UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

|

Check the appropriate box:

|

|

☐

|

Preliminary Information Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c‑5(d)(2))

|

|

☒

|

Definitive Information Statement

|

| |

|

|

BLACKBOXSTOCKS INC.

|

| (Name of Registrant as Specified in its Charter) |

|

Payment of Filing Fee (Check all boxes that apply):

|

|

☒

|

No fee required

|

| |

|

|

☐

|

Fee paid previously with preliminary materials.

|

| |

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11

|

BLACKBOXSTOCKS INC.

5430 LBJ Freeway, Suite 1485

Dallas, Texas 75240

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF THE

SECURITIES EXCHANGE ACT OF 1934 AND REGULATION 14C THEREUNDER

WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE REQUESTED NOT TO SEND US A PROXY

To the Stockholders of Blackboxstocks Inc.:

This Information Statement is furnished to holders of shares of Common Stock, $0.001 par value (the “Common Stock”) of Blackboxstocks Inc. (“Blackboxstocks,” “we,” “us” or the “Company”). We are sending you this Information Statement to inform you that the holders of a majority in voting power of issued and outstanding Common Stock, as a class, and all of our issued and outstanding shares of Series A Convertible Preferred Stock have approved an amendment (the “Amendment”) to the Company’s Articles of Incorporation that will effect reverse split of the Company’s Common Stock at a ratio of up to one-for-seven, with our Board of Directors being authorized to determing the exact ratio within such range (the “Split Ratio”).

The accompanying Information Statement is being furnished to our stockholders for informational purposes only, pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations prescribed thereunder. As described in this Information Statement, the Amendment was approved by our Board of Directors (the “Board”) by written consent on March 14, 2023. Thereafter, on March 14, 2023, the stockholders of the Company (the “Consenting Stockholders”) holding a majority in voting power of issued and outstanding Common Stock, as a class, and all of our issued and outstanding shares of Series A Convertible Preferred Stock, adopted by written consent resolutions approving the Amendment. Such written consent constitutes the only stockholder approval required to amend the Company’s Articles of Incorporation under the Nevada Revised Statutes. Because the written consent of the Consenting Stockholders satisfies all applicable stockholder voting requirements, the Board is not soliciting your proxy or consent in connection with the matters discussed above. You are urged to read the Information Statement carefully and in its entirety for a description of the action taken by the Company.

The actions will not become effective before the date which is 20 days after this Information Statement was first mailed to stockholders. This Information Statement is being mailed on or about March 21, 2023 to stockholders of record on March 14, 2023 (the “Record Date”).

|

By order of the Board of Directors

|

| |

|

/s/ Gust Kepler

|

| |

|

Gust Kepler

President and Chief Executive Officer

|

Dallas, Texas

March 21, 2023

BLACKBOXSTOCKS INC.

5430 LBJ Freeway, Suite 1485

Dallas, Texas 75240

INFORMATION STATEMENT PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

This Information Statement (the “Information Statement”) is being mailed on or about March 21, 2023 to the holders of record at the close of business on March 14, 2023 (the “Record Date”), of the Common Stock (the “Common Stock”) of Blackboxstocks Inc., a Nevada corporation (“Blackboxstocks,” “we,” “us” or the “Company”), in connection with an action taken by written consent of the holders of a majority in voting power of issued and outstanding Common Stock, as a class, and all of our issued and outstanding shares of Series A Converible Preferred Stock (“Series A Preferred”) in lieu of a meeting to approve an Amendment (the “Amendment”) to our Articles of Incorporation, as amended to date (the “Articles”), effecting a reverse split of the Company’s Common Stock (the “Reverse Stock Split”) at a ratio of up to one-for-seven, with our Board of Directors being authorized to determing the exact ratio within such range (the “Split Ratio”).

The Board of Directors (the “Board”) and the stockholders beneficially owning 6,846,378 issued and outstanding shares of our Common Stock and all 3,269,998 issued and outstanding shares of our Series A Preferred Stock (collectively, the “Consenting Stockholders”) have executed written consents approving the Amendment. The Consenting Stockholders held of record on the Record Date approximately 50.22% of the total issued and outstanding Common Stock of the Company and 100% of our issued and outstanding Series A Preferred Stock, which was sufficient to approve the proposed Amendment. Dissenting stockholders do not have any statutory appraisal rights as a result of the action taken. The Board does not intend to solicit any proxies or consents from any other stockholders in connection with this action. All necessary corporate approvals have been obtained, and this Information Statement is furnished solely to advise stockholders of the actions taken by written consent.

Section 78.320 of the Nevada Revised Statutes (the “NRS”) generally provides that any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if, before or after the action, a written consent thereto is signed by stockholders holding at least a majority of the voting power, except that if a different proportion of voting power is required for such an action at a meeting, then that proportion of written consents is required. Pursuant to NRS 78.390, a majority of the outstanding voting shares of stock entitled to vote thereon is required in order to amend the Articles. In order to eliminate the costs and management time involved in obtaining proxies and in order to effect the above actions as early as possible in order to accomplish the purposes of the Company as herein described, the Board consented to the utilization of, and did in fact obtain, the written consent of the Consenting Stockholders who own shares representing a majority in voting power of issued and outstanding Common Stock, as a class, and all of our Series A Preferred stock.

This Information Statement is being distributed pursuant to the requirements of Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) to the Company’s stockholders of record on the Record Date. The corporate action described herein may be effective as early as 20 days (the “20-day Period”) after the mailing of this Information Statement. The 20-day Period is expected to conclude on or about April 10, 2023.

The entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of the Common Stock held of record by them and will reimburse such persons for their reasonable charges and expenses in connection therewith.

FORWARD LOOKING STATEMENTS

This Information Statement and other reports that the Company files with the U.S. Securities and Exchange Commission (the “SEC”) contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical information provided herein are forward-looking and may contain information about financial results, economic conditions, trends and known uncertainties. We caution the reader that actual results could differ materially from those expected by us depending on the outcome of certain factors, including, without limitation, the risk that the assumptions upon which the forward-looking statements are based ultimately may prove to be incorrect or incomplete, that the Reverse Stock Split will not be consummated in a timely manner or at all, as well as other risks and uncertainties that are described in the Company’s filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligations to release publicly the results of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date of this information statement, including, without limitation, changes in our business strategy or planned capital expenditures, or to reflect the occurrence of unanticipated events.

VOTE REQUIRED TO APPROVE THE AMENDMENT

The shares of Common Stock and Preferred Stock are the only classes of voting securities of the Company outstanding (the “Voting Stock”). Each share of Common Stock is entitled to one (1) vote per share on all matters submitted to a vote of the stockholders. As of the Record Date, there were 13,633,948 shares of Common Stock issued and outstanding. Each share of Series A Preferred stock of the Company is entitled to one hundred (100) votes per share on all matters submitted to a vote of the stockholders. As of the Record Date, there were 3,269,998 shares of Series A Preferred stock issued and outstanding, collectively representing 326,999,800 votes on each matter presented to the stockholders for a vote. For the approval of the Amendment, the consent of a majority of issued and outstanding Common Stock, as a class, and a majority of the total voting power on the Record Date, or 6,816,975 shares of Common Stock, voting as a class, of the total 13,633,948 issued and outstanding shares, and 170,316,875 out of 340,633,748 total stockholder votes, was required for approval by written consent without a meeting.

CONSENTING STOCKHOLDERS

On June 12, 2019, the Board unanimously adopted resolutions declaring the advisability of, and recommending that stockholders approve, the Amendment to the Company’s Articles to effect a Reverse Stock Split of the Company’s Common Stock at a Split Ratio of up to one-for-seven, with the Board being authorized to determin the exact Split Ratio. In connection with the adoption of such resolutions, the Board elected to seek the written consent of the holders of a majority of the issued and outstanding shares of Common Stock and all of our issued and outstanding shares of Series A Preferred Stock in order to reduce the costs and implement the proposal in a timely manner.

On March 14, 2023, the Consenting Stockholders, who on the Record Date owned shares of the Company’s issued and outstanding Common Stock, voting as a class, entitled to 6,846,378 out of 13,633,948 total votes, representing approximately 50.22% of the class, and 3,269,998 shares of the Company’s issued and outstanding shares of Series A Preferred stock, collectively entitled to 329,331,468 votes, representing approximately 98% of the 340,633,748 total stockholder votes on all matters submitted to a vote of the stockholders, consented in writing to the proposed Amendment.

Under Section 14(c) of the Exchange Act, the filing of the Amendment effecting the Reverse Stock Split cannot become effective until the expiration of the 20-day Period.

The Company is not seeking written consent from any of our other stockholders, and stockholders other than the Consenting Stockholders will not be given an opportunity to vote with respect to the Amendment. All necessary corporate approvals have been obtained, and this Information Statement is furnished solely for the purpose of providing stockholders advance notice of the actions taken, as required by the Exchange Act.

Stockholders who were not afforded an opportunity to consent or otherwise vote with respect to the actions taken have no right under the NRS to dissent or require a vote of all stockholders.

APPROVAL OF THE REVERSE STOCK SPLIT OF OUR OUTSTANDING COMMON STOCK

General

Our Board has unanimously approved a proposal to amend Article III of our Articles to effect an up to one-for-seven Reverse Stock Split of the Company's outstanding Common Stock, with the Board retaining discretion to determine the exact Split Ratio. The Consenting Stockholders have also approved this Amendment. The text of the Amendment is set forth in the Certificate of Amendment to Articles of Incorporation of Blackboxstocks Inc. attached to this Information Statement as Appendix A.

The Amendment provides for the combination of our presently issued and outstanding shares of Common Stock into a smaller number of shares of identical Common Stock. This is known as a "reverse stock split." Under the proposal, depending upon the Split Ratio determined by our Board of Directors, each of up to seven (7) shares of our presently issued and outstanding Common Stock as of the close of business on the effective date of the Amendment will be converted automatically into one (1) share of our post-Reverse Stock Split Common Stock. Fractional shares of Common Stock will not be issued. Instead, we will issue one (1) full share of our post-Reverse Stock Split Common Stock to any stockholder who would have been entitled to receive a fractional share of Common Stock as a result of the Reverse Stock Split.

Each stockholder will hold the same percentage of our outstanding Common Stock immediately following the Reverse Stock Split as he did immediately prior to the Reverse Stock Split, except for adjustments required due to the treatment of fractional shares. The Amendment does not change the number of authorized shares of Common Stock.

Reasons for the Reverse Stock Split

In determining to authorize the Reverse Stock Split, and in light of the foregoing, our Board of Directors considered, among other things, the requirements of the Nasdaq Capital Market to maintain a trading price above $1.00 per share, and to have additional authorized shares available in the event the Company requires additional financing to maintain or grow operations.

In evaluating whether or not to authorize the Reverse Stock Split, in addition to the considerations described above, our Board of Directors also took into account various negative factors associated with reverse stock splits. These factors include:

| |

●

|

the negative perception of reverse stock splits held by some investors, analysts and other stock market participants;

|

| |

●

|

the fact that the stock price of some companies that have implemented reverse stock splits has subsequently declined back to pre-reverse stock split levels; and

|

| |

●

|

the adverse effect on liquidity that might be caused by a reduced number of shares outstanding, and the potential concomitant downward pressure decreased liquidity could have on the trading price of our Common Stock.

|

Also, other factors such as our financial results, market conditions and the market perception of our business may adversely affect the market price of our Common Stock. As a result, there can be no assurance that the price of our Common Stock would be maintained at the per share price in effect immediately following the effective time of the Reverse Stock Split. Stockholders should recognize that if the Reverse Stock Split is affected, they will own a fewer number of shares than they currently own (a number equal to the number of shares owned immediately prior to the Reverse Stock Split divided by up to seven). While we expect that the Reverse Stock Split will result in an increase in the per share price of our Common Stock, the Reverse Stock Split may not increase the per share price of our Common Stock in proportion to the reduction in the number of shares of our Common Stock outstanding. It also may not result in a permanent increase in the per share price, which depends on many factors, including our performance, prospects and other factors that may be unrelated to the number of shares outstanding. The history of similar reverse splits for companies in similar circumstances is varied.

If the Reverse Stock Split is effected and the per share price of our Common Stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split. Furthermore, the liquidity of our Common Stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Stock Split.

In addition, the Reverse Stock Split will likely increase the number of stockholders who own “odd lots” (stock holdings in amounts of less than 100 shares, in this case often one share). Stockholders who hold odd lots typically will experience an increase in the cost of selling their shares, as well as possible greater difficulty in effecting such sales. Any reduction in brokerage commissions resulting from the Reverse Stock Split may be offset, in whole or in part, by increased brokerage commissions required to be paid by stockholders selling odd lots created by the split.

Finally, following the Reverse Stock Split the number of authorized but unissued shares of our Common Stock relative to the number of issued shares of our Common Stock will be increased. This increased number of authorized but unissued shares of our Common Stock could be issued by the Board of Directors without further stockholder approval, which could result in dilution to the holders of our Common Stock. The perception that the Company may be able to dilute investors may place downward pressure on the market price for our Common Stock.

Exchange Act Matters

Our Common Stock is currently registered under the Exchange, and we are subject to the periodic reporting and other requirements of the Exchange Act. The Reverse Stock Split, if implemented, will not affect the registration of our Common Stock under the Exchange Act or our reporting or other requirements thereunder. Our Common Stock is currently traded and following the Reverse Stock Split will continue to be traded on the Nasdaq Capital Market under the symbol “BLBX”, subject to our continued satisfaction of the Nasdaq Capital Market listing requirements. Note, however, that the CUSIP number for our Common Stock will change in connection with the Reverse Stock Split and will be reflected on new certificates issued by the Company and in electronic entry systems.

Effects of the Reverse Stock Split

The Reverse Stock Split will be effected by filing the Amendment with the Secretary of State of the State of Nevada and will be effective upon a date on or after the expiration of the 20-day Period after the mailing of this Information Statement. The 20-day Period is expected to conclude on or about April 10, 2023. However, the actual timing of the filing and the Split Ratio will be determined by our Board based upon its evaluation as to when the filing will be most advantageous to the Company and our stockholders. We reserve the right to forego or postpone filing the Amendment for up to a year if we determine that action to be in the best interests of the Company and the stockholders.

We are currently authorized to issue 100,000,000 shares of Common Stock of which 13,633,948 shares were issued and outstanding at the close of business on the Record Date. Adoption of the Reverse Stock Split will reduce the shares of Common Stock outstanding but will not affect the number of authorized shares of Common Stock. The Reverse Stock Split will have no effect on the par value of the Common Stock.

The effect of the Reverse Stock Split upon holders of Common Stock will be that the total number of shares of our Common Stock held by each stockholder will be automatically converted into the number of whole shares of Common Stock equal to the number of shares of Common Stock owned immediately prior to the Reverse Stock Split divided by up to seven (7) (depending upon the Split Ratio determined by the Board), then further adjusted to account for any fractional shares. Each of our stockholders will continue to own shares of Common Stock and will continue to share in the assets and future growth of the Company as a stockholder. Each stockholder that would have been entitled to receive a fractional share of Common Stock as a result of the Reverse Stock Split will receive one (1) whole share of Common Stock in lieu of such fractional share as a result of the reverse stock split.

All outstanding but unexercised options and warrants entitling the holders thereof to purchase shares of our Common Stock will enable such holders to purchase, upon exercise of their options or warrants, up to one-seventh (depending upon the Split Ratio determined by the Board) of the number of shares of our Common Stock that such holders would have been able to purchase upon exercise of their options or warrants immediately preceding the Reverse Stock Split, at an exercise price equal to up to seven times (depending upon the Split Ratio determined by the Board) the exercise price per share specified before the Reverse Stock Split, resulting in approximately the same aggregate exercise price being required to be paid upon exercise thereof immediately preceding the Reverse Stock Split.

The Reverse Stock Split will affect all of the stockholders uniformly and will not affect any stockholder’s percentage ownership interests in the Company, except to the extent that the Reverse Stock Split results in any of the Company’s stockholders owning a fractional share. As described herein, stockholders holding fractional shares as a result of the Reverse Stock Split will be entitled to one (1) whole share of Common Stock in lieu of such fractional shares. The number of stockholders of record will also not be affected by the Reverse Stock Split. The Company will continue to be subject to the periodic reporting requirements of the Exchange Act.

Fractional Shares

No scrip or fractional share certificates will be issued in connection with the Reverse Stock Split. Stockholders who otherwise would be entitled to receive fractional shares because they hold a number of shares of the Common Stock not evenly divisible by the Split Ratio will be entitled, upon surrender of certificate(s) representing such shares, to new certificate(s) representing the number of shares such stockholder would otherwise be entitled to rounded up to the next whole share.

Authorized but Unissued Shares; Potential Dilution and Anti-Takeover Effects

Adoption of the Reverse Stock Split will reduce the shares of Common Stock outstanding as described elsewhere in this Information Statement. After effecting the Reverse Stock Split, additional shares will be available for issuance from time to time for business purposes as reasonably determined by the Board, without the necessity of soliciting further stockholder approval.

If the Board issues additional shares, the aggregate ownership interest of our current stockholders, and the interest of each such existing stockholder, would be diluted, and such dilution could be substantial.

The significant increase in the proportion of unissued authorized shares to issued shares after the Reverse Stock Split could, under certain circumstances, have an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of our Board or contemplating a tender offer or other transaction for the combination of our Company with another company).

Discretionary Authority of the Board of Directors to set the Split Ratio, File the Amendment and Abandon Reverse Stock Split

The Reverse Stock Split will become effective upon the filing of the Amendment to our Articles with the Secretary of State of the State of Nevada. The Split Ratio and timing of the filing of the Certificate of Amendment that will effectuate the Reverse Stock Split will be determined by our Board based on its evaluation as to the appropriate Split Ratio and when such action will be the most advantageous to us and our stockholders. Our Board also reserves the right to abandon the Amendment without further action by our stockholders at any time before the effectiveness of the filing with the Nevada Secretary of State of the Amendment, notwithstanding the approval of the Reverse Stock Split by the Consenting Stockholder.

If the Amendment effecting the Reverse Stock Split has not been filed with the Secretary of State of the State of Nevada by the close of one year from the Record Date, our Board will abandon the Reverse Stock Split.

No Dissenters’ Rights

Under the NRS, the Company’s stockholders are not entitled to dissenters’ rights with respect to the Reverse Stock Split, and the Company will not independently provide stockholders with any such right.

Procedure for Effecting Reverse Stock Split and Exchange of Stock Certificates

As soon as practicable after the effective time (the “Effective Time”) of the Reverse Split, stockholders will be notified that the Reverse Stock Split has been effected. If you hold shares of Common Stock in a book-entry form, you will receive a transmittal letter from Securities Transfer Corporation, the Company’s transfer agent (the “Transfer Agent”) as soon as practicable after the effective times of the Reverse Stock Split with instructions on how to exchange your shares. After you submit your completed transmittal letter, if you are entitled to post-split shares of our Common Stock, a transaction statement will be sent to your address of record as soon as practicable after the Effective Time of the Reverse Stock Split indicating the number of shares of Common Stock you hold.

Some stockholders hold their shares of Common Stock in certificate form or a combination of certificate and book-entry form. We expect that the Transfer Agent will act as exchange agent for purposes of implementing the exchange of stock certificates, if applicable. If you are a stockholder holding pre-split shares in certificate form, you will receive a transmittal letter from the Company’s Transfer Agent as soon as practicable after the Effective Time of the Reverse Stock Split. The transmittal letter will be accompanied by instructions specifying how you can exchange your certificate representing the pre-split shares of our Common Stock for a statement of holding.

Beginning on the Effective Time of the Reverse Stock Split, each certificate representing pre-split shares will be deemed for all corporate purposes to evidence ownership of post-split shares.

In connection with the Reverse Stock Split, our Common Stock will change its current CUSIP number. This new CUSIP number will appear on any new certificates representing post-Reverse Split shares of our Common Stock.

Street Name and Book-Entry Holders

Upon the Reverse Stock Split, the Company intends to treat shares held by stockholders in “street name”, through a bank, broker or other nominee, in the same manner as stockholders whose shares are registered in their own names. Banks, brokers and other nominees will be instructed to affect the Reverse Stock Split for their beneficial holders. These brokers, banks and other nominees may have other procedures for processing the transaction, however, and stockholders holding in street name are encouraged to ask their brokers, banks or other nominees any questions they may have regarding such procedures.

Certain Federal Income Tax Considerations

The following discussion describes certain material federal income tax considerations relating to the Reverse Stock Split. This discussion is based upon the Internal Revenue Code, existing and proposed regulations thereunder, legislative history, judicial decisions and current administrative rulings and practices, all as amended and in effect on the date hereof. Any of these authorities could be repealed, overruled or modified at any time. Any such change could be retroactive and, accordingly, could cause the tax consequences to vary substantially from the consequences described herein. No ruling from the Internal Revenue Service (the "IRS") with respect to the matters discussed herein has been requested, and there is no assurance that the IRS would agree with the conclusions set forth in this discussion.

This discussion may not address certain federal income tax consequences that may be relevant to particular stockholders in light of their personal circumstances or to stockholders who may be subject to special treatment under the federal income tax laws. This discussion also does not address any tax consequences under state, local or foreign laws.

STOCKHOLDERS ARE URGED TO CONSULT THEIR TAX ADVISORS AS TO THE PARTICULAR TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT FOR THEM, INCLUDING THE APPLICABILITY OF ANY STATE, LOCAL OR FOREIGN TAX LAWS, CHANGES IN APPLICABLE TAX LAWS AND ANY PENDING OR PROPOSED LEGISLATION.

The Reverse Stock Split is intended to be a tax-free recapitalization to the Company and its stockholders, except for those stockholders who receive a whole share of Common Stock in lieu of a fractional share. Stockholders will not recognize any gain or loss for federal income tax purposes as a result of the Reverse Stock Split, except for those stockholders receiving a whole share of Common Stock in lieu of a fractional share. The Stockholder’s holding period for the shares of our Common Stock after the Reverse Stock Split will include the period during which the Stockholder held the shares of our Common Stock surrendered in the Reverse Stock Split. The adjusted basis of the shares of Common Stock after the Reverse Stock Split will be the same as the adjusted basis of the shares of Common Stock before the Reverse Stock Split, excluding the basis of fractional shares.

A stockholder who receives a whole share of Common Stock in lieu of a fractional share generally may recognize gain in an amount not to exceed the excess of the fair market value of such whole shares over the fair market value of the fractional share to which the stockholder was otherwise entitled.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our Common Stock and Series A Preferred Stock as of March 13, 2023, unless otherwise indicated, by: (1) each person known to us to be the beneficial owner of more than 5% of each class of our capital stock; (2) each director of the Company; (3) the Company’s current named executive officers and (4) all current directors and executive officers as a group. To the best of our knowledge, each of the persons named in the table below as beneficially owning the shares set forth therein has sole voting power and sole investment power with respect to such shares, unless otherwise indicated. Applicable percentages are based upon 13,633,948 shares of Common Stock and 3,269,998 shares of Series A Preferred Stock outstanding as of March 13, 2023. Unless otherwise specified, the address of each of the persons set forth below is in care of the Company, at the address of 5430 LBJ Freeway, Suite 1485, Dallas, Texas 75240.

|

Title of Class

|

Name and Address of

Beneficial Owner(1)

|

|

Amount and

Nature of

Beneficial

Ownership

|

|

|

Percent of

Class

|

|

|

Common Stock

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

As Individuals

|

Gust Kepler (2)

|

|

|

3,462,837

|

|

|

|

25.4

|

%

|

| |

|

|

|

|

|

|

|

|

|

| |

Eric Pharis

|

|

|

791,615

|

|

|

|

5.8

|

%

|

| |

|

|

|

|

|

|

|

|

|

| |

Robert Winspear (3)

|

|

|

228,556

|

|

|

|

1.

|

7%

|

| |

|

|

|

|

|

|

|

|

|

| |

Brandon Smith (4)

|

|

|

170,279

|

|

|

|

1.

|

3%

|

| |

|

|

|

|

|

|

|

|

|

| |

Ray Balestri (5)(7)

|

|

|

159,355

|

|

|

|

1.

|

2%

|

| |

|

|

|

|

|

|

|

|

|

| |

Dalya Sulaiman (5)

|

|

|

119,444

|

|

|

|

*

|

|

| |

Keller Reid (6)

|

|

|

4,325

|

|

|

|

*

|

|

| |

|

|

|

|

|

|

|

|

|

|

As a Group

|

Executive Officers and Directors as a group (7 persons)

|

|

|

4,936,411

|

|

|

|

36.2

|

%

|

| |

|

|

|

|

|

|

|

|

|

| |

David Kyle

|

|

|

833,334

|

|

|

|

6.1

|

%

|

| |

|

|

|

|

|

|

|

|

|

| |

Stephen Chiang

8 Kitchener Link

City Square Residences #21-14

Singapore 207226

|

|

|

1,000,000

|

|

|

|

7.3

|

%

|

|

Series A Preferred Stock

|

|

|

|

|

|

|

|

|

|

|

As a Group

|

Officers and Directors (1 person)

|

|

|

3,269,998

|

|

|

|

100

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

As Individuals

|

Gust Kepler

|

|

|

3,269,998

|

|

|

|

100

|

%

|

*Less than 1%

(1) Beneficial ownership is calculated in accordance with the rules of the SEC in accordance with Rule 13d-3(d)(1) of the Exchange Act. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options or warrants held by that person that are currently exercisable or will become exercisable within 60 days following March 13, 2023 are deemed outstanding. However, these shares are not deemed outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated in the footnotes to this table, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable.

(2) Includes 767 shares owned by Judy Children Inheritance Trust for which Mr. Kepler serves as trustee. Excludes 3,269,998 shares of Series A Preferred Stock held by Mr. Kepler (separately noted in the table) which may be converted on a 5-for-1 share ratio (for a total of 653,999 shares of common stock) based upon the Company’s current market capitalization and the limitations provided for in our Conversion Agreement with Mr. Kepler. Each share of Series A Preferred Stock held by Mr. Kepler is entitled to 100 votes on all stockholder matters, and along with the common stock held by Mr. Kepler collectively represents approximately 25.4% of our issued and outstanding capital stock and approximately 97.0% of the voting power of our stockholders.

(3) Includes 148,000 shares owned by Winspear Investments LLC which is 100% owned by Mr. Winspear and his wife, and 25,000 shares owned by ACM Winspear Investments L.P. of which Mr. Winspear is general partner. Also includes 55,556 shares underlying a warrant exercisable by Mr. Winspear for 100,000 shares that vest over 36 months.

(4) Includes 146,668 shares owned by Cyfeon Solutions Inc which is controlled by Mr. Smith and 23,611 shares underlying an option granted to Mr. Smith to purchase 50,000 shares which vest over 36 months.

(5) Includes 8,333 shares underlying options that are exercisable within 60 days of the date of this Information Statement resulting from an option granted to Mr. Balestri and Ms. Sulaiman to purchase 10,000 shares of Common Stock under the 2021 Plan which vest ratably over twelve months. and 5,000 shares underlying an option exercisable within 60 days of this Information Statement

(6) Includes 1,250 shares underlying an option that is exercisable within 60 days of the date of this Information Statement resulting from an option to purchase 5,000 shares of Common Stock under the 2021 Plan which vest ratably over twelve months

(7) Includes 50,000 shares held by Balestri Family Investments LP, 12,555 shares of restricted stock granted in lieu of the retainer for non-employee directors that becomes unrestricted within 60 days and 20,366 shares held by Mr. Balestri for his minor children.

INTERESTS OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Our directors and executive officers, and each associate of the foregoing persons, have no substantial interests, directly or indirectly, in the Amendment, except to the extent of their ownership of shares of Common Stock and Series A Convertible Preferred Stock.

STOCKHOLDERS SHARING THE SAME LAST NAME AND ADDRESS

Some banks, brokers, and other record holders may participate in the practice of “householding” information statements. This means that, unless stockholders give contrary instructions, only one copy of this information statement may be sent to multiple stockholders sharing an address. The Company will promptly deliver a separate copy of this document to any stockholder at a shared address upon written or oral request by such stockholder at the following address or telephone number: Blackboxstocks Inc., 5430 LBJ Freeway, Suite 1485, Dallas, Texas 75240, Attn: Corporate Secretary, telephone (972) 726-9203. Any stockholder who wants to receive a separate copy of this information statement in the future, or any stockholder who is receiving multiple copies and would like to receive only one copy per household, should contact such stockholder’s bank, broker, or other record holder, or contact the Company at the above address or telephone number.

ADDITIONAL INFORMATION

The Company files annual, quarterly and current reports and other information with the SEC under the Exchange Act. You may obtain copies of this information by mail from the Public Reference Room of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may obtain information on the operation of the public reference rooms by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet website that contains reports and other information about issuers that file electronically with the SEC. The address of that website is www.sec.gov.

THE CONSENTING STOCKHOLDERS WHO OWN SHARES REPRESENTING A MAJORITY OF OUR ISSUED AND OUTSTANDING COMMON STOCK AND ALL OF OUR ISSUED AND OUTSTANDING SERIES A PREFERRED STOCK HAVE CONSENTED TO THE AMENDMENT EFFECTING THE REVERSE STOCK SPLIT. NO FURTHER VOTES OR PROXIES ARE NEEDED AND NONE ARE REQUESTED. THE BOARD IS NOT REQUESTING A PROXY FROM YOU AND YOU ARE REQUESTED NOT TO SEND A PROXY.

|

BY ORDER OF THE BOARD OF DIRECTORS

|

| |

|

/s/ Gust Kepler

|

|

Gust Kepler

|

|

President and Chief Executive Officer

|

| |

Dallas, Texas

March 21, 2023

APPENDIX A

Attachment A to Certificate of Amendment to Articles of Incorporation of Blackboxstocks Inc.

| |

|

As of the close of business on [________] (4:01 p.m. Eastern Daylight Time) (the “Reverse Split Date”), each [________] ([_]) shares of Common Stock issued and outstanding immediately prior to the Reverse Split Date (referred to in this paragraph as the “Old Common Stock”) automatically and without any action on the part of the holder thereof will be reclassified and changed into one (1) share of new Common Stock, par value $0.001 per share (referred to in this paragraph as the “New Common Stock”), subject to the treatment of fractional share interests as described below. Each holder of a certificate or certificates that immediately prior to the Reverse Split Date represented outstanding shares of Old Common Stock (the “Old Certificates”) will be entitled to receive, upon surrender of such Old Certificates to the Company for cancellation, a certificate or certificates (the “New Certificates”, whether one or more) representing the number of whole shares (rounded up to the nearest whole share) of the New Common Stock into which and for which the shares of the Old Common Stock formerly represented by such Old Certificates so surrendered are reclassified under the terms hereof. From and after the Reverse Split Date, Old Certificates shall represent only the right to receive New Certificates pursuant to the provisions hereof. No certificates or scrip representing fractional share interests in New Common Stock will be issued. In lieu of any such fractional shares of New Common Stock, each stockholder with a fractional share will be entitled to receive, upon surrender of Old Certificates to the Company for cancellation, a New Certificate representing the number of shares such stockholder would otherwise be entitled to rounded up to the next whole share. If more than one Old Certificate shall be surrendered at one time for the account of the same stockholder, the number of full shares of New Common Stock for which New Certificates shall be issued shall be computed on the basis of the aggregate number of shares represented by the Old Certificates so surrendered. In the event that the Company determines that a holder of Old Certificates has not tendered all his, her or its certificates for exchange, the Company shall carry forward any fractional shares until all certificates of that holder have been presented for exchange. The Old Certificates surrendered for exchange shall be properly endorsed and otherwise in proper form for transfer. From and after the Reverse Split Date, the amount of capital represented by the shares of the New Common Stock into which and for which the shares of the Old Common Stock are reclassified under the terms hereof shall be an amount equal to the product of the number of issued and outstanding shares of New Common Stock and the $0.001 par value of each such share.

|

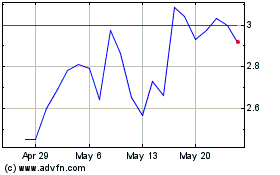

BlackBoxStocks (NASDAQ:BLBX)

Historical Stock Chart

From Apr 2024 to May 2024

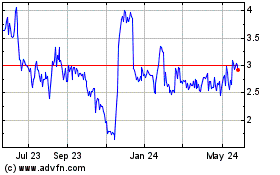

BlackBoxStocks (NASDAQ:BLBX)

Historical Stock Chart

From May 2023 to May 2024