0000896429false00008964292024-09-102024-09-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

September 10, 2024

Date of Report (date of earliest event reported)

Cantaloupe, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Pennsylvania | 001-33365 | 23-2679963 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

101 Lindenwood Drive | Malvern | Pennsylvania | 19355 |

(Address of Principal Executive Offices) | (Zip Code) |

(610) 989-0340

Registrant's telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, no par value | CTLP | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On September 10, 2024 Cantaloupe, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the fourth quarter and fiscal year ended June 30, 2024. A copy of this press release is attached hereto as Exhibit 99.1.

The information contained in this Current Report on Form 8-K pursuant to this “Item 2.02 Results of Operations and Financial Condition” is being furnished. This information shall not be deemed to be filed for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section or shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, unless specifically identified therein as being incorporated by reference.

Item 9.01 Financial Statements and Exhibits

| | | | | |

| Exhibit Number | Ex. Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Cantaloupe, Inc.

Date: September 10, 2024

By: /s/ Anna Novoseletsky

Anna Novoseletsky, Chief Legal & Compliance Officer and General Counsel

Exhibit 99.1

Cantaloupe, Inc. Reports Fourth Quarter Fiscal Year 2024 Financial Results

Fourth Quarter 2024 Revenue of $72.7 Million, Driven by a 15.4% Year Over Year Growth in Subscription and Transaction Fees

Fiscal Year 2024 Revenue of $268.6 Million, a 10.2% Year over Year Increase

Fiscal Year 2024 U.S. GAAP Net Income Applicable to Common Shares of $11.4 million

Fiscal Year 2024 Adjusted EBITDA[1] of $34.0 million, a 90.9% Year over Year increase

MALVERN, Pa. -- September 10, 2024 -- Cantaloupe, Inc. (Nasdaq: CTLP) (“Cantaloupe” or the “Company”), a global leading provider of end-to-end technology solutions for self-service commerce, today reported results for the fourth quarter and fiscal year ended June 30, 2024.

“It’s been a strong year for Cantaloupe capped off by a solid fourth quarter,” said Ravi Venkatesan, chief executive officer, Cantaloupe. “During Fiscal Year 2024, we executed on our strategy to expand operating leverage by driving recurring revenue growth while also optimizing cost of sales and controlling operational expenses, as evidenced by our expansion of Adjusted Gross Margin and strong growth in Adjusted EBITDA. Our acquisition of SB Software Limited further enhances our international expansion efforts in Europe as we look to increase our footprint and breadth of solutions. We continue to benefit from the secular trend toward cashless payments and the demand for self-service solutions, which will fuel our growth in FY25 and beyond.”

Fourth Quarter 2024 Key Financial Results:

•Revenue of $72.7 million, an increase of 13.2% compared to fourth quarter of fiscal year 2023.

◦Transaction fees of $41.2 million, an increase of 16.0%.

◦Subscription fees of $19.9 million, an increase of 14.1%.

◦Equipment sales of $11.5 million, an increase of 2.9%.

•Total dollar volumes of transactions were $815.7 million, an increase of 15.9% compared to fourth quarter of fiscal year 2023.

•Transaction volume totaled 290.4 million, an increase of 4.2%, compared to 278.6 million for fourth quarter fiscal year 2023.

•Adjusted Gross Margin[1] of 37.3% compared with 40.1% in fourth quarter fiscal 2023. During fourth quarter fiscal year 2023, we benefited from certain one-time items which increased Adjusted Gross Margin[1] by 2.3%. Without these items, Adjusted Gross Margin[1] would have been relatively consistent between these two quarters.

◦Subscription and transaction fees Adjusted Gross Margin[1] declined to 43.0% compared to 44.2%.

◦Equipment sales gross margins declined to 7.2% compared to 20.8%.

•Net income applicable to common shares of $2.2 million, or $0.03 diluted earnings per share, compared to net income applicable to common shares of $2.8 million, or $0.04 diluted earnings per share, in the prior year quarter. The decrease in net income applicable to common shares is the result the one-time items noted above.

•Adjusted EBITDA[1] of $7.5 million compared to $9.2 million in fourth quarter of fiscal year 2023, a decrease of 19.0%. The decrease in Adjusted EBITDA[1] is the result the one-time items noted above.

Fiscal Year 2024 Key Financial Results:

•Revenue of $268.6 million, an increase of 10.2% year over year.

◦Transaction fees of $156.2 million, an increase of 17.8% year over year.

◦Subscription fees of $75.3 million, an increase of 11.4% year over year.

◦Equipment sales of $37.1 million, a decrease of 14.6% year over year.

•Total dollar volumes of Transactions were $3.0 billion, an increase of 14.8% year over year

•Transactions totaled 1.14 billion at the end of 2024 compared to 1.10 billion at the end of 2023, an increase of 4.4%.

•Average revenue per unit[2] increased 11.5% to $193.64, compared to $173.70 for fiscal year 2023.

•Adjusted Gross Margin[1] of 38.2% compared with 33.3% for fiscal year 2023.

◦Subscription and transaction fees Adjusted Gross Margin[1] of 43.2% compared to 40.2% for fiscal year 2023.

◦Equipment sales gross margins of 6.9% compared to 1.7% for fiscal year 2023.

•Net income applicable to common shares of $11.4 million, or $0.15 diluted earnings per share, compared to $0.01 million, or $0.00 diluted earnings per share, for fiscal year 2023.

•Adjusted EBITDA[1] of $34.0 million, compared to $17.8 million in the prior year, an increase of 90.9% year over year.

Fourth Quarter 2024 Business Highlights:

•Active Customers totaled 31,466 at the end of the fourth quarter of 2024 compared to 28,584 at the end of the fourth quarter of 2023, an increase of 10.1%.

•Active Devices totaled 1.22 million at the end of the fourth quarter of 2024 compared to 1.17 million at the end of the fourth quarter of 2023, an increase of 4.7%.

Fiscal Year 2025 Outlook:

For the full fiscal year 2025, the Company updates the following:

•Total Revenue to be between $308 million and $322 million.

•The combination of Subscription and Transaction revenue growth to be in the range of 15% - 20%.

•Total US GAAP net income applicable to common shares to be between $22 million and $32 million.

•Adjusted EBITDA[1] to be between $44 million and $52 million.

•Total Operating Cash Flow to be between $24 million and $32 million.

Webcast and Conference Call:

Cantaloupe will host a live webcast at 5:00 p.m. Eastern Time today which may be accessed in the Investor Relations section of the Company’s website at https://cantaloupeinc.gcs-web.com/events-and-presentations.

To join the live call in order to ask questions, please register here. A dial in and unique PIN will be provided to join the conference call.

A replay of the conference call will also be available in the Investor Relations section of the Company’s website.

About Cantaloupe, Inc.

Cantaloupe, Inc. is a global technology leader powering self-service commerce. With over a million active locations, processing more than a billion transactions every year, Cantaloupe is enabling businesses of all sizes to provide self-service experiences for consumers. The company's vertically integrated solutions fuel growth by offering micro-payments processing, enterprise cloud software, IoT technology, as well as kiosk and POS innovations. Cantaloupe’s end-to-end platform increases consumer engagement and sales revenue through digital payments, consumer promotions and loyalty programs, while providing business owners increased profitability by leveraging software to drive efficiencies across an entire operation. Cantaloupe’s solutions are used by a variety of consumer services in the United States, Mexico, Europe, and Australia including vending machines, micro markets and smart retail, EV charging stations, laundromats, metered parking terminals, amusement and entertainment venues, IoT services and more. To learn more about Cantaloupe, Inc., visit cantaloupe.com or follow the company on LinkedIn, Twitter (X), Facebook, Instagram or YouTube.

______________

1 Adjusted Gross Margin and Adjusted EBITDA represent non-GAAP financial measures. See Discussion of Non-GAAP Financial Measures and the Reconciliations of Adjusted Gross Margin and U.S GAAP Net Income to Adjusted EBITDA.

2We define average revenue per unit ("ARPU") as our total subscription and transaction fees for the trailing 12 months divided by average total active devices for the trailing 12 months.

Forward-looking Statements:

All statements other than statements of historical fact included in this release, including without limitation Cantaloupe’s future prospects and performance, the business strategy and the plans and objectives of Cantaloupe's management for future operations, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this release, words such as “estimate,” “could,” “should,” “would,” “likely,” “may,” “will,” “plan,” “intend,” “believes,” “expects,” “anticipates,” “projected,” and variations of these terms and similar expressions. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Actual results or business conditions may differ materially from those projected or suggested in forward-looking statements as a result of various factors including, but not limited to, those described below and in Part I, Item 1A, “Risk Factors” of our most recent Annual Report.

Actual results could differ materially from those contemplated by the forward-looking statements as a result of certain factors, including but not limited to general economic, market or business conditions unrelated to our operating performance, including inflation, elevated interests rates, supply chain disruptions, financial institution disruptions, geopolitical conflicts, public health emergencies and declines in consumer confidence and discretionary spending; our ability to

compete with our competitors and increase market share; failure to comply with the financial covenants in our debt facilities; our ability to maintain compliance with rules and regulations applicable to our business operations and industry; disruptions in other card payment processors, software and manufacturing partners upon whom we rely; whether our customers continue to utilize our transaction processing and related services, as our customer agreements are generally cancellable by the customer with thirty days’ notice; our ability to acquire and develop relevant technology offerings for current, new and potential customers and partners; risks and uncertainties associated with our expansion into and our operations in Europe, Mexico and other foreign markets, including general economic conditions, policy changes affecting international trade, political instability, inflation rates, recessions, sanctions, foreign currency exchange rates and controls, foreign investment and repatriation restrictions, legal and regulatory constraints, civil unrest, armed conflict, war and other economic and political factors; our ability to satisfy our trade obligations included in accounts payable and accrued expenses; our ability to attract, develop and retain key personnel, or our loss of the services of our key executives; the incurrence by us of any unanticipated or unusual non-operating expenses, which may require us to divert our cash resources from achieving our business plan; our ability to predict or estimate our future quarterly or annual revenue and expenses given the developing and unpredictable market for our products; our ability to successfully integrate acquired companies into our current products and services structure; our ability to add new customers and retain key existing customers from whom a significant portion of our revenue is derived; the ability of a key customer to reduce or delay purchasing products from us; our ability to obtain widespread commercial acceptance of our products and service offerings; whether any patents issued to us will provide any competitive advantages or adequate protection for our products, or would be challenged, invalidated or circumvented by others; the ability of our products and services to avoid disruptions to our systems or unauthorized hacking or credit card fraud; risks associated with cyber-attacks and data breaches; and our ability to maintain effective internal controls and to timely file periodic and current reports with the Securities and Exchange Commission ("SEC").

Readers are cautioned not to place undue reliance on these forward-looking statements. Any forward-looking statement made by us in this release speaks only as of the date of this release. Unless required by law, Cantaloupe does not undertake to release publicly any revisions to these forward-looking statements to reflect future events or circumstances or to reflect the occurrence of unanticipated events. If Cantaloupe updates one or more forward-looking statements, no inference should be drawn that Cantaloupe will make additional updates with respect to those or other forward-looking statements.

Discussion of Non-GAAP Financial Measures:

This press release contains discussion of Adjusted Gross Margin and Adjusted EBITDA, two non-GAAP financial measures which are not required or defined under U.S. GAAP (Generally Accepted Accounting Principles). Generally, a non-GAAP financial measure is a numerical measure of a company's performance, financial position or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. Reconciliations between non-GAAP financial measures and the most comparable GAAP financial measures are set forth below. However, we do not provide forward-looking guidance for certain financial measures on a GAAP basis because we are unable to predict certain items contained in the U.S. measures without unreasonable efforts. These items may include acquisition and integration related costs, severance expenses, litigation charges or settlements, and certain other unusual adjustments.

We use Adjusted Gross Profit, Adjusted Gross Margin and Adjusted EBITDA for financial and operational decision-making purposes and as a means to evaluate period-to-period comparisons. We believe that these non-GAAP financial measure provide useful information about our operating results, enhance the overall understanding of past financial performance and future prospects and allows for greater transparency with respect to metrics used by our management in its financial and operational decision making. The presentation of these financial measure is not intended to be considered in isolation or as a substitute for the financial measures prepared and presented in accordance with GAAP, including our net income or net cash provided in operating activities. Management recognizes that non-GAAP financial measures have limitations in that they do not reflect all of the items associated with our net income as determined in accordance with GAAP, and are not a substitute for or a measure of our profitability or net earnings. Adjusted Gross Margin and Adjusted EBITDA are presented because we believe they are useful to investors as measures of comparative operating performance. Additionally, we utilize Adjusted EBITDA as a metric in our executive officer and management incentive compensation plans.

We define Adjusted Gross Profit as revenue less cost of sales, exclusive of depreciation of internally-developed software and amortization of intangible assets related to technologies obtained through acquisitions. We believe this non-GAAP measure is useful to view the resulting figures excluding the aforementioned non-cash charges because the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations and such amounts vary substantially from company to company depending on their financing and capital structures and the method by which their assets were acquired. We define Adjusted Gross Margin as Adjusted Gross Profit divided by revenue.

We define Adjusted EBITDA as U.S. GAAP net income before (i) interest income on cash and leases, (ii) interest expense on debt and sales tax reserves, (iii) income tax provision, (iv) depreciation, (v) amortization, (vi) stock-based compensation expense, (vii) fees and charges, net of reimbursement from insurance proceeds, that were incurred in connection with the 2019 Investigation and financial statement restatement activities as well as proxy solicitation costs that are not indicative of our core operations, (viii) one-time project expense, one-time severance expenses, and infrequent integration and acquisition expense, and (ix) certain other significant infrequent or unusual losses and gains that are not indicative of our core operations including asset impairment charges, and gain on extinguishment of debt.

Investor Relations:

ICR, Inc.

CantaloupeIR@icrinc.com

Media:

Jenifer Howard | 202-273-4246

jhoward@jhowardpr.com

media@cantaloupe.com

Cantaloupe, Inc.

Consolidated Balance Sheets (unaudited) | | | | | | | | | | | |

| As of June 30, |

| ($ in thousands, except share data) | 2024 | | 2023 |

| | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 58,920 | | | $ | 50,927 | |

| Accounts receivable, net | 43,848 | | | 30,162 | |

| Finance receivables, net | 6,391 | | | 6,668 | |

| Inventory, net | 40,791 | | | 31,872 | |

| Prepaid expenses and other current assets | 7,844 | | | 3,754 | |

| Total current assets | 157,794 | | | 123,383 | |

| | | |

| Non-current assets: | | | |

| Finance receivables non-current, net | 10,036 | | | 13,307 | |

| Property and equipment, net | 34,029 | | | 25,281 | |

| Operating lease right-of-use assets | 7,986 | | | 2,575 | |

| Intangibles, net | 24,626 | | | 27,812 | |

| Goodwill | 94,903 | | | 92,005 | |

| Other assets | 6,194 | | | 5,249 | |

| Total non-current assets | 177,774 | | | 166,229 | |

| | | |

| Total assets | $ | 335,568 | | | $ | 289,612 | |

| | | |

| Liabilities, convertible preferred stock, and shareholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 78,895 | | | $ | 52,869 | |

| Accrued expenses | 24,008 | | | 26,276 | |

| Current obligations under long-term debt | 1,266 | | | 882 | |

| Deferred revenue | 1,726 | | | 1,666 | |

| Total current liabilities | 105,895 | | | 81,693 | |

| | | |

| Long-term liabilities: | | | |

| Deferred income taxes | 466 | | | 275 | |

| Long-term debt, less current portion | 36,284 | | | 37,548 | |

| Operating lease liabilities, non-current | 8,457 | | | 2,504 | |

| Total long-term liabilities | 45,207 | | | 40,327 | |

| | | |

| Total liabilities | $ | 151,102 | | | $ | 122,020 | |

| Commitments and contingencies | | | |

| Convertible preferred stock: | | | |

Series A convertible preferred stock, 900,000 shares authorized, 385,782 and 385,782 issued and outstanding, with liquidation preferences of $22,722 and $22,144 at June 30, 2024 and 2023, respectively | 2,720 | | | 2,720 | |

| Shareholders’ equity: | | | |

Common stock, no par value, 640,000,000 shares authorized, 72,935,497 and 72,664,464 shares issued and outstanding at June 30, 2024 and 2023, respectively | — | | | — | |

Additional paid-in capital | 482,329 | | | 477,324 | |

| Accumulated deficit | (300,459) | | | (312,452) | |

| Accumulated other comprehensive loss | (124) | | | — | |

| Total shareholders’ equity | 181,746 | | | 164,872 | |

| Total liabilities, convertible preferred stock, and shareholders’ equity | $ | 335,568 | | | $ | 289,612 | |

Cantaloupe, Inc.

Consolidated Statements of Operations (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Year ended |

| | June 30, | | June 30, |

| ($ in thousands, except per share data) | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | | |

| Subscription and transaction fees | | $ | 61,126 | | | $ | 52,971 | | | $ | 231,497 | | | $ | 200,223 | |

| Equipment sales | | 11,531 | | | 11,202 | | | 37,099 | | | 43,418 | |

| Total revenues | | 72,657 | | | 64,173 | | | 268,596 | | | 243,641 | |

| | | | | | | | |

| Costs of sales (exclusive of certain depreciation and amortization): | | | | | | | | |

| Cost of subscription and transaction fees | | 34,861 | | | 29,566 | | | 131,400 | | | 119,715 | |

| Cost of equipment sales | | 10,696 | | | 8,867 | | | 34,545 | | | 42,690 | |

| Total costs of sales | | 45,557 | | | 38,433 | | | 165,945 | | | 162,405 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Sales and marketing | | 6,054 | | | 3,539 | | | 20,310 | | | 12,427 | |

| Technology and product development | | 4,417 | | | 3,969 | | | 16,532 | | | 20,726 | |

| General and administrative | | 11,902 | | | 11,747 | | | 41,395 | | | 36,926 | |

| Investigation, proxy solicitation and restatement expenses, net of insurance recoveries | | (1,522) | | | 91 | | | (1,522) | | | (362) | |

| Integration and acquisition expenses | | 119 | | | 354 | | | 1,197 | | | 3,141 | |

| Depreciation and amortization | | 2,594 | | | 2,589 | | | 10,570 | | | 7,618 | |

| Total operating expenses | | 23,564 | | | 22,289 | | | 88,482 | | | 80,476 | |

| | | | | | | | |

| Operating income (loss) | | 3,536 | | | 3,451 | | | 14,169 | | | 760 | |

| | | | | | | | |

| Other (expense) income: | | | | | | | | |

| Interest income | | 464 | | | 530 | | | 1,969 | | | 2,515 | |

| Interest expense | | (987) | | | (1,068) | | | (2,934) | | | (2,326) | |

| Other expense | | (68) | | | (23) | | | (226) | | | (135) | |

| Total other (expense) income, net | | (591) | | | (561) | | | (1,191) | | | 54 | |

| | | | | | | | |

| Income before income taxes | | 2,945 | | | 2,890 | | | 12,978 | | | 814 | |

| Provision for income taxes | | (739) | | | (58) | | | (985) | | | (181) | |

| | | | | | | | |

| Net income | | 2,206 | | | 2,832 | | | 11,993 | | | 633 | |

| Preferred dividends | | — | | | — | | | (578) | | | (623) | |

| Net income applicable to common shares | | $ | 2,206 | | | $ | 2,832 | | | $ | 11,415 | | | $ | 10 | |

| | | | | | | | |

| Net earnings per common share | | | | | | | | |

| Basic | | $ | 0.03 | | | $ | 0.04 | | | $ | 0.16 | | | $ | — | |

| Diluted | | $ | 0.03 | | | $ | 0.04 | | | $ | 0.15 | | | $ | — | |

| | | | | | | | |

| Weighted average number of common shares outstanding used to compute net earnings per share applicable to common shares | | | | | | | | |

| Basic | | 72,819,220 | | 72,604,484 | | 72,819,220 | | | 71,978,901 | |

| Diluted | | 74,172,098 | | 72,765,369 | | 74,172,098 | | | 72,514,634 | |

Cantaloupe, Inc.

Consolidated Statements of Cash Flows (unaudited)

| | | | | | | | | | | |

| Year ended June 30, |

| ($ in thousands) | 2024 | | 2023 |

| | | |

| Cash flows from operating activities: | | | |

| Net income | $ | 11,993 | | | $ | 633 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Stock-based compensation | 5,109 | | | 4,737 | |

| Amortization of debt issuance costs and discounts | 124 | | | 128 | |

| Provision for expected losses | 3,861 | | | 5,815 | |

| Provision for inventory reserve | 240 | | | 280 | |

Depreciation and amortization | 12,204 | | | 8,807 | |

| Property and equipment write-off | 601 | | | 364 | |

Noncash lease expense | 1,246 | | | — | |

Deferred income taxes and other | 192 | | | (116) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (18,542) | | | 4,960 | |

| Finance receivables | 3,712 | | | (32) | |

| Inventory | (9,447) | | | (10,387) | |

| Prepaid expenses and other assets | (4,035) | | | (180) | |

| Accounts payable and accrued expenses | 21,131 | | | (458) | |

| Operating lease liabilities | (651) | | | (133) | |

| Deferred revenue | 7 | | | (226) | |

| Net cash provided by operating activities | 27,745 | | | 14,192 | |

| | | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (14,935) | | | (16,151) | |

| Acquisition of business, net of cash acquired | (3,701) | | | (35,714) | |

| | | |

| Net cash used in investing activities | (18,636) | | | (51,865) | |

| | | |

| Cash flows from financing activities: | | | |

| Proceeds from long-term debt | — | | | 25,000 | |

| Repayment of long-term debt | (954) | | | (1,270) | |

| | | |

| | | |

| Contingent consideration paid for acquisition | — | | | (1,000) | |

| Repurchase of Series A Convertible Preferred Stock | — | | | (2,151) | |

| Payment of employee taxes related to stock-based compensation | (219) | | | (104) | |

| Proceeds from exercise of common stock options | 115 | | | — | |

| | | |

| Net cash (used in) provided by financing activities | (1,058) | | | 20,475 | |

| | | |

| Effect of currency exchange rate changes on cash and cash equivalents | (58) | | | — | |

| | | |

| Net increase (decrease) in cash and cash equivalents | 7,993 | | | (17,198) | |

| Cash and cash equivalents at beginning of year | 50,927 | | | 68,125 | |

| Cash and cash equivalents at end of year | $ | 58,920 | | | $ | 50,927 | |

| | | |

Supplemental disclosures of cash flow information: | | | |

| Interest paid in cash | $ | 3,656 | | | $ | 2,641 | |

| Income taxes paid in cash | $ | 223 | | | $ | 61 | |

| Common stock issued in business combination (non-cash financing activity) | $ | — | | | $ | 4,506 | |

| | | |

Cantaloupe, Inc.

U.S. GAAP Gross Profit (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Year Ended June 30, |

| ($ in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Subscription and transaction fee revenue | $ | 61,126 | | | $ | 52,971 | | | $ | 231,497 | | | $ | 200,223 | |

| | | | | | | |

Cost of subscription and transaction fees(1) | 34,861 | | | 29,566 | | | 131,400 | | | 119,715 | |

Amortization(2) | 1,723 | | | 1,675 | | | 6,767 | | | 5,020 | |

| | | | | | | |

| Gross profit, subscription and transaction fees | $ | 24,542 | | | $ | 21,730 | | | $ | 93,330 | | | $ | 75,488 | |

| | | | | | | |

| | | | | | | |

| Equipment sales | $ | 11,531 | | | 11,202 | | | $ | 37,099 | | | 43,418 | |

| | | | | | | |

| Cost of equipment sales | 10,696 | | | 8,867 | | | 34,545 | | | 42,690 | |

| | | | | | | |

Gross profit, equipment(3) | $ | 835 | | | $ | 2,335 | | | $ | 2,554 | | | $ | 728 | |

| | | | | | | |

| Total Gross Profit | $ | 25,377 | | | $ | 24,065 | | | $ | 95,884 | | | $ | 76,216 | |

| | | | | | | |

| Gross margin | | | | | | | |

| Subscription and transaction fees | 40.1 | % | | 41.0 | % | | 40.3 | % | | 37.7 | % |

| Equipment sales | 7.2 | % | | 20.8 | % | | 6.9 | % | | 1.7 | % |

| Total gross margin | 34.9 | % | | 37.5 | % | | 35.7 | % | | 31.3 | % |

(1) Cost of subscription and transaction fees excludes amortization of certain technology assets, see (2) below.

(2) Amortization of internal-use software assets and developed technology assets.

(3) The Company's internal-use software assets and developed technology assets are not associated with equipment sales.

Cantaloupe, Inc.

Reconciliation of U.S. GAAP Gross Profit to Adjusted Gross Profit (non-GAAP) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Year Ended June 30, |

| ($ in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

Gross profit, subscription and transaction fees (GAAP) | $ | 24,542 | | | $ | 21,730 | | | $ | 93,330 | | | $ | 75,488 | |

| | | | | | | |

Amortization(1) | 1,723 | | | 1,675 | | | 6,767 | | | 5,020 | |

| | | | | | | |

| Adjusted Gross Profit, subscription and transaction fees (non-GAAP) | $ | 26,265 | | | $ | 23,405 | | | $ | 100,097 | | | $ | 80,508 | |

| | | | | | | |

Gross profit, equipment (GAAP) | $ | 835 | | | $ | 2,335 | | | $ | 2,554 | | | $ | 728 | |

| | | | | | | |

| Total Adjusted Gross Profit (non-GAAP) | $ | 27,100 | | | $ | 25,740 | | | $ | 102,651 | | | $ | 81,236 | |

| | | | | | | |

| Adjusted Gross Margin (non-GAAP): | | | | | | | |

Subscription and transaction fees (non-GAAP) | 43.0 | % | | 44.2 | % | | 43.2 | % | | 40.2 | % |

Equipment sales (GAAP) | 7.2 | % | | 20.8 | % | | 6.9 | % | | 1.7 | % |

| Total Adjusted Gross Margin (non-GAAP) | 37.3 | % | | 40.1 | % | | 38.2 | % | | 33.3 | % |

(1) Amortization of internal-use software assets and developed technology assets.

Cantaloupe, Inc.

Reconciliation of U.S. GAAP Net Income to Adjusted EBITDA (unaudited)

| | | | | | | | | | | |

| Three months ended June 30, |

| ($ in thousands) | 2024 | | 2023 |

| U.S. GAAP net income | $ | 2,206 | | | $ | 2,832 | |

| Less: interest income | (464) | | (530) | |

| Plus: interest expense | 987 | | 1,068 |

| Plus: income tax provision | 739 | | 58 | |

| Plus: depreciation expense included in costs of sales for rentals | 497 | | 337 | |

| Plus: depreciation and amortization expense in operating expenses | 2,594 | | | 2,589 | |

| EBITDA | 6,559 | | | 6,354 | |

Plus: stock-based compensation (a) | 1,062 | | 1,848 | |

Plus: investigation, proxy solicitation and restatement expenses, net of insurance recoveries (b) | (1,522) | | | 91 | |

Plus: integration and acquisition expenses (c) | 119 | | | 354 | |

Plus: severance expenses (d) | 27 | | | — | |

Plus: remediation expense (e) | 1,221 | | | 573 | |

| Adjustments to EBITDA | 907 | | | 2,866 | |

| Adjusted EBITDA | $ | 7,466 | | | $ | 9,220 | |

(a) We have excluded stock-based compensation, as it does not reflect our cash-based operations.

(b) We have excluded the costs and corresponding reimbursements related to the 2019 Investigation, because we believe that they represent charges that are not related to our core operations. During the year ended June 30, 2024, we received $1.5 million in insurance reimbursement for legal fees and expenses incurred in connection with the 2019 Investigation. Accordingly, Adjusted EBITDA contains a negative adjustment.

(c) We have excluded expenses incurred in connection with business acquisitions as it does not represent recurring costs or charges related to our core operations.

(d) Consists of expenses incurred in connection with non-recurring severance charges related to work force reduction.

(e) Consists of expenses incurred in connection with fully remediating previously identified material weaknesses in our internal control over financial reporting.

Cantaloupe, Inc.

Reconciliation of U.S. GAAP Net Income to Adjusted EBITDA

| | | | | | | | | | | |

| Year ended June 30, |

| ($ in thousands) | 2024 | | 2023 |

| | | |

| Net income | $ | 11,993 | | | $ | 633 | |

| Less: interest income | (1,969) | | | (2,515) | |

| Plus: interest expense | 2,934 | | | 2,326 | |

| Plus: income tax provision | 985 | | | 181 | |

| Plus: depreciation expense included in cost of sales for rentals | 1,634 | | 1,189 |

| Plus: depreciation and amortization expense in operating expenses | 10,570 | | | 7,618 | |

| EBITDA | 26,147 | | | 9,432 | |

Plus: stock-based compensation (a) | 5,109 | | | 4,737 | |

Plus: investigation, proxy solicitation and restatement expenses, net of insurance recoveries (b) | (1,522) | | | (362) | |

Plus: integration and acquisition expenses (c) | 1,197 | | | 3,141 | |

Plus: severance expenses (d) | 53 | | | 273 | |

Plus: remediation expenses (e) | 2,976 | | | 573 | |

| Adjustments to EBITDA | 7,813 | | | 8,362 | |

| Adjusted EBITDA | $ | 33,960 | | | $ | 17,794 | |

(a) We have excluded stock-based compensation, as it does not reflect our cash-based operations.

(b) We have excluded the costs and corresponding reimbursements related to the 2019 Investigation, because we believe that they represent charges that are not related to our core operations. During the year ended June 30, 2024, we received $1.5 million in insurance reimbursement for legal fees and expenses incurred in connection with the 2019 Investigation. Accordingly, Adjusted EBITDA contains a negative adjustment.

(c) We have excluded expenses incurred in connection with business acquisitions as it does not represent recurring costs or charges related to our core operations.

(d) Consists of expenses incurred in connection with non-recurring severance charges related to work force reduction.

(e) Consists of expenses incurred in connection with fully remediating previously identified material weaknesses in our internal control over financial reporting from the prior year.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

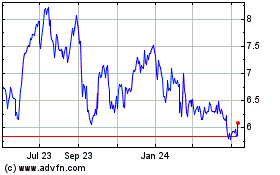

Cantaloupe (NASDAQ:CTLP)

Historical Stock Chart

From Oct 2024 to Nov 2024

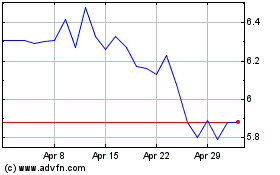

Cantaloupe (NASDAQ:CTLP)

Historical Stock Chart

From Nov 2023 to Nov 2024