false0001665988--12-312023Q2http://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortization00016659882023-01-012023-07-010001665988us-gaap:CommonClassAMember2023-08-02xbrli:shares0001665988us-gaap:CommonClassBMember2023-08-0200016659882023-04-022023-07-01iso4217:USD00016659882022-04-032022-07-0200016659882022-01-012022-07-02iso4217:USDxbrli:shares00016659882023-07-0100016659882022-12-310001665988us-gaap:CommonClassAMember2022-12-310001665988us-gaap:CommonClassAMember2023-07-010001665988us-gaap:CommonClassBMember2023-07-010001665988us-gaap:CommonClassBMember2022-12-310001665988us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-04-010001665988us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-04-010001665988us-gaap:AdditionalPaidInCapitalMember2023-04-010001665988us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-04-010001665988us-gaap:RetainedEarningsMember2023-04-010001665988us-gaap:NoncontrollingInterestMember2023-04-0100016659882023-04-010001665988us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-04-022023-07-010001665988us-gaap:AdditionalPaidInCapitalMember2023-04-022023-07-010001665988us-gaap:RetainedEarningsMember2023-04-022023-07-010001665988us-gaap:NoncontrollingInterestMember2023-04-022023-07-010001665988us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-04-022023-07-010001665988us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-07-010001665988us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-07-010001665988us-gaap:AdditionalPaidInCapitalMember2023-07-010001665988us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-07-010001665988us-gaap:RetainedEarningsMember2023-07-010001665988us-gaap:NoncontrollingInterestMember2023-07-010001665988us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-04-020001665988us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-04-020001665988us-gaap:AdditionalPaidInCapitalMember2022-04-020001665988us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-04-020001665988us-gaap:RetainedEarningsMember2022-04-020001665988us-gaap:NoncontrollingInterestMember2022-04-0200016659882022-04-020001665988us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-04-032022-07-020001665988us-gaap:AdditionalPaidInCapitalMember2022-04-032022-07-020001665988us-gaap:RetainedEarningsMember2022-04-032022-07-020001665988us-gaap:NoncontrollingInterestMember2022-04-032022-07-020001665988us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-04-032022-07-020001665988us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-07-020001665988us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-07-020001665988us-gaap:AdditionalPaidInCapitalMember2022-07-020001665988us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-07-020001665988us-gaap:RetainedEarningsMember2022-07-020001665988us-gaap:NoncontrollingInterestMember2022-07-0200016659882022-07-020001665988us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001665988us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001665988us-gaap:AdditionalPaidInCapitalMember2022-12-310001665988us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-12-310001665988us-gaap:RetainedEarningsMember2022-12-310001665988us-gaap:NoncontrollingInterestMember2022-12-310001665988us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-07-010001665988us-gaap:AdditionalPaidInCapitalMember2023-01-012023-07-010001665988us-gaap:RetainedEarningsMember2023-01-012023-07-010001665988us-gaap:NoncontrollingInterestMember2023-01-012023-07-010001665988us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-07-010001665988us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-12-310001665988us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-12-310001665988us-gaap:AdditionalPaidInCapitalMember2021-12-310001665988us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-12-310001665988us-gaap:RetainedEarningsMember2021-12-310001665988us-gaap:NoncontrollingInterestMember2021-12-3100016659882021-12-310001665988us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-01-012022-07-020001665988us-gaap:AdditionalPaidInCapitalMember2022-01-012022-07-020001665988us-gaap:RetainedEarningsMember2022-01-012022-07-020001665988us-gaap:NoncontrollingInterestMember2022-01-012022-07-020001665988us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-01-012022-07-020001665988bvs:BVLLCMember2023-07-01bvs:employee0001665988srt:ScenarioPreviouslyReportedMember2022-12-310001665988srt:RestatementAdjustmentMember2022-12-310001665988srt:ScenarioPreviouslyReportedMember2021-12-310001665988srt:RestatementAdjustmentMember2021-12-310001665988srt:RestatementAdjustmentMemberbvs:EquityRebalancingMember2021-12-310001665988srt:RestatementAdjustmentMemberbvs:EquityRebalancingMember2022-12-310001665988bvs:ErrorCorrectionInCalculationOfDeferredTaxAssetsMembersrt:RestatementAdjustmentMember2021-12-310001665988bvs:ErrorCorrectionInCalculationOfDeferredTaxAssetsMembersrt:RestatementAdjustmentMember2022-12-310001665988srt:RestatementAdjustmentMemberbvs:EquityRebalancingForIssuanceOfStockThroughEquityPlansMember2022-12-310001665988bvs:DeferredTaxImpactFor2022Membersrt:RestatementAdjustmentMember2022-12-310001665988bvs:CartiHealLtdMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2022-12-310001665988bvs:CustomerOneMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-07-01xbrli:pure0001665988us-gaap:IntellectualPropertyMember2023-07-010001665988us-gaap:IntellectualPropertyMember2022-12-310001665988us-gaap:DistributionRightsMember2023-07-010001665988us-gaap:DistributionRightsMember2022-12-310001665988us-gaap:CustomerRelationshipsMember2023-07-010001665988us-gaap:CustomerRelationshipsMember2022-12-310001665988us-gaap:InProcessResearchAndDevelopmentMember2023-07-010001665988us-gaap:InProcessResearchAndDevelopmentMember2022-12-310001665988us-gaap:DevelopedTechnologyRightsMember2023-07-010001665988us-gaap:DevelopedTechnologyRightsMember2022-12-310001665988bvs:CartiHealLtdMemberus-gaap:IntellectualPropertyMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2022-12-310001665988us-gaap:IntellectualPropertyMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2023-01-012023-07-01bvs:reporting_unit0001665988bvs:CartiHealLtdMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2023-07-010001665988country:US2022-01-012022-12-310001665988bvs:WoundBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-05-220001665988bvs:WoundBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-05-222023-05-2200016659882023-05-222023-05-220001665988bvs:WoundBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-04-022023-07-010001665988bvs:WoundBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-01-012023-07-010001665988bvs:A2024EarnOutPaymentMemberbvs:EarnOutPaymentNetRevenueThresholdOneMemberbvs:WoundBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-05-220001665988bvs:A2024EarnOutPaymentMemberbvs:WoundBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-05-222023-05-220001665988bvs:EarnOutPaymentNetRevenueThresholdTwoMemberbvs:A2024EarnOutPaymentMemberbvs:WoundBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-05-220001665988bvs:EarnOutPaymentNetRevenueThresholdOneMemberbvs:A2025EarnOutPaymentMemberbvs:WoundBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-05-220001665988bvs:A2025EarnOutPaymentMemberbvs:WoundBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-05-222023-05-220001665988bvs:EarnOutPaymentNetRevenueThresholdTwoMemberbvs:A2025EarnOutPaymentMemberbvs:WoundBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-05-220001665988bvs:A2025EarnOutPaymentMemberbvs:WoundBusinessMemberbvs:EarnOutPaymentNetRevenueThresholdThreeMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-05-220001665988bvs:A2026EarnOutPaymentMemberbvs:EarnOutPaymentNetRevenueThresholdOneMemberbvs:WoundBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-05-220001665988bvs:A2026EarnOutPaymentMemberbvs:WoundBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-05-222023-05-220001665988bvs:EarnOutPaymentNetRevenueThresholdTwoMemberbvs:A2026EarnOutPaymentMemberbvs:WoundBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-05-220001665988bvs:A2026EarnOutPaymentMemberbvs:WoundBusinessMemberbvs:EarnOutPaymentNetRevenueThresholdThreeMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-05-220001665988bvs:CartiHealLtdMember2022-07-120001665988bvs:CartiHealLtdMemberus-gaap:SeriesGPreferredStockMember2022-07-120001665988bvs:CartiHealLtdMemberus-gaap:SeriesGPreferredStockMember2021-12-310001665988bvs:CartiHealLtdMember2022-04-032022-07-020001665988bvs:CartiHealLtdMember2022-01-012022-07-020001665988bvs:CartiHealLtdMember2022-07-122022-07-120001665988bvs:SalesMilestoneMemberbvs:CartiHealLtdMember2022-07-120001665988bvs:TermLoanFacilityMemberbvs:CartiHealLtdMemberus-gaap:LineOfCreditMember2022-07-122022-07-120001665988bvs:DeferredConsiderationMemberbvs:CartiHealLtdMember2022-07-12bvs:tranche0001665988bvs:CartiHealLtdMemberbvs:DeferredAmountPayableByJuly12023Member2022-07-120001665988bvs:DeferredAmountPayableBySeptember12023Memberbvs:CartiHealLtdMember2022-07-120001665988bvs:DeferredAmountPayableByJanuary12025Memberbvs:CartiHealLtdMember2022-07-120001665988bvs:DeferredAmountPayableByJanuary12026Memberbvs:CartiHealLtdMember2022-07-120001665988bvs:DeferredAmountPayableByJanuary12027Memberbvs:CartiHealLtdMember2022-07-120001665988bvs:DeferredAmountMemberbvs:CartiHealLtdMember2022-06-300001665988bvs:TrailingTwelveMonthSalesMemberbvs:CartiHealLtdMember2022-06-300001665988bvs:CartiHealLtdMemberus-gaap:CallOptionMember2022-06-300001665988us-gaap:PutOptionMemberbvs:CartiHealLtdMember2022-06-300001665988bvs:CartiHealLtdMember2021-08-310001665988bvs:CartiHealLtdMemberbvs:DeferredAmountPayableByJuly12023Member2023-02-132023-02-130001665988bvs:CartiHealLtdMember2023-02-272023-02-270001665988bvs:ElronMember2023-02-272023-02-270001665988bvs:CartiHealLtdMember2023-02-272023-02-2700016659882023-02-272023-02-270001665988us-gaap:EstimateOfFairValueFairValueDisclosureMemberbvs:CartiHealLtdMember2022-07-122022-07-120001665988bvs:DeferredAmountMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberbvs:CartiHealLtdMember2022-07-120001665988bvs:SalesMilestoneMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberbvs:CartiHealLtdMember2022-07-120001665988bvs:CartiHealLtdMember2022-07-032022-10-010001665988bvs:CartiHealLtdMemberbvs:CartiHealLtdMember2022-07-110001665988country:USus-gaap:IntellectualPropertyMemberbvs:CartiHealLtdMember2023-07-010001665988bvs:InternationalMemberus-gaap:IntellectualPropertyMemberbvs:CartiHealLtdMember2023-07-010001665988us-gaap:IntellectualPropertyMemberbvs:USSegmentMemberbvs:CartiHealLtdMember2022-07-122022-07-120001665988us-gaap:IntellectualPropertyMemberbvs:USSegmentMemberbvs:CartiHealLtdMember2022-07-120001665988us-gaap:IntellectualPropertyMemberbvs:CartiHealLtdMemberbvs:InternationalSegmentMember2022-07-122022-07-120001665988us-gaap:IntellectualPropertyMemberbvs:CartiHealLtdMemberbvs:InternationalSegmentMember2022-07-120001665988bvs:TermLoanMember2023-07-010001665988bvs:TermLoanMember2022-12-310001665988us-gaap:RevolvingCreditFacilityMember2023-07-010001665988us-gaap:RevolvingCreditFacilityMember2022-12-310001665988us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2019-12-060001665988us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2019-12-060001665988us-gaap:LineOfCreditMemberbvs:TermLoanFacilityJuly2022Memberus-gaap:SecuredDebtMember2022-07-112022-07-110001665988bvs:TermLoanMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2021-10-290001665988us-gaap:SecuredDebtMember2023-03-310001665988us-gaap:LineOfCreditMemberbvs:TermLoanFacilityJuly2022Memberus-gaap:SecuredDebtMember2023-07-010001665988us-gaap:LineOfCreditMemberbvs:TermLoanFacilityJuly2022Memberus-gaap:SecuredDebtMember2023-01-012023-07-010001665988us-gaap:LineOfCreditMember2023-01-012023-07-010001665988bvs:TermLoanFacilitiesMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2023-07-010001665988bvs:TermLoanFacilitiesMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2023-04-022023-07-010001665988bvs:TermLoanFacilitiesMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2022-04-032022-07-020001665988bvs:TermLoanFacilitiesMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2023-01-012023-07-010001665988bvs:TermLoanFacilitiesMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2022-01-012022-07-020001665988us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-07-010001665988us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-12-310001665988us-gaap:FairValueInputsLevel2Memberbvs:TermLoanMember2023-07-010001665988us-gaap:InterestRateSwapMember2023-07-01bvs:derivative0001665988us-gaap:InterestRateSwapMember2022-10-282022-10-280001665988us-gaap:InterestRateSwapMember2022-04-032022-07-020001665988us-gaap:InterestRateSwapMember2022-01-012022-07-020001665988us-gaap:FairValueMeasurementsRecurringMemberbvs:DeferredAmountMemberbvs:CartiHealLtdMember2023-07-010001665988us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberbvs:DeferredAmountMemberbvs:CartiHealLtdMember2023-07-010001665988us-gaap:FairValueMeasurementsRecurringMemberbvs:DeferredAmountMemberbvs:CartiHealLtdMember2022-12-310001665988us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberbvs:DeferredAmountMemberbvs:CartiHealLtdMember2022-12-310001665988bvs:SalesMilestoneMemberus-gaap:FairValueMeasurementsRecurringMemberbvs:CartiHealLtdMember2023-07-010001665988bvs:SalesMilestoneMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberbvs:CartiHealLtdMember2023-07-010001665988bvs:SalesMilestoneMemberus-gaap:FairValueMeasurementsRecurringMemberbvs:CartiHealLtdMember2022-12-310001665988bvs:SalesMilestoneMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberbvs:CartiHealLtdMember2022-12-310001665988us-gaap:FairValueMeasurementsRecurringMemberbvs:BionessIncMember2023-07-010001665988us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberbvs:BionessIncMember2023-07-010001665988us-gaap:FairValueMeasurementsRecurringMemberbvs:BionessIncMember2022-12-310001665988us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberbvs:BionessIncMember2022-12-310001665988us-gaap:FairValueMeasurementsRecurringMember2023-07-010001665988us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-07-010001665988us-gaap:FairValueMeasurementsRecurringMember2022-12-310001665988us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001665988us-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMemberbvs:BionessIncMember2023-07-010001665988us-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMemberbvs:BionessIncMembersrt:MaximumMember2023-07-010001665988bvs:BionessIncMember2023-04-022023-07-010001665988bvs:BionessIncMember2022-04-032022-07-020001665988bvs:BionessIncMember2023-01-012023-07-010001665988bvs:BionessIncMember2022-01-012022-07-020001665988bvs:CartiHealMember2023-01-012023-07-010001665988bvs:A2021PlanMemberus-gaap:CommonClassAMember2023-07-010001665988bvs:A2023PlanMemberus-gaap:CommonClassAMember2023-07-010001665988bvs:A2021And2023PlanMember2023-04-022023-07-010001665988bvs:A2021And2023PlanMember2023-01-012023-07-010001665988bvs:A2021And2023PlanMember2022-04-032022-07-020001665988bvs:A2021And2023PlanMember2022-01-012022-07-020001665988us-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2023-01-012023-07-010001665988us-gaap:RestrictedStockUnitsRSUMembersrt:MaximumMember2023-01-012023-07-010001665988us-gaap:RestrictedStockUnitsRSUMember2023-07-010001665988us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-07-010001665988us-gaap:RestrictedStockUnitsRSUMember2022-12-310001665988srt:MinimumMemberus-gaap:EmployeeStockOptionMember2023-01-012023-07-010001665988srt:MinimumMemberus-gaap:EmployeeStockOptionMember2023-04-022023-07-010001665988us-gaap:EmployeeStockOptionMembersrt:MaximumMember2023-04-022023-07-010001665988us-gaap:EmployeeStockOptionMembersrt:MaximumMember2023-01-012023-07-010001665988us-gaap:EmployeeStockOptionMember2023-01-012023-07-010001665988us-gaap:CommonClassAMember2023-06-300001665988us-gaap:EmployeeStockMember2023-07-010001665988us-gaap:EmployeeStockMember2023-04-022023-07-010001665988us-gaap:EmployeeStockMember2023-01-012023-07-010001665988us-gaap:EmployeeStockMember2022-04-032022-07-020001665988us-gaap:EmployeeStockMember2022-01-012022-07-020001665988bvs:PublicOfferingMemberus-gaap:CommonClassAMember2021-02-162021-02-1600016659882021-02-160001665988us-gaap:OverAllotmentOptionMemberus-gaap:CommonClassAMember2021-02-162021-02-160001665988us-gaap:CommonClassBMember2021-02-160001665988us-gaap:CommonClassAMemberbvs:BVLLCMember2021-02-162021-02-16bvs:entity0001665988bvs:BVLLCMember2021-02-160001665988us-gaap:CommonClassBMember2021-02-162021-02-160001665988us-gaap:CommonClassAMember2021-02-160001665988us-gaap:CommonClassAMember2023-01-012023-07-01bvs:vote0001665988bvs:BVLLCMember2023-07-010001665988bvs:BVLLCMember2023-01-012023-07-010001665988bvs:BVLLCMember2022-12-310001665988bvs:BVLLCMember2022-01-012022-12-310001665988bvs:ContinuingLLCOwnerMemberbvs:BVLLCMember2023-07-010001665988bvs:ContinuingLLCOwnerMemberbvs:BVLLCMember2023-01-012023-07-010001665988bvs:ContinuingLLCOwnerMemberbvs:BVLLCMember2022-12-310001665988bvs:ContinuingLLCOwnerMemberbvs:BVLLCMember2022-01-012022-12-310001665988bvs:BVLLCMemberbvs:BioventusAndContinuingLLCOwnerMember2023-07-010001665988bvs:BVLLCMemberbvs:BioventusAndContinuingLLCOwnerMember2023-01-012023-07-010001665988bvs:BVLLCMemberbvs:BioventusAndContinuingLLCOwnerMember2022-12-310001665988bvs:BVLLCMemberbvs:BioventusAndContinuingLLCOwnerMember2022-01-012022-12-310001665988bvs:LimitedLiabilityCompanyInterestsMember2023-04-022023-07-010001665988bvs:LimitedLiabilityCompanyInterestsMember2022-04-032022-07-020001665988bvs:LimitedLiabilityCompanyInterestsMember2023-01-012023-07-010001665988bvs:LimitedLiabilityCompanyInterestsMember2022-01-012022-07-020001665988us-gaap:EmployeeStockOptionMember2023-04-022023-07-010001665988us-gaap:EmployeeStockOptionMember2022-04-032022-07-020001665988us-gaap:EmployeeStockOptionMember2023-01-012023-07-010001665988us-gaap:EmployeeStockOptionMember2022-01-012022-07-020001665988us-gaap:RestrictedStockUnitsRSUMember2023-04-022023-07-010001665988us-gaap:RestrictedStockUnitsRSUMember2022-04-032022-07-020001665988us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-07-010001665988us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-07-020001665988bvs:RestructuringPlanOf2022Membersrt:MinimumMember2023-07-010001665988bvs:RestructuringPlanOf2022Membersrt:MaximumMember2023-07-010001665988bvs:RestructuringPlanOf2022Member2023-04-022023-07-010001665988bvs:RestructuringPlanOf2022Member2023-01-012023-07-010001665988bvs:RestructuringPlanOf2022Member2022-01-012022-12-310001665988bvs:RestructuringPlanOf2021Member2023-07-010001665988bvs:AcquisitionRestructuringPlanOf2022Member2023-07-010001665988bvs:RestructuringPlanOf2021Member2022-04-032022-07-020001665988bvs:RestructuringPlanOf2021Member2022-01-012022-07-020001665988bvs:RestructuringPlanOf2021Member2022-01-012022-12-310001665988bvs:RestructuringPlanOf2021Member2021-01-012021-12-310001665988bvs:AcquisitionRestructuringPlanOf2022Member2023-01-012023-07-010001665988bvs:AcquisitionRestructuringPlanOf2022Member2022-04-032022-07-020001665988bvs:AcquisitionRestructuringPlanOf2022Member2022-01-012022-07-020001665988bvs:AcquisitionRestructuringPlanOf2022Member2022-01-012022-12-310001665988us-gaap:EmployeeSeveranceMember2022-12-310001665988us-gaap:OtherRestructuringMember2022-12-310001665988us-gaap:EmployeeSeveranceMember2023-01-012023-07-010001665988us-gaap:OtherRestructuringMember2023-01-012023-07-010001665988us-gaap:EmployeeSeveranceMember2023-07-010001665988us-gaap:OtherRestructuringMember2023-07-010001665988srt:MinimumMember2023-07-010001665988srt:MaximumMember2023-07-010001665988us-gaap:DiscontinuedOperationsHeldforsaleMember2022-12-3100016659882021-02-012021-02-280001665988bvs:BionessIncMember2021-08-190001665988bvs:BionessIncMember2021-08-192021-08-190001665988bvs:BionessIncMember2022-11-012022-11-010001665988bvs:BionessIncMember2022-12-232022-12-230001665988bvs:BionessIncMember2022-12-282022-12-280001665988bvs:BionessIncMember2022-12-282022-12-280001665988bvs:HAProductMember2021-11-102021-11-100001665988bvs:HAProductMember2022-01-012022-12-310001665988bvs:HAProductMember2023-03-082023-03-080001665988bvs:HAProductMember2023-04-022023-07-010001665988bvs:HarborMember2019-08-232019-08-230001665988bvs:SupplierOfSingleInjectionOAProductMember2023-04-022023-07-010001665988bvs:SupplierOfSingleInjectionOAProductMember2022-04-032022-07-020001665988bvs:SupplierOfSingleInjectionOAProductMember2023-01-012023-07-010001665988bvs:SupplierOfSingleInjectionOAProductMember2022-01-012022-07-020001665988bvs:ThreeInjectionOAProductMember2016-02-092016-02-090001665988bvs:HarborMember2020-12-222020-12-220001665988bvs:PainTreatmentsMembercountry:US2023-04-022023-07-010001665988bvs:PainTreatmentsMembercountry:US2022-04-032022-07-020001665988bvs:PainTreatmentsMembercountry:US2023-01-012023-07-010001665988bvs:PainTreatmentsMembercountry:US2022-01-012022-07-020001665988bvs:RestorativeTherapiesMembercountry:US2023-04-022023-07-010001665988bvs:RestorativeTherapiesMembercountry:US2022-04-032022-07-020001665988bvs:RestorativeTherapiesMembercountry:US2023-01-012023-07-010001665988bvs:RestorativeTherapiesMembercountry:US2022-01-012022-07-020001665988bvs:SurgicalSolutionsMembercountry:US2023-04-022023-07-010001665988bvs:SurgicalSolutionsMembercountry:US2022-04-032022-07-020001665988bvs:SurgicalSolutionsMembercountry:US2023-01-012023-07-010001665988bvs:SurgicalSolutionsMembercountry:US2022-01-012022-07-020001665988country:US2023-04-022023-07-010001665988country:US2022-04-032022-07-020001665988country:US2023-01-012023-07-010001665988country:US2022-01-012022-07-020001665988bvs:PainTreatmentsMemberus-gaap:NonUsMember2023-04-022023-07-010001665988bvs:PainTreatmentsMemberus-gaap:NonUsMember2022-04-032022-07-020001665988bvs:PainTreatmentsMemberus-gaap:NonUsMember2023-01-012023-07-010001665988bvs:PainTreatmentsMemberus-gaap:NonUsMember2022-01-012022-07-020001665988bvs:RestorativeTherapiesMemberus-gaap:NonUsMember2023-04-022023-07-010001665988bvs:RestorativeTherapiesMemberus-gaap:NonUsMember2022-04-032022-07-020001665988bvs:RestorativeTherapiesMemberus-gaap:NonUsMember2023-01-012023-07-010001665988bvs:RestorativeTherapiesMemberus-gaap:NonUsMember2022-01-012022-07-020001665988bvs:SurgicalSolutionsMemberus-gaap:NonUsMember2023-04-022023-07-010001665988bvs:SurgicalSolutionsMemberus-gaap:NonUsMember2022-04-032022-07-020001665988bvs:SurgicalSolutionsMemberus-gaap:NonUsMember2023-01-012023-07-010001665988bvs:SurgicalSolutionsMemberus-gaap:NonUsMember2022-01-012022-07-020001665988us-gaap:NonUsMember2023-04-022023-07-010001665988us-gaap:NonUsMember2022-04-032022-07-020001665988us-gaap:NonUsMember2023-01-012023-07-010001665988us-gaap:NonUsMember2022-01-012022-07-02bvs:segment0001665988us-gaap:OperatingSegmentsMemberbvs:USSegmentMember2023-04-022023-07-010001665988us-gaap:OperatingSegmentsMemberbvs:USSegmentMember2022-04-032022-07-020001665988us-gaap:OperatingSegmentsMemberbvs:USSegmentMember2023-01-012023-07-010001665988us-gaap:OperatingSegmentsMemberbvs:USSegmentMember2022-01-012022-07-020001665988us-gaap:OperatingSegmentsMemberbvs:InternationalSegmentMember2023-04-022023-07-010001665988us-gaap:OperatingSegmentsMemberbvs:InternationalSegmentMember2022-04-032022-07-020001665988us-gaap:OperatingSegmentsMemberbvs:InternationalSegmentMember2023-01-012023-07-010001665988us-gaap:OperatingSegmentsMemberbvs:InternationalSegmentMember2022-01-012022-07-020001665988us-gaap:MaterialReconcilingItemsMember2023-04-022023-07-010001665988us-gaap:MaterialReconcilingItemsMember2022-04-032022-07-020001665988us-gaap:MaterialReconcilingItemsMember2023-01-012023-07-010001665988us-gaap:MaterialReconcilingItemsMember2022-01-012022-07-020001665988bvs:CartiHealMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2022-12-310001665988bvs:CartiHealMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-04-022023-07-010001665988bvs:CartiHealMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2022-04-032022-07-020001665988bvs:CartiHealMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-01-012023-07-010001665988bvs:CartiHealMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2022-01-012022-07-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 10-Q

________________

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended July 1, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission File Number: 001-37844

BIOVENTUS INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | | 81-0980861 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

4721 Emperor Boulevard, Suite 100 | | |

Durham, North Carolina | | 27703 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(919) 474-6700

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

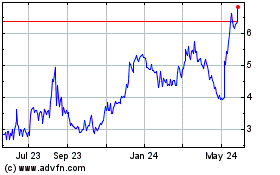

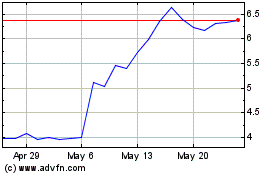

| Class A Common Stock, $0.001 par value per share | BVS | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging Growth Company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 2, 2023, there were 62,792,850 shares of Class A common stock outstanding and 15,786,737 shares of Class B common stock outstanding.

| | | | | | | | |

| BIOVENTUS INC. |

| | |

| TABLE OF CONTENTS |

| | |

|

| | |

| | |

| | |

| | |

| |

| | |

| |

| | |

| | |

| | |

| |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

As used in this Quarterly Report on Form 10-Q, unless expressly indicated or the context otherwise requires, references to "Bioventus," "we," "us," "our," "the Company," and similar references refer to Bioventus Inc. and its consolidated subsidiaries, including Bioventus LLC (“BV LLC”).

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), and Section 27A of the Securities Act of 1933, as amended (“Securities Act”), concerning our business, operations and financial performance and condition, as well as our plans, objectives and expectations for our business operations and financial performance and condition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements including, without limitation, statements regarding our business strategy, including, without limitation, expectations relating to our acquisitions of Misonix and Bioness, expected expansion of our pipeline and research and development investment, new therapy launches, expected costs related to, and potential future options for, MOTYS, recent dispositions of non-core assets, our operations and expected financial performance and condition, and impacts of the COVID-19 pandemic and inflation. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words.

Forward-looking statements are based on management’s current expectations, estimates, forecasts and projections about our business and the industry in which we operate, and management’s beliefs and assumptions are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this Quarterly Report on Form 10-Q may turn out to be inaccurate. Furthermore, if the forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. Important factors that may cause actual results to differ materially from current expectations include, among other things: the risk that previously identified material weaknesses or new material weaknesses could adversely affect our ability to report our results of operations and financial condition accurately and in a timely manner; we might not be able to continue to fund our operations for at least the next twelve months as a going concern; we might not meet certain of our debt covenants under our Credit Agreement and might be required to repay our indebtedness; risks associated with the disposition of our Wound Business and expected impacts on our business; restrictions on operations and other costs associated with our indebtedness; our ability to complete acquisitions or successfully integrate new businesses, products or technologies in a cost-effective and non-disruptive manner; we maintain cash at financial institutions, often in balance that exceed federally insured limits; we are subject to securities class action litigation and may be subject to similar or other litigation in the future, which will require significant management time and attention, result in significant legal expenses and may result in unfavorable outcomes; our ability to maintain our competitive position depends on our ability to attract, retain and motivate our senior management team and highly qualified personnel; we are highly dependent on a limited number of products; our long-term growth depends on our ability to develop, acquire and commercialize new products, line extensions or expanded indications; we may be unable to successfully commercialize newly developed or acquired products or therapies in the United States; demand for our existing portfolio of products and any new products, line extensions or expanded indications depends on the continued and future acceptance of our products by physicians, patients, third-party payers and others in the medical community; the proposed down classification of non-invasive bone growth stimulators, including our Exogen system, by the U.S. Food and Drug Administration (FDA) could increase future competition for bone growth stimulators and otherwise adversely affect the Company’s sales of Exogen; failure to achieve and maintain adequate levels of coverage and/or reimbursement for our products or future products, the procedures using our products, such as our hyaluronic acid (HA) viscosupplements, or future products we may seek to commercialize; pricing pressure and other competitive factors; governments outside the United States might not provide coverage or reimbursement of our products; we compete and may compete in the future against other companies, some of which have longer operating histories, more established products or greater resources than we do; the reclassification of our HA products from medical devices to drugs in the United States by the FDA could negatively impact our ability to market these products and may require that we conduct costly additional clinical studies to support current or future indications for use of those products; our failure to properly manage our anticipated growth and strengthen our brands; risks related to product liability claims; fluctuations in demand for our products; issues relating to the supply of our products, potential supply chain disruptions and the increased cost of parts and components used to manufacture our products due to inflation; our reliance on a limited number of third-party manufacturers to manufacture certain of our products; if our facilities are damaged or become

inoperable, we will be unable to continue to research, develop and manufacture our products; failure to maintain contractual relationships; security breaches, unauthorized disclosure of information, denial of service attacks or the perception that confidential information in our possession is not secure; failure of key information technology and communications systems, process or sites; risks related to international sales and operations; risks related to our debt and future capital needs; failure to comply with extensive governmental regulation relevant to us and our products; we may be subject to enforcement action if we engage in improper claims submission practices and resulting audits or denials of our claims by government agencies could reduce our net sales or profits; the FDA regulatory process is expensive, time-consuming and uncertain, and the failure to obtain and maintain required regulatory clearances and approvals could prevent us from commercializing our products; if clinical studies of our future product candidates do not produce results necessary to support regulatory clearance or approval in the United States or elsewhere, we will be unable to expand the indications for or commercialize these products; legislative or regulatory reforms; our business may continue to experience adverse impacts as a result of the COVID-19 pandemic or similar epidemics; risks related to intellectual property matters; and other important factors described in Part I. Item 1A. Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2022, as updated by our subsequent Quarterly Report on Form 10-Q for the quarter ended April 1, 2023, and as may be further updated from time to time in our other filings with the SEC. You are urged to consider these factors carefully in evaluating these forward-looking statements. These forward-looking statements speak only as of the date hereof. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

Bioventus Inc.

Consolidated Condensed Statements of Operations and Comprehensive Loss

Three and Six Months Ended July 1, 2023 and July 2, 2022

(Amounts in thousands, except share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 1, 2023 | | July 2, 2022 | | July 1, 2023 | | July 2, 2022 |

| Net sales | $ | 137,069 | | | $ | 140,331 | | | $ | 256,128 | | | $ | 257,621 | |

Cost of sales (including depreciation and amortization of $12,301, $9,684, $26,640 and $18,902 respectively) | 47,946 | | | 43,677 | | | 93,086 | | | 85,265 | |

| Gross profit | 89,123 | | | 96,654 | | | 163,042 | | | 172,356 | |

| Selling, general and administrative expense | 74,844 | | | 89,620 | | | 155,702 | | | 175,744 | |

| Research and development expense | 3,398 | | | 6,366 | | | 7,169 | | | 13,294 | |

| Restructuring costs | 620 | | | 1,007 | | | 937 | | | 1,584 | |

| Change in fair value of contingent consideration | 240 | | | 273 | | | 527 | | | 542 | |

| Depreciation and amortization | 2,294 | | | 2,696 | | | 4,423 | | | 5,950 | |

| Impairment of assets | — | | | — | | | 78,615 | | | — | |

| Loss on disposal of a business | 977 | | | — | | | 977 | | | — | |

| Operating income (loss) | 6,750 | | | (3,308) | | | (85,308) | | | (24,758) | |

| Interest expense, net | 10,587 | | | 2,578 | | | 20,281 | | | 1,028 | |

| Other expense (income) | 513 | | | 604 | | | (1,075) | | | 241 | |

| Other expense | 11,100 | | | 3,182 | | | 19,206 | | | 1,269 | |

| Loss before income taxes | (4,350) | | | (6,490) | | | (104,514) | | | (26,027) | |

| Income tax expense (benefit), net | 381 | | | 1,244 | | | 235 | | | (3,888) | |

| Net loss from continuing operations | (4,731) | | | (7,734) | | | (104,749) | | | (22,139) | |

| Loss from discontinued operations, net of tax | — | | | (280) | | | (74,429) | | | (681) | |

| Net loss | (4,731) | | | (8,014) | | | (179,178) | | | (22,820) | |

Loss attributable to noncontrolling interest -

continuing operations | 1,050 | | | 762 | | | 21,410 | | | 4,291 | |

Loss attributable to noncontrolling interest -

discontinued operations | — | | | — | | | 14,937 | | | — | |

| Net loss attributable to Bioventus Inc. | $ | (3,681) | | | $ | (7,252) | | | $ | (142,831) | | | $ | (18,529) | |

| | | | | | | |

| Net loss from continuing operations | $ | (4,731) | | | $ | (7,734) | | | $ | (104,749) | | | $ | (22,139) | |

| Other comprehensive income (loss), net of tax | | | | | | | |

| Change in foreign currency translation adjustments | 303 | | | (507) | | | 960 | | | (1,189) | |

| Comprehensive loss | (4,428) | | | (8,241) | | | (103,789) | | | (23,328) | |

Comprehensive loss attributable to noncontrolling interest -

continuing operations | 989 | | | 868 | | | 21,215 | | | 4,537 | |

Comprehensive loss attributable to noncontrolling interest -

discontinued operations | — | | | — | | | 14,937 | | | — | |

| Comprehensive loss attributable to Bioventus Inc. | $ | (3,439) | | | $ | (7,373) | | | $ | (67,637) | | | $ | (18,791) | |

| | | | | | | |

Loss per share of Class A common stock from continuing

operations, basic and diluted: | $ | (0.06) | | | $ | (0.11) | | | $ | (1.34) | | | $ | (0.29) | |

Loss per share of Class A common stock from discontinued

operations, basic and diluted: | — | | | — | | | (0.95) | | | (0.01) | |

Loss per share of Class A common stock,

basic and diluted | $ | (0.06) | | | $ | (0.11) | | | $ | (2.29) | | | $ | (0.30) | |

| | | | | | | |

Weighted-average shares of Class A common stock

outstanding, basic and diluted: | 62,551,285 | | | 61,475,350 | | 62,338,018 | | 60,977,556 |

| | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

Bioventus Inc.

Consolidated Condensed Balance Sheets as of July 1, 2023 and December 31, 2022

(Amounts in thousands, except share amounts)

(Unaudited)

| | | | | | | | | | | |

| July 1, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 29,389 | | | $ | 30,186 | |

| | | |

| | | |

| Accounts receivable, net | 119,636 | | | 136,295 | |

| Inventory | 96,276 | | | 84,766 | |

| Prepaid and other current assets | 15,337 | | | 18,551 | |

| | | |

| | | |

| Current assets attributable to discontinued operations | — | | | 2,777 | |

| Total current assets | 260,638 | | | 272,575 | |

| Property and equipment, net | 41,862 | | | 27,456 | |

| Goodwill | 7,462 | | | 7,462 | |

| Intangible assets, net | 505,223 | | | 639,851 | |

| Operating lease assets | 15,238 | | | 16,690 | |

| Investment and other assets | 6,539 | | | 2,621 | |

| Long-term assets attributable to discontinued operations | — | | | 405,994 | |

| Total assets | $ | 836,962 | | | $ | 1,372,649 | |

| | | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 41,364 | | | $ | 36,697 | |

| Accrued liabilities | 121,748 | | | 111,570 | |

| Current portion of long-term debt | 11,320 | | | 33,056 | |

| | | |

| | | |

| Other current liabilities | 4,672 | | | 3,607 | |

| | | |

| | | |

| Current liabilities attributable to discontinued operations | — | | | 119,087 | |

| Total current liabilities | 179,104 | | | 304,017 | |

| Long-term debt, less current portion | 374,568 | | | 385,010 | |

| Deferred income taxes | — | | | 2,248 | |

| | | |

| | | |

| Contingent consideration | 17,958 | | | 17,431 | |

| Other long-term liabilities | 31,991 | | | 22,810 | |

| Long-term liabilities attributable to discontinued operations | — | | | 228,911 | |

| Total liabilities | 603,621 | | | 960,427 | |

| Commitments and contingencies (Note 11) | | | |

| Stockholders’ Equity | | | |

Preferred stock, $0.001 par value, 10,000,000 shares authorized, 0 shares issued | | | |

Class A common stock, $0.001 par value, 250,000,000 shares authorized as of July 1, 2023 and December 31, 2022, 62,804,506 and 62,063,014 shares issued and outstanding as of July 1, 2023 and December 31, 2022, respectively | 63 | | | 62 | |

Class B common stock, $0.001 par value, 50,000,000 shares authorized, 15,786,737 shares issued and outstanding as of July 1, 2023 and December 31, 2022 | 16 | | | 16 | |

| Additional paid-in capital | 490,598 | | | 490,576 | |

| Accumulated deficit | (308,137) | | | (165,306) | |

| Accumulated other comprehensive income (loss) | 655 | | | (110) | |

| Total stockholders’ equity attributable to Bioventus Inc. | 183,195 | | | 325,238 | |

| Noncontrolling interest | 50,146 | | | 86,984 | |

| Total stockholders’ equity | 233,341 | | | 412,222 | |

| Total liabilities and stockholders’ equity | $ | 836,962 | | | $ | 1,372,649 | |

The accompanying notes are an integral part of these consolidated financial statements.

Bioventus Inc.

Consolidated Condensed Statements of Changes in Stockholders’ Equity

Three and Six Months Ended July 1, 2023 and July 2, 2022

(Amounts in thousands, except share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended July 1, 2023 |

| Class A Common Stock | | Class B Common Stock | | | | | | | | | | |

| Shares | Amount | | Shares | Amount | | Additional Paid-in Capital | | Accumulated other comprehensive (loss) income | | Accumulated Deficit | | Non-

controlling

interest | | Total Stockholders'

equity |

| Balance at April 1, 2023 | 62,507,917 | | $ | 63 | | | 15,786,737 | | $ | 16 | | | $ | 492,475 | | | $ | 413 | | | $ | (304,456) | | | $ | 51,851 | | | $ | 240,362 | |

Issuance of Class A common stock

for equity plans | 296,589 | | — | | | — | | — | | | 139 | | | — | | | — | | | — | | | 139 | |

| Net loss | — | | — | | | — | | — | | | — | | | — | | | (3,681) | | | (1,050) | | | (4,731) | |

| Change in noncontrolling interest allocation | — | | — | | | — | | — | | | 108 | | | — | | | — | | | (108) | | | — | |

| Equity based compensation | — | | — | | | — | | — | | | (2,124) | | | — | | | — | | | (608) | | | (2,732) | |

| Translation adjustment | — | | — | | | — | | — | | | — | | | 242 | | | — | | | 61 | | | 303 | |

| Balance at July 1, 2023 | 62,804,506 | | $ | 63 | | | 15,786,737 | | $ | 16 | | | $ | 490,598 | | | $ | 655 | | | $ | (308,137) | | | $ | 50,146 | | | $ | 233,341 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended July 2, 2022 |

| Class A Common Stock | | Class B Common Stock | | | | | | | | | | |

| Shares | Amount | | Shares | Amount | | Additional Paid-in Capital | | Accumulated other comprehensive (loss) income | | Accumulated Deficit | | Non-

controlling

interest | | Total Stockholders'

equity |

| Balance at April 2, 2022 | 61,357,270 | | $ | 62 | | | 15,786,737 | | $ | 16 | | | $ | 476,661 | | | $ | (363) | | | $ | (17,879) | | | $ | 135,311 | | | $ | 593,808 | |

Issuance of Class A common stock

for equity plans | 299,229 | | 2 | | | — | | — | | | 2,175 | | | — | | | — | | | — | | | 2,177 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net loss | — | | — | | | — | | — | | | — | | | — | | | (7,252) | | | (762) | | | (8,014) | |

| Change in noncontrolling interest allocation | — | | — | | | — | | — | | | (65) | | | — | | | — | | | 65 | | | — | |

| Equity based compensation | — | | — | | | — | | — | | | 3,681 | | | — | | | — | | | 935 | | | 4,616 | |

| Translation adjustment | — | | — | | | — | | — | | | — | | | (401) | | | — | | | (106) | | | (507) | |

| Balance at July 2, 2022 | 61,656,499 | | $ | 64 | | | 15,786,737 | | $ | 16 | | | $ | 482,452 | | | $ | (764) | | | $ | (25,131) | | | $ | 135,443 | | | $ | 592,080 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended July 1, 2023 |

| Class A Common Stock | | Class B Common Stock | | | | | | | | | | |

| Shares | Amount | | Shares | Amount | | Additional Paid-in Capital | | Accumulated other comprehensive (loss) income | | Accumulated Deficit | | Non-

controlling

interest | | Total Stockholders'

equity |

| Balance at December 31, 2022 | 62,063,014 | | $ | 62 | | | 15,786,737 | | $ | 16 | | | $ | 490,576 | | | $ | (110) | | | $ | (165,306) | | | $ | 86,984 | | | $ | 412,222 | |

| Issuance of Class A common stock for equity plans | 741,492 | | 1 | | | — | | — | | | 222 | | | — | | | — | | | — | | | 223 | |

| Net loss | — | | — | | | — | | — | | | — | | | — | | | (142,831) | | | (36,347) | | | (179,178) | |

| Change in noncontrolling interest allocation | — | | — | | | — | | — | | | 385 | | | — | | | — | | | (385) | | | — | |

| Equity based compensation | — | | — | | | — | | — | | | (585) | | | — | | | — | | | (301) | | | (886) | |

| Translation adjustment | — | | — | | | — | | — | | | — | | | 765 | | | — | | | 195 | | | 960 | |

| Balance at July 1, 2023 | 62,804,506 | | $ | 63 | | | 15,786,737 | | $ | 16 | | | $ | 490,598 | | | $ | 655 | | | $ | (308,137) | | | $ | 50,146 | | | $ | 233,341 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended July 2, 2022 |

| Class A Common Stock | | Class B Common Stock | | | | | | | | | | |

| Shares | Amount | | Shares | Amount | | Additional Paid-in Capital | | Accumulated other comprehensive (loss) income | | Accumulated Deficit | | Non-

controlling

interest | | Total Stockholders'

equity |

| Balance at December 31, 2021 | 59,548,504 | | $ | 59 | | | 15,786,737 | | $ | 16 | | | $ | 473,318 | | | $ | 179 | | | $ | (6,602) | | | $ | 140,686 | | | $ | 607,656 | |

| Issuance of Class A common stock for equity plans | 2,107,995 | | 5 | | | — | | — | | | 4,252 | | | — | | | — | | | | | 4,257 | |

| Deferred taxes on equity rebalancing | — | | — | | | — | | — | | | (1,977) | | | — | | | — | | | — | | | (1,977) | |

| Net loss | — | | — | | | — | | — | | | — | | | — | | | (18,529) | | | (4,291) | | | (22,820) | |

| Change in noncontrolling interest allocation | — | | — | | | — | | — | | | 2,587 | | | — | | | — | | | (2,587) | | | — | |

| Equity based compensation | — | | — | | | — | | — | | | 7,624 | | | — | | | — | | | 1,881 | | | 9,505 | |

| Tax withholdings on equity compensation awards | — | | — | | | — | | — | | | (3,352) | | | — | | | — | | | — | | | (3,352) | |

| Translation adjustment | — | | — | | | — | | — | | | — | | | (943) | | | — | | | (246) | | | (1,189) | |

| Balance at July 2, 2022 | 61,656,499 | | $ | 64 | | | 15,786,737 | | $ | 16 | | | $ | 482,452 | | | $ | (764) | | | $ | (25,131) | | | $ | 135,443 | | | $ | 592,080 | |

The accompanying notes are an integral part of these consolidated financial statements.

Bioventus Inc.

Consolidated Condensed Statements of Cash Flows

Six Months Ended July 1, 2023 and July 2, 2022

(Amounts in thousands)

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended |

| July 1, 2023 | | July 2, 2022 |

| Operating activities: | | | |

| Net loss | $ | (179,178) | | | $ | (22,820) | |

| Less: Loss from discontinued operations, net of tax | (74,429) | | | (681) | |

| Loss from continuing operations | (104,749) | | | (22,139) | |

| Adjustments to reconcile net loss to net cash from operating activities: | | | |

| Depreciation and amortization | 31,073 | | | 24,863 | |

| Provision for expected credit losses | 640 | | | 2,505 | |

| Equity based compensation | (886) | | | 9,505 | |

| Change in fair value of contingent consideration | 527 | | | 542 | |

| Change in fair value of interest rate swap | — | | | (4,196) | |

| Deferred income taxes | (3,540) | | | (27,698) | |

| Impairment of assets | 78,615 | | | — | |

| Loss on disposal of a business | 977 | | | — | |

| Unrealized loss on foreign currency fluctuations | 601 | | | 1,020 | |

| Other, net | 1,139 | | | 408 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 11,329 | | | (21,157) | |

| Inventories | (13,074) | | | (2,614) | |

| Accounts payable and accrued expenses | 14,765 | | | 17,747 | |

| Other current and noncurrent assets and liabilities | (1,963) | | | 3,134 | |

| Net cash from operating activities - continuing operations | 15,454 | | | (18,080) | |

| Net cash from operating activities - discontinued operations | (2,169) | | | — | |

| Net cash from operating activities | 13,285 | | | (18,080) | |

| Investing activities: | | | |

| Proceeds from sale of a business | 34,897 | | | — | |

| Investment held in trust for the acquisition of CartiHeal | — | | | (50,000) | |

| Acquisitions, net of cash acquired | — | | | (231) | |

| Purchase of property and equipment | (4,957) | | | (4,990) | |

| Investments and acquisition of distribution rights | — | | | (1,478) | |

| | | |

| | | |

| Net cash from investing activities - continuing operations | 29,940 | | | (56,699) | |

| Net cash from investing activities - discontinued operations | (11,506) | | | — | |

| Net cash from investing activities | 18,434 | | | (56,699) | |

| Financing activities: | | | |

| Proceeds from issuance of Class A and B common stock | 223 | | | 4,257 | |

| Tax withholdings on equity-based compensation | — | | | (3,352) | |

| Borrowing on revolver | 49,000 | | | 25,000 | |

| Payment on revolver | (42,000) | | | — | |

| Debt refinancing costs | (3,661) | | | — | |

| Payments on long-term debt | (38,264) | | | (9,019) | |

| Other, net | (166) | | | (26) | |

| Net cash from financing activities | (34,868) | | | 16,860 | |

| Effect of exchange rate changes on cash | 701 | | | (293) | |

| Net change in cash, cash equivalents and restricted cash | (2,448) | | | (58,212) | |

| Cash, cash equivalents and restricted cash at the beginning of the period | 31,837 | | | 99,213 | |

| Cash, cash equivalents and restricted cash at the end of the period | $ | 29,389 | | | $ | 41,001 | |

| Supplemental disclosure of noncash investing and financing activities | | | |

| Accrued liabilities for intellectual property | $ | 709 | | | $ | — | |

| Accounts payable for purchase of property, plant and equipment | $ | 968 | | | $ | 67 | |

| | | |

| | | |

The accompanying notes are an integral part of these consolidated financial statements.

Bioventus Inc.

Notes to the unaudited consolidated condensed financial statements

(Amounts in thousands, except unit and share amounts)

1. Organization

The Company

Bioventus Inc. (together with its subsidiaries, the “Company”) was formed as a Delaware corporation for the purpose of facilitating an initial public offering and other related transactions in order to carry on the business of Bioventus LLC and its subsidiaries (“BV LLC”). Bioventus Inc. functions as a holding company with no direct operations, material assets or liabilities other than the equity interest in BV LLC. BV LLC is a limited liability company formed under the laws of the state of Delaware on November 23, 2011 and operates as a partnership. BV LLC commenced operations in May 2012.

On February 16, 2021, the Company completed its initial public offering (“IPO”), which was conducted through what is commonly referred to as an umbrella partnership C Corporation (“UP-C”) structure. The Company has majority interest, sole voting interest and controls the management of BV LLC. As a result, the Company consolidates the financial results of BV LLC and reports a noncontrolling interest representing the interest of BV LLC held by its continuing LLC owner.

The Company is focused on developing and commercializing clinically differentiated, cost efficient and minimally invasive treatments that engage and enhance the body’s natural healing processes. The Company is headquartered in Durham, North Carolina and has approximately 950 employees.

Interim periods

The Company reports quarterly interim periods on a 13-week basis within a standard calendar year. Each annual reporting period begins on January 1 and ends on December 31. Each quarter ends on the Saturday closest to calendar quarter-end, with the exception of the fourth quarter, which ends on December 31. The 13-week quarterly periods for fiscal year 2023 end on April 1, July 1 and September 30. Comparable periods for 2022 ended on April 2, July 2 and October 1. The fourth and first quarters may vary in length depending on the calendar year.

Unaudited interim financial information

The accompanying unaudited consolidated financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Pursuant to these rules and regulations, they do not include all information and notes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring adjustments, and the adjustments discussed in Note 1. Organization) considered necessary for a fair statement of the Company’s financial condition and results of operations have been included. Operating results for the periods presented are not necessarily indicative of the results that may be expected for the full year. As such, the information included in this report should be read in conjunction with the Company’s Annual Report on Form 10-K for the year ended December 31, 2022. The consolidated balance sheet at December 31, 2022 has been derived from the audited consolidated financial statements of the Company, but does not include all the disclosures required by U.S. GAAP.

Correction of immaterial misstatements

During the quarter ended April 1, 2023 and as part of the balance sheet review process, the Company identified misstatements in its calculation of the carrying amount of noncontrolling interest as it applies to the Company’s complex UP-C tax and ownership structure as prescribed in the amended and restated limited liability company agreement of BV LLC. Specifically, the Company failed to adjust the carrying amount of its noncontrolling interest to reflect changes in ownership interests relating to BV LLC. As a result, the previously issued consolidated financial statements reflect an understatement of noncontrolling interest and an overstatement of additional paid-in capital.

As a result of further research conducted, the Company discovered an additional error related to historical deferred income tax balances. The Company concluded that it had inappropriately calculated deferred income taxes by using an incorrect book basis in its investment of BV LLC during the Company’s IPO, which resulted in an overstatement of deferred tax liabilities, an understatement of noncontrolling interest and an understatement of additional paid-in capital.

The statements affected by these errors include the consolidated balance sheets and consolidated statements of stockholders’ and members’ equity issued in the Company’s Annual Report on Form 10-K for the years ended December 31, 2022 and December 31, 2021. There was no impact to any other financial statements for the periods presented. The Company concluded that these misstatements were not material, individually or in the aggregate, as evaluated under the Securities and Exchange Commission Staff Bulletin No. 99, Materiality; No. 108, Considering the Effects of Prior Year Misstatements in Current Year Financial Statements; and Financial Accounting Standards Board ASC 250-10, Accounting Changes and Error Corrections. However, because of the significance of these items, and to facilitate comparison among periods, the Company has decided to revise its previously issued consolidated financial statements on a prospective basis. The Company will correct its prior period presentation for this error in its future 2023 quarterly financial statements included in its Forms 10-Q and 2023 Annual Report on Form 10-K for the period ended December 31, 2023. The adjustments did not have an impact on revenues, total assets or cash flows.

The following are selected line items from our aforementioned impacted financial statements illustrating the effect of the error corrections thereon:

| | | | | | | | | | | | | | | | | |

| Consolidated Balance Sheets — December 31, 2022 | As Previously Reported | | Adjustments | | As Adjusted |

| Deferred income taxes (b)(d) | $ | 74,138 | | | $ | (71,890) | | | $ | 2,248 | |

| Total liabilities | 1,032,317 | | | (71,890) | | | 960,427 | |

| Additional paid-in capital (a)(b)(c)(d) | 481,919 | | | 8,657 | | | 490,576 | |

| Noncontrolling interest (a)(c) | 23,751 | | | 63,233 | | | 86,984 | |

| Total stockholders’ equity | 340,332 | | | 71,890 | | | 412,222 | |

| | | | | | | | | | | | | | | | | |

| Consolidated Balance Sheets — December 31, 2021 | As Previously Reported | | Adjustments | | As Adjusted |

| Deferred income taxes (b) | $ | 133,518 | | | $ | (73,867) | | | $ | 59,651 | |

| Total liabilities | 692,073 | | | (73,867) | | | 618,206 | |

| Additional paid-in capital (a)(b) | 465,272 | | | 8,046 | | | 473,318 | |

| Noncontrolling interest (a) | 74,865 | | | 65,821 | | | 140,686 | |

| Total stockholders’ equity | 533,789 | | | 73,867 | | | 607,656 | |

The Company’s consolidated statements of changes in stockholders’ and members equity as of December 31, 2022 and December 31, 2021 have been corrected to reflect the above adjustments. The Company revised the amounts originally reported for the years ended December 31, 2022 and December 31, 2021 for the following items:

(a)Recorded a $65,821 decrease to additional paid-in capital and a corresponding increase to noncontrolling interest. This action effectively rebalanced equity appropriately between the Company and its noncontrolling interests according to their respective BV LLC ownership interests.

(b)Recorded a $73,867 decrease to deferred income tax balances and an increase to additional paid in capital to reflect the correction of an error that occurred during the calculation of deferred taxes at the Company’s IPO.

(c)Reflects the entry as discussed in (a) above and additional rebalancing activity of $2,588 relating to the issuance of Class A common stock for equity plans during the year ended December 31, 2022.

(d)Reflects the entry as discussed in (b) and an additional $1,977 increase to deferred income tax balances and a reduction to additional paid in capital to reflect the deferred tax impact during the year ended December 31, 2022.

Going concern

The accompanying unaudited consolidated financial statements have been prepared under the going concern basis of accounting, which presumes that the Company’s liquidation is not imminent; however, based on the Company’s current financial position and liquidity sources, including current cash balances, and forecasted future cash flows, the Company is at risk of violating certain of its financial covenants under the Credit and Guaranty Agreement, dated December 6, 2019 (as amended on October 29, 2021, July 11, 2022 and March 31, 2023).

If mitigating steps are not taken or are not successful, the Company is at substantial risk of failing its covenants in 2024. A breach of a financial covenant under the Credit and Guaranty Agreement could accelerate repayment of our obligations under the agreement. Refer to Note 4. Financial instruments for further discussion concerning the Company’s long-term debt obligations.

The Company is actively pursuing plans to mitigate these conditions and events, such as considering various additional cost cutting measures, and exploring additional divestiture opportunities such as the recently completed divestiture of certain assets within the Company’s Wound Business (as defined in Note 3. Acquisitions and divestitures); however, there can be no assurances that it is probable these plans will be successfully implemented or that they will successfully mitigate these conditions and events. Therefore, these plans do not alleviate the substantial doubt about the Company’s ability to continue as a going concern.

As part of efforts to improve its financial condition, on February 27, 2023, the Company reached an agreement to return the assets and liabilities of CartiHeal (2009) Ltd. (“CartiHeal”), a wholly-owned subsidiary of the Company, to its former securityholders. The deconsolidation of CartiHeal relieved deferred consideration liabilities and milestone obligations related to the acquisition of CartiHeal. Refer to Note 3. Acquisitions and divestitures for further information regarding the acquisition and subsequent deconsolidation of CartiHeal. In addition, the Company announced a restructuring plan in December 2022 to align the Company’s organizational and management cost structure to improve profitability and cash flow. Refer to Note 9. Restructuring costs for further information.

Recent accounting pronouncements

The Company is an accelerated public company filer. Therefore, required effective dates for adopting new or revised accounting standards are generally earlier than when emerging growth companies are required to adopt.

2. Balance sheet information

Accounts receivable, net

Accounts receivable, net are amounts billed and currently due from customers. The Company records the amounts due net of allowance for credit losses. Collection of the consideration that the Company expects to receive typically occurs within 30 to 90 days of billing. The Company applies the practical expedient for contracts with payment terms of one year or less which does not consider the effects of the time value of money. Occasionally, the Company enters into payment agreements with patients that allow payment terms beyond one year. In those cases, the financing component is not deemed significant to the contract.

Accounts receivable, net of allowances, consisted of the following as of:

| | | | | | | | | | | |

| July 1, 2023 | | December 31, 2022 |

Accounts receivable(a) | $ | 126,777 | | | $ | 143,317 | |

| Less: Allowance for credit losses | (7,141) | | | (7,022) | |

| $ | 119,636 | | | $ | 136,295 | |

(a)Other receivables of $350 attributable to CartiHeal was reclassified to current assets attributable to discontinued operations within the December 31, 2022 consolidated balance sheets. Refer to Note 3. Acquisitions and divestitures and Note 14. Discontinued operations for further details regarding the deconsolidation of CartiHeal.

Due to the short-term nature of the Company’s receivables, the estimate of expected credit losses is based on aging of the account receivable balances. The allowance is adjusted on a specific identification basis for certain accounts as well as pooling of accounts with similar characteristics. The Company has a diverse customer base with no single customer representing ten percent or more of sales. The Company has one customer representing approximately 15.2% of the accounts receivable balance as of July 1, 2023. Historically, the Company’s reserves have been adequate to cover credit losses.

Changes in credit losses were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 1, 2023 | | July 2, 2022 | | July 1, 2023 | | July 2, 2022 |

| Beginning balance | $ | (7,401) | | | $ | (4,254) | | | $ | (7,022) | | | $ | (3,402) | |

| Benefit (provision) for expected credit losses | 439 | | | (1,353) | | | (640) | | | (2,505) | |

| Write-offs | 768 | | | 456 | | | 1,054 | | | 825 | |

| Recoveries | (479) | | | (141) | | | (963) | | | (210) | |

| Disposition | (468) | | | — | | | 430 | | | — | |

| Ending balance | $ | (7,141) | | | $ | (5,292) | | | $ | (7,141) | | | $ | (5,292) | |

Inventory

Inventory consisted of the following as of:

| | | | | | | | | | | |

| July 1, 2023 | | December 31, 2022 |

Raw materials and supplies(a) | $ | 26,438 | | | $ | 19,133 | |

| Finished goods | 72,347 | | | 67,484 | |

| Gross | 98,785 | | | 86,617 | |

| Excess and obsolete reserves | (2,509) | | | (1,851) | |

| $ | 96,276 | | | $ | 84,766 | |

(a)Raw material inventory of $642 attributable to CartiHeal has been reclassified to current assets attributable to discontinued operations within the December 31, 2022 consolidated balance sheets. Refer to Note 3. Acquisitions and divestitures and Note 14. Discontinued operations for further details regarding the deconsolidation of CartiHeal.

Prepaid and other current assets

Prepaid and other current assets consisted of the following as of:

| | | | | | | | | | | |

| July 1, 2023 | | December 31, 2022 |

| Prepaid taxes | $ | 4,224 | | | $ | 4,442 | |

Prepaid and other current assets(a) | 11,113 | | | 14,109 | |

| $ | 15,337 | | | $ | 18,551 | |

(a)Prepaid and other current assets of $134 attributable to CartiHeal was reclassified to current assets attributable to discontinued operations within the December 31, 2022 balance sheet. Refer to Note 3. Acquisitions and divestitures and Note 14. Discontinued operations for further details regarding the deconsolidation of CartiHeal.

Intangible assets, net

Intangible assets consisted of the following as of:

| | | | | | | | | | | |

| July 1, 2023 | | December 31, 2022 |

Intellectual property(a)(b) | $ | 677,258 | | | $ | 790,049 | |

| Distribution rights | 61,325 | | | 61,325 | |

Customer relationships(b) | 57,950 | | | 67,450 | |

| IPR&D | 5,500 | | | 5,500 | |

| Developed technology and other | 13,998 | | | 13,998 | |

| Total carrying amount | 816,031 | | | 938,322 | |

| Less accumulated amortization: | | | |

Intellectual property(a)(b) | (198,141) | | | (187,767) | |

| Distribution rights | (46,810) | | | (44,319) | |

Customer relationships(b) | (57,950) | | | (58,842) | |

| Developed technology and other | (6,899) | | | (6,276) | |

| Total accumulated amortization | (309,800) | | | (297,204) | |

| Intangible assets, net before currency translation | 506,231 | | | 641,118 | |

| Currency translation | (1,008) | | | (1,267) | |

| $ | 505,223 | | | $ | 639,851 | |

(a)Intellectual property and accumulated depreciation attributable to CartiHeal totaling $410,200 and $11,327, respectively, were reclassified to long-term assets attributable to discontinued operations within the December 31, 2022 consolidated balance sheets. Refer to Note 3. Acquisitions and divestitures and Note 14. Discontinued operations for further details regarding the deconsolidation of CartiHeal.

(b)The Company recorded an impairment loss of $78,615 for the six months ended July 1, 2023 in the U.S. reporting segment of net intellectual property attributable to the TheraSkin and TheraGenesis products, which were sold in May 2023. The loss was recorded in impairment of assets within the consolidated condensed statements of operations and comprehensive loss. Refer to Refer to Note 3. Acquisitions and divestitures for further details regarding businesses held for sale.

Estimated amortization expense for intangibles subsequent to reclassifications, impairment and additions for the remainder of 2023 and for the years ended December 31, 2024 through 2027 is expected to be $13,814, $26,590, $23,922, $20,461 and $20,109, respectively.

Goodwill

Goodwill is evaluated for impairment annually or more frequently if events or changes in circumstances indicate that goodwill might be impaired. The Company assesses goodwill impairment by applying a quantitative impairment analysis comparing the carrying value of the Company’s reporting units to their respective fair values. A goodwill impairment exists if the carrying value of the reporting unit exceeds its fair value.

The Company has two reporting units and assesses impairment based upon qualitative factors and if necessary, quantitative factors. A reporting unit's fair value is determined using the income approach and discounted cash flow models by utilizing Level 3 inputs and assumptions such as future cash flows, discount rates, long-term growth rates, market value and income tax considerations. Specifically, the value of each reporting unit is determined on a stand-alone basis from the perspective of a market participant and represents the price estimated to be received in a sale of the reporting unit in an orderly transaction between market participants at the measurement date. The Company then reconciles the values of all reporting units to the market capitalization of the Company.

The Company’s goodwill resides within the International segment, of which $6,297 related to CartiHeal and was reclassified to long-term assets attributable to discontinued operations within the December 31, 2022 consolidated balance sheets. The amount was recorded in discontinued operations, net of tax on the consolidated condensed statements of operations for the six months ended July 1, 2023 as a result of CartiHeal’s deconsolidation. Refer to Note 3. Acquisitions and divestitures and Note 14. Discontinued operations for further details concerning the deconsolidation of CartiHeal.

On November 8, 2022, due to a significant decline in the Company’s Class A common stock price, circumstances became evident that a possible goodwill impairment existed as of the third quarter 2022 balance sheet date. The Company concluded that the carrying value of the U.S. reporting unit exceeded its fair value and recorded a non-cash goodwill impairment charge of $189,197 during the year ended December 31, 2022. There were no impairment losses or indicators of impairment during the six months ended July 1, 2023. There were also no accumulated impairment losses prior to the year ended December 31, 2022.

Accrued liabilities

Accrued liabilities consisted of the following as of:

| | | | | | | | | | | |

| July 1, 2023 | | December 31, 2022 |

| Gross-to-net deductions | $ | 68,304 | | | $ | 71,227 | |

| Bonus and commission | 13,368 | | | 9,179 | |

| Compensation and benefits | 9,080 | | | 11,428 | |

| Accrued interest | 6,933 | | | 217 | |

| Income and other taxes | 5,175 | | | 2,572 | |

Other liabilities(a) | 18,888 | | | 16,947 | |

| $ | 121,748 | | | $ | 111,570 | |

(a)Other liabilities attributable to CartiHeal of $384 were reclassified into current liabilities attributable to discontinued operations within December 31, 2022 consolidated balance sheets. Refer to Note 3. Acquisitions and divestitures and Note 14. Discontinued operations for further details.

3. Acquisitions and divestitures

Wound Business

On May 22, 2023, the Company closed the sale of certain assets within its Wound Business, including the TheraSkin and TheraGenesis products (collectively, the “Wound Business” or the “Disposal Group”), for potential consideration of $84,897, including $34,897 at closing, $5,000 deferred for 18 months and up to $45,000 in potential earn-out payments (“Earn-out Payments”). The Company incurred $3,880 in transactional fees resulting from the sale of the Wound Business. The deconsolidation of Disposal Group resulted in the recognition of a $977 loss on disposal of a business recorded within the consolidated statements of operations and comprehensive loss for the three and six months ended July 1, 2023.

The Company used the proceeds from the sale of its Wound Business to prepay $30,000 of long-term debt obligations. Refer to Note 4. Financial Instruments for further details regarding the Company’s outstanding long-term debt obligations.

The Earn-out Payments are based on the achievement of certain revenue thresholds by the purchaser of the Wound Business for sales of the TheraSkin and TheraGenesis products during the 2024, 2025 and 2026 fiscal years. The net revenue thresholds are as follows:

•2024 Earn-out Payment—$5,000 due if net revenue for the period January 1, 2024 through December 31, 2024 is equal to or greater than $54,300 or zero if net revenue is less than $54,300.

•2025 Earn-out Payment—$20,000 due if net revenue for the period January 1, 2025 through December 31, 2025 is equal to or greater than $69,700 or $10,000 due if net revenue is greater than or equal to $55,760 but less than $69,700 or zero if net revenue is less than $55,760.

•2026 Earn-out Payment—$20,000 due if net revenue for the period January 1, 2026 through December 31, 2026 is equal to or greater than $83,700 or $10,000 due if net revenue is greater than or equal to $66,960 but less than $83,700 or zero if net revenue is less than $66,960.

The Company evaluated the Wound Business for impairment prior to its sale and recorded a $78,615 ($63,337 after tax) impairment within the consolidated statements of operations and comprehensive loss during the six months ended July 1, 2023 as a result of this evaluation to reduce the intangible assets of the Disposal Group to reflect their respective fair values less any costs to sell. The fair value of the Disposal Group’s intangibles was determined based on the consideration received for the Wound Business.

CartiHeal (2009) Ltd

On July 12, 2022, the Company completed the acquisition of 100% of the remaining shares in CartiHeal, a privately held company headquartered in Israel and the developer of the proprietary Agili-C implant for the treatment of joint surface lesions in traumatic and osteoarthritic joints. The Company previously held an equity interest in CartiHeal’s fully diluted shares with a carrying value of $15,768 and $16,771 as of July 12, 2022 and December 31, 2021, respectively. Net equity losses associated with CartiHeal for the three and six months ended July 2, 2022 totaled $280 and $681, respectively, which were included in discontinued operations, net on the consolidated condensed statements of operations and comprehensive loss.

The Company acquired CartiHeal (the “CartiHeal Acquisition”) for an aggregate purchase price of approximately $315,000 and an additional $135,000, payable after closing upon the achievement of a certain sales milestone (“Sales Milestone”, or “CartiHeal Contingent Consideration”). The Company paid $100,000 of the aggregate purchase price upon closing consisting of a $50,000 deposit held in trust and $50,000 from a financing arrangement (Refer to Note 4. Financial instruments for further information regarding financing arrangements). The Company also paid approximately $8,622 of CartiHeal’s transaction-related fees and expenses and deferred $215,000 (“Deferred Amount”) of the aggregate purchase price otherwise due at closing.

The Deferred Amount was to be paid in five tranches commencing in 2023 and ending no later than 2027 as follows: