosed include adjusted

gross profit; adjusted gross margin; adjusted selling, general and

administrative expenses; adjusted selling, general and

administrative expense rate; adjusted operating income (loss);

adjusted operating income (loss) margin; adjusted net income;

adjusted effective tax rate; adjusted diluted earnings per share;

and free cash flow. The Company believes providing additional

information in these non-GAAP measures that exclude the unusual

expenses described below is beneficial to the users of its

financial statements in evaluating the Company's current operating

results in relation to past periods. In addition, the Company's

debt covenants exclude the impact of certain unusual expenses. The

Company has included a reconciliation of these non-GAAP financial

measures to the most comparable GAAP measures in the following

tables. 1.) In the first quarter of fiscal 2023, the Company

recorded a $30.0 million charge to its legal reserve for West

Memphis-related matters. In the fourth quarter of fiscal 2023, an

additional $26.7 million charge was recorded to the legal reserve

for these matters. 2.) During the fourth quarter of fiscal 2023, we

announced that we had initiated a comprehensive store portfolio

optimization review which involved identifying stores for closure,

relocation or re-bannering based on an evaluation of current market

conditions and individual store performance, among other factors.

As a result of this portfolio optimization review, we plan to close

approximately 970 underperforming Family Dollar stores, including

approximately 600 stores to be closed in the first half of fiscal

2024, and approximately 370 stores to be closed at the end of each

store's current lease term. Additionally, we identified

approximately 30 underperforming Dollar Tree stores for closure and

plan to close each at the end of the store's current lease term. In

the fourth quarter of fiscal 2023, we incurred $594.4 million of

charges in connection with the store portfolio optimization review,

comprised of $503.9 million of store long-lived asset impairment

charges, $80.6 million of inventory markdowns, $5.6 million of

capitalized distribution cost impairment and $4.3 million in third

party consulting fees incurred related to the review. 3.) In the

fourth quarter of fiscal 2023, the Company performed its annual

impairment testing of goodwill and nonamortizing intangible assets.

The impairment test of nonamortizing intangible assets indicated

that the carrying value of the Family Dollar trade name exceeded

its estimated fair value resulting in the recognition of a $950.0

million impairment charge in the fourth quarter of fiscal 2023. The

goodwill impairment test indicated that the fair value of the

Family Dollar reporting unit was lower than its carrying value

resulting in the recognition of a $1,069.0 million impairment

charge in the fourth quarter of fiscal 2023. In addition, the

Company discloses free cash flow, a non-GAAP financial measure that

we calculate as net cash provided by operating activities less

capital expenditures. The Company believes free cash flow is an

important indicator of our liquidity as it measures the amount of

cash we generate from our business operations. Free cash flow may

not represent the amount of cash flow available for general

discretionary use, because it excludes non-discretionary

expenditures, such as mandatory debt repayments and required

settlements of recorded and/or contingent liabilities not reflected

in cash flow from operations. The Company has included a

reconciliation of free cash flow to the most comparable GAAP

measures in the following tables.

Reconciliation of

Adjusted Gross Profit 14 Weeks Ended 13 Weeks

Ended 53 Weeks Ended 52 Weeks Ended February

3, 2024 January 28, 2023 February 3, 2024

January 28, 2023 Gross profit (GAAP)

$

2,771.5

32.1

%

$

2,385.5

30.9

%

$

9,309.6

30.4

%

$

8,921.9

31.5

%

Add: Inventory markdowns - store closures

80.6

0.9

%

-

0.0

%

80.6

0.3

%

-

0.0

%

Add: Distribution costs - store closures

5.6

0.1

%

-

0.0

%

5.6

0.0

%

-

0.0

%

Adjusted gross profit (Non-GAAP)

$

2,857.7

33.1

%

$

2,385.5

30.9

%

$

9,395.8

30.7

%

$

8,921.9

31.5

%

Reconciliation of Adjusted Gross Profit - Family

Dollar Segment 14 Weeks Ended 13 Weeks Ended

53 Weeks Ended 52 Weeks Ended February 3, 2024

January 28, 2023 February 3, 2024 January 28,

2023 Gross profit (GAAP)

$

838.3

22.8

%

$

807.9

23.6

%

$

3,300.7

23.9

%

$

3,146.4

24.4

%

Add: Inventory markdowns - store closures

80.6

2.2

%

-

0.0

%

80.6

0.6

%

-

0.0

%

Add: Distribution costs - store closures

5.6

0.2

%

-

0.0

%

5.6

0.0

%

-

0.0

%

Adjusted gross profit (Non-GAAP)

$

924.5

25.2

%

$

807.9

23.6

%

$

3,386.9

24.5

%

$

3,146.4

24.4

%

Gross profit margin is calculated as gross profit (i.e., net sales

less cost of sales) divided by net sales.

DOLLAR TREE, INC.

Reconciliation of Non-GAAP Financial Measures (In

millions, except per share data) (Unaudited)

Reconciliation of Adjusted Selling, General and Administrative

Expenses 14 Weeks Ended 13 Weeks Ended 53

Weeks Ended 52 Weeks Ended February 3, 2024

January 28, 2023 February 3, 2024 January 28,

2023 Selling, general and administrative expenses (GAAP)

$

4,669.5

54.0

%

$

1,771.9

22.9

%

$

10,213.6

33.4

%

$

6,699.1

23.6

%

Deduct: Goodwill impairment

1,069.0

12.4

%

-

0.0

%

1,069.0

3.5

%

-

0.0

%

Deduct: Trade name intangible asset impairment

950.0

11.0

%

-

0.0

%

950.0

3.1

%

-

0.0

%

Deduct: Long-lived asset impairment

503.9

5.8

%

-

0.0

%

503.9

1.7

%

-

0.0

%

Deduct: Legal reserve

26.7

0.3

%

-

0.0

%

56.7

0.2

%

-

0.0

%

Deduct: Other consulting fees

4.3

0.1

%

-

0.0

%

4.3

0.0

%

-

0.0

%

Total adjustments

2,553.9

29.6

%

-

0.0

%

2,583.9

8.5

%

-

0.0

%

Adjusted selling, general and administrative expenses (Non-GAAP)

$

2,115.6

24.4

%

$

1,771.9

22.9

%

$

7,629.7

24.9

%

$

6,699.1

23.6

%

Reconciliation of Adjusted Selling, General and

Administrative Expenses - Family Dollar Segment 14 Weeks

Ended 13 Weeks Ended 53 Weeks Ended 52 Weeks

Ended February 3, 2024 January 28, 2023

February 3, 2024 January 28, 2023 Selling, general

and administrative expenses (GAAP)

$

3,460.2

94.0

%

$

809.0

23.6

%

$

5,975.6

43.2

%

$

3,026.7

23.4

%

Deduct: Goodwill impairment

1,069.0

29.1

%

-

0.0

%

1,069.0

7.7

%

-

0.0

%

Deduct: Trade name intangible asset impairment

950.0

25.8

%

-

0.0

%

950.0

6.9

%

-

0.0

%

Deduct: Long-lived asset impairment

493.1

13.4

%

-

0.0

%

493.1

3.6

%

-

0.0

%

Deduct: Legal reserve

26.7

0.7

%

-

0.0

%

56.7

0.4

%

-

0.0

%

Total adjustments

2,538.8

69.0

%

-

0.0

%

2,568.8

18.6

%

-

0.0

%

Adjusted selling, general and administrative expenses (Non-GAAP)

$

921.4

25.0

%

$

809.0

23.6

%

$

3,406.8

24.6

%

$

3,026.7

23.4

%

Reconciliation of Adjusted Selling, General and

Administrative Expenses - Dollar Tree Segment 14 Weeks

Ended 13 Weeks Ended 53 Weeks Ended 52 Weeks

Ended February 3, 2024 January 28, 2023

February 3, 2024 January 28, 2023 Selling, general

and administrative expenses (GAAP)

$

1,070.6

21.6

%

$

856.5

19.9

%

$

3,730.2

22.2

%

$

3,239.7

21.0

%

Deduct: Long-lived asset impairment

10.8

0.2

%

-

0.0

%

10.8

0.1

%

-

0.0

%

Total adjustments

10.8

0.2

%

-

0.0

%

10.8

0.1

%

-

0.0

%

Adjusted selling, general and administrative expenses (Non-GAAP)

$

1,059.8

21.4

%

$

856.5

19.9

%

$

3,719.4

22.1

%

$

3,239.7

21.0

%

DOLLAR TREE, INC. Reconciliation of Non-GAAP

Financial Measures (In millions, except per share data)

(Unaudited) Reconciliation of Adjusted Operating

Income 14 Weeks Ended 13 Weeks Ended 53 Weeks

Ended 52 Weeks Ended February 3, 2024 January

28, 2023 February 3, 2024 January 28, 2023

Operating income (loss) (GAAP)

$

(1,891.0

)

(21.9

%)

$

618.1

8.0

%

$

(881.8

)

(2.9

%)

$

2,236.3

7.9

%

Gross profit adjustments: Add: Inventory markdowns - store closures

80.6

0.9

%

-

0.0

%

80.6

0.3

%

-

0.0

%

Add: Distribution costs - store closures

5.6

0.1

%

-

0.0

%

5.6

0.0

%

-

0.0

%

SG&A adjustments: Add: Goodwill impairment

1,069.0

12.4

%

-

0.0

%

1,069.0

3.5

%

-

0.0

%

Add: Trade name intangible asset impairment

950.0

11.0

%

-

0.0

%

950.0

3.1

%

-

0.0

%

Add: Long-lived asset impairment

503.9

5.8

%

-

0.0

%

503.9

1.6

%

-

0.0

%

Add: Legal reserve

26.7

0.3

%

-

0.0

%

56.7

0.2

%

-

0.0

%

Add: Other consulting fees

4.3

0.1

%

-

0.0

%

4.3

0.0

%

-

0.0

%

Total adjustments

2,640.1

30.6

%

-

0.0

%

2,670.1

8.7

%

-

0.0

%

Adjusted operating income (Non-GAAP)

$

749.1

8.7

%

$

618.1

8.0

%

$

1,788.3

5.8

%

$

2,236.3

7.9

%

Reconciliation of Adjusted Operating Income -

Family Dollar Segment 14 Weeks Ended 13 Weeks

Ended 53 Weeks Ended 52 Weeks Ended February

3, 2024 January 28, 2023 February 3, 2024

January 28, 2023 Operating income (loss) (GAAP)

$

(2,617.8

)

(71.2

%)

$

1.4

0.0

%

$

(2,663.5

)

(19.3

%)

$

127.5

1.0

%

Gross profit adjustments: Add: Inventory markdowns - store closures

80.6

2.2

%

-

0.0

%

80.6

0.6

%

-

0.0

%

Add: Distribution costs - store closures

5.6

0.2

%

-

0.0

%

5.6

0.0

%

-

0.0

%

SG&A adjustments: Add: Goodwill impairment

1,069.0

29.1

%

-

0.0

%

1,069.0

7.7

%

-

0.0

%

Add: Trade name intangible asset impairment

950.0

25.8

%

-

0.0

%

950.0

6.9

%

-

0.0

%

Add: Long-lived asset impairment

493.1

13.4

%

-

0.0

%

493.1

3.6

%

-

0.0

%

Add: Legal reserve

26.7

0.7

%

-

0.0

%

56.7

0.4

%

-

0.0

%

Total adjustments

2,625.0

71.4

%

-

0.0

%

2,655.0

19.2

%

-

0.0

%

Adjusted operating income (loss) (Non-GAAP)

$

7.2

0.2

%

$

1.4

0.0

%

$

(8.5

)

(0.1

%)

$

127.5

1.0

%

DOLLAR TREE, INC. Reconciliation of Non-GAAP

Financial Measures (In millions, except per share data)

(Unaudited) Reconciliation of Adjusted Operating

Income - Dollar Tree Segment 14 Weeks Ended 13 Weeks

Ended 53 Weeks Ended 52 Weeks Ended February

3, 2024 January 28, 2023 February 3, 2024

January 28, 2023 Operating income (GAAP)

$

862.6

17.4

%

$

721.3

16.8

%

$

2,278.8

13.6

%

$

2,536.0

16.5

%

SG&A adjustment: Add: Long-lived asset impairment

10.8

0.2

%

-

0.0

%

10.8

0.1

%

-

0.0

%

Total adjustments

10.8

0.2

%

-

0.0

%

10.8

0.1

%

-

0.0

%

Adjusted operating income (Non-GAAP)

$

873.4

17.6

%

$

721.3

16.8

%

$

2,289.6

13.7

%

$

2,536.0

16.5

%

Reconciliation of Adjusted Net Income 14 Weeks

Ended 13 Weeks Ended 53 Weeks Ended 52 Weeks

Ended February 3, 2024 January 28, 2023

February 3, 2024 January 28, 2023 Net income (loss)

(GAAP)

$

(1,709.8

)

$

452.2

$

(998.4

)

$

1,615.4

Gross profit adjustments: Add: Inventory markdowns - store closures

80.6

-

80.6

-

Add: Distribution costs - store closures

5.6

-

5.6

-

SG&A adjustments: Add: Goodwill impairment

1,069.0

-

1,069.0

-

Add: Trade name intangible asset impairment

950.0

-

950.0

-

Add: Long-lived asset impairment

503.9

-

503.9

-

Add: Legal reserve

26.7

-

56.7

-

Add: Other consulting fees

4.3

-

4.3

-

Total adjustments

2,640.1

-

2,670.1

-

Provision for income taxes on adjustments

(374.6

)

-

(378.4

)

-

Adjusted net income (Non-GAAP)

$

555.7

$

452.2

$

1,293.3

$

1,615.4

Reconciliation of Adjusted Effective Tax Rate 14

Weeks Ended 13 Weeks Ended 53 Weeks Ended 52

Weeks Ended February 3, 2024 January 28, 2023

February 3, 2024 January 28, 2023 Effective tax rate

(GAAP)

10.8

%

23.4

%

(1.0

%)

23.5

%

Add: Tax impact of non-GAAP adjustments (c)

12.3

%

0.0

%

24.1

%

0.0

%

Adjusted effective tax rate (Non-GAAP)

23.1

%

23.4

%

23.1

%

23.5

%

(c) Adjustments related to the tax effect of non-GAAP adjustments,

which were determined based on the nature of the underlying

non-GAAP adjustments and their relevant tax rates.

DOLLAR TREE,

INC. Reconciliation of Non-GAAP Financial Measures

(In millions, except per share data) (Unaudited)

Reconciliation of Adjusted Diluted Earnings Per Share

14 WeeksEnded 13 WeeksEnded 53 WeeksEnded

52 WeeksEnded February 3,2024 January 28,2023

February 3,2024 January 28,2023 Diluted net income

(loss) per share (GAAP)

$

(7.85

)

$

2.04

$

(4.55

)

$

7.21

Gross profit adjustments: Add: Inventory markdowns - store closures

0.37

-

0.37

-

Add: Distribution costs - store closures

0.03

-

0.02

-

SG&A adjustments: Add: Goodwill impairment

4.91

-

4.87

-

Add: Trade name intangible asset impairment

4.36

-

4.33

-

Add: Long-lived asset impairment

2.31

-

2.29

-

Add: Legal reserve

0.12

-

0.26

-

Add: Other consulting fees

0.02

-

0.02

-

Total adjustments

12.12

-

12.16

-

Provision for income taxes on adjustments

(1.72

)

-

(1.72

)

-

Adjusted diluted net income per share (Non-GAAP)

$

2.55

$

2.04

$

5.89

$

7.21

Reconciliation of Net Cash Provided by Operating

Activities to Free Cash Flow 14 WeeksEnded 13

WeeksEnded 53 WeeksEnded 52 WeeksEnded

February 3,2024 January 28,2023 February

3,2024 January 28,2023 Net cash provided by operating

activities (GAAP)

$

1,254.9

$

880.7

$

2,684.5

$

1,614.8

Deduct: Capital expenditures

(784.1

)

(328.0

)

(2,101.3

)

(1,248.8

)

Free cash flow (Non-GAAP)

$

470.8

$

552.7

$

583.2

$

366.0

Net cash used in investing activities (GAAP) (d)

$

(785.3

)

$

(327.9

)

$

(2,107.6

)

$

(1,253.8

)

Net cash used in financing activities (GAAP)

(228.1

)

(349.0

)

(530.0

)

(686.8

)

(d) Net cash used in investing activities includes capital

expenditures, which is included in our computation of free cash

flow.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240313982700/en/

Dollar Tree, Inc. Robert A. LaFleur, 757-991-5645 Senior Vice

President, Investor Relations www.DollarTree.com DLTR-E

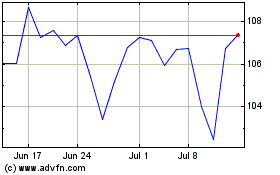

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Nov 2023 to Nov 2024