0001501989false00015019892024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 08, 2024 |

CytomX Therapeutics, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37587 |

27-3521219 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

151 Oyster Point Blvd Suite 400 |

|

South San Francisco, California |

|

94080 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 650 515-3185 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.00001 par value per share |

|

CTMX |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 8, 2024, CytomX Therapeutics, Inc., a Delaware corporation (the “Company”) issued a press release reporting its unaudited financial results as of and for the three months ended March 31, 2024. A copy of the press release is furnished herewith as Exhibit 99.1.

The information in Item 2.02 of this Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the accompanying Exhibit 99.1 shall not be incorporated by reference into any filing with the Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit is furnished as part of this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

CYTOMX THERAPEUTICS, INC. |

|

|

|

|

Date: |

May 8, 2024 |

By: |

/s/ Lloyd Rowland |

|

|

|

Lloyd Rowland

SVP, General Counsel |

Exhibit 99.1

CytomX Therapeutics Reports First Quarter 2024 Financial Results and Provides Business Update

- Company announces positive initial Phase 1a dose escalation data for monotherapy CX-904 (EGFRxCD3 T-cell engager) in solid tumors -

- First dose cohort cleared in Phase 1 clinical study of CX-2051, an EpCAM Targeting PROBODY® ADC, in solid tumors. Initial data anticipated in the first half of 2025 -

- Phase 1 study initiation activities continue for CX-801, an interferon alpha-2b PROBODY® cytokine, including the execution of a clinical collaboration agreement with Merck to supply KEYTRUDA® (pembrolizumab) for evaluation in combination with CX-801. Initial data anticipated in 2025 -

- Achieved $10 million of milestones under T-cell engaging bispecific collaboration with Astellas for preclinical progress on the first two programs in the collaboration -

- Dr. Zhen Su appointed to Board of Directors -

- Management to hold conference call today at 5 p.m. EDT / 2 p.m. PDT -

SOUTH SAN FRANCISCO, Calif., May 8, 2024 – CytomX Therapeutics, Inc. (Nasdaq: CTMX), a leader in the field of masked, conditionally activated biologics, today reported first quarter 2024 financial results and provided a business update.

“CytomX’s multi-modality PROBODY® therapeutic pipeline encompasses some of the most exciting areas of current oncology R&D, including T-cell engagers, ADCs, and cytokines. CytomX’s leadership and continuous innovation in the field of masked, conditionally activated biologics ideally positions us to develop novel, potent therapies for cancer patients in key areas of unmet need,” said Sean McCarthy, D.Phil., chief executive officer and chairman of CytomX.

McCarthy added, “CytomX entered 2024 executing to our plan and with substantial momentum, looking towards key data readouts from our multi-modality PROBODY® therapeutic pipeline over the next 12 to 24 months. Our exciting announcement today of positive initial Phase 1a clinical data for CX-904 marks the beginning of this data-rich period and we look forward to making continued progress with our broad program of masked, PROBODY® T-cell engagers and to also demonstrating clinical proof of concept for CX-2051 and CX-801, for which we anticipate initial Phase 1 data in 2025.”

First Quarter Business Highlights and Recent Developments

Pipeline

CX-904, PROBODY® T-cell-engager (TCE) targeted to EGFRxCD3, demonstrates a favorable safety profile and encouraging anti-cancer activity in Phase 1 dose escalation. Dose escalation continues.

CX-904 is a conditionally activated PROBODY TCE designed to target the epidermal growth factor receptor (EGFR) on cancer cells and the CD3 receptor on T cells within the tumor microenvironment. CX-904 is being evaluated in an ongoing Phase 1 study.

Today, the Company announced positive initial Phase 1 dose escalation data in heavily pre-treated patients with advanced metastatic solid tumor types that are generally known to express EGFR. 19 patients were initially enrolled into non-step dosing cohorts with target doses ranging from 0.007 mg to 6 mg. 16 patients were subsequently enrolled into step-dosing cohorts with target doses ranging from 5 mg to 10 mg and with tocilizumab prophylaxis. Dose escalation continues and enrollment into a cohort with a target dose of 15 mg is ongoing.

•As of the April 16, 2024 data cutoff, CX-904 demonstrated a favorable safety profile including no observed cases of CRS of any grade in step-dosing cohorts and only Grade 1 CRS observed in patients treated at the highest non-step dose. The most common treatment-related adverse events (TRAEs) were arthralgia, arthritis, rash, pruritis, and vomiting, the majority of which were low grade.

•Eight patients had measurable tumor reduction, including 2 of 6 (33%) efficacy-evaluable pancreatic cancer patients with confirmed partial responses per RECIST 1.1.

•Preliminary pharmacokinetic and pharmacodynamic data were consistent with the PROBODY TCE mechanism of action, including maintained masking in circulation, and CD8+ T-cell margination and tumor infiltration.

•CX-904 Phase 1a dose escalation and optimization continue, with future enrollment focused on determining a recommended Phase 2 dose.

•The Company expects to provide an additional Phase 1a dose escalation update by the end of 2024. These additional data will help inform next steps along with partner Amgen, towards initiation of Phase 1b expansion cohorts in specific EGFR positive tumor types.

CX-2051, an EpCAM-directed PROBODY® antibody drug conjugate, first patient dosed in Phase 1 in April 2024, initial data expected in 2025.

EpCAM is a promising oncology target with significant potential that is highly expressed across many indications including colorectal, gastric, endometrial, and ovarian cancers. EpCAM has been clinically validated by locally administered, previously approved cancer therapies. To date, systemically administered anti-EpCAM therapeutics have been unsuccessful due to toxicities in certain epithelial tissues. CX-2051 utilizes a cytotoxic payload that is a derivative of camptothecin, a topoisomerase-1 inhibitor, a class of drug that has shown potent clinical anti-cancer activity in the ADC context for multiple targets and cancer types. CX-2051 has demonstrated a wide predicted therapeutic index in multiple preclinical models, constituting an opportunity for broad clinical use in large patient populations.

•In April 2024, the first patient was dosed as part of the Phase 1 dose escalation of CX-2051 in patients with solid tumors generally known to express EpCAM, including CRC. The first dose cohort in the CX-2051 Phase 1 study has been cleared and dose escalation continues.

•The Phase 1 dose escalation study is following a Bayesian Optimal Interval (BOIN) design and is intended to demonstrate initial clinical proof of concept to inform a potential decision to move into dose expansion cohorts in 2025.

•Initial data for CX-2051 is expected in the first half of 2025.

CX-801, a dually-masked PROBODY® interferon-alpha 2b, advancing to Phase 1 in Q2 2024. Executed Clinical Collaboration Agreement with Merck (known as MSD outside of the US and Canada) to evaluate CX-801 in combination with Merck’s anti-PD-1 therapy KEYTRUDA® (pembrolizumab).

Interferon-alpha 2b is an immunotherapeutic cytokine that has demonstrated clinical activity and gained regulatory approval previously in multiple cancer types, including locally advanced or metastatic melanoma, renal cancer and bladder cancer. IFNα2b provides a potentially superior approach to activating anti-tumor immune responses compared to other cytokines but its clinical benefit has been limited to date by severe dose-limiting toxicities. CX-801 is an optimized, dually masked, conditionally activated IFNα2b, designed to have an expanded therapeutic index that has the potential to become a cornerstone of combination therapy for a wide range of tumor types.

•Announced a clinical collaboration agreement with Merck to supply KEYTRUDA for a Phase 1 study of CX-801 in combination with KEYTRUDA.

•CX-801 is anticipated to initiate Phase 1 dose escalation in patients with solid tumors including melanoma, renal, and head and neck squamous cell carcinoma in Q2 2024. The Phase 1 dose escalation will utilize a BOIN design to evaluate safety and signs of clinical activity for CX-801 monotherapy and for CX-801 in combination with KEYTRUDA.

•Initial Phase 1 data for CX-801 is expected in 2025.

KEYTRUDA® is a registered trademark of Merck Sharp & Dohme LLC, a subsidiary of Merck & Co., Inc., Rahway, NJ, USA.

CytomX continues to make progress in its R&D partnerships.

CytomX has multiple active research and development partnerships and more than 10 ongoing research programs with major biotechnology and pharmaceutical companies (Amgen, Astellas, Bristol Myers Squibb, Moderna and Regeneron). The majority of these programs are focused on masked, conditionally activated PROBODY® T-cell engagers.

In Q1 2024, CytomX achieved $10.0 million in milestones under its multi-target T-cell Engager collaboration with Astellas related to two separate PROBODY® TCE programs:

•A $5.0 million milestone for the initiation of GLP toxicology studies for the first clinical candidate program in the collaboration.

•A $5.0 million milestone for the nomination of the second clinical candidate in the collaboration.

2024 Priorities and Key Milestones:

oCX-904 Phase 1a dose escalation and optimization continue, with future enrollment focused on determining a recommended Phase 2 dose or doses.

oAn additional Phase 1a dose escalation update is expected by the end of 2024.

oA potential decision, to be taken with Amgen, to initiate Phase 1b expansion cohorts in specific EGFR positive tumor types is expected by the end of 2024.

oContinued Phase 1 dose escalation in solid tumors with known EpCAM expression.

oInitial Phase 1a data is expected in the first half 2025.

oInitiation of Phase 1 dose escalation in solid tumors including melanoma, renal, and head and neck squamous cell carcinoma is expected by Q2 2024.

oInitial Phase 1a data is expected in 2025.

oContinuation of T-cell engager focused drug discovery and development activities with Bristol Myers Squibb, Amgen, Astellas, and Regeneron.

oProgress with Moderna on conditionally activated mRNA-based programs.

oPotential additional pre-clinical and clinical milestones in 2024 and beyond.

Q1 2024 Financial Results

Cash, cash equivalents and investments totaled $150.3 million as of March 31, 2024, compared to $174.5 million as of December 31, 2023. The cash balance as of March 31, 2024, does not include the $10.0 million of Astellas milestone achievements earned in the first quarter of 2024.

Total revenue was $41.5 million for the three months ended March 31, 2024 compared to $23.5 million for the corresponding period in 2023. The increase in revenue was driven primarily by a higher percentage of work completion of existing targets under the BMS, Moderna and Regeneron agreements as well as the $10.0 million of milestones earned under the collaboration with Astellas.

Research and development expenses increased by $0.9 million for the three months ended March 31, 2024 to $22.1 million, compared to $21.2 million for the corresponding period of 2023. This was primarily due to increased laboratory contract services and manufacturing activities related to CX-904, CX-2051 and other wholly owned and partnered

programs, as well as consulting, personnel and license related expenses, offset by decreased manufacturing activities for CX-801 program and winding down of clinical study activities related to the CX-2009 and CX-2029 programs.

General and administrative expenses decreased by $0.2 million for the three months ended March 31, 2024 to $7.8 million compared to $8.0 million for the corresponding period of 2023, primarily due to lower building rent as a result of partial sublease of the Company’s headquarters.

Conference Call & Webcast

CytomX management will host a conference call and simultaneous webcast today at 5 p.m. EDT (2 p.m. PDT) to discuss the financial results and provide a business update. Participants may access the live webcast of the conference call from the Events and Presentations page of CytomX’s website at https://ir.cytomx.com/events-and-presentations. Participants may register for the conference call here and are advised to do so at least 10 minutes prior to joining the call. An archived replay of the webcast will be available on the company’s website.

About CytomX Therapeutics

CytomX is a clinical-stage, oncology-focused biopharmaceutical company focused on developing novel conditionally activated, masked biologics designed to be localized to the tumor microenvironment. By pioneering a novel pipeline of localized biologics, powered by its PROBODY® therapeutic platform, CytomX’s vision is to create safer, more effective therapies for the treatment of cancer. CytomX’s robust and differentiated pipeline comprises therapeutic candidates across multiple treatment modalities including antibody-drug conjugates (“ADCs”), T-cell engagers, and immune modulators such as cytokines. CytomX’s clinical-stage pipeline includes CX-904, CX-2051 and CX-801. CX-904 is a masked, conditionally activated T-cell-engaging bispecific antibody targeting the epidermal growth factor receptor (EGFR) on tumor cells and the CD3 receptor on T cells. CX-904 is partnered with Amgen in a global co-development alliance. CX-2051 is a masked, conditionally activated ADC directed toward epithelial cell adhesion molecule, EpCAM, with potential applicability across multiple EpCAM-expressing epithelial cancers. CX-2051 was discovered in collaboration with Immunogen, now part of AbbVie. CX-801 is a masked interferon alpha-2b PROBODY® cytokine with broad potential applicability in traditionally immuno-oncology sensitive as well as insensitive (cold) tumors. CytomX has established strategic collaborations with multiple leaders in oncology, including Amgen, Astellas, Bristol Myers Squibb, Regeneron and Moderna. For more information about CytomX and how it is working to make conditionally activated treatments the new standard-of-care in the fight against cancer, visit www.cytomx.com and follow us on LinkedIn and X (formerly Twitter).

CytomX Therapeutics Forward-Looking Statements

This press release includes forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors that are difficult to predict, may be beyond our control, and may cause the actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied in such statements, including those related to the future potential of partnerships or collaboration agreements. Accordingly, you should not rely on any of these forward-looking statements, including those relating to the potential benefits, safety and efficacy or progress of CytomX’s or any of its collaborative partners’ product candidates, including CX-904, CX-2051, and CX-801, the potential benefits or applications of CytomX’s PROBODY® therapeutic platform, CytomX’s or its collaborative partners’ ability to develop and advance product candidates into and successfully complete clinical trials, including the ongoing and planned clinical trials of CX-904, and the timing of the commencement of clinical trials or initial and ongoing data availability for CX-801 and CX-2051, and other development milestones. Risks and uncertainties that contribute to the uncertain nature of the forward-looking statements include: the unproven nature of CytomX’s novel PROBODY® therapeutic technology; CytomX’s clinical trial product candidates are in the initial stages of clinical development and its other product candidates are currently in preclinical development, and the process by which preclinical and clinical development could potentially lead to an approved product is long and subject to significant risks and uncertainties, including the possibility that the results of preclinical research and early clinical trials, including initial CX-904 results, may not be predictive of future results; the possibility that CytomX’s clinical trials will not be successful; the possibility that current preclinical research may not result in additional product candidates; CytomX’s

dependence on the success of CX-904, CX-801, and CX-2051; CytomX’s reliance on third parties for the manufacture of the Company’s product candidates; possible regulatory developments in the United States and foreign countries; and the risk that we may incur higher costs than expected for research and development or unexpected costs and expenses. Additional applicable risks and uncertainties include those relating to our preclinical research and development, clinical development, and other risks identified under the heading "Risk Factors" included in CytomX’s Quarterly Report on Form 10-Q filed with the SEC on May 8, 2024. The forward-looking statements contained in this press release are based on information currently available to CytomX and speak only as of the date on which they are made. CytomX does not undertake and specifically disclaims any obligation to update any forward-looking statements, whether as a result of any new information, future events, changed circumstances or otherwise.

PROBODY is a U.S. registered trademark of CytomX Therapeutics, Inc.

Company Contact:

Chris Ogden

SVP, Finance and Accounting

cogden@cytomx.com

Investor Contact:

Stern Investor Relations

Stephanie Ascher

stephanie.ascher@sternir.com

Media Contact:

Redhouse Communications

Teri Dahlman

teri@redhousecomms.com

CYTOMX THERAPEUTICS, INC.

CONDENSED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Revenues |

|

$ |

41,463 |

|

|

$ |

23,499 |

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

|

22,052 |

|

|

|

21,175 |

|

General and administrative |

|

|

7,754 |

|

|

|

7,977 |

|

Total operating expenses |

|

|

29,806 |

|

|

|

29,152 |

|

Income (Loss) from operations |

|

|

11,657 |

|

|

|

(5,653 |

) |

Interest income |

|

|

2,194 |

|

|

|

2,327 |

|

Other (expense) income, net |

|

|

(11 |

) |

|

|

15 |

|

Income (Loss) before income taxes |

|

|

13,840 |

|

|

|

(3,311 |

) |

Provision for income taxes |

|

|

49 |

|

|

|

— |

|

Net Income (loss) |

|

|

13,791 |

|

|

|

(3,311 |

) |

Other comprehensive income (loss): |

|

|

|

|

|

|

Unrealized (loss) gain on investments, net of tax |

|

|

(105 |

) |

|

|

16 |

|

Total comprehensive income (loss) |

|

$ |

13,686 |

|

|

$ |

(3,295 |

) |

|

|

|

|

|

|

|

Net income (loss) per share: |

|

|

|

|

|

|

Basic |

|

$ |

0.17 |

|

|

$ |

(0.05 |

) |

Diluted |

|

$ |

0.17 |

|

|

$ |

(0.05 |

) |

Shares used to compute net income (loss) per share |

|

|

|

|

|

|

Basic |

|

|

82,029,466 |

|

|

|

66,248,992 |

|

Diluted |

|

|

82,630,020 |

|

|

|

66,248,992 |

|

CYTOMX THERAPEUTICS, INC.

CONDENSED BALANCE SHEETS

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(unaudited) |

|

|

(1) |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

36,185 |

|

|

$ |

17,171 |

|

Short-term investments |

|

|

114,099 |

|

|

|

157,338 |

|

Accounts receivable |

|

|

13,177 |

|

|

|

3,432 |

|

Prepaid expenses and other current assets |

|

|

3,786 |

|

|

|

4,995 |

|

Total current assets |

|

|

167,247 |

|

|

|

182,936 |

|

Property and equipment, net |

|

|

3,567 |

|

|

|

3,958 |

|

Intangible assets, net |

|

|

693 |

|

|

|

729 |

|

Goodwill |

|

|

949 |

|

|

|

949 |

|

Restricted cash |

|

|

917 |

|

|

|

917 |

|

Operating lease right-of-use asset |

|

|

11,234 |

|

|

|

12,220 |

|

Other assets |

|

|

80 |

|

|

|

83 |

|

Total assets |

|

$ |

184,687 |

|

|

$ |

201,792 |

|

Liabilities and Stockholders' Deficit |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

1,964 |

|

|

$ |

1,458 |

|

Accrued liabilities |

|

|

14,220 |

|

|

|

17,599 |

|

Operating lease liabilities - short term |

|

|

4,724 |

|

|

|

4,589 |

|

Deferred revenue, current portion |

|

|

123,628 |

|

|

|

132,267 |

|

Total current liabilities |

|

|

144,536 |

|

|

|

155,913 |

|

Deferred revenue, net of current portion |

|

|

59,743 |

|

|

|

80,048 |

|

Operating lease liabilities - long term |

|

|

8,148 |

|

|

|

9,385 |

|

Other long term liabilities |

|

|

3,940 |

|

|

|

3,893 |

|

Total liabilities |

|

|

216,367 |

|

|

|

249,239 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders' deficit: |

|

|

|

|

|

|

Convertible preferred stock |

|

|

— |

|

|

|

— |

|

Common stock |

|

|

1 |

|

|

|

1 |

|

Additional paid-in capital |

|

|

677,986 |

|

|

|

675,905 |

|

Accumulated other comprehensive (loss) income |

|

|

(10 |

) |

|

|

95 |

|

Accumulated deficit |

|

|

(709,657 |

) |

|

|

(723,448 |

) |

Total stockholders' deficit |

|

|

(31,680 |

) |

|

|

(47,447 |

) |

Total liabilities and stockholders' deficit |

|

$ |

184,687 |

|

|

$ |

201,792 |

|

_____________

(1)The condensed balance sheet as of December 31, 2023 was derived from the audited financial statements included in the Company's Annual Report on Form 10-K for the year ended December 31, 2023.

v3.24.1.u1

Document And Entity Information

|

May 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 08, 2024

|

| Entity Registrant Name |

CytomX Therapeutics, Inc.

|

| Entity Central Index Key |

0001501989

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-37587

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

27-3521219

|

| Entity Address, Address Line One |

151 Oyster Point Blvd

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

South San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94080

|

| City Area Code |

650

|

| Local Phone Number |

515-3185

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.00001 par value per share

|

| Trading Symbol |

CTMX

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

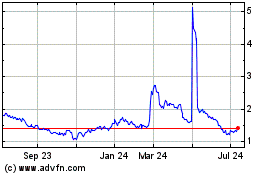

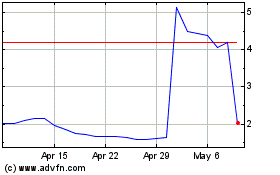

CytomX Therapeutics (NASDAQ:CTMX)

Historical Stock Chart

From Apr 2024 to May 2024

CytomX Therapeutics (NASDAQ:CTMX)

Historical Stock Chart

From May 2023 to May 2024